Europe Fuel Injection Systems Market By Vehicle Type (Passenger Car, Light Commercial Vehicles & Heavy Commercial Vehicles), By Fuel Type (Gasoline & Diesel), By Country (Germany, U.K., France, Poland, Turkey) - Analysis & Forecast To 2020

The Europe fuel injection systems market is projected to reach USD 18.57 billion by 2020, at a CAGR of 5.9% from 2015 to 2020. Fuel injection is a system comprising various components including fuel pump, injectors, fuel rail, regulators, computers, and sensors. The function of a fuel injection system is to atomize fuel into fine droplets depending on the airflow inside an internal combustion engine. This in turn, helps in optimum utilization of fuel by the engine and responsible for its performance, durability, and stabilizing emission.

Both top-down approach and bottom-up approaches were used to estimate and validate the market size of the fuel injection systems. The process of research started with the collection of secondary data related to key vendors and other markets. The product portfolio of different vendors was also considered to determine market segmentation. The geographical presence of top players in varied regions was traced to understand the geographical market segmentation. To derive the global market numbers, bottom-up approach was employed, whereas, the top-down approach was used to verify and validate these global numbers.

Primary interviews were conducted with market experts, including CEOs, VPs, directors, and executives of top companies. Primary research helped us to understand the market dynamics and strategies governing the decision-making process in top five companies. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and breakdown procedure were applied.

The Europe fuel injection systems ecosystem comprises distributors, component manufacturers, technology providers, and raw material suppliers.

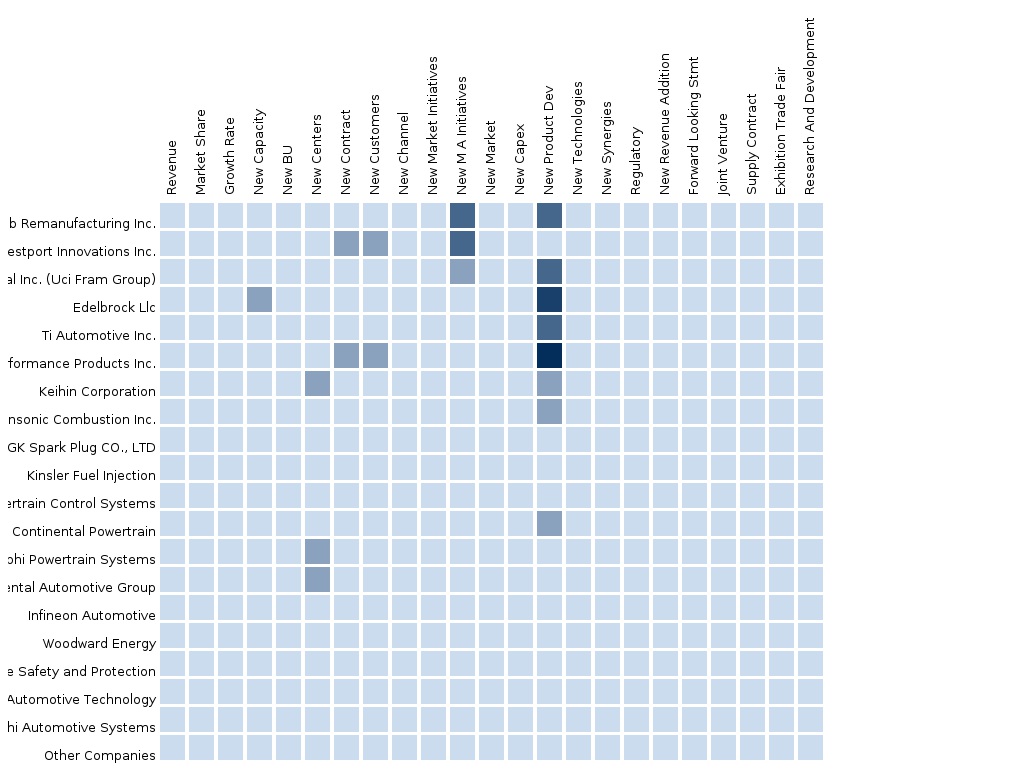

In 2014, the Europe fuel injection systems market was dominated by Continental AG, Delphi Automotive PLC, Denso Corporation, and Robert Bosch GmbH. These market players dominated the Europe fuel injection systems market by developing and launching more innovative products in the market with cooperation and association of various partners give them an advantage over other players in the market.

To know about the assumptions considered for the study, Download the PDF Brochure.

Scope of the Report

This research report categorizes the Europe fuel injection systems market into the following segments and subsegments:

I. Europe Fuel Injection Systems Market Size and Forecast, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

II. Europe Fuel Injection Systems Market Size and Forecast, By Fuel Type

- Gasoline

- Diesel

III. Europe Fuel Injection Systems Market Size and Forecast, by Region

- Germany

- France

- U.K.

- Turkey

- Poland

- Rest of Europe

Related Titles

1. Asia Pacific Fuel Injection Systems Market By Engine Type (Gasoline, Diesel), by Application (Passenger Car, LCV, HCV), by Geography (China, Japan, India, & South Korea) - Analysis and Forecast to 2019

http://www.micromarketmonitor.com/market/asia-pacific-fuel-injection-systems-4165763167.html

2. North America Fuel Injection System Market By Engine Type (Gasoline, Diesel), by Vehicle Type (Passenger Car, LCV, HCV), and by Geography (U.S., Canada, Mexico) - Analysis and Forecast to 2019

http://www.micromarketmonitor.com/market/north-america-fuel-injection-systems-8072986521.html

1..... Introduction

1.1 Objectives Of Study

1.2 Market Segmentation And Coverage

1.2.1 Years Considered In The Report

1.3 Stakeholders

2..... Research Methodology

2.1 Integrated Ecosystem Of Fuel Injection Systems

2.2 Arriving At The Europe Fuel Injection Systems Market Size

2.2.1 Top Down Approach

2.2.2 Bottom Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3..... Executive Summary

4..... Market Overview

4.1 Introduction

4.2 Europe Fuel Injection Systems Market

4.3 Market Drivers And Restraints

5..... Europe Fuel Injection Systems Market, By Vehicle Type

5.1 Introduction

5.2 Europe Fuel Injection Systems Market In Passenger Cars

5.3 Europe Fuel Injection Systems Market In Light Commercial Vehicles

5.4 Europe Fuel Injection Systems Market In Heavy Commercial Vehicles

6..... Europe Fuel Injection Systems Market, By Fuel Type

6.1 Introduction

6.2 Europe Fuel Injection Systems Market In Diesel

6.3 Europe Fuel Injection Systems Market In Gasoline

7..... Europe Fuel Injection Systems Market, By Geography

7.1 Introduction

7.2 Germany Fuel Injection Systems Market

7.2.1 Germany Fuel Injection Systems Market, By Vehicle Type

7.2.2 Germany Fuel Injection Systems Market, By Fuel Type

7.3 France Fuel Injection Systems Market

7.3.1 France Fuel Injection Systems Market, By Vehicle Type

7.3.2 France Fuel Injection Systems Market, By Fuel Type

7.4 U.K. Fuel Injection Systems Market

7.4.1 U.K. Fuel Injection Systems Market, By Vehicle Type

7.4.2 U.K. Fuel Injection Systems Market, By Fuel Type

7.5 Turkey Fuel Injection Systems Market

7.5.1 Turkey Fuel Injection Systems Market, By Vehicle Type

7.5.2 Turkey Fuel Injection Systems Market, By Fuel Type

7.6 Poland Fuel Injection Systems Market

7.6.1 Poland Fuel Injection Systems Market, By Vehicle Type

7.6.2 Poland Fuel Injection Systems Market, By Fuel Type

7.7 Rest Of Europe Fuel Injection Systems Market

7.7.1 Rest Of Europe Fuel Injection Systems Market,By Vehicle Type

7.7.2 Rest Of Europe Fuel Injection Systems Market, By Fuel Type

8..... Europe Fuel Injection Systems Market: Competitive Landscape

8.1 Mergers, Acquisitions & Joint Ventures

8.2 Expansions

8.3 Partnerships & Agreements

8.4 New Product Launches

9..... Europe Fuel Injection Systems Market, By Company

9.1 Continental Ag

9.1.1 Overview

9.1.2 Key Financials

9.1.3 Product Offerings

9.1.4 Related Developments

9.1.5 Mmm View

9.2 Delphi Automotive Plc

9.2.1 Overview

9.2.2 Key Financials

9.2.3 Product Offerings

9.2.4 Related Developments

9.2.5 Mmm View

9.3 Denso Corporation

9.3.1 Overview

9.3.2 Key Financials

9.3.3 Product Offerings

9.3.4 Related Developments

9.3.5 Mmm View

9.4 Robert Bosch Gmbh

9.4.1 Overview

9.4.2 Key Financials

9.4.3 Products Offerings

9.4.4 Recent Developments

9.4.5 Mmm View

9.5 Infineon Technologies Ag

9.5.1 Overview

9.5.2 Key Financials

9.5.3 Product Offerings

9.5.4 Related Developments

9.6 Keihin Corporation

9.6.1 Overview

9.6.2 Key Financials

9.6.3 Product Offerings

9.6.4 Related Developments

9.6.5 Mmm View

9.7 Magneti Marelli S.P.A.

9.7.1 Overview

9.7.2 Key Financials

9.7.3 Product Offerings

9.7.4 Related Developments

9.7.5 Mmm View

9.8 Ti Automotive

9.8.1 Overview

9.8.2 Key Financials

9.8.3 Product Offerings

9.8.4 Related Developments

9.8.5 Mmm View

10... Appendix0

10.1 Customization Options0

10.1.1 Europe Fuel Injection Systems Market Vehicle Type Matrix0

10.1.2 Europe Fuel Injection Systems Market Competitive Benchmarking0

10.1.3 Europe Fuel Injection Systems Market Vendor Landscaping0

10.1.4 Europe Fuel Injection Systems Market Data Tracker0

10.1.5 Europe Fuel Injection Systems Market Emerging Vendor Landscape0

10.1.6 Europe Fuel Injection Systems Market Channel Analysis0

10.2 Introducing Rt: Real Time Market Intelligence1

10.3 Related Reports2

List Of Tables

Uu

Table 1 Global Fuel Injection System Peer Market Size, 2014 (Usd Mn)

Table 2 European Fuel Injection Systems Market: Vehicle Production Statistics,

By Geography, 2013 & 2014 (Units)

Table 3 Europe Fuel Injection Systems Market, 2013–2020 (Usd Bn)

Table 4 Europe Fuel Injection Systems Market, 2013–2020 (Mn Units)

Table 5 Europe Fuel Injection Systems Market: Drivers And Restraints

Table 6 Europe Fuel Injection Systems Market, By Vehicle Type,

2013-2020 (Usd Million)

Table 7 Europe Fuel Injection Systems Market, By Vehicle Type,

2013-2020 (‘000 Units)

Table 8 Europe Fuel Injection Systems Market In Passenger Cars,

By Geography, 2013-2020 (Usd Million)

Table 9 Europe Fuel Injection Systems Market In Passenger Cars,

By Geography, 2013-2020 (‘000 Units)

Table 10 Europe Fuel Injection Systems Market In Light Commercial Vehicles,

By Geography, 2013-2020 (Usd Million)

Table 11 Europe Fuel Injection Systems Market In Light Commercial Vehicles,

By Geography, 2013-2020 (‘000 Units)

Table 12 Europe Fuel Injection Systems Market In Heavy Commercial Vehicles,

By Geography, 2013-2020 (Usd Million)

Table 13 Europe Fuel Injection Systems Market In Heavy Commercial Vehicles,

By Geography, 2013-2020 (‘000 Units)

Table 14 Europe Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Million)

Table 15 Europe Fuel Injection Systems Market, By Fuel Type, 2013-2020 (‘000 Units)

Table 16 Europe Fuel Injection Systems Market In Diesel, By Geography,

2013-2020 (Usd Million)

Table 17 Europe Fuel Injection Systems Market In Diesel, By Geography,

2013-2020 (‘000 Units)

Table 18 Europe Fuel Injection Systems Market In Gasoline, By Geography,

2013-2020 (Usd Million)

Table 19 Europe Fuel Injection Systems Market In Gasoline, By Geography,

2013-2020 (‘000 Units)

Table 20 Europe Fuel Injection Systems Market, By Geography, 2013-2020 (Usd Mn)

Table 21 Europe Fuel Injection Systems Market, By Geography, 2013-2020 (‘000 Units)

Table 22 Germany Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Table 23 Germany Fuel Injection Systems Market, By Vehicle Type,

2013-2020 (‘000 Units)

Table 24 Germany Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Table 25 Germany Fuel Injection Systems Market, By Fuel Type, 2013-2020 (‘000 Units)

Table 26 France Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Table 27 France Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (‘000 Units)

Table 28 France Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Table 29 France Fuel Injection Systems Market, By Fuel Type, 2013-2020 (‘000 Units)

Table 30 U.K. Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Table 31 U.K. Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (‘000 Units)

Table 32 U.K. Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Table 33 U.K. Fuel Injection Systems Market, By Fuel Type, 2013-2020 (‘000 Units)

Table 34 Turkey Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Table 35 Turkey Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (‘000 Units)

Table 36 Turkey Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Table 37 Turkey Fuel Injection Systems Market, By Fuel Type, 2013-2020 (‘000 Units)

Table 38 Poland Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Table 39 Poland Fuel Injection Systems Market, By Vehicle Type,

2013-2020 (‘000 Units)

Table 40 Poland Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Table 41 \Poland Fuel Injection Systems Market, By Fuel Type, 2013-2020 (‘000 Units)

Table 42 Rest Of Europe Fuel Injection Systems Market, By Vehicle Type,

2013-2020 (Usd Mn)

Table 43 Rest Of Europe Fuel Injection Systems Market, By Vehicle Type,

2013-2020 (‘000 Units)

Table 44 Rest Of Europe Fuel Injection Systems Market, By Fuel Type,

2013-2020 (Usd Mn)

Table 45 Rest Of Europe Fuel Injection Systems Market, By Fuel Type,

2013-2020 (‘000 Units)

Table 46 Europe Fuel Injection Systems Market: Mergers, Acquisitions & Joint Ventures

Table 47 Europe Fuel Injection Systems Market: Expansions

Table 48 Europe Fuel Injection Systems Market: Partnerships & Agreements

Table 49 Europe Fuel Injection Systems Market: New Product Launches

Table 50 Continental Ag: Key Financials, 2011-2014 (Usd Mn)

Table 51 Continental Ag: Revenue, By Geography, 2011-2014 (Usd Mn)

Table 52 Continental Ag: Key Financials, By Business Segment, 2011-2014 (Usd Mn)

Table 53 Delphi Automotive Plc: Key Financials,2011-2014 (Usd Mn)

Table 54 Delphi Automotive Plc: Revenue, By Region, 2011-2014 (Usd Mn)

Table 55 Delphi Automotive Plc: Key Financials, By Business Segment,

2011-2014 (Usd Mn)

Table 56 Denso Corporation: Key Financials, 2011-2014 (Usd Million)

Table 57 Denso Corporation: Revenue, By Geography, 2011-2014 (Usd Million)

Table 58 Robert Bosch Gmbh: Key Financials, 2012-2014 (Usd Million)

Table 59 Robert Bosch Gmbh: Revenue, By Geography, 2012–2014 (Usd Million)

Table 60 Robert Bosch Gmbh: Key Financials, By Business Segment,

2012-2014 (Usd Million)

Table 61 Infineon Technologies Ag: Key Financials, 2011-2014 (Usd Million)

Table 62 Infineon Technologies Ag: Revenue, By Geography, 2011–2014 (Usd Million)

Table 63 Infineon Technologies Ag: Key Financials, By Business Segment,

2011-2014 (Usd Million)

Table 64 Keihin Corporation: Key Financials, 2011– 2014 (Usd Million)

Table 65 Keihin Corporation: Revenue, By Geography, 2011–2014 (Usd Million)

Table 66 Keihin Corporation: Key Financials, By Business Segment,

2011-2014 (Usd Million)

Table 67 Magneti Marelli S.P.A: Key Financials, 2011-2014 (Usd Million)

List Of Figures

Figure 1 Europe Fuel Injection Systems Market: Segmentation & Coverage

Figure 2 Fuel Injection Systems Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 Europe Fuel Injection Systems Market: Value Snapshot

Figure 8 Europe Fuel Injection Systems Market: Volume Snapshot

Figure 9 Europe Fuel Injection Systems Market, 2015-2020 (Usd Mn)

Figure 10 Europe Fuel Injection Systems Market, 2015-2020 (‘000 Units)

Figure 11 Europe Fuel Injection Systems Market: Drivers And Restraints

Figure 12 Europe Fuel Injection Systems Market, By Vehicle Type,

2015 & 2020 (Usd Million)

Figure 13 Europe Fuel Injection Systems Market In Passenger Cars,

By Geography, 2013-2020 (Usd Million)

Figure 14 Europe Fuel Injection Systems Market In Light Commercial Vehicles,

By Geography, 2013-2020 (Usd Million)

Figure 15 Europe Fuel Injection Systems Market In Heavy Commercial Vehicles,

By Geography, 2013-2020 (Usd Million)

Figure 16 Europe Fuel Injection Systems Market, By Fuel Type,

2015 & 2020 (Usd Million)

Figure 17 Europe Fuel Injection Systems Market In Diesel, By Geography,

2013-2020 (Usd Million)

Figure 18 Europe Fuel Injection Systems Market In Gasoline, By Geography,

2013-2020 (Usd Million)

Figure 19 Europe Fuel Injection Systems Market: Growth Analysis,

By Geography, 2015 & 2020 (Usd Mn)

Figure 20 Germany Fuel Injection Systems Market Overview, 2015 & 2020 (%)

Figure 21 Germany Fuel Injection Systems Market, By Vehicle Type,

2013-2020 (Usd Mn)

Figure 22 Germany Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Figure 23 France Fuel Injection Systems Market Overview, 2015 & 2020 (%)

Figure 24 France Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Figure 25 France Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Figure 26 U.K. Fuel Injection Systems Market Overview, 2015 & 2020 (%)

Figure 27 U.K. Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Figure 28 U.K. Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Figure 29 Turkey Fuel Injection Systems Market Overview, 2015 & 2020 (%)

Figure 30 Turkey Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Figure 31 Turkey Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Figure 32 Poland Fuel Injection Systems Market Overview, 2015 & 2020 (%)

Figure 33 Poland Fuel Injection Systems Market, By Vehicle Type, 2013-2020 (Usd Mn)

Figure 34 Poland Fuel Injection Systems Market, By Fuel Type, 2013-2020 (Usd Mn)

Figure 35 Rest Of Europe Fuel Injection Systems Market Overview, 2015 & 2020 (%)

Figure 36 Rest Of Europe Fuel Injection Systems Market, By Vehicle Type,

2013-2020 (Usd Mn)

Figure 37 Rest Of Europe Fuel Injection Systems Market, By Fuel Type,

2013-2020 (Usd Mn)

Figure 38 Continental Ag: Revenue Mix, 2014 (%)

Figure 39 Delphi Automotive Plc: Revenue Mix, 2014 (%)

Figure 40 Denso Corporation: Revenue Mix, 2014 (%)

Figure 41 Robert Bosch Gmbh: Revenue Mix, 2014 (%)

Figure 42 Infineon Technologies Ag: Revenue Mix, 2014 (%)

Figure 43 Keihin Corporation: Revenue Mix, 2014 (%)

Figure 44 Magneti Marelli S.P.A: Revenue Mix, 2013 (%)

The Europe fuel injection systems market is expected to reach USD 18.57 billion by 2020, at a CAGR of 5.9% from 2015 to 2020. The automotive industry has witnessed radical changes in terms of structure, technology, and safety of vehicles as well as environment. Various type of fuel injection systems is one such milestone achieved by the industry, which has helped the OEMs to deal with the key issues of fuel economy, power, and tail-pipe emissions.

The rising demand of vehicles, coupled with engine capacity expansion and upgradations by OEMs has driven the demand for fuel-efficient and environment friendly vehicles. Also, in order to lower down the consumption of fuels and reduce pollutant emission such as carbon monoxide (CO) and sulfur dioxide (SO2), vehicles need be more fuel-efficient.

Furthermore, environmentalists are continuously stressing on the issue of ozone layer depletion due to excessive emission of harmful gases. In regard to this, several countries are focused on regulating the existing emission norms to control air pollution. Also, in order to adhere to the stringent emission standards, automobile manufacturers have started to refine its exhaust and fuel injection systems. Automobile companies are investing significantly in R&D activities to undergo technological advancements in the field of fuel injection. As a result, OEMs are focusing on manufacturing fuel-efficient and environmentally clean vehicles. This has resulted a significant increase in the demand for fuel injection systems and expected to witness exponentially growth in the coming years, due to its efficiency to maintain emission stability and increase performance of the engine.

Europe is the global leader in terms of diesel vehicles production, and has implemented legislations and norms, which demand cleaner emissions and higher fuel efficiency from automobiles. In Europe, the diesel segment is estimated to hold largest share, and projected to grow at a significant pace during the forecast period. However, the light commercial vehicles segment is likely to grow at the highest CAGR from 2015 to 2020. The growth is attributed to the demand for new commercial vehicles registration.

Also, there are various other challenges faced by automobile manufactures on the global and economic front. In the recent years, Europe witnessed a slump in production following the economic debt crisis and increasing competition from emerging markets such as Asia-Oceania and RoW.

Major players operating in the Europe fuel injection systems market include Continental AG, Delphi Automotive LLC, Denso Corporation, Robert Bosch GmbH, Infineon Technology AG, Keihin Corporation, Magneti Marelli S.p.A., and others.

Speak to our expert analyst for a discussion on the above findings, Click Speak to Analyst !

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement