Turf & Ornamentals Biostimulants Market by Active Ingredients (Acids and Extracts), by Application (Foliar, Seed, Soil), by End-User, by Geography - Global Trends and Forecast to 2019

The global agricultural biostimulants in turf and ornamentals market is estimated to grow at a CAGR of 14.5% during the forecast period of 2014 to 2019. Biostimulants are organic agricultural substances, which when applied to plants or soils, enhance the plants metabolic processes and enhance or stimulate the plant’s growth, crop yield, taste, and color of fruits & vegetables. In other words, biostimulants are products applied to plants or crops, foliar, in soil or on seeds, to stimulate plant’s natural processes of metabolism. It catalyzes nutrient uptake and enhance growth of plants. They provide protection against various plants diseases and also prevent the burning of plants.

On the basis of end-users, the market has been segmented into turf & ornamentals, row crops, fruits & vegetables, and other crops. The main active ingredients of the market include acids, extracts. The major application segments of the market are foliar, soil, and seed.

Europe is the most dominant region in the global biostimulants in turfs & ornamentals market, having accounted for nearly 50% of the total revenues generated in 2014. Spain, Italy, France, Germany, the U.K., and Poland are some of the major countries driving the growth of organic farming in the European region. Latin America is projected to be the fastest-growing regional segment of the global market, owing to the rapidly-increasing demand from Brazil and Argentina.

The global agricultural biostimulants in turf and ornamentals market is a highly competitive market, with operational firms such as Taminco (US), Agrinos AS (Norway), BASF SE (Germany), and Novozymes A/S (Denmark), among others, which are expanding their market share rapidly across the globe. To gain significant positions in the global market, these companies are adopting numerous market strategies, including innovative product development, partnerships, mergers & acquisitions, and expansions of existing facilities. Apart from these companies, there are large numbers of small firms present in the global agricultural biostimulants in turf and ornamentals market.

Scope of the Report

This research report categorizes the global agricultural biostimulants in turf and ornamentals market into the following segments and sub segments:

Global Agricultural Biostimulants in Turf & Ornamentals Market, By Active Ingredient

•Acid-Based

•Extract-Based

•Other Biostimulants

Global Agricultural Biostimulants in Turf & Ornamentals Market, By Application

•Foliar

•Seed

•Soil

Global Agricultural Biostimulants in Turf & Ornamentals Market, By Geography

•North America

•Europe

•Asia-Pacific

•Latin America

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition and Scope of Study

1.3 Markets Covered

1.4 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of Biostimulants in Turf & Ornamentals Market

2.2 Top-Down Approach

2.3 Bottom-Up Approach

2.4 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 20)

4.1 Introduction

4.2 Global Market Share Analysis, By Company

4.3 Drivers and Inhibitors of the Biostimulants in Turf & Ornamentals Market

5 Global Biostimulants Market, By End User (Page No. - 23)

5.1 Introduction

6 Global Biostimulants Market in Turf & Ornamentals (Page No. - 28)

6.1 Introduction

6.2 Turf & Ornamentals: North America

6.3 Turf & Ornamentals: Europe

6.4 Turf & Ornamentals: Asia-Pacific

6.5 Turf & Ornamentals: Latin America

7 Global Biostimulants and Biostimulants in Turf & Ornamentals Market, By Active Ingredients (Page No. - 40)

7.1 Introduction

7.2 Global Biostimulants: Turf and Ornamentals, By Active Ingredients

7.3 Global Biostimulants: By Active Ingredients

8 Global Biostimulants and Biostimulants in Turf & Ornamentls Market, By Application (Page No. - 47)

8.1 Introduction

8.2 Global Biostimulants in Turfs and Ornamentals, By Application, 2013 - 2019 (USD MN)

8.3 Global Biostimulants Market, By Application, 2013 - 2019 (USD Million)

9 Global Biostimulants Market, By Geography (Page No. - 53)

9.1 Introduction

10 Agricultural Biostimulants in Turf and Ornamentals Market: Competitive Landscape (Page No. - 57)

10.1 Overview

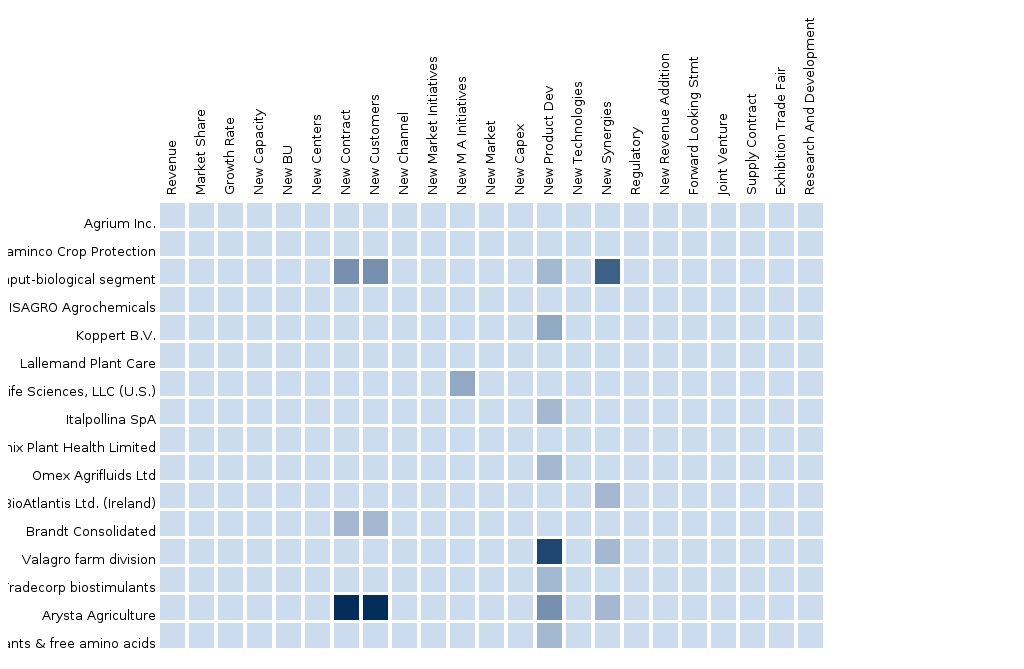

10.2 Competitive Trends

10.3 Mergers and Acquisitions

10.4 Agreements, Partnerships, Collaborations, and Joint Ventures

10.5 New Product Launches

10.6 Investments, Expansions, and Other Developments

11 Company Profiles (Page No. - 67)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 BASF SE

11.2 Novozymes A/S

11.3 Agrinos as

11.4 Koppert B.V.

11.5 Isagro SPA

11.6 Omex Agrifluids Ltd.

11.7 Arysta Lifescience Corporation

11.8 Valagro SPA

11.9 Biostadt India Limited

11.10 Italpollina SPA

*Details on overview, financials, product & services, strategy, and developments might not be captured in case of unlisted company

12 Appendix (Page No. - 93)

12.1 Customization Options

12.1.1 Technical Analysis

12.1.2 Low-Cost Sourcing Locations

12.1.3 Regulatory Framework

12.1.4 Crop-Biostimulants Usage Data

12.1.5 Impact Analysis

12.1.6 Trade Analysis

12.1.7 Historical Data and Trends

12.2 Related Reports

12.3 Introducing RT: Real Time Market Intelligence

12.3.1 RT Snapshots

List of Tables (33 Tables)

Table 1 Global Biostimulants: Market Values,By End Users, 2014 – 2019 (USD Million)

Table 2 Global Biostimulants: Land, By End Users, 2014 – 2019 (‘000 HA)

Table 3 Turf & Ornamentals: By Geography, 2014-2019 (USD Mtillion)

Table 4 Turf & Ornamentals: By Geography, 2014-2019 (‘000 HA)

Table 5 Turf & Ornamentals, North America:By Geography, 2014-2019 (USD Million)

Table 6 Turf & Ornamentals, North America: By Geography, 2014-2019 (‘000 HA)

Table 7 Turf & Ornamentals, Europe: By Geography, 2014-2019 (USD Million)

Table 8 Turf & Ornamentals, Europe: By Geography, 2014-2019 (‘000 HA)

Table 9 Turf & Ornamentals, Asia-Pacific: By Geography, 2014-2019 (USD Million)

Table 10 Turf & Ornamentals, Asia-Pacific: By Geography, 2014-2019 (‘000 HA)

Table 11 Turf & Ornamentals, Latin America: By Geography, 2014-2019 (USD Million)

Table 12 Turf & Ornamentals, Latin America: By Geography, 2014-2019 (‘000 HA)

Table 13 Global Biostimulants in Turf & Ornamentals: Market Values,By Active Ingredients, 2014 – 2019 (USD Million)

Table 14 Global Biostimulants: Market Values, By Active Ingredients,2014 – 2019 (USD Million)

Table 15 Global Biostimulants: Land, By Active Ingredients, 2014 – 2019 (‘000 HA)

Table 16 Global Biostimulants Market in Turfs and Ornamentals,By Application, 2013 – 2019 (USD Million)

Table 17 Global Biostimulants Market, By Application, 2013 - 2019 (USD MN)

Table 18 Global Biostimulants Market: Land, By Application, 2013 - 2019 (‘000 HA)

Table 19 Global Biostimulants Market, By Geography, 2013 - 2018 (USD MN)

Table 20 Global Biostimulants Market, By Geography, 2012 - 2018 (KT)

Table 21 Mergers and Acquisitions (January 2011 – October 2014)

Table 22 Agreements, Partnerships, Collaborations, and Joint Ventures(January 2011 – October 2014)

Table 23 New Product Launches (January 2011 – October 2014)

Table 24 Investments, Expansions, and Other Developments January 2011 – October 2014)

Table 25 BASF SE : Annual Revenue, By Business Segments, 2012 – 2013 (USD Million)

Table 26 BASF SE Agricultural Solutions: Annual Revenue,By Geography, 2012 – 2013 (USD Million)

Table 27 BASF SE Agriculture Solutions Segment:Annual Revenue 2012 – 2013 (USD Million)

Table 28 Novozymes A/S: Annual Revenue, By Business Segments,2012 – 2013 (USD Million)

Table 29 Novozymes A/S: Annual Revenue, By Business Geography,2012 – 2013 (USD Million)

Table 30 Novozymes A/S: Annual Revenue, 2012 – 2013 (USD Million)

Table 31 Agrinos AS:Annual Revenue, 2012 – 2013 (USD Million)

Table 32 Isagro SPA: Annual Revenue, By Geography, 2012 – 2013 (USD Million)

Table 33 Isagro SPA: Annual Revenue, 2012 – 2013 (USD Million)

List of Figures (29 Figures)

Figure 1 Global Biostimulants for Turf & Ornamentals Market: Segmentation & Coverage

Figure 2 Global Biostimulants for Turf & Ornamentals Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 Bottom-Up Approach

Figure 5 Global Biostimulants in Turf & Ornamentals Market Snapshot

Figure 6 Key Players in Global Market

Figure 7 Global Biostimulants: Market Values, By End Users, 2014 – 2019(USD Million)

Figure 8 Global Biostimulants: Land, By End Users, 2014 – 2019 (‘000 HA)

Figure 9 Turf & Ornamentals: By Geography, 2014-2019 (USD Million)

Figure 10 Turf & Ornamentals: By Geography, 2014-2019 ('000 HA)

Figure 11 Turf & Ornamentals: Value and Area Analysis,By Geography, 2014 – 2019 (CAGR %)

Figure 12 Turf & Ornamentals, North America Snapshot:By Geography (2014 Vs 2019)

Figure 13 Turf & Ornamentals, Europe Snapshot: By Geography (2014 Vs 2019)

Figure 14 Turf & Ornamentals, Asia-Pacific Snapshot: Geography (2014 Vs 2019)

Figure 15 Turf & Ornamentals, Latin America Snapshot: By Geography (2014 Vs 2019)

Figure 16 Global Biostimulants in Turf & Ornamentals: Market Values,By Active Ingredients, 2014 – 2019 (USD Millions)

Figure 17 Global Biostimulants: Market Values,By Active Ingredients, 2014 – 2019 (USD Million)

Figure 18 Global Biostimulants: Land, By Active Ingredients, 2014 – 2019 (‘000 HA)

Figure 19 Biostimulants: Application Market Scenario

Figure 20 Global Biostimulants in Turfs and Ornamentals,By Application, 2013 - 2019 (USD Million)

Figure 21 Global Biostimulants Market, By Application, 2013 - 2019 (USD Million)

Figure 22 Global Biostimulants Market: Land, By Application, 2012 - 2019 (‘000 HA)

Figure 23 Global Biostimulants Market: Growth Analysis,By Geography, 2012-2018 (USD MN)

Figure 24 Global Biostimulants Market: Growth Analysis,By Geography, 2012-2019 (KT)

Figure 25 Competitive Trends

Figure 26 BASF SE: Reveue Mix, 2013 (%)

Figure 27 Contribution of Agricultural Solutions Segment Towards Company Revenues, 2009-2013 (USD Million)

Figure 28 Novozymes A/S Revenue Mix, 2013 (%)

Figure 29 Isagro SPA Revenue Mix, By Geography 2013 (%)

Biostimulants are organic agricultural substances, which when applied to plants or soils, enhance the plants metabolic processes and stimulate the plant’s growth, crop yield, taste, and color of fruits & vegetables. It catalyzes nutrient uptake and enhance growth of plants. They provide protection against plants diseases and also prevent the burning of plants.

The purpose of this study is to analyze the global market for the use agricultural biostimulants in turf & ornamentals. This report includes revenue forecasts, market trends, and opportunities for the period from 2014 to 2019. The analysis has been conducted on the various biostimulants market segments derived on the basis of end-users, active ingredients, applications, and geography.

On the basis of active ingredients, the global biostimulants in turfs & ornamentals market is segmented into acids, extracts, and others; the major applications of the market are foliar, soil, and seed. The geographical analysis includes the regions of Asia-Pacific (APAC), North America, Latin America, Europe, and Rest of the World (RoW). The report also includes the key market drivers and inhibitors, along with their impacts, described in detail.

The global agricultural biostimulants in turf & ornamentals market was valued at $330.9 million in 2014 and is projected to reach $652.7 million by 2019, at a CAGR of 14.5% during the forecast period of 2014 to 2019. The market, in terms of applications, has led by the foliar segment in 2014 with an 84.2% share. Acid-based biostimulants find a majority of their applications in the turf & ornamentals segment. In 2014, the acid-based biostimulants segment held a market share of 53.3% of the global agricultural biostimulants in turf & ornamentals market.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement