Asia Pacific Spine Surgery Devices Market by Products (Non-Fusion Implants, Spinal Fusion & Fixation Devices, Spine Biologics, Spine Bone Stimulators, Vertebral Compression Fracture Treatment Devices), by End-User, by Geography - Analysis and Forecast to 2019

The Asia Pacific Spine Surgery Devices Market is broadly segmented into four classes such as non-fusion implants, spinal fusion & fixation devices, spine biologics, spine bone stimulators, and vertebral compression fracture treatment devices. The Spinal Fusion & Fixation Devices Market was the largest market of the overall Asia Pacific spine surgery devices market in 2013.

Factors which are driving the demand for spine surgery devices are the increasing incidents of road accidents, spinal deformities, such as disc compression amongst the aging population in the APAC region, and the popularity of non-fusion devices like artificial spinal disc and nucleus have triggered the market. The increasing demand from the aging population and the advancement in medical technologies are driving the demand for spine surgery devices in this region.

The Asia Pacific spine surgery devices market is estimated to be dominated by new product launches and mergers & acquisitions, and they are the main strategies adopted by most of the market players to achieve growth in this market. In November 2014, Zimmer Holdings Inc. (U.S.) launched Virage® OCT Spinal Fixation System. This system is featured with a 360 degree Omnidirectional Extreme-Angle Screw, which allows a 112 degree conical range of motion. This system is designed to minimize the required operating time and to simplify rod alignment. Likewise, in October 2014, Medtronic Plc, one of the leading orthopedic medical technology companies launched the Pure Titanium Coating (PTC) platform of interbody fusion devices. This platform includes CAPSTONE PTC(TM) Spinal System, CLYDESDALE PTC(TM) Spinal System, ANATOMIC PEEK PTC Cervical Fusion System, and CORNERSTONE-SR® Ti- Coated Anatomical Cervical Cage. The compression of the nerve roots or spinal cord causes pain, and this device will help to reduce the pain by restoring the normal height of discs.

This Asia Pacific spine surgery devices market is expected to reach $2,223.1 million by 2019, at a CAGR of 10.5% from 2014 to 2019. In 2014, the spinal fusion & fixation devices segment was the largest segment in the Asia Pacific spine surgery devices market, with a share of 64.9% in terms of value. It is projected to grow at a CAGR of 9.3% during the forecast period.

An in-depth market share analysis, by revenue, of the top companies is also included in the report. These numbers are arrived at, based on key facts, annual financial information from SEC filings, annual reports, and interviews with industry experts, key opinion leaders, such as CEOs, directors, and marketing executives. Top market players that have established their base in the global trauma fixation devices are the Stryker Corporation (U.S.), DePuy Synthes Companies of Johnson & Johnson (U.S.), Zimmer Holdings, Inc. (U.S.), Smith & Nephew Plc (U.K.), Tornier, Inc. (France) and Biomet, Inc. (U.S.), and other companies.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Integrated Ecosystem of Spine Surgery Devices Market

2.2 Arriving at the Spine Surgery Devices Market Size

2.2.1 Top-Down Approach

2.2.2 Demand-Side Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 23)

4 Market Overview (Page No. - 25)

4.1 Introduction

4.2 Spine Surgery Devices Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Asia Pacific Spine Surgery Devices Market, By Product (Page No. - 30)

5.1 Introduction

5.2 Asia Pacific Spine Surgery Devices, By Product

5.3 Asia Pacific Spine Surgery Devices Market, Type Comparison With Orthopedic Devices Market

5.4 Spinal Fusion & Fixation Devices

5.4.1 Cervical Fusion

5.4.2 Thoracic Fusion & Lumbar Fusion

5.4.2.1 Anterior Thoracic Fusion and Lumbar Fusion

5.4.2.2 Posterior Thoracolumbar Fusion

5.4.2.3 Inter-Body Thoracic Fusion and Lumbar Fusion

5.4.2.3.1 By Approach

5.4.2.3.1.1 Anterior Lumbar Inter-Body Fusion

5.4.2.3.1.2 Posterior Lumbar Inter-Body Fusion

5.4.2.3.1.3 Transforaminal Lumbar Inter-Body Fusion

5.4.2.3.1.4 Lateral Lumbar Inter-Body Fusion

5.4.2.3.2 By Material

5.4.2.3.2.1 Non-Bone Inter-Body Cervical Fusion Devices

5.4.2.3.2.2 Bone Inter-Body Fusion Devices

5.5 Spine Biologics

5.5.1 Spinal Allografts

5.5.2 Demineralized Bone Matrix

5.5.3 Bone Morphogenetic Proteins

5.5.4 Bone Substitutes

5.5.5 Machined Bones

5.6 Vertebral Compression Fracture (Vcf) Treatment Devices

5.6.1 Vertebroplasty

5.6.2 Balloon Kyphoplasty Devices

5.7 Non-Fusion Implants

5.7.1 Dynamic Stabilization

5.7.1.1 Interspinous Process Spacers

5.7.1.2 Pedicle Screw-Based Systems

5.7.1.3 Facet Replacement Products

5.7.2 Artificial Disc Replacement

5.7.2.1 Artificial Cervical Discs

5.7.2.2 Artificial Lumbar Discs

5.8 Spine Bone Stimulators

5.8.1 Electrical Stimulators

5.8.1.1 Non-Invasive

5.8.1.1.1 Pulsed Electromagnetic Field Devices

5.8.1.1.2 Capacitive Coupling(Cc) and Combined (Electro) Magnetic Field (CMF) Devices

5.8.1.2 Invasive

6 Asia Pacific Spine Surgery Devices Market, By End-Users (Page No. - 55)

6.1 Introduction

6.2 Asia Pacific Spine Surgery Devices Market, By End-User: Orthopedic Clinic & Spine Center

6.3 Asia Pacific Spine Surgery Devices Market, By End-User: Hospitals

7 Asia Pacific Spine Surgery Devices Market, By Geography (Page No. - 59)

7.1 Introduction

7.2 China Spine Surgery Devices Market

7.2.1 China Spine Surgery Devices Market, By Product

7.2.2 China Spine Surgery Devices Market, By End-User

7.3 Japan Spine Surgery Devices Market

7.3.1 Japan Spine Surgery Devices Market, By Product

7.3.2 Japan Spine Surgery Devices Market, By End-User

7.4 India Spine Surgery Devices Market

7.4.1 India Spine Surgery Devices Market, By Product

7.4.2 India Spine Surgery Devices Market, By End-User

7.5 Republic of Korea Spine Surgery Devices Market

7.5.1 Republic of Korea Spine Surgery Devices Market, By Product

7.5.2 Republic of Korea Spine Surgery Devices Market, By End-User

7.6 Australia Spine Surgery Devices Market

7.6.1 Australia Spine Surgery Devices Market, By Product

7.6.2 Australia Spine Surgery Devices Market, By End-User

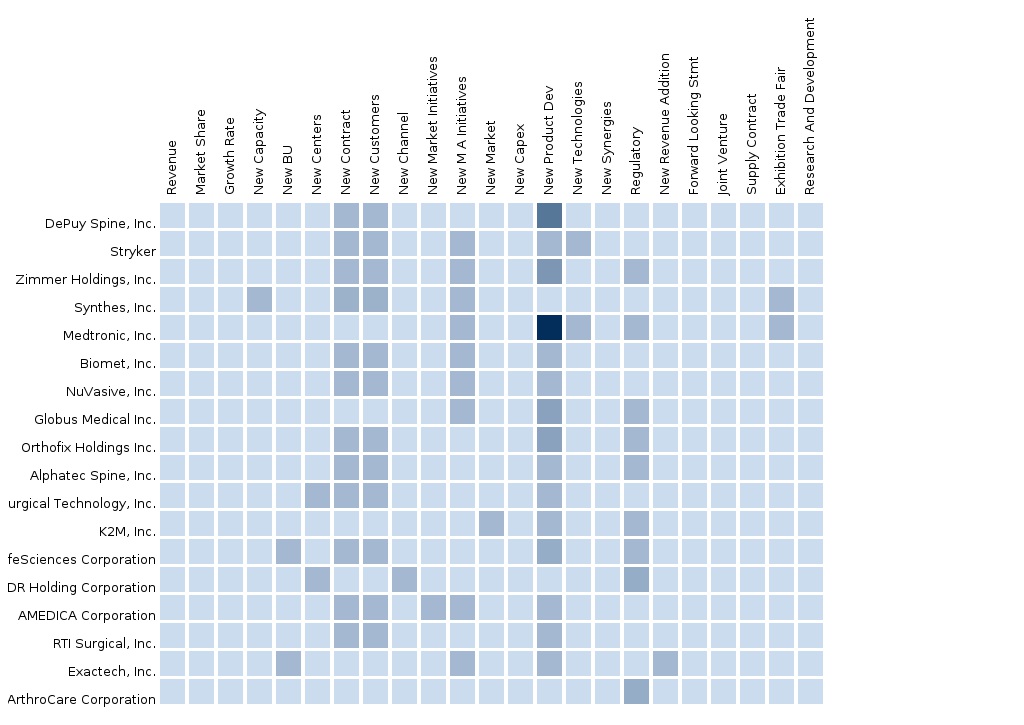

8 Asia Pacific Spine Surgery Devices Market: Competitive Landscape (Page No. - 81)

8.1 Spine Surgery Devices Market: Company Share Analysis

8.2 Mergers & Acquisitions

8.3 New Product Launch

8.4 Agreement

8.5 Approval

8.6 Financining

9 Asia Pacific Spine Surgery Devices Market, By Company (Page No. - 87)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Alphatec Spine, Inc.

9.2 Biomet, Inc.

9.3 Depuy Synthes Companies.

9.4 Globus Medical, Inc.

9.5 Integra Lifesciences Holdings Corporation.

9.6 Medtronic, Inc. (U.S.)

9.7 Nuvasive Inc

9.8 Stryker Corporation

9.9 Zimmer Holding, Inc.

9.10 Amedica Corporation

*Details On Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

10 Appendix (Page No. - 124)

10.1 Customization Options

10.1.1 Product Analysis:

10.1.2 Epidemiology Data:

10.1.3 Procedure Volume Data:

10.1.4 Surgeons/Physicians Perception Analysis:

10.1.5 Brand/Product Perception Matrix:

10.1.6 Regulatory Framework

10.1.7 Alternative Products: Impact Analysis

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (42 Tables)

Table 1 APAC Number of Road Accidents, 2014

Table 2 APAC Aging Population, 2014 (MN)

Table 3 Asia Pacific Spine Surgery Devices Market: Macro Indicators, By Geography,2014 (USD MN)

Table 4 Asia Pacific Spine Surgery Devices Market: Comparison With Parent Market,2013-2019 (USD MN)

Table 5 Asia Pacific Spine Surgery Devices Market: Drivers and Inhibitors

Table 6 Asia Pacific Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Table 7 Asia Pacific Spine Surgery Devices Market, By Geography, 2013-2019 (USD MN)

Table 8 Asia Pacific Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Table 9 Asia Pacific Spine Surgery Devices Market: Type Comparison With Orthopedic Devices Market, 2013-2019 (USD MN)

Table 10 Spinal Fusion & Fixation Devices Market, By Geography, 2013-2019 (USD MN)

Table 11 Spine Biologics Market, By Geography, 2013-2019 (USD MN)

Table 12 VCF Treatment Devices Market, By Geography 2013-2019 (USD MN)

Table 13 Non-Fusion Implants Market, By Geography, 2013-2019 (USD MN)

Table 14 Spine Bone Stimulators Market, By Geography, 2013-2019 (USD MN)

Table 15 Orthopedic Clinic & Spine Center, By Geography, 2013-2019 (USD MN)

Table 16 Hospitals, By Geography, 2013-2019 (USD MN)

Table 17 Spine Surgery Devices Market, By Geography, 2013-2019 (USD MN)

Table 18 China Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Table 19 China Spine Surgery Devices Market, By End-User, 2013-2019 (USD MN)

Table 20 Japan Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Table 21 India Spine Surgery Devices Market, By End-User, 2013-2019 (USD MN)

Table 22 India Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Table 23 India Spine Surgery Devices Market, By End-User, 2013-2019 (USD MN)

Table 24 Republic of Korea Spine Surgery Devices Market, By Product,2013-2019 (USD MN)

Table 25 Republic of Korea Spine Surgery Devices Market, By End-User,2013-2019 (USD MN)

Table 26 Australia Spine Surgery Devices Market, By Product 2013-2019 (USD MN)

Table 27 Australia Spine Surgery Devices Market, By End-User, 2013-2019 (USD MN)

Table 28 APAC Spine Surgery Devices Market: Company Share Analysis, 2013 (%)

Table 29 APAC Spine Surgery Devices Market: Mergers & Acquisitions

Table 30 APAC Spine Surgery Devices Market: New Product Launch

Table 31 APAC Spine Surgery Devices Market: Agreement

Table 32 APAC Spine Surgery Devices Market: Approval

Table 33 APAC Spine Surgery Devices Market: Financing

Table 34 Alphatec Spine, Inc.: Key Financials, 2012-2014 (USD MN)

Table 35 Biomet, Inc.: Key Financials, 2011-2013 (USD MN)

Table 36 Johnson & Johnson Ltd.: Key Financials, 2011-2014 (USD MN)

Table 37 Integra Lifesciences Holdings Corporation: Key Financials,2011-2013 (USD MN)

Table 38 Medtronic, Inc. : Key Financials, By Segment, 2009 - 2013 (Usd Million)

Table 39 Nuvasive Inc: Key Financials, 2009-2013 (USD MN)

Table 40 Stryker Corporation.: Key Financials, 2009-2013 (USD MN)

Table 41 Zimmer Holding, Inc.: Key Financials, 2009-2013 (USD MN)

Table 42 Amedica Corporation.: Key Financials, 2011-2013 (USD MN)

List of Figures (54 Figures)

Figure 1 APAC Spine Surgery Devices Market: Segmentation & Coverage

Figure 2 Spine Surgery Devices Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Demand-Side Approach: Number of Road Accidents

Figure 6 Demand-Side Approach: Aging Population (MN)

Figure 7 Macro Indicator-Based Approach

Figure 8 APAC Spine Surgery Devices Market Snapshot - 2014

Figure 9 APAC Spine Surgery Devices Market: Comparision With the Parent Market

Figure 10 APAC Spine Surgery Devices Types, By Geography, 2014 (USD MN)

Figure 11 APAC Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Figure 12 APAC Spine Surgery Devices Market: Type Comparison With Spine Surgery Devices Market, 2013-2019 (USD MN)

Figure 13 Spinal Fusion & Fixation Devices Market, By Geography, 2013-2019 (USD MN)

Figure 14 Spine Biologics Market, By Geography, 2013-2019 (USD MN)

Figure 15 VCF Treatment Devices Market, By Geography, 2013-2019 (USD MN)

Figure 16 Non-Fusion Implants Market, By Geography, 2013-2019 (USD MN)

Figure 17 Spine Bone Stimulators Market, By Geography, 2013-2019 (USD MN)

Figure 18 APAC Spine Surgery Devices Market, By End-User: Orthopedic Clinic & Spine Center, By Geography 2013-2019 (USD MN)

Figure 19 APAC Spine Surgery Devices Market, By End-User: Hospitals, By Geography 2013-2019 (USD MN)

Figure 20 Spine Surgery Devices Market: Growth Analysis, By Geography,2014-2019 (USD MN)

Figure 21 China Spine Surgery Devices Market Overview, 2014 & 2019 (%)

Figure 22 China Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Figure 23 China Spine Surgery Devices Market, By Product, 2014-2019 (%)

Figure 24 China Spine Surgery Devices Market: End-Users Snapshot

Figure 25 China Spine Surgery Devices Market, By End-User, 2013-2019 (USD MN)

Figure 26 Japan Spine Surgery Devices Market Overview, 2014 & 2019 (%)

Figure 27 Japan Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Figure 28 Japan Spine Surgery Devices Market, By Product, 2014-2019 (%)

Figure 29 Japan Spine Surgery Devices Market: End-Users Snapshot

Figure 30 Japan Spine Surgery Devices Market, By End-User, 2013-2019 (USD MN)

Figure 31 India Spine Surgery Devices Market Overview, 2014 & 2019 (%)

Figure 32 India Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Figure 33 India Spine Surgery Devices Market, By Product, 2014-2019 (%)

Figure 34 India Spine Surgery Devices Market: End-Users Snapshot

Figure 35 India Spine Surgery Devices Market, By End-User, 2013-2019 (USD MN)

Figure 36 Republic of Korea Spine Surgery Devices Market Overview, 2014 & 2019 (%)

Figure 37 Republic of Korea Spine Surgery Devices Market, By Product,2013-2019 (USD MN)

Figure 38 Republic of Korea Spine Surgery Devices Market, By Product, 2014-2019 (%)

Figure 39 Republic of Korea Spine Surgery Devices Market: End-User Snapshot

Figure 40 Republic of Korea Spine Surgery Devices Market, By End-User,2013-2019 (USD MN)

Figure 41 Australia Spine Surgery Devices Market Overview, 2014 & 2019 (%)

Figure 42 Australia Spine Surgery Devices Market, By Product, 2013-2019 (USD MN)

Figure 43 Australia Spine Surgery Devices Market, By Product, 2014-2019 (%)

Figure 44 Australia Spine Surgery Devices Market: End-User Snapshot

Figure 45 Australia Spine Surgery Devices Market, By End-User, 2013-2019 (USD MN)

Figure 46 Spine Surgery Devices Market

Figure 47 Biomet, Inc.: Reveue Mix, 2013 (%)

Figure 48 Johnson & Johnson Ltd. Revenue Mix, 2014 (%)

Figure 49 Integra Lifesciences Holdings Corporation. Reveue Mix, 2014 (%)

Figure 50 Medtronic, Inc. Revenue Mix, 2013

Figure 51 Nuvasive Inc Reveue Mix, 2013 (%)

Figure 52 Stryker Corporation Revenue Mix, 2014 (%)

Figure 53 Zimmer Holding, Inc.: Reveue Mix, 2013 (%)

Figure 54 Amedica Corporation.: Reveue Mix, 2013 (%)

The Asia Pacific Spine Surgery Devices Market is broadly segmented into four classes, such as fusion, non-fusion, spinal decompression, and spine biologics. The fusion category can be divided into spine fusion and fixation and spinal bone stimulators. The non-fusion segment consists of motion preservation technologies such as dynamic stabilization, artificial discs, annual repair, and nucleus replacement. The vertebral compression factures treatment category includes market for vertebroplasty and kyphoplasty kits. The spinal decompression segment consists of niche markets, such as corpectomy, disectomy, foraminotomy/forminectomy, and laminotomy/laminectomy. Allogarfts, bone morphonenetic proteins, demineralised bone matrix, bone substitutes, and machined bones together contribute to the overall category of spine biologics.

The market will be driven by the increasing aging population, technological advancements, rising industry players, and increasing demand for MIS procedures are the major drivers which are slated to propel this market. However, the pricing pressures, economic slowdown, and unstable reimbursement policies will restrict the growth of this market to a certain extent.

The Asia Pacific spine surgery devices market is expected to reach $2,223.1 million by 2019, at a CAGR of 10.5% from 2014 to 2019. This is mainly due to the increasing incidents of spinal deformities, such as disc compression amongst the aging population in the Asia-Pacific region, and the popularity of non-fusion devices, such as artificial spinal disc and nucleus. The increasing demand from the aging population, along with the advancement in medical technology, is driving the demand for the spine surgery devices market in this region.

This market is witnessing a significant growth due to the increasing awareness among patients about the advantages of advanced treatments and technologies, such as orthobiologics and minimally invasive surgery. According to various medical records, 25 people in every 1000 in the age group of 45 to 64 years undergo a joint replacement surgery, mainly as a result of osteoarthritis due to obesity. In addition, there has been a significant increase in the number of patients who demand artificial bone and soft tissue healing treatments. This has contributed significantly to the growth of the fixation devices market. The increasing demand from the aging population for orthopedic treatment, along with the aforementioned factors, is driving the Asia-Pacific spine surgery devices market.

Advancements in the Asia-Pacific spine surgery devices market are a result of the shifting focus from experimental to application-based advancements and mechanized implants in the early 90s. The key players in the market, such as the Stryker Corporation (U.S.), DePuy Synthes Companies of Johnson & Johnson (U.S.), Zimmer Holdings, Inc. (U.S.), Smith & Nephew Plc (U.K.), Tornier, Inc. (France), and Biomet, Inc. (U.S.) emphasize upon research & development of spinal & joint replacement techniques, products, and so on. This era of orthopedics can be termed as an era of mechanized solutions, where developments in mechanical devices are prioritized by most of these companies.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia Orthopedics Device Market The report “Asian Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. The main companies operating in Asian Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. ... |

Upcoming |

|

North America Orthopedic Devices The report “North American Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. Both the markets have been witnessing the maximum growth because of increase in patient pool and procedure numbers of hip and knee osteoarthritis and rheumatoid arthritis. The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in North American Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. ... |

Upcoming |

|

Europe Orthopedics Device Market The report “European Orthopedic Devices Market forecast, 2012-2018 “analyzes the market of devices by 8 segments such as Orthopedic Braces & Support Systems, Joint Reconstruction Devices, Trauma Fixation Devices, Arthroscopic Devices, Spine Surgery Devices, Orthobiologics and Orthopedic Accessories. All of these segments experienced a positive growth till 2012 with an increased awareness for procedures and sophisticated diagnostic techniques.The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in European Orthopedic Devices market and extensively covered in this report are Stryker, Zimmer, DePuy Synthes, Medtronic, Smith and Nephew, Exactech Inc., Tornier, Biomet Inc., Wright Medical Group and Ottobock. |

Upcoming |