North America Perimeter Security Market by Vertical (Critical Infrastructure, Defense & Government, Transportation, Commercial Facilities, Sensitive Areas) by Type (System & Service), by Country - Analysis & Forecasts to 2019

The North American perimeter security market is expected to grow from $4,261.4 million in 2014 to $5,166.5 million by 2019, at a CAGR of 3.9% from 2014 to 2019. The market is primarily driven by government regulations, increasing need for security against terrorist attacks, and technological advancements in the field of security.

Perimeter security is provided to the outdoor premises of various sites/areas such as critical infrastructures, public facilities, and government and defense facilities, which are prone to risks involving loss of human life and intellectual and physical property. Perimeter security is imperative due to the increasing number of threats, which may disrupt operations and lead to huge losses. The perimeter security systems comprise Intrusion Detection Systems (IDS), video surveillance systems, communication/alarms and notification systems, and access control systems.

North America has witnessed major terrorist and criminal incidents in the past decades. The 9/11 attack put perimeter security solutions’ implementations on a high priority list in the region. This has led to huge investments in the North American perimeter security market. The U.S. spends the highest amount of its budgets on the nation’s defense and security deployments, which further fuels the growth of the North America perimeter security market. The market is very mature in the region and hence needs innovative technologies to drive it further.

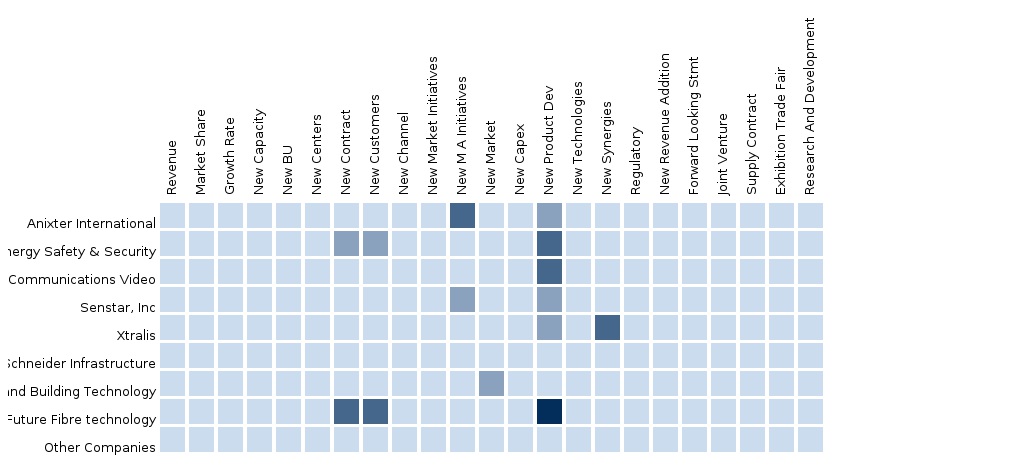

The North America perimeter security market report further provides a competitive benchmarking of the leading players in the industry, such as Honeywell International, Anixter Inc., Axis Communications, Senstar, and Xtralis, among others, in terms of their product offerings, key strategies, and operational parameters. The report provides market trends, overall adoption scenarios, competitive landscapes, and key drivers, restraints, and opportunities in this market. The report aims in estimating the current size and the future growth potential of this market across the different verticals and countries.

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

1.4 Assumptions

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Perimeter Security Market

2.2 Arriving at the Perimeter Security Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator-Based Approach

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 North America Perimeter Security Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 North America Perimeter Security Market, By Vertical (Page No. - 31)

5.1 Introduction

5.2 Demand Side Analysis

5.2.1 Critical Infrastructure

5.2.2 Defense and Government

5.2.3 Transportation

5.3 Perimeter Security in Defense and Government, By Geography

5.4 Perimeter Security in Critical Infrastructure, By Geography

5.5 Perimeter Security in Transportation, By Geography

5.6 Perimeter Security in Sensitive Areas, By Geography

5.7 Perimeter Security in Commercial Facilities, By Geography

6 North America Perimeter Security Market, By Type (Page No. - 42)

6.1 Introduction

6.2 North America Perimeter Security Market: Type Comparison With Security Market

6.3 North America Perimeter Security Market, By System

6.3.1 North America Intrusion Detection System Market, By Geography

6.3.2 North America Video Surveillance System Market, By Geography

6.3.3 North America Communication/Alarm and Notification System Market, By Geography

6.3.4 North America Access Control Market, By Geography

6.4 North America Perimeter Security Market, By Service

6.4.1 Introduction

6.4.2 North America Perimeter Security Market in System Integration & Consulting, By Geography

6.4.3 North America Perimeter Security Market in Managed Services, By Geography

6.4.4 North America Perimeter Security Market in Maintenance & Support, By Geography

6.4.5 North America Perimeter Security Market in Risk Assessment & Analysis, By Geography

7 North America Perimeter Security Market, By Geography (Page No. - 55)

7.1 Introduction

7.2 U.S. Perimeter Security Market

7.2.1 U.S. Perimeter Security Market, By Vertical

7.2.2 U.S. Perimeter Security Market, By System

7.2.3 U.S. Perimeter Security Market, By Service

7.3 Canada Perimeter Security Market

7.3.1 Canada Perimeter Security Market, By Vertical

7.3.2 Canada Perimeter Security Market, By System

7.3.3 Canada Perimeter Security Market, By Service

7.4 Mexico Perimeter Security Market

7.4.1 Mexico Perimeter Security Market, By Vertical

7.4.2 Mexico Perimeter Security Market, By System

7.4.3 Mexico Perimeter Security Market, By Service

8 North America Perimeter Security Market: Competitive Landscape (Page No. - 73)

8.1 North America Perimeter Security Market: Company Share Analysis

8.2 Company Presence in Perimeter Security Market, By Type

8.3 Mergers & Acquisition

8.4 Expansion

8.5 New Product Launch

8.6 Joint Venture

9 North America Perimeter Security Market, By Company (Page No. - 77)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Anixter International

9.2 Axis Communications AB

9.3 Honeywell International, Inc.

9.4 Senstar

9.5 Xtralis

*Details On Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

10 Appendix (Page No. - 90)

10.1 Customization Options

10.1.1 Product Portfolio Analysis

10.1.2 Country Level Data Analysis

10.1.3 Product Comparison of Various Competitors

10.1.4 Trade Analysis

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (52 Tables)

Table 1 Global Perimeter Security Peer Market Size, 2014 (USD MN)

Table 2 North America Perimeter Security: Vertical Markets, 2014 (USD MN)

Table 3 North America Perimeter Security Market: Macroindicator, By Geography, 2013 (USD MN)

Table 4 North America Perimeter Security Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 5 North America Perimeter Security Market: Drivers and Inhibitors

Table 6 North America Perimeter Security Market, By Industry Vertical, 2013-2019 (USD MN)

Table 7 North America Perimeter Security Market, By Geography, 2013-2019 (USD MN)

Table 8 North America Perimeter Security Market, By Type, 2013–2019 (USD MN)

Table 9 North America Perimeter Security Market, By System, 2013 – 2019 (USD MN)

Table 10 North America Perimeter Security Market, By Service, 2013 – 2019 (USD MN)

Table 11 North America Perimeter Security Market: Comparison With Vertical Markets, 2013-2019 (USD MN)

Table 12 North America Perimeter Security Market, By Vertical, 2013-2019 (USD MN)

Table 13 Comparison of Ict Expenditure and Critical Infrastructure

Table 14 Comparison of Ict Expenditure and Defense & Government

Table 15 Comparison of Ict Expenditure and Transportation

Table 16 North America Perimeter Security in Defense and Government, By Geography, 2013-2019 (USD MN)

Table 17 North America Perimeter Security in Critical Infrastructure, By Geography, 2013-2019 (USD MN)

Table 18 North America Perimeter Security in Transportation, By Geography, 2013-2019 (USD MN)

Table 19 North America Perimeter Security in Sensitive Areas, By Geography, 2013-2019 (USD MN)

Table 20 North America Perimeter Security Market in Commercial Facilities,By Geography, 2013-2019 (USD MN)

Table 21 North America Perimeter Security Market, By System, 2013-2019 (USD MN)

Table 22 North America Perimeter Security Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 23 North America Intrusion Detection System Market, By Geography, 2013–2019 (USD MN)

Table 24 North America Video Surveillance System Market, By Geography, 2013-2019 (USD MN)

Table 25 North America Communication/Alarm and Notification System Market, By Geography, 2013-2019 (USD MN)

Table 26 North America Access Control Market, By Geography, 2013-2019 (USD MN)

Table 27 North America Perimeter Security Market, By Service, 2013-2019 (USD MN)

Table 28 North America Perimeter Security Market: Services Comparison With Parent Market, 2013–2019 (USD MN)

Table 29 North America Perimeter Security Market in System Integration & Consulting, By Geography, 2013-2019 (USD MN)

Table 30 North America Perimeter Security in Managed Services, By Geography, 2013-2019 (USD MN)

Table 31 North America Perimeter Security Market in Maintenance & Support, By Geography, 2013-2019 (USD MN)

Table 32 North America Perimeter Security Market in Risk Assessment & Analysis, By Geography, 2013-2019 (USD MN)

Table 33 North America Perimeter Security Market, By Geography, 2013-2019 (USD MN)

Table 34 U.S. Perimeter Security Market, By Vertical , 2013-2019 (USD MN)

Table 35 U.S. Perimeter Security Market, By System, 2013–2019 (USD MN)

Table 36 U.S. Perimeter Security Market, By Service, 2013–2019 (USD MN)

Table 37 Canada Perimeter Security Market, By Vertical, 2013-2019 (USD MN)

Table 38 Canada Perimeter Security Market, By System, 2013–2019 (USD MN)

Table 39 Canada Perimeter Security Market, By Service, 2013–2019 (USD MN)

Table 40 Mexico Perimeter Security Market, By Vertical, 2013-2019 (USD MN)

Table 41 Mexico Perimeter Security Market, By System, 2013–2019 (USD MN)

Table 42 Mexico Perimeter Security Market, By Service, 2013–2019 (USD MN)

Table 43 North America Perimeter Security Market: Company Share Analysis, 2013 (%)

Table 44 North America Perimeter Security Market: Mergers & Acquisitions

Table 45 North America Perimeter Security Market: Expansion

Table 46 Table 36 North America Perimeter Security Market: New Product Launch

Table 47 North America Perimeter Security Market: Joint Venture

Table 48 Anixter Inc.: Key Financials, By Region 2011-2013 (USD MN)

Table 49 Anixter International Key Financials, By Business Segment, 2009 – 2013 (USD MN)

Table 50 Axis Communication Revenue, 2009-2013 (USD MN)

Table 51 Axis Communication Revenue, By Region, 2009–2013 (USD MN)

Table 52 Honeywell International: Key Financials, By Business Segment 2011-2013 (USD MN)

List of Figures (56 Figures)

Figure 1 North America Perimeter Security Market: Segmentation & Coverage

Figure 2 Perimeter Security Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 North America Perimeter Security Market: Snapshot 2014

Figure 9 Perimeter Security Market: Growth Aspects

Figure 10 North America Perimeter Security Market, By Industry Vertical, 2014 vs 2019, (USD MN)

Figure 11 North America Perimeter Security Market Type, By Geography, 2014 (USD MN)

Figure 12 North America Perimeter Security Market, By Vertical, 2014 & 2019 (USD MN)

Figure 13 North America Perimeter Security Market in Defense and Government, By Geography, 2013–2019 (USD MN)

Figure 14 North America Perimeter Security Market in Critical Infrastructure, By Geography, 2013-2019 (USD MN)

Figure 15 North America Perimeter Security Market in Transportation, By Geography, 2013-2019 (USD MN)

Figure 16 North America Perimeter Security Market in Sensitive Areas, By Geography, 2013-2019 (USD MN)

Figure 17 North America Perimeter Security Market in Commercial Facilities, By Geography, 2013-2019 (USD MN)

Figure 18 North America Perimeter Security Market, By System, 2014 &2019 (USD MN)

Figure 19 North America Perimeter Security Market: Type Comparison With Security Market, 2013–2019 (USD MN)

Figure 20 North America Intrusion Detection System Market, By Geography, 201–2019 (USD MN)

Figure 21 North America Video Surveillance System Market, By Geography, 2013-2019 (USD MN)

Figure 22 North America Communication/Alarm and Notification System Market, By Geography, 2013-2019 (USD MN)

Figure 23 North America Access Control Market, By Geography, 2013–2019 (USD MN)

Figure 24 North America Perimeter Security Market, By Service, 2014& 2019 (USD MN)

Figure 25 North America Perimeter Security Market: Services Comparison With Parent Market, 2013–2019 (USD MN)

Figure 26 North America Perimeter Security Market in System Integration & Consulting, By Geography, 2013-2019 (USD MN)

Figure 27 North America Perimeter Security Market in Managed Services, By Geography, 2013-2019 (USD MN)

Figure 28 North America Perimeter Security in Maintenance & Support, By Geography, 2013-2019 (USD MN)

Figure 29 North America Perimeter Security in Risk Assessment & Analysis, By Geography, 2013-2019 (USD MN)

Figure 30 North America Perimeter Security Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 31 U.S. Perimeter Security Market Overview, 2014 & 2019 (%)

Figure 32 Figure 32 U.S. Perimeter Security Market, By Vertical, 2013–2019 (USD MN)

Figure 33 U.S. Perimeter Security Market: Verticals Snapshot 2014 & 2019 (USD MN)

Figure 34 U.S. Perimeter Security Market, By System, 2013-2019 (USD MN)

Figure 35 U.S. Perimeter Security Market, By System, 2014 & 2019 (%)

Figure 36 U.S. Perimeter Security Market, By Service, 2013–2019 (USD MN)

Figure 37 U.S. Perimeter Security Market, By Service, 2014 & 2019 (%)

Figure 38 Canada Perimeter Security Market Overview, 2014 & 2019

Figure 39 Canada Perimeter Security Market, By Vertical, 2013-2019 (USD MN)

Figure 40 Canada Perimeter Security Market: Verticals Snapshot 2014 & 2019

Figure 41 Canada Perimeter Security Market, By System, 2013–2019 (USD MN)

Figure 42 Canada Perimeter Security Market, By System, 2014 & 2019 (%)

Figure 43 Canada Perimeter Security Market, By Service, 2013-2019 (USD MN)

Figure 44 Canada Perimeter Security Market, By Service, 2014 & 2019 (%)

Figure 45 Mexico Perimeter Security Market Overview, 2014 & 2019 (%)

Figure 46 Mexico Perimeter Security Market, By Vertical, 2013–2019 (USD MN)

Figure 47 Mexico Perimeter Security Market: Vertical Snapshot, 2014 & 2019

Figure 48 Mexico Perimeter Security Market, By System, 2013-2019 (USD MN)

Figure 49 Mexico Perimeter Security Market, By System, 2014 & 2019 (%)

Figure 50 Mexico Perimeter Security Market, By Service, 2013-2019 (USD MN)

Figure 51 Mexico Perimeter Security Market, By Service, 2014 & 2019 (USD MN)

Figure 52 North America Perimeter Security Market: Company Share Analysis, 2013 (%)

Figure 53 North America Perimeter Security: Company Product Coverage, By Type (Systems & Services), 2013

Figure 54 Anixter International: Revenue Mix, 2013 (%)

Figure 55 Axis International Ab.: Revenue Mix, By Region, 2013 (%)

Figure 56 Honeywell International Inc.: Revenue Mix, By Business Segment, 2013 (%)

North America Perimeter security is the security provided to the outdoor perimeters of various sites/areas such as critical infrastructures, transportation facilities, government & defense facilities, commercial facilities, and sensitive areas, among others. These sites are prone to the risks on human lives, and intellectual & physical property. The North American perimeter security market includes systems such as Intrusion Detection System (IDS), video surveillance systems, communication/alarms & notification systems, and access control systems. In North America, perimeter security is imperative due to the increasing number of threats, which may disrupt operations and also lead to huge losses.

The North American perimeter security market was valued at $4,261.4 million in 2014 and is projected to reach $5,166.5 million by 2019, at a CAGR of 3.9% during the period under consideration. The market, by systems, is led by the video surveillance system segment, having accounted for a share of 35.6% in 2014. The market size of this segment is projected to reach $1,508.6 million by 2019, at a CAGR of 4.5% during the given forecast period. The market, by vertical, is led by the critical infrastructure segment, which accounted for a share of 34.5% in 2014, and revenues of $1,472.1 million. Its market size is expected to grow at a CAGR of 2.9% during the given forecast period. In this region, the perimeter security market has observed significant growth in recent years, owing to strengthening of laws & regulations, the high technological advancements, and the increasing need for security against terrorist attacks.

As of 2014, the North American perimeter security market is dominated by Anixter, Inc., Axis Communications, Senstar, Honeywell International, and Xtralis, among others. New product launches, partnerships, acquisitions, and collaborations are the major strategies adopted by the most of the players to achieve growth in the North American perimeter security market. The market is led by Anixter, Inc., followed by Honeywell and Axis Communications.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement