The bio stimulants market in Europe was valued at $0.53 billion in 2013, and is expected to grow at a CAGR of 12.2% annually, to reach $0.94 billion by 2018. The market constitutes 41.7% of the global bio stimulants market. the major segments of this market include bio insecticides, bio fungicides, and bio herbicides, among others, comprising 53.3%, 38.2% and 8.5% respectively, of the European market. Agricultural land is one of the most important macroindicator for this market.

What makes our report unique?

- You can request a 10% customization in the research that matches your requirement. For example, you could request a deep dive research in any specific region, technology, or application.

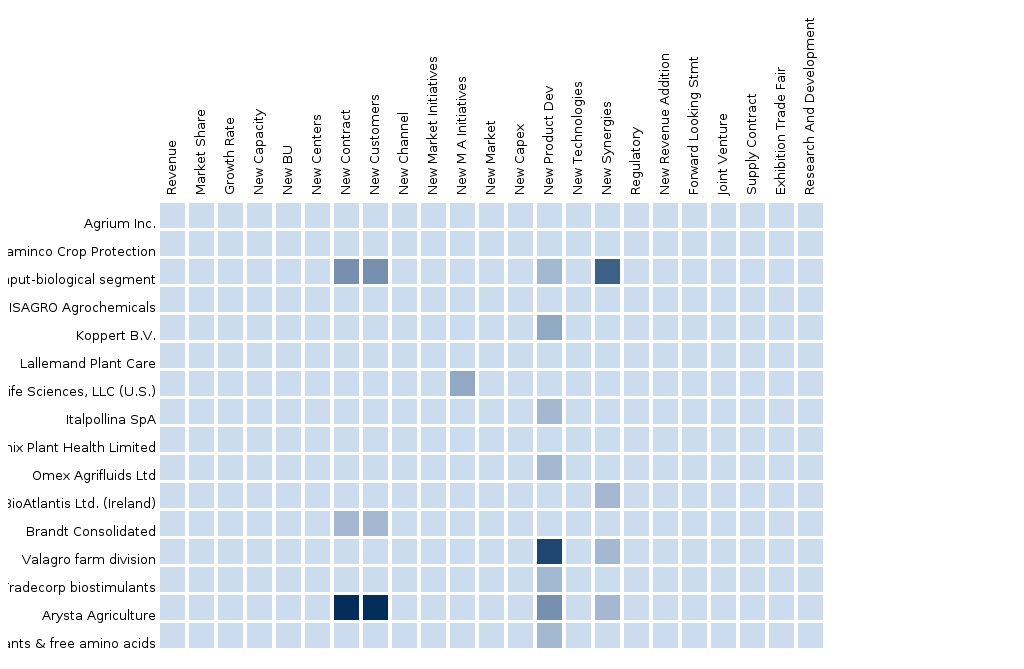

- This report provides a competitive landscape of the top players in the European bio stimulants market. Under the strategic benchmarking section, we will provide you with their key developments along with the impacts that include new product developments, M&A, a strategic focus on any specific application, technology, and geography. Under the Financials section, we will provide you with details that span Capex (Investments), revenues, EBITDA, and so on. Under the operational insights section, we will provide you with the new capacities added, new centers, and new key employments. Under the sales and marketing section, we will provide you with insights on new contracts (available on the public domain), new distribution channels added, new marketing initiatives, and so on.

Key questions answered

- What are the market estimates and forecasts based on which the markets are doing well, and which are not?

- What is the competitive landscape; who are the main players in each segment; what are their strategic directives, operational strengths, key selling products, and product pipelines? Who is doing what?

Audience for this report

- European Bio Stimulants Companies

CUSTOMIZATION OPTIONS FOR BIOSTIMULANT MARKET IN EUROPE

Along with market data, customize the MMM assessment in alignment with your company’s specific needs. Customize to get a comprehensive summary of the industry standards and the deep dive analysis of the following parameters:

Technical analysis

The earlier input-output notion of more nitrogen resulting in greater yield and lesser pests has proved to be futile. The use and efficiency of crop protection inputs depend upon the type of soil and other geographical factors, essential for agriculture. The biostimulants, classified on the basis of ingredients (Humic acid, Fulvic acid, Amino Acid, Seaweed extracts),may deliver different results for similar conditions.

- A regional geographical analysis and its suitability for a particular type of biostimulant product

- Extreme climatic conditions such as high rainfall and high temperature require crops to be more resilient to withstand stress. Biostimulants increase plant tolerance and help them recover from environmental stresses and hence indicated that the use of the right biostimulant is highly essential

- The type of soil under cultivation should be studied, as biostimulants also maintain the health of the soil. A healthy soil retains more water and resists erosion and hence, is more productive

Pattern in usage of Biostimulants

- Biostimulants are not used widely for conventional farming, and still are treated as inputs meant for organic farming and gardening

- To study the usage pattern of biostimulants (Humic acid, Fulvic acid, Amino Acid, Seaweed extracts) which are often non-scientific

- To study the usage of biostimulants in terms of volume (Humic acid, Fulvic acid, Amino Acid, Seaweed extracts) which are often applied arbitrarily

Low-cost Sourcing Locations

With the rising cost of raw materials, the overall pressure on prices has been increasing. Cost optimization is taking place at every value addition process. But a good percentage of the reduction in cost can be achieved the input level itself.

- Studying the various raw material sourcing locations to give a comparative analysis of low-cost raw material sourcing locations

- Discover locations with good logistics and connectivity along with low costs of inputs

Competitive Intelligence

- The competitive advantage the competitor is enjoying over other market players

- The companies operating in the segment with a similar product portfolio or targeting the similar markets

- Arriving at a competitive benchmarking by taking into account the top industry players in the same category

Regulatory framework

- The European Biostimulants Industry Consortium (EBIC) drives its safety measures based on the existing regulations implemented by the European Union (EU)

- List the regulatory issues in import policies of the countries, if they are adversely affecting the business

- To study whether the government is offering any fertilizer subsidies or non-tariff barriers for agricultural inputs

Crop - application usage data

- Types of biostimulants (Humic acid, Fulvic acid, Amino Acid, Seaweed extracts) preferred for a particular crop (Row crops, fruits & vegetables, turf & ornamental crops)

- Types of biostimulants (Humic acid, Fulvic acid, Amino Acid, Seaweed extracts) preferred for a particular application (Foliar, soil, & seed)

1 Introduction

1.1 Objectives of the study

1.1.1 Overall goal of writing the report

1.2 Market Definition and Scope of the study

1.2.1 Market Definition

1.2.2 Areas covered

1.2.3 Markets Covered

1.3 Stakeholders

1.4 Research Methodology

1.4.1 Secondary sources

1.4.2 Primary Sources

1.4.3 Market estimation methodology (Top-down, bottom-up, data triangulation.)

1.4.4 Macro indicators for the study

1.5 Assumptions

1.6 List of Acronyms

2 Market Overview

3 Bio Stimulants-Europe, By Endusers

3.1 Split By Geography

3.1 Spain by Endusers

3.1 Italy by Endusers

3.1 France by Endusers

3.1 United Kingdom by Endusers

3.1 Ireland by Endusers

3.1 Switzerland by Endusers

3.1 Netherlands by Endusers

3.1 Poland by Endusers

3.1 Europe - Other Geographies by Endusers

3.2 Bio Stimulants-Row crops-Europe

3.2.1 Row crops-Europe, By MacroIndicators

3.2.1.1 Row crops-Agricultural Land-Europe

3.2.2 Row crops-Europe, By Geographies

3.2.2.1 Row crops-Spain

3.2.2.2 Row crops-United Kingdom

3.2.2.3 Row crops-Italy

3.2.2.4 Row crops-France

3.2.2.5 Row crops-Europe - Other Geographies

3.3 Bio Stimulants-Fruits & Vegetables-Europe

3.3.1 Fruits & Vegetables-Europe, By MacroIndicators

3.3.1.1 Fruits & Vegetables-Agricultural Land-Europe

3.3.2 Fruits & Vegetables-Europe, By Geographies

3.3.2.1 Fruits & Vegetables-Spain

3.3.2.2 Fruits & Vegetables-Italy

3.3.2.3 Fruits & Vegetables-France

3.3.2.4 Fruits & Vegetables-United Kingdom

3.3.2.5 Fruits & Vegetables-Europe - Other Geographies

3.4 Bio Stimulants-Turf and ornamentals-Europe

3.4.1 Turf and ornamentals-Europe, By MacroIndicators

3.4.1.1 Turf and ornamentals-Agricultural Land-Europe

3.4.2 Turf and ornamentals-Europe, By Geographies

3.4.2.1 Turf and ornamentals-Spain

3.4.2.2 Turf and ornamentals-Italy

3.4.2.3 Turf and ornamentals-France

3.4.2.4 Turf and ornamentals-United Kingdom

3.4.2.5 Turf and ornamentals-Europe - Other Geographies

3.5 Bio Stimulants-Rest (Crops)-Europe

3.5.1 Rest (Crops)-Europe, By MacroIndicators

3.5.1.1 Rest (Crops)-Agricultural Land-Europe

3.5.2 Rest (Crops)-Europe, By Geographies

3.5.2.1 Rest (Crops)-Spain

3.5.2.2 Rest (Crops)-United Kingdom

3.5.2.3 Rest (Crops)-Italy

3.5.2.4 Rest (Crops)-France

3.5.2.5 Rest (Crops)-Europe - Other Geographies

4 Bio Stimulants-Europe, By Ingredients

4.1 Split By Geography

4.2 Spain by Ingredients

4.1 Italy by Ingredients

4.1 France by Ingredients

4.1 United Kingdom by Ingredients

4.1 Ireland by Ingredients

4.1 Switzerland by Ingredients

4.1 Netherlands by Ingredients

4.1 Poland by Ingredients

4.1 Europe - Other Geographies by Ingredients

4.2 Extracts (Active Ingredients)-Europe

4.2.1 Extracts (Active Ingredients)-Europe, By MacroIndicators

4.2.1.1 Extracts (Active Ingredients)-Agricultural Land-Europe

4.2.2 Extracts (Active Ingredients)-Europe, By Geographies

4.2.2.1 Extracts (Active Ingredients)-Spain

4.2.2.2 Extracts (Active Ingredients)-Italy

4.2.2.3 Extracts (Active Ingredients)-France

4.2.2.4 Extracts (Active Ingredients)-United Kingdom

4.2.2.5 Extracts (Active Ingredients)-Europe - Other Geographies

4.2.3 Extracts (Active Ingredients)-Europe, By Ingredients

4.2.3.1 Others plant extracts-Europe

4.2.3.2 Seaweed extracts-Europe

4.3 Others (Active Ingredients)-Europe

4.3.1 Others (Active Ingredients)-Europe, By MacroIndicators

4.3.1.1 Others (Active Ingredients)-Agricultural Land-Europe

4.3.2 Others (Active Ingredients)-Europe, By Geographies

4.3.2.1 Others (Active Ingredients)-Spain

4.3.2.2 Others (Active Ingredients)-Italy

4.3.2.3 Others (Active Ingredients)-France

4.3.2.4 Others (Active Ingredients)-United Kingdom

4.3.2.5 Others (Active Ingredients)-Europe - Other Geographies

4.3.3 Others (Active Ingredients)-Europe, By Ingredients

4.3.3.1 Chitin & Chitosin-Europe

4.3.3.2 Microbial soil amendments-Europe

4.3.3.3 B-Vitamins-Europe

4.4 Acids (Active Ingredients)-Europe

4.4.1 Acids (Active Ingredients)-Europe, By MacroIndicators

4.4.1.1 Acids (Active Ingredients)-Agricultural Land-Europe

4.4.2 Acids (Active Ingredients)-Europe, By Geographies

4.4.2.1 Acids (Active Ingredients)-United Kingdom

4.4.2.2 Acids (Active Ingredients)-Spain

4.4.2.3 Acids (Active Ingredients)-Italy

4.4.2.4 Acids (Active Ingredients)-France

4.4.2.5 Acids (Active Ingredients)-Netherlands

4.4.2.6 Acids (Active Ingredients)-Europe - Other Geographies

4.4.3 Acids (Active Ingredients)-Europe, By Ingredients

4.4.3.1 Humic acid-Europe

4.4.3.2 Amino acid-Europe

4.4.3.3 Fulvic acid-Europe

5 Bio Stimulants-Europe, By Geographies

5.1 Spain

5.1.1 Spain, By MacroIndicators

5.1.1.1 Agricultural Land-Spain

5.1.2 Spain, By Companies

5.1.2.1 Atlantica biostimulants & free amino acids-Spain

5.1.2.2 Agrinos crop input-biological segment-Spain

5.1.2.3 Tradecorp biostimulants-Spain

5.1.3 Spain, By Ingredients

5.1.3.1 Extracts (Active Ingredients)-Spain

5.1.3.2 Others (Active Ingredients)-Spain

5.1.3.3 Acids (Active Ingredients)-Spain

5.2 Italy

5.2.1 Italy, By MacroIndicators

5.2.1.1 Agricultural Land-Italy

5.2.2 Italy, By Companies

5.2.2.1 Valagro farm division-Italy

5.2.2.2 Italpollina SpA-Italy

5.2.3 Italy, By Ingredients

5.2.3.1 Extracts (Active Ingredients)-Italy

5.2.3.2 Others (Active Ingredients)-Italy

5.2.3.3 Acids (Active Ingredients)-Italy

5.3 France

5.3.1 France, By MacroIndicators

5.3.1.1 Agricultural Land-France

5.3.2 France, By Companies

5.3.2.1 Arysta Agriculture-France

5.3.2.2 Valagro farm division-France

5.3.3 France, By Ingredients

5.3.3.1 Extracts (Active Ingredients)-France

5.3.3.2 Others (Active Ingredients)-France

5.3.3.3 Acids (Active Ingredients)-France

5.4 United Kingdom

5.4.1 United Kingdom, By MacroIndicators

5.4.1.1 Agricultural Land-United Kingdom

5.4.2 United Kingdom, By Companies

5.4.2.1 Omex Agrifluids Ltd-United Kingdom

5.4.3 United Kingdom, By Ingredients

5.4.3.1 Extracts (Active Ingredients)-United Kingdom

5.4.3.2 Others (Active Ingredients)-United Kingdom

5.4.3.3 Acids (Active Ingredients)-United Kingdom

5.5 Ireland

5.5.1 Ireland, By Companies

5.5.1.1 BioAtlantis Ltd. (Ireland)-Ireland

5.6 Switzerland

5.6.1 Switzerland, By Companies

5.6.1.1 Agrinos crop input-biological segment-Switzerland

5.7 Netherlands

5.7.1 Netherlands, By Companies

5.7.1.1 Koppert B.V.-Netherlands

5.7.2 Netherlands, By Ingredients

5.7.2.1 Acids (Active Ingredients)-Netherlands

5.8 Poland

5.8.1 Poland, By Companies

5.8.1.1 Arysta Agriculture-Poland

5.9 Europe - Other Geographies

5.9.1 Europe - Other Geographies, By Companies

5.9.1.1 Agrinos crop input-biological segment-Europe - Other Geographies

5.9.2 Europe - Other Geographies, By MacroIndicators

5.9.2.1 Agricultural Land-Europe - Other Geographies

5.9.3 Europe - Other Geographies, By Endusers

5.9.3.1 Row crops-Europe - Other Geographies

5.9.3.2 Fruits & Vegetables-Europe - Other Geographies

5.9.3.3 Turf and ornamentals-Europe - Other Geographies

5.9.3.4 Rest (Crops)-Europe - Other Geographies

5.9.4 Europe - Other Geographies, By Ingredients

5.9.4.1 Acids (Active Ingredients)-Europe - Other Geographies

5.9.4.2 Extracts (Active Ingredients)-Europe - Other Geographies

5.9.4.3 Others (Active Ingredients)-Europe - Other Geographies

6 Bio Stimulants-Europe, By Companies

6.1 Split By Geography

6.3 Spain by Companies

6.1 Italy by Companies

6.1 France by Companies

6.1 United Kingdom by Companies

6.1 Ireland by Companies

6.1 Switzerland by Companies

6.1 Netherlands by Companies

6.1 Poland by Companies

6.1 Europe - Other Geographies by Companies

6.2 Bio Stimulants-ISAGRO Agrochemicals-Europe

6.3 Bio Stimulants-Taminco Crop Protection-Europe

6.4 Bio Stimulants-Koppert B.V.-Europe

6.4.1 Koppert B.V.-Europe, By Geographies

6.4.1.1 Koppert B.V.-Netherlands

6.5 Bio Stimulants-Agrium Inc.-Europe

6.6 Bio Stimulants-Lallemand Plant Care-Europe

6.7 Bio Stimulants-Italpollina SpA-Europe

6.7.1 Italpollina SpA-Europe, By Geographies

6.7.1.1 Italpollina SpA-Italy

6.8 Bio Stimulants-Atlantica biostimulants & free amino acids-Europe

6.8.1 Atlantica biostimulants & free amino acids-Europe, By Geographies

6.8.1.1 Atlantica biostimulants & free amino acids-Spain

6.9 Bio Stimulants-Valagro farm division-Europe

6.9.1 Valagro farm division-Europe, By Geographies

6.9.1.1 Valagro farm division-Italy

6.9.1.2 Valagro farm division-France

6.10 Bio Stimulants-BioAtlantis Ltd. (Ireland)-Europe

6.10.1 BioAtlantis Ltd. (Ireland)-Europe, By Geographies

6.10.1.1 BioAtlantis Ltd. (Ireland)-Ireland

6.11 Bio Stimulants-Arysta Agriculture-Europe

6.11.1 Arysta Agriculture-Europe, By Geographies

6.11.1.1 Arysta Agriculture-France

6.11.1.2 Arysta Agriculture-Poland

6.12 Bio Stimulants-Agrinos crop input-biological segment-Europe

6.12.1 Agrinos crop input-biological segment-Europe, By Geographies

6.12.1.1 Agrinos crop input-biological segment-Europe - Other Geographies

6.12.1.2 Agrinos crop input-biological segment-Spain

6.12.1.3 Agrinos crop input-biological segment-Switzerland

6.13 Bio Stimulants-Tradecorp biostimulants-Europe

6.13.1 Tradecorp biostimulants-Europe, By Geographies

6.13.1.1 Tradecorp biostimulants-Spain

6.14 Bio Stimulants-Omex Agrifluids Ltd-Europe

6.14.1 Omex Agrifluids Ltd-Europe, By Geographies

6.14.1.1 Omex Agrifluids Ltd-United Kingdom

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Agriculture Biologicals Market Biologicals-Europe and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Asia-Pacific Agriculture Biologicals Market Biologicals-Asia and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Latin America Agriculture Biologicals Market Biologicals-Latin America and Agriculture Biopesticides Market, Bio... |

Apr 2015 |

|

North America Agriculture Biologicals Market The North America agriculture biologicals market was valued at $1,409.07 million in 2014 and is projected to reach $2,758.24 million by 2019 at a CAGR of 14.4% during the forecast period. The market, by application is led by cereals and grains in 2014. In North America, U.S. has the largest share in the agriculture biologicals market. It constitutes of 72.47% of North America agriculture biologicals market. The biopesticides are mostly consumed in North America than other biological types. |

May 2015 |