U.S. Fraud Detection & Prevention and Anti Money Laundering and Account Takeover Market by Fraud Detection & Prevention Type, by End User, By Vertical – Market Trends & Forecasts Till 2019

With the rise in fraud incidents around the globe, the demand for robust fraud detection & prevention, anti-money laundering and account takeover systems have also increased. Globalization and increasing number of transactions results in the amount of data to be stored becoming unmanageable every day. Organizations have to maintain bigger databases, which store massive organizational data. This data is generally of significant importance for any organization.

Frauds evolved from casual fraud incidents to organized frauds (hacking into network, databases). With the present loopholes in the organizational systems, such as low awareness levels and slow execution, fraudsters keep attacking organizations with the help of new tools and technologies. To combat these tech-savvy fraudsters and to avoid losses, organizations have started deploying solutions based on newer technologies. This is one of the main reasons for fraud detection & prevention, anti-money laundering and account takeover solutions gaining traction in the U.S. market.

With new advancements in the technological domains such as fraud analytics and fraud authentication, it has become comparatively easier for organizations to keep their data and money safe and secure from fraudsters. Fraud analytical tools and applications help organizations to analyze data and determine the irregularities in the organizational frameworks. On one hand, fraud analytics enables organizations to not only analyze the data but also decode the data, playing a significant role in providing insights about the possible occurrences of fraud incidents in the near future. On the other hand, fraud authentication tools make it difficult for fraudsters to commit fraud. Today, both fraud analytics and fraud authentication tools and applications are important to all organizations.

Anti-money laundering software is utilized in the finance and legal industries to fulfill the legal requirements for financial institutions and other regulated entities to forestall or report money laundering activities. Every business with an online presence must be concerned about its users’ or customers’ accounts being accessed by the wrong people. When user accounts are compromised, the costs are enormous, ranging from loss of customer trust and brand reputation to significant financial damages. For enterprises or government agencies, account takeover jeopardizes public security, regulatory compliance or intellectual property.

Cybercriminals have become very effective at stealing the user names and passwords traditionally used to protect online accounts. It seems that every week another article describes the results of new phishing, social engineering, and malware attacks focused on stealing user names and passwords. These are easily sold in the global black market created specifically for buying and selling stolen credentials.

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives Of The Study

1.2 Market Segmentation & Coverage

1.2.1 Years Considered In The Report

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Integrated Ecosystem of FDP, AML and Account Takeover Market

2.2 Arriving at the FDP, AML and Account Takeover Market Size

2.2.1 Top Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 22)

4 Market Overview (Page No. - 25)

4.1 Introduction

4.2 U.S. FDP, AML and Account Takeover Market

4.3 Market Drivers And Inhibitors

5 U.S. FDP, AML and Account Takeover Market, By Vertical (Page No. - 33)

5.1 Introduction

5.2 U.S. FDP in BFSI

5.3 U.S. FDP in Energy & Utilities

5.4 U.S. FDP in Retail

5.5 U.S. FDP in Telecommunications & IT

5.6 U.S. FDP in Healthcare

5.7 U.S. FDP in Public Sector & Government

5.8 U.S. AML in BFSI

5.9 U.S. AML in Real Estate

5.1 U.S. Account Takeover in BFSI

5.11 U.S. Account Takeover in E-Retail & E-Commerce

5.12 U.S. Account Takeover in Public Sector & Government

6 FDP and AML Market, By End User (Page No. - 49)

6.1 Introduction

6.2 U.S. FDP, AML in SME

6.3 U.S. FDP, AML in Large Enterprises

7 FDP Market, By Type (Page No. - 57)

7.1 Introduction

7.2 U.S. Fraud Authentication Market

7.3 U.S. Fraud Analytics Market

7.4 U.S. Governance, Risk, And Compliance Market

7.5 U.S. Reporting & Visualization Tools Market

7.6 U.S. Professional Services Market

7.7 U.S. Managed Security Services Market

7.8 U.S. Support & Maintenance Services Market

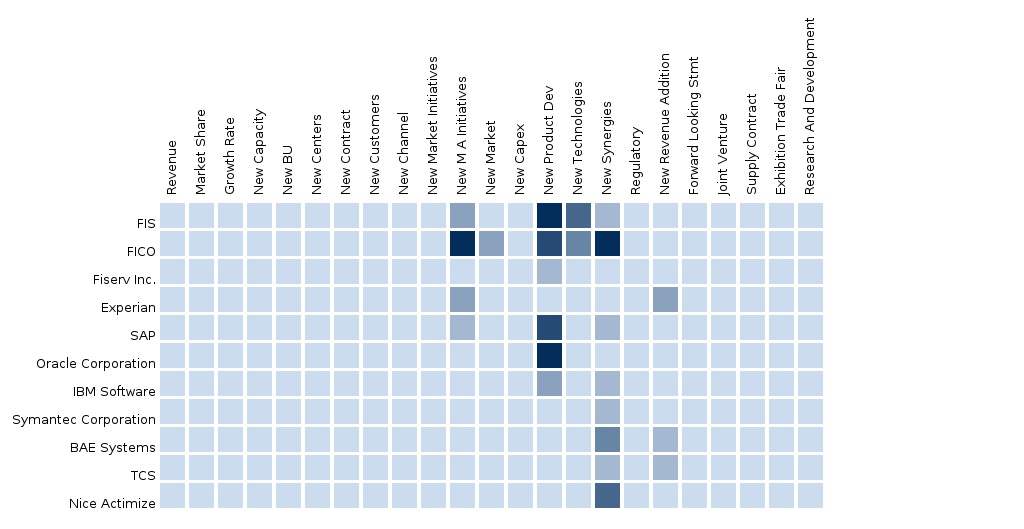

8 FDP, AML and Account Takeover Market: Competitive Landscape (Page No. - 68)

8.1 Company Presence In The FDP, AML and Account FDP, AML and Account Takeover Market, By Product

8.2 Mergers & Acquisitions

8.3 New Product Development

8.4 Joint Ventures, Partnerships, And Collaborations

9 FDP, AML and Account Takeover Market, By Company (Page No. - 72)

9.1 Equifax, Inc.

9.1.1 Overview

9.1.2 Key Financials

9.1.3 Product And Service Offerings

9.1.4 Related Developments

9.1.5 Mmm View

9.2 Intellinx

9.2.1 Overview

9.2.2 Key Financials

9.2.3 Product And Service Offerings

9.2.4 Related Developments

9.2.5 Mmm View

9.3 Nice Actimize

9.3.1 Overview

9.3.2 Key Financials

9.3.3 Product And Service Offerings

9.3.4 Related Developments

9.3.5 Mmm View

9.4 Experian

9.4.1 Overview

9.4.2 Key Financials

9.4.3 Product And Service Offerings

9.4.4 Related Developments

9.4.5 Mmm View

9.5 Callcredit

9.5.1 Overview

9.5.2 Key Financials

9.5.3 Product And Service Offerings

9.5.4 Related Developments

9.5.5 Mmm View

9.6 Easy Solutions

9.6.1 Overview

9.6.2 Key Financials

9.6.3 Product And Service Offerings

9.6.4 Related Developments

9.6.5 Mmm View

9.7 Aci Worldwide Inc.

9.7.1 Overview

9.7.2 Key Financials

9.7.3 Product And Service Offerings

9.7.4 Related Developments

9.7.5 Mmm View

9.8 Transunion

9.8.1 Overview

9.8.2 Key Financials

9.8.3 Product And Service Offerings

9.8.4 Related Developments

9.8.5 Mmm View

9.9 Lexisnexis

9.9.1 Overview

9.9.2 Key Financials

9.9.3 Product And Service Offerings

9.9.4 Related Developments

9.9.5 Mmm View

9.1 Guardian Analytics

9.10.1 Overview

9.10.2 Key Financials

9.10.3 Product And Service Offerings

9.10.4 Related Developments

9.10.5 Mmm View

9.11 Lavastorm Analytics

9.11.1 Overview

9.11.2 Key Financials

9.11.3 Product And Service Offerings

9.11.4 Related Developments

9.11.5 Mmm View

10 Appendix (Page No. - 123)

10.1 Customization Options

10.1.1 Fdp, Aml And Account Takeover Market Types Matrix

10.1.2 Fdp, Aml And Account Takeover Market Competitive Benchmarking

10.1.3 Fdp, Aml And Account Takeover Market Vendor Landscaping

10.1.4 Fdp, Aml And Account Takeover Market Data Tracker

10.1.5 Fdp, Aml And Account Takeover Market Emerging Vendor Landscape

10.1.6 Fdp, Aml And Account Takeover Market Channel Analysis

10.2 Related Reports

10.3 Introducing Rt: Real Time Market Intelligence

10.3.1 Rt Snapshots

List of Tables

Table 1 North America Fdp, Aml And Account Takeover Market: Macro Indicators, By Geography, 2014 (Usd Mn)

Table 2 U.S. Fdp, Aml And Account Takeover Market, 2013-2019 (Usd Mn)

Table 3 U.S. Fdp, Aml And Account Takeover Market: Drivers And Inhibitors

Table 4 U.S. Fdp Market, By Vertical, 2013-2019 (Usd Mn)

Table 5 U.S. Aml Market, By Vertical, 2013-2019 (Usd Mn)

Table 6 U.S. Account Takeover Market, By Vertical, 2013-2019 (Usd Mn)

Table 7 U.S. Fdp In Bfsi, 2013-2019 (Usd Mn)

Table 8 U.S. Fdp In Energy & Utilities, 2013-2019 (Usd Mn)

Table 9 U.S. Fdp In Retail, 2013-2019 (Usd Mn)

Table 10 U.S. Fdp In Telecommunications & It, 2013-2019 (Usd Mn)

Table 11 U.S. Fdp In Healthcare, By Geography, 2013-2019 (Usd Mn)

Table 12 U.S. Fdp In Public Sector & Government, 2013-2019 (Usd Mn)

Table 13 U.S. Aml In Bfsi, 2013-2019 (Usd Mn)

Table 14 U.S. Aml In Real Estate, 2013-2019 (Usd Mn)

Table 15 U.S. Account Takeover In Bfsi, 2013-2019 (Usd Mn)

Table 16 U.S. Account Takeover In E-Retail & E-Commerce, 2013-2019 (Usd Mn)

Table 17 U.S. Account Takeover In Public Sector & Government, 2013-2019 (Usd Mn)

Table 18 U.S. Fdp Market, By End User, 2013-2019 (Usd Mn)

Table 19 U.S. Aml Market, By End User, 2013-2019 (Usd Mn)

Table 20 U.S. Fdp In Sme, 2013-2019 (Usd Mn)

Table 21 U.S. Aml In Sme, 2013-2019 (Usd Mn)

Table 22 U.S. Fdp In Large Enterprises, 2013-2019 (Usd Mn)

Table 23 U.S. Aml In Large Enterprises, 2013-2019 (Usd Mn)

Table 24 U.S. Fdp Market, By Type, 2013-2019 (Usd Mn)

Table 25 U.S. Fdp Market, By Solutions, 2013-2019 (Usd Mn)

Table 26 U.S. Fdp Market, By Services, 2013-2019 (Usd Mn)

Table 27 U.S. Fraud Authentication Market, 2013-2019 (Usd Mn)

Table 28 U.S. Fraud Analytics Market, 2013-2019 (Usd Mn)

Table 29 U.S. Governance, Risk, And Compliance Market, 2013-2019 (Usd Mn)

Table 30 U.S. Reporting & Visualization Tools Market, 2013-2019 (Usd Mn)

Table 31 U.S. Professional Services Market, 2013-2019 (Usd Mn)

Table 32 U.S. Managed Security Services Market, 2013-2019 (Usd Mn)

Table 33 U.S. Support & Maintenance Services Market, 2013-2019 (Usd Mn)

Table 34 U.S. Fdp, Aml And Account Takeover Market: Mergers & Acquisitions

Table 35 U.S. Fdp, Aml And Account Takeover Market: New Product Development

Table 36 U.S. Fdp, Aml And Account Takeover Market: Joint Ventures, Partnerships, And Collaborations

Table 37 Equifax: Key Financials, 2009-2014 (Usd Mn)

Table 38 Experian: Key Financials, 2010-2014 (Usd Mn)

Table 39 Aci Worldwide Inc.: Key Financials, 2009-2013 (Usd Mn)

Table 40 Transunion: Key Financials, 2010-2014 (Usd Mn)

List Of Figures

Figure 1 U.S. Fraud Detection And Prevention Market: Segmentation & Coverage

Figure 2 U.S. Anti Money Laundering Market: Segmentation & Coverage

Figure 3 U.S. Account Takeover Market: Segmentation & Coverage

Figure 4 Fdp, Aml And Account Takeover Market: Integrated Ecosystem

Figure 5 Research Methodology

Figure 6 Top Down Approach

Figure 7 Bottom-Up Approach

Figure 8 Macro Indicator-Based Approach

Figure 9 U.S. Fraud Detection And Prevention Market: Snapshot

Figure 10 U.S. Anti Money Laundering Market: Snapshot

Figure 11 U.S. Account Takeover Market: Snapshot

Figure 12 Fdp, Aml And Account Takeover Market: Growth Aspects

Figure 13 U.S. Fdp, Aml And Account Takeover Market Snapshot

Figure 14 U.S. Fdp, Aml And Account Takeover Market: Key Market Dynamics

Figure 15 U.S. Fdp, Aml And Account Takeover Market: Drivers And Inhibitors

Figure 16 Fdp, Aml And Account Takeover: Verticals Market Scenario

Figure 17 U.S. Fdp Market, By Vertical, 2014-2019 (Usd Mn)

Figure 18 U.S. Aml Market, By Vertical, 2014-2019 (Usd Mn)

Figure 19 U.S. Account Takeover Market, By Vertical, 2014-2019 (Usd Mn)

Figure 20 U.S. Fdp Market In Bfsi, 2013-2019 (Usd Mn)

Figure 21 U.S. Fdp Market In Energy & Utilities, 2013-2019 (Usd Mn)

Figure 22 U.S. Fdp Market In Retail, 2013-2019 (Usd Mn)

Figure 23 U.S. Fdp Market In Telecommunications & It, 2013-2019 (Usd Mn)

Figure 24 U.S. Fdp Market In Healthcare, 2013-2019 (Usd Mn)

Figure 25 U.S. Fdp Market In Public Sector & Government, 2013-2019 (Usd Mn)

Figure 26 U.S. Aml Market In Bfsi, 2013-2019 (Usd Mn)

Figure 27 U.S. Aml Market In Real Estate, 2013-2019 (Usd Mn)

Figure 28 U.S. Account Takeover Market In Bfsi, 2013-2019 (Usd Mn)

Figure 29 U.S. Account Takeover Market In E-Retail & E-Commerce, 2013-2019 (Usd Mn)

Figure 30 U.S. Account Takeover Market In Public Sector & Government, 2013-2019 (Usd Mn)

Figure 31 Fdp, Aml And Account Takeover: End User Market Scenario

Figure 32 U.S. Fdp Market, By End User, 2014-2019 (Usd Mn)

Figure 33 U.S. Aml Market, By End User, 2014-2019 (Usd Mn)

Figure 34 U.S. Fdp Market In Sme, 2013-2019 (Usd Mn)

Figure 35 U.S. Aml Market In Sme, 2013-2019 (Usd Mn)

Figure 36 U.S. Fdp Market In Large Enterprises, 2013-2019 (Usd Mn)

Figure 37 U.S. Aml Market In Large Enterprises, 2013-2019 (Usd Mn)

Figure 38 U.S. Fdp Market, By Type, 2014-2019 (Usd Mn)

Figure 39 U.S. Fdp Market, By Solutions, 2014-2019 (Usd Mn)

Figure 40 U.S. Fdp Market, By Services, 2014-2019 (Usd Mn)

Figure 41 U.S. Fraud Authentication Market, 2013-2019 (Usd Mn)

Figure 42 U.S. Fraud Analytics Market, 2013-2019 (Usd Mn)

Figure 43 U.S. Governance, Risk, And Compliance Market, 2013-2019 (Usd Mn)

Figure 44 U.S. Reporting & Visualization Tools Market, 2013-2019 (Usd Mn)

Figure 45 U.S. Professional Services Market, 2013-2019 (Usd Mn)

Figure 46 U.S. Managed Security Services Market, 2013-2019 (Usd Mn)

Figure 47 U.S. Support & Maintenance Services Market, 2013-2019 (Usd Mn)

Figure 48 Fdp, Aml And Account Takeover: Company Product Coverage, By Type, 2014

Figure 49 Equifax, Inc.: Revenue Mix

Figure 50 Experian: Revenue Mix, 2014

Figure 51 Aci Worldwide Inc.: Revenue Mix

Figure 52 Transunion: Revenue Mix

Fraud is defined as the misleading or false representation of facts and the victim relies on that statement, which then benefits the criminal. Enterprises today are more vulnerable to fraud incidents, with the prime reasons behind this vulnerability being the massive amount of enterprise data and the technological advancements. As the size of the enterprise data increases, analysis of that data becomes more complex. On the other hand, criminals always try to cheat enterprises for their own benefits and personal interests. The other main reason contributing for the occurrence of fraud includes weaknesses in the internal framework of an organization.

The other type of fraud that commonly occurs is money laundering. Money laundering is the representation of large amounts of money as being acquired from legal sources, although obtained from illegal sources. Organizations, in order to address these challenges, use the fraud detection and prevention tools and techniques that enable them to detect the occurrence of fraud as and when it occurs and also helps to prevent it in the future. Fraud detection and prevention solutions provide strong defense against such incidents and help to find and/or prevent such occurrences. The fraud detection and prevention tools and techniques include fraud authentication, fraud analytics, GRC, reporting and visualization tools.

Counter measures against frauds used to be manual but, with time, the size of the enterprise data has increased and automatic software-based applications replaced many of the old manual methods. In this era of globalization, the size of the enterprise data has increased exponentially. It has become very difficult for traditional data mining applications and tools to analyze this data in real-time. New technological advancements are shaping the market with newer breed of fraud detection and prevention solutions coming into existence. Moreover, organizations need to bear heavy financial losses and, with the risk of the fraud today having increased, organizations are adopting the latest fraud detection and prevention techniques.

Companies dominating the U.S. fraud detection & prevention, anti money laundering and account takeover market include Equifax, Inc., Intellinx, Nice Actimize, Experian, Call Credit, Easy Solutions, ACI Worldwide, Inc., TransUnion, and LexisNexis Risk Solutions. The market is expected to grow from $2,068.7 million in 2014 to $3,876.2 million by 2019, at a CAGR of 13.4% from 2014 to 2019.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Identity and Access Management (IAM) Market The North America Incident and Emergency Management (IEM) Market is expected to grow $28.69 million in 2013 to $33.99 million in 2018, with an expected CAGR of 3.4% for the period of 2013-2018. This report on the North America Incident and Emergency Management (IEM) Market provides insights on key market players, future scope, drivers, restraints and challenges of the market. |

Upcoming |

|

Europe Identity and Access Management (IAM) Market The Europe Incident and Emergency Management (IEM) Market is expected to grow $17.02 million in 2013 to $23.45 million in 2018, with an expected CAGR of 6.6%.Europe Incident and Emergency Management (IEM) Market revenue is classified into types such as Simulation tools, Communication technologies, System and Platforms, and Professional services. |

Upcoming |

|

Asia Pacific and Japan (APAC) Identity Access Management (IAM) Market The APAC Incident and Emergency Management (IEM) Market is expected to grow $14.38 million in 2013 to $21.29 million in 2018, with an expected CAGR of 8.2% for the period of 2013-2018. This report on the APAC Incident and Emergency Management (IEM) Market provides insights on key market players, future scope, drivers, restraints and challenges of the market. |

Upcoming |

|

Middle East and Africa Identity and Access Management (IAM) Market The Middle East and Africa Incident and Emergency Management (IEM) Market is expected to grow $5.91 million in 2013 to $8.87 million in 2018, with an expected CAGR of 8.5%. This report on the Middle East and Africa Incident and Emergency Management (IEM) Market provides insights on key market players, future scope, drivers, restraints and challenges of the market. |

Upcoming |

|

Latin America Identity and Access Management (IAM) Market The Latin America Incident and Emergency Management (IEM) Market is expected to grow $3.47 million in 2013 to $5.79 million in 2018, with an expected CAGR of 10.8%.Latin America Incident and Emergency Management (IEM) Market revenue is classified into types such as Simulation tools, Communication technologies, System and Platforms, and Professional services. |

Upcoming |