Asia-Pacific Clinical Chemistry Analyzer Market by Product (Semi-Automated Clinical Chemistry, Fully-Automated Clinical Chemistry Analyzer), by Technology (Dry Chemistry, Wet Chemistry) - Analysis and Forecast to 2019

Clinical chemistry is the application of chemical, molecular, and cellular concepts and techniques to understand and evaluate the human health. Routine tests including testing for blood albumin, ALT/SGPT, ammonia, blood gases, and calcium and creatinine levels are required before undergoing advanced tests. Clinical chemistry tests thus form the center stage of the IVD market. The significant changes in this sector have been brought about as a result of the convergence of system engineering, automation, and IT technology. Thus, the new technologies have enabled a better understanding of disease processes.

The clinical chemistry market is expanding, consolidating, and becoming highly competitive with a myriad of opportunities for various new instruments, reagents, calibrators, and other systems. The largest segment of clinical chemistry is the general chemistry testing of the clinical chemistry market.

The introduction of user-friendly automated devices has minimized the human efforts and increased the efficiency of diagnostic procedures. For instance, the Ortho Clinical Vitros 350 Chemistry System accommodates up to 40 samples in one of its four trays, allowing laboratories to effectively meet the testing needs of the patient population. These systems, with their enhanced software and elaborate menu, are responsible for the speeding up of the treatment process at lower costs.

The key players of this market are Siemens, Abbott Laboratories, Danaher Corporation, Ortho Clinical Diagnostics, bioMerieux SA, Bio-rad, Alere, Becton Dickinson and Company, and Thermo Fisher Scientific.

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objective of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of Clinical Chemistry Analyzer Market

2.2 Arriving At the Clinical Chemistry Analyzer Market Size

2.3 Top Down Approach

2.3.1 Bottom-Up Approach

2.3.2 Macro Indicator-Based Approach

2.4 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 20)

4.1 Clinical Chemistry Analyzer Market: Comparison With Parent Market

4.2 Market Drivers and Inhibitors

4.3 Key Market Dynamics

5 Asia-Pacific Clinical Chemistry Analyzer Market, By Type (Page No. - 26)

5.1 Introduction

5.2 Asia-Pacific Clinical Chemistry Analyzer Market, By Type

5.3 Asia-Pacific Clinical Chemistry Analyzer , By Geography

6 Asia-Pacific Clinical Chemistry Analyzer Market, By Technology (Page No. - 33)

6.1 Asia-Pacific Wet Clinical Chemistry Analyzer Market, By Geography

6.2 Asia-Pacific Dry Clinical Chemistry Analyzer Market, By Geography

7 Asia-Pacific Clinical Chemistry Analyzer, By Geography (Page No. - 37)

7.1 Introduction

7.2 Japan Clinical Chemistry Market

7.2.1 Japan Clinical Chemistry Analyzer Market, By Type

7.3 China Clinical Chemistry Analyzer Market

7.3.1 China Clinical Chemistry Analyzer Market, By Type

7.4 India Clinical Chemistry Analyzer Market

7.4.1 Indian Clinical Chemistry Analyzer Market, By Type

7.5 Republic of Korea Clinical Chemistry Analyzer Market, By Type

7.5.1 Republic of Korea Clinical Chemistry Analyzer Market, By Type

7.6 Australia Clinical Chemistry Analyzer Market

7.6.1 Australia Clinical Chemistry Analyzer Market, By Type

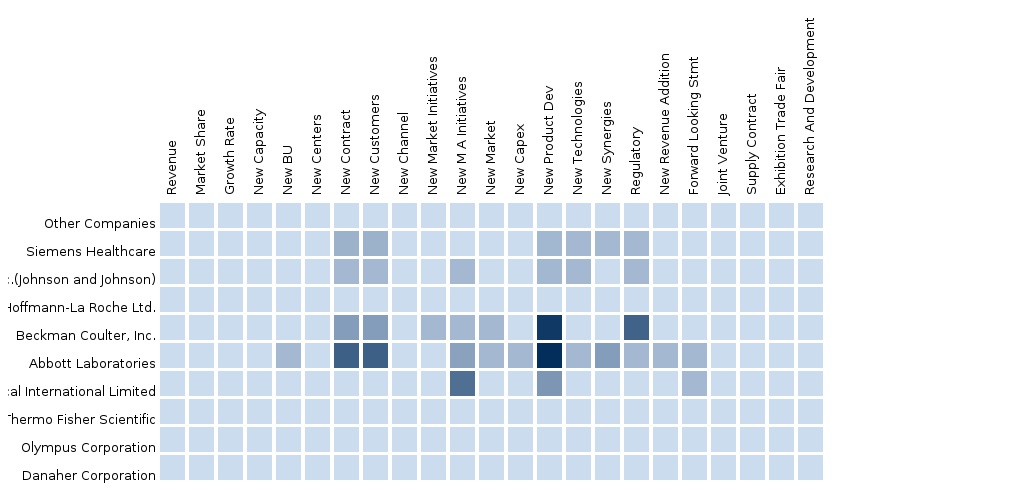

8 Clinical Chemistry Analyzer Market: Competitive Landscape (Page No. - 53)

8.1 Clinical Chemistry Analyzer Market: Company Share Analysis

8.2 Company Presence in Clinical Chemistry Analyzer Market, By Technology

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 Investments

9 Clinical Chemistry Market, By Company (Page No. - 57)

9.1 Hitachi High Technology Corp.

9.1.1 Overview

9.1.2 Key Financials

9.1.3 Product and Service Offerings

9.1.4 Related Developments

9.2 F.Hoffmann La-Roche Ltd.

9.2.1 Overview

9.2.2 Key Financials

9.2.3 Product and Service Offerings

9.2.4 Related Developments

9.3 Beckman Coulter Inc.

9.3.1 Overview

9.3.2 Key Financials

9.3.3 Product and Service Offerings

9.3.4 Related Developments

9.4 Orthoclinical Diagnostics Inc.

9.4.1 Overview

9.4.2 Key Financials

9.4.3 Product and Service Offerings

9.4.4 Related Developments

9.5 Siemens AG

9.5.1 Overview

9.5.2 Key Financials

9.5.3 Product and Service Offerings

9.5.4 Related Developments

9.6 Abbott Laboratories

9.6.1 Overview

9.6.2 Key Financials

9.6.3 Product and Service Offerings

9.6.4 Related Developments

9.7 Thermosfisher Scientifics Inc.

9.7.1 Overview

9.7.2 Key Financials

9.7.3 Product and Service Offerings

9.7.4 Related Developments

10 Appendix (Page No. - 75)

10.1 Customization Options

10.1.1 Technical Analysis

10.2 Introducing RT: Real Time Market Intelligence

List of Tables (33 Tables)

Table 1 Asia-Pacific Clinical Chemistry Analyzer Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 2 Asia-Pacific Clinical Chemistry Analyzer Market: Drivers and Inhibitors

Table 3 Asia-Pacific Clinical Chemistry Analyzer Market, By Type, 2013 – 2019 (USD MN)

Table 4 Asia-Pacific Wet Clinical Chemistry Analyzer Market, By Geography, 2014 (USD MN)

Table 5 Asia-Pacific Dry Clinical Chemistry Analyzer Market, By Geography, 2014 (USD MN)

Table 6 Asia-Pacific Clinical Chemistry Analyzer Market: Type Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 7 Asia-Pacific Clinical Chemistry Analyzer, By Geography, 2013 – 2019 (USD MN)

Table 8 Clinical Chemistry Analyzer in Fully Automated Clinical Chemistry Analyzer, By Geography, 2013 – 2019 (USD MN)

Table 9 Clinical Chemistry Analyzer in Semi-Automated Segment, By Geography, 2013 – 2019 (USD MN)

Table 10 Asia-Pacific Clinical Chemistry Analyzer Market, By Technology, 2013 – 2019 (USD MN)

Table 11 Asia-Pacific Wet Clinical Chemistry Analyzer Market, By Geography, 2013 - 2019 (USD MN)

Table 12 Asia-Pacific Dry Clinical Chemistry Market, By Geography, 2013 - 2019 (USD MN)

Table 13 Japan Clinical Chemistry Analyzer Market, By Type, 2013 - 2019 (USD MN)

Table 14 Japan Clinical Chemistry Analyzer Market, By Type, 2013 - 2019 (Units)

Table 15 China Clinical Chemistry Analyzer Market, By Type, 2013 – 2019 (USD MN)

Table 16 China Clinical Chemistry Analyzer Market, By Type, 2013 - 2019 (Units)

Table 17 Indian Clinical Chemistry Analyzer : Market, By Type, 2013 - 2019 (USD MN)

Table 18 India Clinical Chemistry Analyzer Market, By Type, 2013 - 2019 (Units)

Table 19 Republic of Korea Clinical Chemistry Analyzer Market, By Type, 2013 - 2019 (USD MN)

Table 20 Republic of Korea Clinical Chemistry Analyzer Market, By Type, 2013 - 2019 (Units)

Table 21 Australia Clinical Chemistry Analyzer Market, By Type, 2013 – 2019 (USD MN)

Table 22 Australia Clinical Chemistry Analyzer : Market, By Type, 2013 - 2019 (Units)

Table 23 Clinical Chemistry Analyzer Market: Company Share Analysis, 2014(%)

Table 24 Asia-Pacific Clinical Chemistry Analyzer Market: Mergers & Acquisitions

Table 25 Apac Clinical Chemistry Analyzer Market: Expansions

Table 26 Apac Clinical Chemistry Analyzer Market: Investments

Table 27 Hitachi High Technology Corp.Holdings, Inc.: Key Financials, 2011 - 2013 (USD MN)

Table 28 F.Hoffmann La-Roche Ltd..: Key Financials, 2012 - 2014 (USD MN)Segments

Table 29 Beckman Coulter Inc..: Key Financials, 2011 - 2013 (USD MN)

Table 30 Orthoclinical Diagnostics Inc.: Key Financials, 2009 - 2013 (USD MN)Segments

Table 31 Siemens Ag: Key Financials, 2011 - 2013 (USD MN)

Table 32 Abbott Laboratories: Key Financials, 2011- 2013 (USD MN)

Table 33 Thermofisher Scientific Inc: Key Financials, 2011- 2013 (USD MN)

List of Figures (35 Figures)

Figure 1 Asia-Pacific Clinical Chemistry Analyzer Market: Segmentation & Coverage

Figure 2 Research Methodology

Figure 3 Bottom-Up Approach

Figure 4 Macro Indicator-Based Approach

Figure 5 Asia-Pacific Clinical Chemistry Analyzer Market Snapshot

Figure 6 Asia-Pacific Clinical Chemistry Analyzer, By Geography, 2014

Figure 7 Asia-Pacific Wet Clinical Chemistry Analyzer, By Geography, 2014

Figure 8 Asia-Pacific Dry Clinical Chemistry Analyzer, By Geography, 2014

Figure 9 Asia-Pacific Clinical Chemistry Analyzer Market, By Type, 2013 – 2019 (USD MN)

Figure 10 Asia-Pacific Clinical Chemistry Analyzer Market , By Geography, 2013 – 2019 (USD MN)

Figure 11 Asia-Pacific Fully Automated Clinical Chemistry Analyzer Market , By Geography, 2013 - 2019 (USD MN)

Figure 12 Asia-Pacific Semi-Automated Clinical Chemistry Analyzer Segment , By Geography, 2013 - 2019 (USD MN)

Figure 13 Asia-Pacific Clinical Chemistry Analyzer Market, By Technology, 2014–2019 (USD MN)

Figure 14 Asia-Pacific Wet Clinical Chemistry Analyzer Market, By Technology, 2013–2019 (USD MN)

Figure 15 Asia-Pacific Dry Clinical Chemistry Analyzer Market, By Geography, 2013- 2019 (USD MN)

Figure 16 Japan Clinical Chemistry Analyzer Market Overview, 2014 & 2019 (%)

Figure 17 Japan Clinical Chemistry Analyzer Market, By Type, 2013 - 2019 (USD MN)

Figure 18 Japan Clinical Chemistry Analyzer Market Share, By Type, 2014-2019 (%)

Figure 19 China Clinical Chemistry Analyzer Market Overview, 2014 & 2019 (%)

Figure 20 China Clinical Chemistry Analyzer Market, By Type, 2013 – 2019

Figure 21 China Clinical Chemistry Analyzer Market Share, By Type, 2014 – 2019 (%)

Figure 22 India Clinical Chemistry Analyzer Market Overview, 2014 & 2019 (%)

Figure 23 India Clinical Chemistry Analyzer Market Share, By Type, 2014-2019 (%)

Figure 24 Republic of Korea Clinical Chemistry Analyzer Market Overview, 2014 & 2019 (%)

Figure 25 Republic of Korea Clinical Chemistry Analyzer Market Share, By Type, 2014-2019 (%)

Figure 26 Australia Clinical Chemistry Analyzer Market Overview, 2014 & 2019 (%)

Figure 27 Australia Clinical Chemistry Analyzer Market Share, By Type, 2014-2019 (%)

Figure 28 Clinical Chemistry Analyzer Market: Company Share Analysis, 2013 (%)

Figure 29 Clinical Chemistry Analyzer: Company Product Coverage, By Technology, 2014

Figure 30 F.Hoffmann La-Roche Ltd. Revenue Mix, 2013 (%)

Figure 31 Beckman Coulter Revenue Mix, 2013 (%)

Figure 32 Orthoclinical Diagnostics Inc. Revenue Mix, 2013 (%)

Figure 33 Siemens Ag, Revenue Mix, 2014 (%)

Figure 34 Abbott Laboratories: Revenue Mix 2013 (%)

Figure 35 Thermofisher Scientific Inc.: Revenue Mix 2013 (%)

Clinical chemistry is a branch of clinical pathology that deals with the analysis of body fluids and other biochemical tests. It is also known as chemical pathology, clinical biochemistry, or medical biochemistry.

The report defines, describes, and forecasts the Asia-Pacific clinical chemistry analyzers market. It also provides strategic analysis of the key players in this market.

The market has been categorized based on application and type of products as well as on basis of region. On the basis of region, the report is segmented based into Japan, China, India, and the rest of Asia-Pacific.

The Asia-Pacific clinical chemistry instruments market is estimated to grow owing to rapid growth in adoption of point-of-care testing, rise in healthcare spending, increasing awareness regarding preventative healthcare, increasing diabetic population in India, and growth in prevalence of lifestyle diseases. However, high cost of instrument may hinder the growth of this market in APAC.

The Asia-Pacific Clinical Chemistry Instruments/Analyzers market reached a value of $1002.2 million in 2014, which is projected to grow to $1,658.3 million by 2019, at a CAGR of 10.6% between 2014 and 2019.

The key players in the Asia-Pacific Clinical Chemistry Instruments market are Roche Diagnostics (Switzerland), Beckman Coulter (U.S.), Abbott Diagnostics (U.S.), Siemens AG (Germany), Ortho-Clinical Diagnostics (U.S.), Thermo Fisher Scientific (U.S.), Randox Laboratories Ltd. (U.K.), ElitechGroup (France), Mindray (China), and Horiba (Japan).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America In Vitro Diagnostics In 2013, the Americas had the largest market, a 42% share of the Global IVD market, followed by Europe with a 31% share. However, the BRIC countries represent the fastest-growing markets due to the economic growth, the rising number of chronic diseases, and an increasing awareness about the use of IVD tests to control the spread of diseases. Moreover, the economic slowdown, pricing pressures, and high competition in mature countries will compel companies to focus on emerging markets. The report “North American In Vitro Diagnostics Market forecast for 2018 “analyzes the market by 5 segments such as reagents, instruments, techniques, applications and end-users. |

Upcoming |

|

Europe In Vitro Diagnostics In 2013, the Americas had the largest market, a 42% share of the European IVD market, followed by Europe with a 31% share. However, the BRIC countries represent the fastest-growing markets due to the economic growth, the rising number of chronic diseases, and an increasing awareness about the use of IVD tests to control the spread of diseases. Moreover, the economic slowdown, pricing pressures, and high competition in mature countries will compel companies to focus on emerging markets. The report “European In Vitro Diagnostics Market forecast for 2018 “analyzes the market by 5 segments such as reagents, instruments, techniques, applications and end-users. Germany commanded the largest share in European IVD market. |

Upcoming |

|

Asia In Vitro Diagnostics Asian IVD market is growing in double digit and will continue to grow in future. China commanded the largest share in Asian IVD market. The report “Asian In Vitro Diagnostics Market forecast for 2018 “analyzes the market by 5 segments such as reagents, instruments, techniques, applications and end-users. |

Upcoming |