North America Unmanned Aerial Vehicles (UAV) Market by Class Type (Strategic, Special Purpose, Small & Tactical) by Application (Military, Civil & Commercial and Homeland Security) by Geography (U.S. & Canada) - Analysis and Forecast to 2019

In this report, the North America UAV market has been broadly classified on the basis of class type, application, and country. The major class types include strategic UAV, special purpose UAV, small UAV, and tactical UAV. The strategic UAV market for military applications is expected to be the largest segment in North America, which is projected to grow at a CAGR of 8.3% from 2014 to 2019. Factors such as the increasing defense spending for UAVs, the growing use of UAVs in civil & commercial applications, and the need for better operational efficiency for military applications are further driving the market at a significant pace.

The North American market is competitive with both large and small players. As of 2014, the North America UAV market was majorly dominated by General Atomics Aeronautical Systems, Inc. (U.S.), Northrop Grumman Corp. (U.S.), and The Boeing Co. (U.S.). New product launches, partnerships, and business expansions are the major strategies adopted by these key players to achieve market growth and dominance in the North America UAV market.

Key Take-away:

From an insight perspective, this research report has focused on various levels of analysis such as market share analysis of top players and company profiles, among others, which together provide basic views on the competitive landscape; emerging and high-growth segments of the UAV market in North America. In addition, high-growth countries & their respective regulatory policies and government initiatives, along with regional market drivers, restraints, and opportunities are also presented in this report.

This report will enrich both the established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn will help firms garner a greater share in the North America UAV market. Firms that purchase this report could use any one or a combination of five strategies, such as market penetration, product development/innovation, market development, market diversification, and competitive assessment to strengthen their market share.

This report provides insights on the following pointers:

- Market Penetration: Comprehensive information on UAVs offered by top players in the North American market for various applications

- Product Development/Innovation: Detailed insights on upcoming UAV technologies, research & development activities, and new product launches in North America

- Market Development: Comprehensive information of lucrative emerging markets in North America for various UAV class types at regional and country levels

- Market Diversification: Exhaustive information of new products launches, untapped geographies, recent developments, and expansions in the North America UAV market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and contracts of leading players in the North America UAV market

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 11)

2.1 Integrated Ecosystem of UAV Market

2.2 Arriving at the UAV Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Research Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 20)

4.1 Introduction

4.2 North America UAV Market: Comparison With Parent Market

4.3 Market Drivers & Inhibitors

4.4 Key Market Dynamics

4.5 Demand-Side Analysis

5 North America UAV Market, By Application (Page No. - 28)

5.1 Introduction

5.2 Demand-Side Analysis

5.3 North America UAV Market in Military Application, By Geography

5.4 North American UAV Market in Civil & Commercial Application, By Geography

5.5 North American UAV Market in Homeland Security Application, By Geography

5.6 Sneak View: North American Unmanned Vehicle Market, By Application

6 North America UAV Market, By Class Type (Page No. - 37)

6.1 Introduction

6.2 North American UAV Market, Class Type Comparison With Parent Market

6.3 North American Strategic UAV Market, By Geography

6.4 North American Special Purpose UAV Market, By Geography

6.5 North American Small UAV Market, By Geography

6.6 North American Tactical UAV Market, By Geography

6.7 Sneak View: North American Unmanned Vehicle Market, By Class Type

7 North American UAV Market, By Geography (Page No. - 48)

7.1 Introduction

7.2 U.S. UAV Market

7.2.1 U.S. UAV Market, By Application

7.2.2 U.S. UAV Market, By Class Type

7.3 Canada UAV Market

7.3.1 Canada UAV Market, By Application

7.3.2 Canada UAV Market, By Class Type

8 North America UAV Market: Competitive Landscape (Page No. - 59)

8.1 North American UAV Market: Company Share Analysis

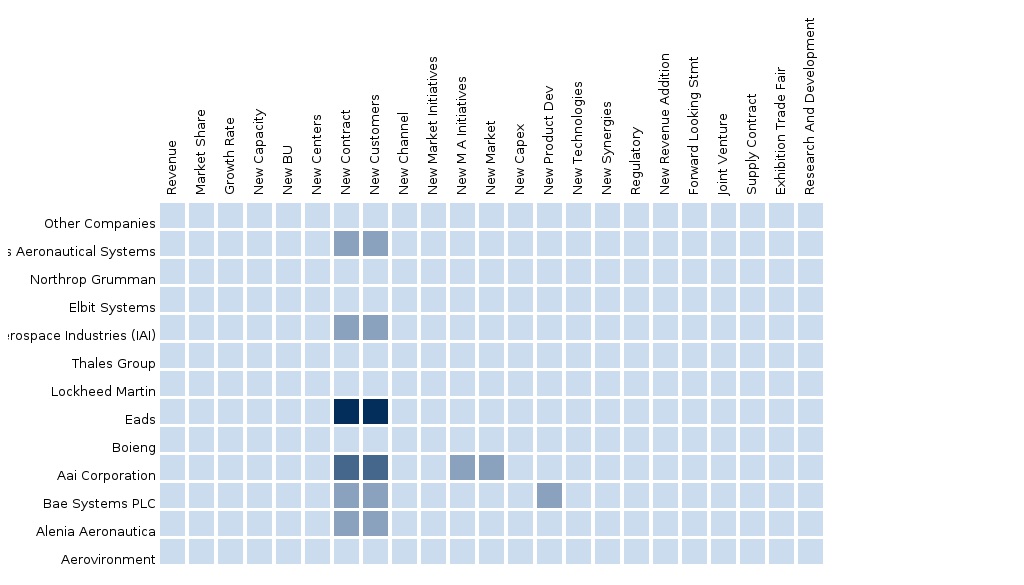

8.2 Company Presence in North American UAV Market, By Class Type

8.3 Contracts

8.4 Achievements

8.5 Partnerships, Agreements & Joint Ventures

8.6 New Product/Service Launches

8.7 Expansions

9 North America UAV Market, By Company (Page No. - 66)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 General Atomics Aeronautical Systems, Inc. (Ga-ASi)

9.2 Northrop Grumman Corporation

9.3 The Boeing Company

9.4 Textron, Inc.

9.5 Lockheed Martin Corporation

9.6 Aerovironment, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 90)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 UAV Usage Data

10.1.5 Impact Analysis

10.1.6 Trade Analysis

10.1.7 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (43 Tables)

Table 1 Global UAV Peer Market Size, 2014 (USD MN)

Table 2 North America UAV Application Market, 2014 (USD MN)

Table 3 North America UAV Market: Macro-Indicator, By Geography, 2014 (USD MN)

Table 4 North America UAV Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 North America UAV Market: Drivers and Inhibitors

Table 6 North America UAV Market, By Application, 2013 - 2019 (USD MN)

Table 7 North America UAV Market, By Class Type, 2013 - 2019 (USD MN)

Table 8 North America UAV Market, By Geography, 2013 - 2019 (USD MN)

Table 9 North America UAV Market: Comparison With Parent Market, 2013 - 2019 (USD MN)

Table 10 North America UAV Market, By Application, 2013 - 2019 (USD MN)

Table 11 North America UAV Application Market, By Geography, 2013 - 2019 (USD MN)

Table 12 North America UAV Market in Military Application, By Geography, 2013 - 2019 (USD MN)

Table 13 North America UAV Market in Civil & Commercial Application, By Country, 2013 - 2019 (USD MN)

Table 14 North American UAV Market in Homeland Security Application, By Country, 2013 - 2019 (USD MN)

Table 15 North American UAV Market, By Class Type, 2013 - 2019 (USD MN)

Table 16 North American UAV Market: Class Type Comparison With Parent Markets, 2013 - 2019 (USD MN)

Table 17 North America Strategic UAV Market, By Geography, 2013 - 2019 (USD MN)

Table 18 Strategic UAV Specification, By Type

Table 19 North American Special Purpose UAV Market, By Geography, 2013 - 2019 (USD MN)

Table 20 Special Purpose UAV Specification, By Type

Table 21 North America Small UAV Market, By Geography, 2013 - 2019 (USD MN)

Table 22 Small UAV Specification, By Type

Table 23 North America Tactical UAV Market, By Geography, 2013 - 2019 (USD MN)

Table 24 Tactical UAV Specification, By Type

Table 25 Examples of Global Uavs, By Class Type

Table 26 North America UAV Market, By Geography, 2013 - 2019 (USD MN)

Table 27 U.S. UAV Market, By Application, 2013 - 2019 (USD MN)

Table 28 U.S. UAV Market, By Class Type, 2013 - 2019 (USD MN)

Table 29 Canada UAV Market, By Application, 2013 - 2019 (USD MN)

Table 30 Canada UAV Market, By Class Type, 2013 - 2019 (USD MN)

Table 31 North America UAV Market: Company Share Analysis, 2013 (%)

Table 32 North America UAV Market: Contracts

Table 33 North America UAV Market: Achievements

Table 34 North America UAV Market: Partnerships, Agreements & Joint Ventures

Table 35 North America UAV Market: New Product/Service Launches

Table 36 North America UAV Market: Expansions

Table 37 Northrop Grumman Corporation: Key Operations Data, 2010 - 2014 (USD MN)

Table 38 Northrop Grumman Corporation: Key Segment Financials, 2010 - 2014 (USD MN)

Table 39 The Boeing Company: Key Segment Financials, 2009 - 2013 (USD MN)

Table 40 Textron, Inc.: Key Segment Financials, 2009 - 2013 (USD MN)

Table 41 Lockheed Martin Corporation: Key Segment Financials, 2010 - 2014 (USD MN)

Table 42 Aerovironment, Inc.: Key Operations Data, 2010 – 2014 (USD MN)

Table 43 Aerovironment, Inc. Key Segment Financials, 2010 - 2014 (USD MN)

List of Figures (55 Figures)

Figure 1 North America UAV Market: Segmentation & Coverage

Figure 2 North America UAV Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 North American UAV Market Share Snapshot, 2014

Figure 9 Global UAV Market: Regional Growth Aspects, 2014-2019 (%)

Figure 10 North America UAV Market: Comparison With Parent Market, 2013-2019 (USD MN)

Figure 11 North America UAV Market, By Application, 2014 vs. 2019 (USD MN)

Figure 12 North America UAV Market: Growth Analysis, By Application, 2014 (%)

Figure 13 North America UAV Market, By Class Type, 2014 vs. 2019 (USD MN)

Figure 14 North America UAV Market: Growth Analysis, By Class Type, 2014 – 2019 (%)

Figure 15 North America UAV Market, By Geography, 2014 vs. 2019 (USD MN)

Figure 16 Demand-Side Analysis

Figure 17 North America UAV Market: Application Market Scenario

Figure 18 North America UAV Market, By Application, 2014 vs. 2019 (USD MN)

Figure 19 North America UAV Application Market, By Geography, 2014 vs. 2019 (USD MN)

Figure 20 Demand-Side Analysis

Figure 21 North America UAV Market in Military Application, By Geography, 2013 - 2019 (USD MN)

Figure 22 North America UAV Market in Civil & Commercial Application, By Geography, 2013 - 2019 (USD MN)

Figure 23 North America UAV Market in Homeland Security Application, By Geography, 2013 - 2019 (USD MN)

Figure 24 Sneak View: North American Unmanned Vehicle Market, By Application, 2014 (USD MN)

Figure 25 North America UAV Market, By Class Type, 2014 & 2019 (USD MN)

Figure 26 North America UAV Market: Class Type Comparison With Parent Markets, 2013 - 2019 (USD MN)

Figure 27 North America Strategic UAV Market, By Geography, 2013 - 2019 (USD MN)

Figure 28 North America Special Purpose UAV Market, By Geography, 2013 - 2019 (USD MN)

Figure 29 North America Small UAV Market, By Geography, 2013 - 2019 (USD MN)

Figure 30 North America Tactical UAV Market, By Geography, 2013 - 2019 (USD MN)

Figure 31 Sneak View: North American Unmanned Vehicle Market, By Class Type, 2014 (USD MN)

Figure 32 North America UAV Market: Growth Analysis, By Geography, 2014 - 2019 (USD MN)

Figure 33 U.S. UAV Market Overview, 2014 & 2019 (%)

Figure 34 U.S. UAV Market, By Application, 2013 - 2019 (USD MN)

Figure 35 U.S. UAV Market, By Application, 2014 & 2019 (USD MN)

Figure 36 U.S. UAV Market, By Class Type, 2013 - 2019 (USD MN)

Figure 37 U.S. UAV Market Share, By Class Type, 2014 & 2019 (%)

Figure 38 Canada UAV Market Overview, 2014 & 2019 (%)

Figure 39 Canada UAV Market, By Application, 2013 - 2019 (USD MN)

Figure 40 Canada UAV Market, By Application, 2014 & 2019 (USD MN)

Figure 41 Canada UAV Market, By Class Type, 2013 - 2019 (USD MN)

Figure 42 Canada UAV Market Share, By Class Type, 2014 & 2019 (%)

Figure 43 North America UAV Market: Company Share Analysis, 2013 (%)

Figure 44 North America UAV Market: Company Product Coverage, By Class Type, 2013

Figure 45 Ga-ASi Revenue, 2011 - 2013 (USD MN)

Figure 46 Northrop Grumman Corporation Revenue Mix, 2013 (%)

Figure 47 Northrop Grumman Corporation Revenue, 2010 - 2014 (USD MN)

Figure 48 The Boeing Company Revenue Mix, 2013 (%)

Figure 49 The Boeing Company Revenue, 2009 - 2013 (USD MN)

Figure 50 Textron, Inc. Revenue Mix, 2013 (%)

Figure 51 Textron, Inc. Revenue, 2009 - 2013 (USD MN)

Figure 52 Lockheed Martin Corporation Revenue Mix, 2014 (%)

Figure 53 Lockheed Martin Corporation Revenue, 2010 - 2014 (USD MN)

Figure 54 Aerovironment, Inc. Revenue Mix, 2014 (%)

Figure 55 Aerovironment, Inc. Revenue, 2010-2014 (USD MN)

The recovery of the defense sector from the global economic crisis and defense budget cuts from 2007 to 2008 have helped UAV manufacturers garner new orders. UAV manufacturers are increasing their production capacity along with innovative aircraft that are aimed at better operational efficiency. The industry is witnessing new entrants from emerging economies in the small UAV segment. These in turn act as a boon for UAV component manufacturers.

The global UAV industry is expected to grow at a CAGR of 7.7% from 2014 to 2019. The industry is currently trying to tackle a major challenge, that is, the stricter airspace regulations for the use of UAVs for civil & commercial applications. This has forced UAV operators to obtain certifications from their respective country’s regulatory aviation authorities in order to operate in restricted national airspace system.

The North America UAV market size was valued at $4,667.1 million in 2014. The market is expected to grow in tandem with growth in the defense sector. Increasing defense spending on UAVs, rising use of UAVs for civil & commercial applications, and growing need for technological advancements in UAVs are the key drivers for the industry.

The North America UAV market size was valued at $4,667.1 million in 2014 and is projected to reach to $6,776.9 million by the end of 2019, at a CAGR of 7.7% during the forecast period. The North American market, by class type, was led by the strategic UAV segment in 2014, with a 45% share. The North American strategic UAV market size is projected to reach to $3,134.3 million by 2019, at a CAGR of 8.3% through the forecast period.

The small UAV market is estimated to grow at the highest CAGR of 11.5% from 2014 to 2019. The U.S. is a key market for small UAVs in the North American region. Small UAVs held a larger share in the civil & commercial applications market in North America in 2014.

Key players in the North America UAV Market include GA-ASI (U.S.), Northrop Grumman Corp. (U.S.), The Boeing Co. (U.S.), Lockheed Martin Corp. (U.S.), Textron, Inc. (U.S.), and AeroVironment, Inc. (U.S.), among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement