The U.S enterprise collaboration market is estimated to grow from $19.06 billion in 2013 to $28.10 billion by 2019, at a CAGR of 6.7% from 2014 to 2019. The U.S market is primarily driven by the expansion of the cloud market.

Enterprise collaboration is a method to communicate with other employees, and it includes the use of enterprise social networking tools, corporate intranet, public internet, and collaboration platform. Enterprise collaboration helps employees to share information across various geographical locations, through the combination of software, and network capabilities.

Today, every company is affected by globalization, and more globalized businesses need improvised communication and collaboration to synchronize and work towards common goals. Several emerging markets have experienced double-digit growth in Internet adoption, smart phones and mobile computing devices, which trigger the need for better techniques of integration and collaboration.

The report provides a competitive benchmarking of the leading players in this market such as IBM, Cisco, Google, Microsoft, and Adobe. The report also gives the financial analysis, which includes CAGRs and market shares of the different region, vendors, overall adoption scenario, competitive landscape, key drivers, restraints, and opportunities in the market.

Report Options:

The market segmentation covered in this report is as given below:

- By Solution: Telephony, unified messaging, conferencing, collaborative platforms and applications, and enterprise social networks

- By Services: Professionals and support services, and consulting services

- By Deployment Type: On-premise and on-demand

- By Types of End-Users: Small and medium businesses (SMBs) and enterprises

- By Industry Verticals: BFSI, business services, IT and telecom, manufacturing, retail and wholesale, healthcare, and governments, among others

Customization Options:

Along with the MMM assessment, customize the report in alignment with your company’s specific needs. The following customization options provide a comprehensive summary of the industry standards and deep dive analysis:

Enterprise Collaboration Market Solutions Matrix and Key Recommendations

- A comprehensive analysis and benchmarking by solution, by services, by deployment type, by type of users and by industry verticals in the market

- To evaluate current usage, expected adoption, and preferences surrounding collaboration technologies and services

- Recommendations on which collaborative service to use to drive better business results

- An impact analysis of enterprise social software, mobile, and SaaS/cloud computing on traditional collaborative applications

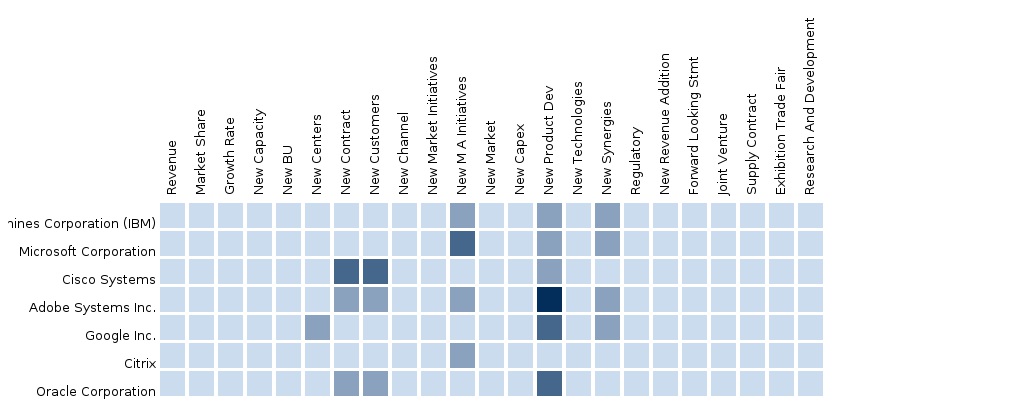

Enterprise Collaboration Market Competitive Benchmarking

- Value-chain evaluation using events, developments, market data for vendors in the market ecosystem, across various industrial verticals, market segmentation and categorization

- To uncover hidden opportunities by connecting related markets using cascaded value chain analysis

Enterprise Collaboration Market Vendor Landscaping

- Vendor market watch and predictions, vendor market shares and offerings, categorization of adoption trends and market dominance (leaders, challengers, and followers)

Enterprise Collaboration Market Data Tracker

- Country-specific market forecast and analysis

- The identification of key end-user segments, by country

Enterprise Collaboration Market Vertical Analysis

- An analysis of different industrial verticals by solution, by services, by deployment type, by type of users, and by industry verticals in the market

Enterprise Collaboration Market Emerging Vendor Landscape

- Evaluating Tier-2/3 vendors’ market offerings using a 2X2 framework (realizing leaders, challengers, and followers)

Enterprise Collaboration Market Channel Analysis

- Channel/distribution partners/alliances for tier-1 vendors and application-specific products being build towards the customer end of the value chain

Enterprise Collaboration Market Client Tracker

- The listing and analysis of deals, case studies, R&D investments, events, discussion forums, campaigns, alliances and partners of tier-1 and tier-2/3 vendors for the last 3 years

1 Introduction

1.1 Key Take-aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Points

1.5.2 Data Triangulation and Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary

2.1 Abstract

2.2 Overall Market Size

3 U.S. Enterprise Collaboration: Market Overview

3.1 Market Definition

3.2 Market Evolution

3.3 Market Segmentation

3.4 Market Dynamics

3.4.1 Drivers

3.4.2 Restraints and Challenges

3.4.3 Opportunities

3.4.4 Impact Analysis of DRO

3.5 Value Chain

3.6 Enterprise Collaboration Elements

3.6.1 Communication

3.6.2 Coordination

3.6.3 Standards and Processes

3.6.4 Technology

3.6.5 Policy and Governance

3.7 Enterprise Collaboration Framework

3.7.1 Structuring Business Process Model

3.7.2 Directions and Guidelines For Enterprise Collaboration

3.7.3 Evaluation

3.8 Enterprise Collaboration Types

3.8.1 Process Oriented Solutions

3.8.2 People Oriented Solutions

3.9 Collaboration As A Service (Caas)

4 U.S. Enterprise Collaboration: Market Size and Forecast By Solutions

4.1 Introduction

4.2 Telephony

4.2.1 Overview

4.2.2 Market Size and Forecast

4.2.2.1 Market Size and Forecast By Verticals

4.2.2.2 Market Size and Forecast By Users

4.3 Unified Messaging

4.3.1 Overview

4.3.2 Market Size and Forecast

4.3.2.1 Market Size and Forecast By Verticals

4.3.2.2 Market Size and Forecast By Users

4.4 Conferencing

4.4.1 Overview

4.4.2 Market Size and Forecast

4.4.2.1 Market Size and Forecast By Verticals

4.4.2.2 Market Size and Forecast By Users

4.5 Collaborative Platforms and Applications

4.5.1 Overview

4.5.2 Market Size and Forecast

4.5.2.1 Market Size and Forecast By Verticals

4.5.2.2 Market Size and Forecast By Users

4.6 Enterprise Social Networks

4.6.1 Overview

4.6.2 Market Size and Forecast

4.6.2.1 Market Size and Forecast By Verticals

4.6.2.2 Market Size and Forecast By Users

5 U.S. Enterprise Collaboration: Market Size and Forecast By Services

5.1 Introduction

5.2 Professional and Support Services

5.2.1 Overview

5.2.2 Market Size and Forecast

5.2.2.1 Market Size and Forecast By Verticals

5.2.2.2 Market Size and Forecast By Users

5.3 Consulting Services

5.3.1 Overview

5.3.2 Market Size and Forecast

5.3.2.1 Market Size and Forecast By Verticals

5.3.2.2 Market Size and Forecast By Users

6 U.S. Enterprise Collaboration: Market Size and Forecast By Deployment Types

6.1 Introduction

6.2 On-Premise

6.2.1 Overview

6.2.2 Market Size and Forecast

6.2.2.1 Market Size and Forecast By Verticals

6.2.2.2 Market Size and Forecast By Countries

6.3 On-Demand

6.3.1 Overview

6.3.2 Market Size and Forecast

6.3.2.1 Market Size and Forecast By Verticals

6.3.2.2 Market Size and Forecast By Countries

7 U.S. Enterprise Collaboration: Market Size and Forecast By Users

7.1 Introduction

7.2 Small and Medium Enterprises

7.2.1 Overview

7.2.2 Market Size and Forecast

7.2.2.1 Market Size and Forecast By Verticals

7.2.2.2 Market Size and Forecast By Countries

7.3 Large Enterprise

7.3.1 Overview

7.3.2 Market Size and Forecast

7.3.2.1 Market Size and Forecast By Verticals

7.3.2.2 Market Size and Forecast By Countries

8 U.S. Enterprise Collaboration: Market Size and Forecast By Verticals

8.1 Introduction

8.2 Banking, Financial Services and Insurance (BFSI)

8.2.1 Overview

8.2.2 Market Size and Forecast

8.2.2.1 Market Size and Forecast By Countries

8.3 Business Services

8.3.1 Overview

8.3.2 Market Size and Forecast

8.3.2.1 Market Size and Forecast By Countries

8.4 IT and Telecom

8.4.1 Overview

8.4.2 Market Size and Forecast

8.4.2.1 Market Size and Forecast By Countries

8.5 Manufacturing

8.5.1 Overview

8.5.2 Market Size and Forecast

8.5.2.1 Market Size and Forecast By Countries

8.6 Retail and Wholesale

8.6.1 Overview

8.6.2 Market Size and Forecast

8.6.2.1 Market Size and Forecast By Countries

8.7 Healthcare

8.7.1 Overview

8.7.2 Market Size and Forecast

8.7.2.1 Market Size and Forecast By Countries

8.8 Government

8.8.1 Overview

8.8.2 Market Size and Forecast

8.8.2.1 Market Size and Forecast By Countries

8.9 Others

8.9.1 Overview

8.9.2 Market Size and Forecast

8.9.2.1 Market Size and Forecast By Countries

9 U.S. Enterprise Collaboration: Market Landscape

9.1 Competitive Landscape

9.1.1 Ecosystem and Roles

9.1.2 Portfolio Comparison

9.1.2.1 Overview

9.1.2.2 Product Category Mapping

9.2 End-User Landscape

9.2.1 Market Opportunity Analysis

9.2.2 End-User Analysis

9.2.2.1 Global Mobile Data Traffic to Grow At A Cagr of 40.31% in the Next Five Years

9.2.2.2 Global Smartphones Are Expected to Hold More Than 70% of the total Handset Market By 2018

9.2.2.3 Global Internet Speed Has Grown By 12 Percent Worldwide

10 Company Profile (MMM View, Overview, Products & Services, Strategy & Analyst Insights, Developments)

10.1 Adobe Systems

10.2 Cisco Systems, Inc.

10.3 Citrix

10.4 Google

10.5 Ibm

10.6 Jive Software

10.7 Microsoft

10.8 Novell

10.9 Open Text Corporation

10.10 Oracle

Appendix

Mergers and Acquisitions (M&A)

Venture Capital

List of Tables

Table 1 U.S. Enterprise Collaboration: Market Size, 2014–2019 ($Billion)

Table 2 U.S. Enterprise Collaboration Solution Market Size, 2014-2019 ($Billion)

Table 3 U.S. Solution Market, By Types, 2014-2019, Y-O-Y (%)

Table 4 U.S. Enterprise Collaboration Telephony Solutions Market Size, By Verticals, 2014-2019 ($Billion)

Table 5 U.S. Telephony Solutions Market Size, By Verticals, 2014-2019, Y-O-Y (%)

Table 6 U.S. Telephony Solutions Market Size, By Users, 2014-2019 ($Billion)

Table 7 U.S. Telephony Solutions Market Size, By Users, 2014-2019, Y-O-Y (%)

Table 8 U.S. Unified Messaging Solutions Market, By Verticals, 2014-2019 ($Billion)

Table 9 U.S. Unified Messaging Solutions Market, By Verticals, 2014 -2019, Y-O-Y (%)

Table 10 U.S. Unified Messaging Solutions Market, By Users, 2014-2019 ($Billion)

Table 11 U.S. Unified Messaging Solutions Market, By Users, 2014-2019, Y-O-Y (%)

Table 12 U.S. Enterprise Collaboration Conferencing Solutions Market, By Verticals, 2014-2019 ($Billion)

Table 13 U.S. Conferencing Solutions Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 14 U.S. Conferencing Solutions Market, By Users, 2014-2019 ($Billion)

Table 15 U.S. Conferencing Solutions Market, By Users, 2014-2019, Y-O-Y (%)

Table 16 U.S. Enterprise Collaboration Collaborative Platforms and Applications Market, By Verticals, 2014-2019 ($Billion)

Table 17 U.S. Collaborative Platforms and Applications Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 18 U.S. Collaborative Platforms and Applications Market, By Users, 2014-2019 ($Billion)

Table 19 U.S. Collaborative Platforms and Applications Market, By Users, 2014 -2019, Y-O-Y (%)

Table 20 U.S. Enterprise Social Networks Market, By Verticals, 2014-2019 ($Billion)

Table 21 U.S. Enterprise Social Networks Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 22 U.S. Enterprise Social Network Market, By Users, 2014 -2019 ($Billion)

Table 23 U.S. Enterprise Social Networks Market, By Users, 2014-2019, Y-O-Y (%)

Table 24 U.S. Enterprise Collaboration Services Market Size, By Types, 2014-2019 ($Billion)

Table 25 U.S. Services Market Size, 2014-2019, Y-O-Y (%)

Table 26 U.S. Professional and Support Service Market, By Verticals, 2014-2019 ($Billion)

Table 27 U.S. Professional and Support Service Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 28 U.S. Professional and Support Service Market, By Users, 2014-2019 ($Billion)

Table 29 U.S. Professional and Support Service Market, By Users, 2014-2019, Y-O-Y (%)

Table 30 U.S. Consulting Service Market, By Verticals, 2014-2019 ($Billion)

Table 31 U.S. Consulting Service Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 32 U.S. Consulting Service Market, By Users, 2014-2019 ($Billion)

Table 33 U.S. Consulting Service Market, By Users, 2014-2019, Y-O-Y (%)

Table 34 U.S. Enterprise Collaboration Deployment Type Market Size, 2014-2019 ($ Billion)

Table 35 U.S. Deployment Type Market Size, By Type, 2014-2019, Y-O-Y (%) By Verticals, 2014-2019 ($ Billion)

Table 36 U.S. On-Premise Deployment Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 37 U.S. On-Premise Deployment Market, By Countries, 2014-2019 ($Billion)

Table 38 U.S. On-Premise Deployment Market, By Countries, 2014-2019, Y-O-Y (%)

Table 39 U.S. On-Demand Deployment Market, By Verticals, 2014-2019 ($Billion)

Table 40 U.S. On-Demand Deployment Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 41 U.S. On-Demand Deployment Market, By Countries, 2014-2019 ($Billion)

Table 42 U.S. On-Demand Deployment Market, By Countries, 2014-2019, Y-O-Y (%)

Table 43 U.S. Enterprise Collaboration: Market, By End Users, 2014-2019 ($Billion)

Table 44 U.S. Market, By End Users, 2014-2019, Y-O-Y (%)

Table 45 U.S. Small and Medium Enterprises Market, By Verticals, 2014-2019 ($Billion)

Table 46 U.S. Small and Medium Enterprises Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 47 U.S. Small and Medium Enterprises Market, By Countries, 2014-2019 ($Billion)

Table 48 U.S. Small and Medium Enterprises Market, By Countries, 2014-2019, Y-O-Y (%)

Table 49 U.S. Large Enterprise Market, By Verticals, 2014-2019 ($Billion)

Table 50 U.S. Large Enterprise Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 50 U.S. Large Enterprise Market, By Countries, 2014-2019 ($Billion)

Table 52 U.S. Large Enterprise Market, By Countries, 2014-2019, Y-0-Y (%)

Table 53 U.S. Enterprise Collaboration Market, By Verticals, 2014-2019 ($Billion)

Table 54 U.S. Market, By Verticals, 2014-2019, Y-O-Y (%)

Table 55 U.S. BFSI Market, By Countries, 2014-2019 ($Billion)

Table 56 U.S. BFSI Market, By Countries, 2014-2019, Y-O-Y (%)

Table 57 U.S. Business Services Market, By Countries, 2014-2019 ($Billion)

Table 58 U.S. Business Services Market, By Countries, 2014-2019, Y-O-Y (%)

Table 59 U.S. Enterprise Collaboration IT and Telecom Market, By Countries, 2014-2019 ($Billion)

Table 60 U.S. IT and Telecom Market, By Countries, 2014-2019, Y-O-Y (%)

Table 61 U.S. Manufacturing Market, By Countries, 2014-2019 ($Billion)

Table 62 U.S. Manufacturing Market, By Countries, 2014-2019, Y-O-Y (%)

Table 63 U.S. Retail and Wholesale Market, By Countries, 2014-2019 ($Billion)

Table 64 U.S. Retail and Wholesale Market, By Countries, 2014-2019, Y-O-Y (%)

Table 65 U.S. Healthcare Market, By Countries, 2014-2019 ($Billion)

Table 66 U.S. Healthcare Market, By Countries, 2014-2019, Y-O-Y (%)

Table 67 U.S. Government Market, By Countries, 2014-2019 ($Billion)

Table 68 U.S. Government Market, By Countries, 2014-2019, Y-O-Y (%)

Table 69 U.S. Enterprise Collaboration Other Verticals Market, By Countries, 2014-2019 ($Billion)

Table 70 U.S. Other Verticals Market, By Countries, 2014-2019, Y-O-Y (%)

Table 71 U.S. Enterprise Collaboration: Market, By Countries, 2014-2019 ($Billion)

Table 72 U.S. Market, By Countries, 2014-2019, Y-O-Y (%)

Table 73 U.S. Enterprise Collaboration U.S. Market, By Solutions, 2014-2019 ($Billion)

Table 74 U.S. Market, By Solutions, 2014-2019, Y-O-Y (%)

Table 75 U.S. Market, By Services, 2014-2019 ($Billion)

Table 76 U.S. Market, By Services, 2014-2019, Y-O-Y (%)

List of Figures

Figure 1 Stakeholders

Figure 2 Research Methodology

Figure 3 Enterprise Collaboration: Market Growth, 2014–2019, ($Billion, Y-O-Y %)

Figure 4 Evolution

Figure 5 Market Segmentation

Figure 6 Impact Analysis of DRO

Figure 7 Value Chain

Figure 8 Framework

Figure 9 U.S. Enterprise Collaboration Solution Market, By Types, 2014-2019, Y-O-Y (%)

Figure 10 U.S. Telephony Solutions Market Size, 2014-2019 ($Billion, Y-O-Y %)

Figure 11 U.S. Unified Messaging Solutions Market Size, 2014-2019 ($Billion, Y-O-Y %)

Figure 12 U.S. Conferencing Solutions Market Size, 2014-2019 ($Billion, Y-O-Y %)

Figure 13 U.S. Collaborative Platforms and Applications Solutions Market Size, 2014-2019 ($Billion, Y-O-Y %)

Figure 14 U.S. Enterprise Social Networks Solutions Market Size, 2014 -2019 ($ Billion, Y-O-Y %)

Figure 15 U.S. Services Market Size, By Types, 2014-2019, Y-O-Y (%)

Figure 16 U.S. Professional Services Market Size, 2014-2019 ($Billion, Y-O-Y %)

Figure 17 U.S. Consulting Services Market Size, 2014-2019 ($Billion, Y-O-Y %)

Figure 18 U.S. Deployment Types Market Size, By Types, 2014-2019, Y-O-Y (%)

Figure 19 U.S. On-Premise Deployment Type, 2014-2019 ($ Billion, Y-O-Y %)

Figure 20 U.S. On-Demand Deployment Type, 2014-2019 ($Billion, Y-O-Y %)

Figure 21 U.S. Enterprise Collaboration Market, By End Users, 2014-2019, Y-O-Y (%)

Figure 22 U.S. Small and Medium Enterprises Market, 2014-2019 ($ Billion, Y-O-Y %)

Figure 23 U.S. Large Enterprise Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 24 U.S. Enterprise Collaboration: Market, By Verticals, 2014-2019, Y-O-Y (%)

Figure 25 U.S. BFSI Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 26 U.S. Business Service Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 27 U.S. IT and Telecom Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 28 U.S. Manufacturing Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 29 U.S. Retail and Wholesale Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 30 U.S. Healthcare Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 31 U.S. Government Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 32 U.S. Enterprise Collaboration Other Verticals Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 33 U.S. Enterprise Collaboration: Market, By Countries, 2014-2019, Y-O-Y (%)

Figure 34 U.S. Parfait Chart

Figure 35 U.S. Market, 2014-2019 ($Billion, Y-O-Y %)

Figure 36 U.S. Ecosystem

Figure 37 U.S. Product Category Mapping

Figure 38 U.S. Market Opportunity Plot

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement