North America Predictive Analytics Market by Application (Customer Analytics, Marketing Analytics, Operation & Workforce Management), by Vertical (BFSI, Consumer Goods & Retail, Telecommunication & IT, Healthcare) - Analysis & Forecast to 2019

The North America predictive analytics market was valued at $761.3 million and is expected to reach $2,276.4 million by 2019 at a CAGR of 24.5%. The major driver for this growth is the amount of unstructured data present in the ecosystem. The high volume of unstructured data needs proper analysis for use and for that predictive analytics is used. Furthermore, the user friendly nature of the technique and the technological advancements in the market also fuel the growth of this technique.

Predictive analytics is a technique that includes clustering, data mining, machine learning and various other techniques to extract the relevant information from the past data sets and accordingly predict the future outcomes, possibilities and market trends. This helps the users in predicting customer behavior and trends that lead to increase in efficiency and reduction in losses. However, implementation and deployment of predictive analytics consumes time, even so there is huge requirement of data mining and predictive modelling techniques.

The North America predictive analytics market report further segments predictive analytics by applications and the industry verticals. It also provides an insight on the major players providing predictive analytics solutions in North America. The players considered are IBM, Oracle, SAS, SAP, Teradata and FICO. A detailed description on the recent developments including mergers and acquisitions, partnerships, alliances and related products and services has also been included.

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of North America Predictive Analytics Market

2.2 Arriving at the North America Predictive Analytics Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 23)

4 North America Predictive Analytics Market Overview (Page No. - 25)

4.1 Introduction

4.2 North America Predictive Analytics Market: Comparison With Parent Market, 2013-2019 (USD MN)

4.3 North America Predictive Analytics Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 North America Predictive Analytics Market, By Application (Page No. - 33)

5.1 Introduction

5.2 North America Predictive Analytics in Customer Analytics, By Geography

5.3 North America Predictive Analytics in Marketing Analytics, By Geography

5.4 North America Predictive Analytics in Operations & Workforce Management, By Geography

5.5 North America Predictive Analytics in Risk Analytics, By Geography

5.6 North America Predictive Analytics in Fraud Analytics, By Geography

5.7 North America Predictive Analytics in Network Analytics, By Geography

6 North America Predictive Analytics Market, By Vertical (Page No. - 42)

6.1 Introduction

6.2 Demand Side Analysis

6.3 North America Predictive Analytics in Bfsi, By Geography

6.4 North America Predictive Analytics in Consumer Goods & Retail, By Geography

6.5 North America Predictive Analytics in Environment & Government, By Geography

6.6 North America Predictive Analytics in Telecommunication & It, By Geography

6.7 North America Predictive Analytics in Media & Entertainment, By Geography

6.8 North America Predictive Analytics in Healthcare, By Geography

7 North America Predictive Analytics Market, By Geography (Page No. - 57)

7.1 Introduction

7.2 U.S. Predictive Analytics Market

7.2.1 U.S. Predictive Analytics Market, By Verticals

7.2.2 U.S. Predictive Analytics Market, By Application

7.3 Canada Predictive Analytics Market

7.3.1 Canada Predictive Analytics Market, By Verticals

7.3.2 Canada Predictive Analytics Market, By Application

7.4 Mexico Predictive Analytics Market

7.4.1 Mexico Predictive Analytics Market, By Verticals

7.4.2 Mexico Predictive Analytics Market, By Application

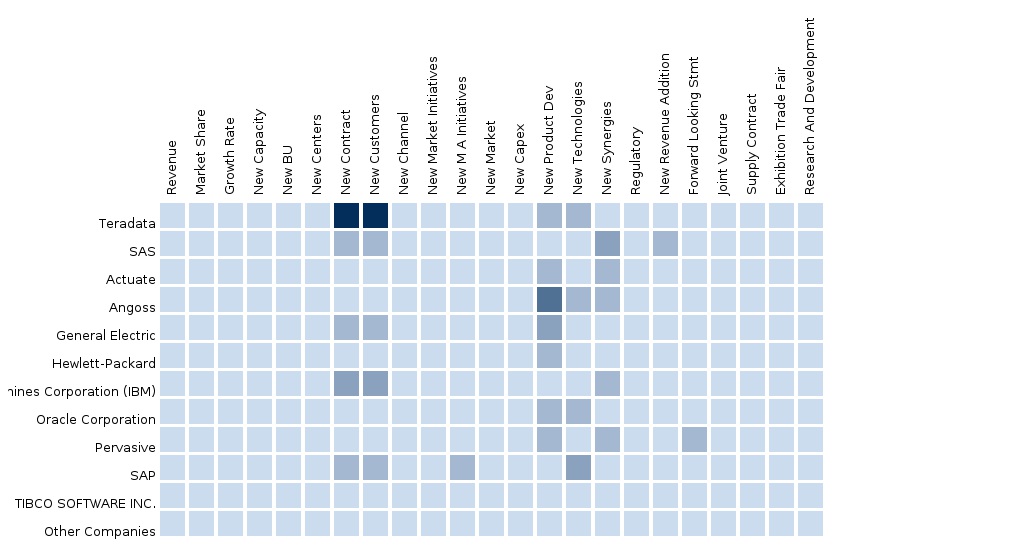

8 Competitive Landscape: (Page No. - 73)

8.1 Industry Coverage Analysis:

8.2 Mergers and Acquisitions:

8.3 Partnership:

8.4 Product Launch:

8.5 Global Alliance:

9 North America Predictive Analytics Market, By Company (Page No. - 76)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 IBM

9.2 Oracle

9.3 SAS Institute, Inc

9.4 SAP SE

9.5 Teradata Corporation

9.6 Fair Isaac Corp

*Details On Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 95)

10.1 Customization Options

10.1.1 Predictive Analytics: Application Data

10.1.2 Regulatory Framework

10.1.3 Predictive Analytics: Verticals Data

10.1.4 Impact Analysis

10.1.5 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.4 Features and Benefits of RT

List of Tables (68 Tables)

Table 1 North America Predictive Analytics Peer Market Size, 2014 (USD MN)

Table 2 North America Predictive Analytics Application Market Size, 2014 (USD MN)

Table 3 North America Predictive Analytics Market: Macro Indicators, By Geography, 2014 (USD MN)

Table 4 North America Predictive Analytics Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 North America Predictive Analytics Market: Drivers and Inhibitors

Table 6 North America Predictive Analytics Market, By Vertical,2013 - 2019 (USD MN)

Table 7 North America Predictive Analytics Market, By Application,2013 - 2019 (USD MN)

Table 8 North America Predictive Analytics Market, By Geography, 2013 - 2019

Table 9 North America Predictive Analytics Market: Comparison With Ict Expenditure of Verticals, 2013 - 2019 (USD MN)

Table 10 North America Predictive Analytics Market, By Application,2013-2019 (USD MN)

Table 11 North American Predictive Analytics in Customer Analytics, By Geography, 2013 - 2019 (USD MN)

Table 12 North American Predictive Analytics in Marketing Analytics, By Geography, 2013 - 2019 (USD MN)

Table 13 North American Predictive Analytics in Operations & Workforce Management, By Geography, 2013 - 2019 (USD MN)

Table 14 North American Predictive Analytics in Risk Analytics, By Geography,2013 - 2019 (USD MN)

Table 15 North American Predictive Analytics in Fraud Analytics, By Geography, 2013 - 2019 (USD MN)

Table 16 North American Predictive Analytics in Network Analytics, By Geography, 2013 - 2019 (USD MN)

Table 17 North America Predictive Analytics Market, By Vertical,2014 - 2019 (USD MN)

Table 18 Banking, Financial Services & Insurance

Table 19 Consumer Goods & Retail

Table 20 Environment & Government

Table 21 Telecommunication & It

Table 22 Media & Entertainment

Table 23 Healthcare

Table 24 North American Predictive Analytics in Bfsi, By Geography,2013 - 2019 (USD MN)

Table 25 North American Predictive Analytics in Consumer Goods & Retail,By Geography, 2013- 2019 (USD MN)

Table 26 North American Predictive Analytics in Environment & Government,By Geography, 2013 - 2019 (USD MN)

Table 27 North American Predictive Analytics in Telecommunication & It,By Geography, 2013 - 2019 (USD MN)

Table 28 North American Predictive Analytics in Media & Entertainment,By Geography, 2014 - 2019 (USD MN)

Table 29 North American Predictive Analytics in Healthcare, By Geography,2013 - 2019 (USD MN)

Table 30 North America Predictive Analytics Market: By Geography,2013 - 2019 (USD MN)

Table 31 U.S. Predictive Analytics Market, By Verticals 2013 – 2019 (USD MN)

Table 32 U.S. Predictive Analytics Market, By Application 2013 – 2019 (USD MN)

Table 33 Canada Predictive Analytics Market, By Verticals, 2013 – 2019 (USD MN)

Table 34 Canada Predictive Analytics Market, By Application, 2013 – 2019 (USD MN)

Table 35 Mexico Predictive Analytics Market, By Verticals, 2013 – 2019 (USD MN)

Table 36 Mexico Predictive Analytics Market, By Application 2013 – 2019 (USD MN)

Table 37 Mergers and Acquisitions:

Table 38 Partnership

Table 39 Product Launch

Table 40 Global Alliance

Table 41 Key Financials of Ibm, 2011 – 2014, USD MN

Table 42 Geographic Revenue Mix 2010-2014 (USD MN)

Table 43 Business Revenue Mix 2010-2014 (USD MN)

Table 44 Product and Service Offerings:

Table 45 Recent Developments:

Table 46 Key Financial Findings for Oracle, 2011 - 2014 (USD MN)

Table 47 Geographic Revenue Mix, 2009-2014 (USD MN)

Table 48 Business Revenue Mix 2009-2014

Table 49 Products and Services Offerings

Table 50 Recent Developments

Table 51 Key Financial Findings for Sas, 2010 - 2014 (USD MN)

Table 52 Products and Services Offerings:

Table 53 Recent Developments

Table 54 Key Financial Findings for Sap, 2011 - 2014 (USD MN)

Table 55 Geographic Revenue Mix, 2010-2014 (USD MN)

Table 56 Business Revenue Mix, 2010-2014 (USD MN)

Table 57 Products and Services Offerings

Table 58 Recent Developments

Table 59 Key Financials for Teradata, 2011 - 2014 (USD MN)

Table 60 Geographic Revenue Mix, 2011-2014 (USD MN)

Table 61 Business Revenue Mix, 2011-2014 (USD MN)

Table 62 Products and Services Offerings

Table 63 Recent Developments

Table 64 Key Financials for Fico From 2011 - 2014 (USD MN)

Table 65 Geographic Revenue Mix, 2011-2014 (USD MN)

Table 66 Business Revenue Mix, 2011-2014 (USD MN)

Table 67 Products and Services Offerings

Table 68 Recent Developments

List of Figures (56 Figures)

Figure 1 North America Predictive Analytics Market: Segmentation & Coverage

Figure 2 North America Predictive Analytics Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 North America Predictive Analytics Market Snapshot

Figure 9 North America Predictive Analytics Market: Growth Aspects

Figure 10 North America Predictive Analytics Market: Comparison With Parent Market

Figure 11 North America Predictive Analytics Market, By Vertical, 2014 vs 2019

Figure 12 North America Predictive Analytics, By Application, 2014 - 2019(USD MN)

Figure 13 North America Predictive Analytics, Application By Geography,2014 - 2019(USD MN)

Figure 14 North America Predictive Analytics: Comparison With Verticals,2013 - 2019(USD MN)

Figure 15 North America Predictive Analytics Market, By Application,2014 - 2019 (USD MN)

Figure 16 North America Predictive Analytics Market in Customer Analytics,By Geography, 2013 - 2019 (USD MN)

Figure 17 North America Predictive Analytics Market in Marketing Analytics,By Geography, 2013- 2019 (USD MN)

Figure 18 North America Predictive Analytics Market in Operations & Workforce Management, By Geography, 2013 - 2019 (USD MN)

Figure 19 North America Predictive Analytics Market in Risk Analytics, By Geography, 2013 - 2019 (USD MN)

Figure 20 North America Predictive Analytics Market in Fraud Analytics,By Geography, 2013 - 2019 (USD MN)

Figure 21 North America Predictive Analytics Market in Network Analytics,By Geography, 2013 - 2019 (USD MN)

Figure 22 North America Predictive Analytics Market: By Vertical Scenario

Figure 23 North America Predictive Analytics Market, By Vertical,2014 - 2019 (USD MN)

Figure 24 Banking, Financial Services & Insurance

Figure 25 Consumer Goods & Retail

Figure 26 Environment & Government

Figure 27 Telecommunication & It

Figure 28 Media & Entertainment

Figure 29 Healthcare

Figure 30 North America Predictive Analytics Market in Bfsi, By Geography,2014 - 2019 (USD MN)

Figure 31 North America Predictive Analytics Market in Consumer Goods & Retail, By Geography, 2014 - 2019 (USD MN)

Figure 32 North America Predictive Analytics Market in Environment & Government, By Geography, 2014 - 2019 (USD MN)

Figure 33 North America Predictive Analytics Market in Telecommunication & It,By Geography, 2014 - 2019 (USD MN)

Figure 34 North America Predictive Analytics Market in Media & Entertainment,By Geography, 2014 - 2019 (USD MN)

Figure 35 North America Predictive Analytics Market in Healthcare, By Geography, 2013 - 2019 (USD MN)

Figure 36 North America Predictive Analytics Market, By Geography,2014 - 2019 (USD MN)

Figure 37 Figure U.S. Predictive Analytics Market Overview, 2014 – 2019 (USD MN)

Figure 38 U.S. Predictive Analytics Market, By Verticals 2014 – 2019 (USD MN)

Figure 39 U.S. Predictive Analytics Market, By Vertical Snapshot, 2014 – 2019 (USD MN)

Figure 40 U.S. Predictive Analytics Market, By Application 2014 – 2019 (USD MN)

Figure 41 U.S. Predictive Analytics Market, By Application, Snapshot,2014 – 2019 (USD MN)

Figure 42 Figure Canada Predictive Analytics Market Overview, 2014 – 2019 (USD MN)

Figure 43 Canada Predictive Analytics Market, By Verticals 2013 – 2019 (USD MN)

Figure 44 Snapshot of Canada Predictive Analytics Market, By Verticals

Figure 45 Canada Predictive Analytics Market, By Application, 2013 – 2019 (USD MN)

Figure 46 Canada Predictive Analytics Market, By Application, Snapshot,2014 – 2019 (USD MN)

Figure 47 Mexico Predictive Analytics Market Overview, 2014 – 2019 (USD MN)

Figure 48 Mexico Predictive Analytics Market, By Verticals, 2013 – 2019 (USD MN)

Figure 49 Snapshot of Mexico Predictive Analytics Market, By Verticals,2014 – 2019 (USD MN)

Figure 50 Mexico Predictive Analytics Market, By Application, 2013 – 2019 (USD MN)

Figure 51 Mexico Predictive Analytics Market, By Application, Snapshot,2014 – 2019 (USD MN)

Figure 52 Industry Coverage Analysis

Figure 53 IBM Corporation Revenue Mix, 2013 (%)

Figure 54 Oracle Corporation Revenue Mix, 2013-2014 (%)

Figure 55 SAP: Revenue Mix, 2013 (%)

Figure 56 Teradata Revenue Mix, 2014

The North America predictive analytics market is expected to grow at a CAGR of 24.5%. The market was valued at $761.3 million in 2014 and is expected to reach $2,276.4 million by 2019. Predictive analytics is a method of extracting relevant information from past data sets to identify trends and predict future outcomes. Predictive analytics solutions help organizations to improve their decision-making process by determining the trends with the help of data mining, regression, clustering, machine learning and others. It is widely used in different industry verticals such as banking, financial services & insurance (BFSI), consumer goods & retail, media & entertainment, healthcare, environment & government and others.

This study has been undertaken so as to understand the market dynamics in the area of predictive analytics, current revenue generated by predictive analytics, and its future forecast in terms of revenue. A study has been conducted to identify the key applications and geography, where huge opportunities can be expected in the coming future. Further, the market revenue has also been analyzed by clubbing the revenue of the top market players providing predictive analytics solutions. The demand for solutions has also been considered to arrive at the market value.

The growth of predictive analytics is primarily driven by the technological advancements and the massive amount of data deluge faced by the companies. The time consumption and knowledge of algorithms are the main restraining factors. Furthermore, cloud deployment has opened the window of opportunity for predictive analytics as it reduces the time consumption along with the cost of maintenance and installation.

The North America predictive analytics market is broadly segmented into customer analytics, marketing analytics, operations & workforce management, risk analytics, fraud analytics, network analytics and others. The customer analytics segment accounted for the largest market size of the predictive analytics market in 2014, while operations & workforce management is expected to grow at the highest CAGR from 2014 to 2019. The competition in North America is intense and this has fuelled the growth of predictive analytics market. This is because companies are in dire need to know the market trend and be able to predict consumer behavior in future so as to gain competitive advantage.

The North America predictive analytics market is further segmented into industry verticals. The verticals are BFSI, consumer goods & retail, environment & government, telecommunication & IT, media & entertainment, healthcare and others. The BFSI segment holds the maximum share of the market. The use of risk analytics, fraud analytics, asset management and workforce planning is very vast in this segment which has helped the segment in capturing the market. The healthcare segment is expected to grow at the highest CAGR from 2014 to 2019.

Major companies in the predictive analytics industry include IBM Corporation (U.S.), Oracle Corporation (U.S.), SAP SE (Germany), SAS Institute, Inc. (U.S.), Teradata Corporation (U.S.) and FICO (Fair Isaac Corporation) (U.S.)

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement