Malaysia Biopesticides Market Research Report By Type (Bioinsecticides, Biofungicides, Bioherbicides, Bionematicides), By Origin (Microbial, Biochemicals, Beneficial Insects), By Mode of Application, By Crop Type and By Region – Forecast to 2021

The Malaysia biopesticides market is projected to reach USD 5.95 million by 2021, at a CAGR of 13.2% from 2016 to 2021. The market has been segmented based on type, origin, mode of application, crop type, and region. The objective of the study is to provide detailed information about the key factors, such as drivers, restraints, opportunities, and industry-specific challenges that may influence the growth of the market; strategically profile key players; and comprehensively analyze their market share and core competencies. The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2021

- Forecast period – 2016 to 2021

This report includes estimation of market sizes for value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the Malaysia biopesticides market and various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in Malaysia has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

Breakdown of primary interviews

The major raw materials for the production for biopesticides are microorganisms derived from plants and animals. Biopesticides products usually have a low shelf life, and therefore efficient supply chain management plays an important role in delivering products to the customers and contributes to the growth of the biopesticides market.

“To know about assumptions considered for this research report, download the pdf brochure.”

Target audience:

- Suppliers

- R&D institutes

- Technology providers

- biopesticide manufacturers/suppliers

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users

- Retailers

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the report

This research report categorizes the Malaysia biopesticide market based on type, origin, mode of application, crop type, and region.

On the basis of type, the market has been segmented as follows:

- Bioinsecticides

- Biofungicides

- Bioherbicides

- Bionematicides

On the basis of origin, the market has been segmented as follows:

- Microbial

- Fungi

- Bacteria

- Virus

- Nematodes

- Others (algae, protozoa, and other microbes)

- Beneficial insects

- Biochemical

On the basis of mode of application, the market has been segmented as follows:

- Seed treatment

- Soil treatment

- Foliar spray

- Others (post harvest & chemigation)

On the basis of crop type, the market has been segmented as follows:

- Field crops

- Fruits

- Vegetables

- Plantation crops

- Others (grasses, flower, and spice crops)

On the basis of region, the market has been segmented as follows:

- Peninsular Malaysia

- East Malaysia

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions

2.4.1 Assumptions of the Research Study

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in Malaysian Biopesticides Market

4.2 Malaysian Biopesticides Market Across Different Segments

4.3 Biopesticides Market Potential

5 Market Overview

5.1 Introduction

5.2 Evolution of Biopesticides

5.3 Market Segmentation

5.3.1 by Type

5.3.2 by Mode of Application

5.3.3 by Crop Type

5.3.4 by Origin

5.3.5 by Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Implementation of Integrated Pest Management

5.4.1.2 Easier Residue Management

5.4.1.3 Lower Cost of Research & Development

5.4.1.4 Labor and Harvest Flexibility

5.4.1.5 Growing Market for Organic Products

5.4.2 Restraints

5.4.2.1 Barriers in Adoption of Biopesticides

5.4.2.2 Erratic Availability of Biopesticides

5.4.3 Opportunities

5.4.3.1 Rapid Growth in Biocontrol Seed Treatment Solutions

5.4.3.2 Use of Plant Essential Oil-Based Insecticides in Organic Agriculture

5.4.4 Challenges

5.4.4.1 Variable Efficacy and Low Shelf Life

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Malaysian Biopesticides Market: Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of Substitutes

6.4.4 Threat of New Entrants

6.4.5 Intensity of Competitive Rivalry

7 Malaysian Biopesticides Market, by Type

7.1 Introduction

7.2 Bioinsecticides

7.3 Biofungicides

7.4 Bioherbicides

7.5 Bionematicides

8 Malaysian Biopesticides Market, by Origin

8.1 Introduction

8.2 Microbial Pesticides

8.2.1 Bacteria

8.2.2 Fungi

8.2.3 Virus

8.2.4 Nematodes

8.3 Beneficial Insects

8.4 Biochemical

9 Malaysian Biopesticides Market, by Mode of Application

9.1 Introduction

9.2 Foliar Spray

9.3 Seed Treatment

9.4 Soil Treatment

9.5 Others

10 Malaysian Biopesticides Market, by Crop Type

10.1 Introduction

10.2 Plantation Crops

10.3 Field Crops

10.4 Fruits

10.5 Vegetables

10.6 Others

11 Malaysian Biopesticides Market, by Region

11.1 Introduction

11.1.1 Evolution of Agriculture in Malaysia

11.1.2 Regulatory Framework

11.2 Peninsular Malaysia

11.3 East Malaysia

12 Competitive Landscape

12.1 Overview

12.2 Competitive Situation & Trends

12.2.1 Expansions & Investments

12.2.2 Mergers & Acquisitions

12.2.3 New Product Launches

12.2.4 Agreements, Partnerships & Collaborations

13 Company Profiles

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.1 Introduction

13.2 Basf Se

13.3 Syngenta

13.4 Bayer Cropscience Ag

13.5 Monsanto Company

13.6 Imaspro Corporation Bhd

13.7 Valent Biosciences Corporation

13.8 Emery Oleochemicals

13.9 Aef Global

13.1 Power Biotechnologies

13.11 Koppert B.V.

*Details On Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

14 Appendix

14.1 Discussion Guide

14.2 Introducing Rt: Real Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

14.4.1 Rt Snapshot

List of Tables

Table 1 Malaysia: Biopesticides Market Size, by Type, 2014-2021 (USD Thousand)

Table 2 Biopesticides Market Size, by Origin, 2014-2021 (USD Thousand)

Table 3 Malaysia: Microbial Biopesticides Market Size, by Type, 2014-2021 (USD Thousand)

Table 4 Malaysia: Biopesticides Market Size, by Mode of Application, 2014–2021 (USD Thousand)

Table 5 Biopesticides Market Size, by Crop Type, 2014-2021 (USD Thousand)

Table 6 Export-Import of Agricultural Commodities in Malaysia (USD Million)

Table 7 Biopesticides Market Size, by Region, 2014-2021 (USD Thousand)

Table 8 Peninsular Malaysia: Biopesticides Market Size, by Type, 2014-2021 (USD Thousand)

Table 9 Peninsular Malaysia: Biopesticides Market Size, by Crop Type, 2014-2021 (USD Thousand)

Table 10 East Malaysia: Biopesticides Market Size, by Type, 2014-2021 (USD Thousand)

Table 11 East Malaysia: Biopesticides Market Size, by Crop Type, 2014-2021 (USD Thousand)

Table 12 Expansions & Investments, 2011–2016

Table 13 Mergers & Acquisitions, 2011–2016

Table 14 New Product Launches, 2011–2016

Table 15 Agreements, Partnerships & Collaborations, 2011–2016

List of Figures

Figure 1 Malaysian Biopesticides Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Bioinsecticides to Lead the Malaysian Biopesticides Market by Value, 2015, (USD Thousand)

Figure 6 Microbial Segment Expected to Dominate The Malaysian Biopesticides Market 2015, (USD Thousand)

Figure 7 Malaysian Biopesticides Market Size, by Mode of Application, 2016-2021

Figure 8 Malaysian Biopesticides Market Size, by Crop Type, 2016 Vs. 2021 (USD Thousand)

Figure 9 Malaysian Biopesticides Market Projected to Reach USD 5,946.8 Thousand by 2021

Figure 10 Bioinsecticides to Account for Major Share in Malaysian Biopesticides Market in 2016

Figure 11 Plantation Segment to Lead The Malaysian Biopesticides Market in Terms of Value, From 2016 to 2021

Figure 12 Seed Treatment Segment Is Projected to Grow At The Highest Cagr in The Malaysian Biopesticides Market, From 2016 to 2021

Figure 13 Biopesticides Market Evolution and Milestones Chart

Figure 14 Malaysian Biopesticides Market: Ecosystem

Figure 15 Malaysian Biopesticides Market: Value Chain

Figure 16 Malaysian Biopesticides Market: Supply Chain

Figure 17 Malaysian Biopesticides Market: Porter’s Five Forces Analysis

Figure 18 Malaysian Biopesticides Market, by Type, 2016 Vs. 2021 (USD Thousand)

Figure 19 Biopesticides Market Size, by Origin, 2016 Vs. 2021 (USD Thousand)

Figure 20 Malaysia: Microbial Biopesticides Market Size, by Type, 2016 Vs. 2021 (USD Thousand)

Figure 21 Foliar Spray Application to Dominate The Malaysian Biopesticides Market Through 2021 (USD Thousand)

Figure 22 Crop Production in Malaysia, by Crop Type, 2013 (Kt)

Figure 23 Biopesticides Market, by Crop Type, 2016 Vs. 2021 (USD Thousand)

Figure 24 Key Plantation Crops in Malaysia, by Area Harvested, 2004-2013 (‘000 Ha)

Figure 25 Key Field Crops in Malaysia, by Area Harvested, 2004-2013 (‘000 Ha)

Figure 26 Key Fruit Crops in Malaysia, by Area Harvested, 2004-2013 (‘000 Ha)

Figure 27 Key Vegetable Crops in Malaysia, by Area Harvested, 2004-2013 (‘000 Ha)

Figure 28 Other Crops in Malaysia, by Area Harvested, 2004-2013 (Ha)

Figure 29 Export of Crude and Refined Palm Oil From Malaysia, 2010-2015 (Kt)

Figure 30 Regulatory Structure of Malaysia for Biopesticides Usage and Trade

Figure 31 Pests and Their Registered Biopesticides in Malaysia

Figure 32 Malaysian Biopesticides Market, by Region, 2016 Vs. 2021 (USD Thousand)

Figure 33 Peninsular Malaysian Biopesticides Market, by Type, 2016 Vs. 2021 (USD Thousand)

Figure 34 Peninsular Malaysian Biopesticides Market, by Crop Type, 2016 Vs. 2021 (USD Thousand)

Figure 35 East Malaysian Biopesticides Market, by Type, 2016 Vs. 2021 (USD Thousand)

Figure 36 East Malaysian Biopesticides Market, by Crop Type, 2016 Vs. 2021 (USD Thousand)

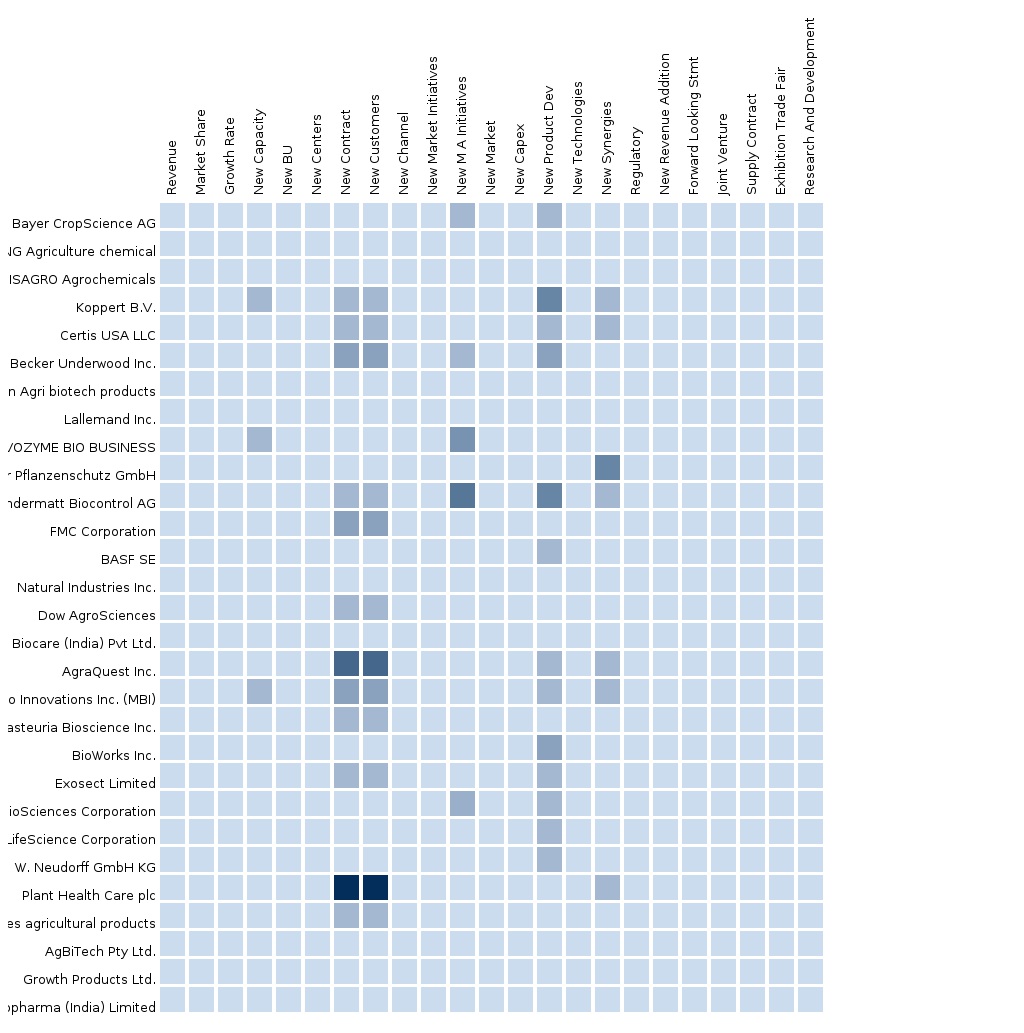

Figure 37 Companies Adopted Agreements, Partnerships & Collaborations As Key Growth Strategies Between 2011 & 2016

Figure 38 Battle for Market Share

Figure 39 Basf Se: Company Snapshot

Figure 40 Syngenta: Company Snapshot

Figure 41 Syngenta: Swot Analysis

Figure 42 Bayer Cropscience Ag: Business Overview

Figure 43 Monsanto Company: Company Snapshot

Figure 44 Monsanto Company: Swot Analysis

Figure 45 Imaspro Corporation Bhd: Company Snapshot

Figure 46 Imaspro Corporation Bhd: Swot Analysis

Figure 47 Valent Bioscience Corporation: Business Overview

Figure 48 Emery Oleochemicals: Company Snapshot

Figure 49 Aef Global: Company Snapshot

Figure 50 Power Biotechnologies: Company Snapshot

Figure 51 Koppert B.V.: Company Snapshot

The Malaysia biopesticides market has witnessed significant growth in the last few years. The market is expected to reach USD 5.95 million by 2021, at a CAGR of around 13.2% from 2016 to 2021. The growth of the market is driven by factors, such as low cost for R&D initiatives, flexibility in labor, and the rising demand for organic products.

The Malaysia biopesticides market, on the basis of type, has been segmented into bioinsecticides, biofungicides, bioherbicides, and bionematicides. The bioinsecticides segment accounted for the largest market share in 2015, as bioinsecticides are the most commonly used type of biopesticides in Malaysia for pest and insect control.

The Malaysia biopesticides market, based on mode of application, has been segmented into seed treatment, soil treatment, foliar sprays, and others. The others segment consists of post harvest mode of applications. The foliar spray segment accounted for the largest share of the Malaysia biopesticides market in 2015. Foliar sprays are easy to use and are effective in the terms of destroying a large number of unwanted grasses, herbs, and shrubs.

MALAYSIA BIOPESTICIDES MARKET, BY REGION, 2021 (USD MILLION)

Source: Experts’ Interviews and MicroMarketMonitor Analysis

Barriers in the adoption of biopesticides, and low awareness regarding the benefits of biopesticides are some of the factors that may restrain the growth of the market. Chemical pesticides are cheaper than biopesticides; thus, it is difficult for small companies to develop marketing programs, educate the masses, and conduct field trials. On the other hand, the farmers are more accustomed to using traditional chemical pesticides. Since different biopesticides have different application procedures and benefits, the awareness among farmers about the advantages of biopesticides is low, which may also limit its adoption in the coming years.

The Malaysia biopesticides market is characterized by high competition, due to the presence of a number of large- and small-scale firms. New product launches, expansions, and mergers & acquisitions are the key strategies adopted by these players to achieve growth in the market. The key players operational in the market are BASF SE (Germany), Syngenta (Switzerland), Monsanto Company (U.S.), Bayer CropScience AG (Germany), and Valent Bioscience Corporation (U.S.) Emery Oleochemicals (Malaysia), AEF Global (Canada), Power Biotechnologies (Malaysia), and Koppert B.V. (The Netherlands), and Imaspro Corporation Bhd (Malaysia), and Imaspro Corporation Bhd (Malaysia).

To speak to our analyst for a discussion on the above findings, please fill up the required details by clicking on the Speak to Analyst tab.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Agriculture Biologicals Market Biologicals-Europe and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Asia-Pacific Agriculture Biologicals Market Biologicals-Asia and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Latin America Agriculture Biologicals Market Biologicals-Latin America and Agriculture Biopesticides Market, Bio... |

Apr 2015 |

|

North America Agriculture Biologicals Market The North America agriculture biologicals market was valued at $1,409.07 million in 2014 and is projected to reach $2,758.24 million by 2019 at a CAGR of 14.4% during the forecast period. The market, by application is led by cereals and grains in 2014. In North America, U.S. has the largest share in the agriculture biologicals market. It constitutes of 72.47% of North America agriculture biologicals market. The biopesticides are mostly consumed in North America than other biological types. |

May 2015 |