Asia Healthcare Workflow System Market by Type (Fraud Detection, Pharmacy Audit & Analysis, Claim Management System, Customer Relationship Management), by End-User - Analysis and Forecast to 2019

The healthcare workflow systems report defines and segments the concerned market in Asia with analysis and forecast of revenue. The Healthcare workflow systems market in Asia was valued at $1,188.9 million in 2014 and is estimated to grow at a CAGR of 6.1% from 2014 to 2019.

The Asian healthcare workflow systems market is growing at a faster rate. This is attributed to a number of favorable factors such as reduction in installation cost of healthcare IT systems, increasing focus of major market players in the emerging economies, and growing aging population leading to rise in incidences of diseases to stimulate the demand of workflow solutions in this region. For instance, the Indian government annually spends approximately 5% of its GDP on healthcare sector and has approved 100% FDI for setting up hospitals. Healthcare organizations in the Asian region are actively moving towards advanced payer IT solutions, like healthcare workflow systems to streamline the entire workflow system in large healthcare enterprises.

The penetration for general insurance in 2011 in highly populated countries like India and China was 3.4% and 1.8% of GDP respectively. Also, medical tourism is also one of the factors contributing to the growth of payer healthcare IT market, which is contributing to the growth of the healthcare workflow systems market in Asia. All these aspects are expected to bolster the growth of this market. Oracle (U.S.), Aspect Software (U.S.), Cerner Corporation (U.S.) and Avaya Inc. (U.S.) are the key players operating in this market.

This market is segmented and forecast on the basis of four different segments namely Customer Relationship Management (HCIT), Fraud Detection, Payer Claim Management, and Pharmacy Audit and Analysis. On the basis of components and deployments, the market is segmented into hardware, software and services, while the deployments are on-premise, cloud-based, and web-based. The market is further segmented and forecast on the basis of geography, which includes Japan, China, India, Republic of Korea, and Rest of Asia. This report also includes the market share, value chain analyses, and market metrics such as drivers, restraints and upcoming opportunities in the market. In addition, it presents a competitive landscape and company profiles of the key players in the market.

Scope of the Report

This research report categorizes the Asian workflow market into the following segments:

Asia Workflow System Market, by Application

- Claim Management

- Pharmacy Audit and Analysis

- Fraud Detection

- Customer Relationship Management

Asia Workflow System Market, by Component

- Hardware

- Software

- Services

Asia Workflow System Market, by Deployment

- On-Premise

- Web-Based

- Cloud-Based

Asia Workflow System Market, by Geography

- China

- Japan

- India

- Republic of Korea

- Rest of Asia

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Workflow Systems Market

2.2 Arriving at the Workflow Systems Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 20)

4.1 Introduction

4.2 Workflow Systems Market: Comparison With the Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Asian Workflow Systems Market, By Application (Page No. - 25)

5.1 Introduction

5.2 Workflow Systems in Claims Management, By Country

5.3 Workflow Systems in Pharmacy Audit & Analysis, By Country

5.4 Workflow Systems in Fraud Detection, By Country

5.5 Workflow Systems in Customer Relationship Management, By Country

6 Asian Workflow Systems Market, By Component (Page No. - 31)

6.1 Introduction

6.2 Workflow Systems Market, By Component (Comparison With the Healthcare Payer IT Market)

6.3 Workflow Systems in Services Market, By Country

6.4 Workflow Systems in Software Market, By Country

6.5 Workflow Systems in Hardware Market, By Country

7 Asian Workflow Systems Market, By Deployment (Page No. - 37)

7.1 Introduction

7.2 Workflow Systems Market, Deployment Comparison With the Healthcare Payer Market

7.3 Workflow Systems in Web-Based Market, By Country

7.4 Workflow Systems in On-Premise Market, By Country

7.5 Workflow Systems in Cloud-Based Market, By Country

8 Asian Workflow Systems Market, By Country (Page No. - 43)

8.1 Introduction

8.2 Japan Workflow Systems Market

8.2.1 Japan Workflow Systems Market, By Application

8.2.2 Japan Workflow Systems Market, By Component

8.2.3 Japan Workflow Systems Market, By Deployment

8.3 China Workflow Systems Market

8.3.1 China Workflow Systems Market, By Application

8.3.2 China Workflow Systems Market, By Component

8.3.3 China Workflow Systems Market, By Deployment

8.4 India Workflow Systems Market

8.4.1 India Workflow Systems Market, By Application

8.4.2 India Workflow Systems Market, By Component

8.4.3 India Workflow Systems Market, By Deployment

8.5 Republic of Korea Workflow Systems Market

8.5.1 Republic of Korea Workflow Systems Market, By Application

8.5.2 Republic of Korea Workflow Systems Market, By Component

8.5.3 Republic of Korea Workflow Systems Market, By Deployment

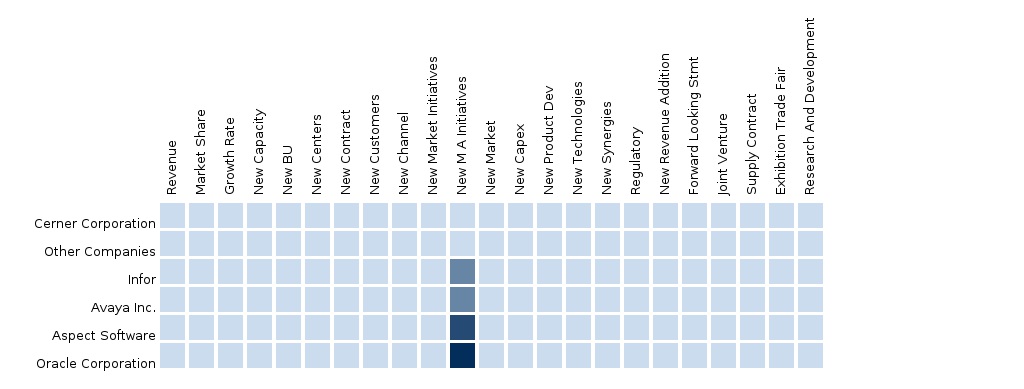

9 Asian Workflow Systems Market: Competitive Landscape (Page No. - 61)

9.1 Workflow Systems Market: Company Share Analysis

9.2 Company Presence in Workflow Systems Market, By Application

9.3 Collaborations

9.4 New Product Development

9.5 Partnerships

9.6 Acquisitions

10 Company Profiles (Page No. - 67)

10.1 Aspect Software Group Holding Ltd.

10.1.1 Overview

10.1.2 Key Financials

10.1.3 Product Offerings

10.1.4 Related Developments

10.2 Avaya Inc.

10.2.1 Overview

10.2.2 Key Operations Data

10.2.3 Key Financials

10.2.4 Product Offerings

10.2.5 Related Developments

10.3 Cerner Corporation

10.3.1 Overview

10.3.2 Key Operations Data

10.3.3 Key Financials

10.3.4 Product and Service Offerings

10.3.5 Related Developments

10.4 Infor

10.4.1 Overview

10.4.2 Key Financials

10.4.3 Product Offerings

10.4.4 Related Developments

10.5 Oracle Corporation

10.5.1 Overview

10.5.2 Key Operations Data

10.5.3 Key Financials

10.5.4 Product and Service Offerings

10.5.5 Related Developments

10.6 IBM Corporation

10.6.1 Overview

10.6.2 Key Operations Data

10.6.3 Key Financials

10.6.4 Product Offerings

10.6.5 Related Developments

10.7 GE Healthcare

10.7.1 Overview

10.7.2 Key Operations Data

10.7.3 Key Financials

10.7.4 Product Offerings

10.7.5 Related Developments

10.8 Mckesson Corporation

10.8.1 Overview

10.8.2 Key Operations Data

10.8.3 Key Financials

10.8.4 Product Offerings

10.9 Siemens Healthcare

10.9.1 Overview

10.9.2 Key Operations Data

10.9.3 Key Financials

10.9.4 Product Offerings

10.9.5 Related Developments

10.10 SAP

10.10.1 Overview

10.10.2 Key Operations Data

10.10.3 Key Financials

10.10.4 Product Offerings

11 Appendix (Page No. - 101)

11.1 Customization Options

11.1.1 Product Analysis

11.1.2 Brand/Product Perception Matrix

11.1.3 Impact Analysis

11.1.4 Porter’s Five Forces Analysis

11.2 Related Reports

11.3 Introducing RT: Real-Time Market Intelligence

11.3.1 RT Snapshots

List of Tables (58 Tables)

Table 1 Asian Workflow Systems Peer Market Size, 2013 (USD MN)

Table 2 Asian Workflow Systems Market: Macroindicators, By Country, 2014 (USD MN)

Table 3 Asian Workflow Systems Market: Comparison With Parent Market (Healthcare Payer IT), 2013 – 2019 (USD MN)

Table 4 Asian Workflow Systems Market: Drivers and Inhibitors

Table 5 Asian Workflow Systems Market, By Application, 2013 - 2019 (USD MN)

Table 6 Asian Workflow Systems Market, By Component, 2013 - 2019 (USD MN)

Table 7 Asian Workflow Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 8 Asian Workflow Systems Market, By Country, 2013 - 2019 (USD MN)

Table 9 Asian Workflow Systems Market, By Application, 2013 - 2019 (USD MN)

Table 10 Asian Workflow Systems in Claims Management, By Country, 2013 - 2019 (USD MN)

Table 11 Asian Workflow Systems in Pharmacy Audit & Analysis, By Country, 2013 - 2019 (USD MN)

Table 12 Asian Workflow Systems in Fraud Detection Market, By Country, 2013 - 2019 (USD MN)

Table 13 Asian Workflow Systems in Customer Relationship Management Market, By Country, 2013 - 2019 (USD MN)

Table 14 Asian Workflow Systems Market, By Component, 2013 - 2019 (USD MN)

Table 15 Asian Workflow Systems Market: Component Comparison With the Parent Market, 2013–2019 (USD MN)

Table 16 Asian Workflow Systems in Services Market, By Country, 2013–2019 (USD MN)

Table 17 Asian Workflow Systems in Software Market, By Country, 2013–2019 (USD MN)

Table 18 Asian Workflow Systems in Hardware Market, By Country, 2013–2019 (USD MN)

Table 19 Asian Workflow Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 20 Asian Workflow Systems Market: Deployment Comparison With Parent Market, 2013–2019 (USD MN)

Table 21 Asian Workflow Systems in Web-Based Market, By Country, 2013–2019 (USD MN)

Table 22 Asian Workflow Systems in On-Premise Market, By Country, 2013–2019 (USD MN)

Table 23 Asian Workflow Systems in Cloud-Based Market, By Country, 2013–2019 (USD MN)

Table 24 Asian Workflow Systems Market, By Country, 2013 - 2019 (USD MN)

Table 25 Japan Workflow Systems Market, By Application, 2013-2019 (USD MN)

Table 26 Japan Workflow Systems Market, By Component, 2013 - 2019 (USD MN)

Table 27 Japan Workflow Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 28 China Workflow Systems Market, By Application, 2013 - 2019 (USD MN)

Table 29 China Workflow Systems Market, By Component, 2013 - 2019 (USD MN)

Table 30 China Workflow Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 31 India Workflow Systems Market, By Application, 2013 - 2019 (USD MN)

Table 32 India Workflow Systems Market, By Component, 2013 - 2019 (USD MN)

Table 33 India Workflow Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 34 Republic of Korea Workflow Systems Market, By Application, 2013 - 2019 (USD MN)

Table 35 Republic of Korea Workflow Systems Market, By Component, 2013 - 2019 (USD MN)

Table 36 Republic of Korea Workflow Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 37 Asian Workflow Systems Market: Company Share Analysis, 2014 (%)

Table 38 Asian Workflow Systems Market: Collaborations

Table 39 Asian Workflow Systems Market: New Product Development

Table 40 Asian Workflow Systems Market: Partnerships

Table 41 Asian Workflow Systems Market: Acquisitions

Table 42 Avaya Inc.: Key Operations Data, 2012 - 2014 (USD MN)

Table 43 Avaya Inc.: Key Financial Data, 2012 - 2014 (USD MN)

Table 44 Cerner Corporation: Key Operations Data, 2011 - 2013 (USD MN)

Table 45 Cerner Corporation: Key Financials, 2011 - 2013 (USD MN)

Table 46 Infor: Key Financials, 2012 - 2014 (USD MN)

Table 47 Oracle Corporation: Key Operations Data, 2012 - 2014 (USD MN)

Table 48 Oracle Corporation: Key Financials, 2012 - 2014 (USD MN)

Table 49 IBM Corporation: Key Operations Data, 2011 - 2013 (USD MN)

Table 50 IBM Corporation: Key Financials, 2011 - 2013 (USD MN)

Table 51 General Electric Company: Key Operations Data, 2011-2013 (USD MN)

Table 52 GE Healthcare: Key Financials, 2011-2013 (USD MN)

Table 53 Mckesson Corporation: Key Operations Data, 2012-2014 (USD MN)

Table 54 Mckesson Corporation: Key Financials, 2012-2014 (USD MN)

Table 55 Siemens Healthcare: Key Operations Data, 2012 - 2014 (USD MN)

Table 56 Siemens Healthcare: Key Financials, 2012 - 2014 (USD MN)

Table 57 SAP: Key Operations Data, 2012 - 2014 (USD MN)

Table 58 SAP: Key Financials, 2012 - 2014 (USD MN)

List of Figures (50 Figures)

Figure 1 Asian Workflow Systems Market: Segmentation & Coverage

Figure 2 Workflow Systems Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macroindicator-Based Approach

Figure 7 Workflow Systems Market Snapshot

Figure 8 Asian Workflow Systems Market, By Application, 2014 - 2019 (USD MN)

Figure 9 Asian Workflow Systems in Claims Management, By Country, 2013 - 2019 (USD MN)

Figure 10 Asian Workflow Systems in Pharmacy Audit & Analysis, By Country, 2013 - 2019 (USD MN)

Figure 11 Asian Workflow Systems in Fraud Detection, By Country, 2013 - 2019 (USD MN)

Figure 12 Asian Workflow Systems in Customer Relationship Management, By Country, 2013 - 2019 (USD MN)

Figure 13 Asian Workflow Systems Market, By Component, 2013 - 2019 (USD MN)

Figure 14 Asian Workflow Systems Market: Component Comparison With the Healthcare Payer IT Market, 2013–2019(USD MN)

Figure 15 Asian Workflow Systems in Services Market, By Country, 2013–2019 (USD MN)

Figure 16 Asian Workflow Systems in Software Market, By Country, 2013 - 2019 (USD MN)

Figure 17 Asian Workflow Systems in Hardware Market, By Country, 2013 - 2019 (USD MN)

Figure 18 Asian Workflow Systems Market, By Deployment, 2013 - 2019 (USD MN)

Figure 19 Asian Workflow Systems Market: Deployment Comparison With the Healthcare Payer Market, 2013–2019

(USD MN)

Figure 20 Asian Workflow Systems in Web-Based Market, By Country, 2013–2019 (USD MN)

Figure 21 Asian Workflow Systems in On-Premise Market, By Country, 2013 - 2019 (USD MN)

Figure 22 Asian Workflow Systems in Cloud-Based Market, By Country, 2013 - 2019 (USD MN)

Figure 23 Asian Workflow Systems Market: Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 24 Japan Workflow Systems Market Overview, 2014 & 2019 (%)

Figure 25 Japan Workflow Systems Market, By Application, 2013-2019 (USD MN)

Figure 26 Japan Workflow Systems Market, By Component, 2013 - 2019 (USD MN)

Figure 27 Japan Workflow Systems Market, By Deployment, 2013 - 2019 (USD MN)

Figure 28 China Workflow Systems Market Overview, 2014 & 2019 (%)

Figure 29 China Workflow Systems Market, By Application, 2013-2019 (USD MN)

Figure 30 China Workflow Systems Market, By Component, 2013-2019 (USD MN)

Figure 31 China Workflow Systems Market, By Deployment, 2013-2019 (USD MN)

Figure 32 India Workflow Systems Market Overview, 2014 & 2019(%)

Figure 33 India Workflow Systems Market, By Application, 2013-2019 (USD MN)

Figure 34 India Workflow Systems Market, By Component, 2013-2019 (USD MN)

Figure 35 India Workflow Systems Market, By Deployment, 2013-2019 (USD MN)

Figure 36 Republic of Korea Workflow Systems Market Overview, 2014 & 2019 (%)

Figure 37 Republic of Korea Workflow Systems Market, By Application, 2013-2019 (USD MN)

Figure 38 Republic of Korea Workflow Systems Market, By Component, 2013-2019 (USD MN)

Figure 39 Republic of Korea Workflow Systems Market, By Deployment, 2013-2019 (USD MN)

Figure 40 Asian Workflow Systems Market: Company Share Analysis, 2014 (%)

Figure 41 Workflow Systems: Company Product Coverage, By Application, 2013

Figure 42 Avaya Inc. Revenue Mix, 2014 (%)

Figure 43 Cerner Corporation Revenue Mix, 2013 (%)

Figure 44 Infor Revenue Mix, 2014 (%)

Figure 45 Oracle Corporation, Revenue Mix, 2014 (%)

Figure 46 IBM Corporation: Revenue Mix 2013 (%)

Figure 47 General Electric Company Revenue Mix, 2013 (%)

Figure 48 Mckesson Corporation Revenue Mix, 2014 (%)

Figure 49 Siemens Healthcare Revenue Mix, 2014 (%)

Figure 50 SAP Revenue Mix, 2014 (%)

Workflow management systems comprise information management, document management, automation of work procedures, comprehensive conceptualization, and model building of business operations. The workflow management solutions sequence and mechanize multifaceted business processes, and encourage business process re-engineering.

The Asian healthcare workflow systems market was valued at $1,188.9 million in 2014, and is projected to reach $1,601.4 million by 2019, at a CAGR of 6.1% from 2014 to 2019.

In this report, the workflow systems market is segmented on the basis of application, deployment, component, and region. The market based on the application, is segmented into claims management, pharmacy audit and analysis, customer relationship management, and fraud detection. Based on the deployment, the market is categorized into on-premise systems, web-based systems, and cloud-based systems. Based on the component, the market is segmented into hardware, software, and services.

Among applications, the claims management segment dominated the market and is estimated to reach a value of $647.7 million by 2019. Among components, the service segment (Healthcare IT) dominated the market and is projected to reach a value of $568.7 million by 2019. Among deployments, the web-based systems segment dominated the market and is projected to reach a value of $1004.9 million by 2019. The market in Japan is the key market for workflow systems in this market.

Key players in the market are Aspect Software Group Holding Ltd. (U.S.), Avaya Inc. (U.S.), Cerner Corporation (U.S.), Oracle Corporation (U.S.), among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Health Pouplation- The increasing number of healthcare and medical care delivery facilities in the region and the resultant demand for payer IT systems for efficient administration, communication, and accounting, are among the drivers of the North American healthcare payer IT market. This market report provides insights into the market values; market drivers, restraints, & opportunities; competitive landscape, and market developments & opportunities. The U.S., Canada, and Mexico are the countries that have been considered for this extensive market analysis. |

Upcoming |

|

European Healthcare Payer IT The European Healthcare Payer IT market has kep players that encompass Cerner Corporation, McKesson Corporation, Allscripts, Epic Systems, and GE Healthcare. |

Upcoming |

|

Asian Healthcare Payer IT The Asian healthcare payer IT market was valued at $1,561.0 million in 2013, and is expected to grow at a CAGR of 5.8% from 2013 to 2018. In this report, the Asian payer IT market is segmented on the basis of deployment, component, product, type, and end user. A deep-dive analysis of the top players of this domain has been provided in this report. |

Upcoming |