The Asia-Pacific aquafeed market dominates the global aquafeed market and is estimated to grow at a CAGR of 12.4%, in the period 2013 to 2018. Asia-Pacific aquafeed market is in the growth phase due to the increasing demand for aquaculture and seafood in the region. To tap the market potential, companies in the segment are focusing on expansion as their growth strategy.

The aquafeed market is segmented on the basis of type of submarkets.

s and companies. On the basis of submarkets, it has been classified as aquafeed, fishes feed, crustaceans feed, and molluscs feed. The different companies that are part of this market are AFL Shrimp Feed, Alltech Inc., Biomar A/S, Evonik Industries AG, and Gold Coin Holdings.

China dominates the market with a share of more than 55%. The rapid development of aquaculture in the country is improving the food supply and has also generated job opportunities to the people of China. Vietnam and Thailand, with around 25% market share collectively, follow the Asia-Pacific market. Japan and Indonesia collectively account for less than 10% of the market share, where in, Indonesia has ambitious plans to grow in near future. Imports and exports of Japan were affected, as its coastline was damaged in 2011 due to Tohuku earthquake and devastating Tsunami. However, the southern part was not affected by the calamity; therefore Japan’s aquaculture growth is still intact, boosting the aquafeed market.

Tongwei Group (China), Charoen Pokphand (Thailand), Nutreco NV (Netherlands), Archer Daniels Midland Co. (U.S.) are some of the major players in the aquafeed and aquafeed additives market.

Scope of the Report

This research report categorizes the Asia-Pacific Aquafeed market into the following segments:

Aquafeed Market, by Type

- Fishes

- Molluscs

- Crustaceans

- Others

Aquafeed Market, by Aquafeed Additives

- Antibiotics

- Vitamins

- Antioxidants

- Feed Enzymes

- Feed Acidifiers

- Amino Acids

- Others

Aquafeed Market, by Country

- China

- Indonesia

- Japan

- Thailand

- Vietnam

- Others

1.2 Market Segmentation & Coverage

2.1 Integrated Ecosystem of Aquafeed Market

2.2 Arriving At the Aquafeed Market Size

2.2.4 Macro Indicator-Based Approach

4.1 Introduction

4.2 Asia-Pacific Aquafeed Market: Comparison with Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 Aquafeed Market, By Types

5.1 Introduction

5.2 Demand side analysis

5.5 Asia-Pacific Fishes market, by Geography

5.6 Asia-Pacific Crustaceans, by Geography

5.7 Asia-Pacific Molluscs, by Geography

5.8 Asia-Pacific Other Aquafeed, by Geography

6 Aquafeed Market, By Aquafeed Additives

6.1 Introduction

6.2 Asia-Pacific Antibiotics Market, By Geography

6.3 Asia-Pacific Vitamins Market, By Geography

6.4 Asia-Pacific Antioxidants Market, By Geography

6.5 Asia-Pacific Amino Acids Market, By Geography

6.6 Asia-Pacific Feed Enzymes Market, By Geography

6.7 Asia-Pacific Feed Acidifiers Market, By Geography

6.8 Asia-Pacific Other Aquafeed Additives Market, By Geography

6.5 Sneak View: Asia-Pacific Animal Feed Market, By Animal Feed Additives

7 Aquafeed Market, By Geography

7.1 Research Methodology

7.2 Introduction

7.3 China Aquafeed Market

7.3.1 China Aquafeed Market, by Types

7.3.2 China Aquafeed Market, by Aquafeed Additives

7.4 Japan Aquafeed Market

7.4.1 Japan Aquafeed Market, by Types

7.4.2 Japan Aquafeed Market, by Aquafeed Additives

7.5 Indonesia Aquafeed Market

7.5.1 Indonesia Aquafeed Market, by Types

7.5.2 Indonesia Aquafeed Market, by Aquafeed Additives

7.6 Thailand Aquafeed Market

7.6.1 Thailand Aquafeed Market, by Types

7.6.2 Thailand Aquafeed Market, by Aquafeed Additives

7.7 Vietnam Aquafeed Market

7.7.1 Vietnam Aquafeed Market, by Types

7.7.2 Vietnam Aquafeed Market, by Aquafeed Additives

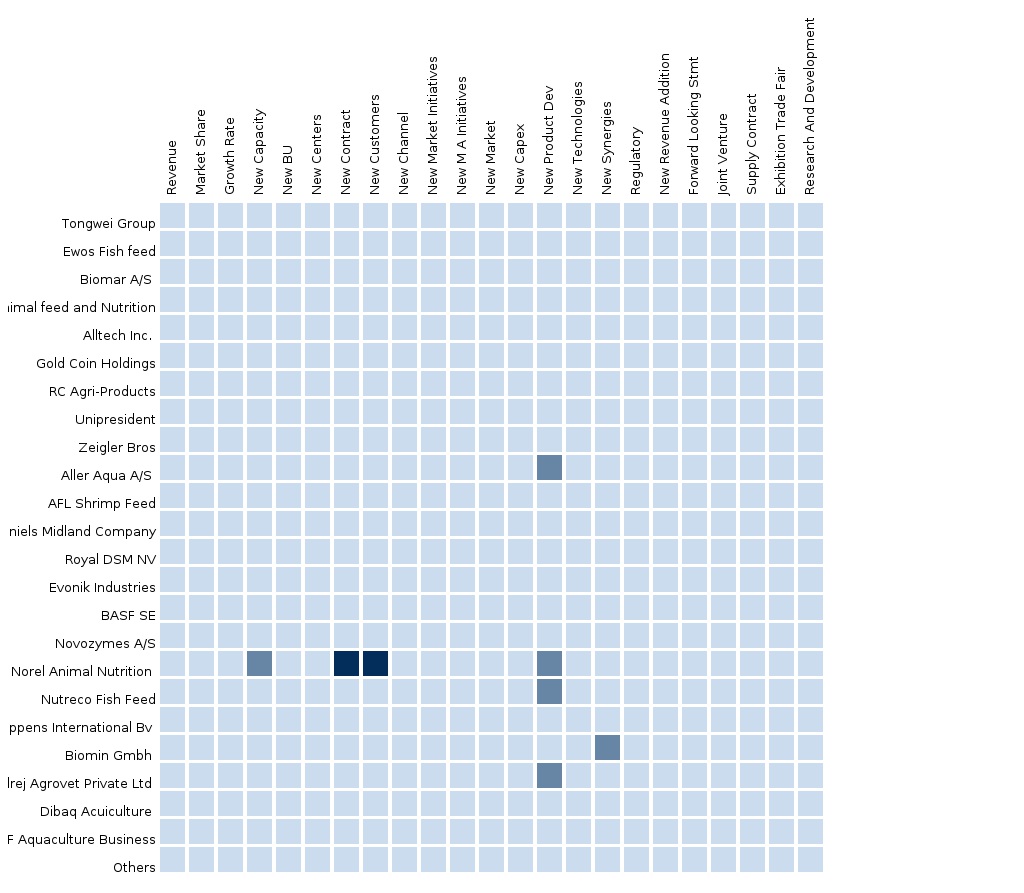

8 Aquafeed Market Competitive Landscape

8.1 Merger &Acquisitions

8.2 Agreements, Alliances, partnerships & Joint Ventures

8.3 New Product Launches

8.4 Expansion & Investment

9 Aquafeed & Aquafeed Additives Market – Asia-Pacific, By Company

9.1 Alltech Inc.

10.1.1 Overview

10.1.2 Key Financials

10.1.3 Product Portfolio

10.1.4 Key Developments

10.1.5 MMM Analysis

10.2 Cargill Inc.

10.2.1 Overview

10.2.2 Key Financials

10.2.3 Product Portfolio

10.2.4 Key Developments

10.2.5 MMM Analysis

10.3 Avanti Feeds Co.

10.3.1 Overview

10.3.2 Key Financials

10.3.3 Product Portfolio

10.3.4 Key Developments

10.3.5 MMM Analysis

10.4 Nutreco NV

10.4.1 Overview

10.4.2 Key Financials

10.4.3 Product Portfolio

10.4.4 Key Developments

10.4.5 MMM Analysis

10.5 Charoen Pokphand Group

10.5.1 Overview

10.5.2 Key Financials

10.5.3 Product Portfolio

10.5.4 Key Developments

10.5.5 MMM Analysis

10.6 Ewos Group

10.6.1 Overview

10.6.2 Key Financials

10.6.3 Product Portfolio

10.6.4 Key Developments

10.6.5 MMM Analysis

10.7 Golden Coin Holdings Co.

10.7.1 Overview

10.7.2 Key Financials

10.7.3 Product Portfolio

10.7.4 Key Developments

10.7.5 MMM Analysis

10.8 Archer Daniels Midland Co.

10.8.1 Overview

10.8.2 Key Financials

10.8.3 Product Portfolio

10.8.4 Key Developments

10.8.5 MMM Analysis

10.9 Novozymes A/S

10.9.1 Overview

10.9.2 Key Financials

10.9.3 Product Portfolio

10.9.4 Key Developments

10.9.5 MMM Analysis

10.10 DSM NV

10.10.1 Overview

10.10.2 Key Financials

10.10.3 Product Portfolio

10.10.4 Key Developments

10.10.5 MMM Analysis

11 Appendix

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Payment Link - Vietnam Feed The Vietnamese feed market is projected to reach a value of USD 9.52 billion by 2021, at a CAGR of 5.6% from 2016 to 2021. The market is driven by factors such as gradual shift from unorganized livestock farming to organized sector and the growing awareness regarding the importance of health and hygiene of livestock. The support provided by the government to foreign companies has also led to the development and growth of this market. |

Aug 2016 |