Europe Commercial Flight Management System Market by Cockpit Architecture (VLA, WBA, NBA, & RTA), By Hardware Type (VDU, CDU, & FMC), By Geography (U.K., France, Germany, and Russia) - Analysis & Forecast to 2019

In this report, the European commercial flight management system market has been broadly classified on the basis of cockpit architecture, hardware type, and geography. According to cockpit architecture, the market is categorized into narrow body aircraft, wide body aircraft, very large aircraft, and regional transport aircraft.

The wide body aircraft segment in the commercial flight management system is expected to be the fastest growing segment progressing at a CAGR of 7.4% from 2014 to 2019. Factors such as rise in aircraft deliveries, increasing passenger traffic, and need for better fuel efficiency are driving the growth of this market.

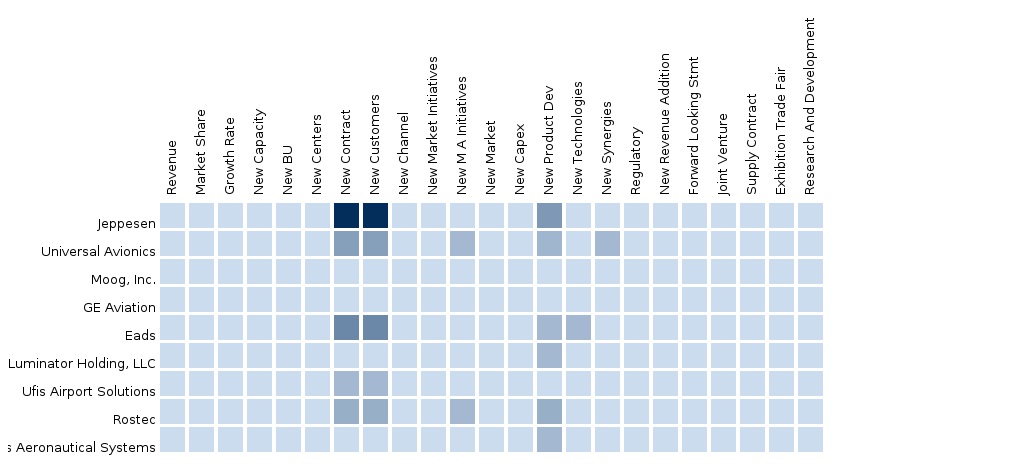

The European commercial flight management system market is a competitive market that is dominated by numerous players. Leading players of this market include Thales Group, Honeywell international Inc., and General Electric Company among others. New product launches, agreements, contracts, and joint ventures are major strategies adopted by these players to enhance their position in the Europe commercial flight management system market.

Reasons to Buy the Report:

From an insight perspective, this research report has focused on various levels of analysis—industry analysis (industry trends and PEST analysis), market share analysis of top players, supply chain analysis, and company profiles, which together provide the basic views on the competitive landscape, emerging and high-growth segments of the aircraft commercial flight management system market, high-growth countries & their respective regulatory policies, government initiatives, and market drivers, restraints, and opportunities.

The report will enrich both the established firms as well as new entrants/smaller firms to gauge the pulse of the market. Firms that purchase the report could use any one or a combination of five strategies that include market penetration, product development/innovation, market development, market diversification, and competitive assessment to strengthen their market share.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on commercial flight management system offered by leading market players

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the commercial flight management system market

- Market Development: Comprehensive information on emerging markets. The report analyzes the commercial flight management system market at regional as well as country level

- Market Diversification: Exhaustive information of new products, untapped geographies, recent developments, and investments in the commercial flight management system market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and manufacturing capabilities of leading players in the commercial flight management system market

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology

2.1 Integrated Ecosystem of Commercial Flight Management Systems Market

2.2 Arriving at the Commercial Flight Management Systems Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro-Indicator-Based Approach

2.3 Assumptions

3 Executive Summary

4 Market Overview

4.1 Introduction

4.2 Commercial Flight Management System Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Europe Commercial Flight Management System, By Cockpit Architecture

5.1 Introduction

5.2 Demand Side Analysis

5.3 Europe Commercial Flight Management System Market in Narrow Body Aircraft, By Geography

5.4 Europe Commercial Flight Management System Market in Wide Body Aircraft, By Geography

5.5 Europe Commercial Flight Management System Market in Very Large Aircraft, By Geography

5.6 Europe Commercial Flight Management System Market in Regional Transport Aircraft, By Geography

5.7 Sneak View: Europe Commercial Flight Management System Market, By Cockpit Architecture

6 Europe Commercial Flight Management System Market, By Hardware Type

6.1 Introduction

6.2 Europe Commercial Flight Management System Market, By Hardware Type

6.3 Europe Commercial Flight Management System Market, Type Comparison With Navigation System Market

6.4 Europe Flight Management System Market in Flight Management Computer, By Geography

6.5 Europe Flight Management System Market in Computer Display Unit, By Geography

6.6 Europe Flight Management System Market in Visual Display Unit, By Geography

6.7 Sneak View: Europe Commercial Flight Management System Market, By Hardware Type

7 Europe Commercial Flight Management System Market, By Geography

7.1 Introduction

7.2 U.K. Commercial Flight Management System Market

7.2.1 U.K. Commercial Flight Management System Market, By Cockpit Architecture

7.2.2 U.K. Commercial Flight Management System Market, By Hardware Type

7.3 France Commercial Flight Management System Market

7.3.1 France Commercial Flight Management System Market, By Cockpit Architecture

7.3.2 France Commercial Flight Management System Market, By Hardware Type

7.4 Germany Commercial Flight Management System Market

7.4.1 Germany Commercial Flight Management System Market, By Cockpit Architecture

7.4.2 Germany Commercial Flight Management System Market, By Hardware Type

7.5 Russia Commercial Flight Management System Market

7.5.1 Russia Commercial Flight Management System Market, By Cockpit Architecture

7.5.2 Russia Commercial Flight Management System Market, By Hardware & Type

8 Europe Commercial Flight Management System Market: Competitive Landscape

8.1 Europe Commercial Flight Management System Market: Company Market Share Analysis

8.2 Company Presence in Europe Commercial Flight Management System Market, By Type

8.3 Contracts

8.4 Joint Ventures

8.5 Agreements

8.6 New Product Launches

9 Commercial Flight Management Systems Market, By Company

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Rockwell Collins, Inc.

9.2 Thales Group S.A.

9.3 Honeywell International, Inc.

9.4 General Electric Co.

9.5 Esterline Technologies Corporation

9.6 Universal Avionics Systems Corporation

9.7 Garmin Limited

9.8 Lufthansa Group

9.9 Navtech, Inc.

*Details On Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

10 Appendix

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 Impact Analysis

10.1.5 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshot

List of Tables (50 Tables)

Table 1 Global Commercial Flight Management Systems Peer Market Size, 2014 (USD MN)

Table 2 Europe Commercial Flight Management System Market, By Aircraft Deliveries, 2014 (Units)

Table 3 Europe Commercial Flight Management Systems Market: Macro Indicators, By Geography, 2014 (%)

Table 4 Europe Commercial Flight Management System Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 Europe Commercial Flight Management System Market: Drivers and Inhibitors

Table 6 Europe Commercial Flight Management System Market, By Cockpit Architecture, 2013 - 2019 (USD MN)

Table 7 Europe Commercial Flight Management System Market, By Hardware, 2013 - 2019 (USD MN)

Table 8 Europe Commercial Flight Management System Market, By Geography, 2013 - 2019 (USD MN)

Table 9 Europe Commercial Flight Management System Market:Aircraft Deliveries, 2013 - 2019 (Absolute Units)

Table 10 Europe Commercial Flight Management System Market, By Cockpit Architecture, 2013 - 2019 (USD MN)

Table 11 Specification of Aircraft Types

Table 12 Europe Aircraft Deliveries and Fms Demand, 2014-2019 (Absolute Units)

Table 13 Europe Aircraft Deliveries Market Share, By Aircraft Type, 2014 (%)

Table 14 Europe Commercial Flight Management System Market in Narrow Body Aircraft, By Geography, 2013 - 2019 (USD MN)

Table 15 Europe Commercial Flight Management System Market in Wide Body Aircraft, By Geography, 2013 - 2019 (USD MN)

Table 16 Europe Commercial Flight Management System Market in Very Large Aircraft, By Geography, 2013 - 2019 (USD MN)

Table 17 Europe Commercial Flight Management System Market in Regional Transport Aircraft, By Geography, 2013 - 2019 (USD MN)

Table 18 Europe Commercial Flight Management System Market, By Hardware Type, 2013-2019 (USD MN)

Table 19 Europe Commercial Flight Management System Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 20 Europe Commercial Flight Management Computer Market, By Geography, 2013–2019 (USD MN)

Table 21 Europe Computer Display Unit Market, By Geography, 2013-2019 (USD MN)

Table 22 Europe Visual Display Unit Market, By Geography, 2013-2019 (USD MN)

Table 23 Europe Commercial Flight Management System Market, By Geography, 2013-2019 (USD MN)

Table 24 U.K. Commercial Flight Management System Market, By Cockpit Architecture, 2013-2019 (USD MN)

Table 25 U.K. Commercial Flight Management System Market, By Hardware Type, 2013-2019 (USD MN)

Table 26 France Commercial Flight Management System Market, By Cockpit Architecture, 2013-2019 (USD MN)

Table 27 France Commercial Flight Management System Market, By Hardware Type, 2013-2019 (USD MN)

Table 28 Germany Commercial Flight Management System Market, By Cockpit Architecture, 2013-2019 (USD MN)

Table 29 Germany Commercial Flight Management System Market, By Hardware Type, 2013-2019 (USD MN)

Table 30 Russia Commercial Flight Management System Market, By Cockpit Architecture, 2013-2019 (USD MN)

Table 31 Russia Commercial Flight Management System Market, By Hardware Type, 2013-2019 (USD MN)

Table 32 Europe Commercial Flight Management System Market: Company Market Share Analysis, 2013 (%)

Table 33 Europe Commercial Flight Management System Market: Contracts

Table 34 Europe Commercial Flight Management System Market: Joint Ventures

Table 35 Europe Commercial Flight Management System Market: Agreements

Table 36 Europe Commercial Flight Management System Market: New Product Launches

Table 37 Rockwell Collins: Key Operations Data, 2010 - 2014 (USD MN)

Table 38 Rockwell Collins, Inc.: Key Financials, 2010 - 2014 (USD MN)

Table 39 Thales Group S.A.: Key Operations Data, 2009 - 2013 (USD MN)

Table 40 Thales Group Sa.: Key Financials, 2009 - 2013 (USD MN)

Table 41 Honeywell International Inc.: Key Operations Data, 2010 - 2014 (USD MN)

Table 42 Honeywell International Inc.: Key Financials, 2010 - 2014 (USD MN)

Table 43 General Electric Co.: Key Operations Data, 2009 - 2013 (USD MN)

Table 44 General Electric Co.: Key Financials, 2009 - 2013 (USD MN)

Table 45 Esterline Technologies Corp.: Key Operations Data, 2010 - 2014 (USD MN)

Table 46 Esterline Technologies Corp.: Key Financials, 2010 - 2014 (USD MN)

Table 47 Garmin Limited: Key Operations Data, 2010 - 2014 (USD MN)

Table 48 Garmin Limited: Key Financials, 2010 - 2014 (USD MN)

Table 49 Lufthansa Group: Key Operations Data, 2009 - 2013 (USD MN)

Table 50 Lufthansa Group: Key Financials, 2009 - 2013 (USD MN)

List of Figures (60 Figures)

Figure 1 Europe Commercial Flight Management Systems Market: Segmentation & Coverage

Figure 2 Commercial Flight Management Systems Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro-Indicator-Based Approach

Figure 8 Europe Commercial Flight Management System Market Snapshot, 2014

Figure 9 Commercial Flight Management System: Growth Aspects

Figure 10 Commercial Flight Management System Market: Comparison With Parent Market 2013-2019 (USD MN)

Figure 11 Europe Commercial Flight Management System Market, By Cockpit Architecture, 2014 vs 2019 (USD MN)

Figure 12 Europe Commercial Flight Management System Market, By Hardware, By Geography, 2014 (USD MN)

Figure 13 Europe Commercial Flight Management System Market: Demand Side Analysis, 2013- 2019 (Absolute Units)

Figure 14 Europe Commercial Flight Management System Market, By Cockpit Architecture, 2014 V/S 2019 (USD MN)

Figure 15 Europe Commercial Flight Management System Demand , 2014-2019 (Absolute Units)

Figure 16 Europe Commercial Flight Management System Market in Narrow Body Aircraft, By Geography, 2013 - 2019 (USD MN)

Figure 17 Europe Commercial Flight Management System Market in Wide Body Aircraft, By Geography, 2013 - 2019 (USD MN)

Figure 18 Europe Commercial Flight Management System Market in Very Large Aircraft, By Geography, 2013 - 2019 (USD MN)

Figure 19 Europe Commercial Flight Management System Market in Regional Transport Aircraft, By Geography, 2013 - 2019 (USD MN)

Figure 20 Sneak View: Europe Flight Management System Market, 2014

Figure 21 Europe Commercial Flight Management System Market, By Hardware Type, 2014 V/S 2019 (USD MN)

Figure 22 Europe Commercial Flight Management System Market, By Hardware Type, 2013-2019 (USD MN)

Figure 23 Europe Commercial Flight Management System Market: Type Comparison With Navigation System Market 2013-2019 (USD MN)

Figure 24 Europe of Flight Management System Market in Flight Management Computer, By Geography, 2013–2019 (USD MN)

Figure 25 Europe Flight Management System Market in Computer Display Unit, By Geography, 2013–2019 (USD MN)

Figure 26 Europe Flight Management System Market in Visual Display Unit, By Geography, 2013–2019 (USD MN)

Figure 27 Europe Commercial Flight Management System Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 28 U.K. Commercial Flight Management System Market Overview, 2014 V/S 2019 (%)

Figure 29 U.K. Commercial Flight Management System Market, By Cockpit Architecture, 2013-2019 (USD MN)

Figure 30 U.K. Commercial Flight Management System Market: Cockpit Architecture Type Snapshot

Figure 31 U.K. Commercial Flight Management System Market, By Hardware, 2013-2019 (USD MN)

Figure 32 U.K. Commercial Flight Management System Market, By Hardware, 2014 V/S 2019 (%)

Figure 33 France Commercial Flight Management System Market Overview, 2014 V/S 2019 (USD MN)

Figure 34 France Commercial Flight Management System Market, By Cockpit Architecture, 2013-2019 (USD MN)

Figure 35 France Commercial Flight Management System Market: By Cockpit Architecture Snapshot

Figure 36 France Commercial Flight Management System Market, By Hardware Type, 2013-2019 (USD MN)

Figure 37 France Flight Management System Market Share, By Hardware Type, 2014 V/S 2019 (%)

Figure 38 Germany Commercial Flight Management System Market Overview, 2014 V/S 2019 (%)

Figure 39 Germany Commercial Flight Management System Market, By Cockpit Architecture, 2013-2019 (USD MN)

Figure 40 Germany Commercial Flight Management System Market: Cockpit Architecture Type Snapshot

Figure 41 Germany Commercial Flight Management System Market, By Hardware, 2013-2019 (USD MN)

Figure 42 Germany Commercial Flight Management System Market, By Hardware, 2014 V/S 2019 (%)

Figure 43 Russia Commercial Flight Management System Market Overview, 2014 V/S 2019 (USD MN)

Figure 44 Russia Commercial Flight Management System Market, By Cockpit Architecture, 2013-2019 (USD MN)

Figure 45 Russia Commercial Flight Management System Market: By Cockpit Architecture Snapshot

Figure 46 Russia Commercial Flight Management System Market, By Hardware Type, 2013-2019 (USD MN)

Figure 47 Russia Commercial Flight Management System Market Share, By Hardware Type, 2014 V/S 2019 (%)

Figure 48 Europe Commercial Flight Management System Market: Company Market Share Analysis, 2013 (%)

Figure 49 Europe Commercial Flight Management System Market: Company Product Coverage, 2013

Figure 50 Rockwell Collins, Inc. Revenue Mix, 2014 (%)

Figure 51 Thales Group S.A., Revenue Mix, 2013 (%)

Figure 52 Contribution of Aerospace Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 53 Honeywell International Inc., Revenue Mix, 2014(%)

Figure 54 Contribution of Aerospace Segment Towards Company Revenues, 2010-2014 (USD MN)

Figure 55 General Electric Co., Revenue Mix, 2013(%)

Figure 56 Contribution of Aviation Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 57 Esterline Technologies Corporation, Revenue Mix, 2014(%)

Figure 58 Contribution of Avionics and Control Segment Towards Company Revenues, 2010-2014 (USD MN)

Figure 59 Garmin Limited, Revenue Mix, 2014(%)

Figure 60 Lufthansa Group, Revenue Mix, 2014(%)

Flight management system has become a fundamental component of every aircraft’s cockpit, as it serves to be the primary interface for the pilot, which further enables flight planning operations, thereby increasing safety and efficiency. This system includes aeronautical navigation database for controlled flight operations, and also results in increasing fuel and time efficiency by optimizing route plans for any airport, with no costly ground-based infrastructure. The Europe commercial flight management system market was valued at $143.4 million in 2014, and is expected to reach $204.6 million by 2019, at a CAGR of 7.4% from 2014 to 2019.

Factors influencing the overall growth of the commercial flight management system market are increase in aircraft deliveries in both developed and developing nations, need for real-time information sharing and collaboration, and introduction of technologically advanced systems to reduce the fuel burn. However, factors such as slow economic growth, aircraft cancellation orders, and limited data storage capacity are restraining the growth of this market.

The Europe commercial flight management system market is broadly segmented on the basis of cockpit architecture into very large aircraft, narrow body aircraft, wide-body aircraft, and regional transport aircraft. Narrow body aircraft (NBA) segment has occupied the highest market share of 76.1% in 2014, and is projected to reach $156.0 million by 2019, at a CAGR of 7.4% during the forecast period.

The European commercial flight management system market, by hardware is classified into visual display unit, flight management computer, and control display unit. The visual display unit segment accounted for a market share of 39.7% in the European commercial flight management system market. The flight management system is similar to global positioning system (GPS) in devices, with waypoints programmed in between the origin and the destination.

Key players in the Europe commercial flight management system markets include Thales Group (France) Honeywell International Inc. (U.S.), General Electric Company (U.S.), Esterline Technologies Corporation (U.S.), and Rockwell Collins (U.S.), Lufthansa Group (Germany), and Universal Avionics Systems Corporation (U.S.) among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement