Europe Big Data Market By Type (Software, Hardware, Services), By Big Data-as-a-Service (Hadoop-as-a-Service, Data-as-a-Service, Data Analytics-as-a- Service), By Vertical, By Geography (U.K., Germany, France, Rest of Europe) - Analysis and Forecast to 2021

The size of the Europe big data market is estimated to grow from USD 9.38 billion in 2016 to USD 29.42 billion in 2021, at a CAGR of 25.7% from 2016 to 2021. The massive growth and heterogeneity in data structure across various domains has fueled the growth of big data market. The new trend of focusing on relevant data to get actionable insights rather than collecting data has provided a new approach to the analysis of a huge amount of data. Organizations have realized that machine-generated data adds more value to their businesses than the data collected from customers and employees. With the usage of Internet of Things (IoT) and connected devices, such as mobile, tablets, and laptops gaining traction over the past few years, the amount of machine-generated data has increased tremendously. An increasing number of organizations are merging the data generated by machines with data generated by humans to get best possible results. Rise in the generation of unstructured data, such as photos, videos, and social media is also expected to drive the growth of the big data market.

Increase in the use of mobile devices and applications has increased the rate of big data generation. It has been estimated that there are over 1.9 billion mobile phones in use across the globe, as of 2015. These mobile devices are generating data in the form of log data through various applications, financial transactions, and online shopping. Most people spend approximately 4 to 5 hours on mobile applications on a daily basis. This increase in usage has enhanced the growth of big data. Mobile traffic has outperformed web traffic and will continue to gain momentum. This growth in the trajectory of mobile traffic has increased the demand for big data analytical solutions. Due to this increased generation of data, big data vendors are also offering mobile big data analytics solutions, which can provide useful trends, such as customer buying pattern and consumer psychology. Various organizations are implementing big data solutions to analyze the data generated through mobile devices and applications. This data provides actionable insights on the basis of user sentiment and behavioral patterns.

This research report segments the Europe big data market on the basis of type, Big Data-as-a-Service (BDaaS), vertical, and geography. On the basis of type, the market is broadly classified into software, hardware, and services. The software segment is further divided into applications & analytics, database (SQL and NoSQL, among others), and Hadoop & other infrastructure software. The hardware segment is further divided into servers, storage, and networking. The services segment is sub-divided into consulting & system integration, training & support, and managed services. The big data market is further segmented on the basis of verticals into BFSI, IT & telecommunications, consumer goods & retail, energy & natural resources (oil & gas), government & public utilities, healthcare, and manufacturing, among others.

To know about the assumptions considered for the study, Download PDF Brochure.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.2.1 Years Considered in the Study

1.3 Stakeholders

2 Research Methodology

2.1 Integrated Ecosystem of Big Data Market

2.2 Arriving at the Big Data Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary

4 Market Overview

4.1 Introduction

4.2 Market Drivers and Restraints

5 Europe Big Data Market, By Type

5.1 Introduction

5.2 Europe Big Data Services Market

5.2.1 Europe Big Data Consulting and System Integration Market

5.2.2 Europe Big Data Training and Support Market

5.2.3 Europe Big Data Managed Services Market

5.3 Europe Big Data Hardware Market

5.3.1 Europe Big Data Servers Market

5.3.2 Europe Big Data Storage Market

5.3.3 Europe Big Data Networking Market

5.4 Europe Big Data Software Market

5.4.1 Europe Big Data Applications and Analytics Market

5.4.2 Europe Big Data Database Market

5.4.3 Europe Big Data Hadoop and Other Infrastructure Software Market

6 Europe Big Data Market, By Big Data-As-A-Service

6.1 Introduction

6.2 Europe Hadoop-As-A-Service Market

6.3 Europe Data-As-A-Service Market

6.4 Europe Data Analytics-As-A-Service Market

7 Europe Big Data Market, By Vertical

7.1 Introduction

7.2 Europe Big Data Market in It & Telecommunications

7.3 Europe Big Data Market in Manufacturing

7.4 Europe Big Data Market in BFSI

7.5 Europe Big Data Market in Consumer Goods & Retail

7.6 Europe Big Data Market in Government & Public Utilities

7.7 Europe Big Data Market in Energy & Natural Resources (Oil & Gas)

7.8 Europe Big Data Market in Healthcare

7.9 Europe Big Data Market in Other Verticals

8 Europe Big Data Market, By Geography

8.1 Introduction

8.2 U.K. Big Data Market

8.2.1 U.K. Big Data Market, By Vertical

8.2.2 U.K. Big Data Market, By Type

8.2.2.1 U.K. Big Data Services Market

8.2.2.2 U.K. Big Data Hardware Market

8.2.2.3 U.K. Big Data Software Market

8.2.3 U.K. Big Data Market, By Big Data-As-A-Service (BDAAS)

8.3 Germany Big Data Market

8.3.1 Germany Big Data Market, By Vertical

8.3.2 Germany Big Data Market, By Type

8.3.2.1 Germany Big Data Services Market

8.3.2.2 Germany Big Data Hardware Market

8.3.2.3 Germany Big Data Software Market

8.3.3 Germany Big Data Market, By Big Data-As-A-Service (BDAAS)

8.4 France Big Data Market

8.4.1 France Big Data Market, By Vertical

8.4.2 France Big Data Market, By Type

8.4.2.1 France Big Data Services Market

8.4.2.2 France Big Data Hardware Market

8.4.2.3 France Big Data Software Market

8.4.3 France Big Data Market, By Big Data-As-A-Service (BDAAS)

8.5 Rest of Europe Big Data Market

8.5.1 Rest of Europe Big Data Market, By Vertical

8.5.2 Rest of Europe Big Data Market, By Type

8.5.2.1 Rest of Europe Big Data Services Market

8.5.2.2 Rest of Europe Big Data Hardware Market

8.5.2.3 Rest of Europe Big Data Software Market

8.5.3 Rest of Europe Big Data Market, By Big Data-As-A-Service (BDAAS)

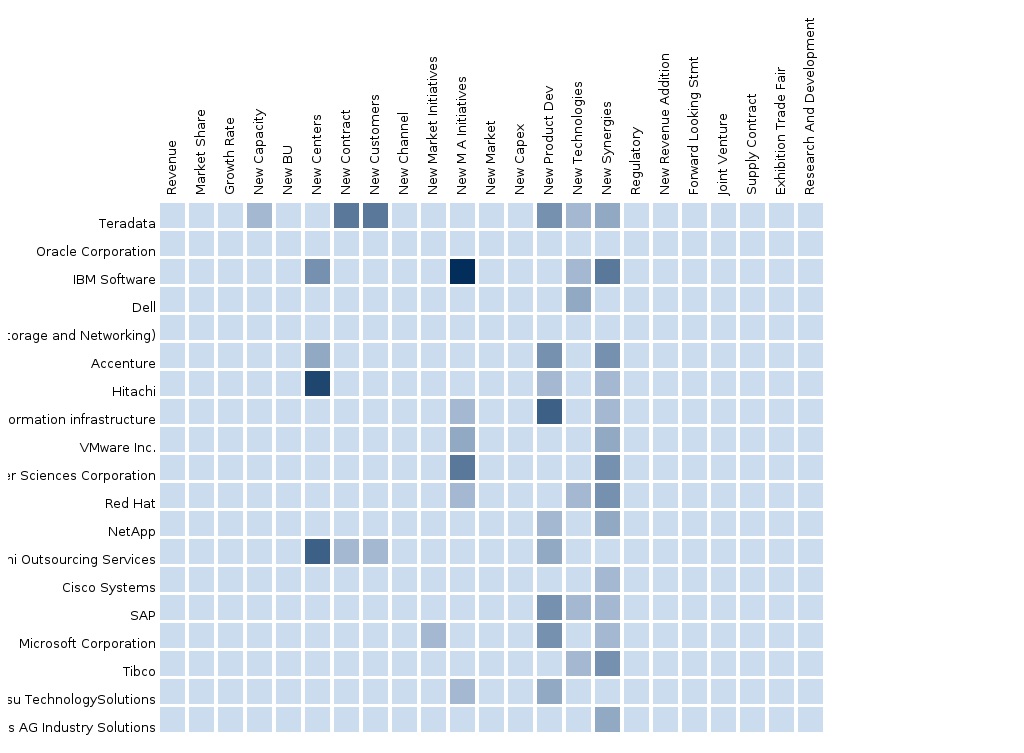

9 Europe Big Data Market: Competitive Landscape

9.1 Acquisitions

9.2 Agreements, Partnerships & Collaborations

9.3 New Product Launches

10 Europe Big Data Market, By Company

10.1 Microsoft Corporation

10.1.1 Overview

10.1.2 Key Financials

10.1.3 Solutions Offered

10.1.4 Related Developments

10.1.5 MMM View

10.2 Oracle Corporation

10.2.1 Overview

10.2.2 Key Financials

10.2.3 Products Offered

10.2.4 Related Developments

10.2.5 MMM View

10.3 Sas Institute

10.3.1 Overview

10.3.2 Key Financials

10.3.3 Products Offered

10.3.4 Recent Developments

10.3.5 MMM View

10.4 Amazon Web Services (AWS)

10.4.1 Overview

10.4.2 Key Financials

10.4.3 Products Offered

10.4.4 Related Developments

10.4.5 MMM View

10.5 International Business Machines (IBM) Corporation

10.5.1 Overview

10.5.2 Key Financials

10.5.3 Product Offered

10.5.4 Related Developments

10.5.5 MMM View

10.6 Sap Se

10.6.1 Overview

10.6.2 Key Financials

10.6.3 Products Offered

10.6.4 Related Developments

10.6.5 MMM View

10.7 Hewlett Packard Enterprise

10.7.1 Overview

10.7.2 Key Financials

10.7.3 Products Offered

10.7.4 Related Developments

10.7.5 MMM View

11 Appendix

11.1 Customization Options

11.1.1 Product Portfolio Analysis

11.1.2 Country-Level Data Analysis

11.1.3 Product Comparison of Various Competitors

11.2 Related Reports

11.3 Introducing Rt: Real Time Market Intelligence

11.3.1 Rt Snapshots

List of Tables

Table 1 Europe Big Data Market: Macro Indicator, By Geography, 2015 (USD Million)

Table 2 Europe Big Data Market: Drivers and Restraints

Table 3 Europe Big Data Market, By Type, 2014-2021 (USD Billion)

Table 4 Europe Big Data Services Market, By Geography, 2014–2021 (USD Million)

Table 5 Europe Big Data Consulting and System Integration Market, By Geography, 2014-2021 (USD Million)

Table 6 Europe Big Data Training and Support Market, By Geography, 2014-2021 (USD Million)

Table 7 Europe Big Data Managed Services Market, By Geography, 2014-2021 (USD Million)

Table 8 Europe Big Data Hardware Market, By Geography, 2014–2021 (USD Million)

Table 9 Europe Big Data Servers Market, By Geography, 2014-2021 (USD Million)

Table 10 Europe Big Data Storage Market, By Geography, 2014-2021 (USD Million)

Table 11 Europe Big Data Networking Market, By Geography, 2014-2021 (USD Million)

Table 12 Europe Big Data Software Market, By Geography, 2014–2021 (USD Million)

Table 13 Europe Big Data Applications and Analytics Market, By Geography, 2014-2021 (USD Million)

Table 14 Europe Big Data Database Market, By Geography, 2014-2021 (USD Million)

Table 15 Europe Big Data Hadoop and Other Infrastructure Software Market, By Geography, 2014-2021 (USD Million)

Table 16 Europe Big Data Market, By Big Data-As-A-Service, 2014-2021 (USD Million)

Table 17 Europe Hadoop-As-A-Service Market, By Geography, 2014-2021 (USD Million)

Table 18 Europe Data-As-A-Service Market, By Geography, 2014-2021 (USD Million)

Table 19 Europe Data Analytics-As-A-Service Market, By Geography, 2014-2021 (USD Million)

Table 20 Europe Big Data Market, By Vertical, 2014-2021 (USD Million)

Table 21 Europe Big Data in It & Telecommunications, By Geography, 2014-2021 (USD Million)

Table 22 Europe Big Data Market in Manufacturing, By Geography, 2014-2021 (USD Million)

Table 23 Europe Big Data Market in Bfsi, By Geography, 2014-2021 (USD Million)

Table 24 Europe Big Data Market in Consumer Goods & Retail, By Geography, 2014-2021 (USD Million)

Table 25 Europe Big Data Market in Government & Public Utilities, By Geography, 2014-2021 (USD Million)

Table 26 Europe Big Data Market in Energy & Natural Resources (Oil & Gas), By Geography, 2014-2021 (USD Million)

Table 27 Europe Big Data Market in Healthcare, By Geography, 2014-2021 (USD Million)

Table 28 Europe Big Data Market in Other Verticals, By Geography, 2014-2021 (USD Million)

Table 29 Europe Big Data Market, By Geography, 2014-2021 (USD Billion)

Table 30 U.K. Big Data Market, By Vertical, 2014-2021 (USD Million)

Table 31 U.K. Big Data Market, By Type, 2014-2021 (USD Million)

Table 32 U.K. Big Data Services Market, 2014-2021 (USD Million)

Table 33 U.K. Big Data Hardware Market, 2014-2021 (USD Million)

Table 34 U.K. Big Data Software Market, 2014-2021 (USD Million)

Table 35 U.K. Big Data Market, By Big Data-As-A-Service (BDAAS), 2014-2021 (USD Million)

Table 36 Germany Big Data Market, By Vertical, 2014-2021 (USD Million)

Table 37 Germany Big Data Market, By Type, 2014-2021 (USD Million)

Table 38 Germany Big Data Services Market, 2014-2021 (USD Million)

Table 39 Germany Big Data Hardware Market, 2014-2021 (USD Million)

Table 40 Germany Big Data Software Market, 2014-2021 (USD Million)

Table 41 Germany Big Data Market, By Big Data-As-A-Service (BDAAS), 2014-2021 (USD Million)

Table 42 France Big Data Market, By Vertical, 2014-2021 (USD Million)

Table 43 France Big Data Market, By Type, 2014-2021 (USD Million)

Table 44 France Big Data Services Market, 2014-2021 (USD Million)

Table 45 France Big Data Hardware Market, 2014-2021 (USD Million)

Table 46 France Big Data Software Market, 2014-2021 (USD Million)

Table 47 France Big Data Market, By Big Data-As-A-Service (BDAAS), 2014-2021 (USD Million)

Table 48 Rest of Europe Big Data Market, By Vertical, 2014-2021 (USD Million)

Table 49 Rest of Europe Big Data Market, By Type, 2014-2021 (USD Million)

Table 50 Rest of Europe Big Data Services Market, 2014-2021 (USD Million)

Table 51 Rest of Europe Big Data Hardware Market, 2014-2021 (USD Million)

Table 52 Rest of Europe Big Data Software Market, 2014-2021 (USD Million)

Table 53 Rest of Europe Big Data Market, By Big Data-As-A-Service (BDAAS), 2014-2021 (USD Million)

Table 54 Europe Big Data Market: Acquisitions

Table 55 Europe Big Data Market: Agreements, Partnerships & Collaborations

Table 56 Europe Big Data Market: New Product Launches

Table 57 Microsoft Corporation: Revenue and Net Income, 2012-2015 (USD Billion)

Table 58 Microsoft Corporation: Key Financials, By Business Segment, 2012-2015 (USD Billion)

Table 59 Microsoft Corporation: Key Financials, By Geography, 2012-2015 (USD Billion)

Table 60 Oracle Corporation: Revenue and Net Income, 2012-2015 (USD Billion)

Table 61 Oracle Corporation: Key Financials, By Geographic Segment, 2012-2015 (USD Billion)

Table 62 Oracle Corporation: Key Financials, By Business Segment, 2012-2015 (USD Billion)

Table 63 International Business Machines (IBM) Corporation: Revenue and Net Income, 2012-2015 (USD Billion)

Table 64 International Business Machines (IBM) Corporation: Key Financials, By Geographic Segment, 2012-2015 (USD Billion)

Table 65 International Business Machines (IBM) Corporation: Key Financials, By Business Segment, 2012-2015 (USD Billion)

Table 66 Sap Se: Revenue and Net Income, 2012-2015 (USD Billion)

Table 67 Sap Se: Key Financials, By Geographic Revenue, 2012-2015 (USD Billion)

Table 68 Sap Se: Key Financials, By Business Segment, 2012-2015 (USD Billion)

Table 69 Hewlett Packard Enterprise: Revenue and Net Income, 2013-2015 (USD Billion)

Table 70 Hewlett Packard Enterprise: Key Financials, By Geographic Segment, 2013-2015 (USD Billion)

Table 71 Hewlett Packard Enterprise: Key Financials, By Business Segment, 2013-2015 (USD Billion)

List of Figures

Figure 1 Market Break-Up

Figure 2 Europe Big Data Market: Segmentation & Coverage

Figure 3 Years Considered in the Study

Figure 4 Big Data Market: Integrated Ecosystem

Figure 5 Research Methodology

Figure 6 Top-Down Approach

Figure 7 Bottom-Up Approach

Figure 8 Macro Indicator-Based Approach

Figure 9 Europe Big Data Market: Snapshot, 2015

Figure 10 Big Data Market: Drivers and Restraints

Figure 11 Europe Big Data Market, By Type, 2016 & 2021 (USD Billion)

Figure 12 Europe Big Data Services Market, By Geography, 2014-2021 (USD Million)

Figure 13 Europe Big Data Consulting and System Integration Market, By Geography, 2014-2021 (USD Million)

Figure 14 Europe Big Data Training and Support Market, By Geography, 2014-2021 (USD Million)

Figure 15 Europe Big Data Managed Services Market, By Geography, 2014-2021 (USD Million)

Figure 16 Europe Big Data Hardware Market, By Geography, 2014-2021 (USD Million)

Figure 17 Europe Big Data Servers Market, By Geography, 2014-2021 (USD Million)

Figure 18 Europe Big Data Storage Market, By Geography, 2014-2021 (USD Million)

Figure 19 Europe Big Data Networking Market, By Geography, 2014-2021 (USD Million)

Figure 20 Europe Big Data Software Market, By Geography, 2014-2021 (USD Million)

Figure 21 Europe Big Data Applications and Analytics Market, By Geography, 2014-2021 (USD Million)

Figure 22 Europe Big Data Database Market, By Geography, 2014-2021 (USD Million)

Figure 23 Europe Big Data Hadoop and Other Infrastructure Software Market, By Geography, 2014-2021 (USD Million)

Figure 24 Europe Big Data Market, By Big Data-As-A-Service, 2016-2021 (USD Million)

Figure 25 Europe Hadoop-As-A-Service, By Geography, 2014-2021 (USD Million)

Figure 26 Europe Data-As-A-Service Market, By Geography, 2014-2021 (USD Million)

Figure 27 Europe Data Analytics-As-A-Service Market, By Geography, 2014-2021 (USD Million)

Figure 28 Europe Big Data Market, By Vertical, 2016 & 2021 (USD Million)

Figure 29 Europe Big Data Market in It & Telecommunications, By Geography, 2014-2021 (USD Million)

Figure 30 Europe Big Data Market in Manufacturing, By Geography, 2014-2021 (USD Million)

Figure 31 Europe Big Data Market in Bfsi, By Geography, 2014-2021 (USD Million)

Figure 32 Europe Big Data Market in Consumer Goods & Retail, By Geography, 2014-2021 (USD Million)

Figure 33 Europe Big Data Market in Government & Public Utilities, By Geography, 2014-2021 (USD Million)

Figure 34 Europe Big Data Market in Energy & Natural Resources (Oil & Gas), By Geography, 2014-2021 (USD Million)

Figure 35 Europe Big Data Market in Healthcare, By Geography, 2014-2021 (USD Million)

Figure 36 Europe Big Data Market in Other Verticals, By Geography, 2014-2021 (USD Million)

Figure 37 Europe Big Data Market: Growth Analysis, By Geography, 2016 & 2021 (USD Billion)

Figure 38 U.K. Big Data Market Overview, 2016 & 2021 (%)

Figure 39 U.K. Big Data Market, By Vertical, 2014-2021 (USD Million)

Figure 40 U.K. Big Data Market, By Type, 2014-2021 (USD Million)

Figure 41 U.K. Big Data Services Market, 2014-2021 (USD Million)

Figure 42 U.K. Big Data Hardware Market, 2014-2021 (USD Million)

Figure 43 U.K. Big Data Software Market, 2014-2021 (USD Million)

Figure 44 U.K. Big Data Market, By Big Data-As-A-Service (BDAAS), 2014-2021 (USD Million)

Figure 45 Germany Big Data Market Overview, 2016 & 2021 (%)

Figure 46 Germany Big Data Market, By Vertical, 2014-2021 (USD Million)

Figure 47 Germany Big Data Market, By Type, 2014-2021 (USD Million)

Figure 48 Germany Big Data Services Market, 2014-2021 (USD Million)

Figure 49 Germany Big Data Hardware Market, 2014-2021 (USD Million)

Figure 50 Germany Big Data Software Market, 2014-2021 (USD Million)

Figure 51 Germany Big Data Market, By Big Data-As-A-Service (BDAAS), 2014-2021 (USD Million)

Figure 52 France Big Data Market Overview, 2016 & 2021 (%)

Figure 53 France Big Data Market, By Vertical, 2014-2021 (USD Million)

Figure 54 France Big Data Market, By Type, 2014-2021 (USD Million)

Figure 55 France Big Data Services Market, 2014-2021 (USD Million)

Figure 56 France Big Data Hardware Market, 2014-2021 (USD Million)

Figure 57 France Big Data Software Market, 2014-2021 (USD Million)

Figure 58 France Big Data Market, By Big Data-As-A-Service (BDAAS), 2014-2021 (USD Million)

Figure 59 Rest of Europe Big Data Market Overview, 2016 & 2021 (%)

Figure 60 Rest of Europe Big Data Market, By Vertical, 2014-2021 (USD Million)

Figure 61 Rest of Europe Big Data Market, By Type, 2014-2021 (USD Million)

Figure 62 Rest of Europe Big Data Services Market, 2014-2021 (USD Million)

Figure 63 Rest of Europe Big Data Hardware Market, 2014-2021 (USD Million)

Figure 64 Rest of Europe Big Data Software Market, 2014-2021 (USD Million)

Figure 65 Rest of Europe Big Data Market, By Big Data-As-A-Service (BDAAS), 2014-2021 (USD Million)

Figure 66 Microsoft Corporation: Business Revenue Mix, 2015 (%)

Figure 67 Oracle Corporation: Revenue Mix, 2015 (%)

Figure 68 International Business Machines (IBM) Corporation: Revenue Mix, 2015 (%)

Figure 69 Sap Se: Revenue Mix, 2015 (%)

Figure 70 Hewlett Packard Enterprise: Revenue Mix, 2015 (%)

The Europe big data market is expected to be valued at USD 9.38 billion in 2016 and reach USD 29.42 billion by 2021, at a CAGR of 25.7% from 2016 to 2021. In terms of service, the Europe big data market was led by consulting & system integration segment in 2015, with a share of 53.2%. The market size of this segment is projected to reach USD 6.09 billion by 2021, at a CAGR of 24.6% during the forecast period. Among verticals, the Europe big data market was led by IT & telecommunications segment in 2015, with a share of 25.0% and a revenue of USD 1.91 billion. The market size of this segment is expected to grow at a CAGR of 24.4% during the forecast period.

Big data refers to large volume of data that may be structured, unstructured, or semi-structured. Organizations have started deploying big data solutions to access and analyze huge data sets efficiently. This provides actionable insights to organizations, which help them take quick decisions to provide customer-centric solutions. In past few years, big data has become an important part of the technological landscape.

The big data market established its footprint in 1999 when the term first appeared in Visually Exploring Gigabytes Datasets in Real Time. Later, in 2000s, the volume of data increased to gigabytes, and services which were capable of handling huge amount of data came into existence. Moreover, data came to be defined by three Vs, namely, volume, variety, velocity, and veracity. Various organizations started realizing the importance of analyzing the volume of data being generated by social media activities.

Large companies and small and medium-sized enterprises (SMEs) in Europe have realized the potential of big data for disruptive change in markets and business models. They are exploring opportunities such as enhancing the organizational return on investment (ROI) by utilizing big data analytics. Europe is still at an early stage of adopting big data technologies and services. It is lagging behind North American companies which are intending to build and rely on data-driven solutions.

This research report is based on extensive research on the Europe big data market and submarkets within the ecosystem. It focuses on giving a general view of the market with respect to software, such as big data analytics, which provides analysis of large amounts of data to get actionable insights; data discovery and visualization, which provides rapid access to data at real time; and data management, which includes data capturing, managing, processing, and storage.

Key players operational in the big data market include IBM (U.S), Oracle Corporation (U.S.), Microsoft Corporation (U.S.), Hewlett-Packard Enterprise (U.S.), SAP SE (Germany), Amazon Web Services (U.S.), and SAS Institute (U.S.). This research report includes strategic alliances and acquisitions by various global and local players in the Europe big data market. The players have mainly adopted the strategy of new product launch to enhance their product portfolio. A notable example of this strategy is Microsoft’s launch of Big Data Mainstream with Cortana Analytics Suite.

Speak to our expert analyst for a discussion on the above findings, Click Speak to Analyst.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement