North America Mass Notification System Market By Product (Hardware, Software & Services), by Deployment (On-premise, On-demand), by Solution (In-building, Wide-area, Distributed Recipient), by Application, and by Geography – Forecasts to 2019

The North American mass notification system market is mainly driven by the increasing demand for fast message delivery and message prioritization in the emergency situations. The North American mass notification market was valued at $1,774.6 million for 2014, and is projected to reach $3,450.7 million by 2019 at a CAGR of 14.2% from 2014 to 2019.

Mass notification system refers to a set of methods that enable the dissemination or broadcast of messages to one or many groups of people by alerting them of an emergency situation. Mass notification systems are designed with a view to integrate the cross-communication of messages between several communication technologies. It forms a unified communication system, which is intended to optimize communications during emergency situations. Presently, the mass notification system is considered as a necessity, as it helps to promote public safety and avoid panic during natural calamities, terrorist attacks, crimes, and other similar incidents. The technologies which are used in mass notification include communication systems, such as Wi-Fi, IP Ethernet, satellite, radio frequency, geographical positioning systems (GPS), geographical information systems (GIS), and mobile applications.

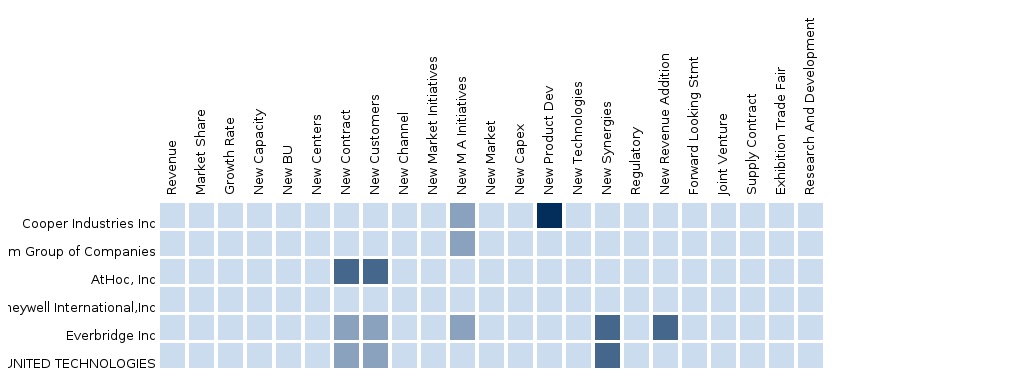

The report also provides an extensive competitive landscape of companies that operate in this market. The main companies that operate in this market and extensively covered in this report are AtHoc Inc. (U.S.), Cooper Industries (U.S.), Everbridge (U.S.), Omnilert LLC. (U.S.), Send Word Now (U.S.), Xmatters (U.S.), and so on.

Segment and country-specific company shares, news & deals, M&A, segment-specific pipeline products, product approvals, and product recalls of major companies have been provided in detail in the report.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Integrated Ecosystem of Mass Notification System Market

2.2 Arriving at the Mass Notification System Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 25)

4 Market Overview (Page No. - 27)

4.1 Introduction

4.2 Mass Notification Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Mass Notification System Market, By Product (Page No. - 32)

5.1 Introduction

5.2 North America Mass Notification System Market, Product Comparison With Parent Market

5.3 North America Hardware Market, By Geography

5.4 North America Software & Services Market, By Geography

6 Mass Notification System Market, By Deployment Type (Page No. - 37)

6.1 Introduction

6.2 North America Mass Notification System Market, Deployment Type Comparison With Parent Market

6.3 North America On-Premise Market, By Geography

6.4 North America On-Demand Market, By Geography

7 Mass Notification System Market, By Solution (Page No. - 42)

7.1 Introduction

7.2 North America In-Building Solution Market, By Geography

7.3 North America Wide-Area Solution Market, By Geography

7.4 North America Distributed Recipient Solution Market, By Geography

8 Mass Notification System Market, By Application (Page No. - 47)

8.1 Introduction

8.2 North America Interoperable Emergency Communication Market, By Geography

8.3 North America Business Continuity & Disaster Recovery Market, By Geography

8.4 North America Integrated Public Alert & Warning Market, By Geography

8.5 North America Business Operation Market, By Geography

9 Mass Notification System Market, By Vertical (Page No. - 53)

9.1 Introduction

9.2 North America Mass Notification System Market, Vertical Comparison With Parent Market

9.3 Demand Side Analysis

9.4 North America Education Market, By Geography

9.5 North America Defense Market, By Geography

9.6 North America Healthcare Market, By Geography

9.7 North America Energy & Power Market, By Geography

9.8 North America Government Market, By Geography

9.9 North America Automotive, Transportation & Logistics Market, By Geography

9.10 North America Commercial Market, By Geography

10 Mass Notification System Market, By Geography (Page No. - 68)

10.1 Introduction

10.2 U.S. Mass Notification System Market

10.2.1 U.S. Mass Notification Market, By Product

10.2.2 U.S. Mass Notification Market, By Deployment Model

10.2.3 U.S. Mass Notification Market, By Solution

10.2.4 U.S. Mass Notification System Market, By Application

10.2.5 U.S. Mass Notification System Market, By Vertical

10.3 Canada Mass Notification System Market

10.3.1 Canada Mass Notification Market, By Product

10.3.2 Canada Mass Notification Market, By Deployment Model

10.3.3 Canada Mass Notification System Market, By Solution

10.3.4 Canada Mass Notification System Market, By Application

10.3.5 Canada Mass Notification System Market, By Vertical

10.4 Mexico Mass Notification System Market

10.4.1 Mexico Mass Notification Market, By Product

10.4.2 Mexico Mass Notification Market, By Deployment Model

10.4.3 Mexico Mass Notification System Market, By Solution

10.4.4 Mexico Mass Notification System Market, By Application

10.4.5 Mexico Mass Notification Market, By Vertical

11 Mass Notification System Market: Competitive Landscape (Page No. - 97)

11.1 Industries

11.2 Product and Solution Offering

11.3 Mergers & Acquisitions

11.4 Product Launch

11.5 Expansions

11.6 Product Agreement

12 Mass Notification Market, By Company (Page No. - 101)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 Athoc Inc.

12.2 Cooper Industries (Eaton Corporation)

12.3 Everbridge

12.4 Mir3, Inc.

12.5 Mircom Group of Companies

12.6 Omnilert, Llc.

12.7 Send Word Now

12.8 Xmatters

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

13 Appendix (Page No. - 117)

13.1 Customization Options

13.2 Related Reports

13.3 Introducing RT: Real Time Market Intelligence

13.3.1 RT Snapshots

List of Tables (58 Tables)

Table 1 North America Mass Notification System Peer Market Size, 2014 (USD MN)

Table 2 North America Mass Notification System Vertical Market, 2014 (USD MN)

Table 3 North America Mass Notification System Market: Macro Indicators, By Geography, 2014 (USD MN)

Table 4 North America Mass Notification Market: Comparison With Parent Market, 2013-2019 (USD MN)

Table 5 North America Mass Notification System Market: Drivers and Inhibitors

Table 6 North America Mass Notification System Market, By Application, 2014 - 2019 (USD MN)

Table 7 North America Mass Notification System Market, By Geography, 2014 - 2019 (USD MN)

Table 8 North America Mass Notification System Market, By Product, 2013-2019 (USD MN)

Table 9 North America Mass Notification System Market: Product Comparison With Parent Market, 2013-2019 (USD MN)

Table 10 North America Hardware Market, By Geography, 2013-2019 (USD MN)

Table 11 North America Software & Services Market, By Geography, 2013-2019 (USD MN)

Table 12 North America Mass Notification System Market, By Deployment Type, 2013-2019 (USD MN)

Table 13 North America Mass Notification System Market: Deployment Type Comparison With Parent Market, 2013-2019 (USD MN)

Table 14 North America On-Premise Market, By Geography, 2013-2019 (USD MN)

Table 15 North America On-Demand Market, By Geography, 2013-2019 (USD MN)

Table 16 North America Mass Notification System Market, By Product, 2013-2019 (USD MN)

Table 17 North America In-Building Solution Market, By Geography, 2013-2019 (USD MN)

Table 18 North America Wide-Area Solution Market, By Geography, 2013-2019 (USD MN)

Table 19 North America Distributed Recipient Solution Market, By Geography, 2013-2019 (USD MN)

Table 20 North America Mass Notification System Market, By Application, 2013-2019 (USD MN)

Table 21 North America Interoperable Emergency Communication Market, By Geography, 2013-2019 (USD MN)

Table 22 North America Business Continuity & Disaster Recovery Market, By Geography, 2013-2019 (USD MN)

Table 23 North America Integrated Public Alert & Warning Market, By Geography, 2013-2019 (USD MN)

Table 24 North America Business Operation Market, By Geography, 2013-2019 (USD MN)

Table 25 North America Mass Notification System Market, By Verticals, 2013-2019 (USD MN)

Table 26 North America Mass Notification System Market: Vertical Comparison With Parent Market, 2013-2019 (USD MN)

Table 27 North America Education Market, By Geography, 2013-2019 (USD MN)

Table 28 North America Defense Market, By Geography, 2013-2019 (USD MN)

Table 29 North America Healthcare Market, By Geography, 2013-2019 (USD MN)

Table 30 North America Energy & Power Market, By Geography, 2013-2019 (USD MN)

Table 31 North America Government Market, By Geography, 2013-2019 (USD MN)

Table 32 North America Automotive, Transportation & Logistics Market, By Geography, 2013-2019 (USD MN)

Table 33 North America Commercial Market, By Geography, 2013-2019 (USD MN)

Table 34 North America Mass Notification System Market, By Geography, 2013-2019 (USD MN)

Table 35 U.S. Mass Notification System Market, By Product, 2013-2019 (USD MN)

Table 36 U.S. Mass Notification System Market, By Deployment Model, 2013-2019 (USD MN)

Table 37 U.S. Mass Notification System Market, By Solution, 2013-2019 (USD MN)

Table 38 U.S. Mass Notification System Market, By Application, 2013-2019 (USD MN)

Table 39 U.S. Mass Notification System Market, By Vertical, 2013-2019 (USD MN)

Table 40 Canada Mass Notification System Market, By Product, 2013-2019 (USD MN)

Table 41 Canada Mass Notification System Market, By Deployment Model, 2013-2019 (USD MN)

Table 42 Canada Mass Notification System Market, By Solution, 2013-2019 (USD MN)

Table 43 Canada Mass Notification System Market, By Application, 2013-2019 (USD MN)

Table 44 Canada Mass Notification System Market, By Vertical, 2013-2019 (USD MN)

Table 45 Mexico Mass Notification System Market, By Product, 2013-2019 (USD MN)

Table 46 Mexico Mass Notification System Market, By Deployment Model, 2013-2019 (USD MN)

Table 47 Mexico Mass Notification System Market, By Solution, 2013-2019 (USD MN)

Table 48 Mexico Mass Notification System Market, By Application, 2013-2019 (USD MN)

Table 49 Mexico Mass Notification System Market, By Vertical, 2013-2019 (USD MN)

Table 50 North America Mass Notification System Market: Industries

Table 51 North America Mass Notification System Market Product/Solution

Table 52 North America Mass Notification System Market: Mergers & Acquisitions

Table 53 North America Mass Notification System Market: Product Launch

Table 54 North America Mass Notification Market: Expansions

Table 55 North America Mass Notification Market: Product Agreement

Table 56 Cooper Industries (Eaton Corporation): Key Financials, 2010-2014 (USD MN)

Table 57 Cooper Industries (Eaton Corporation): Revenue, By Business Segment, 2010-2013 (USD MN)

Table 58 Cooper Industries (Eaton Corporation): Revenue, By Geography, 2010-2013 (USD MN)

List of Figures (77 Figures)

Figure 1 North America Mass Notification System Market: Segmentation & Coverage

Figure 2 Mass Notification System Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 North America Mass Notification System Market Snapshot

Figure 9 Mass Notification System Market: Growth Aspects

Figure 10 North America Mass Notification System Application, By Geography, 2014 (USD MN)

Figure 11 North America Mass Notification System Market, By Product, 2013 & 2019 (USD MN)

Figure 12 North America Mass Notification System Market: Product Comparison With Market, 2014-2019 (USD MN)

Figure 13 North America Hardware Market, By Geography, 2013-2019 (USD MN)

Figure 14 North America Software & Services Market, By Geography, 2013-2019 (USD MN)

Figure 15 North America Mass Notification System Market, By Deployment Type, 2013-2019 (USD MN)

Figure 16 North America Mass Notification System Market: Deployment Type Comparison With Parent Market, 2013-2019 (USD MN)

Figure 17 North America On-Premise Market, By Geography, 2013-2019 (USD MN)

Figure 18 North America On-Demand Market, By Geography, 2013-2019 (USD MN)

Figure 19 North America Mass Notification System Market, By Solution, 2014 & 2019 (USD MN)

Figure 20 North America In-Building Solutions Market, By Geography, 2013-2019 (USD MN)

Figure 21 North America Wide-Area Solution Market, By Geography, 2013-2019 (USD MN)

Figure 22 North America Distributed Recipient Solution Market, By Geography, 2013-2019 (USD MN)

Figure 23 North America Mass Notification System Market, By Application, 2013 & 2019 (USD MN)

Figure 24 North America Interoperable Emergency Communication Market, By Geography, 2013-2019 (USD MN)

Figure 25 North America Business Continuity & Disaster Recovery Market, By Geography, 2013-2019 (USD MN)

Figure 26 North America Integrated Public Alert & Warning Market, By Geography,2013-2019 (USD MN)

Figure 27 North America Business Operation Market, By Geography, 2013-2019 (USD MN)

Figure 28 North America Mass Notification System Market, By Vertical, 2014 & 2019(USD MN)

Figure 29 North America Mass Notification System Market: Vertical Comparison With Parent Market, 2013-2019 (USD MN)

Figure 30 Education

Figure 31 Defense

Figure 32 Healthcare

Figure 33 Energy & Power

Figure 34 Government

Figure 35 Automotive, Transportation & Logistic

Figure 36 North America Education Market, By Geography, 2013-2019 (USD MN)

Figure 37 North America Defense Market, By Geography, 2013-2019 (USD MN)

Figure 38 North America Healthcare Market, By Geography, 2013-2019 (USD MN)

Figure 39 North America Energy & Power Market, By Geography, 2013-2019 (USD MN)

Figure 40 North America Government Market, By Geography, 2013-2019 (USD MN)

Figure 41 North America Automotive, Transportation & Logistics Market, ByGeography, 2013-2019 (USD MN)

Figure 42 North America Commercial Market, By Geography, 2013-2019 (USD MN)

Figure 43 North America Mass Notification System Market: Growth Analysis, ByGeography, 2013-2019 (USD MN)

Figure 44 U.S. Mass Notification System Market Overview, 2014 & 2019 (%)

Figure 45 U.S. Mass Notification Market, By Product, 2013-2019 (USD MN)

Figure 46 U.S. Mass Notification System Market Share, By Product, 2014 & 2019 (%)

Figure 47 U.S. Mass Notification Market, By Deployment Model, 2013-2019 (USD MN)

Figure 48 U.S. Mass Notification System Market Share, By Deployment Model, 2014 &2019 (%)

Figure 49 U.S. Mass Notification Market, By Solution, 2013-2019 (USD MN)

Figure 50 U.S. Mass Notification System Market Share, By Solution, 2014 & 2019 (%)

Figure 51 U.S. Mass Notification System Market, By Application, 2013-2019 (USD MN)

Figure 52 U.S. Mass Notification System Market: Application Snapshot

Figure 53 U.S. Mass Notification System Market, By Vertical, 2013-2019 (USD MN)

Figure 54 U.S. Mass Notification System Market Share, By Vertical, Snapshot 2014 &2019 (%)

Figure 55 Canada Mass Notification System Market Overview, 2014 & 2019 (%)

Figure 56 Canada Mass Notification Market, By Product, 2013-2019 (USD MN)

Figure 57 Canada Mass Notification System Market Share, By Product, 2014 & 2019 (%)

Figure 58 Canada Mass Notification Market, By Deployment Model, 2013-2019 (USD MN)

Figure 59 Canada Mass Notification System Market Share, By Deployment Model, 2014 &2019 (%)

Figure 60 Canada Mass Notification System Market, By Solution, 2013-2019 (USD MN)

Figure 61 Canada Mass Notification System Market Share, By Solution, 2014-2019 (%)

Figure 62 Canada Mass Notification System Market, By Application, 2013-2019 (USDMN)

Figure 63 Canada Mass Notification System Market: Application Snapshot

Figure 64 Canada Mass Notification System Market, By Vertical, 2013-2019 (USD MN)

Figure 65 Canada Mass Notification System Market Share, By Vertical, Snapshot 2014& 2019 (%)

Figure 66 Mexico Mass Notification System Market Overview, 2014 & 2019 (%)

Figure 67 Mexico Mass Notification System Market, By Product, 2013-2019 (USD MN)

Figure 68 Mexico Mass Notification System Market Share, By Product, 2014 & 2019 (%)

Figure 69 Mexico Mass Notification Market, By Deployment Model, 2013-2019 (USD MN)

Figure 70 Mexico Mass Notification System Market Share, By Deployment Model, 2014 &2019 (%)

Figure 71 Mexico Mass Notification System Market, By Solution, 2013-2019 (USD MN)

Figure 72 Mexico Mass Notification System Market: Type Snapshot

Figure 73 Mexico Mass Notification System Market, By Application, 2014 - 2019 (USDMN)

Figure 74 Mexico Mass Notification System Market: Application Snapshot

Figure 75 Mexico Mass Notification Market, By Vertical, 2013-2019 (USD MN)

Figure 76 Mexico Mass Notification System Market Share, By Vertical, Snapshot 2014& 2019 (%)

Figure 77 Eaton Revenue Mix, 2013 (%)

The North American mass notification market was valued at $1,774.6 million for 2014, and is projected to reach $3,450.7 million by 2019 at a CAGR of 14.2% from 2014 to 2019.

Mass notification system refers to a set of methods that enable the dissemination or broadcast of messages to one or many groups of people by alerting them of an emergency situation. This broadcast acts as a preventive measure to avoid possible loss to financial assets or human life. Mass notification systems are designed with a view to integrate the cross-communication of messages between varieties of communication technologies. It forms a unified communication system, which is intended to optimize communications during emergency situations.

This study has been undertaken so as to understand the market dynamics in the area of mass notification systems, current revenue generated by mass notification systems, and its future forecast in terms of revenue. This study identified the key applications, verticals, and geographies, where opportunities for the North American mass notification market can be expected in the coming future. Total mass notification system shipment and its average selling price have been analysed in order to arrive at the final market size of the mass notification system. Further, the North Americna mass notification system market revenue has also been analysed by clubbing the revenue of the top market players involved in the development of mass notification systems. This is further verified post a discussion with key market players.

The growth of the North American mass notification system market is primarily driven by the in-building solution segment due to growing need for public safety, increasing awareness for emergency communication solutions, requisite for business continuity, and the trend towards mobility is rising.

The North American mass notification system market is broadly segmented into verticals, such as education, defence, automotive, transportation & logistics, government, healthcare, energy & power, and commercial. The education vertical was the largest segment of this market in 2014, while the energy & power is expected to be the fastest-growing vertical from 2014 to 2019. Based on solution, the mass notification systems market in North America is broadly classified into in-building solution, wide-area solution and distributed recipient solution. The in-building solution segment accounted for the largest share of the mass notification system market in 2014. The distributed recipient segment is expected to be the fastest-growing segment of the market, segmented by solution.

Major companies operational in the North American mass notification system market include AtHoc Inc. (U.S.), Cooper Industries (U.S.), Everbridge (U.S.), Omnilert LLC. (U.S.), Send Word Now (U.S.), and Xmatters (U.S.), MIR3 (U.S.), and Mircom Group of Companies (Canada).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement