The Asia-Pacific oilfield communication market is projected to grow from $350.6 million in 2013 to $454.7million by 2019, at a CAGR of 5.1% for the given period. The expansion of the existing oil industry is the key driver for the oilfield communications market in this region.

The Asia-Pacific region comprises the world’s second-largest population. The increase in vehicular and air traffic in this region has led to an increase in the consumption of oil. Companies engaged in the process of oil exploration and production are expanding their footprints in this emerging market. The need of faster connectivity and real time data transfer has increased the oilfield communication market potential in this region. Technological advancements, high standard of living, and rapid consumption of gas and petroleum resources are the key drivers for the oilfield communication market in this region.

The market research report consists of the current and future trends of the oilfield communication market. It also presents a detailed analysis and market sizing and forecast for the emerging submarkets of oilfield communication.

The report is inclusive of the competitive landscape and profile of the leading oilfield communication solution providing companies. Various developments undertaken by these companies in order to broaden their portfolio and market presence have also been elaborated upon. Upcoming opportunities in the market have also been identified for maximum competitive advantage of the market players.

The segments of this market are based on the oilfield communication solutions, services, communication network technologies, and field site communication market.

1. INTRODUCTION

1.1 Objective of the Study

1.2 Market Definition and Scope of the Study

1.3 Markets Covered

1.4 Stakeholders

2. RESEARCH METHODOLOGY

2.1 Integrated Ecosystem of Oilfield Communication

2.2 Arriving at the Oilfield Communication Market Size

2.2.1 Top-down Approach

2.2.2 Bottom-up Approach

2.2.3 Demand Side Analysis

2.2.4 Macro Indicators

2.3 Assumptions

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

4.1 Introduction

4.2 Comparison with Parent Market

4.3 Market Drivers and Inhibitors

4.4 Demand Side Analysis

4.5 Vendor Side Analysis

5. ASIA-PACIFIC OILFIELD COMMUNICATIONS: MARKET SIZE AND FORECAST, BY SOLUTIONS

5.1 Introduction

5.2 Upstream Communication Solutions

5.2.1 Overview

5.2.2 Market Size and Forecast

5.2.3 Operational Data Communication Solutions

5.2.3.1 Overview

5.2.3.2 Market Size and Forecast

5.2.3.2.1 Asset Performance Communication

5.2.3.2.1.1 Overview

5.2.3.2.1.2 Market Size and Forecast

5.2.3.2.2 M2M Communication

5.2.3.2.2.1 Overview

5.2.3.2.2.2 Market Size and Forecast

5.2.3.2.3 Real-Time Drilling and Production Data Communication

5.2.3.2.3.1 Overview

5.2.3.2.3.2 Market Size and Forecast

5.2.4 Integrated Communication Technology Solution

5.2.4.1 Overview

5.2.4.2 Market Size and Forecast

5.2.4.2.1 Unified Communication Solutions

5.2.4.2.1.1 Overview

5.2.4.2.1.2 Market Size and Forecast

5.2.4.2.2 VOIP Solutions

5.2.4.2.2.1 Overview

5.2.4.2.2.2 Market Size and Forecast

5.2.4.2.3 Video Conferencing

5.2.4.2.3.1 Overview

5.2.4.2.3.2 Market Size and Forecast

5.2.4.2.4 Two-Way Radio Communication

5.2.4.2.4.1 Overview

5.2.4.2.4.2 Market Size and Forecast

5.2.4.2.5 Wireless Intercom System

5.2.4.2.5.1 Overview

5.2.4.2.5.2 Market Size and Forecast

5.2.4.2.6 On-Site Network Connectivity Solutions

5.2.4.2.6.1 Overview

5.2.4.2.6.2 Market Size and Forecast

5.2.4.2.7 WiMAX

5.2.4.2.7.1 Overview

5.2.4.2.7.2 Market Size and Forecast

5.2.4.2.8 Wi-Fi Hotspot

5.2.4.2.8.1 Overview

5.2.4.2.8.2 Market Size and Forecast

5.2.4.2.9 Remote Field WAN and LAN

5.2.4.2.9.1 Overview

5.2.4.2.9.2 Market Size and Forecast

5.3 Midstream Communication Solutions

5.3.1 Overview

5.3.2 Market Size and Forecast

5.3.2.1 Pipeline Supervisory Control and Data Acquisition (SCADA)

5.3.2.1.1 Overview

5.3.2.1.2 Market Size and Forecast

5.3.2.2 Fleet Management Communication

5.3.2.2.1 Overview

5.3.2.2.2 Market Size and Forecast

5.3.2.3 Unified Communication For Pipeline Transportation

5.3.2.3.1 Overview

5.3.2.3.2 Market Size and Forecast

5.4 Downstream Communication Solutions

5.4.1 Overview

5.4.2 Market Size and Forecast

5.4.2.1 Oilfield To Control Center Data Communication

5.4.2.1.1 Overview

5.4.2.1.2 Market Size and Forecast

5.4.2.2 Wireless Communication For Intelligent Refineries

5.4.2.2.1 Overview

5.4.2.2.2 Market Size and Forecast

5.5 Asia-Pacific Oilfield Communication Market Sneak View, By Solutions

6. ASIA-PACIFIC OILFIELD COMMUNICATIONS MARKET SIZE ANALYSIS AND FORECAST, BY COMMUNICATION NETWORK TECHNOLOGY

6.1 Introduction

6.2 Cellular Communication Network

6.2.1 Overview

6.2.2 Market Size and Forecast

6.3 Very Small Aperture Terminal (VSAT) Communication Network

6.3.1 Overview

6.3.2 Market Size and Forecast

6.3.3 Market Size and Forecast, By Network Type

6.3.3.1 Managed VSAT Network

6.3.3.1.1 Overview

6.3.3.1.2 Market Size and Forecast

6.3.3.2 Fixed VSAT Network

6.3.3.2.1 Overview

6.3.3.2.2 Market Size and Forecast

6.3.3.3 Mobile VSAT Network

6.3.3.3.1 Overview

6.3.3.3.2 Market Size and Forecast

6.3.4 Market Size and Forecast By Band Type

6.3.4.1 L–Band

6.3.4.1.1 Overview

6.3.4.1.2 Market Size and Forecast

6.3.4.2 HTS

6.3.4.2.1 Overview

6.3.4.2.2 Market Size and Forecast

6.3.4.3 KU–Band

6.3.4.3.1 Overview

6.3.4.3.2 Market Size and Forecast

6.3.4.4 C–Band

6.3.4.4.1 Overview

6.3.4.4.2 Market Size and Forecast

6.4 Fiber Optic Based Communication Network

6.4.1 Overview

6.4.2 Market Size and Forecast

6.5 Microwave Communication Network

6.5.1 Overview

6.5.2 Market Size and Forecast

6.6 Tetra Network

6.6.1 Overview

6.6.2 Market Size and Forecast

6.7 Asia-Pacific Oilfield Communication Market Sneak View, By Communication Network

7. ASIA-PACIFIC OILFIELD COMMUNICATIONS MARKET SIZE ANALYSIS AND FORECAST, BY FIELD SITE

7.1 Introduction

7.2 Onshore Communications Market

7.2.1 Overview

7.2.2 Market Size and Forecast

7.3 Offshore Communications Market

7.3.1 Overview

7.3.2 Market Size and Forecast

7.4 Asia-Pacific Oilfield Communication Market Sneak View, By Field Site

8. ASIA-PACIFIC OILFIELD COMMUNICATIONS MARKET SIZE ANALYSIS AND FORECAST, BY SERVICES

8.1 Introduction

8.2 Professional Services

8.2.1 Overview

8.2.2 Market Size and Forecast

8.3 Cloud Hosting Services

8.3.1 Overview

8.3.2 Market Size and Forecast

8.4 System Integration Services

8.4.1 Overview

8.4.2 Market Size and Forecast

8.5 Asia-Pacific Oilfield Communication Market Sneak View, By Services

9. ASIA-PACIFIC OILFIELD COMMUNICATIONS MARKET SIZE ANALYSIS AND FORECAST, BY GEOGRAPHY

9.1 Research Methodology

9.2 Introduction

9.3 Vendor Side Analysis

9.4 China, Oilfield Communication

9.4.1 China Oilfield Communication Market, By Solutions

9.4.2 China Oilfield Communication Market Size And Forecast, By Communication Network

9.4.3 China Oilfield Communication Market Size And Forecast, By Field Site

9.4.4 China Oilfield Communication Market Size and Forecast, By Services

9.5 India, Oilfield Communication

9.5.1 India Oilfield Communication Market, By Solutions

9.5.2 India Oilfield Communication Market Size And Forecast, By Communication Network

9.5.3 India Oilfield Communication Market Size And Forecast, By Field Site

9.5.4 India Oilfield Communication Market Size And Forecast, By Services

9.6 Rest of Asia-Pacific Oilfield Communication

9.6.1 Rest of Asia-Pacific Oilfield Communication Market, By Solutions

9.6.2 Rest of Asia-Pacific Market Size and Forecast, By Communication Network

9.6.3 Rest of Asia-Pacific Market Size and Forecast, By Field Site

9.6.4 Rest of Asia-Pacific Market Size and Forecast, By Services

9.7 Asia-Pacific Oilfield Communication Market Sneak View, By Geography

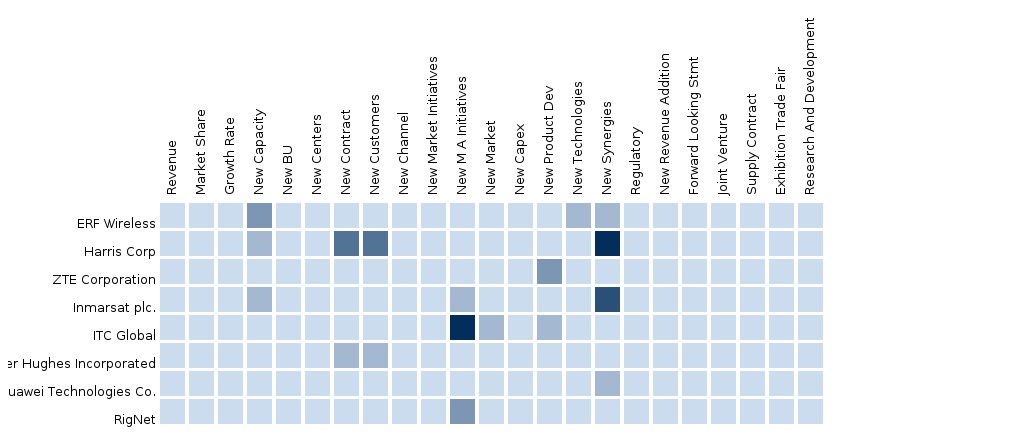

10. ASIA-PACIFIC OILFIELD COMMUNICATIONS MARKET, BY COMPANY

10.1 Competitive Landscape

10.1.1 Mergers and Acquisitions

10.1.2 Expansions

10.1.3 Investments

10.1.4 Joint Ventures

10.2 Alcatel-Lucent International

10.2.1 Overview

10.2.2 Products & Services

10.2.3 Strategies & Insights

10.2.4 Recent Developments

10.2.5 MMM View

10.3 ERF Wireless, Inc.

10.3.1 Overview

10.3.2 Products & Services

10.3.3 Strategies & Insights

10.3.4 Recent Developments

10.3.5 MMM View

10.4 Harris Caprock Communications, Inc.

10.4.1 Overview

10.4.2 Products & Services

10.4.3 Strategies & Insights

10.4.4 Recent Developments

10.4.5 MMM View

10.5 Hermes Data Communications International Ltd.

10.5.1 Overview

10.5.2 Products & Services

10.5.3 Strategies & Insights

10.5.4 Recent Developments

10.5.5 MMM View

10.6 Huawei Technologies Co., Ltd.

10.6.1 Overview

10.6.2 Products & Services

10.6.3 Strategies & Insights

10.6.4 Recent Developments

10.6.5 MMM View

10.7 Hughes Network Systems LLC

10.7.1 Overview

10.7.2 Products & Services

10.7.3 Strategies & Insights

10.7.4 MMM View

10.8 Inmarsat PLC

10.8.1 Overview

10.8.2 Products & Services

10.8.3 Strategies & Insights

10.8.4 Recent Developments

10.8.5 MMM View

10.9 ITC Global, Inc.

10.9.1 Overview

10.9.2 Products & Services

10.9.3 Strategies & Insights

10.9.4 Recent Developments

10.9.5 MMM View

10.10 Redline Communications, Inc.

10.10.1 Overview

10.10.2 Products & Services

10.10.3 Strategies & Insights

10.10.4 Recent Developments

10.10.5 MMM View

10.11 Rignet, Inc.

10.11.1 Overview

10.11.2 Products & Services

10.11.3 Strategies & Insights

10.11.4 Recent Developments

10.11.5 MMM View

11. APPENDIX

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement