North America Traction Transformer by Type (Tap Changing, Tapped, Rectifier), by Application (High Speed Train, Electric Locomotive, Electrical Multiple Unit, Tram), by Voltage Range (AC, DC), by Geography - Analysis & Forecast to 2019

The North American traction transformer market is estimated to grow at a CAGR of 9.4% from 2014 to 2019. In today’s modern dynamic world of technology, cutting-edge technological capabilities of traction transformers are used for various applications. Traction transformers form an integral part of the electric traction, which is mainly used in rail transport system. This traction system utilizes electricity to power trains and other rolling stock.

The North American traction transformer market is sub-divided according to type into tap changing, tapped, and rectifier. Among varied types of traction transformers, the maximum revenue is contributed by the tapped transformers as they are used in locomotives and high speed trains.

Key drivers influencing the overall demand of traction transformers in North America include recent developments made in the rail infrastructure, and rise in governmental spending for the deployment of high speed trains.

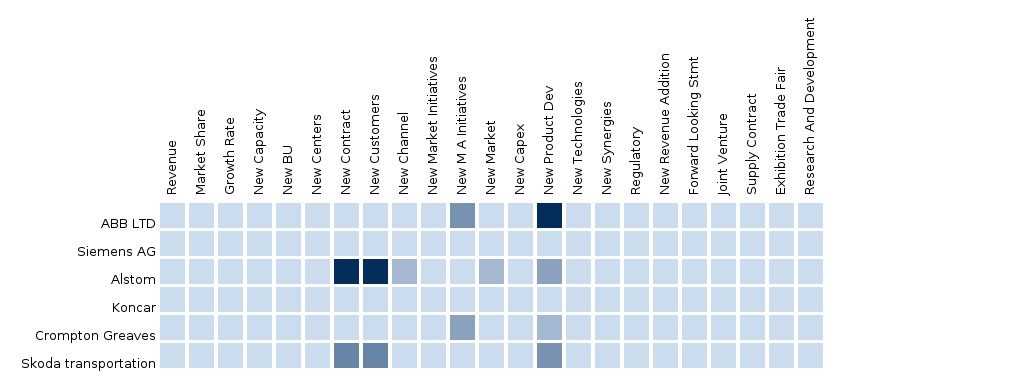

The North American traction transformer market is a competitive market, with companies such as ABB Ltd., (Switzerland) and Alstom (France), which are continuously adopting strategizes to accelerate their cutting-edge technological capabilities and R&D activities to strengthen their competitiveness in the global market. This is successfully achieved with the assistance of numerous market strategies adopted by these companies, which includes new product developments, alliances, and acquisitions.

Customization Options:

Along with market data, you can also customize the MMM assessments that are in accordance to your company’s specific needs. Customize to get comprehensive industry standard and deep-dive analysis of the following parameters:

Product Analysis

- Usage pattern (in-depth trend analysis) of products (segment-wise)

- Product matrix, which gives a detailed comparison of product portfolio of each company mapped at country and sub-segment level

- End-user adoption rate analysis of products (segment-wise and country-wise)

- Comprehensive coverage of product approvals, pipeline products, and product recalls

Data from Manufacturing Firms

- Fast turn-around analysis of manufacturing firms’ responses to recent market events and trends

- Expert opinion about varied applications wherein traction transformers are used

- Qualitative inputs on macro-economic indicators, as well as mergers & acquisitions in each geography

Comparative Analysis

- Market data and key developments of top companies

Shipment/Volume Data

- Tracking the value of components shipped annually in each geography

Trend analysis of Application

- Application matrix, which gives a detailed comparison of application portfolio of each company, mapped in each geography

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation and Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of North American Traction Transformer Market

2.2 Arriving at Market Size of North American Traction Transformer Market

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 North American Traction Transformer Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 North American Traction Transformer Market, By Type (Page No. - 29)

5.1 Introduction

5.2 North American Traction Transformer Market, Type Comparison With Transformer Market

5.3 Tap Changing Traction Transformer

5.4 Tapped Traction Transformer

5.5 Rectifier Traction Transformer

6 North American Traction Transformer Market, By Voltage Range (Page No. - 37)

6.1 Introduction

6.2 Ac Traction Transformer

6.3 Dc Traction Transformer

7 North American Traction Transformer Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Market Overview

7.3 High Speed Trains

7.4 Electric Locomotive

7.5 EMU

7.6 Trams

8 North American Traction Transformer Market, By Geography (Page No. - 51)

8.1 Introduction

8.2 Market Overview

8.3 U.S. Traction Transformer Market

8.3.1 U.S. Traction Transformer Market, By Type

8.3.2 U.S. Traction Transformer Market, By Voltage Range

8.4 Canada Traction Transformer Market

8.4.1 Canada Traction Transformer Market, By Type

8.4.2 Canada Traction Transformer Market, By Voltage Range

8.5 Mexico Traction Transformer Market

8.5.1 Mexico Traction Transformer Market, By Type

8.5.2 Mexico Traction Transformer Market, By Voltage Range

9 North American Traction Transformer Market: Competitive Landscape (Page No. - 63)

9.1 Traction Transformer Market: Company Share Analysis

9.2 Company Presence in Traction Transformers Market, By Type

9.3 Mergers & Acquisitions

9.4 New Agreements and Contracts

10 North American Traction Transformer Market, By Company (Page No. - 67)

(Overview, Financials, Products & Services, Strategy, and Developments)*

10.1 ABB Ltd.

10.2 Alstom

10.3 Siemens Energy

10.4 Crompton Greaves

10.5 Brush Traction

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

11 Appendix (Page No. - 81)

11.1 Customization Options

11.1.1 Product Portfolio Analysis

11.1.2 Country Level Data Analysis

11.1.3 Product Comparison of Various Competitors

11.1.4 Trade Analysis

12 Introducing RT: Real Time Market Intelligence (Page No. - 83)

12.1.1 RT Snapshots

List of Tables (59 Tables)

Table 1 North American Traction Transformer Market Size, 2014 (USD ‘000)

Table 2 North American Traction Transformer Market, By Application, 2014 (USD ‘000)

Table 3 R&D Expenditure, 2012-2013 (USD MN)

Table 4 North American Traction Transformer Market: Comparison With Parent Market, 2014 – 2019 (USD ‘000)

Table 5 North American Traction Transformer Market: Drivers and Inhibitors

Table 6 North American Traction Transformer Application Market, 2013-2019 (USD ’000)

Table 7 North American Traction Transformer Application Market, 2013-2019 (In Units)

Table 8 North American Traction Transformer Product Type Market, 2013-2019 (USD ’000)

Table 9 North American Traction Transformer Product Type Market, 2013-2019 (In Units)

Table 10 North American Traction Transformer Market: Comparison With Application Markets, 2013-2019 (USD ‘000)

Table 11 North American Traction Transformer Market, By Type, 2013-2019 (USD ‘000)

Table 12 North American Traction Transformer Market, By Type, 2013-2019 (In Units)

Table 13 North American Traction Transformer Market, Type Comparison With Transformer Market (USD ‘000)

Table 14 North American Tap Changing Traction Transformer Market, By Geography, 2013–2019 (USD ‘000)

Table 15 North American Tap Changing Traction Transformer Market, By Geography, 2013–2019 (In Units)

Table 16 North America Tapped Traction Transformer Market, By Geography, 2013-2019 (USD ‘000)

Table 17 North America Tapped Traction Transformer Market, By Geography, 2013-2019 (In Units)

Table 18 North America Rectifier Traction Transformer Market, By Geography, 2013-2019 (USD ’000)

Table 19 North America Traction Transformer Market, By Voltage Range, 2013-2019 (USD ‘000)

Table 20 North America Traction Transformer Market, Voltage Range, 2013-2019 (In Units)

Table 21 North America Ac Traction Transformer Market, By Geography, 2013–2019 (USD ‘000)

Table 22 North America Ac Traction Transformer Market, By Geography, 2013–2019 (In Units)

Table 23 North America Dc Traction Transformer Market, By Geography, 2013-2019 (USD ‘000)

Table 24 North America Dc Traction Transformer Market, By Geography, 2013-2019 (In Units)

Table 25 North American Traction Transformer Market, By Application, 2013-2019 (USD ‘000)

Table 26 North American Traction Transformer Market, By Application, 2013-2019 (In Units)

Table 27 North American Traction Transformer Market in High Speed Trains Segment, By Type, 2013-2019 (USD ‘000)

Table 28 North America Traction Transformer Market in High Speed Trains Segment, By Type, 2013-2019 (In Units)

Table 29 North America Traction Transformer Market in Electric Locomotive, By Type, 2013-2019 (USD ’000)

Table 30 North American Traction Transformer Market in Electric Locomotive, By Type, 2013-2019 (In Units)

Table 31 North American Traction Transformer Market in Emu, By Type, 2013-2019 (USD ‘000)

Table 32 North American Traction Transformer Market in Emu, By Type, 2013-2019 (In Units)

Table 33 North American Traction Transformer Market in Trams, By Type, 2013-2019 (USD ‘000)

Table 34 North American Traction Transformer Market, By Geography, 2013 - 2019 (USD ’000)

Table 35 North American Traction Transformer Market, By Geography, 2013 - 2019 (In Units)

Table 36 U.S. Traction Transformer Market, By Type, 2013-2019 (USD ‘000)

Table 37 U.S. Traction Transformer Market, By Type, 2013-2019 (In Units)

Table 38 U.S. Traction Transformer Market, By Voltage Range, 2013-2019 (USD ‘000)

Table 39 U.S. Traction Transformer Market, By Voltage Range, 2013-2019 (In Units)

Table 40 Canada Traction Transformer Market, By Type, 2013-2019 (USD ‘000)

Table 41 Canada Traction Transformer Market, By Voltage Range, 2013-2019 (USD ‘000)

Table 42 Canada Traction Transformer Market, By Voltage Range, 2013-2019 (In Units)

Table 43 Mexico Traction Transformer Market, By Type, 2013-2019 (USD ‘000)

Table 44 Mexico Traction Transformer Market, By Type, 2013-2019 (In Units)

Table 45 Mexico Traction Transformer Market, By Voltage Range, 2013-2019 (USD ‘000)

Table 46 Mexico Traction Transformer Market, By Voltage Range, 2013-2019 (In Units)

Table 47 Traction Transformer Market: Company Share Analysis, 2014 (%)

Table 48 North America Traction Transformers Market: Mergers & Acquisitions

Table 49 North America Traction Transformers Market: New Agreements and Contracts

Table 50 ABB Ltd.: Market Revenue, By Geographical Segment, 2009-2013 (USD MN)

Table 51 ABB Ltd.: Annual Revenue, By Business Segment, 2009–2013 (USD MN)

Table 52 ABB Ltd.: Ebit and Net Income, 2009–2013 (USD MN)

Table 53 Alstom: Market Revenue, By Geographical Segment, 2010-2014 (USD MN)

Table 54 Alstom: Market Revenue, By Business Segment, 2010-2014 (USD MN)

Table 55 Siemens: Annual Revenue, By Business Segment, 2009–2012 (USD MN)

Table 56 Siemens: Annual Revenue, By Geographical Segment, 2009–2012 (USD MN)

Table 57 Siemens: Annual Revenue, 2009–2012 (USD MN)

Table 58 Crompton Greaves: Total Revenue, By Geographical Segment, 2010 – 2014 (USD MN)

Table 59 Crompton Greaves: Total Revenue, By Business Segment, 2010 – 2014 (USD MN)

List of Figures (41 Figures)

Figure 1 North America Traction Transformer Market: Segmentation & Coverage

Figure 2 North America Traction Transformer Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 North America Traction Transformer Market Snapshot

Figure 9 North America Traction Transformer Market, By Application, 2014 vs. 2019

Figure 10 North America Traction Transformer Product Type Market, By Geography, 2014 (USD ‘000)

Figure 11 North America Traction Transformers Market: Growth Analysis, By Type, 2013–2019 (%)

Figure 12 North America Traction Transformer Market: Comparison With Application Markets, 2013-2019 (USD ‘000)

Figure 13 North American Traction Transformer Market, By Type, 2014-2019 (USD ‘000)

Figure 14 North American Traction Transformer Market, By Type, 2014-2019 (In Units)

Figure 15 North American Traction Transformer Market, Type Comparison With Transformer Market

Figure 16 North American Tap Changing Traction Transformer Market, By Geography, 2013–2019 (USD ‘000)

Figure 17 North American Tapped Traction Transformer Market, By Geography, 2013-2019 (USD ‘000)

Figure 18 North American Rectifier Traction Transformer Market, By Geography, 2013-2019 (USD ’000)

Figure 19 North American Traction Transformer Market, By Voltage Range, 2014 - 2019 (USD ‘000)

Figure 20 North American Traction Transformer Market, By Voltage Range, 2014 - 2019 (In Units)

Figure 21 North America Ac Traction Transformer Market, By Geography, 2013–2019 (USD ‘000)

Figure 22 North America Dc Traction Transformer Market, By Geography, 2013-2019 (USD ‘000)

Figure 23 North America Traction Transformer Market, By Application, 2014-2019 (USD ‘000)

Figure 24 North America Traction Transformer Market, By Application, 2014-2019 (In Units)

Figure 25 North America Traction Transformer Market in High Speed Trains Segment, By Type, 2013-2019 (USD ‘000)

Figure 26 North America Traction Transformer Market in Electric Locomotive, By Type, 2013-2019 (USD ’000)

Figure 27 North America Traction Transformer Market in Emu, By Type, 2014-2019 (USD ’000)

Figure 28 North America Traction Transformer Market in Trams, By Type, 2013-2019 (USD ‘000)

Figure 29 North American Traction Transformer Market: Growth Analysis, By Geography, 2014-2019 (USD ‘000)

Figure 30 North American Traction Transformer Market: Growth Analysis, By Geography, 2014-2019 (In Units)

Figure 31 U.S. Traction Transformer Market Overview, 2014 & 2019

Figure 32 U.S. Traction Transformer Market, By Type, 2013 - 2019 (USD ‘000)

Figure 33 U.S. Traction Transformer Market, By Voltage Range, 2013 - 2019 (USD ‘000)

Figure 34 Canada Traction Transformer Market Overview, 2014 & 2019

Figure 35 Canada Traction Transformer Market, By Type, 2013 - 2019 (USD ‘000)

Figure 36 Canada Traction Transformer Market, By Voltage Range, 2013 - 2019 (USD ‘000)

Figure 37 Mexico Traction Transformer Market Overview, 2014 & 2019

Figure 38 Mexico Traction Transformer Market, By Type, 2013 - 2019 (USD ‘000)

Figure 39 U.S. Traction Transformer Market, By Voltage Range, 2013 - 2019 (USD ‘000)

Figure 40 Traction Transformer Market: Company Share Analysis, 2014 (%)

Figure 41 Traction Transformers Company Product Coverage, By Type, 2014

North American traction transformer market serves to be an integral part of the electric traction system. On the basis of types, the traction transformer market is sub-divided into three major segments, namely tap changing, tapped, and rectifier. Tapped transformers segment contributes the maximum market share of 93.4% in the North American traction transformer market, as they are being

Locomotives form a major chunk of the railway transportation system all over the world. The price of traction transformer for high speed train and electric locomotive is much higher in comparison to the ones used in EMUs and trams.

North America once had a flourishing intercity rail and urban transit network, but the government shifted its infrastructure spending decisively to highways and airports. In North America, only a few tracks are electrified, which in turn means a huge potential for the growth of the rail infrastructure in this region. Therefore, the significant demand for rail infrastructure and electrification of railway track are factors driving the growth of the North America traction transformer market.

The purpose of this study is to analyze the North American market for traction transformers. This report includes revenue forecast, market trends, and opportunities during the forecast period. The analysis of this market has been conducted on the varied segments derived on the basis of type, voltage range, application, and geography. According to application, this market is segmented into high-speed trains, electric locomotives, EMUs and trams. With respect to voltage range, the market is segmented into AC and DC traction transformers.

This market research report provides a comprehensive overview of market share and value chain analysis, along with market metrics such as drivers, restraints, and upcoming opportunities. Apart from a general overview of major companies in this market, this report also provides financial analysis, product portfolio, recent developments, and key growth strategies. ABB Ltd., (Switzerland) and Alstom (France) are the leading players covered in the North America traction transformers market.

The traction transformer market for high speed trains is estimated to grow at a CAGR of 10.1% from 2014 to 2019. This growth is mainly attributed to the increase in government funding on railway projects. The North American traction transformers market was valued at $149.1 million in 2014, and is expected to reach $233.1 million by 2019, at a CAGR of 9.4% during the forecast period.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement