North America Commercial Flight Management Systems Market by Cockpit Architecture (VIA, WBA, NBA, and RTA), Hardware (FMC, CDU, and VDU) Forecast and Analysis to 2019

In this report, the North America flight management systems market has been broadly classified on the basis of cockpit architecture, hardware type, fit, and country. The major cockpit architecture on the basis of type of aircrafts includes narrow body aircraft, wide body aircraft, very large aircraft and regional transport aircraft.

Flight Management System in wide body aircraft market is expected to be the fastest growing segment in the North America cockpit architecture flight management system market, projected to grow at the fastest CAGR of 7.27% from 2014 to 2019. Factors such as rise in aircraft deliveries, increasing passenger traffic, need for fuel efficiency is further driving the market at a significant pace.

The North American flight management system market is a competitive market with a number of market players. As of 2014, the North American market is majorly dominated by Honeywell international Inc., General Electric Company and Esterline Technologies Corporation. The launch of new products, agreements, contracts, and joint ventures are the major strategies adopted by these major players to achieve growth in the North America flight management systems market.

Reasons to Buy the Report:

From an insight perspective, this research report has focused on various levels of analysis—industry analysis (industry trends and PEST analysis), market share analysis of top players, supply chain analysis, and company profiles, which together provide the basic views on the competitive landscape; emerging and high-growth segments of the aircraft seating market; high-growth countries & their respective regulatory policies; government initiatives; and market drivers, restraints, and opportunities.

The report will enrich both the established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn will help the firms, garner a greater share in the North American flight management system market. Firms that purchase the report could use any one or a combination of five strategies that include market penetration, product development/innovation, market development, market diversification, and competitive assessment to strengthen their market share.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on flight management system offered by top players in the aircraft seating market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the flight management system market

- Market Development: Comprehensive information of lucrative emerging markets. The report analyzes the markets for various flight management system technologies at regional and country levels

- Market Diversification: Exhaustive information of new products, untapped geographies, recent developments, and investments in the flight management system market

Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the flight management systems market

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Commercial Flight Management Systems Market

2.2 Arriving at the Commercial Flight Management Systems Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.2.4 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Commercial Flight Management Systems Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand-Side Analysis

5 Flight Management System, By Cockpit Architecture (Page No. - 30)

5.1 Introduction

5.2 Demand-Side Analysis

5.3 North America Commercial Flight Management Market in Narrow Body Aircraft, By Geography

5.4 North America Commercial Flight Management Market in Wide Body Aircraft, By Geography

5.5 North America Commercial Flight Management Market in Very Large Aircraft, By Geography

5.6 North America Commercial Flight Management Market in Regional Transport Aircraft, By Geography

5.7 Sneak View: North America Commercial Flight Management Systems Market, By Cockpit Architecture

6 North America Commercial Flight Management Systems Market, By Hardware Type (Page No. - 39)

6.1 Introduction

6.2 North America Commercial Flight Management Market, By Hardware Type

6.3 North America Commercial Flight Management Market, Type Comparison With Navigation System Market

6.4 North America Commercial Flight Management Computer Market, By Geography

6.5 North America Computer Display Unit Market, By Geography

6.6 North America Visual Display Unit Market, By Geography

6.7 Sneak View: North America Commercial Flight Management Systems Market, By Hardware Type

7 North America Commercial Flight Management Systems Market, By Geography (Page No. - 47)

7.1 Introduction

7.2 U.S. Market

7.2.1 U.S. Market, By Cockpit Architecture

7.2.2 U.S. Market, By Hardware Type

7.3 Canada Market

7.3.1 Canada Market, By Cockpit Architecture

7.3.2 Canada Market, By Hardware Type

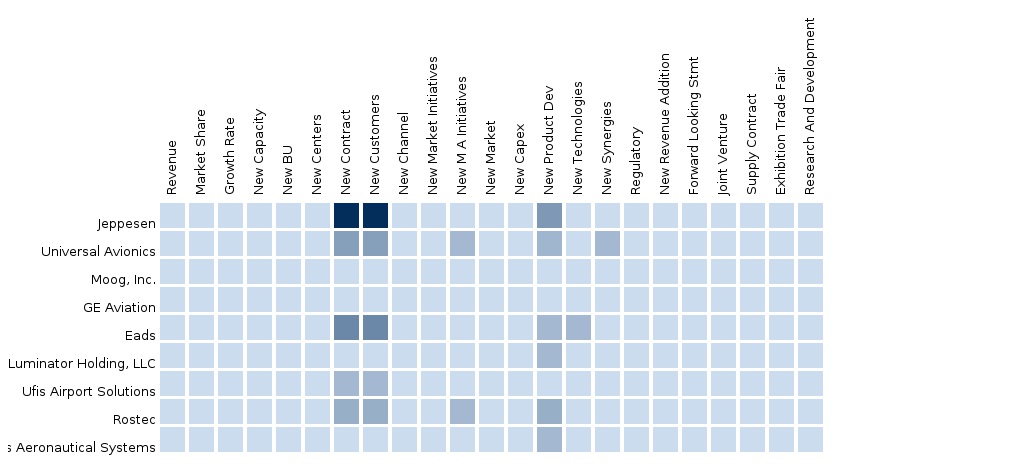

8 North America Commercial Flight Management Systems Market: Competitive Landscape (Page No. - 60)

8.1 North America Market: Company Share Analysis

8.2 Company Presence in North America Market, By Type

8.3 Contracts

8.4 Joint Ventures

8.5 Agreements

8.6 New Product Launches

9 Commercial Flight Management Systems Market, By Company (Page No. - 64)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Rockwell Collins, Inc.

9.2 Thales Group S.A

9.3 Honeywell International, Inc.

9.4 General Electric Co.

9.5 Esterline Technologies Corporation

9.6 Universal Avionics Systems Corporation

9.7 Garmin Limited

9.8 Lufthansa Group

9.9 Navtech, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 94)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 Impact Analysis

10.1.5 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real-Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (47 Tables)

Table 1 Global Commercial Flight Management Systems Peer Market Size, 2014 (USD MN)

Table 2 North America: Macroindicators, By Geography, 2014

Table 3 North America Commercial Flight Management System Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 North America Commercial Flight Management Systems Market: Drivers and Inhibitors

Table 5 North America Flight Management Systems Market, By Cockpit Architecture, 2013 - 2019 (USD MN)

Table 6 North America Flight Management Market, By Cockpit Architecture, 2013 - 2019 (Units)

Table 7 North America Flight Management Systems Market, By Hardware, 2013 - 2019 (USD MN)

Table 8 North America Market, By Geography, 2013 - 2019 (USD MN)

Table 9 North America Market: Comparison With Aircraft Deliveries, 2014 - 2019 (Units)

Table 10 North America Commercial Flight Management Market, By Cockpit Architecture, 2013 - 2019 (USD MN)

Table 11 Characteristics of Aircraft Types

Table 12 North America Aircraft Deliveries and Fms Demand, 2014-2019 (Units)

Table 13 North America Aircraft Deliveries Market Share, By Aircraft Type, 2014

Table 14 North America Commercial Flight Management Market in Narrow Body Aircraft, By Geography, 2013 - 2019 (USD MN)

Table 15 North America Commercial Flight Management Market in Wide Body Aircraft, By Geography, 2013 - 2019 (USD MN)

Table 16 North America Commercial Flight Management Market in Very Large Aircraft, By Geography, 2013 - 2019 (USD MN)

Table 17 North America Flight Management Systems Market in Regional Transport Aircraft, By Geography, 2013 - 2019 (USD MN)

Table 18 North America Flight Management Systems Market, By Hardware Type, 2013-2019 (USD MN)

Table 19 North America Commercial Flight Mangement System Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 20 North America Commercial Flight Management Computer Market, By Geography, 2013–2019 (USD MN)

Table 21 North America Computer Display Market, By Geography, 2013-2019 (USD MN)

Table 22 North America Visual Display Unit Market, By Geography, 2013-2019 (USD MN)

Table 23 North America Growth Measures, 2013

Table 24 North America Flight Management Systems Market, By Geography, 2013-2019 (USD MN)

Table 25 U.S. Market, By Cockpit Architecture, 2013-2019 (USD MN)

Table 26 U.S. Market, By Hardware Type, 2013-2019 (USD MN)

Table 27 Canada Market, By Cockpit Architecture, 2013-2019 (USD MN)

Table 28 Canada Market, By Hardware Type, 2013-2019 (USD MN)

Table 29 North America Market: Company Share Analysis, 2013 (%)

Table 30 North America Flight Management Systems Market: Contracts

Table 31 North America Flight Management Systems Market: Joint Ventures

Table 32 North America Commercial Flight Management Market: Agreements

Table 33 North America Commercial Flight Management Market: New Product Launches

Table 34 Rockwell Collins: Key Operations Data, 2010 - 2014 (USD MN)

Table 35 Rockwell Collins, Inc.: Key Financials, 2010 - 2014 (USD MN)

Table 36 Thales Group S.A.: Key Operations Data, 2010 - 2013 (USD MN)

Table 37 Thales Group S.A.: Key Financials, 2009 - 2013 (USD MN)

Table 38 Honeywell International Inc.: Key Operations Data, 2010 - 2013 (USD MN)

Table 39 Honeywell International Inc.: Key Financials, 2010 - 2014 (USD MN)

Table 40 General Electric Co.: Key Operations Data, 2009 - 2013 (USD MN)

Table 41 General Electric Co.: Key Financials, 2009 - 2013 (USD MN)

Table 42 Esterline Technologies Corp.: Key Operations Data, 2010 - 2014 (USD MN)

Table 43 Esterline Technologies Corp.: Key Financials, 2010 - 2014 (USD MN)

Table 44 Garnim Limited: Key Operations Data, 2010 - 2014 (USD MN)

Table 45 Garnim Limited: Key Financials, 2010 - 2014 (USD MN)

Table 46 Lufthansa Group: Key Operations Data, 2009 - 2013 (USD MN)

Table 47 Lufthansa Group: Key Financials, 2009 - 2013 (USD MN)

List of Figures (46 Figures)

Figure 1 North America Commercial Flight Management Systems Market: Segmentation & Coverage

Figure 2 Commercial Flight Management Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 North America Commercial Flight Management Market Snapshot

Figure 9 Commercial Flight Management System: Growth Aspects

Figure 10 Commercial Flight Management Systems Market: Comparison With Parent Market 2013-2019 (USD MN)

Figure 11 North America Flight Management Systems Market, By Cockpit Architecture, 2014 Vs 2019 (USD MN)

Figure 12 North America Flight Management Systems Market, By Hardware, By Geography, 2014 (USD MN)

Figure 13 North America Flight Management Systems Market: Demand-Side Analysis 2014 - 2019(Units)

Figure 14 North America Commercial Flight Management Market, By Cockpit Architecture, 2014 V/S 2019 (USD MN)

Figure 15 North America Commercial Flight Management System Demand, 2014-2019 (Units)

Figure 16 North America Commercial Flight Management Market in Narrow Body Aircraft, By Geography, 2013 - 2019 (USD MN)

Figure 17 North America Commercial Flight Management Market in Wide Body Aircraft, By Geography, 2013 - 2019 (USD MN)

Figure 18 North America Commercial Flight Management Market in Very Large Aircraft, By Geography, 2013 - 2019 (USD MN)

Figure 19 North America Commercial Flight Management Market in Regional Transport Aircraft, By Geography, 2013 - 2019 (USD MN)

Figure 20 Sneak View: North America Flight Management Systems Market, 2014

Figure 21 North America Commercial Flight Management Systems Market, By Hardware Type, 2014 V/S 2019 (USD MN)

Figure 22 North America Commericial Flight Management Systems Market, By Hardware Type, 2013-2019 (USD MN)

Figure 23 North America Commercial Flight Management Market: Type Comparison With Navigation System Market 2013-2019 (USD MN)

Figure 24 North America Flight Management Computer Market, By Geography, 2013–2019 (USD MN)

Figure 25 North America Computer Display Unit Market, By Geography, 2013–2019 (USD MN)

Figure 26 North America Visual Display Unit Market, By Geography, 2013–2019 (USD MN)

Figure 27 North America Flight Management Systems Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 28 U.S. Flight Management Systems Market Overview, 2014 V/S 2019 (%)

Figure 29 U.S. Market, By Cockpit Architecture, 2013-2019 (USD MN)

Figure 30 U.S. Market: Cockpit Architecture Type Snapshot

Figure 31 U.S. Market, By Hardware, 2013-2019 (USD MN)

Figure 32 U.S. Market, By Hardware, 2014 V/S 2019 (%)

Figure 33 Canada Market Overview, 2014 V/S 2019 (USD MN)

Figure 34 Canada Market By Cockpit Architecture, 2013-2019 (USD MN)

Figure 35 Canada Market: By Cockpit Architecture Snapshot

Figure 36 Canada Market, By Hardware Type, 2013-2019 (USD MN)

Figure 37 Canada Flight Management Systems Market Share, By Hardware Type, 2014 V/S 2019 (%)

Figure 38 North America Flight Management Systems Market: Market Share Analysis, 2013 (%)

Figure 39 North America Commercial Flight Management Market: Company Product Coverage, 2013

Figure 40 Rockwell Collins, Inc. Revenue Mix, 2014 (%)

Figure 41 Thales Group S.A., Revenue Mix, 2013 (%)

Figure 42 Honeywell International Inc., Revenue Mix, 2014(%)

Figure 43 General Electric Co., Revenue Mix, 2013(%)

Figure 44 Esterline Technologies Corporatiomn, Revenue Mix, 2014(%)

Figure 45 Garmin Limited, Revenue Mix, 2014(%)

Figure 46 Lufthansa Group, Revenue Mix, 2014(%)

FMS has become a fundamental component of every aircraft’s cockpit as it is the primary interface for the pilot, which enables flight planning operations, thus increasing safety by enabling flight plan displays. The system also includes aeronautical navigation database for controlled flight operations, globally, increasing fuel and time efficiency by optimizing route plans for any airport with no costly ground-based infrastructure. The global flight management system industry is expected to grow at a CAGR of 7.57% from 2014 to 2019.

The growth of the flight management systems market has been primarily triggered by an increase in aircraft deliveries in both developed and developing nations, the need for real-time information sharing and collaboration, and an introduction of technologically advanced systems to reduce the fuel burn. However, factors such as slow economic growth, aircraft cancellation orders, and limited data storage capacity restrain the growth of this market. The North American flight management systems market is currently valued at $119.06 million. The market is expected to grow in tandem with growth in the aviation sector.

The market has been broadly segmented into very large aircraft, narrow body aircraft, wide-body aircraft, and regional transport aircraft, on the basis of cockpit architecture of an aircraft. Narrow body aircraft (NBA) led the segment in 2014, with a 63.9% share. The market for flight management system in NBA is projected to reach $108.10 million at a CAGR of 7.25% through the forecasted period.

The North American flight management system market, by hardware, is broadly classified into visual display unit, flight management computer, and control display unit. The visual display unit market accounted for a share of 39.70% of the North American flight management system market in 2014. However, the market for control display unit is projected to grow at a higher CAGR of 7.51% from 2014 to 2019. The flight management system is like the global positioning system (GPS) in devices, with waypoints programmed in between the origin and the destination. The FMS will allow the airplane to hook up [the routing with] the autopilot and maintain the heading within a few feet.

The key players in North America flight management system markets include Honeywell International Inc. (U.S.), General Electric Company (U.S.), Esterline Technologies Corporation (U.S.), and Rockwell Collins (U.S.), Thales Group (France) and Universal Avionics Systems Corporation (U.S.) among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement