North America Liquid Chromatography Reagents Market by Type (HPLC Reagents, LPLC Reagents, UHPLC Reagents), by End-User (Pharmaceuticals, Academics, Environmental Biotechnology, Food & Beverage, Hospitals, Cosmetics, Nutraceuticals) - Forecast to 2019

The report analyzes the North American liquid chromatography reagents market on the basis of products, end-users, types, and geography. The North American liquid chromatography reagents market is estimated to grow at a CAGR of 9.3% from 2014 to 2019. Liquid chromatography reagents are used in analytical chromatographic techniques that is useful to separate ions or molecules that are dissolved in a solvent.

The report provides an in-depth analysis of the market landscape and market trends of the North American liquid chromatography reagents market on the basis of type of products-column chromatography reagents and planar chromatography reagents. On the basis of types, the market is segmented into HPLC reagents, LPLC reagents, UHPLC reagents, and other reagents. Similarly, the report also provides comprehensive information on the key trends that affect the market, along with the market landscape of this market. On the basis of end-user segments the market is divided into pharmaceuticals, academics, food & beverages industry, hospitals, cosmetics industry, environmental biotechnology industry, and neutraceuticals.

Based on the geographies, the North American liquid chromatography reagents market is classified into the U.S., Canada, and Mexico.

The major driver of the North American liquid chromatography reagents market is the augmented efficient activities for drug approval and development. In addition to this, the increasing number of conferences and growth in government investments propel the growth of the liquid chromatography reagents market in North America.

The U.S. commands the largest share – 91.9% – of the North American liquid chromatography reagents market, followed by Canada. Innovations, continuous growth in the corporate agreements such as acquisitions/partnerships in the market, and the extensive use of chromatography reagents across various industries further bolster the growth of this market. However, the presence of alternative separation techniques is the major factor that curbs the growth of the market.

In-depth market share analysis, by revenue, of the top companies is also included in the report. These numbers are arrived at, based on key facts, annual financial information from SEC filings, annual reports and interviews with industry experts, key opinion leaders such as CEOs, directors, and marketing executives. Detailed market share analysis of the major players in the North American liquid chromatography reagents market has been covered in this report. The major companies in this market include Agilent Technologies, Inc. (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Merck Millipore (U.S.), and Waters Corporation (U.S.).

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of the Liquid Chromatography Reagents Market

2.2 Arriving at the Liquid Chromatography Reagents Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 17)

4 Market Overview (Page No. - 18)

4.1 Introduction

4.2 North American Liquid Chromatography Reagents Market: Comparison With Chromatography Reagents Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 North American Liquid Chromatography Reagents Market, By Product (Page No. - 23)

5.1 North American Liquid Column Chromatography Reagents Market,By Country

5.2 North American Liquid Planar Chromatography Reagents Market,By Country

6 North American Liquid Chromatography Reagents Market, By Type (Page No. - 27)

6.1 Introduction

6.2 North American Liquid Chromatography Reagents Market, By Type: Comparison With Liquid Chromatography

Reagents Market

6.3 North American Hplc Reagents Market, By Country

6.4 North American Lplc Reagents Market, By Country

6.5 North American Uhplc Reagents Market, By Country

7 North American Liquid Chromatography Reagents Market, By End User (Page No. - 34)

7.1 Introduction

7.2 North America: Pharmaceutical Industry Market, By Country

7.3 North America: Academic Institutes Market, By Country

7.4 North America: Food and Beverage Industry Market, By Country

7.5 North America: Hospitals Market, By Country

7.6 North America: Cosmetics Industry Market, By Country

7.7 North America: Environmental Biotechnology Industry Market,By Country

7.8 North America: Nutraceuticals Industry Market, By Country

8 North America Liquid Chromatography Reagents Market, By Geography (Page No. - 43)

8.1 Introduction

8.2 U.S.: Liquid Chromatography Reagents Market

8.2.1 U.S.: Liquid Chromatography Reagents Market, By Product

8.2.2 U.S.: Liquid Chromatography Reagents Market, By Type

8.2.3 U.S.: Liquid Chromatography Reagents Market, By End User

8.3 Canada: Liquid Chromatography Reagents Market

8.3.1 Canada: Liquid Chromatography Reagents Market, By Product

8.3.2 Canada: Liquid Chromatography Reagents Market, By Type

8.3.3 Canada: Liquid Chromatography Reagents Market, By End User

8.4 Mexico: Liquid Chromatography Reagents Market

8.4.1 Mexico: Liquid Chromatography Reagents Market, By Product

8.4.2 Mexico: Liquid Chromatography Reagents Market, By Type

8.4.3 Mexico: Liquid Chromatography Reagents Market, By End User

9 Liquid Chromatography Reagents Market: Competitive Landscape (Page No. - 57)

9.1 Liquid Chromatography Reagents Market: Company Share Analysis

9.2 Company Presence in the North American Liquid Chromatography Reagents Market, By Type

9.3 Mergers & Acquisitions

9.4 New Product Launches

10 Liquid Chromatography Reagents Market, By Company (Page No. - 60)

(Overview, Financials, Products, Strategies, Recent Developments, & Swot Analysis)*

10.1 Agilent Technologies

10.2 Thermo Fisher Scientific

10.3 Waters Corporation

10.4 Merck Millipore

10.5 GE Healthcare

*Details on Overview, Financials, Products, Strategies, Recent Developments, & Swot Analysis Might Not Be Captured

in Case of Unlisted Companies.

11 Appendix (Page No. - 75)

11.1 Customization Options

11.1.1 Low-Cost Sourcing Locations

11.1.2 Regulatory Framework

11.1.3 Impact Analysis

11.2 Related Reports

11.3 Introducing RT: Real-Time Market Intelligence

11.3.1 RT Snapshots

List of Tables (40 Tables)

Table 1 Global Liquid Chromatography Reagents Peer Market Size, 2013 (USD MN)

Table 2 North America Liquid Chromatography Reagents Market: Healthcare Expenditure, By Country, 2014 (USD BN)

Table 3 North American Liquid Chromatography Reagents Market: Comparison With Chromatography Reagents Market,2013–2019 (USD MN)

Table 4 North American Liquid Chromatography Reagents Market: Drivers and Inhibitors

Table 5 North America: Liquid Chromatography Reagents Market, By Product, 2013 – 2019 (USD MN)

Table 6 North America: Liquid Chromatography Reagents Market, By Type, 2013 – 2019 (USD MN)

Table 7 North America: Liquid Chromatography Reagents Market, By Country, 2013 – 2019 (USD MN)

Table 8 North America: Liquid Chromatography Reagents Market, By Product, 2013 – 2019 (USD MN)

Table 9 North America: Liquid Column Chromatography Reagents Market, By Country, 2013 – 2019 (USD MN)

Table 10 North America: Liquid Planar Chromatography Reagents Market,By Country, 2013 – 2019 (USD MN)

Table 11 North America: Liquid Chromatography Reagents Market, By Type, 2013 – 2019 (USD MN)

Table 12 North America: Liquid Chromatography Reagents Market, By Type (Comparison With Liquid Chromatography Reagents Market), 2013 –2019 (USD MN)

Table 13 North America: Hplc Reagents Market, By Country, 2013 – 2019 (USD MN)

Table 14 North America: Lplc Reagents Market, By Country, 2013 – 2019 (USD MN)

Table 15 North America: Uhplc Reagents Market, By Country, 2013 – 2019 (USD MN)

Table 16 North America: Liquid Chromatography Reagents Market, By End User, 2013 – 2019 (USD MN)

Table 17 North America: Pharmaceutical Industry Market, By Country, 2013 – 2019 (USD MN)

Table 18 North America: Academic Institutes Market, By Country, 2013 – 2019 (USD MN)

Table 19 North America: Food and Beverage Industry Market, By Country, 2013 – 2019 (USD MN)

Table 20 North America: Hospitals Market, By Country, 2013 – 2019 (USD MN)

Table 21 North America: Cosmetics Industry Market, By Country, 2013 – 2019 (USD MN)

Table 22 North America: Environmental Biotechnology Industry Market,By Country, 2013 – 2019 (USD MN)

Table 23 North America: Nutraceuticals Industry Market, By Country, 2013 – 2019 (USD MN)

Table 24 North America: Liquid Chromatography Reagents Market, By Country, 2013 – 2019 (USD MN)

Table 25 U.S.: Liquid Chromatography Reagents Market, By Product, 2013 – 2019 (USD MN)

Table 26 U.S.: Liquid Chromatography Reagents Market, By Type, 2013 – 2019 (USD MN)

Table 27 U.S.: Liquid Chromatography Reagents Market, By End User, 2013– 2019 (USD MN)

Table 28 Canada: Liquid Chromatography Reagents Market, By Product, 2013 - 2019 (USD MN)

Table 29 Canada: Liquid Chromatography Reagents Market , By Type, 2013 – 2019 (USD MN)

Table 30 Canada: Liquid Chromatography Reagents Market, By End User, 2013 – 2019 (USD MN)

Table 31 Mexico: Liquid Chromatography Reagents Market, By Product, 2013 – 2019 (USD MN)

Table 32 Mexico: Liquid Chromatography Reagents Market, By Type, 2013 – 2019 (USD MN)

Table 33 Mexico: Liquid Chromatography Reagents Market, By End User, 2013 – 2019 (USD MN)

Table 34 Liquid Chromatography Reagents Market: Mergers & Acquisitions

Table 35 Liquid Chromatography Reagents Market: New Product Launches

Table 36 Agilent Technologies: Key Financials, 2011 – 2014 (USD MN)

Table 37 Thermo Fisher Scientific: Key Financials, 2010 – 2013 (USD MN)

Table 38 Waters Corporation: Key Financials, 2010 – 2013 (USD MN)

Table 39 Merck Millipore: Key Financials, 2009 – 2013 (USD MN)

Table 40 GE Healthcare: Key Financials, 2009 – 2013 (USD MN)

List of Figures (44 Figures)

Figure 1 North American Liquid Chromatography Reagents Market: Segmentation & Coverage

Figure 2 Liquid Chromatography Reagents Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 Bottom-Up Approach

Figure 5 Macroindicator-Based Approach: Healthcare Expenditure, 2014 (Usd Bn)

Figure 6 North American Liquid Chromatography Reagents Market Snapshot

Figure 7 North American Liquid Chromatography Reagents Market: Comparison With Chromatography Reagents Market

Figure 8 North American Liquid Chromatography Reagents Market, By Type, 2014 (USD MN)

Figure 9 North American Liquid Chromatography Reagents Market, By Product, 2014 vs 2019 (USD MN)

Figure 10 North American Liquid Column Chromatography Reagents Market,By Country, 2013 – 2019 (USD MN)

Figure 11 North American Liquid Planar Chromatography Reagents Market, By Country, 2013 – 2019 (USD MN)

Figure 12 North American Liquid Chromatography Reagents Market, By Type, 2014 vs 2019 (USD MN)

Figure 13 North American Liquid Chromatography Reagents Market, By Type: Comparison With Liquid Chromatography Reagents Market, 2013 – 2019 (USD MN)

Figure 14 North American Hplc Reagents Market, By Country, 2013 – 2019 (USD MN)

Figure 15 North American Lplc Reagents Market, By Country, 2013 - 2019 (USD MN)

Figure 16 North American Uhplc Reagents Market, By Country, 2013 – 2019 (USD MN)

Figure 17 North American Liquid Chromatography Reagents Market, By End User, 2014 vs 2019 (USD MN)

Figure 18 North America: Pharmaceutical Industry Market, By Country, 2013 - 2019 (USD MN)

Figure 19 North America: Academic Institutes Market, By Country, 2013 – 2019 (USD MN)

Figure 20 North America: Food and Beverage Industry Market, By Country, 2013 – 2019 (USD MN)

Figure 21 North America: Hospitals Market, By Country, 2013 – 2019 (USD MN)

Figure 22 North America: Cosmetics Industry Market, By Country, 2013 – 2019 (USD MN)

Figure 23 North America: Environmental Biotechnology Industry Market, By Country, 2013 – 2019 (USD MN)

Figure 24 North America: Nutraceuticals Industry Market, By Country, 2013 – 2019 (USD MN)

Figure 25 North American Liquid Chromatography Reagents Market: Growth Analysis, By Country, 2014 – 2019(USD MN)

Figure 26 U.S.: Liquid Chromatography Reagents Market Overview, 2014 & 2019 (%)

Figure 27 U.S.: Liquid Chromatography Reagents Market, By Product, 2013 – 2019 (USD MN)

Figure 28 U.S.: Liquid Chromatography Reagents Market, By Type, 2013 – 2019 (USD MN)

Figure 29 U.S.: Liquid Chromatography Reagents Market, By End User, 2013 – 2019 (USD MN)

Figure 30 Canada: Liquid Chromatography Reagents Market Overview, 2014 & 2019 (%)

Figure 31 Canada: Liquid Chromatography Reagents Market, By Product, 2013 – 2019 (USD MN)

Figure 32 Canada: Liquid Chromatography Reagents Market, By Type, 2013 – 2019 (USD MN)

Figure 33 Canada: Liquid Chromatography Reagents Market, By End User, 2013 – 2019 (USD MN)

Figure 34 Mexico: Liquid Chromatography Reagents Market Overview, 2014 & 2019 (%)

Figure 35 Mexico: Liquid Chromatography Reagents Market, By Product, 2013 – 2019 (USD MN)

Figure 36 Mexico: Liquid Chromatography Reagents Market, By Type, 2013 – 2019 (USD MN)

Figure 37 Mexico: Liquid Chromatography Reagents Market, By End User, 2013 – 2019 (USD MN)

Figure 38 Liquid Chromatography Reagents Market Shares, By Company, 2013 (%)

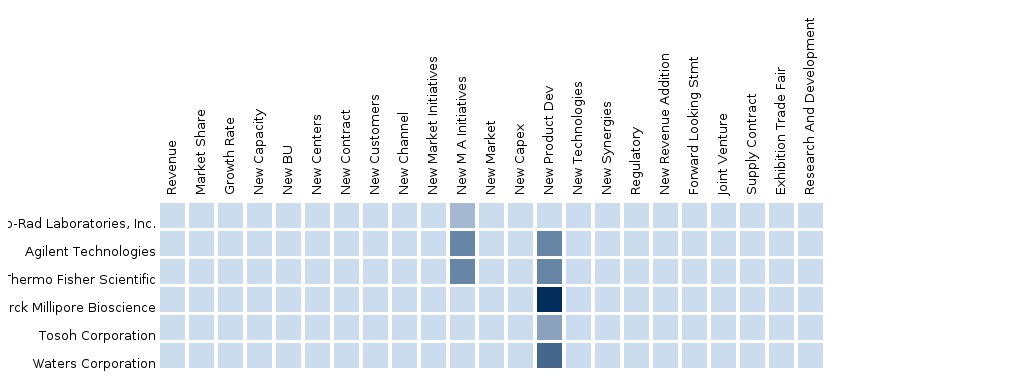

Figure 39 North American Liquid Chromatography Reagents: Company Product Coverage, By Type, 2013

Figure 40 Agilent Technologies: Reveue Mix, 2013 (%)

Figure 41 Thermo Fisher Scientific: Revenue Mix, 2013 (%)

Figure 42 Waters Corporation: Revenue Mix, 2013 (%)

Figure 43 Merck Millipore: Revenue Mix, 2013 (%)

Figure 44 GE Healthcare: Geographic Revenue Mix, 2013 (%)

The report provides a detailed analysis of the North American liquid chromatography reagents market. It involves a deep dive analysis of the market segmentation, which comprises types, products, and end-users. The report also provides deep insights of the strategic analysis of key players in the market. The main objective of the study is to understand the drivers and restraints of each market, to segment the North American liquid chromatography reagents market by end-users, products, and types, and to profile the key players for the North American liquid chromatography reagents market with respect to their product offerings, recent developments, and company financials. The macro indicator used in this study is the healthcare expenditure.

The North American liquid chromatography reagents market is the largest in the world and is slated to grow further in the coming years due to augmented research activities for the development of drugs and biologics, and investments such as that from FedDev Ontario and venture capitalists in Canada. In addition, a large number of conferences and discussions on chromatography are organized by societies and organizations in the U.S. These conferences increase the awareness for new technologies and developments in the chromatography market and discuss new areas of innovation, which in turn stimulates research and development activities.

The liquid chromatography market is driven by investments made by chromatography companies, mergers & acquisitions in the chromatography market, and growth in pharmaceutical and biotechnology industries in the region. Advancements in biotechnology drive the market for chromatography reagents in North America. For instance, the medical biotechnology sector is experiencing rapid growth, which in turn will drive the market for chromatography reagents. Companies that offer chromatography reagents in North America are majorly focusing on the strategy of expansions.

Increase in the development of drugs and biologics, improved research activities, government investments, and venture capitalists in Canada drive the growth of this market. In addition, a large number of conferences held on chromatography in the U.S. contribute to the growth of this market.

Academics, cosmetics, environmental biotechnology, food & beverage, hospitals, nutraceuticals, and pharmaceutical industries are the major end-users of liquid chromatography reagents.

Some of the leading players in the North American liquid chromatography reagents market are Agilent Technologies (U.S.), Thermo Fisher Scientific (U.S.), Merck Millipore, and Waters Corporation.

The global chromatography reagents comprise HPLC reagents, LPLC reagents, UHPLC reagents, and other LC reagents. The upcoming North American market is expected to grow at a CAGR of 9.3%.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North American Chromatography Reagents Market North American chromatography reagents market is the largest in chromatography reagents market, which is expected to reach a value of $3003.1 million by 2018; growing at 9.3% annually during 2013 to 2018. The market is segmented into types, technologies, products, processes, applications, end-users and geography. Deep dive analysis of the key players of this domain, have been considered in this report. |

Upcoming |

|

European Chromatography Reagents Market European Chromatography Reagents Market is the second largest in chromatography reagents market, which is expected to reach a value of $2,101.8 million by 2018; growing at 9.0% annually during 2013- 2018. The market is segmented into types, technologies, products, processes, applications, end-users and geography. Deep dive analysis of the top players of this domain, have been considered in the report. |

Upcoming |

|

Asian Chromatography Reagents Market Chromatography Reagents Market in Asia is estimated at $860.8 million in 2013 and is expected to reach a value of $1663.3 million in 2018 at a CAGR of 14.1% from 2013-2018. Chromatography Reagents-Asia can be segmented by Products, Technologies, Applicatons, Endusers, Companies and MacroIndicators. Deep dive analysis of the key players of this domain, have been considered in this report. |

Upcoming |