North America Food & Beverage Preservatives Market by Application (Beverage Products, Meat & Meat Products, Bakery, Confectionery, Extruded Snacks Food, Dairy Products, Fats & Oils), by Type (Synthetic Ingredients market, Natural Ingredients Market), by Function (Antimicrobials, Antioxidants), By Country (U.S., Canada, Mexico) – Analysis & Forecast to 2019

The North America food and beverage preservatives market is projected to grow at a CAGR of 2.7% from 2014 to 2019. Preservatives are necessary to ensure the safety of varied food items and delay its spoilage. They prevent any alteration in the taste or appearance of food and beverages.

Preservatives enhance the shelf life of food products, and are used to prolong the edibility of the finished foods. Natural and artificial preservatives are the two most common types of food preservatives. Similarly, on the basis of function, this market is classified into antimicrobials and antioxidants.

The North America food and beverage preservatives market is dominated by the U.S. The food and beverage manufacturers are shifting their focus towards the adoption of natural preservatives to replace chemical preservatives, and manufacture food products with clean labels. Numerous herbs and spices carry antimicrobial properties, and thus are being used as natural food preservatives. Owing to their herbal origin, they have little or no harmful side effects. This has in turn increased its market share in the food & beverage industry.

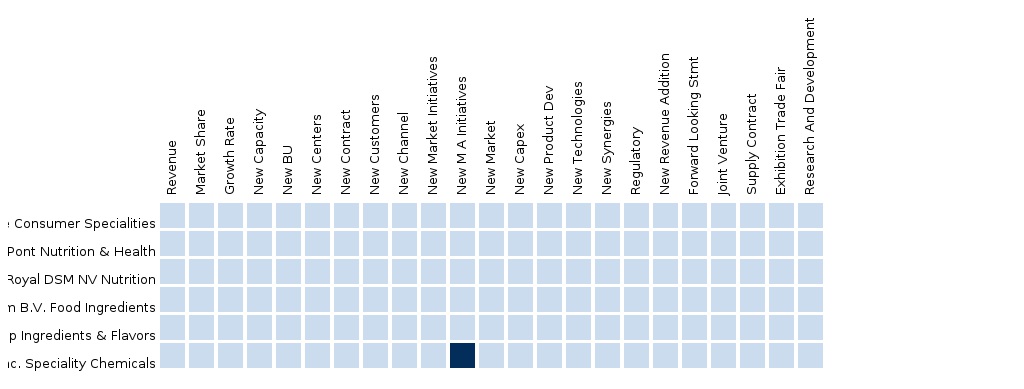

Major companies operating in the North America food and beverage preservatives market include Celanese Corporation (U.S.), Danisco A/S (Denmark), and Royal DSM NV (Netherlands) among others. To expand their market share, these companies are adapting numerous market strategies including innovative product development, partnerships, mergers and acquisitions, and expansion of their existing facilities.

Scope of the Report

This research report categorizes the North American food and beverage preservatives market into the following segments and sub-segments:

North America Food and Beverage Preservatives Market, By Type

- Natural

- Synthetic

North America Food and Beverage Preservatives Market, By Application

- Oils & Fats

- Bakery

- Dairy & Frozen Products

- Snacks, Meat, Poultry & Seafood

- Confectionary

- Beverages

- Others

North America Food and Beverage Preservatives Market, By Geography

- U.S.

- Canada

- Mexico

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Food & Beverage Preservatives Market

2.2 Arriving at the Food & Beverage Preservatives Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 23)

4 North America Food and Beverage Preservatives Market Overview (Page No. - 24)

4.1 Introduction

4.2 Food & Beverage Preservatives Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 North America Food and Beverage Preservatives Market, By Application (Page No. - 36)

5.1 Introduction

5.2 Demand Side Analysis

5.3 Food & Beverage Preservatives in Beverage Products, By Geography

5.4 Food & Beverage Preservatives in Meat & Meat Products, By Geography

5.5 Food & Beverage Preservatives in Bakery, By Geography

5.6 Food & Beverage Preservatives in Confectionery, By Geography

5.7 Food & Beverage Preservatives in Extruded Snacks Food, By Geography

5.8 Food & Beverage Preservatives in Dairy Products, By Geography

5.9 Food & Beverage Preservatives in Fats & Oils, By Geography

6 North America Food and Beverage Preservatives Market, By Type (Page No. - 52)

6.1 Introduction

6.2 North America Food & Beverages Preservatives Market, Type Comparison With Food & Beverage

Ingredients Market

6.3 North America Synthetic Ingredients Market, By Geography

6.4 North America Natural Ingredients Market, By Geography

6.5 Sneak View: North America Food & Beverages Preservatives Market, By Type

7 North America Food and Beverage Preservatives Market, By Function (Page No. - 60)

7.1 Introduction

7.2 North America Antimicrobials Market, By Geography

7.3 North America Antioxidants Market, By Geography

8 North America Food and Beverage Preservatives Market, By Geography (Page No. - 66)

8.1 Introduction

8.2 U.S. Food & Beverage Preservatives Market

8.2.1 U.S. Food & Beverage Preservatives Market, By Application

8.2.2 U.S. Food & Beverage Preservatives Market, By Type

8.2.3 U.S. Food & Beverage Preservatives Market, By Function

8.3 Canada Food & Beverage Preservatives Market

8.3.1 Canada Food & Beverage Preservatives Market, By Application

8.3.2 Canada Food & Beverage Preservatives Market, By Type

8.3.3 Canada Food & Beverage Preservatives Market, By Function

8.4 Mexico Food & Beverage Preservatives Market

8.4.1 Mexico Food & Beverage Preservatives Market, By Application

8.4.2 Mexico Food & Beverage Preservatives Market, By Type

8.4.3 Mexico Food & Beverage Preservatives Market, By Function

9 North America Food and Beverage Preservatives Market: Competitive Landscape (Page No. - 90)

9.1 Food & Beverage Preservatives Market: Company Share Analysis

9.2 Company Presence in Food & Beverage Preservatives Market, By Type

9.3 Mergers & Acquisitions

9.4 Expansions

9.5 Investments

10 North America Food and Beverage Preservatives Market, By Company (Page No. - 94)

(Overview, Financials, Products & Services, Strategy, and Developments)*

10.1 Celanese Corporation

10.2 Danisco A/S

10.3 Royal DSM N.V.

10.4 Purac Biochem B.V.

10.5 Kerry Group

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

11 Appendix (Page No. - 109)

11.1 Customization Options

11.1.1 Product Type Offerings

11.1.2 Market Trends

11.1.3 Legislation Impact

11.1.4 Related Market Analysis

11.2 Related Reports

11.3 Introducing RT: Real Time Market Intelligence

11.3.1 RT Snapshots

List of Tables (72 Tables)

Table 1 Global Food & Beverage Preservatives Peer Market Size, 2014 (USD MN)

Table 2 North America Food and Beverage Preservatives Application Market, 2014 (KT)

Table 3 North America Food and Beverage Preservatives Market: Macro Indicators, By Geography, 2014 (Thousands)

Table 4 North America Food and Beverage Preservatives Market, By Type, 2014-2019 (USD MN)

Table 5 North America Food and Beverage Preservatives Market, By Type, 2014-2019 (KT)

Table 6 North America Food and Beverage Preservatives Market: Drivers and Inhibitors

Table 7 North America Food and Beverage Preservatives Market, By Application, 2013-2019 (USD MN)

Table 8 North America Food and Beverage Preservatives Market, By Application, 2013-2019 (KT)

Table 9 North America Food and Beverage Preservatives Market, By Type, 2013-2019 (USD MN)

Table 10 North America Food and Beverage Preservatives Market, By Type, 2013-2019 (KT)

Table 11 North America Food and Beverage Preservatives Market, By Function, 2013-2019 (USD MN)

Table 12 North America Food & Beverage Preservatives Market, By Function, 2013-2019 (KT)

Table 13 North America Food & Beverage Preservatives Market, By Geography, 2013-2019 (USD MN)

Table 14 North America Food & Beverage Preservatives Market, By Geography, 2013-2019 (KT)

Table 15 North America Food & Beverage Preservatives Market: Comparison With Application Markets, 2013-2019 (USD MN)

Table 16 North America Food & Beverage Preservatives Market, By Application, 2013-2019 (USD MN)

Table 17 North America Food & Beverages Preservatives Market, By Application, 2013-2019 (KT)

Table 18 North America Food & Beverages Preservatives in Beverage Products, By Geography, 2013-2019 (USD MN)

Table 19 North America Food & Beverages Preservatives in Beverage Products, By Geography, 2013-2019 (KT)

Table 20 North America Food & Beverages Preservatives in Meat & Meat Products, By Geography, 2013-2019 (USD MN)

Table 21 North America Food & Beverages Preservatives in Meat & Meat Products, By Geography, 2013-2019 (KT)

Table 22 North American Food & Beverage Preservatives in Bakery, By Geography, 2013-2019 (USD MN)

Table 23 North America Food & Beverage Preservatives in Bakery, By Geography, 2013-2019 (KT)

Table 24 North America Food & Beverage Preservatives in Confectionery, By Geography, 2013-2019 (USD MN)

Table 25 North American Food & Beverage Preservatives in Confectionery, By Geography, 2013-2019 (KT)

Table 26 North America Food & Beverages Preservatives in Extruded Snacks Food, By Geography, 2013-2019 (USD MN)

Table 27 North America Food & Beverages Preservatives in Extruded Snacks Food, By Geography, 2013-2019 (KT)

Table 28 North American Food & Beverage Preservatives in Dairy Products, By Geography, 2013-2019 (USD MN)

Table 29 North American Food & Beverage Preservatives in Dairy Products, By Geography, 2013-2019 (KT)

Table 30 North America Food & Beverage Preservative in Fats & Oils, By Geography, 2013-2019 (USD MN)

Table 31 North America Food & Beverage Preservatives in Fats & Oils, By Geography, 2013-2019 (KT)

Table 32 North America Food & Beverage Preservatives Market, By Type, 2013-2019 (USD MN)

Table 33 North America Food & Beverage Preservatives Market, By Type, 2013-2019 (KT)

Table 34 North America Food & Beverage Preservatives Market: Type Comparison With Parent Market, 2014–2019 (USD MN)

Table 35 North America Synthetic Ingredients Market, By Geography, 2013–2019 (USD MN)

Table 36 North America Synthetic Ingredients Market, By Geography, 2013–2019 (KT)

Table 37 North America Natural Ingredients Market, By Geography, 2013-2019 (USD MN)

Table 38 North America Natural Ingredients Market, By Geography, 2013-2019 (KT)

Table 39 North America Food & Beverage Preservatives Market, By Function, 2013-2019 (USD MN)

Table 40 North America Food & Beverage Preservatives Market, By Function, 2013-2019 (KT)

Table 41 North America Antimicrobials Market, By Geography, 2013–2019 (USD MN)

Table 42 North America Antimicrobials Market, By Geography, 2013–2019 (KT)

Table 43 North America Antioxidants Market, By Geography, 2013-2019 (USD MN)

Table 44 North America Antioxidants Market, By Geography, 2013-2019 (KT)

Table 45 North American Food and Beverage Preservatives Market, By Geography, 2013-2019 (USD MN)

Table 46 North American Food and Beverage Preservatives Market, By Geography, 2013-2019 (KT)

Table 47 U.S. Food & Beverage Preservatives Market, By Application, 2013-2019 (USD MN)

Table 48 U.S. Food & Beverage Preservatives Market, By Application, 2013-2019 (KT)

Table 49 U.S. Food & Beverage Preservatives Market, By Type, 2013-2019 (USD MN)

Table 50 U.S. Food & Beverage Preservatives Market, By Type, 2013-2019 (KT)

Table 51 U.S. Food & Beverage Preservatives Market, By Function, 2013-2019 (USD MN)

Table 52 U.S. Food & Beverage Preservatives Market, By Function, 2013-2019 (KT)

Table 53 Canada Food & Beverage Preservatives Market, By Application, 2013-2019 (USD MN)

Table 54 Canada Food & Beverage Preservatives Market, By Application, 2013-2019 (KT)

Table 55 Canada Food & Beverage Preservatives Market, By Type, 2013-2019 (USD MN)

Table 56 Canada Food & Beverage Preservatives Market, By Type, 2013-2019 (KT)

Table 57 Canada Food & Beverage Preservatives Market, By Function, 2013-2019 (USD MN)

Table 58 Canada Food & Beverage Preservatives Market, By Function, 2013-2019 (KT)

Table 59 Mexico Food & Beverage Preservatives Market, By Application, 2013-2019 (USD MN)

Table 60 Mexico Food & Beverage Preservatives Market, By Application, 2013-2019 (KT)

Table 61 Mexico Food & Beverage Preservatives Market, By Type, 2013-2019 (USD MN)

Table 62 Mexico Food & Beverage Preservatives Market, By Type, 2013-2019 (KT)

Table 63 Mexico Food & Beverage Preservatives Market, By Function, 2013-2019 (USD MN)

Table 64 Mexico Food & Beverage Preservatives Market, By Function, 2013-2019 (KT)

Table 65 Food & Beverage Preservatives Market: Company Share Analysis, 2014 (%)

Table 66 North American Food & Beverage Preservatives Market: Mergers & Acquisitions

Table 67 North American Food & Beverage Preservatives Market: Expansions

Table 68 North American Food & Beverage Preservatives Market: Investments

Table 69 Celanese Corporation: Key Operations Data, 2009 - 2013 (USD MN)

Table 70 Danisco A/S: Key Financials Data, 2009 - 2014 (USD MN)

Table 71 Royal DSM N.V.: Key Operations Data, 2009 - 2014 (USD MN)

Table 72 Purac Biochem B.V.: Key Financials, 2009-2013 (USD MN)

List of Figures (63 Figures)

Figure 1 North America Food and Beverages Preservatives Market: Segmentation & Coverage

Figure 2 Food & Beverage Preservatives Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 North America Food and Beverage Preservatives Market Snapshot

Figure 9 Food & Beverage Preservatives Market: Growth Aspects

Figure 10 North America Food and Beverage Preservatives Market, By Application, 2014 vs. 2019

Figure 11 North America Food & Beverage Preservatives Types, By Geography, 2014 (USD MN)

Figure 12 North America Food & Beverage Preservatives Functions, By Geography, 2014 (USD MN)

Figure 13 North America Food & Beverage Preservatives Market: Growth Analysis, By Type, 2014–2019 (%)

Figure 14 Food & Beverage Preservatives: Application Market Scenario

Figure 15 North American Food & Beverage Preservatives Market, By Application, 2014-2019 (USD MN)

Figure 16 North American Food & Beverage Preservatives Market, By Application, 2014-2019 (KT)

Figure 17 North American Food & Beverage Preservatives Market in Beverage Products, By Geography, 2013-2019 (USD MN)

Figure 18 North America Food & Beverage Preservatives Market in Meat & Meat Products, By Geography, 2013-2019 (USD MN)

Figure 19 North America Food & Beverage Preservative Market in Bakery, By Geography, 2013-2019 (USD MN)

Figure 20 North America Food & Beverages Preservatives Market in Confectionery, By Geography, 2013-2019 (USD MN)

Figure 21 North America Food & Beverages Preservatives Market in Extruded Snacks Food, By Geography, 2013-2019 (USD MN)

Figure 22 North America Food & Beverages Preservatives Market in Dairy Products, By Geography, 2013-2019 (USD MN)

Figure 23 North America Food and Beverages Preservatives Market in Fats & Oils, By Geography, 2013-2019 (USD MN)

Figure 24 North America Food and Beverage Preservatives Market, By Type, 2014 - 2019 (USD MN)

Figure 25 North America Food and Beverage Preservatives Market, By Type, 2014 & 2019 (KT)

Figure 26 North America Food and Beverage Preservatives Market: Type Comparison With Food & Beverage Ingredients Market, 2014–2019 (USD MN)

Figure 27 North America Synthetic Ingredients Market, By Geography, 2013–2019 (USD MN)

Figure 28 North America Natural Ingredients Market, By Geography, 2013-2019 (USD MN)

Figure 29 North America Food & Beverage Preservatives Market, By Function, 2014 - 2019 (USD MN)

Figure 30 North America Food & Beverage Preservatives Market, By Function, 2014 & 2019 (KT)

Figure 31 North America Antimicrobials Market, By Geography, 2013–2019 (USD MN)

Figure 32 North America Antioxidants Market, By Geography, 2013-2019 (USD MN)

Figure 33 North America Food & Beverage Preservatives Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 34 North America Food & Beverage Preservatives Market: Growth Analysis, By Geography, 2014-2019 (KT)

Figure 35 U.S. Food & Beverage Preservatives Market Overview, 2014 & 2019 (%)

Figure 36 U.S. Food & Beverage Preservatives Market, By Application, 2013-2019 (USD MN)

Figure 37 U.S. Food & Beverage Preservatives Market: Application Snapshot

Figure 38 U.S. Food & Beverage Preservatives Market, By Type, 2013-2019 (USD MN)

Figure 39 U.S. Food & Beverage Preservatives Market Share, By Type, 2013-2019 (%)

Figure 40 U.S. Food & Beverage Preservatives Market, By Function, 2014 - 2019 (USD MN)

Figure 41 U.S. Food & Beverage Preservatives Market Share, By Function, 2013-2019 (%)

Figure 42 Canada Food & Beverage Preservatives Market Overview, 2014 & 2019 (%)

Figure 43 Canada Food & Beverage Preservatives Market, By Application, 2013-2019 (USD MN)

Figure 44 Canada Food & Beverage Preservatives Market: Application Snapshot

Figure 45 Canada Food & Beverage Preservatives Market, By Type, 2014 - 2019 (USD MN)

Figure 46 Canada Food & Beverage Preservatives Market Share, By Type, 2013-2019 (%)

Figure 47 Canada Food & Beverage Preservatives Market, By Function, 2014 - 2019 (USD MN)

Figure 48 Canada Food & Beverage Preservatives Market Share, By Function, 2013-2019 (%)

Figure 49 Mexico Food & Beverage Preservatives Market Overview, 2014 & 2019 (%)

Figure 50 Mexico Food & Beverage Preservatives Market, By Application, 2013-2019 (USD MN)

Figure 51 Mexico Food & Beverage Preservatives Market: Application Snapshot

Figure 52 Mexico Food & Beverage Preservatives Market, By Type, 2014 - 2019 (USD MN)

Figure 53 Mexico Food & Beverage Preservatives Market Share, By Type, 2013-2019 (%)

Figure 54 Mexico Food & Beverage Preservatives Market, By Function, 2014 - 2019 (USD MN)

Figure 55 Mexico Food & Beverage Preservatives Market Share, By Function, 2013-2019 (%)

Figure 56 Food & Beverage Preservatives Market: Company Share Analysis, 2014 (%)

Figure 57 Food & Beverage Preservatives: Company Product Coverage, By Type, 2014

Figure 58 Celanese Corporation: Revenue Mix, 2013 (%)

Figure 59 Danisco A/S: Revenue Mix, 2013 (%)

Figure 60 Royal DSM N.V., Revenue Mix, 2013 (%)

Figure 61 Purac Biochem B.V. Revenue Mix, 2013 (%)

Figure 62 Kerry Group, Revenue Mix, 2014 (%)

Figure 63 Purac Biochem B.V.: Key Financials, 2009 - 2013 (USD MN)

The food & beverage preservatives market is a growing market in the food & beverage ingredient sector. There is an increasing trend in the consumption of processed food products, and this has resulted in propelling the demand for preservatives across all regions around the world. Food spoilage is brought about by chemical, physical, or biological factors. To prevent wastage of food products, utilization of varied preservatives becomes imperative. The food & beverage preservatives market is driven by the need to prevent deterioration of food products and preservation of its nutritional content.

The North America food & beverage preservatives market is segmented on the basis of type, function, application, and geography. On the basis of type, this market is segmented into synthetic ingredients and natural ingredients. With respect to application, this market is segmented into meat & meat products, beverage products, bakery, dairy products, confectionary, extruded snacks food, and fats & oils among others. According to function, the market is classified into antimicrobials, antioxidants, and other functions. By geography, this market is segmented into the U.S., Canada, and Mexico.

The purpose of this study is to analyze the North America food and beverage preservatives market. This market was valued at $940.4 million in 2014, and is projected to reach $1,074.1 million by 2019, at a CAGR of 2.7% from 2014 to 2019.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement