North America Heat Exchangers Market By Type (Shell and Tube Type, Plate and Frame Type, Air Cooled, Others), By Application, By Classification & By Geography - Analysis & Forecast to 2019

This market research study provides a detailed qualitative and quantitative analysis of the global Heat Exchangers market. Various secondary sources such as encyclopedia, directories, industry journals, and databases are used to identify and collect information useful for this extensive commercial study of the heat exchangers market. The primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess the future prospects of this market.

The North American heat exchangers market is experiencing enormous growth. Factors such as increasing energy prices, growing demand of heat exchangers across industries are driving the growth of this market.

The North American heat exchangers market is segmented on the basis of application, type, classification, and geography. On the basis of application, the market is segmented into chemical, petrochemical and oil & gas, HVAC & refrigeration, food & beverages, pulp & paper, and power generation. In terms of type, the market is segmented into shell and tube type, plate and frame type, air cooled, and others. Based on classification, the market is segmented into material of construction (MoC), temperature range and fluid type, and others. Countries such as the U.S. and Canada are included in this market report based on geography.

The heat exchangers market in the U.S. accounted for the largest share of 80.2% in the North America heat exchangers market in 2014. The shell and tube type heat exchangers accounted for the largest share in the North American heat exchangers market.

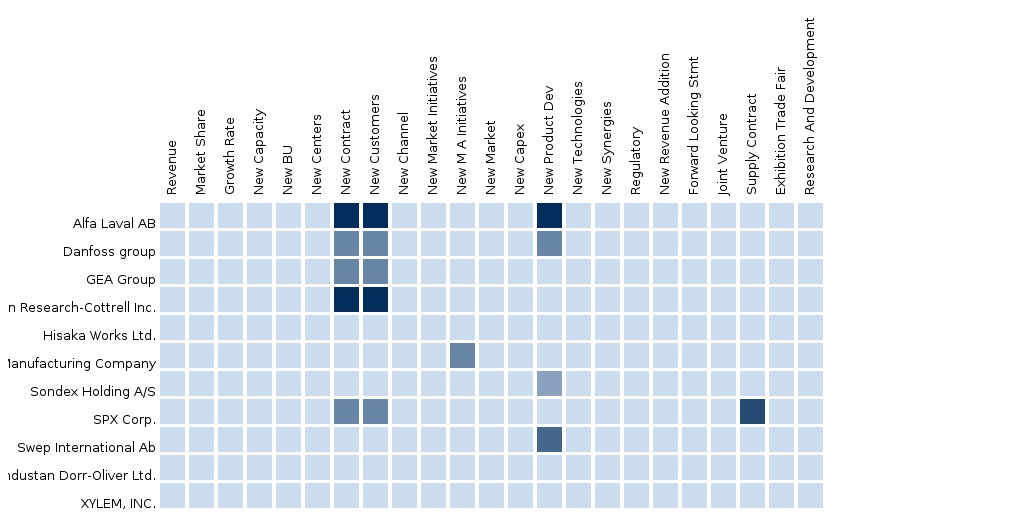

Competitive scenarios of the top players in the North American heat exchangers market have been discussed in detail. Leading players of this industry with their recent developments and other strategic industry activities are profiled in this market report. Some of the key manufacturers of heat exchangers are Tranter, Inc. (U.S.), Xylem Inc. (U.S.), API Heat Transfer (U.S.), Modine Manufacturing Company (U.S.), and SPX Corporation (U.S.), and others.

Scope of the report:

This research report categorizes the global heat exchangers market on the basis of application, type, and geography along with forecasting value, and analyzing trends in each of the submarkets.

On the basis of product type:

- Shell and Tube Type

- Plate and Frame Type

- Air Cooled

- Others

On the basis of applications:

- Chemical

- Petrochemical and Oil & Gas

- HVAC & Refrigeration

- Food & Beverages

- Pulp & Paper

- Power Generation

- Others

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of Heat Exchangers Market

2.2 Arriving at the Heat Exchangers Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 Heat Exchangers Market : Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Opportunities

4.4.1 Large Aftermarket for Heat Exchangers

4.5 Challenges

4.5.1 Fluorinated Greenhouse Gases Regulations

4.6 Burning Issues

4.6.1 Fouling in Heat Exchangers Shifting the Market

4.7 Strategic Benchmarking

4.8 Value Chain Analysis

4.9 Supply Chain Analysis

4.10 Raw Material Analysis

4.11 Regulatory Framework

4.12 Standards

4.13 Codes

4.14 Key Market Dynamics

5 North America Heat Exchangers Market, By Application (Page No. - 33)

5.1 Introduction

5.2 Heat Exchangers Market in Chemical, By Geography

5.3 Heat Exchangers Market in Petrochemical and Oil & Gas, By Geography

5.4 Heat Exchangers Market in HVAC & Refrigeration, By Geography

5.5 Heat Exchangers Market in Food & Beverages, By Geography

5.6 Heat Exchangers Market in Pulp & Paper, By Geography

5.7 Heat Exchangers Market in Power Generation, By Geography

6 North America Heat Exchangers Market, By Type (Page No. - 43)

6.1 Introduction

6.2 North America Heat Exchangers Market: Type Comparison With Heat Exchangers Market

6.3 North America Shell and Tube Type Heat Exchangers Market , By Geography

6.4 North America Plate and Frame Type Heat Exchangers Market , By Geography

6.5 North America Air Cooled Heat Exchangers Market, By Geography

7 North America Heat Exchangers Market, By Geography (Page No. - 51)

7.1 Introduction

7.2 U.S. Heat Exchangers Market

7.2.1 53

7.2.2 U.S. Heat Exchangers Market, By Application

7.2.3 U.S. Heat Exchangers Market, By Type

7.3 Canada Heat Exchangers Market

7.3.1 Canada Heat Exchangers Market, By Application

7.3.2 Canada Heat Exchangers Market, By Type

8 North America Heat Exchangers Market: By Material of Construction, Temperature Range & Fluid Type (Page No. - 61)

8.1 Introduction

8.2 Material of Construction

8.2.1 Steel Heat Exchangers

8.2.2 Non-Steel Heat Exchangers

8.3 Fluid Type: Water Based & Thermic Fluids

8.4 Temperature Range

9 Graphite Heat Exchangers Market (Page No. - 66)

9.1 Introduction

9.1.1 Cubic Heat Exchangers

9.1.2 Graphite Block Heat Exchangers

9.1.3 Polytube Graphite Shell & Tube Heat Exchangers

10 North America Heat Exchangers Market : Competitive Landscape (Page No. - 67)

10.1 Industry Coverage

10.2 New Product Developments

10.3 Mergers & Acquisitions

10.4 Expansions

10.5 Contracts

11 North America Heat Exchangers Market, By Company (Page No. - 72)

11.1 Alfa Laval AB

11.1.1 Overview

11.1.2 Key Financials

11.1.3 Product and Service Offerings

11.1.4 Related Developments

11.1.5 MMM View

11.2 SPX Corporation

11.2.1 Overview

11.2.2 Key Financials

11.2.3 Product and Service Offerings

11.2.4 Related Developments

11.2.5 MMM View

11.3 Xylem Inc.

11.3.1 Overview

11.3.2 Key Financials

11.3.3 Product and Service Offerings

11.3.4 Related Developments

11.3.5 MMM View

11.4 Api Heat Transfer Inc.

11.4.1 Overview

11.4.2 Key Financials

11.4.3 Product and Service Offerings

11.4.4 Related Developments

11.4.5 MMM View

11.5 Modine Manufacturing Company

11.5.1 Overview

11.5.2 Key Financials

11.5.3 Product and Service Offerings

11.5.4 Related Developments

11.5.5 MMM View

11.6 Tranter Inc.

11.6.1 Overview

11.6.2 Key Financials

11.6.3 Product and Service Offerings

11.6.4 Related Developments

11.6.5 MMM View

12 Appendix (Page No. - 92)

12.1 Customization Options

12.1.1 Technical Analysis

12.1.2 Low-Cost Sourcing Locations

12.1.3 Regulatory Framework

12.1.4 Heat Exchangers Usage Data

12.1.5 Impact Analysis

12.1.6 Trade Analysis

12.1.7 Historical Data and Trends

12.2 Related Reports

12.3 Introducing RT: Real-Time Market Intelligence

12.3.1 RT Snapshots

List of Tables

Table 1 Global Heat Exchangers Peer Market Size, 2014 (Usd Bn)

Table 2 Global Application Market Size, 2014 (Usd Bn)

Table 3 Heat Exchangers Market : Comparison With Parent Market,

Table 4 North America Heat Exchangers Market : Drivers and Inhibitors

Table 5 North America Heat Exchangers Market, By Application,

Table 6 North America Heat Exchangers Market, By Type, 2013-2019 (USD MN)

Table 7 North America Heat Exchangers Market, By Application,

Table 8 North America Heat Exchangers Market in Chemical, By Geography,

Table 9 North America Heat Exchangers Market in Petrochemical And

Table 10 North America Heat Exchangers Market in HVAC & Refrigeration, By Geography, 2013 - 2019 (USD MN)

Table 11 North America Heat Exchangers Market in Food & Beverages,

Table 12 North America Heat Exchangers Market in Pulp & Paper,

Table 13 North America Heat Exchangers Market in Power Generation,

Table 14 North America Heat Exchangers Market, By Type, 2013-2019 (USD MN)

Table 15 North America Heat Exchangers Market : Type Comparison With Heat Exchangers Market, 2013–2019 (USD MN)

Table 16 North America Shell & Tube Type Heat Exchangers Market ,

Table 17 North America Plate and Frame Type Heat Exchangers Market ,

Table 18 North America Air Cooled Heat Exchangers Market, By Geography, 2013–2019 (USD MN)

Table 19 North America Heat Exchangers Market, By Geography,

Table 20 U.S. Heat Exchangers Market, By Application, 2013-2019 (USD MN)

Table 21 U.S. Heat Exchangers Market, By Type, 2013-2019 (USD MN)

Table 22 Canada Heat Exchangers Market , By Application, 2013-2019 (USD MN)

Table 23 Canada Heat Exchangers Market, By Type, 2013-2019 (USD MN)

Table 24 Non-Steel Heat Exchangers Market Share, By Type, 2014 (%)

Table 25 North America Graphite Heat Exchangers Market , By Geography,

Table 26 North America Heat Exchangers Market : New Product Developments

Table 27 North America Heat Exchangers Market : Mergers & Acquisitions

Table 28 North America Heat Exchangers Market : Expansions

Table 29 North America Heat Exchangers Market : Contracts

Table 30 Alfa Laval AB.: Key Financials, 2010 - 2014 (USD MN)

Table 31 SPX Corporation.: Key Financials, 2010 - 2014 (USD MN)

Table 32 Xylem Inc.: Key Financials, 2010 - 2014 (USD MN)

Table 33 Modine Manufacturing Company: Key Financials, 2011 - 2015 (USD MN)

List of Figures

Figure 1 North America Heat Exchangers Market : Segmentation & Coverage

Figure 2 Heat Exchangers Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 North America Heat Exchangers Market : Snapshot

Figure 8 Heat Exchangers Market : Growth Aspects

Figure 9 Heat Exchangers Market : Parent Market Comparison

Figure 10 North America Heat Exchangers Market, By Application, 2014 & 2019

Figure 11 North America Heat Exchangers Types, By Geography 2014 (USD MN)

Figure 12 North America Heat Exchangers Market, By Application, 2014 - 2019 (USD MN)

Figure 13 North America Heat Exchangers Market in Chemical,

Figure 14 North America Heat Exchangers Market in Petrochemical And

Figure 15 North America Heat Exchangers Market in HVAC & Refrigeration, By Geography, 2013 - 2019 (USD MN)

Figure 16 North America Heat Exchangers Market in Food & Beverages,

Figure 17 North America Heat Exchangers Market in Pulp & Paper,

Figure 18 North America Heat Exchangers Market in Power Generation,

Figure 19 North America Heat Exchangers Market , By Type, 2014-2019 (USD MN)

Figure 20 North America Heat Exchangers Market : Type Comparison With Heat Exchangers Market, 2013–2019 (USD MN)

Figure 21 North America Shell & Tube Type Heat Exchangers Market ,

Figure 22 North America Plate and Frame Type Heat Exchangers Market ,

Figure 23 North America Air Cooled Heat Exchangers Market, By Geography, 2013–2019 (USD MN)

Figure 24 North America Heat Exchangers Market : Growth Analysis,

Figure 25 U.S. Heat Exchangers Market Overview, 2014 & 2019

Figure 26 U.S. Heat Exchangers Market, By Application, 2013-2019 (USD MN)

Figure 27 U.S. Heat Exchangers Market, Application Snapshot

Figure 28 U.S. Heat Exchangers Market, By Type, 2013-2019 (USD MN)

Figure 29 U.S. Heat Exchangers Market, Product Type Snapshot

Figure 30 Canada Heat Exchangers Market Overview, 2014 & 2019

Figure 31 Canada Heat Exchangers Market, By Application, 2013-2019 (USD MN)

Figure 32 Canada Heat Exchangers Market, Application Snapshot

Figure 33 Canada Heat Exchangers Market , By Type, 2013-2019 (USD MN)

Figure 34 Canada Heat Exchangers Market, Product Type Snapshot

Figure 35 Heat Exchangers Classification

Figure 36 Heat Exchangers Classification

Figure 37 North America Heat Exchangers Market: Industry Coverage,

Figure 38 Alfa Laval AB: Revenue Mix, 2014 (%)

Figure 39 Contribution of Equipment Segment Towards Company

Figure 40 SPX Corporation. Revenue Mix, 2014 (%)

Figure 41 Contribution of Industrial Products Segment Towards Company Revenues, 2010-2014 (USD MN)

Figure 42 Xylem Inc. Revenue Mix, 2014 (%)

Figure 43 Modine Manufacturing Company, Revenue Mix, 2015 (%)

A heat exchanger is a device designed to efficiently transfer heat from one matter to another. It is used across various industries such as chemical, petrochemical, oil & gas, HVAC, pulp & paper, and power generation. It plays a major role in helping these industries increase their operational efficiency and reduce energy consumption.

The North America heat exchangers market is witnessing steady growth on account of technological advancements, and the growing demand in the end user industries The North America market for heat exchangers was estimated at $ 4.0 billion in 2014 and is expected to grow at a CAGR of 6.4% from 2014 to 2019. In 2014, the heat exchangers market in the U.S. accounted for a larger share of 80.2% in the North American heat exchangers market.

The market, by application, was led by the chemical industry in 2014, having accounted for a share of 28.8%. On the basis of type, the heat exchangers market was led by the shell and tube type heat exchangers in 2014.

The key players in the North America Heat exchangers market include, Tranter, Inc. (U.S.), Xylem Inc. (U.S.), API Heat Transfer (U.S.), Modine Manufacturing Company (U.S.), and SPX Corporation (U.S.), among several others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement