Europe Biopesticides Market By Origin (Beneficial Insects, Microbial Pesticides, Biochemical Pesticide), Type (Bioherbicides, Biofungicides, Bioinsecticides, Bionematicides), Application, Crop Type, Formulation, Geography – Forecast to 2020

The biopesticides market in Europe is expected to grow from USD 833.5 million in 2015 to USD 2,117.6 million by 2020, at a CAGR of 20.5% from 2015 to 2020. Rise in the demand for organic products, easier residue management, and innovation in product line have fueled the growth of the market in the recent years. Consumers are have become more vigilant about the usage of harmful chemicals in food production. Agricultural produce with minimal or no chemical application is considered safer for environment and healthier for human consumption. Governments in various European countries, such as Denmark, Sweden, and The Netherlands have mandated for a 50% reduction in the usage of chemical pesticides. Biopesticides help farmers to maintain lower residue limits, as they decompose quickly and leave fewer residues on food and in the environment. Thus, substituting biopesticides with traditional chemical pesticides improves food safety.

The excessive use of chemical pesticides disturbs the texture and physicochemical properties of soil, affects human health, and causes environment hazards. On the other hand, biopesticides are ecofriendly and easy-to-use biochemical pesticides that are made of naturally occurring substances that control pests through non-toxic mechanisms. Biopesticides are the key components of integrated pest management (IPM) programs and are receiving a lot of attention as a means to reduce the consumption of synthetic chemical products that are used to control plant diseases. In agriculture, biopesticides have many benefits in terms of quality and yield. Research and development is needed to develop effective application technologies so that productive biopesticides can be used by farmers.

The research report segments the European biopesticides market based on type, mode of application, crop type, formulation, and origin. Based on type, the market has been divided into bioherbicides, biofungicides, bioinsecticides, bionematicides, and others. Based on mode of application, the market has been segmented into foliar spray, soil treatment, seed treatment, and post-harvest. Furthermore, based on crop type, the biopesticides market in Europe has been divided into fruits & vegetables, and grains & oilseeds, among others. Based on formulation, the market has been segmented into liquid formulation and dry formulation. The market has also been segmented based on origin into microbial pesticides, biochemical pesticides, and beneficial insects. The geographic analysis of the market includes major countries, such as Spain, Italy, France, Germany, and Rest of Europe.

To know about the assumptions considered for the study, Download the PDF Brochure.

EUROPE BIOPESTICIDES MARKET: SEGMENTATION & COVERAGE

Primary research was used to understand the market dynamics and strategies governing decision-making process of the top five companies operational in the Europe biopesticides market. Data triangulation and breakdown procedures were applied to complete the overall market engineering process, and arrive at the exact statistics for all segments and subsegments. Primary interviews were conducted with market experts, including CEOs, VPs, directors, and executives of top companies operational in the market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology

2.1 Integrated Ecosystem of Biopesticides Market

2.2 Arriving at the Europe Biopesticides Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary

4 Market Overview

4.1 Introduction

4.2 Market Drivers and Restraints

5 Europe Biopesticides Market, By Application

5.1 Introduction

5.2 Europe Biopesticides Market in Foliar Spray, By Geography

5.3 Europe Biopesticides Market in Soil Treatment, By Geography

5.4 Europe Biopesticides in Seed Treatment, By Geography

5.5 Europe Biopesticides in Post-Harvest, By Geography

6 Europe Biopesticides Market, By Type

6.1 Introduction

6.2 Europe Bioinsecticides Market

6.3 Europe Bioherbicides Market

6.4 Europe Biofungicides Market

6.5 Europe Bionematicides Market

6.6 Europe Biopesticides Other Type Market

7 Europe Biopesticides Market, By Crop Type

7.1 Introduction

7.2 Europe Fruits & Vegetables Market

7.3 Europe Grains & Oilseeds Market

7.4 Europe Other Crop Type Market

8 Europe Biopesticides Market, By Formulation

8.1 Introduction

8.2 Europe Liquid Formulation Market

8.3 Europe Dry Formulation Market

9 Europe Biopesticides Market, By Origin

9.1 Introduction

9.2 Europe Microbial Pesticides Market

9.3 Europe Biochemical Pesticides Market

9.4 Europe Beneficial Insects Market

10 Europe Biopesticides Market, By Geography

10.1 Introduction

10.2 Spain Biopesticides Market

10.2.1 Spain Biopesticides Market, By Type

10.2.2 Spain Biopesticides Market, By Application

10.2.3 Spain Biopesticides Market, By Crop Type

10.2.4 Spain Biopesticides Market, By Formulation

10.2.5 Spain Biopesticides Market, By Origin

10.3 Italy Biopesticides Market

10.3.1 Italy Biopesticides Market, By Type

10.3.2 Italy Biopesticides Market, By Application

10.3.3 Italy Biopesticides Market, By Crop Type

10.3.4 Italy Biopesticides Market, By Formulation

10.3.5 Italy Biopesticides Market, By Origin

10.4 France Biopesticides Market

10.4.1 France Biopesticides Market, By Type

10.4.2 France Biopesticides Market, By Application

10.4.3 France Biopesticides Market, By Crop Type

10.4.4 France Biopesticides Market, By Formulation

10.4.5 France Biopesticides Market, By Origin

10.5 Germany Biopesticides Market

10.5.1 Germany Biopesticides Market, By Type

10.5.2 Germany Biopesticides Market, By Application

10.5.3 Germany Biopesticides Market, By Crop Type

10.5.4 Germany Biopesticides Market, By Formulation

10.5.5 Germany Biopesticides Market, By Origin

10.6 Rest of the Europe Biopesticides Market

10.6.1 Rest of the Europe Biopesticides Market, By Type

10.6.2 Rest of the Europe Biopesticides Market, By Application

10.6.3 Rest of the Europe Biopesticides Market, By Crop Type

10.6.4 Rest of the Europe Biopesticides Market, By Formulation

10.6.5 Rest of the Europe Biopesticides Market, By Origin

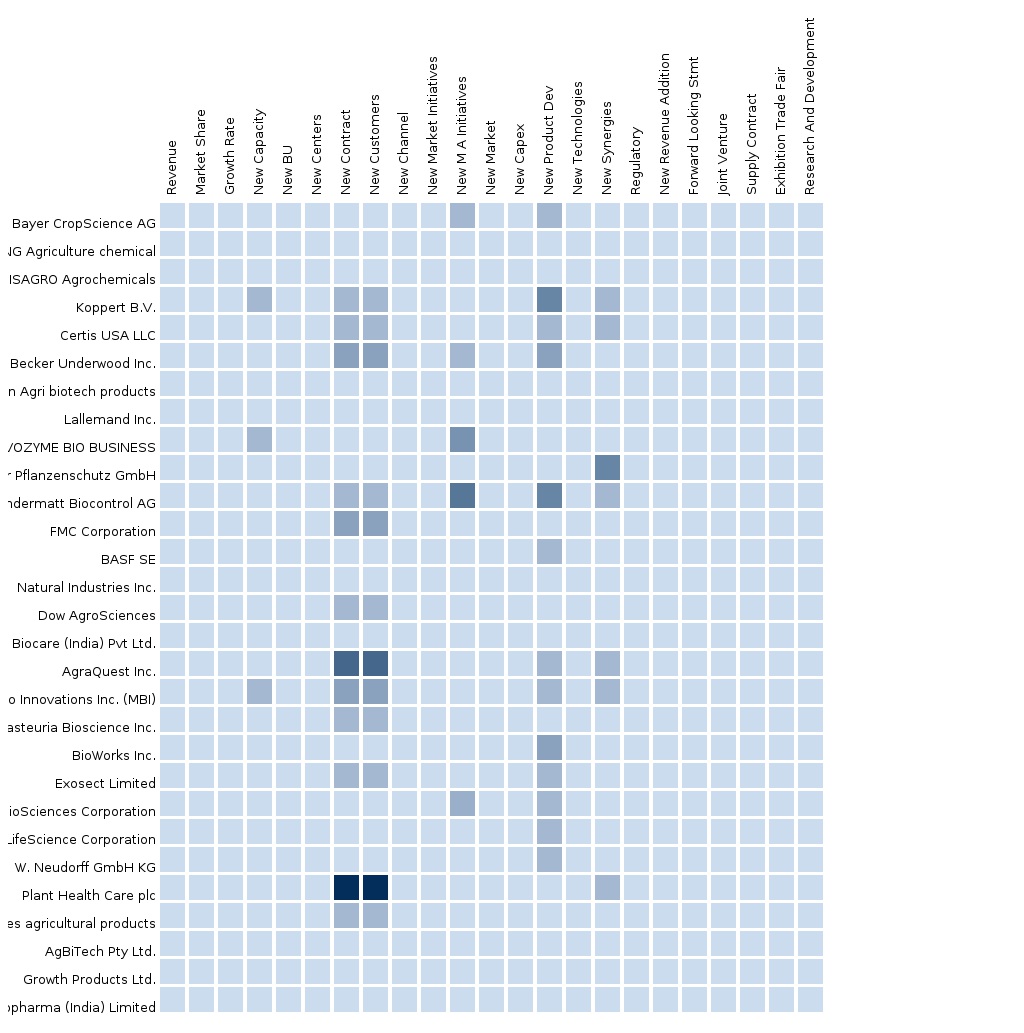

11 Europe Biopesticides Market: Competitive Landscape

11.1 Mergers & Acquisitions

11.2 Expansions

11.3 Partnerships & Agreements

11.4 Investments

11.5 New Product Launches

12 Company Profiles

12.1 Bayer Ag

12.1.1 Overview

12.1.2 Key Financials

12.1.3 Product and Service Offerings

12.1.4 Recent Developments

12.1.5 MMM View

12.2 Isagro S.P.A

12.2.1 Overview

12.2.2 Product and Service Offerings

12.2.3 Key Financials

12.2.4 Key Operation Data

12.2.5 Recent Developments

12.2.6 MMM View

12.3 Monsanto Company

12.3.1 Overview

12.3.2 Product and Service Offerings

12.3.3 Key Financials

12.3.4 Recent Developments

12.3.5 MMM View

12.4 Koppert B.V.

12.4.1 Overview

12.4.2 Key Financials

12.4.3 Product and Service Offerings

12.4.4 Related Developments

12.4.5 MMM View

12.5 Dow Chemical Company

12.5.1 Overview

12.5.2 Key Financials

12.5.3 Key Operation Data

12.5.4 Product and Service Offerings

12.5.5 Related Developments

12.5.6 MMM View

12.6 BASF Se

12.6.1 Overview

12.6.2 Key Financials

12.6.3 Key Operation Data

12.6.4 Product and Service Offerings

12.6.5 Related Developments

12.6.6 MMM View

List of Tables

Table 1 Europe Biopesticides Market: Macroindicators, By Geography, 2013, (Million Ha)

Table 2 Europe Biopesticides Market: Drivers and Restraints

Table 3 Europe Biopesticides Market, By Application, 2014-2020 (USD Million)

Table 4 Europe Biopesticides Market in Foliar Spray, By Geography, 2014-2020 (USD Million)

Table 5 Europe Biopesticides Market in Soil Treatment, By Geography, 2014-2020 (USD Million)

Table 6 Europe Biopesticides in Seed Treatment, By Geography, 2014-2020 (USD Million)

Table 7 Europe Biopesticides in Post-Harvest, By Geography, 2014-2020 (USD Million)

Table 8 Europe Biopesticides Market, By Type, 2014-2020 (USD Million)

Table 9 Europe Bioinsecticides Market, By Geography, 2014-2020 (USD Million)

Table 10 Europe Bioherbicides Market, By Geography, 2014-2020 (USD Million)

Table 11 Europe Biofungicides Market, By Geography, 2014-2020 (USD Million)

Table 12 Europe Bionematicides Market, By Geography, 2014-2020(USD Million)

Table 13 Europe Biopesticides Other Type Market, By Geography, 2014-2020(USD Million)

Table 14 Europe Biopesticides Market, By Crop Types, 2014-2020 (USD Million)

Table 15 Europe Fruits & Vegetables Market, By Geography, 2014-2020 (USD Million)

Table 16 Europe Grains & Oilseeds Market, By Geography, 2014-2020 (USD Million)

Table 17 Europe Other Crop Type Market, By Geography, 2014-2020 (USD Million)

Table 18 Europe Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Table 19 Europe Liquid Formulation Market, By Geography, 2014-2020 (USD Million)

Table 20 Europe Dry Formulation Market, By Geography, 2014-2020 (USD Million)

Table 21 Europe Biopesticides Market, By Origin, 2014-2020 (USD Million)

Table 22 Europe Microbial Pesticides Market, By Geography, 2014-2020 (USD Million)

Table 23 Europe Biochemical Pesticides Market, By Geography, 2014-2020 (USD Million)

Table 24 Europe Beneficial Insects Market, By Geography, 2014-2020 (USD Million)

Table 25 Europe Biopesticides Market, By Geography, 2014-2020 (USD Million)

Table 26 Spain Biopesticides Market, By Type, 2014-2020 (USD Million)

Table 27 Spain Biopesticides Market, By Application, 2014-2020 (USD Million)

Table 28 Spain Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Table 29 Spain Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Table 30 Spain Biopesticides Market, By Origin, 2014-2020 (USD Million)

Table 31 Italy Biopesticides Market, By Type, 2014-2020 (USD Million)

Table 32 Italy Biopesticides Market, By Application, 2014-2020 (USD Million)

Table 33 Italy Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Table 34 Italy Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Table 35 Italy Biopesticides Market, By Origin, 2014-2020 (USD Million)

Table 36 France Biopesticides Market, By Type, 2014-2020 (USD Million)

Table 37 France Biopesticides Market, By Application, 2014-2020 (USD Million)

Table 38 France Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Table 39 France Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Table 40 France Biopesticides Market, By Origin, 2014-2020 (USD Million)

Table 41 Germany Biopesticides Market, By Type, 2014-2020 (USD Million)

Table 42 Germany Biopesticides Market, By Application, 2014-2020 (USD Million)

Table 43 Germany Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Table 44 Germany Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Table 45 Germany Biopesticides Market, By Origin, 2014-2020 (USD Million)

Table 46 Rest of the Europe Biopesticides Market, By Type, 2014-2020 (USD Million)

Table 47 Rest of the Europe Biopesticides Market, By Application, 2014-2020 (USD Million)

Table 48 Rest of the Europe Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Table 49 Rest of the Europe Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Table 50 Rest of the Europe Biopesticides Market, By Origin, 2014-2020 (USD Million)

Table 51 Europe Biopesticides Market: Mergers & Acquisitions

Table 52 Europe Biopesticides Market: Expansions

Table 53 Europe Biopesticides Market: Partnerships & Agreements

Table 54 Europe Biopesticides Market: Investments

Table 55 Europe Biopesticides Market: New Product Launches

Table 56 Bayer Ag: Revenues, By Segment, 2011-2015 (USD Million)

Table 57 Bayer Ag: Key Financials, 2011-2015 (USD Million)

Table 58 Bayer Ag: Revenue, By Geography, 2011-2015 (USD Million)

Table 59 Isagro S.P.A: Annual Revenue, By Geography, 2013 & 2014 (USD Million)

Table 60 Isagro S.P.A: Key Financials, 2011-2015 (USD Million)

Table 61 Monsanto Company: Annual Revenue, By Geography, 2011–2015 (USD Million)

Table 62 Monsanto Company: Annual Revenue, By Business Segment, 2011-2015 (USD Million)

Table 63 Dow Chemical Company: Annual Revenue, By Business Segment, 2013–2015 (USD Million)

Table 64 Dow Chemical Company: Key Financials, 2011-2015 (USD Mn)

Table 65 BASF Se Company: Annual Revenue, By Business Segment, 2011-2015 (USD Million)

Table 66 BASF Se: Key Financials, 2011-2015 (USD Million)

List of Figures

Figure 1 Europe Biopesticides Market: Segmentation & Coverage

Figure 2 Biopesticides Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macroindicator-Based Approach

Figure 7 Europe Biopesticides Market: Snapshot

Figure 8 Europe Biopesticides Market: Drivers and Restraints

Figure 9 Europe Biopesticides Market, By Application, 2015 & 2020 (USD Million)

Figure 10 Europe Biopesticides Market in Foliar Spray, By Geography, 2014-2020 (USD Million)

Figure 11 Europe Biopesticides Market in Soil Treatment, By Geography, 2014-2020 (USD Million)

Figure 12 Europe Biopesticides Market in Seed Treatment, By Geography, 2014-2020 (USD Million)

Figure 13 Europe Biopesticides Market in Post-Harvest, By Geography, 2014-2020 (USD Million)

Figure 14 Europe Biopesticides Market, By Type, 2015-2020 (USD Million)

Figure 15 Europe Bioinsecticides Market, By Geography, 2014-2020(USD Million)

Figure 16 Europe Bioherbicides Market, By Geography, 2014-2020 (USD Million)

Figure 17 Europe Biofungicides Market, By Geography, 2014-2020 (USD Million)

Figure 18 Europe Bionematicides Market, By Geography, 2014-2020 (USD Million)

Figure 19 Europe Biopesticides Other Type Market, By Geography, 2014-2020 (USD Million)

Figure 20 Europe Biopesticides Market, By Crop Type, 2015-2020 (USD Million)

Figure 21 Europe Fruits & Vegetables Market, By Geography, 2014-2020 (USD Million)

Figure 22 Europe Grains & Oilseeds Market, By Geography, 2014-2020 (USD Million)

Figure 23 Europe Other Crop Type Market, By Geography, 2014-2020(USD Million)

Figure 24 Europe Biopesticides Market, By Formulation, 2015 & 2020 (USD Million)

Figure 25 Europe Liquid Formulation Market, By Geography, 2014-2020 (USD Million)

Figure 26 Europe Dry Formulation Market, By Geography, 2014-2020 (USD Million)

Figure 27 Europe Biopesticides Market, By Origin, 2015 & 2020 (USD Million)

Figure 28 Europe Microbial Pesticides Market, By Geography, 2014-2020 (USD Million)

Figure 29 Europe Biochemical Pesticides Market, By Geography, 2014-2020(USD Million)

Figure 30 Europe Beneficial Insects Market, By Geography, 2014-2020 (USD Million)

Figure 31 Europe Biopesticides Market: Growth Analysis, By Geography, 2015 & 2020 (USD Million)

Figure 32 Spain Biopesticides Market Overview, 2015 & 2020 (%)

Figure 33 Spain Biopesticides Market, By Type, 2014-2020 (USD Million)

Figure 34 Spain Biopesticides Market, By Application, 2014-2020 (USD Million)

Figure 35 Spain Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Figure 36 Spain Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Figure 37 Spain Biopesticides Market, By Origin, 2014-2020 (USD Million)

Figure 38 Italy Biopesticides Market Overview, 2015 & 2020 (%)

Figure 39 Italy Biopesticides Market, By Type, 2014-2020 (USD Million)

Figure 40 Italy Biopesticides Market, By Application, 2014-2020 (USD Million)

Figure 41 Italy Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Figure 42 Italy Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Figure 43 Italy Biopesticides Market, By Origin, 2014-2020 (USD Million)

Figure 44 France Biopesticides Market Overview, 2015 & 2020 (%)

Figure 45 France Biopesticides Market, By Type, 2014-2020 (USD Million)

Figure 46 France Biopesticides Market, By Application, 2014-2020 (USD Million)

Figure 47 France Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Figure 48 France Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Figure 49 France Biopesticides Market, By Origin, 2014-2020 (USD Million)

Figure 50 Germany Biopesticides Market Overview, 2015 & 2020 (%)

Figure 51 Germany Biopesticides Market, By Type, 2014-2020 (USD Million)

Figure 52 Germany Biopesticides Market, By Application, 2014-2020 (USD Million)

Figure 53 Germany Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Figure 54 Germany Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Figure 55 Germany Biopesticides Market, By Origin, 2014-2020 (USD Million)

Figure 56 Rest of the Europe Biopesticides Market Overview, 2015 & 2020 (%)

Figure 57 Rest of the Europe Biopesticides Market, By Type, 2014-2020 (USD Million)

Figure 58 Rest of the Europe Biopesticides Market, By Application, 2014-2020 (USD Million)

Figure 59 Rest of the Europe Biopesticides Market, By Crop Type, 2014-2020 (USD Million)

Figure 60 Rest of the Europe Biopesticides Market, By Formulation, 2014-2020 (USD Million)

Figure 61 Rest of the Europe Biopesticides Market, By Origin, 2014-2020 (USD Million)

Figure 62 Bayer Ag: Revenue Mix, 2015 (%)

Figure 63 Isagro S.P.A: Revenue Mix, 2014 (%)

Figure 64 Monsanto Company: Revenue Mix, 2015 (%)

Figure 65 Dow Chemical Company: Revenue Mix, 2015 (%)

Figure 66 BASF Se: Revenue Mix, 2015 (%)

The increasing global population has led to rise in the demand for agriculture produce in the recent years. Thus has consequently resulted increased need to avoid crop yield losses due to pests and crop diseases. This can be achieved with the use of pesticides. However, the use of chemical pesticides has various health and environment related hazards. Therefore, there is a high demand for biopesticides in the market, with the rising awareness about these hazards among masses. Biopesticides are safer substitute for chemical pesticides, since they are less toxic, chemical-free, and easily decomposable. They are eco-friendly and easy-to-use biochemicals that are made of naturally occurring substances that control pests through non-toxic mechanisms. They are also the key components of integrated pest management (IPM) programs and are receiving a lot of attention as a means to reduce the consumption of synthetic chemical products.

The biopesticides market in Europe was valued at USD 833.5 million in 2015 and is projected to reach USD 2,117.6 million by 2020, at a CAGR of 20.5% from 2015 to 2020. The market has grown exponentially in the last few years, and the trend is expected to continue in the coming years. Factors such environment friendliness, innovative production practices, new product offerings, and modernization of various agricultural practices are some of the factors that are expected to drive the growth of the market.

According to the U.S. Environmental Protection Agency (EPA), biopesticides are classified into three major classes: microbial biopesticides, biochemical biopesticides, and plant incorporated protectants. Out of these, the microbial biopesticides are the most commonly used biopesticides. They are becoming more popular among growers, owing to their high efficiency at low cost.

EUROPE BIOPESTICIDES MARKET: BY APPLICATION

The European biopesticides market is projected to witness significant growth in the coming years, due to factors, such as adverse effects on human health due excessive use of conventional chemical pesticides, governmental regulatory bodies actively participating in educating farmers about various eco-friendly techniques, and increasing concerns of consumers and pressure groups regarding safety of pesticide residue on food. The increasing concern for food safety has compelled producers to explore new and environmentally friendly methods to replace. The use of biopesticides has thus emerged as a promising alternative to chemical pesticides.

Need for improved and more effective formulations, higher manufacturing costs compared to conventional agrochemicals, issues related to the registration for commercialization are some of the factors that may act as a challenge for the growth of the market.

Speak to our expert analyst for a discussion on the above findings, Click Speak to Analyst.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Agriculture Biologicals Market Biologicals-Europe and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Asia-Pacific Agriculture Biologicals Market Biologicals-Asia and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Latin America Agriculture Biologicals Market Biologicals-Latin America and Agriculture Biopesticides Market, Bio... |

Apr 2015 |

|

North America Agriculture Biologicals Market The North America agriculture biologicals market was valued at $1,409.07 million in 2014 and is projected to reach $2,758.24 million by 2019 at a CAGR of 14.4% during the forecast period. The market, by application is led by cereals and grains in 2014. In North America, U.S. has the largest share in the agriculture biologicals market. It constitutes of 72.47% of North America agriculture biologicals market. The biopesticides are mostly consumed in North America than other biological types. |

May 2015 |