North America Nitrogenous Fertilizers Market By Type (Ammonium Fertilizers, Ammonium Nitrate Fertilizers, Ammonium Sulfate Fertilizer, Calcium Ammonium Nitrate Fertilizers, Urea, Others); By Application (Grains and Oilseeds, Fruits and Vegetables, Rest Crops); By Country (U.S., Canada, and Mexico) Forecasts to 2019

The North American nitrogenous fertilizers market is estimated to grow at a CAGR of 2.6% from 2014 to 2019. Crops require different types of nutrients such as nitrogen, phosphorus, sulfur, and potassium for its growth. Nitrogen is one of the most essential nutrients for proper growth and development of plants. Grains and oilseeds require a higher application rate of nitrogenous fertilizers than fruits and vegetables.

In 2014, the U.S. was the largest nitrogenous fertilizers market by value, followed by Canada which also has the highest CAGR% among the North American countries for the estimated period. North America is the biggest consumer of meat and meat products. Here, apart from human consumption, the grains are also in demand for producing animal feed for the meat industry. The increased demand can only be met by increasing the agricultural productivity, which can be achieved by use of fertilizers for grain production.

In North America, nitrogenous fertilizers are widely used in the fields. It comes in different types like ammonia, urea, calcium ammonium sulfate, ammonium nitrate, and others. The different nitrogenous fertilizers are required for different type of crops and at different stages of plant growth. Ammonia and urea are the types of nitrogenous fertilizers used widely to grow grains and oilseeds in North America.

To know about the assumptions considered for the study, Download the PDF Brochure.

The growing North American nitrogenous fertilizers market has prominent players that are competing to occupy larger chunks of market share. Companies such as CF Industries (U.S.) have expansion strategies that helped it expand beyond North America and establish its presence in major countries of the world. The other companies present in the North American market are Agrium Inc. (Canada), Yara International (Norway), CVR Partners LP (U.S.), Bunge (U.S.), and Eurochem (Russia). Apart from these companies, the North American nitrogenous fertilizers market is largely fragmented and many small players are present to compete with the maket leaders.

Scope of the Report

This research report categorizes the North American nitrogenous fertilizers market into the following segments and sub-segments:

North America Nitrogenous Fertilizers Market, by Application

- Grain and Oilseeds

- Fruits and Vegetables

- Rest (crops)

North America Nitrogenous Fertilizers Market, by Type

- Urea

- Ammonia

- Ammonium Nitrate

- Ammonium Sulfate

- Calcium Ammonium Nitrate

- Other Nitrogenous Fertilizers

North America Nitrogenous Fertilizers Market, by Country

- U.S.

- Canada

- Mexico

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

1.4 Assumptions

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Nitrogenous Fertilizers Market

2.2 Arriving at the Nitrogenous Fertilizers Market Value

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator-Based Approach

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 Nitrogenous Fertilizer Market: Comparison With Parent Market

4.3 Key Market Dynamics

4.4 Demand Side Analysis

4.5 Vendor Side Analysis

4.6 Market Drivers and Inhibitors

5 Nitrogenous Fertilizers Market, By Application (Page No. - 32)

5.1 Introduction

5.2 Demand Side Analysis

5.3 Vendor Side Analysis

5.4 Nitrogenous Fertilizers in Grains & Oilseeds, By Country

5.5 Nitrogenous Fertilizers in Fruits & Vegetables, By Country

5.6 Sneak View: North America Fertilizers Market, By Application

6 Nitrogenous Fertilizers Market, By Type (Page No. - 42)

6.1 Introduction

6.2 North America Nitrogenous Fertilizers Market, Type Comparison With Parent Market

6.3 North America Urea Fertilizers Market, By Country

6.4 North America Ammonia Fertilizers Market, By Country

6.5 North America Ammonium Sulfate Fertilizers Market, By Country

6.6 North America Ammonium Nitrate Fertilizers Market, By Country

6.7 North America Calcium Ammonium Nitrate Fertilizers Market, By Country

6.8 Sneak View: North America Fertilizers Market, By Type

7 Nitrogenous Fertilizers Market, By Country (Page No. - 54)

7.1 Introduction

7.2 Vendor Side Analysis

7.3 U.S. Nitrogenous Fertilizers Market

7.3.1 U.S. Nitrogenous Fertilizers Market, By Application

7.3.2 U.S. Nitrogenous Fertilizers Market, By Type

7.4 Canada Nitrogenous Fertilizers Market

7.4.1 Canada Nitrogenous Fertilizers Market, By Application

7.4.2 Canada Nitrogenous Fertilizers Market, By Type

7.5 Mexico Nitrogenous Fertilizers Market

7.5.1 Mexico Nitrogenous Fertilizers Market, By Application

7.5.2 Mexico Nitrogenous Fertilizers Market, By Type

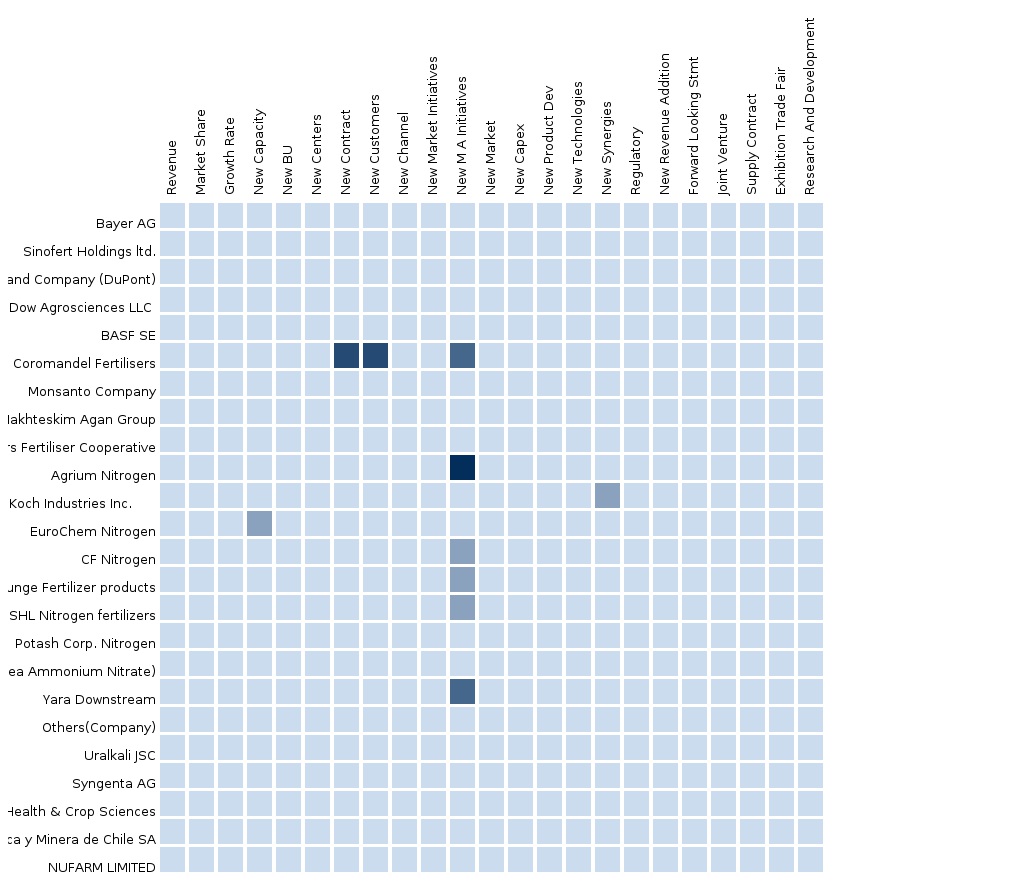

8 Nitrogenous Fertilizers Market: Competitive Landscape (Page No. - 71)

8.1 Nitrogenous Fertilizers Market: Company Share Analysis

8.2 Company Presence in Nitrogenous Fertilizers Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 Investments

8.6 Joint Ventures

9 Company Profiles (Page No. - 76)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 CF Industries Holdings Inc.

9.2 Agrium Inc.

9.3 Potash Corp

9.4 Yara International ASA

9.5 Eurochem

9.6CVR Partners, LP

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 93)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 Crop-Nitrogen Fertilizer Usage Data

10.1.5 Impact Analysis

10.1.6 Trade Analysis

10.1.7 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real-Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (59 Tables)

Table 1 Global Nitrogenous Fertilizers Peer Market Value, 2014 (USD MN)

Table 2 North America Application Market, 2014 (KT)

Table 3 North America Nitrogenous Fertilizers Market: Macroindicators, By Country, 2014 (Mn Ha)

Table 4 North America Nitrogenous Fertilizers Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 5 North America Nitrogenous Fertilizers Market: Comparison With Parent Market, 2013–2019 (KT)

Table 6 North America Nitrogenous Fertilizers Market, By Application, 2013–2019 (USD MN)

Table 7 North America Nitrogenous Fertilizers Market, By Application, 2013–2019 (KT)

Table 8 North America Nitrogenous Fertilizers Market, By Type, 2013–2019 (USD MN)

Table 9 North America Nitrogenous Fertilizers Market, By Type, 2013–2019 (KT)

Table 10 North America Nitrogenous Fertilizers Market, By Country, 2013–2019 (USD MN)

Table 11 North America Nitrogenous Fertilizers Market, By Country, 2013–2019 (KT)

Table 12 North America Nitrogenous Fertilizers Market: Comparison With Application Markets, 2013–2019 (USD MN)

Table 13 North America Nitrogenous Fertilizers Market: Drivers and Inhibitors

Table 14 North America Nitrogenous Fertilizers Market, By Application, 2013–2019 (USD MN)

Table 15 North America Nitrogenous Fertilizers: Market, By Application, 2013–2019 (KT)

Table 16 North America Nitrogenous Fertilizers in Grains & Oilseeds, By Country, 2013–2019 (USD MN)

Table 17 North America Nitrogenous Fertilizers in Grains & Oilseeds, By Country, 2013–2019 (KT)

Table 18 North America Nitrogenous Fertilizers in Fruits & Vegetables, By Country, 2013–2019 (USD MN)

Table 19 North America Nitrogenous Fertilizers in Fruits & Vegetables, By Country, 2013–2019 (KT)

Table 20 North America Nitrogenous Fertilizers Market, By Type, 2013–2019 (USD MN)

Table 21 North America Nitrogenous Fertilizers Market, By Type, 2013–2019 (KT)

Table 22 North America Nitrogenous Fertilizers Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 23 North America Urea Fertilizers Market, By Country, 2013–2019 (USD MN)

Table 24 North America Urea Fertilizers Market, By Country, 2013–2019 (KT)

Table 25 North America Ammonia Fertilizers Market, By Country, 2013–2019 (USD MN)

Table 26 North America Ammonia Fertilizers Market, By Country, 2013–2019 (KT)

Table 27 North America Ammonium Sulfate Fertilizers Market, By Country, 2013–2019 (USD MN)

Table 28 North America Ammonium Sulfate Fertilizers Market, By Country, 2013–2019 (KT)

Table 29 North America Ammonium Nitrate Market, By Country, 2013–2019 (USD MN)

Table 30 North America Ammonium Nitrate Market, By Geography, 2013–2019 (KT)

Table 31 North America Calcium Ammonium Nitrate Market, By Country, 2013–2019 (USD MN)

Table 32 North America Calcium Ammonium Nitrate Market, By Country, 2013–2019 (KT)

Table 33 North America Nitrogenous Fertilizers Market, By Country, 2013–2019 (USD MN)

Table 34 North America Nitrogenous Fertilizers Market, By Country, 2013–2019 (KT)

Table 35 U.S. Nitrogenous Fertilizers Market, By Application, 2013–2019 (USD MN)

Table 36 U.S. Nitrogenous Fertilizers Market, By Application, 2013–2019 (KT)

Table 37 U.S. Nitrogenous Fertilizer Market, By Type, 2013–2019 (USD MN)

Table 38 U.S. Nitrogenous Fertilizers Market, By Type, 2013–2019 (KT)

Table 39 Canada Nitrogenous Fertilizers Market, By Application, 2013–2019 (USD MN)

Table 40 Canada Nitrogenous Fertilizers Market, By Application, 2013–2019 (KT)

Table 41 Canada Nitrogenous Fertilizers Market, By Type, 2013–2019 (USD MN)

Table 42 Canada Nitrogenous Fertilizers Market, By Type, 2013–2019 (KT)

Table 43 Mexico Nitrogenous Fertilizers Market, By Application, 2013–2019 (USD MN)

Table 44 Mexico Nitrogenous Fertilizers Market, By Application, 2013–2019 (KT)

Table 45 Mexico Nitrogenous Fertilizers: Market, By Type, 2013–2019 (USD MN)

Table 46 Mexico Nitrogenous Fertilizers: Market, By Type, 2013–2019 (KT)

Table 47 Nitrogenous Fertilizers Market: Company Share Analysis, 2014 (%)

Table 48 North America Nitrogenous Fertilizers Market: Mergers & Acquisitions

Table 49 North America Nitrogenous Fertilizers Market: Expansions

Table 50 North America Nitrogenous Fertilizers Market: Investments

Table 51 North America Nitrogenous Fertilizers Market: Joint Ventures

Table 52 CF Industries Holdings, Inc.: Key Financials, 2008 - 2013 (USD MN)

Table 53 Agrium, Inc.: Key Operations Data, 2009 - 2013 (USD MN)

Table 54 Agrium, Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 55 Potash Corp: Key Operations Data, 2009 - 2013 (USD MN)

Table 56 Potash Corp: Key Financials, 2009 - 2013 (USD MN)

Table 57 Yara International Asa: Key Financials, 2009 - 2013 (USD MN)

Table 58 Eurochem: Key Financials, 2009 - 2013 (USD MN)

Table 59 CVR Partners, LP: Key Financials, 2009 - 2013 (USD MN)

List of Figures (52 Figures)

Figure 1 North America Nitrogenous Fertilizers Market: Segmentation & Coverage

Figure 2 Nitrogenous Fertilizers Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 North America Nitrogenous Fertilizers Market Snapshot

Figure 9 Nitrogenous Fertilizers Market: Growth Aspects

Figure 10 North America Nitrogenous Fertilizers Market, By Application, 2014 & 2019

Figure 11 North America Nitrogenous Fertilizers Types, By Country, 2014 (USD MN)

Figure 12 North America Nitrogenous Fertilizers Market: Growth Analysis, By Type, 2014–2019 (%)

Figure 13 Nitrogenous Fertilizers: Application Market Scenario

Figure 14 North America Nitrogenous Fertilizers Market, By Application, 2014–2019 (USD MN)

Figure 15 North America Nitrogenous Fertilizers Market, By Application, 2014–2019 (KT)

Figure 16 North America Nitrogenous Fertilizers Market: Vendor Side Analysis

Figure 17 North America Nitrogenous Fertilizers Market in Grains & Oilseeds, By Country, 2013–2019 (USD MN)

Figure 18 North America Nitrogenous Fertilizers Market in Fruits & Vegetables, By Country, 2013–2019 (USD MN)

Figure 19 Sneak View: North America Fertilizers Market

Figure 20 North America Nitrogenous Fertilizers Market, By Type, 2014–2019 (USD MN)

Figure 21 North America Nitrogenous Fertilizers Market, By Type, 2014 & 2019 (KT)

Figure 22 North America Nitrogenous Fertilizers Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Figure 23 North America Urea Fertilizers Market, By Country, 2013–2019 (USD MN)

Figure 24 orth America Ammonia Market, By Country, 2013–2019 (USD MN)

Figure 25 North America Ammonium Sulfate Fertilizers Market, By Country, 2013–2019 (USD MN)

Figure 26 North America Ammonium Nitrate Market, By Country, 2013–2019 (USD MN) 50

Figure 27 North America Calcium Ammonium Nitrate Market, By Country, 2013–2019 (USD MN)

Figure 28 North America Nitrogenous Fertilizers Market: Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 29 North America Nitrogenous Fertilizers Market: Growth Analysis, By Country, 2014–2019 (KT)

Figure 30 U.S. Nitrogenous Fertilizers Market Overview, 2014 & 2019 (%)

Figure 31 U.S. Nitrogenous Fertilizers Market, By Application, 2013–2019 (USD MN)

Figure 32 U.S. Nitrogenous Fertilizers Market: Application Snapshot

Figure 33 U.S. Nitrogenous Fertilizers Market, By Type, 2013–2019 (USD MN)

Figure 34 U.S. Nitrogenous Fertilizers Market Share, By Type, 2014–2019 (%)

Figure 35 Canada Nitrogenous Fertilizers Market Overview, 2014 & 2019 (%)

Figure 36 Canada Nitrogenous Fertilizers Market, By Application, 2014–2019 (USD MN)

Figure 37 Canada Nitrogenous Fertilizers Market: Application Snapshot

Figure 38 Canada Nitrogenous Fertilizers Market, By Type, 2013–2019 (USD MN)

Figure 39 Canada Nitrogenous Fertilizers Market Share, By Type, 2013–2019 (%)

Figure 40 Mexico Nitrogenous Fertilizers Market Overview, 2014 & 2019 (%)

Figure 41 Mexico Nitrogenous Fertilizers Market, By Application, 2013–2019 (USD MN)

Figure 42 Mexico Nitrogenous Fertilizers Market: Application Snapshot

Figure 43 Mexico Nitrogenous Fertilizers Market, By Type, 2013–2019 (USD MN)

Figure 44 Mexico Nitrogenous Fertilizers Market: Type Snapshot

Figure 45 Nitrogenous Fertilizers Market: Company Share Analysis, 2014 (%)

Figure 46 Nitrogenous Fertilizers: Company Product Coverage, By Type, 2014

Figure 47 CF Industries Holdings Inc.: Revenue Mix, 2013 (%)

Figure 48 Agrium Inc. Revenue Mix, 2013 (%)

Figure 49 Potash Corp Revenue Mix, 2013 (%)

Figure 50 Yara International ASA Revenue Mix, 2013 (%)

Figure 51 Eurochem Revenue Mix, 2013 (%)

Figure 52 CVR Partners, LP: Revenue Mix 2013 (%)

Fertilizers are used to aid the growth of crops, particularly when the soil lacks nutrients. Nitrogen is one of the key elements required for a healthy crop. Crops that grow with the help of nitrogenous fertilizers usually have better and higher growth rates. This is because the nitrogen in the fertilizers assimilates into the chlorophyll, generating a better rate of photosynthesis for the plant. The use of nitrogenous fertilizers also gives crops a better color and texture.

Though nitrogen is present in large quantities in the Earth’s atmosphere, not all plants and crops are capable of converting it into a usable form. A nitrogenous fertilizer is an inorganic fertilizer containing nitrous compounds; for example, ammonium nitrate. It is available in two forms: dry pellets, which are scattered on the surface of the soil by hand or by machine and liquid, which needs to be mixed with the soil.

The purpose of this study is to analyze the North American market nitrogenous fertilizers market. This report includes revenue forecasts, market trends, and opportunities for the period from 2014 to 2019. The analysis has been conducted on the various market segments derived on the basis of nitrogenous fertilizers applications. The market has been segmented and analyzed on the basis of nitrogenous fertilizers types. The North American nitrogenous fertilizers market is further segmented and analyzed on the basis of countries, namely the U.S., Canada, and Mexico..

The North American nitrogenous fertilizers market was valued at $15,725.91 million in 2014 and is projected to reach $17,897.19 million by 2019, at a CAGR of 2.6% during the forecast period. The market by application was led by grains and oilseeds in 2014. Urea is the commonly used nitrogenous fertilizers in North America. The U.S. has the largest share in the North American nitrogenous fertilizers market. It constitutes a share of 68.49% of the total nitrogenous fertilizers market in North America.

Speak to our expert analyst for a discussion on the above findings, click Speak to Analyst !

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement