Europe LiDAR Market By Product Type (Airborne LiDAR, Terrestrial LiDAR, Mobile LiDAR, and Short Range LiDAR), By Application, and By Geography - Analysis and Forecast (2014-2019)

In early 1960s, LiDAR was mainly utilized for military and government applications. However, due to technological developments and reduction in cost of LiDARs, it is heavily penetrating into the commercial and industrial sectors. The market research report Europe LiDAR market - Forecast & Analysis (2013 - 2019) covers both the government/military and the commercial applications of light detection and ranging systems. Major applications currently harnessing light detection and ranging technology are corridor mapping, forestry, mining, topographic surveying, and volumetric mapping. This extensive research study resulted in identifying civil engineering and planning as one of the top revenue grossing applications for LiDAR.

The report segments the European LiDAR market on the basis of product, application, and geography. Each classification done for the European LiDAR market comprises of an extensive segmentation with market estimates and forecast for each sub-market. The report analyzes the entire value chain of the LiDAR market.

The report also covers drivers, restraints, challenges, and opportunities impacting the LiDAR market. Reduction in prices of LiDAR devices that has helped in increasing the applicability of these equipment across varied industry verticals, which has become one of the key driving factors of this market.

According to application, the European LiDAR market is categorized into civil engineering, public sector/service and military. Companies of this market are Faro Technology, Intermap Technologies, Saab, Trimble Navigation Limited, Optech Inc., AeroMetric, Airborne Hydrography AB (AHAB), IGI mbH, Pix4D, Raymetrics, and Riegl Laser Measurement Systems. Products of this market are short range LiDAR, mobile LiDAR, airborne LiDAR, and terrestrial LiDAR.

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition and Scope of the Study

1.3 Markets Covered

1.4 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of the European LiDAR Market

2.2 Arriving at Market Size of European LiDAR Market

2.3 Top-Down Approach

2.4 Bottom-Up Approach

2.5 Demand Side Approach

2.6 Macro Indicators

2.7 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Market Drivers and Inhibitors

4.3 Demand Side Analysis

4.4 Key Market Dynamics

5 European LiDAR Market, By Product (Page No. - 25)

5.1 Introduction

5.2 Airborne LiDAR

5.3 Terrestrial LiDAR

5.4 Mobile LiDAR

5.5 Short Range LiDAR

6 European LiDAR Market, By Application (Page No. - 33)

6.1 Introduction

6.2 Market Overview

6.3 Government

6.4 Civil Engineering

6.5 Military, Defense, & Aerospace

6.6 Corridor Mapping

6.7 Topographic Surveys

6.8 Volumetric Mapping

7 European LiDAR Market, By Country (Page No. - 41)

7.1 Introduction

7.2 Market Overview

7.3 Germany

7.3.1 Germany LiDAR Market, By Application

7.3.2 Germany LiDAR Market, By Product Type

7.4 U.K.

7.4.1 U.K. LiDAR Market, By Application

7.4.2 U.K. LiDAR Market, By Product Type

7.5 France

7.5.1 France LiDAR Market, By Application

7.5.2 France LiDAR Market, By Product Type

7.6 Italy

7.6.1 Italy LiDAR Market, By Application

7.6.2 Italy LiDAR Market, By Product Type

7.7 Rest of Europe

7.7.1 Rest of Europe LiDAR Market, By Application

7.7.2 Rest of Europe LiDAR Market, By Product Type

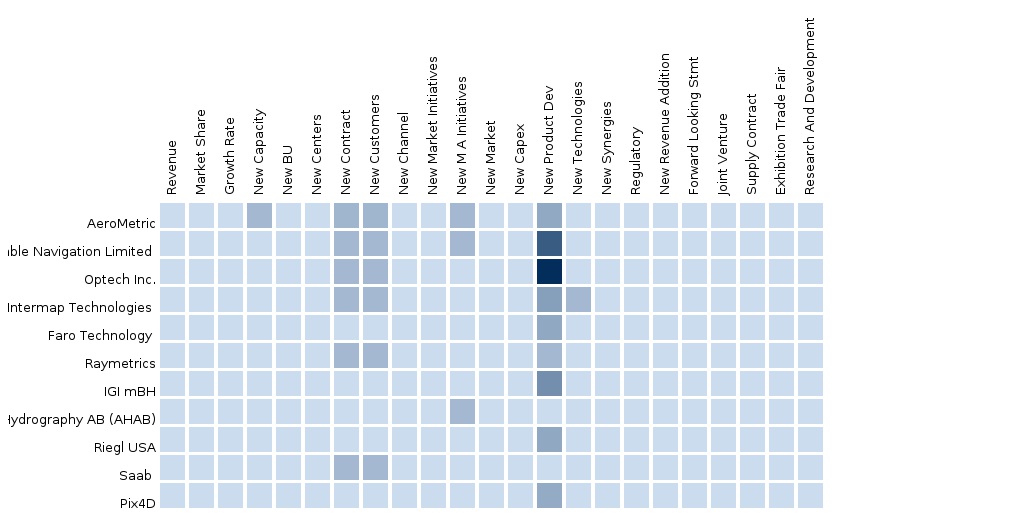

8 European LiDAR Market: Competitive Landscape (Page No. - 56)

8.1 Europe LiDAR Market: Company Share Analysis

8.2 Company Presence In LiDAR Market, By Product Type

8.3 Mergers & Acquisitions

8.4 New Product Development

8.5 Agreements & Collaboration

8.6 Awards and Announcement

9 European LiDAR Market, By Company (Page No. - 63)

9.1 Leica Geosystems

9.2 Optech

9.3 Topcon Corporation

9.4 Trimble Navigation Limited

9.5 Velodyne LiDAR

10 Appendix (Page No. - 82)

10.1 Customization Options

10.1.1 Product Portfolio Analysis

10.1.2 Country Level Data Analysis

10.1.3 Product Comparison of Various Competitors

10.2 Introducing RT: Real Time Market Intelligence

List of Tables (37 Tables)

Table 1 Europe LiDAR Market Size, 2014 (USD Thousands)

Table 2 Europe LiDAR Market, By Application, 2014 (USD Million)

Table 3 R&D Expenditure, 2014 (USD Million)

Table 4 Europe LiDAR Market: Comparison With Parent Market,2014 – 2019 (USD Million)

Table 5 Europe LiDAR Market: Drivers and Inhibitors

Table 6 Europe LiDAR Market: Comparison With Application Markets,2013 - 2019 (USD Million)

Table 7 Europe LiDAR Market, By Product, 2013 - 2019 (USD Million)

Table 8 Europe LiDAR Market, By Product, 2013 - 2019 (USD Million)

Table 9 Europe Airborne LiDAR Market, By Country, 2013–2019 (USD Million)

Table 10 Europe Terrestrial LiDAR Market, By Country, 2013 - 2019 (USD Million)

Table 11 Europe Mobile LiDAR Market, By Country, 2013 – 2019 (USD Million)

Table 12 Europe Short Range LiDAR Market, By Country, 2013 - 2019 (USD Million)

Table 13 Europe LiDAR Market, By Application, 2014-2019 (USD Million)

Table 14 Table 4 Europe LiDAR Market In Government Segment, By Country,2014-2019 (USD Million)

Table 15 European LiDAR Market In Civil Engineering Application, By Country,2014-2019 (USD Million)

Table 16 European LiDAR Market In Military, Defense, & Aerospace, By Geography, 2014-2019 (USD Million)

Table 17 European LiDAR Market In Corridor Mapping Application, By Country, 2014-2019 (USD Million)

Table 18 European LiDAR Market In Topographic Surveys Application, By Country, 2014-2019 (USD Million)

Table 19 Europe LiDAR Market In Volumetric Mapping Application, By Country, 2014-2019 (USD Million)

Table 20 Europe LiDAR Market, By Country, 2014 - 2019 (USD Million)

Table 21 Germany LiDAR Market, By Application, 2014 - 2019 (USD Million)

Table 22 Germany LiDAR Market, By Product, 2014 - 2019 (USD Million)

Table 23 U.K. LiDAR Market, By Application, 2014 - 2019 (USD Million)

Table 24 U.K. LiDAR Market, By Product, 2014 - 2019 (USD Million)

Table 25 France LiDAR Market, By Application, 2014 - 2019 (USD Million)

Table 26 France LiDAR Market, By Product, 2014 - 2019 (USD Million)

Table 27 Italy LiDAR Market, By Application, 2014 - 2019 (USD Million)

Table 28 Italy LiDAR Market, By Product, 2014 - 2019 (USD Million)

Table 29 Rest of Europe LiDAR Market, By Application, 2014 - 2019 (USD Million)

Table 30 Rest of Europe LiDAR Market, By Product, 2014 - 2019 (USD Million)

Table 31 Europe LiDAR: Company Share Analysis, 2014 (%)

Table 32 Europe LiDAR: Mergers & Acquisitions

Table 33 Europe LiDAR: New Product Development

Table 34 Europe LiDAR: Agreements & Collaboration

Table 35 European LiDAR Market : Awards and Announcement

Table 36 Topcon Corporation Market Revenue, By Business Segment,2010-2014 (USD Billion)

Table 37 Trimble: Key Financials, 2010–2014 (USD Million)

List of Figures (39 Figures)

Figure 1 European LiDAR Market: Segmentation & Coverage

Figure 2 European LiDAR Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 European LiDAR Market Snapshot

Figure 9 European LiDAR Market: Comparison With Parent Market

Figure 10 European LiDAR Product Market, By Country, 2014 (USD Million)

Figure 11 European LiDAR Market, By Product, 2014 - 2019 (USD Million)

Figure 12 European Airborne LiDAR Market, By Country, 2013–2019 (USD Million)

Figure 13 European Terrestrial LiDAR Market, By Country, 2013 - 2019 (USD Million)

Figure 14 European Mobile LiDAR Market, By Country, 2013 – 2019 (USD Million)

Figure 15 European Short Range LiDAR Market, By Country, 2013 - 2019 (USD Million)

Figure 16 European LiDAR Market, By Application, 2014-2019 (USD Million)

Figure 17 European LiDAR Market In Government Segment, By Country,2014-2019 (USD Million)

Figure 18 European LiDAR Market In Civil Engineering Application, By Country,2014-2019 (USD Million)

Figure 19 European LiDAR Market In Military, Defence, & Aerospace, By Country, 2014-2019 (USD Million)

Figure 20 Europe LiDAR In Corridor Mapping Application, By Country, 2014-2019 (USD Million)

Figure 21 Europe LiDAR In Topographic Surveys Application, By Country, 2014-2019 (USD Million)

Figure 22 Europe LiDAR In Volumetric Mapping Application, By Country, 2014-2019 (USD Million)

Figure 23 Germany LiDAR Market Overview, 2014 & 2019 (USD Million)

Figure 24 Germany LiDAR Market, By Application, 2013 - 2019 (USD Million)

Figure 25 Germany LiDAR Market, By Product Type: Snapshot

Figure 26 U.K. LiDAR Market Overview, 2014 & 2019 (USD Million)

Figure 27 U.K. LiDAR Market, By Application, 2014 – 2019 (USD Million)

Figure 28 U.K. LiDAR Market, By Product Type: Snapshot

Figure 29 France LiDAR Market Overview, 2014 & 2019 (USD Million)

Figure 30 France LiDAR Market, By Application, 2014 – 2019 (USD Million)

Figure 31 France LiDAR Market, By Product Type: Snapshot

Figure 32 Italy LiDAR Market Overview, 2014 & 2019 (USD Million)

Figure 33 Italy LiDAR Market, By Application, 2014 – 2019 (USD Million)

Figure 34 Italy LiDAR Market, By Product Type: Snapshot

Figure 35 Rest of Europe LiDAR Market Overview, 2014 & 2019 (USD Million)

Figure 36 Rest of Europe LiDAR Market, By Application, 2014 – 2019 (USD Million)

Figure 37 Rest of Europe LiDAR Market, By Product Type: Snapshot

Figure 38 European LiDAR Market: Company Share Analysis, 2014

Figure 39 Company Presence In LiDAR Market, By Product Type

Light Detection and Ranging (LiDAR) is an optical remote sensing technology that is primarily utilized to measure distances by illuminating a target with the help of laser light, and further carrying out an analysis of the reflected light. LiDAR is comparable to radar in certain aspects. However, LiDAR uses waves of shorter wavelengths unlike radar, which uses radio waves for measuring targets. The LiDAR technology uses waves typically in the visible, ultraviolet, and infrared range. This technology enables direct measurement of 3D structures and underlying terrain with high resolution and high data accuracy. The capability of LiDAR equipment to achieve high resolution makes them superior to other traditional optical instruments used for measuring heights. The LiDAR market can be segmented based on types into short range, airborne, mobile and terrestrial LiDAR. According to application, the LiDAR market is categorized into coastal, forestry, transportation, infrastructure, defense and aerospace, transmission lines, and flood mapping applications.

Escalating demand for 3D imagery in consumer, commercial, and government applications is one of the major factors driving the global LiDAR market. The demand for LiDAR technology is increasing in these application segments, along with an increase in the demand for 3D scanning and 3D imagery. The adoption of LiDAR technology is slowly penetrating in various government sectors, such as roadways, railways, and forestry management among others. Thus, huge demand from government sectors in different countries is supporting the LiDAR market. Further, LiDAR is superior to photogrammetry in terms of accuracy and speed and thus, LiDAR has vastly acquired consumers of photogrammetry in the recent years. However, the LiDAR market faces challenge related to the complexity in interpreting the output data, due to lack of data set standardization.

Apart from a general overview of major companies in this market, this report also provides financial analysis, growth strategies, and key development of players operating in the LiDAR market segment. Airborne imaging, Inc. (U.S.), Leica Geosystems (U.S.), Optech Incorporated (Canada), Trimble Navigation Limited (U.S.), RIEGL Laser Measurement Systems GmbH (Austria), and Renishaw Plc (U.K.)., are some of the leading players covered in the European LiDAR market report.

The Europe LiDAR market was valued at $91.8 million in 2014, and is projected to reach $172.8 million by 2019, at a CAGR of 13.4% from 2014 to 2019.

The European LiDAR market for building/infrastructure and corridor mapping application is estimated to grow at a CAGR of 15.1% and 18.5%, respectively during the forecast period. This growth is mainly attributed to the high demand for security at commercial places, such as airports, hotels, hospitals, and offices, which in turn, increases the adoption of LiDAR devices worldwide.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement