Automotive Fluid Filter Market by Vehicle Type (Passenger Car, LCV & HCV), by Type (Oil & Fuel Filter), by Fuel Type (Gasoline, Diesel) & Geography - Global Trends & Forecast to 2019

The global automotive fluid filter market is estimated to grow at a CAGR of 7.0% from 2014 to 2019. Asia-Pacific holds the largest market share in the global fluid filter market and is expected to grow at a CAGR of 12.2% during the forecast period. It is followed by North America and Europe.

To analyze the global automotive fluid filter market thoroughly, the report is segmented on the basis of type, vehicle type, and geography. The market is segmented by vehicle type into passenger cars, light commercial vehicles, and heavy commercial vehicles. On the basis of type it has been segmented into oil and fuel. Regions included in the report are Asia-Pacific, North America, Europe, and RoW.

The passenger car segment of the automotive fluid filter market is estimated to grow at the highest CAGR—that is, 7.2%—from 2014 to 2019, followed by the light commercial vehicle and heavy commercial vehicle segment. The fuel filter segment of the fluid filter market is set to grow at the highest CAGR—12.5%—over the forecast period.

The growth of the automotive fluid filter market is driven by factors such as increase in vehicle production, stringent emission norms, increasing adoption of personal cars for daily commutes in emerging economies, and small but efficient filters. A restraining force is longer drain intervals.

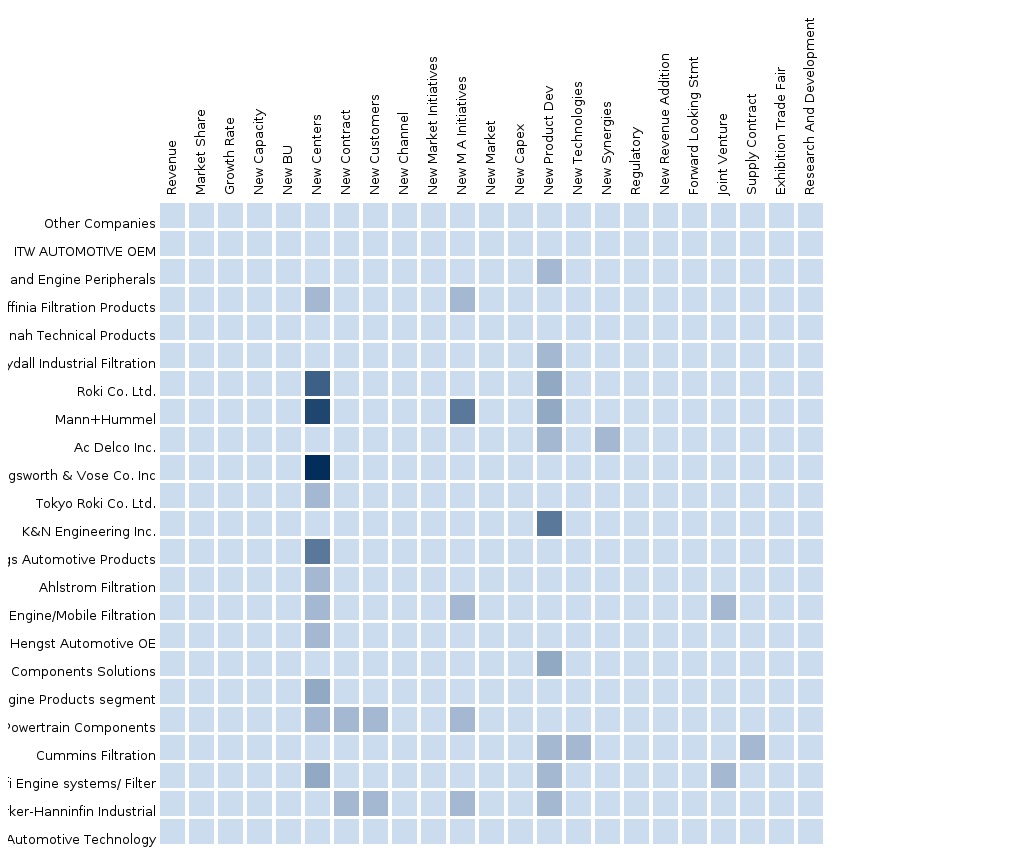

The global automotive fluid market is a competitive market with a number of market players. Currently, the market is estimated to be dominated by Cummins Inc. (U.S.), Mann+Hummel (Germany), and Mahle GMBH (Germany). New product launches and partnerships, agreements, collaborations, joint ventures, supply contacts, investments, and expansions are the key strategies adopted by most market players to achieve growth in the fluid filter market.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of the Fluid Filter Market

2.2 Arriving at the Fluid Filter Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro-Indicator Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 Fluid Filter Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Global Automotive Fluid Filter Market, By Vehicle Type (Page No. - 30)

5.1 Introduction

5.2 Demand Side Analysis

5.3 Passenger Car Fluid Filter Market

5.4 LCV Fluid Filter Market

5.5 HCV Fluid Filter Market

5.6 Sneak View: Fluid Filter Market, By Vehicle Type

6 Global Automotive Fluid Filter Market, By Type (Page No. - 44)

6.1 Introduction

6.2 Global Oil Filter Market

6.1 Global Fuel Filter Market

7 Global Automotive Fluid Filter Market, By Fuel Type (Page No. - 50)

7.1 Introduction

7.2 Gasoline Fluid Filter Market

7.3 Diesel Fluid Filter Market

8 Global Automotive Fluid Filter Market, By Geography (Page No. - 65)

8.1 Introduction

8.2 Asia-Pacific Fluid Filter Market

8.3 Europe Fluid Filter Market

8.4 North America Fluid Filter Market

8.5 Row Fluid Filter Market

9 Automotive Fluid Filter Market: Competitive Landscape (Page No. - 75)

9.1 Global Fluid Filter Market: Company Share Analysis

9.1.1 Expansions

9.1.2 New Product Developments

9.1.3 Acquisitions

9.2 Joint Ventures, Collaborations, Partnerships, & Agreements

9.2.1 Investments

9.2.2 Supply Contracts

10 Global Automotive Fluid Filter Market, By Company (Page No. - 82)

(Overview, Financials, Products & Services, Strategy, and Developments)*

10.1 Affinia Group Inc.

10.2 Clarcor Inc.

10.3 Cummins Inc.

10.4 Donaldson Co. Inc.

10.5 Illinois Tool Works Inc.

10.6 Gud Holdings Limited

10.7 Ahlstrom Corporation

10.8 Mahle GmbH

10.9 Mann+Hummel

10.1 Sogefi SPA

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

11 Appendix

11.1 Customization Options

11.1.1 Regulatory Framework

11.1.2 Impact Analysis

11.1.3 Historical Data & Trends

11.2 Related Reports

11.3 Introducing RT: Real Time Market Intelligence

11.3.1 RT Snapshot

List of Tables (81 Tables)

Table 1 Global Automotive Fluid Filter Market Size, 2014 (USD MN)

Table 2 Global Automotive Fluid Filter Market: Macroindicators, By Geography, 2014 ( ‘000 Units)

Table 3 Global Automotive Fluid Filter Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 Global Automotive Fluid Filter Market : Drivers and Inhibitors

Table 5 Global Automotive Fluid Filter Market, By Vehicle Type, 2013 - 2019 (‘000 Units)

Table 6 Global Automotive Fluid Filter Market, By Vehicle Type 2013 - 2019 (USD MN)

Table 7 Global Automotive Fluid Filter Market, By Type, 2013 - 2019 (USD MN)

Table 8 Global Automotive Fluid Filter Market, By Vehicle Type : Comparison With World Vehicle Production, 2013 - 2019 (‘000units)

Table 9 Global Automotive Fluid Filter Market, By Vehicle Type 2013 - 2019 (‘000 Units)

Table 10 Global Automotive Fluid Filter Market, By Vehicle Type, 2013 - 2019 (USD MN)

Table 11 Global Passenger Car Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Table 12 Global Passenger Car Fluid Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 13 Global Passenger Car Fluid Filter Market, By Fuel Type, 2013-2019 (‘000 Units)

Table 14 Global Passenger Car Fluid Filter Market, By Fuel Type, 2013-2019 (USD MN)

Table 15 Global LCV Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Table 16 Global LCV Fluid Filter Market, By Geography 2013 – 2019 (USD MN)

Table 17 Global LCV Fluid Filter Market, By Fuel Type, 2013-2019 (‘000 Units)

Table 18 Global LCV Fluid Filter Market, By Fuel Type, 2013-2019 (USD MN)

Table 19 Global HCV Fluid Filter Market By Geography, 2013 - 2019 (‘000 Units)

Table 20 Global HCV Fluid Filter Market By Geography, 2013 - 2019 (USD MN)

Table 21 Global HCV Fluid Filter Market, By Fuel Type, 2013-2019 (‘000 Units)

Table 22 Global HCV Fluid Filter Market, By Fuel Type, 2013-2019 (USD MN)

Table 23 Sneak View: Global Fluid Filter Market, 2014 (USD MN)

Table 24 Global Automotive Fluid Filter Market, By Type 2013 - 2019 (USD MN)

Table 25 Global Oil Filter Market, By Geography 2013 - 2019 (USD MN)

Table 26 Global Oil Filter Market, By Vehicle Type, 2013 - 2019 (USD MN)

Table 27 Global Fuel Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 28 Global Fuel Filter Market, By Vehicle, 2013 - 2019 (USD MN)

Table 29 Global Automotive Fluid Filter Market, By Fuel Type, 2013 - 2019 (‘000 Units)

Table 30 Global Fluid Filter Market, By Fuel Type, 2013 - 2019 (USD MN)

Table 31 Global Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Table 32 Global Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 33 Asia-Pacific Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Table 34 Asia-Pacific Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 35 Europe Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Table 36 Europe Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 37 North America Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Table 38 North America Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 39 Row Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Table 40 Row Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 41 Global Diesel Fluid Filter Market, By Geography 2013 - 2019 (‘000 Units)

Table 42 Global Diesel Fluid Filter Market, By Geography 2013 - 2019 (USD MN)

Table 43 Asia-Pacific Diesel Fluid Filter Market, By Geography 2013 - 2019 (‘000 Units)

Table 44 Asia-Pacific Diesel Fluid Filter Market, By Geography 2013 -2019 (USD MN)

Table 45 Europe Diesel Fluid Filter Market, By Geography 2013 - 2019 (‘000 Units)

Table 46 Europe Diesel Fluid Filter Market, By Geography 2013 - 2019 (USD MN)

Table 47 North America Diesel Fluid Filter Market, By Geography 2013 - 2019 (‘000 Units)

Table 48 North America Diesel Fluid Filter Market, By Geography 2013 - 2019 (USD MN)

Table 49 Row Diesel Fluid Filter Market, By Geography 2013 - 2019 (‘000 Units)

Table 50 Row Diesel Fluid Filter Market, By Geography 2013 - 2019 (USD MN)

Table 51 Global Gasoline Fluid Filter Market, By Vehicle Type 2013 - 2019 (‘000 Units)

Table 52 Global Gasoline Fluid Filter Market, By Vehicle Type 2013 - 2019 (USD MN)

Table 53 Global Diesel Fluid Filter Market, By Vehicle Type 2013 - 2019 (‘000 Units)

Table 54 Global Diesel Fluid Filter Market, By Vehicle Type 2013 - 2019 (USD MN)

Table 55 Global Fluid Filter Market, By Geography , 2013–2019 (‘000 Units)

Table 56 Global Fluid Filter Market, By Geography, 2013–2019 (USD MN)

Table 57 Asia-Pacific Fluid Filter Market, By Geography, 2012 - 2018 (‘000 Units)

Table 58 Asia-Pacific Fluid Filter Market, By Geography, 2012 - 2018 (USD MN)

Table 59 Europe Fluid Filter Market, By Geography, 2012 - 2018 (000’ Units)

Table 60 Europe Fluid Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 61 North America Fluid Filter Market, By Geography, 2013 – 2019 (‘000 Units)

Table 62 North America Fluid Filter Market, By Geography, 2013 - 2019 (USD MN)

Table 63 Row Fluid Filter Market, By Geography, 2013–2019 (‘000 Units)

Table 64 Row Fluid Filter Market, By Geography, 2013–2019 (USD MN)

Table 65 Global Fluid Filter Market: Company Market Share Analysis, 2014 (%)

Table 66 Automotive Fluid Filter Market : Expansions

Table 67 Automotive Fluid Filter Market: New Product Development

Table 68 Automotive Fluid Filter Market: Acquisition

Table 69 Automotive Fluid Filter Market: Joint Ventures, Collaborations, Partnerships, & Agreements

Table 70 Automotive Fluid Filter Market: Investment

Table 71 Automotive Fluid Filter Market: Supply Contracts

Table 72 Affinia Group Inc.: Key Operations Data, 2009 - 2013 (USD MN)

Table 73 Clarcor Key Financials, 2009 - 2013 (USD MN)

Table 74 Cummins Key Operations Data, 2009 - 2013 (USD MN)

Table 75 Donaldson Co. Ltd.: Key Operations Data,2009 - 2013 (USD MN)

Table 76 Illinois Tools and Works: Key Operations Data, 2009 - 2013 ( USD MN)

Table 77 Gud Holdings Key Financials, 2009 - 2013 (USD MN)

Table 78 Ahlstrom Limited Key Financials, 2009 - 2013 (USD MN)

Table 79 Mahle GmbH Key Financials, 2009 - 2013 (USD MN)

Table 80 Mann+Hummel Key Financials, 2009 - 2013 (USD MN)

Table 81 Sogefi SPA Key Financials, 2009 - 2013 (USD MN)

List of Figures (47 Figures)

Figure 1 Global Fluid Filter Market: Segmentation & Coverage

Figure 2 Fluid Filter Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro-Indicator Based Approach (‘000 Units)

Figure 7 Global Fluid Filter Market Snapshot, 2014

Figure 8 Fluid Filter: Growth Aspects

Figure 9 Global Fluid Filter Market, By Vehicle Type

Figure 10 Global Fluid Filter Type, By Region 2014 (USD MN)

Figure 11 Global Fluid Filter Market, By Vehicle Type, 2014 vs 2019 (‘000 Units)

Figure 12 Global Fluid Filter Market, By Vehicle Type, 2014 - 2019 (USD MN)

Figure 13 Global Fluid Filter Market in the Passenger Car Segment, By Region, 2013 - 2019 (‘000 Units)

Figure 14 Global LCV Fluid Filter Market, By Geography, 2013 - 2019 (‘000’ Units)

Figure 15 Global HCV Fuel Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Figure 16 Sneak View: Global Fluid Filter Market, 2014 (USD MN)

Figure 17 Global Oil Filter Market, 2014 - 2019 (USD MN)

Figure 18 Global Oil Filter Market, 2014 – 2019, By Vehicle Type (USD MN)

Figure 19 Global Fuel Filter Market, 2014 - 2019 (USD MN)

Figure 20 Global Fuel Filter Market, 2014 – 2019, By Vehicle Type (USD MN)

Figure 21 Gasoline Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Figure 22 Asia-Pacific Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Figure 23 Global Fluid Filter Market, By Geography , 2013–2019 (‘000 Units)

Figure 24 Global Fluid Filter Market, By Geography, 2013–2019 (USD MN)

Figure 25 Geographic Presence, By Company,2014

Figure 26 Asia-Pacific Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units)

Figure 27 Europe Fluid Filter Market, By Geography, 2013 - 2019 (‘000 Units

Figure 28 North America Fluid Filter Market, By Geography, 2013- 2019 (‘000 Units

Figure 29 Row Fluid Filter Market, By Geography, 2013–2019 (‘000 Units)

Figure 30 Global Fluid Filter Market: Company Share Analysis, 2014 (%)

Figure 31 Affinia Geography and Business Mix, 2013 (%)

Figure 32 Contribution of Fluid Filter Segment To Company Revenue, 2009-2013 (USD MN)

Figure 33 Clarcor Business Mix, 2013 (%)

Figure 34 Cummins Inc. Geographical and Business Mix

Figure 35 Contribution of Fluid Filter Segment To Company Revenue, 2009-2013 (USD MN)

Figure 36 Donaldson Co. Ltd Business Mix, 2013 (%)

Figure 37 Contribution of Fluid Filter Segments To Company Revenue, 2009-2013 (USD MN)

Figure 38 Illinois Tools and Works Business and Geography Mix, 2013 (%)

Figure 39 Contribution of Fluid Filter Segment To Company Revenue, 2009-2013 (USD MN)

Figure 40 Gud Holdings Business Mix 2013 (%)

Figure 41 Contribution of Fluid Filter Segment To Company Revenue, 2009-2013 (USD MN)

Figure 42 Ahlstrom Limited Business Mix and Geography Mix, 2013 (%)

Figure 43 Contribution of Fluid Filter Segment To Company Revenue, 2009-2013 (USD MN)

Figure 44 Mahle GmbH Geography Mix, 2013 (%)

Figure 45 Mann+Hummel Geography Mix, 2013 (%)

Figure 46 Sogefi SPA Geography Mix, 2013 (%)

Figure 47 Contribution of Fluid Filter Segment To Company Revenue, 2009-2013 (USD MN)

As automobile engine technologies across the world become increasingly sophisticated, providing clean oil and fuel to these complex engines has also become essential. Strict emission and engine efficiency norms enforced by governments and legislative bodies across the world have compelled automotive manufacturers to seek various avenues to meet these standards, thereby driving the demand for automotive oil and fuel filters.

The global automotive fluid filter market is classified on the basis of type, vehicle type, and geography. The vehicle type segment is further categorized into passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV). The fluid filter market is segmented by type into fuel filter and oil filter. Regions taken into consideration are Asia-Pacific, North America, and Europe. The global fluid filter market attained a market size, in terms of value, of $823.1 million in 2014, and is expected to reach $1,463.7 million by 2019, growing at a CAGR of 12.2% from 2014 to 2019.

Asia-Pacific and North America account for a significant portion of the automotive fluid filter market. Asia-Pacific holds the largest market share, in terms of volume, and is estimated to have a market size, by volume, of 101,564.4 thousand units in 2014. It is followed by North America and Europe. The passenger car segment is the largest segment of the fluid filter market by vehicle type, followed by the LCV and HCV segments. The passenger car segment is estimated to grow at the highest CAGR—that is, 7.2%—from 2014 to 2019, followed by the LCV and HCV segments. The fuel filter segment of the fluid filter market, by type is poised to grow at the highest CAGR of 12.5% over the forecast period.

The major automotive fluid filter market players are Cummins Inc. (U.S.), Mann+Hummel (Germany), and Mahle GMBH (Germany). Leading players have adopted strategies such as new product launches, partnerships, agreements, collaborations, joint ventures, acquisitions, supply contacts, and expansions. These strategies were adopted by market players to expand their product portfolio, to increase their market share, and to gain access to new markets.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Fuel Filter Fuel filters are responsible for the filtration of particles if present any in the fuel before they hit the injectors allowing them to function properly. As the automobile engine technology have become more sophisticated providing clean fuel to the complex engines has become more critical thus fuel filter have evolved as the integral part of the automobile. Stringent emission norms and environment regulation around the world has increased the demand of fuel filters. The study shows that the global automotive fuel filter demand will increase at a CAGR of 12.3% during 2013 to 2018 generating a revenue of $958.55 million by 2018. |

Upcoming |

|

Oil Filter Oil filters clean all the gunk that the engine picks up before it go and mix into the internal combustion; it cleans the lubricant which facilitates the engine to run smoothly. An initiative taken by the government and the people around the globe to reduce the green house gases emission from automobiles has triggered OEMs to incorporate these filters in their vehicles and tell their consumers about the benefit of regular replacement. The study shows that the global automotive oil filter demand will increase at a CAGR of 11.1% during 2013 to 2018 generating a revenue of $336.78 million by 2018. |

Upcoming |

|

North America Oil Filter Owing to the increased pollution levels affecting the climatic conditions, stringent emission norms have been introduced by the government of the region. Oil filters which are responsible of cleaning all the gunk that the engine picks up before it go and mix into the internal combustion; it cleans the lubricant which facilitates the engine to run smoothly thereby decreasing the emissions. This factor is driving the future of oil filter market in the region. The North America automotive oil filter market is estimated to grow at a CAGR of 11.1% during 2013 to 2018 reaching a value of $47.15 million by 2018. |

Upcoming |

|

Europe Oil Filter With the increasing CO2 emission in the environment by the automobiles has caused the government to impose stringent emission norms. This has caused the regulated use of oil filters and its replacement at regular intervals has increased the market of oil filter in the region. The Europe automotive oil filter market is estimated to grow at a CAGR of 8.3% during 2013 to 2018 reaching a value of $74.09 billion by 2018. |

Upcoming |

|

Asia-Pacific Oil Filter Owing to the stable economic conditions resulting into the rising purchasing power of the individuals has increased the vehicle production in the region. Production of oil filters can be linked directly with the production of vehicles thus found with the increasing trend in the Asia-Pacific market. . The Asia-Oceania automotive oil filter market is estimated to grow at a CAGR of 12.7% during 2013 to 2018 generating revenue of $195.33 million by the end of 2018. |

Upcoming |

|

North America Fluid Filter The North American fluid filter market is estimated to grow from $97.76 million in the year 2013 to a projected value of $190.93 million by the year 2018 at a rate of 14.3%. It constitutes 13.27% of the Global fluid filter market and is poised to grow its market share to 14.74% by the end of 2018. Stringent emission norms and environmental regulations have made OEMs to adopt technologies leading to lower emissions. The increasing research and development for developing more advance products has led to the introduction of technologies which has increased the life of the filters. However the large use of vehicle for daily activities, preference of private vehicles over public transport has reduced the life of filters thus replacement of filters takes place frequently. |

Upcoming |

|

Europe Fluid Filter The Europe automotive fuel filter market is estimated to grow at a CAGR of 9.2% during 2013 to 2018 reaching a value of $294.56 Million by 2018. The increasing CO2 emission in the environment by the automobiles has caused the government to impose stringent emission norms. This has caused the regulated use of filters and its replacement at regular intervals has increased the market of filters in the region. |

Upcoming |

|

Asia-Pacific Fluid Filter The Asia-Oceania automotive fuel filter market is estimated to grow at a CAGR of 13% during 2013 to 2018 generating a revenue of $732.12 Million by the end of 2018. Owing to the stable economic conditions resulting into the rising purchasing power of the individuals has increased the vehicle production in the region.The rising consciousness regarding the environment has pushed the government of the region to impose regulation norms which is driving the future of filter market which are responsible of restricting the entry of unwanted particles present in the fuel to reach injectors allowing them to function smoothly. This decreases the carbon vehicle emission in the atmosphere. After market plays an important role since in the region fuel used is dirty and also the diesel which consists of high particulate matter is getting popular hence the replacement of these filters will take place frequently opening the opportunities for after-market players. |

Upcoming |

|

Asia-Pacific Fuel Filter The rising consciousness regarding the environment has pushed the government of the region to impose regulation norms which is driving the future of fuel filter market which are responsible of restricting the entry of unwanted particles present in the fuel to reach injectors allowing them to function smoothly. This decreases the carbon vehicle emission in the atmosphere. After market plays an important role since in the region fuel used is dirty and also the diesel which consists of high particulate matter is getting popular hence the replacement of these filters will take place frequently opening the opportunities for after-market players. The Asia-Oceania automotive fuel filter market is estimated to grow at a CAGR of 13.1% during 2013 to 2018 generating revenue of $536.78 million by the end of 2018. |

Upcoming |

|

Europe Fuel Filter The stringent emission norms imposed by the government of Europe for controlling the rising levels of the carbon in the atmosphere has accelerated the demand of fuel filters. This has opened up the opportunities both for the OEMs and the after-market players as the replacement of these filters at regular interval of time will become necessary. The Europe automotive fuel filter market is estimated to grow at a CAGR of 9.5% during 2013 to 2018 reaching a value of $220.46 Million by 2018. |

Upcoming |

|

North America Fuel Filter The demand of fuel filter is increasing in North America owing to the stringent emission norms imposed by the government of the region. In order to control the carbon emission levels in the atmosphere, awareness program are being run by the OEMs to tell people about the benefit of the replacement of these filters at regular interval of time opening up the opportunity for after-market players in North America. The North America automotive fuel filter market is estimated to grow at a CAGR of 15.5% during 2013 to 2018 reaching a value of $143.78 Million by 2018. |

Upcoming |