North America Software Defined Networking Market, by Solution (SDN Switching, SDN Controllers, Virtual Cloud Application), by End User (Enterprise, Telecommunication Service Providers, Cloud Service Providers), by Geography - Analysis & Forecast to 2019

Software-defined networking is emerging as one of the most lucrative and promising networking technologies, which has the competence to enable network virtualization and innovation, and hence addressing most of the most persistent networking problems. SDN is poised to redefine networking with an innovative approach of separating the data plane from the control plane, which is quite a lucid improvisation to the traditionally distributed control planes. This is basically executed by splitting the forwarding hardware of the Ethernet switches (data plane) from the logical link that controls the flow of packets.

SDN’s key attributes include a logically centralized control plane akin to the network operating system, which in turn facilitates logical mapping of the network to control applications and services implemented over it. SDN also brings with it a pool of exclusive capabilities, such as slicing and virtualization of the underlying networks. This feature essentially allows logical manipulation of a particular slice in the network, thereby increasing network flexibility. These solutions promise to give more infrastructural control to data centres and network operators by allowing enhanced optimization and customization, which results in the reduction of their overall capital and operational costs. The cloud and carrier providers are embracing SDN in a big way to compete with the incumbent network service providers, who plan to improvise their infrastructure using this innovative technology, while networking start-ups are developing a wide gamut of products for data centres, service providers, and enterprises.

Traditional network architectures strive, but fail to meet the requirements of today’s carriers and data centres. Carriers are faced with various network challenges as the demand for bandwidth and mobility becomes the need of the hour. Drastically shrinking profit margins and escalating capital equipment costs have given rise to a severe need for upgrading the incumbent network architectures.

The static nature of the incumbent networks stands in stark contrast with the dynamic nature of the virtualization environment. Prior to virtualization, applications resided on a single server and exchanged traffic with only a few selected clients. Today, applications are distributed across various virtual machines, thereby making it crucial to incorporate a more scalable and flexible networking environment.

Originated from the academic community, SDN is a rather new concept, which principally decouples the data plane from the control plane, thereby implementing software-driven virtual ecosystem. SDN adopters have implemented the concept with two distinct approaches, where each is suitable for different markets and applications. OpenFlow, primarily supported by the Open Networking Forum (ONF), removes the entire control plane from the network equipment and is mostly preferred by closed environments like data centres.

The North America Software-Defined Networking (SDN) Market report covers solutions segment, end-user types, geographical analysis, and company profiles for key industry players in this market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology

2.1 Integrated Ecosystem Of Software-Defined Networking Market

2.2 Arriving At The Software-Defined Networking Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary

4 Market Overview

4.1 Introduction

4.2 North America Software-Defined Networking Market: Comparison With Software-Defined Data Center Market

4.3 Market Drivers And Inhibitors

4.4 Key Market Dynamics

5 North America Software-Defined Networking Market, By End User

5.1 Introduction

5.2 North America Software-Defined Networking Market In Enterprises, By Geography

5.3 North America Software-Defined Networking Market In Telecommunications Service Providers, By Geography

5.4 North America Software-Defined Networking Market In Cloud Service Providers, By Geography

6 North America Software-Defined Networking Market, By Solution

6.1 Introduction

6.2 North America Software-Defined Networking Market, By Solution: Comparison With Software-Defined Data Center Market

6.3 North America Sdn Switching Market

6.4 North America Sdn Controllers Market

6.5 North America Sdn Virtual Cloud Application Market

7 North America Software-Defined Networking Market, By Geography

7.1 Introduction

7.2 U.S. Software-Defined Networking Market

7.2.1 U.S. Software-Defined Networking Market, By End User

7.2.2 U.S. Software-Defined Networking Market, By Solution

7.3 Canada Software-Defined Networking Market

7.3.1 Canada Software-Defined Networking Market, By End User

7.3.2 Canada Software-Defined Networking Market, By Solution

8 North America Sdn Market, By Company

8.1 Cisco Systems, Inc.

8.1.1 Overview

8.1.2 Key Financials

8.1.3 Product And Service Offerings

8.1.4 Related Developments

8.1.5 Mmm View

8.2 Hewlett-Packard Company

8.2.1 Overview

8.2.2 Key Financials

8.2.3 Product And Service Offerings

8.2.4 Related Developments

8.2.5 Mmm View

8.3 Juniper Networks, Inc.

8.3.1 Overview

8.3.2 Key Financials

8.3.3 Product And Service Offerings

8.3.4 Related Developments

8.3.5 Mmm View

8.4 IBM

8.4.1 Overview

8.4.2 Key Financials

8.4.3 Product And Service Offerings

8.4.4 Related Developments

8.4.5 Mmm View

8.5 Plexxi, Inc.

8.5.1 Overview

8.5.2 Key Financials

8.5.3 Product And Service Offerings

8.5.4 Related Developments

8.5.5 Mmm View

9 Appendix

9.1 Customization Options

9.1.1 Software-Defined Networking Market Solutions Matrix

9.1.2 Software-Defined Networking Market Competitive Benchmarking

9.1.3 Software-Defined Networking Market Vendor Landscaping

9.1.4 Software-Defined Networking Market Data Tracker

9.1.5 Software-Defined Networking Market Emerging Vendor Landscape

9.1.6 Software-Defined Networking Market Channel Analysis

9.2 Related Reports

9.3 Introducing Rt: Real Time Market Intelligence

9.3.1 Rt Snapshots

List of Tables

Table 1 Global Software-Defined Networking Peer Market Size, 2014 (USD MN)

Table 2 North America Software-Defined Networking Market: Macroindicators, By Geography, 2014 (USD MN)

Table 3 North America Software-Defined Networking Market: Comparison With Software-Defined Data Center Market, 2013-2019 (USD MN)

Table 4 North America Software-Defined Networking Market: Drivers And Inhibitors

Table 5 North America Software-Defined Networking Market, By End User, 2013-2019 (USD MN)

Table 6 North America Software-Defined Networking Market In Enterprises, By Geography, 2013-2019 (USD MN)

Table 7 North America Software-Defined Networking Market In Telecommunications Service Providers, By Geography, 2013-2019 (USD MN)

Table 8 North America Software-Defined Networking Market In Cloud Service Providers, By Geography, 2013-2019 (USD MN)

Table 9 North America Software-Defined Networking Market, By Solution, 2014-2019 (USD MN)

Table 10 North America Software-Defined Networking Market, By Solution: Comparison With Software-Defined Data Center Market, 2013-2019 (USD MN)

Table 11 North America Sdn Switching Market, By Geography, 2013-2019 (USD MN)

Table 12 North America Sdn Controllers Market, By Geography, 2013-2019 (USD MN)

Table 13 North America Sdn Virtual Cloud Application Market, By Geography, 2013-2019 (USD MN)

Table 14 North America Software-Defined Networking Market, By Geography, 2014-2019 (USD MN)

Table 15 U.S. Software-Defined Networking Market, By End User, 2014-2019 (USD MN)

Table 16 U.S. Software-Defined Networking Market, By Solution, 2014-2019 (USD MN)

Table 17 Canada Software-Defined Networking Market, By End User, 2014-2019 (USD MN)

Table 18 Canada Software Defined Networking Market, By Solution, 2014-2019 (USD MN)

Table 19 Cisco Systems, Inc.: Business Revenue Mix, 2011-2014 (USD MN)

Table 20 Cisco Systems, Inc.: Geographic Revenue Mix, 2011-2014 (USD MN)

Table 21 Hewlett-Packard Company: Business Revenue , 2011-2014 (USD MN)

Table 22 Hewlett-Packard Company: Geographic Revenue Mix, 2011-2014 (USD MN)

Table 23 Juniper Networks, Inc.: Business Revenue Mix, 2011-2014 (USD MN)

Table 24 Juniper Networks, Inc.: Geographic Revenue Mix, 2011-2014 (USD MN)

Table 25 Ibm Business Revenue Mix, 2011-2014 (USD MN)

Table 26 Ibm Geographic Revenue Mix, 2011-2014 (USD MN)

List of Figures

Figure 1 North America Software Defined Networking Market: Segmentation & Coverage

Figure 2 Software-Defined Networking Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macroindicator-Based Approach

Figure 7 North America Software-Defined Networking Market: Snapshot

Figure 8 Software-Defined Networking Market: Growth Aspects

Figure 9 North America Software-Defined Networking Market, By Geography, 2014

Figure 10 North America Software-Defined Networking Market: End User Market Scenario

Figure 11 North America Software-Defined Networking Market, By End User, 2014 Vs. 2019 (USD MN)

Figure 12 North America Software-Defined Networking Market In Enterprises, By Geography, 2013-2019 (USD MN)

Figure 13 North America Software-Defined Networking Market In Telecommunications Service Providers, By Geography, 2013-2019 (USD MN)

Figure 14 North America Software-Defined Networking Market In Cloud Service Providers, By Geography, 2013-2019 (USD MN)

Figure 15 North America Software-Defined Networking Market, By Solution, 2014-2019 (USD MN)

Figure 16 North America Software-Defined Networking Market, By Solution: Comparison With Software-Defined Data Center Market, 2013-2019 (USD MN)

Figure 17 North America Sdn Switching Market, By Geography, 2013-2019 (USD MN)

Figure 18 North America Sdn Controllers Market, By Geography, 2013-2019 (USD MN)

Figure 19 North America Sdn Virtual Cloud Application Market, By Geography, 2013-2019 (USD MN)

Figure 20 North America Software-Defined Networking Market Overview, 2014 & 2019

Figure 21 North America Software-Defined Networking Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 22 U.S. Software-Defined Networking Market Overview, 2014 & 2019

Figure 23 U.S. Software-Defined Networking Market, By End User, 2014-2019 (USD MN)

Figure 24 U.S. Software-Defined Networking Market: End User Snapshot

Figure 25 U.S. Software-Defined Networking Market, By Solution, 2014-2019 (USD MN)

Figure 26 U.S. Software-Defined Networking Market Share, By Solution, 2014-2019

Figure 27 Canada Software-Defined Networking Market Overview, 2014 & 2019

Figure 28 Canada Software-Defined Networking Market, By End User, 2014-2019 (USD MN)

Figure 29 Canada Software-Defined Networking Market: End User Snapshot

Figure 30 Canada Software-Defined Networking Market, By Solution, 2014-2019 (USD MN)

Figure 31 Canada Software-Defined Networking Market, By Solution, 2014-2019

Figure 32 Cisco Systems, Inc.: Revenue Mix

Figure 33 Hewlett-Packard Company: Revenue Mix

Figure 34 Juniper Networks, Inc.: Revenue Mix

Figure 35 Ibm: Revenue Mix

Telecommunication providers have been looking for different ways to optimize their costs and increase their network efficiency since the last decade. At the same time, this industry is also witnessing a huge push for newer forms of networking that are faster, simpler and easier to manage. In this aspect, SDN has grown into a key technology to address this trend. SDN is a first of its kind networking concept that has picked up significant market traction over the last year. The technology helps communication providers to redirect network traffic and ease the network congestion, which ultimately results in significant cost savings that can be utilized to drive core business goals. While the SDN and network virtualization market is presently at a nascent, fragmented stage, the industry consolidation is set to happen in the near future, driving a better adoption rate with concentrated messaging in enterprises.

The market for SDN will evolve gradually from being a standards-driven one to becoming a function of software development, which would ultimately revolutionize network utilization. Over the next 5 years, SDN is expected to become highly pervasive, ubiquitous, and penetrative across telecom and enterprise networks.

The major forces driving the market are factors, such as network expansion, telco operating expenditure savings, and mobility, which will positively impact the SDN market because of the global push for mobility. At the same time, opportunities in controller applications and value-added resellers’ products will benefit the growth rate in this market.

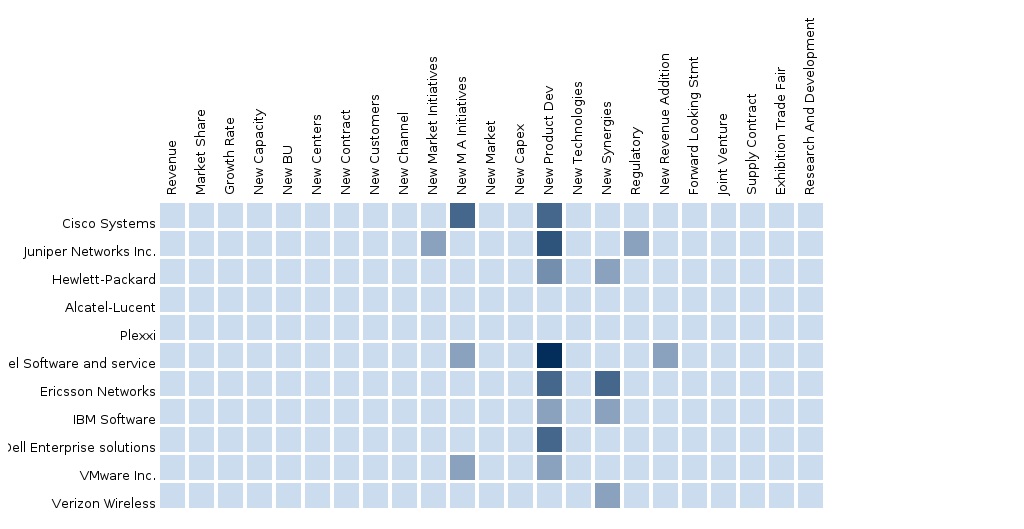

The companies dominating the North America SDN market include Cisco Systems, Inc., Hewlett-Packard Company (HP), Juniper Networks, International Business Machines Corporation (IBM), Plexxi, Inc., VMware, Inc., and others.

The North America SDN market is expected to grow from $1,478.3 million in 2014 to $4,604.4 million by 2019, at a CAGR of 25.5% during the period under consideration.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement