Europe Non-Lethal Weapons Market, by Type (Offensive and Defensive), by Technology (Electromagnetic & Sonic, Kinetic Impact, Chemical Agents), by Application (Police Forces, Special Forces, First Responders), by Country (U.K., Russia, Germany) - Analysis and Forecast to 2019

Non-lethal weapons are specially designed and employed to incapacitate an individual or a vehicle while reducing injury to personnel and damage to property and surrounding. They act as options between verbal warnings or psychological operations and using lethal force. Non-lethal weapons are broadly classified into counter-personnel and counter-material capabilities which are used to control crowds and stop vehicles respectively.

The European non-lethal weapons market was valued at $287.3 million in the year 2013, and is expected to grow at a CAGR of 5.3% during the period 2013-2018. It is projected to reach $372.4 million by the end of 2018. It has been observed that disperse non lethal weapons have the highest market value compared to the other non lethal weapons. Russia has the highest market value of non-lethal weapons among other countries. Rising economic crises and civil unrest are the major drivers the European non lethal weapons market. Training and doctrine limitations are the challenges in the market.

Key players in the market are Alliant Techsystems, BAE Systems, Boeing Defense, Space & Security, Denel Dynamics, Israel Aerospace Industries Ltd., and General Dynamics.

The purpose of the European non-lethal weapons market report is to identify the various products and distribution channels of the European non-lethal weapons market. It contains a deep dive analysis of market segmentation, which comprises sub-sectors and countries. This market is segmented on the basis of sub-sectors, namely non-lethal electrical devices, directed-energy, blunt impact, disperse, and anti-vehicle non-lethal weapons.

The report tracks, analyses, and lays out the market size of the major players spending in the European defense sector. The impact analysis of dynamic forces that are currently driving and restraining the growth of the market are covered in the report. Brief information about industry, market, and technology trends that are currently prevailing in the market are also included.

CUSTOMIZATION OFFERINGS

1.HISTORICAL DATA FOR 5 YEARS

- Financials

- Macro Indicator Data

- M&A data

- Budget and Defense Program Information

2.COMPANY PROFILES

- In-depth analysis of the company’s product portfolio

- Competitive landscape (revenue, operating margin, marginal cost, P/E ratio, EPS, developments/deals/events)

- Ratio analysis

3.REGION-SPECIFIC INFORMATION (North America, Europe, APAC, Middle East and RoW)

This covers market sizing/mapping, global footprint, operation and financials information, and the competitive landscape. The MMM offering will cover a detailed market study of the point(s) mentioned below:

- Country wise international arms transfer, suppliers, and recipients of conventional weapons

4.GLOBAL TRENDS/MARKET ENVIRONMENT

- Product and technological advancements/Latest innovation and development

- Demand and supply analysis

- Market consolidation (M&A, joint ventures, divestment, and spin off)

- Export/Import data

- Industrial production and capacity optimization data

5.GLOBAL FORECAST NUMBERS/OUTLOOK (Historical and Forecast by Year)

- Milicas (Military Aircraft) and Helicas (Military Rotary Wing, i.e., Helicopter)

6.PREDICTIVE FORECASTING

- Time Series

- Regression Analysis

7.DEFENSE PROGRAMS (By Name, Type, User, Spending by year in $ million, Prime contractor, Program status)

Programs Covered

- Aircraft Programs

- Ground Vehicle Programs

- Missile Programs

- Naval Programs

- Vehicle Programs

8.DEFENSE BUDGET/SEQUESTRATION IMPACT

- Impact of sequestration on defense programs

- Programs impacted due to budget cuts

- Impact on company’s overall revenue, operations, and profitability

9.OPPORTUNITY ANALYSIS

A comprehensive analysis to help understand potential growth markets based on parameters like:

- GDP percentage with respect to military expenditure of particular country

- Defense review of countries active in this market

10.PRODUCT ANALYSIS

- Usage pattern (in-depth trend analysis) of products (segment wise)

- Product matrix which gives a detailed comparison of the product portfolio of each company mapped at country and sub-segment level

- End-user adoption rate analysis of the products (segment wise and country wise)

- Comprehensive coverage of product approvals, pipeline products, and product recalls

11.SUPPLY CHAIN/VENDOR ANALYSIS

Coverage - Vendor analysis, vendor financing, self/customer funding, and distribution network

1 Introduction

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology

2.1 Integrated Ecosystem of Non-Lethal Weapons Market

2.2 Arriving At the Non-Lethal Weapons Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary

4 Market Overview

4.1 Introduction

4.2 Non-Lethal Weapons Market: Comparison with Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Non-Lethal Weapons Market, By Application

5.1 Introduction

5.2 Demand Side Analysis

5.3 Non-Lethal Weapons in Police Forces, By Geography

5.4 Non-Lethal Weapons in Special Forces, By Geography

5.5 Non-Lethal Weapons in First Responders, By Geography

6 Non-Lethal Weapons Market, By Type

6.1 Introduction

6.2 Europe: Offensive Non-Lethal Weapons Market, By Type

6.3 Europe: Defensive Non-Lethal Weapons Market, By Type

6.4 Europe Non-Lethal Weapons Market: Direct Contact Weapon, By Type

6.5 Europe Non-Lethal Weapons Market: Directed Energy Weapons, By Type

6.6 Europe Non-Lethal Weapons Market: Personal Protective Equipment Market, By Type

6.7 Europe Direct Contact Weapons Market, By Geography

6.8 Europe Directed Energy Weapons Market, By Geography

6.9 Europe Personal Protective Equipment Market, By Geography

6.10 Europe Surveillance Systems Market, By Geography

7 Non-Lethal Weapons Market, By Technology

7.1 Introduction

7.2 Europe Electromagnetic & Sonic Weapons Market, By Geography

7.3 Europe Kinetic Impact Weapons Market, By Geography

7.4 Europe Chemical Agents Market, By Geography

7.5 Europe Other Weapons Market, By Geography

8 Non-Lethal Weapons Market, By Geography

8.1 U.K. Non-Lethal Weapons Market

8.1.1 U.K. Non-Lethal Weapons Market, By Type

8.1.2 U.K. Non-Lethal Weapons Market, By Application

8.2 Russia Non-Lethal Weapons Market

8.2.1 Russia Non-Lethal Weapons Market, By Type

8.2.2 Russia Non-Lethal Weapons Market, By Application

8.3 Germany Non-Lethal Weapons Market

8.3.1 Germany Non-Lethal Weapons Market, By Type

8.3.2 Germany Non-Lethal Weapons Market, By Application

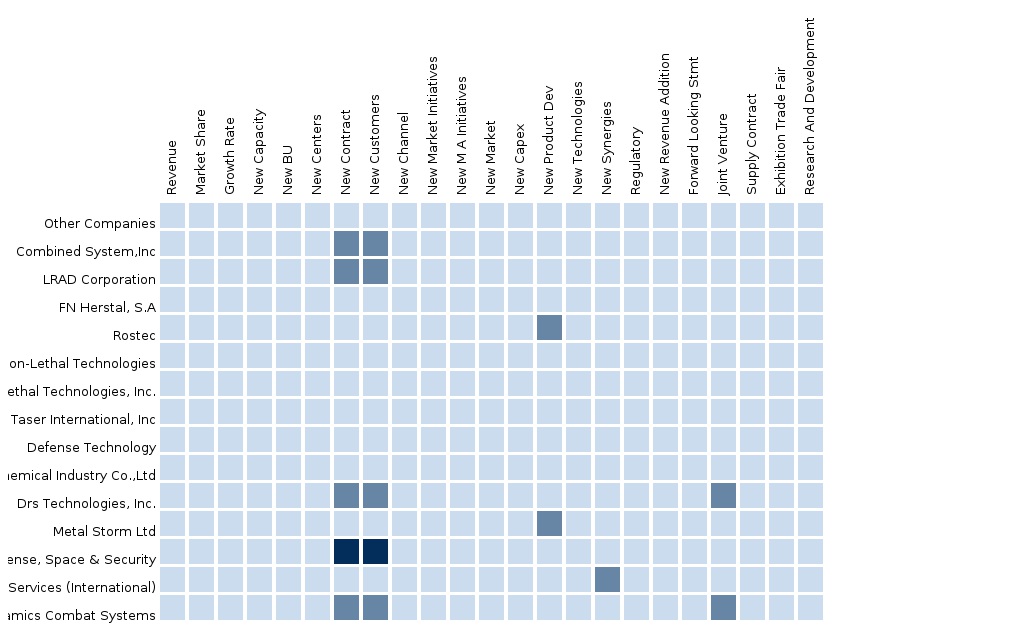

9 Non-Lethal Weapons Market: Competitive Landscape

9.1 Non-Lethal Weapons Market: Company Share Analysis

9.2 Company Presence in Non-Lethal Weapons Market, By Type

9.3 Contracts

9.4 Expansions & Agreements

9.5 New Product Launch

10 Non-Lethal Weapons Market, By Company

10.1 LRAD CORPORATION

10.1.1 Overview

10.1.2 Key Operations Data

10.1.3 Key Financials

10.1.4 Product and Service Offerings

10.1.5 Related Developments

10.1.6 MMM Analysis

10.2 RAYTHEON COMPANY

10.2.1 Overview

10.2.2 Key Operations Data

10.2.3 Key Financials

10.2.4 Product and Service Offerings

10.2.5 Related Developments

10.2.6 MMM Analysis

10.3 BOEING

10.3.1 Overview

10.3.2 Key Operations Data

10.3.3 Key Financials

10.3.4 Product and Service Offerings

10.3.5 Related Developments

10.3.6 MMM Analysis

10.4 BAE SYSTEMS

10.4.1 Overview

10.4.2 Key Operations Data

10.4.3 Key Financials

10.4.4 Product and Service Offerings

10.4.5 Related Developments

10.4.6 MMM Analysis

10.5 GENERAL DYNAMICS SYSTEMS

10.5.1 Overview

10.5.2 Key Operations Data

10.5.3 Key Financials

10.5.4 Product and Service Offerings

10.5.5 Related Developments

10.5.6 MMM Analysis

10.6 SMITH & WESSON HOLDING CORP.

10.6.1 Overview

10.6.2 Key Operations Data

10.6.3 Key Financials

10.6.4 Product and Service Offerings

10.6.5 Related Developments

10.6.6 MMM Analysis

11 Appendix

11.1 Customization Options

11.1.1 Technical Analysis

11.1.2 Weapon Types

11.1.3 Regulatory Framework

11.1.4 Impact Analysis

11.1.5 Historical Data and Trends

11.2 Related Reports

11.2.1 RT Snapshots

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement