North America Pharmacy Information System Market by Type (Inpatient Pis, Outpatient Pis), by Component, By Deployment (Web-Based, On-Premise, Cloud-Based), by End-User (Hospitals, Emergency Healthcare Service Providers) – Analysis & Forecast To 2019

This report covers the definition, description, and forecast of the North American pharmacy information system market. It involves a detailed analysis of the market segmentation, which comprises types, components, deployments, end-users, and geography. The report also provides the strategic analysis of the key players in this market. Based on product types, the North America pharmacy information system market has been segmented into inpatient pharmacy information systems and outpatient pharmacy information systems, wherein the inpatient pharmacy information system segment dominates the North American market, having accounted for a 73.0% market share in 2014. Based on end-users, the pharmacy information system market has been categorized into hospitals, office-based physicians, and emergency healthcare service providers. The main components of the market include services, software, and hardware.

Pharmacy information system is a complex computer system that is designed to fulfil the needs of the pharmacy department, in order to supervise and use inputs on medication used in hospitals and among patients. Pharmacy information systems are used for clinical screening, management of prescriptions, inventory control, and patient drug profiles. The PIS is designed in order to streamline and automate the regular workflows of pharmacists through inpatient and ambulatory capabilities. This also avoids human errors in terms of prescription of medications and has efficient verification of their orders.

The rising number of manufacturers of healthcare instruments is the one of the major factors propelling the growth of the pharmacy information system market. These manufacturers offer complete solutions rather than application-specific solutions for healthcare providers. Most of these firms have chosen backward integration to establish themselves in the healthcare information technology market.

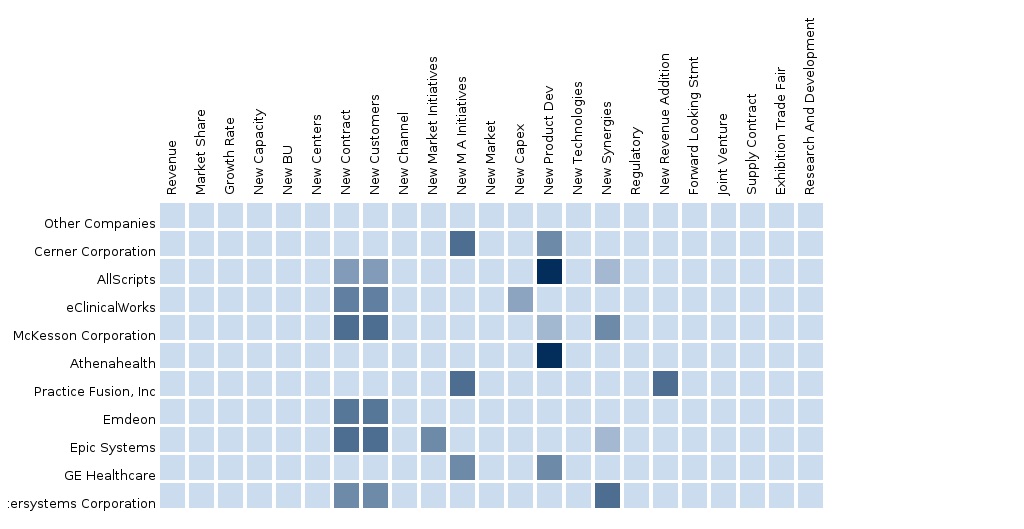

The report also provides a detailed competitive landscaping of companies operating in this market. Segment and country-specific company shares, news & deals, M&As, and segment-specific pipeline products, product approvals, and product recalls of the major companies have also been detailed in the report. Allscripts Healthcare Solutions, Inc. (U.S.), Cerner Corporation (U.S.), ScriptPro LLC (U.S.), athenahealth, Inc. (U.S.), and McKesson Corporation (U.S.), among others, are some of the key players engaged in this market.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Integrated Ecosystem of the Pharmacy Information System Market

2.2 Arriving at the Pharmacy Information System Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 22)

4 Market Overview (Page No. - 24)

4.1 Introduction

4.2 North America Pharmacy Information System Market: Comparison With the Parent Market

4.3 Market Drivers and Inhibitors

4.4 Opportunities

4.5 Key Market Dynamics

5 North America Pharmacy Information System Market, By Type (Page No. - 30)

5.1 Introduction

5.2 North America Pharmacy Information System Market: Type Comparison With North America Pharmacy Information System Market

5.3 North America Inpatient Pharmacy Information System Market, By Geography

5.4 North America Outpatient Pharmacy Information System Market, By Geography

6 North America Pharmacy Information System Market, By Component (Page No. - 35)

6.1 Introduction

6.2 North America Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

6.3 North America Pharmacy Information System Market: Component Comparison With North America Pharmacy Information System Market

6.4 North America Pharmacy Information System Services Market, By Geography, 2013-2019 (USD MN)

6.5 North America Pharmacy Information System Software Market, By Geography, 2013-2019 (USD MN)

6.6 North America Pharmacy Information System Hardware Market, By Geography, 2013-2019 (USD MN)

7 North America Pharmacy Information System Market, By Deployment (Page No. - 41)

7.1 Introduction

7.2 North America Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

7.3 North America Pharmacy Information System Market: Deployment Comparison With Pharmacy Information System Market

7.4 North America Web-Based Pharmacy Information System Market, By Geography

7.5 North America On-Premise Pharmacy Information System Market, By Geography

7.6 North America Cloud-Based Pharmacy Information System Market, By Geography

8 North America Pharmacy Information System Market, By End-User (Page No. - 47)

8.1 Introduction

8.2 North America Pharmacy Information System in Hospitals, By Geography

8.3 North America Pharmacy Information System in Office-Based Physicians, By Geography

8.4 North America Pharmacy Information System in Emergency Healthcare Service Providers, By Geography

9 North America Pharmacy Information System Market, By Geography (Page No. - 52)

9.1 Introduction

9.2 U.S. Pharmacy Information System Market

9.2.1 U.S. Pharmacy Information System Market, By Type

9.2.2 U.S. Pharmacy Information System Market, By Component

9.2.3 U.S. Pharmacy Information System Market, By Deployment

9.2.4 U.S. Pharmacy Information System Market, By End-User

9.3 Canada Pharmacy Information System Market

9.3.1 Canada Pharmacy Information System Market,By Type

9.3.2 Canada Pharmacy Information System Market, By Component

9.3.3 Canada Pharmacy Information System Market, By Deployment

9.3.4 Canada Pharmacy Information System Market, By End-User

9.4 Mexico Pharmacy Information System Market

9.4.1 Mexico Pharmacy Information System Market, By Type

9.4.2 Mexico Pharmacy Information System Market, By Component

9.4.3 Mexico Pharmacy Information System Market, By Deployment

9.4.4 Mexico Pharmacy Information System Market, By End-User

10 North America Pharmacy Information System Market: Competitive Landscape (Page No. - 75)

10.1 North America Pharmacy Information System Market Share, By Company

10.2 Acquisitions

10.3 New Product Launch

10.4 Agreements and Collaborations

10.5 Partnerships

10.6 Others

11 North America Pharmacy Information System Market, By Company (Page No. - 81)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 Allscripts Healthcare Solutions, Inc.

11.2 Athenahealth, Inc.

11.3 Carestream Health

11.4 Cerner Corporation

11.5 Eclinicalworks, Llc

11.6 Epic Systems Corporation

11.7 Mckesson Corporation

11.8 Parata Systems

11.9 Scriptpro Llc

11.10 Swisslog

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

12 Appendix (Page No. - 110)

12.1 Customization Options

12.1.1 Impact Analysis

12.2 Related Reports

12.3 Introducing RT: Real Time Market Intelligence

12.3.1 RT Snapshots

List of Tables (53 Tables)

Table 1 North America Pharmacy Information System Peer Market Size, 2014 (USD MN)

Table 2 North America Pharmacy Information System Market: Macroindicators, By Geography, 2014 (USD MN)

Table 3 North America Pharmacy Information System Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 4 North America Pharmacy Information System Market: Drivers and Inhibitors

Table 5 North America Pharmacy Information System Market, By Type, 2013-2019 (USD MN)

Table 6 North America Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

Table 7 North America Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

Table 8 North America Pharmacy Information System Market, By End-User, 2013-2019 (USD MN)

Table 9 North America Pharmacy Information System Market, By Geography, 2013-2019 (USD MN)

Table 10 North America Pharmacy Information System Market, By Type, 2013–2019 (USD MN)

Table 11 North American Pharmacy Information System Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 12 North America Inpatient Pharmacy Information System Market, By Geography, 2013–2019 (USD MN)

Table 13 North America Outpatient Pharmacy Information System Market, By Geography, 2013–2019 (USD MN)

Table 14 North America Pharmacy Information System Market, By Component, 2013–2019 (USD MN)

Table 15 North America Pharmacy Information System Market: Component Comparison With Parent Market, 2013–2019 (USD MN)

Table 16 North America Pharmacy Information System Services Market, By Geography, 2013–2019 (USD MN)

Table 17 North America Pharmacy Information System Software Market, By Geography, 2013–2019 (USD MN)

Table 18 North America Pharmacy Information System Hardware Market, By Geography, 2013–2019 (USD MN)

Table 19 North America Pharmacy Information System Market, By Deployment, 2013–2019 (USD MN)

Table 20 North America Pharmacy Information System Market: Deployment Comparison With Parent Market, 2013–2019 (USD MN)

Table 21 North America Web-Based Pharmacy Information System Market, By Geography, 2013–2019 (USD MN)

Table 22 North America On-Premise Pharmacy Information System Market, By Geography, 2013–2019 (USD MN)

Table 23 North America Cloud-Based Pharmacy Information System Market, By Geography, 2013–2019 (USD MN)

Table 24 North America Pharmacy Information System Market, By End-User, 2013-2019 (USD MN)

Table 25 North America Pharmacy Information System in Hospitals, By Geography, 2013-2019 (USD MN)

Table 26 North America Pharmacy Information System in Office-Based Physicians, By Geography, 2013-2019 (USD MN)

Table 27 North America Pharmacy Information System in Emergency Healthcare Service Providers, By Geography, 2013-2019 (USD MN)

Table 28 North America Pharmacy Information System Market, By Geography, 2013-2019 (USD MN)

Table 29 U.S. Pharmacy Information System Market, By Type, 2013-2019 (USD MN)

Table 30 U.S. Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

Table 31 U.S. Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

Table 32 U.S. Pharmacy Information System Market, By End-User, 2013-2019 (USD MN)

Table 33 Canada Pharmacy Information System Market, By Type, 2013-2019 (USD MN)

Table 34 Canada Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

Table 35 Canada Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

Table 36 Canada Pharmacy Information System Market, By End-User, 2013-2019 (USD MN)

Table 37 Mexico Pharmacy Information System Market, By Type, 2013-2019 (USD MN)

Table 38 Mexico Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

Table 39 Mexico Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

Table 40 Mexico Pharmacy Information System Market, By End-User, 2013-2019 (USD MN)

Table 41 North America Pharmacy Information System Market: Company Share Analysis, 2013 (%)

Table 42 North America Pharmacy Information System Market: Acquisitions

Table 43 North America Pharmacy Information System Market: New Product Launch

Table 44 North America Pharmacy Information System Market: Agreements and Collaborations

Table 45 North America Pharmacy Information System Market: Partnerships

Table 46 North America Pharmacy Information System Market: Others

Table 47 Allscripts Healthcare Solutions, Inc.: Key Operations Data, 2009-2013 (USD MN)

Table 48 Allscripts Healthcare Solutions, Inc.: Key Financials, 2011-2013 (USD MN)

Table 49 Athenahealth, Inc. : Key Financials, 2010-2014 (USD MN)

Table 50 Cerner Corporation: Key Financials, 2008-2013 (USD MN)

Table 51 Mckesson Corporation: Key Operations Data, 2010-2014 (USD MN)

Table 52 Mckesson Corporation: Key Financials, 2009-2014 (USD MN)

Table 53 Swisslog: Key Financials, 2010-2014 (USD MN)

List of Figures (60 Figures)

Figure 1 North American Pharmacy Information System Market: Segmentation & Coverage

Figure 2 Pharmacy Information System Market: Integrated Ecosystem

Figure 3 Arriving at the Pharmacy Information System Market Size

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macroindicator-Based Approach 2014

Figure 7 North America Pharmacy Information System Market: Snapshot

Figure 8 North American Pharmacy Information System Market, By Geography, 2014 & 2019 (USD MN)

Figure 9 North America Pharmacy Information System Market, By Type, 2013-2019 (USD MN)

Figure 10 North America Pharmacy Information System Market: Type Comparison With North America Pharmacy Information System Market, 2013–2019 (USD MN)

Figure 11 North America Inpatient Pharmacy Information System Market, By Geography, 2013-2019 (USD MN)

Figure 12 North America Outpatient Pharmacy Information System Market, By Geography, 2013-2019 (USD MN)

Figure 13 North America Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

Figure 14 North America Pharmacy Information System Market: Component Comparison With Pharmacy Information System Market, 2013–2019 (USD MN)

Figure 15 North America Pharmacy Information System Services Market, By Geography, 2013-2019 (USD MN)

Figure 16 North America Pharmacy Information System Software Market, By Geography, 2013-2019 (USD MN)

Figure 17 North America Pharmacy Information System Hardware Market, By Geography, 2013-2019 (USD MN)

Figure 18 North America Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

Figure 19 North America Pharmacy Information System Market: Deployment Comparison With Parent Market, 2013–2019 (USD MN)

Figure 20 North America Web-Based Pharmacy Information System Market, By Geography, 2013–2019 (USD MN)

Figure 21 North America On-Premise Pharmacy Information System Market, By Geography, 2013–2019 (USD MN)

Figure 22 North America Cloud-Based Pharmacy Information System Market, By Geography, 2013–2019 (USD MN)

Figure 23 North America Pharmacy Information System Market, By End-User, 2014-2019 (USD MN)

Figure 24 North America Pharmacy Information System in Hospitals, By Geography, 2013-2019 (USD MN)

Figure 25 North America Pharmacy Information System in Office-Based Physicians, By Geography, 2013-2019 (USD MN)

Figure 26 North America Pharmacy Information System in Emergency Healthcare Service Providers, By Geography, 2013-2019 (USD MN)

Figure 27 North America Pharmacy Information System Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 28 U.S. Pharmacy Information System Market Overview, 2014 & 2019 (%)

Figure 29 U.S.: Pharmacy Information System Market, By Type, 2013-2019 (USD MN)

Figure 30 U.S. Pharmacy Information System Market: Type Snapshot, 2014 & 2019 (%)

Figure 31 U.S. Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

Figure 32 U.S. Pharmacy Information System Market: Component Snapshot, 2014-2019 (USD MN)

Figure 33 U.S. Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

Figure 34 U.S. Pharmacy Information System Market: Deployment Snapshot, 2014-2019 (USD MN)

Figure 35 U.S. Pharmacy Information System Market, By End-User, 2013-2019 (USD MN)

Figure 36 U.S. Pharmacy Information System Market: End-User Snapshot, 2014-2019 (USD MN)

Figure 37 Canada Pharmacy Information System Market Overview, 2014 & 2019 (%)

Figure 38 Canada Pharmacy Information System Market, By Type, 2013-2019 (USD MN)

Figure 39 Canada Pharmacy Information System Market: Type Snapshot, 2014 & 2019 (%)

Figure 40 Canada Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

Figure 41 Canada Pharmacy Information System Market: Component Snapshot, 2014-2019 (USD MN)

Figure 42 Canada Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

Figure 43 Canada Pharmacy Information System Market: Deployment Snapshot, 2014-2019 (USD MN)

Figure 44 Canada Pharmacy Information System Market, By End-User, 2013-2019 (USD MN)

Figure 45 Canada Pharmacy Information System Market: End-User Snapshot, 2014-2019 (USD MN)

Figure 46 Mexico Pharmacy Information System Market Overview, 2014 & 2019 (%)

Figure 47 Mexico Pharmacy Information System Market, By Type, 2013-2019 (USD MN)

Figure 48 Mexico Pharmacy Information System Market: Type Snapshot, 2014 & 2019 (%)

Figure 49 Mexico Pharmacy Information System Market, By Component, 2013-2019 (USD MN)

Figure 50 Mexico Pharmacy Information System Market: Component Snapshot , 2014-2019 (USD MN)

Figure 51 Mexico Pharmacy Information System Market, By Deployment, 2013-2019 (USD MN)

Figure 52 Mexico Pharmacy Information System Market: Deployment Snapshot , 2014-2019 (USD MN)

Figure 53 Mexico Pharmacy Information System Market, By End-User, 2013-2019 (USD MN)

Figure 54 Mexico Pharmacy Information System Market: End-User Snapshot , 2014-2019 (USD MN)

Figure 55 North America Pharmacy Information System Market Share, By Company, 2013

Figure 56 Allscripts: Revenue Mix, 2013 (%)

Figure 57 Athenahealth, Inc.: Revenue Mix, 2013 (%)

Figure 58 Cerner Corporation: Revenue Mix, 2013 (%)

Figure 59 Mckesson Corporation: Revenue Mix, 2014 (%)

Figure 60 Swisslog: Revenue Mix, 2013 (%)

Pharmacy information system is a web-based system that has been designed in order to give high flexibility and easy usage facility in clinics and pharmacy stores. It consists of one central store and many pharmacies connected through a network distributed through various geographical locations. The pharmacy information system has been developed in order to ease complex information search, as well as to coordinate among doctors and pharmacists. It also helps in maintaining medical stock with least paper work. Its main functionality includes dispensing the medicines over the centers that are associated with this system. There are many success stories of the use of pharmacy information system; for instance, in the U.S. Department of Defense Military Health System, it has helped in the improvement of safety and quality of the department of defense prescription services.

The North American pharmacy information system market was valued at $1,380.9 million in 2014 and is expected to reach a value of $2,034.6 million by 2019, at a CAGR of 8.1% from 2014 to 2019.

Among the types of pharmacy information system, the inpatient pharmacy information system is estimated to reach a value of $1,437.4 million by 2019. Among the end-users, the hospitals segment is estimated to grow at a CAGR of 7.3% from 2014 to 2019, to reach a market value of $902.1 by 2019. The services segment is expected to grow at the fastest CAGR of 8.9% during the given forecast period, among components. The Web-based segment led the North American pharmacy information system market with a value of $861.1 million in 2014 and is estimated to reach $1,308.8 million by 2019, at a CAGR of 8.7% during the period under consideration.

An in-depth profiling of the key players has been conducted, along with the recent developments (new product launches, partnerships, agreements, collaborations, and joint ventures) and the strategies adopted by them to sustain and strengthen their positions in the North America pharmacy information system market. The key players of the North American PIS market have been identified as Cerner Corporation (U.S.), athenahealth, Inc. (U.S.), eClinical Works (U.S.), Epic Systems (U.S.), Allscripts (U.S.), McKesson Corporation (U.S.), and ScriptPro LLC (U.S.), among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North American Clinical Cardiovascular Information And Imaging Solution The North American Clinical CVIS market is anticipated to boom due to the inherent advantages it offers in the field of interventional cardiology. This report encompasses the market share, value chain analysis, and market metrics along with the market drivers and restraints. A DeepDive analysis of the top players of this domain have also been considered in the report. |

Upcoming |

|

European Clinical Cardiovascular Information And Imaging Solution market Globally, Europe is the second largest Clinical Information Systems market, which is expected to reach a CAGR value of 6.35%, from 2012 to 2018. The European chromatography market is segmented into geography, sub-market, application, component, deployment, and end-user. A DeepDive analysis of the top players of this domain have also been considered in the report. |

Upcoming |

|

Asia Clinical Information Systems Market The Asian clinical CVIS market report includes the market share, value chain analysis, and market metrics that include drivers, restraints, and upcoming opportunities. The market is segmented into geography, sub-market, application, component, deployment, and end-user. A DeepDive analysis of the top players of this domain have also been considered in this report. |

Upcoming |