European Clinical Chemistry Analyzer Market by Product (Semi-Automated Clinical Chemistry and Fully-Automated Clinical Chemistry Analyzer), by End-Users (Academics Research Institutes, Diagnostic Laboratories, Hospitals) - Forecast to 2019

The European clinical chemistry market is growing due to the ongoing developments in analytical laboratory automation, the swift progress in various fields of diagnosis such as point-of-care testing, molecular diagnosis, immunoassays, hematology, flow cytometry, and microbiology, and finally, the geographical market expansion within emerging countries. Although Europe showed a negative growth rate in this market, in some countries revenues grew compared to 2011. Germany commanded the largest share (20%) at an estimated $652.8 million in 2013 and is expected to reach $853.3 million by 2018, at a CAGR of 5.8% from 2013 to 2018.

The most important trend witnessed recently in the in vitro diagnostics (IVD) industry is the trend of self-testing as opposed to patients visiting hospitals. This is one of the biggest factors responsible for the growth of point-of-care testing, as patients prefer self-testing so as to avoid unnecessary visits to the hospital. Clinical chemistry accounted for 21.3% share of the IVD market in 2012. Clinical chemistry routine tests such as testing for blood albumin, ALT/SGPT, ammonia, blood gases, and calcium and creatinine levels, are required before undergoing advanced tests. These tests, thus, form the center stage of the IVD market. The United States commanded the largest share (89%) of the North American clinical chemistry market at an estimated $3,852.7 million in 2013 and is expected to reach $5,370.5 million by 2019, at a CAGR of 7.2% from 2013 to 2018.

The major changes in clinical chemistry have been brought about as a result of the convergence of system engineering, automation, and IT technology. Thus, new technologies have enabled a better understanding of disease processes. The clinical chemistry market is expanding, consolidating, and becoming highly competitive with a myriad of opportunities for various new instruments, reagents, calibrators, and other systems.

The Center for Medicare & Medicaid Services (CMS) has estimated that healthcare spending in the U.S. is expected to grow from $2.7 trillion in 2011 to about $4.6 trillion in 2019, at a CAGR of 6.8% for the same period. Similarly, in emerging countries, the growing awareness and an increasing middle-class population, with a more disposable income to spend on healthcare, will be the major driving factors for the growth of this market.

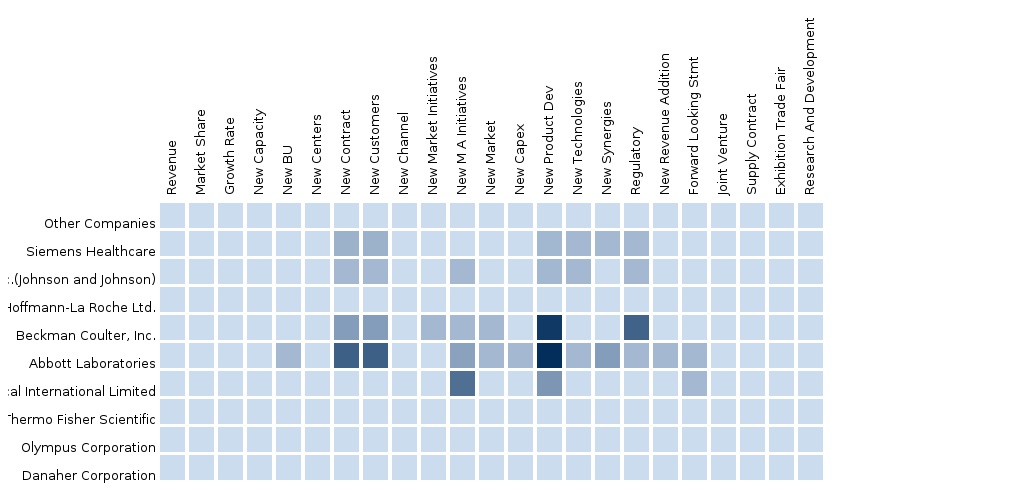

The report on the European clinical chemistry market analyzes the market by three segments, namely, clinical chemistry reagents, instruments, and accessories. The report also provides an extensive competitive landscaping of companies operating in this market. The main companies extensively covered in this report are Abbott Laboratories, Alere, Inc., Arkray, Inc., Bayer AG, Becton, Dickinson and Company, bioMérieux, Bio-Rad Laboratories, Inc., Danaher Corporation, Diagnostica Stago S.A.S, DiaSorin S.p.A., Hologic, Inc., Horiba, Johnson & Johnson, Novartis International AG, Qiagen N.V., Roche Diagnostics, Siemens Healthcare, Sysmex Corporation, Thermo Fisher Scientific, Inc., and others.

The details of segment and country-specific company shares, news and deals, mergers and acquisitions, segment-specific pipeline products, product approvals, and product recalls of the major companies have also been covered in the report.

Report Customization Options

Along with market data, you can also customize MMM offerings that are in keeping with your company’s specific needs. Customize your report on the European clinical chemistry market for to get an insight into all-inclusive industry standards and a deep-dive analysis of the following considerations:

Opportunity Analysis:

- Unmet needs, revenue pockets, and potential areas for expansion

Supplier Evaluation:

- Comprehensive review of key suppliers

Lab-Testing Data:

- Number of clinical chemistry tests performed annually in each country, tracked till sub-segment level

Current and Emerging Products:

- An analysis of current and emerging clinical chemistry and immunodiagnostic tests

- A review of current clinical chemistry instrumentation technologies and feature comparison of high, medium, and low-volume POC analyzers

Product Analysis

- Usage pattern (in-depth trend analysis) of products (segment wise)

- Product matrix which gives a detailed comparison of the product portfolio of each company mapped at country and sub-segment level

- End-user adoption rate analysis of the products (segment wise and country wise)

- Comprehensive coverage of product approvals, pipeline products, and product recalls

Brand/Product Perception Matrix

- Comprehensive study of customers perception and behavior through our inbuilt social connection tool checking the virality and tonality of blogs

- Analysis of overall brand usage and familiarity and brand advocacy distribution (detractor/neutral/familiar)

Alternative Products: Impact Analysis

MMM’s Healthcare Decision Making Quadrant: It is an innovative and useful quadrant for vendors who wish to analyze potential growth markets based on parameters like patient dynamics (patient pool, epidemiology of disease, preference towards surgeries/alternative therapies) and macroeconomic indicators (number of hospitals and orthopedic clinics, reimbursement scenario, diagnosis rate, treatment rate, and healthcare expenditure).

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America In Vitro Diagnostics In 2013, the Americas had the largest market, a 42% share of the Global IVD market, followed by Europe with a 31% share. However, the BRIC countries represent the fastest-growing markets due to the economic growth, the rising number of chronic diseases, and an increasing awareness about the use of IVD tests to control the spread of diseases. Moreover, the economic slowdown, pricing pressures, and high competition in mature countries will compel companies to focus on emerging markets. The report “North American In Vitro Diagnostics Market forecast for 2018 “analyzes the market by 5 segments such as reagents, instruments, techniques, applications and end-users. |

Upcoming |

|

Europe In Vitro Diagnostics In 2013, the Americas had the largest market, a 42% share of the European IVD market, followed by Europe with a 31% share. However, the BRIC countries represent the fastest-growing markets due to the economic growth, the rising number of chronic diseases, and an increasing awareness about the use of IVD tests to control the spread of diseases. Moreover, the economic slowdown, pricing pressures, and high competition in mature countries will compel companies to focus on emerging markets. The report “European In Vitro Diagnostics Market forecast for 2018 “analyzes the market by 5 segments such as reagents, instruments, techniques, applications and end-users. Germany commanded the largest share in European IVD market. |

Upcoming |

|

Asia In Vitro Diagnostics Asian IVD market is growing in double digit and will continue to grow in future. China commanded the largest share in Asian IVD market. The report “Asian In Vitro Diagnostics Market forecast for 2018 “analyzes the market by 5 segments such as reagents, instruments, techniques, applications and end-users. |

Upcoming |