The Middle East & Africa (MEA) software defined networking market is estimated to grow from $5.1 million in 2013 to $118.0 million by 2019, at a CAGR of 77.3%, for the given period. The market is primarily driven by the prominent network infrastructure requirements in the MEA region.

Software defined networking is an advanced way of networking in which the de-couple action takes place between network and physical hardware, and later, network is handled by a software application called ‘Controller’. This way, it is easy to remove the limitation of networks due to infrastructure. SDN improves the network in terms of programmability of networks, improves agility of network, organizes and manages the network centrally. Software defined networking proposes cost-effective approach to lower down the operation costs, thereby reducing the latency and efficient performance of network traffic management.

Software defined networking in the Middle East & Africa region is expected to see a strong growth in mobile data traffic in the coming years. Better infrastructure is required to tackle the exponentially increasing and varying type of data from a variety of devices. SDN solutions offer a method to cope with the large number of connections, along with the above mentioned devices, at reduced capital and operational expenditures.

The report provides a competitive benchmarking of the leading players in this market such as Cisco Systems, Inc., Hewlett-Packard, Juniper Networks, Plexxi, and Alcatel-Lucent. The report gives the financial analysis, which includes CAGR and market share of the different region, vendors, overall adoption scenario, competitive landscape, key drivers, restraints, and opportunities in the market.

Report Options:

The market segmentation covered in this report is as given below:

- By Solution: SDN switching, SDN controllers, cloud virtualization applications, and network virtualization security

- By End-Users: Telecommunications providers, cloud service providers, and enterprises

Customization Options:

Along with the MMM assessment, customize the report in alignment with your company’s specific needs. The following customization options provide a comprehensive summary of the industry standards and deep dive analysis:

Software Defined Networking Market Solutions Matrix

- A comprehensive analysis and benchmarking by solutions, by end-users, and by regions in the market

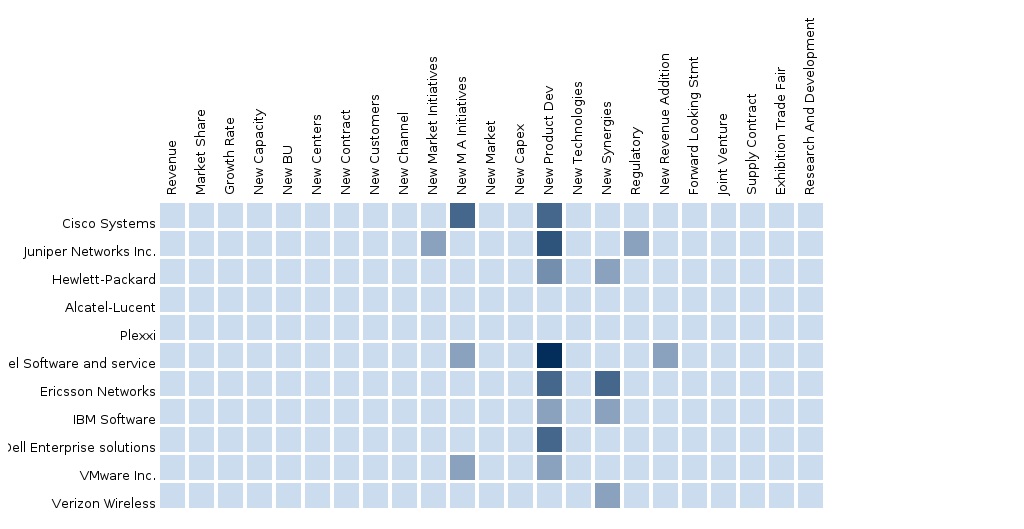

Software Defined Networking Market Competitive Benchmarking

- Value-chain evaluation using events, developments, market data for vendors in the market ecosystem, across various end users, market segmentation and categorization

- To uncover hidden opportunities by connecting related markets using cascaded value chain analysis

Software Defined Networking Market Vendor Landscaping

- Vendor market watch and predictions, vendor market shares and offerings, categorization of adoption trends and market dominance (leaders, challengers, and followers)

Software Defined Networking Market Data Tracker

- Country-specific market forecast and analysis

- The identification of key end-user segments, by country

Software Defined Networking Market Emerging Vendor Landscape

- Evaluate Tier-2/3 vendors’ market offerings using a 2X2 framework (realizing leaders, challengers, and followers)

Software Defined Networking Market Channel Analysis

- Channel/distribution partners/alliances for tier-1 vendors and application-specific products being build towards the customer end of the value chain

1 Introduction

1.1 Key Take-aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Points

1.5.2 Data Triangulation and Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary

2.1 Abstract

2.2 Overall Market Size

3 Market Overview

3.1 Market Definition

3.2 Market Evolution

3.3 Business/Application/Cloud Orchestration

3.4 Path Computation Element (PCE)

3.5 Openflow

3.6 Market Segmentation

3.7 Market Dynamics

3.7.1 Drivers

3.7.2 Restraints

3.7.3 Opportunities

3.8 Impact Analysis of DRO

3.9 Value Chain

3.10 SDN Ecosystem

4 MEA Software Defined Networking (SDN): Technology Trends, Standards, Business Model and Adoption Factors

4.1 Introduction

4.2 Technologies and Platforms

4.2.1 Recent Trends

4.2.2 Deep Packet Inspection (DPI)

4.2.3 Geographic Load Balancing

4.2.4 Power Management

4.2.5 Cloud Management

4.2.6 Software Applications

4.3 Standards

4.3.1 Data Center Bridging (DCB)

4.3.1.1 Priority Flow Control (PFC) 802.1qbb

4.3.1.2 Congestion Management (802.1qau)

4.3.1.3 Bandwidth Management (802.1qaz)

4.3.1.4 Data Center Bridging Exchange (CBX)

4.3.2 Fiber Channel Over Ethernet (FCOE)

4.3.3 Network Virtualization Using Generic Routing Encapsulation (NVGRE)

4.3.4 Shortest Path Bridging (Spb)

4.3.5 Transparent Interconnection of Lots of Links (TRILL)

4.3.6 Virtual Ethernet Port Aggregator (VEPA)

4.3.7 Multiprotocol Label Switching (MPLS)

4.3.8 Virtual Extensible Local Area Network (VXLAN)

4.4 Business Model

4.4.1 Business Model: Now

4.4.1.1 Manual Process-Driven Approach

4.4.1.2 Network Functionality At A Virtual Layer

4.4.1.3 Device Centricity

4.4.1.4 Openflow-Driven Approach

4.4.1.5 Critical Success Factors

4.4.2 Business Model: in The Future

4.4.2.1 Enterprise Data Center Networks Approach

4.4.2.2 Hyper-Scale Cloud Networking

4.4.2.3 SDN: A Function of Software Development

4.4.2.4 Collaboration With Virtual Networking Frameworks

4.4.2.5 Virtual Networking Leadership

4.5 SDN-Adoption Factors

4.5.1 Academia and Open Source Communities

4.5.1.1 Opendaylight

4.5.1.2 Opencontrail

4.5.1.3 Open Network Operating System (ONOS)

4.5.1.4 Floodlight

4.5.1.5 Nodeflow

4.5.1.6 Mininet

4.5.1.7 Snabb Switch

4.5.1.8 Openvswitch

4.5.1.9 Pantou

4.5.1.10 Nox

4.5.1.11 Pox

4.5.1.12 Jaxon

4.5.1.13 Routeflow

4.5.1.14 Flowvisor

4.5.1.15 Flowscale

4.5.2 Early Standardization

4.5.3 SDN Is A Solution Sell, Not A Box Sell

4.5.4 SDN Overcomes The “Rip and Replace” Strategy

4.5.5 Role of Var

4.6 Technology and Market Roadmap

4.6.1 SDN Inevitable

4.6.2 Functionality To Openflow Controllers

4.6.3 Revolutionizing Network Utilization

4.6.4 Transitioning For Competitive Advantage

4.6.5 Enterprise Commercialization

5 MEA SDN Market Size, Analysis and Forecast By Solution

5.1 Introduction

5.2 SDN Switching

5.2.1 Overview

5.2.2 Markets Size and Forecast

5.2.3 Market Size & Forecast By Countries

5.3 SDN Controllers

5.3.1 Overview

5.3.2 Market Size & Forecast

5.3.3 Market Size and Forecast By Countries

5.4 Cloud Virtualization Applications

5.4.1 Overview

5.4.2 Market Size and Forecast

5.4.3 Market Size & Forecast By Countries

5.5 Network Virtualization Security

5.5.1 Overview

5.5.2 Market Size and Forecast

5.5.3 Market Size & Forecast By Countries

6 MEA SDN: Market Analysis and Forecast By End Users

6.1 Introduction

6.2 Telecommunications Providers

6.2.1 Overview

6.2.2 Market Size and Forecast

6.2.3 Market Size & Forecast By Countries

6.3 Cloud Service Providers

6.3.1 Overview

6.3.2 Market Size and Forecast

6.3.3 Market Size & Forecast By Countries

6.4 Enterprises

6.4.1 Overview

6.4.2 Market Size and Forecast

6.4.3 Market Size & Forecast By Countries

7 MEA SDN: Market Analysis and Forecast By Countries

7.1 Introduction

7.2 Parfait Chart

7.3 KSA

7.3.1 Overview

7.3.2 Market Size and Forecast

7.3.3 Market Size & Forecast By End-User

7.3.4 Market Size and Forecast By Solutions

7.4 UAE

7.4.1 Overview

7.4.2 Market Size and Forecast

7.4.3 Market Size and Forecast By End-Users

7.4.4 Market Size and Forecast By Solutions

7.5 Rest of MEA

7.5.1 Overview

7.5.2 Market Size and Forecast

7.5.3 Market Size & Forecast By End-Users

7.5.4 Market Size and Forecast By Solutions

8 MEA SDN: Competitive Landscape

8.1 Competitive Landscape

8.2 Ecosystem and Roles

8.2.1 Portfolio Comparison

8.3 End-User Landscape

8.3.1 Market Opportunity Analysis

8.3.2 End-User Analysis

8.3.2.1 The Global Networking Is Expected to Reach $50 Billion By 2019

8.3.2.2 The Smartphone Market Will Experience Immense Growth By 2019 and Is Expected to Reach $9.3 Billion Driven By Byod Trend

8.3.2.3 Cloud Computing Market Is Expected to Reach $480 Billion By 2019 Driving The Demand For SDN Solutions

9 Company Profiles

9.1 AT&T Inc.

9.1.1 Introduction

9.1.2 Products & Services

9.1.3 Strategies & Insights

9.1.4 New Developments

9.1.5 MMM View

9.2 Cisco Systems, Inc.

9.2.1 Introduction

9.2.2 Products & Services

9.2.3 Strategies & Insights

9.2.4 New Developments

9.2.5 MMM View

9.3 Dell Inc.

9.3.1 Introduction

9.3.2 Products & Services

9.3.3 Strategies & Insights

9.3.4 New Developments

9.3.5 MMM View

9.4 Hewlett-Packard Company

9.4.1 Introduction

9.4.2 Products & Services

9.4.3 Strategies & Insights

9.4.4 New Developments

9.4.5 MMM View

9.5 Ibm

9.5.1 Introduction

9.5.2 Products & Services

9.5.3 Strategies & Insights

9.5.4 New Developments

9.5.5 MMM View

9.6 Intel Corporation

9.6.1 Introduction

9.6.2 Products & Services

9.6.3 Strategies & Insights

9.6.4 New Developments

9.6.5 MMM View

9.7 Juniper Networks

9.7.1 Introduction

9.7.2 Products & Services

9.7.3 Strategies & Insights

9.7.4 New Developments

9.7.5 MMM View

9.8 Nec Corporation

9.8.1 Introduction

9.8.2 Products & Services

9.8.3 Strategies & Insights

9.8.4 New Developments

9.8.5 MMM View

9.9 Pica8 Inc.

9.9.1 Introduction

9.9.2 Products & Services

9.9.3 Strategies & Insights

9.9.4 New Developments

9.9.5 MMM View

9.10 Plexxi, Inc.

9.10.1 Introduction

9.10.2 Products & Services

9.10.3 Strategies & Insights

9.10.4 New Developments

9.10.5 MMM View

9.11 Alcatel-Lucent

9.11.1 Introduction

9.11.2 Products & Services

9.11.3 Strategies & Insights

9.11.4 New Developments

9.11.5 MMM View

10 Appendix

10.1 Venture Capital (VC) Funding

10.2 Merger & Acquisitions (M&A)

List of Tables

Table 1 Forecast Assumptions

Table 2 Global SDN Market Size, 2014-2019 ($Million)

Table 3 MEA SDN Market, By Solutions, 2014 – 2019 ($Million)

Table 4 MEA SDN Market, By Solutions, 2014 – 2019 (Y-O-Y %)

Table 5 MEA SDN: Switching Market, 2014-2019 ($Million, Y-O-Y %)

Table 6 MEA SDN: Switching Market, By Countries, 2014 – 2019 ($Million)

Table 7 MEA SDN: Switching Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 8 MEA SDN: Controllers Market, 2014-2019 ($Million, Y-O-Y %)

Table 9 MEA SDN: Controllers Market, By Countries, 2014 – 2019 ($Million)

Table 10 MEA SDN: Controllers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 11 MEA SDN: Cloud Virtualization Application Market, 2014-2019 ($Million, Y-O-Y %)

Table 12 MEA SDN: Cloud Virtualization Applications Market, By Countries, 2014 – 2019 ($Million)

Table 13 MEA SDN: Cloud Virtualization Applications Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 14 MEA SDN: Network Virtualization Security Market, 2014-2019 ($Million, Y-O-Y %)

Table 15 MEA SDN: Network Virtualization Security Market, By Countries, 2014 – 2019 ($Million)

Table 16 MEA SDN: Network Virtualization Security Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 17 MEA SDN Market, By End-Users, 2014 – 2019 ($Million)

Table 18 MEA SDN Market, By End-Users, 2014 – 2019 (Y-O-Y %)

Table 19 MEA SDN: Telecommunications Provider Market, 2014-2019 ($ Million, Y-O-Y %)

Table 20 MEA SDN: Telecom Providers Market, By Countries, 2014 – 2019 ($Million)

Table 21 MEA SDN: Telecom Providers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 22 MEA SDN: Cloud Service Providers Market, 2014-2019 ($ Million, Y-O-Y %)

Table 23 MEA SDN: Cloud Service Providers Market, By Countries, 2014 – 2019 ($Million)

Table 24 MEA SDN: Cloud Service Providers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 25 MEA SDN: Enterprise Data Center Market, 2014-2019 ($ Million, Y-O-Y %)

Table 26 MEA SDN: Enterprise Data Centers Market, By Countries, 2014 – 2019 ($Million)

Table 27 MEA SDN: Enterprise Data Centers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 28 MEA SDN Market Revenue By Countries, 2014 – 2019 ($Million)

Table 29 MEA SDN Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 30 MEA SDN: MEA Market, 2014-2019 ($Million, Y-O-Y %)

Table 31 MEA SDN: MEA Market, By End-Users, 2014 – 2019 ($Million)

Table 32 MEA SDN: MEA Market, By End-Users, 2014 – 2019 (Y-O-Y %)

Table 33 MEA SDN: MEA Market, By Solutions, 2014 – 2019 ($Million)

Table 34 MEA SDN: MEA Market, By Solutions, 2014 – 2019 (Y-O-Y %)

Table 35 MEA SDN Competitive Ecosystem

Table 36 MEA SDN: Venture Capital (VC) Funding

Table 37 MEA SDN: Mergers and Acquisitions (M&A)

List of Figures

Figure 1 Secondary and Primary Research

Figure 2 Data Triangulation and Market Forecasting

Figure 3 Global SDN Market Size, 2014-2019 ($Million)

Figure 4 MEA SDN Market Evolution

Figure 5 SDN Market Segmentation

Figure 6 Impact Analysis of DRO on MEA SDN Market

Figure 7 MEA SDN: Value Chain

Figure 8 Aster*X Controller Design For The Main Control Logic

Figure 9 Google SDN Wan History

Figure 10 MEA SDN Market, By Solutions, 2014 – 2019 (Y-O-Y %)

Figure 11 MEA SDN: Switching Market, 2014-2019 ($Million, Y-O-Y %)

Figure 12 MEA SDN: Switching Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 13 MEA SDN: Controllers Market, 2014-2019 ($Million, Y-O-Y %)

Figure 14 MEA SDN: Controllers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 15 MEA SDN: Cloud Virtualization Application Market, 2014-2019 ($Million, Y-O-Y %)

Figure 16 MEA SDN: Cloud Virtualization Applications Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 17 MEA SDN: Network Virtualization Security Market, 2014-2019 ($Million, Y-O-Y %)

Figure 18 MEA SDN: Network Virtualization Security Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 19 MEA SDN Market, By End-Users, 2014 – 2019 (Y-O-Y %)

Figure 20 MEA SDN: Telecommunications Provider Market, 2014-2019 ($Million, Y-O-Y %)

Figure 21 MEA SDN: Telecom Providers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 22 MEA SDN: Cloud Service Providers Market, 2014-2019 ($Million, Y-O-Y %)

Figure 23 MEA SDN: Cloud Service Providers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 24 MEA SDN: Enterprise Data Center Market, 2014-2019 ($Million, Y-O-Y %)

Figure 25 MEA SDN: Enterprise Data Centers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 26 MEA SDN Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 27 MEA SDN Market: Parfait Chart

Figure 28 MEA SDN: MEA Market, 2014-2019 ($Million, Y-O-Y %)

Figure 29 MEA SDN: MEA Market, By End-Users, 2014 – 2019 (Y-O-Y %)

Figure 30 MEA SDN: MEA Market, By Solutions, 2014 – 2019 (Y-O-Y %)

Figure 31 MEA SDN: Portfolio Comparison

Figure 32 MEA SDN: Market Opportunity Plot

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement