South America Image Sensor Market by Type (CMOS Image Sensor, CCD Image Sensor, Others), by Application - Analysis and Forecast to 2019

The South American image sensor market, mainly driven by the increasing demand for high quality cameras in smartphones and tablets, along with the increasing application of image sensors in the South American medical diagnostic and image sensor market was estimated to be $622.3 million in 2014 and is projected to reach $1,053.6 million by 2019 at a CAGR of 11.1% from 2014 to 2019.

An image sensor is a device used to convert optical image presented by lens into an electrical signal, which is mostly used in digital cameras, camera modules, and other imaging devices. Currently, most digital still cameras make use of either a CCD image sensor or a CMOS sensor. For years, CCDs were favoured where image quality was the most important parameter, while CMOS image sensors were used in applications such as PC cameras and camera phones due to qualities such as low power consumption and a high degree of on-chip integration. Over the last decade, CMOS image sensor technology made huge progress. Advances in pixel structure such as global shutter pixels have already reduced the gap between speed and image quality, which had been an issue in high speed applications.

The report also provides an extensive competitive landscape of companies that operate in this market. The main companies that operate in this market and extensively covered in this report are Canon Inc., Aptina Imaging, CMOSIS, Fujifilm, Hitachi Ltd., Sony Corporation, and so on.

Segment and country-specific company shares, news & deals, M&A, segment-specific pipeline products, product approvals, and product recalls of major companies have been provided in detail.

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of South America Image Sensor Market

2.2 Arriving at the Image Sensor Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 South America Image Sensor Market: Comparison With Parent Market

4.3 Market Drivers And Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 South America Image Sensor Market, By Technology (Page No. - 28)

5.1 Introduction

5.2 South America Image Sensor Market, Type Comparison With Sensor Market

5.3 South America CMOS Image Sensor Market, By Geography

5.4 South America CCD Image Sensor Market, By Geography

5.5 South America Contact Image Sensor Market, By Geography

6 South America Image Sensor Market, By Application (Page No. - 35)

6.1 Introduction

6.2 Demand Side Analysis

6.3 South America Image Sensor Market in Consumer Sector, By Geography

6.4 South America Image Sensor Market in Consumer Sector, By Application

6.5 South America Image Sensor Market in Surveillance, By Geography

6.6 South America Image Sensor Market in Automotive, By Geography

6.7 South America Image Sensor Market in Automotive, By Application

6.8 South America Image Sensor Market in Medical Sector, By Geography

6.9 South America Image Sensor Market in Medical Sector, By Application

6.10 South America Image Sensor Market in Endoscopy, By Geography

6.11 South America Image Sensor Market in Endoscopy, By Application

6.12 South America Image Sensor Market in Rigid Endoscopy, By Application

6.13 South America Image Sensor Market in Flexible Endoscopy, By Application

6.14 South America Image Sensor Market in Digital Radiology, By Geography

6.15 South America Image Sensor Market in Digital Radiology, By Application

6.16 South America Image Sensor Market in Ophthalmology, By Geography

6.17 South America Image Sensor Market in Opthalmology, By Application

6.18 South America Image Sensor Market in Defense And Aerospace Sector, By Geography

6.19 South America Image Sensor Market in Defense And Aerospace Sector, By Application

6.20 South America Image Sensor Market in Global Visible Spectrum Image Sensors By Defense Equipment, By Application

6.21 South America Image Sensor Market in Industrial Sector, By Geography

6.22 South America Image Sensor Market in Industrial Sector, By Application

6.23 South America Image Sensor Market in Industrial Sector (Scan Types), By Application

7 South America Image Sensor, By Geography (Page No. - 59)

7.1 Introduction

7.2 Brazil Image Sensor Market

7.2.1 Brazil Image Sensor Market, By Application

7.2.2 Brazil Image Sensor Market, By Technology

7.3 Argentina Image Sensor Market

7.3.1 Argentina Image Sensor Market, By Application

7.3.2 Argentina Image Sensor Market, By Type

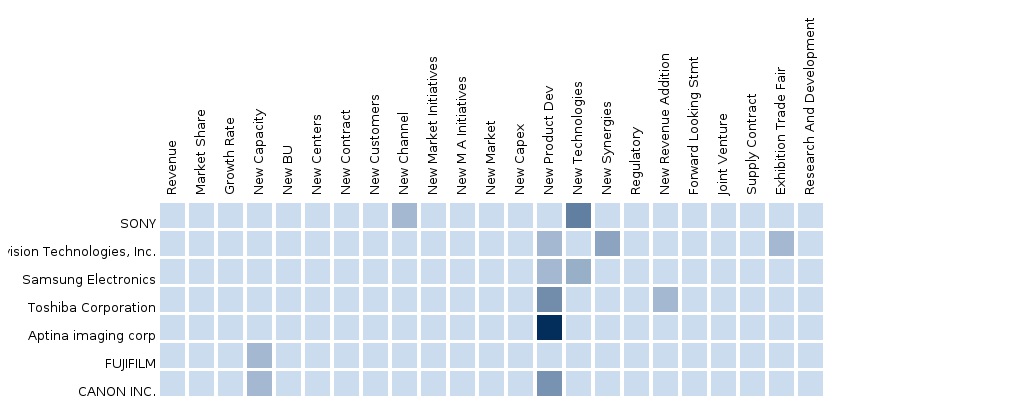

8 South America Image Sensor Market Competitive Landscape (Page No. - 69)

8.1 South America Image Sensor Market: Company Share Analysis

8.2 Company Presence in Image Sensor Market, By Technology

8.3 New Product Development And New Launches

8.4 Mergers & Acquisitions

8.5 Collaborations

9 Image Sensor Market, By Company (Page No. - 74)

9.1 Omnivision Technologies Ltd.

9.1.1 Company Snapshot

9.1.2 Product Portfolio

9.1.3 Key Financials

9.1.4 Strategy

9.1.5 Developments

9.2 Aptina Imaging Corporation

9.2.1 Company Snapshot

9.2.2 Product Portfolio

9.2.3 Key Financials

9.2.4 Strategy

9.2.5 Developments

9.3 Samsung Electronics

9.3.1 Company Snapshot

9.3.2 Product Portfolio

9.3.3 Key Financials

9.3.4 Strategy

9.3.5 Developments

9.4 Sony Corporation

9.4.1 Company Snapshot

9.4.2 Product Portfolio

9.4.3 Key Financials

9.4.4 Strategy

9.4.5 Developments

9.5 Toshiba Corporation

9.5.1 Company Snapshot

9.5.2 Product Portfolio

9.5.3 Key Financials

9.5.4 Strategy

9.5.5 Developments

10 Appendix (Page No. - 92)

10.1 Customization Options

10.1.1 Product Portfolio Analysis

10.1.2 Country Level Data Analysis

10.1.3 Product Comparison of Various Competitors

10.1.4 Trade Analysis

10.2 Introducing RT: Real Time Market Intelligence

10.2.1 RT Snapshots

List of Tables (43 Tables)

Table 1 Global Image Sensor Market Size, By Technology, 2014 (USD )

Table 2 South America Image Sensor Application Market, 2014 (USD Thousand)

Table 3 Image Sensor Market: Macroindicators, By Geography, 2012 & 2013 (USD Thousand)

Table 4 South America Image Sensor Market: Comparison With Parent Market, 2013 – 2019 (USD Thousand)

Table 5 South America Image Sensor Market: Drivers And Inhibitors

Table 6 South America Image Sensor Market, By Application, 2013 - 2019 (USD Thousand)

Table 7 South America Image Sensor Market, By Type, 2014 (USD Thousand)

Table 8 South America Image Sensor Market: Comparison With Application Markets, 2013 - 2019 (USD Thousand)

Table 9 South America Image Sensor Market, By Type, 2013 - 2019 (Usd Mn)

Table 10 South America Image Sensor Market: Type Comparison With Parent Market, 2013–2019 (USD Thousand)

Table 11 South America CMOS Image Sensor Market, By Geography, 2013–2019 (USD Thousand)

Table 12 South America CCD Image Sensor Market, By Geography, 2013 - 2019 (USD Thousand)

Table 13 South America Contact Image Sensor Market, By Geography, 2013 - 2019 (USD Thousand)

Table 14 South America Image Sensor Market, By Application, 2013 - 2019 (USD Thousand)

Table 15 South America Image Sensor Market in Consumer Sector , By Geography, 2013 - 2019 (USD Thousand)

Table 16 South America Image Sensor Market in Consumer Sector , By Application, 2013 - 2019 (USD Thousand)

Table 17 South America Image Sensor Market in Surveillance, By Geography, 2013 - 2019 (USD Thousand)

Table 18 South America Image Sensor Market in Automotive, By Geography, 2013 - 2019 (USD Thousand)

Table 19 South America Image Sensor Market in Automotive, By Application, 2013 - 2019 (USD Thousand)

Table 20 South America Image Sensor Market in Medical Sector, By Application, 2013 - 2019 (USD Thousand)

Table 21 South America Image Sensor Market in Endoscopy, By Geography, 2013 - 2019 (USD Thousand)

Table 22 South America Image Sensor Market in Endoscopy, By Application, 2013 - 2019 (USD Thousand)

Table 23 South America Image Sensor Market in Rigid Endoscopy, By Application, 2013 - 2019 (USD Thousand)

Table 24 South America Image Sensor Market in Flexible Endoscopy, By Application, 2013 - 2019 (USD Thousand)

Table 25 South America Image Sensor Market in Digital Radiology, By Geography, 2013 - 2019 (USD Thousand)

Table 26 South America Image Sensor Market in Digital Radiology, By Application, 2013 - 2019 (USD Thousand)

Table 27 South America Image Sensor Market in Opthalmology, By Geography, 2013 - 2019 (USD Thousand)

Table 28 South America Image Sensor Market in Opthalmology, By Application, 2013 - 2019 (USD Thousand)

Table 29 South America Image Sensor Market in Defense And Aerospace Sector, By Geography, 2013 - 2019 (USD Thousand)

Table 30 South America Image Sensor Market in Defense And Aerospace Application Sector, By Application, 2013 - 2019 (USD Thousand)

Table 31 South America Image Sensor Market in Global Visible Spectrum Image Sensors By Defense Equipment, By Application, 2013 - 2019 (USD Thousand)

Table 32 South America Image Sensor Market in Industrial Sector, By Geography, 2013 - 2019 (USD Thousand)

Table 33 South America Image Sensor Market in Industrial Sector, By Application, 2013 - 2019 (USD Thousand)

Table 34 South America Image Sensor Market in Industrial Sector (Scan Types), By Application, 2013 - 2019 (USD Thousand)

Table 35 South America Image Sensor Market, By Geography, 2013 - 2019 (USD Thousand)

Table 36 Brazil Image Sensor Market, By Application, 2013-2019 (USD Thousand)

Table 37 Brazil Image Sensor Market, By Technology, 2013 - 2019 (USD Thousand)

Table 38 Argentina Image Sensor Market, By Application, 2013-2019 (USD Thousand)

Table 39 Argentina Image Sensor Market, By Technology, 2013 - 2019 (USD Thousand)

Table 40 South America Image Sensor Market: Company Share Analysis, 2013 (%)

Table 41 South America: New Product Development And New Launches

Table 42 Image Sensor Market: Mergers & Acquisitions

Table 43 Image Sensor Market: Collaborations

List of Figures (50 Figures)

Figure 1 South America Image Sensor Market: Segmentation & Coverage

Figure 2 South America Image Sensor Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 South America Image Sensor Market Snapshot

Figure 9 Image Sensor Market: Growth Aspects

Figure 10 South America Image Sensor Market, By Application, 2014 vs 2019

Figure 11 South America Image Sensor Types, By Geography, 2014 (USD Thousand)

Figure 12 South America Image Sensor Market, By Type, 2014 & 2019 (Usd Thousands)

Figure 13 South America Image Sensor Market: Type Comparison With Sensor Market, 2013–2019 (USD Thousand)

Figure 14 South America CMOS Image Sensor Market, By Geography, 2013–2019 (USD Thousand)

Figure 15 South America CCD Image Sensor Market, By Geography, 2013 - 2019 (USD Thousand)

Figure 16 South America Contact Image Sensor Market, By Geography, 2013 - 2019 (USD Thousand)

Figure 17 South America Image Sensor Market, By Application, 2014 - 2019 (USD Thousand)

Figure 18 South America Image Sensor Market in Consumer Sector, By Geography, 2013 - 2019 (USD Thousand)

Figure 19 South America Image Sensor Market in Consumer Sector, By Application, 2013 - 2019 (USD Thousand)

Figure 20 South America Image Sensor Market in Surveillance, By Geography, 2013 - 2019 (USD Thousand)

Figure 21 South America Image Sensor Market in Automotive, By Geography, 2013 - 2019 (USD Thousand)

Figure 22 South America Image Sensor Market in Automotive, By Application, 2013 - 2019 (USD Thousand)

Figure 23 South America Image Sensor Market in Medical Sector, By Geography, 2013 - 2019 (USD Thousand)

Figure 24 South America Image Sensor Market in Medical Sector, By Application, 2013 - 2019 (USD Thousand)

Figure 25 South America Image Sensor Market in Endoscopy, By Geography, 2013 - 2019 (USD Thousand)

Figure 26 South America Image Sensor Market in Endoscopy, By Application, 2013 - 2019 (USD Thousand)

Figure 27 South America Image Sensor Market in Rigid Endoscopy, By Application, 2013 - 2019 (USD Thousand)

Figure 28 South America Image Sensor Market in Flexible Endoscopy, By Application, 2013 - 2019 (USD Thousand)

Figure 29 South America Image Sensor Market in Digital Radiology, By Geography, 2013 - 2019 (USD Thousand)

Figure 30 South America Image Sensor Market in Digital Radiology, By Application, 2013 - 2019 (USD Thousand)

Figure 31 South America Image Sensor Market in Ophthalmology, By Geography, 2013 - 2019 (USD Thousand)

Figure 32 South America Image Sensor Market in Opthalmology, By Application, 2013 - 2019 (USD Thousand)

Figure 33 South America Image Sensor Market in Defense And Aerospace Sector, By Geography, 2013 - 2019 (USD Thousand)

Figure 34 South America Image Sensor Market in Defense And Aerospace Sector, By Application, 2013 - 2019 (USD Thousand)

Figure 35 South America Image Sensor Market in Global Visible Spectrum Image Sensors By Defense Equipment,By Application, 2013 - 2019 (USD Thousand)

Figure 36 South America Image Sensor Market in Industrial Sector, By Geography, 2013 - 2019 (USD Thousand)

Figure 37 South America Image Sensor Market in Industrial Sector, By Application, 2013 - 2019 (USD Thousand)

Figure 38 South America Image Sensor Market in Industrial Sector (Scan Types), By Application, 2013-2019(USD Thousand)

Figure 39 South America Image Sensor Market: Growth Analysis, By Geography, 2013-2019 (USD Thousand)

Figure 40 Brazil Image Sensor Market Overview, 2014 & 2019 (%)

Figure 41 Brazil Image Sensor Market, By Application, 2013-2019 (USD Thousand)

Figure 42 Brazil Image Sensor Market: Application Snapshot

Figure 43 Brazil Image Sensor Market, By Technology, 2013 - 2019 (USD Thousand)

Figure 44 Argentina Image Sensor Market Overview, 2014 & 2019 (%)

Figure 45 Argentina Image Sensor Market, By Application, 2013-2019 (USD Thousand)

Figure 46 Argentina Image Sensor Market: Application Snapshot

Figure 47 Argentina Image Sensor, By Type, 2013 - 2019 (USD Thousand)

Figure 48 Image Sensor Market: Company Share Analysis, 2013 (%)

Figure 49 Image Sensor: Company Product Coverage, By Technology, 2013

Figure 50 Omnivision: Application Markets Served, 2014

The South American image sensor market was estimated to be $622.3 million in 2014 and is projected to reach $1,053.6 million by 2019, at a CAGR of 11.1% from 2014 to 2019. Image sensor is an electronic photosensitive device that is used to convert an optical image into an electronic signal. It consists of millions of photodiodes and acts as an image receiver in digital imaging equipment. It is widely used in digital cameras, camera modules, and other imaging devices. Previously, there used to be analog sensors such as video tubes that are currently replaced by mostly CCD (charge-coupled device) and CMOS (complementary metal oxide semiconductor) image sensors. An increasing craze for photography in the youth fuels the growth of the image sensor market.

This study has been undertaken so as to understand the market dynamics in the area of image sensors, current revenue generated by image sensors, and its future forecast in terms of revenue. A study has been conducted to identify the key applications and geography, where huge opportunities can be expected in the coming future. Total image sensor shipment and its average selling price have been analysed in order to arrive at the final market size of the image sensor. Further, the image sensor revenue has also been analysed by clubbing the revenue of the top market players involved in the development of image sensors. This is further verified post a discussion with key market players.

The growth of image sensors is primarily driven by the consumer electronics segment due to an increased demand for camera-enabled mobile phones, digital cameras, and tablets PC. The consumption of additional power by the CCD image sensor is one of the main restraining factors, whereas low power consumption and high frame rate are some of the important growth factors for the development of CMOS image sensors.

The image sensor market is broadly segmented into consumer electronics, automotive & transportation, aerospace & defence, healthcare, industrial, and security & surveillance. The consumer electronics segment accounted for the largest market size of the image sensor market in 2014, while automotive and transportation is expected to grow at the highest CAGR from 2014 to 2020. Technological advancements in CMOS sensors such as the use of BSI (Back Side Illumination) technology, implementation of global shutter in CMOS sensors, key players focusing on new product developments, the U.S. Government supporting activities to develop monolithic CMOS sensors, increased use of CMOS sensors in NASA (The National Aeronautics and Space Administration), and increased awareness of the security are the key factors that stimulate the growth of the image sensors market.

The image sensor market is broadly classified into CCD sensors, CMOS sensors, and other sensors, where the others include IngAas, NMOS, and sCMOS sensors. CMOS image sensors accounted for the largest share of the image sensor market in 2014. CMOS image sensors are expected to grow at the highest rate from 2014 to 2020. This is mainly due to an increased use of CMOS sensors in consumer electronics, automotive & transportation, security & surveillance, and the industrial segment, as it can offer features such as low power consumption, low manufacturing cost, ease of integration, and higher frame rate. In addition, with the use of BSI technology, CMOS image sensors can produce better quality images in low light conditions, too. An implementation of global shutter made it possible to capture images of fast moving objects without any distortion. This results in an increased market share of CMOS image sensors.

Major companies in the image sensor industry include Sony Corporation (Japan), OmniVision Technologies (U.S.), Aptina Imaging Corporation (U.S.), Samsung Group (South Korea), and Toshiba Corporation (Japan) that focus on BSI technology to manufacture CMOS image sensors.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement