Europe Orthobiologics Market by Product (Bone Graft Substitutes, Bone Allografts, Bone Growth Factors & Spinal Stimulation, Stem Cell Therapy, Viscosupplementation), by End-User, by Geography - Analysis & Forecast to 2019

The report analyzes the European orthobiologics market by product, end-user, and country. On the basis of product, the market is segmented into bone graft substitutes, bone allografts, bone growth factor and spinal stimulation, stem cell therapy, and viscosupplementation. Based on end-user, the market has been segmented into hospitals, orthopedic clinics, and other end-users.

Germany is the largest contributor to the European orthobiologics market, due to the rising awareness levels of the benefits of orthobiologics and the changing preference from mechanical implants to biological implants.

Increasing awareness among people owing to the benefits associated with orthobiologics include faster bone healing, reduction in the number of hospital visits, and faster recovery. There is increased awareness among people with respect to the technological advancements in this field. Product launches is also driving the growth of the market. For instance; in February 2012, Zimmer, Inc. announced the launch of Chondrofix Osteochondral Allograft, a product that helps treat osteochondral lesions using a single stage process. The product helps company to expand its musculoskeletal range of products.

In-depth market share analysis, by revenue, of the top companies is also included in the report. These numbers are arrived at, based on key facts, annual financial information from SEC filings, annual reports and interviews with industry experts, key opinion leaders such as CEOs, directors, and marketing executives. In addition, the report also profiled key players of the market on various parameters such as business overview, financial overview, product portfolio, business strategies and recent developments of the respective company. Some of the key market players of the European orthobiologics market include Biomet, Inc. (U.S.), Medtronic, Plc. (U.S.), Integra Life Sciences Corporation (U.S.)., Stryker Corporation (U.S.), Zimmer, Inc. (U.S.), DePuy Synthes (U.S.), Tornier, Inc. (Netherlands), NuVasive, Inc. (U.S.), Exactech, Inc. (U.S.), Globus Medical, Inc. (U.S.), and Wright Medical Technology, Inc. (U.S.).

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Orthobiologics Market

2.2 Arriving at the Orthobiologics Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 European Orthobiologics Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 European Orthobiologics Market, By Product (Page No. - 27)

5.1 Introduction

5.2 European Orthobiologics Market, Product Comparison With Orthopedic Devices Market

5.3 Europe Bone Graft Substitutes Market, By Country

5.4 Europe Bone Allografts Market, By Country

5.5 Europe Bone Growth Factor & Spinal Stimulation Market, By Country

5.6 Europe Stem Cell Therapy Market, By Country

5.7 Europe Viscosupplementation Market, By Country

6 European Orthobiologics Market, By End-User (Page No. - 36)

6.1 Introduction

6.2 Europe: Orthobiologics Market in Hospitals, By Country

6.3 Europe: Orthobiologics Market in Orthopedic Clinics, By Country

6.4 Europe: Orthobiologics Market in Other End-User Market, By Country

7 European Orthobiologics Market, By Country (Page No. - 41)

7.1 Introduction

7.2 Germany Orthobiologics Market

7.2.1 Germany Orthobiologics Market, By Product

7.2.2 Germany Orthobiologics Market, By End-User

7.3 France Orthobiologics Market

7.3.1 France Orthobiologics Market, By Product

7.3.2 France Orthobiologics Market, By End-User

7.4 Italy Orthobiologics Market

7.4.1 Italy Orthobiologics Market, By Product

7.4.2 Italy Orthobiologics Market, By End-User

7.5 Spain Orthobiologics Market

7.5.1 Spain Orthobiologics Market, By Product

7.5.2 Spain Orthobiologics Market, By End-User

7.6 U.K. Orthobiologics Market

7.6.1 U.K.Orthobiologics Market, By Product

7.6.2 U.K. Orthobiologics Market, By End-User

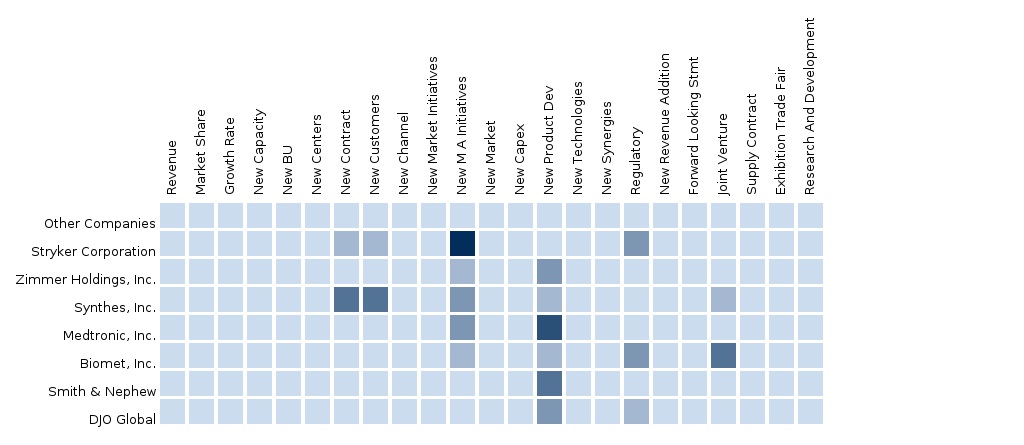

8 European Orthobiologics Market: Competitive Landscape (Page No. - 61)

8.1 Orthobiologics Market: Company Share Analysis

8.2 Company Presence in Orthobiologics Market, By Product

8.3 Mergers & Acquisitions

8.4 New Product Launches

8.5 Expansions

8.6 Agreements

8.7 Other Developments

9 European Orthobiologics Market, By Company (Page No. - 68)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Biomet, Inc.

9.2 Medtronic PLC

9.3 Integra Life Sciences Corporation

9.4 Stryker Corporation

9.5 Zimmer, Inc.

9.6 Depuy Synthes

9.7 Tornier, Inc.

9.8 Nuvasive, Inc.

9.9 Exactech, Inc.

9.10 Globus Medical Inc.

9.11 Wright Medical Technology, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 105)

10.1 Customization Options

10.1.1 Regulatory Framework

10.1.2 Epidemiology Data

10.1.3 Surgeons/Physicians Perception Analysis

10.1.4 Impact Analysis

10.2 Related Reports

10.3 Introducing RT: Real-Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (44 Tables)

Table 1 European Orthobiologics Peer Market Size, 2014 (USD MN)

Table 2 Europe: Orthobiologics Market: Macro Indicator, By Country, 2014

Table 3 Europe: Orthobiologics Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 European Orthobiologics Market: Drivers And Inhibitors

Table 5 European Orthobiologics Market, By Product, 2013 - 2019 (USD MN)

Table 6 Europe: Orthobiologics Market, By Product, 2013 - 2019 (USD MN)

Table 7 Europe: Orthobiologics Market, Product Comparison With Parent Market, 2013–2019 (USD MN)

Table 8 Europe: Bone Graft Substitutes Market, By Country, 2013–2019 (USD MN)

Table 9 Europe: Bone Allografts Market, By Country, 2013 - 2019 (USD MN)

Table 10 Europe: Bone Growth Factor & Spinal Stimulation Market, By Country, 2013 - 2019 (USD MN)

Table 11 Europe: Stem Cell Therapy Market, By Country, 2013 - 2019 (USD MN)

Table 12 Europe: Viscosupplementation Market, By Country, 2013–2019 (USD MN)

Table 13 Europe: Orthobiologics Market Size, By End-User, 2013 - 2019 (USD MN)

Table 14 Europe: Orthobiologics Market in Hospitals, By Country, 2013 - 2019 (USD MN)

Table 15 Europe: Orthobiologics Market in Orthopedic Clinics Market Size, By Country, 2013 - 2019 (USD MN)

Table 16 Europe: Other End-Users Market Size, By Country, 2013 - 2019 (USD MN)

Table 17 Europe: Orthobiologics Market Size, By Country, 2013 - 2019 (USD MN)

Table 18 Germany: Orthobiologics Market Size, By Product, 2013-2019 (USD MN)

Table 19 Germany: Orthobiologics Market Size, By End-User, 2013 - 2019 (USD MN)

Table 20 France: Orthobiologics Market Size, By Product, 2013 - 2019 (USD MN)

Table 21 France: Orthobiologics Market Size, By End-User, 2013 – 2019 (USD MN)

Table 22 Italy: Orthobiologics Market Size, By Product, 2013 - 2019 (USD MN)

Table 23 Italy Orthobiologics Market Size, By End-User, 2013 - 2019 (USD MN)

Table 24 Spain: Orthobiologics Market Size, By Product, 2013 - 2019 (USD MN)

Table 25 Spain: Orthobiologics Market, By End-User, 2013 - 2019 (USD MN)

Table 26 U.K.: Orthobiologics Market Size, By Product, 2013 - 2019 (USD MN)

Table 27 U.K.: Orthobiologics Market, By End-User, 2013 - 2019 (USD MN)

Table 28 Orthobiologics Market: Company Share Analysis, 2013 (%)

Table 29 European Orthobiologics Market: Mergers & Acquisitions

Table 30 European Orthobiologics Market: New Product Launches

Table 31 European Orthobiologics Market: Expansions

Table 32 European Orthobiologics Market: Agreements

Table 33 European Orthobiologics Market: Other Developments

Table 34 Biomet, Inc.: Key Financials, 2011 - 2013 (USD MN)

Table 35 Medtronic, PLC.: Key Financials, 2009 - 2013 (USD MN)

Table 36 Integra Life Sciences Corporation: Key Financials, 2010 - 2013 (USD MN)

Table 37 Stryker Corporation: Key Financials, 2009 - 2013 (USD MN)

Table 38 Zimmer, Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 39 Depuy Synthes: Key Financials, 2011 - 2013 (USD MN)

Table 40 Tornier, Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 41 Nuvasive, Inc.: Key Financials, 2009 – 2013 (USD MN)

Table 42 Exactech, Inc.: Key Financials, 2009 -2013 (USD MN)

Table 43 Globus Medical, Inc.: Key Financials, 2009 -2013 (USD MN)

Table 44 Wright Medical Technology, Inc.: Key Financials, 2011 -2013 (USD MN)

List of Figures (68 Figures)

Figure 1 European Orthobiologics Market: Segmentation & Coverage

Figure 2 Orthobiologics Market: Integrated Ecosystem

Figure 3 Integrated Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach Aging Population 2014

Figure 7 European Orthobiologics Market Snapshot, 2014

Figure 8 European Orthobiologics Products, By Country, 2014 (USD MN)

Figure 9 Europe Orthobiologics Market, By Product, 2013 - 2019 (USD MN)

Figure 10 Europe: Orthobiologics Market: Product Comparison With Orthopedic Devices Market, 2013–2019 (USD MN)

Figure 11 Europe: Bone Graft Substitutes Market, By Country, 2013–2019 (USD MN)

Figure 12 Europe: Bone Allografts Market, By Country, 2013 - 2019 (USD MN)

Figure 13 Europe: Bone Growth Factor & Spinal Stimulation Market, By Country, 2013 - 2019 (USD MN)

Figure 14 Europe: Stem Cell Therapy Market, By Country, 2013 - 2019 (USD MN)

Figure 15 Europe: Viscosupplementation Market, By Country, 2013–2019 (USD MN)

Figure 16 Europe: Orthobiologics Market, By End-User, 2013 - 2019 (USD MN)

Figure 17 Europe: Orthobiologics Market in Hospitals, By Country, 2013 - 2019 (USD MN)

Figure 18 Europe: Orthobiologics Market in Orthopedic Clinics Market, By Country, 2013 - 2019 (USD MN)

Figure 19 Europe: Orthobiologics Market in Other End-User Market, By Country, 2013 - 2019 (USD MN)

Figure 20 Europe: Orthobiologics Market Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 21 Germany Orthobiologics Market Overview, 2014 & 2019 (%)

Figure 22 Germany: Orthobiologics Market, By Product, 2013-2019 (USD MN)

Figure 23 Germany: Orthobiologics Market: Product Snapshot

Figure 24 Germany: Orthobiologics Market, By End-User, 2013 - 2019 (USD MN)

Figure 25 Germany Orthobiologics Market: Product Snapshot

Figure 26 France Orthobiologics Market Overview, 2014 & 2019 (%)

Figure 27 France Orthobiologics Market, By Product, 2013-2019 (USD MN)

Figure 28 France Orthobiologics Market: Product Snapshot

Figure 29 France: Orthobiologics Market, By End-User, 2013 - 2019 (USD MN)

Figure 30 France: Orthobiologics Market Share, By End-User, 2014 & 2019 (%)

Figure 31 Italy Orthobiologics Market Overview, 2014 & 2019 (%)

Figure 32 Italy: Orthobiologics Market, By Product, 2013 - 2019 (USD MN)

Figure 33 Italy: Orthobiologics Market: Product Snapshot

Figure 34 Italy Orthobiologics Market, By End-User, 2013 - 2019 (USD MN)

Figure 35 Italy Orthobiologics Market: End User Snapshot

Figure 36 Spain: Orthobiologics Market Overview, 2014 & 2019 (%)

Figure 37 Spain: Orthobiologics Market, By Product, 2013 - 2019 (USD MN)

Figure 38 Spain: Orthobiologics Market: Product Snapshot

Figure 39 Spain: Orthobiologics Market, By End-User, 2013 - 2019 (USD MN)

Figure 40 Spain: Orthobiologics Market: End-User Snapshot

Figure 41 U.K.: Orthobiologics Market Overview, 2014 & 2019 (%)

Figure 42 U.K.: Orthobiologics Market, By Product, 2013 - 2019 (USD MN)

Figure 43 U.K.: Orthobiologics Market: Product Snapshot

Figure 44 U.K.: Orthobiologics Market, By End-User, 2013 - 2019 (USD MN)

Figure 45 U.K.: Orthobiologics Market: End User Snapshot

Figure 46 Orthobiologics Market: Company Share Analysis, 2013 (%)

Figure 47 Orthobiologics: Company Product Coverage, 2013

Figure 48 Biomet, Inc.: Revenue Mix, 2013 (%)

Figure 49 Contribution of Spine, Bone Healing, & Microfixation Segment Towards Company Revenues, 2011-2013 (USD MN)

Figure 50 Medtronic, PLC. Revenue Mix, 2013 (%)

Figure 51 Contribution of Restorative Therapies Group Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 52 Integra Life Sciences Corporation Revenue Mix, 2013 (%)

Figure 53 Contribution of U.S. Spine and Other Segment Towards Company Revenues, 2010-2013 (USD MN)

Figure 54 Stryker Corporation Revenue Mix, 2013 (%)

Figure 55 Contribution of Neurotechnology and Spine Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 56 Zimmer, Inc.: Revenue Mix, 2013 (%)

Figure 57 Contribution of Surgical And Other Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 58 Depuy Synthes Revenue Mix, 2013 (%)

Figure 59 Tornier, Inc.: Revenue Mix 2013 (%)

Figure 60 Contribution of Extremities Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 61 Nuvasive, Inc.: Revenue Mix 2013 (%)

Figure 62 Contribution of Biologics Segment Towards Company Revenues, 2009 - 2013 (USD MN)

Figure 63 Exactech, Inc.: Revenue Mix 2013 (%)

Figure 64 Contribution of Biologics & Spine Segment Towards Company Revenues, 2009 - 2013 (USD MN)

Figure 65 Globus Medical, Inc.: Revenue Mix 2013 (%)

Figure 66 Contribution of Disruptive Technology Segment Towards Company Revenues, 2009 - 2013 (USD MN)

Figure 67 Wright Medical Technology, Inc.: Revenue Mix 2013 (%)

Figure 68 Contribution of Biologics Segment Towards Company Revenues, 2011 - 2013 (USD MN)

Orthobiologics are defined as the substances of biological origin which facilitate the bone healing process in an efficient manner. The normal bone healing process involves repositioning of the injured or fractured bone surgically or by immobilization of the dislocated bone and waiting for the body’s normal bone healing process to heal the bone and reposition it in its appropriate place. The importance of orthobiologics is highlighted due to the fact that orthobiologics products accelerate the natural bone healing process, thereby ensuring faster bone healing without facing any immunological barriers.

Orthobiologics have started to experience substantial growth since 2012, owing to the rise in the number of osteoarthritis and osteoporosis patients in this region, and technological advancements made in the field of orthobiologics. It acts as an effective alternative to the mechanical bone implants which take relatively longer time to reposition and heal. Orthobiologics involve products that are derived from the patient’s own body. Due to this feature; the healing process get catalyzed and bone healing happens at a faster pace. Also, orthobiologics possess very few disadvantages because of which the demand for these products has been increasing continuously, and is expected grow rapidly in the coming years.

The European orthobiologics market was valued at $1,319.6 million in 2014, and is expected to reach $1,794.3 million by 2019 at a CAGR of 6.3% from 2014 to 2019. The market has been segmented on the basis of product, end-user, and country. On the basis of product, the market is segmented into bone graft substitutes, stem cell therapy, bone allografts, viscosupplementation, and bone growth factor & spinal stimulation. In terms of end-user, the market is segmented into hospitals, orthopedic clinics, and other end-users. Countries such as the Germany, France, Italy, Spain, the U.K., and the Rest of Europe (ROE) are included in the report based on geographical segmentation.

The key players operating in this market are Biomet, Inc. (U.S.), Medtronic, Plc. (U.S.), Integra Life Sciences Corporation (U.S.), Stryker Corporation (U.S.), Zimmer, Inc. (U.S.), DePuy Synthes (U.S.), Tornier, Inc. (Netherlands), NuVasive (U.S.), Exactech, Inc. (U.S.), Globus Medical, Inc. (U.S.), Wright Medical Technology, Inc. (U.S.), and others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia Orthopedics Device Market The report “Asian Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. The main companies operating in Asian Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. ... |

Upcoming |

|

North America Orthopedic Devices The report “North American Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. Both the markets have been witnessing the maximum growth because of increase in patient pool and procedure numbers of hip and knee osteoarthritis and rheumatoid arthritis. The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in North American Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. ... |

Upcoming |

|

Europe Orthopedics Device Market The report “European Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques.The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in European Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. |

Upcoming |