Asia Pharmacy Information Systems Market By Type (Inpatient PIS, Outpatient PIS), By Component (Hardware, Software, Services), By Deployment (Web Based, On-Premise, Cloud Based), By End-User – Analysis & Forecast To 2019

The pharmacy information system has provided immense productivities in the distribution of medication, with the help of a well-developed information system and related automation process. Pharmacy information system enables an efficient inventory control, for the sole purpose of collecting, storing, and maintaining medical records. This prevents the incidence of stock outs and surplus inventory.

In Asia, the pharmacy information system market is steadily evolving, and is poised to develop at a faster pace in comparison to other regions. Some hospitals present in the Asian region are moving towards e-prescription, however, the government needs to take up further initiatives to build this market. Certain issues pertaining to interoperability of these complex systems among different suppliers, and paucity of healthcare IT professionals are considered as factors acting as significant market restraints.

In India, the medicine usage is quite varied, comprising of ayurvedic, homeopathy, and allopathy. Owing to this fact, keeping track of varied medications might become a tedious task for pharmacists. Therefore, with the assistance of these information systems, pharmacists are able to maintain an efficient drug inventory that helps in managing appropriate stock movement in the pharmacy department.

Advantages of pharmacy information system constitutes offering efficiency in the documentation procedure that involves electronic compilation of data and statistics, reduced human errors/administrative errors, powerful inventory system, and user-friendly interface that guides the user and multiple modules to facilitate numerous work tasks in a timely manner. These essential features of the pharmacy information systems results in its wide-scale adoption across hospitals in the Asia-Pacific region. Additionally, growing expenditure in healthcare IT and incessant rise in the number of healthcare equipment manufacturers are likely to drive the market growth of pharmacy information systems.

The market is segmented on the basis of geography, type, deployment, component, application, and end-user. The Asian Pharmacy Information System Market is estimated to grow at a CAGR of 8.1% from 2014 to 2019.

The report offers a comprehensive overview of markets share of top companies, which are based on key facts, annual financial information from SEC filings, annual reports, and interviews with industry experts, key opinion leaders such as CEOs, directors, and marketing executives. Varied market dynamics with respect to drivers, restraints, and upcoming opportunities are also discussed in this report. Lastly, this market research report lays emphasis on competitive landscape of key players, along with company profiles, financials, growth strategies, and recent developments.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Integrated Ecosystem of the Pharmacy Information Systems Market

2.2 Arriving at the Pharmacy Information Systems Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 22)

4 Market Overview (Page No. - 24)

4.1 Introduction

4.2 Asian Pharmacy Information Systems Market: Comparison With Clinical Information Systems (Parent) Market

4.3 Market Drivers and Inhibitors

4.4 Opportunities

4.5 Key Market Dynamics

5 Asian Pharmacy Information Systems Market, By Type (Page No. - 30)

5.1 Introduction

5.2 Asian Pharmacy Information Systems Market, Comparison With Types

5.3 Asia Inpatient Pharmacy Information Systems Market, By Country

5.4 Asian Outpatient Pharmacy Information Systems Market, By Country

6 Asian Pharmacy Information Systems Market, By Component (Page No. - 35)

6.1 Introduction

6.2 Asian Pharmacy Information Systems Market, By Component

6.3 Asian Pharmacy Information Systems Market, Component Comparison With Asian Pharmacy Information Systems Market

6.4 Asian Pharmacy Information Systems Market for Services, By Country, 2013-2019 (USD MN)

6.5 Asian Pharmacy Information Systems Market for Software, By Country, 2013-2019 (USD MN)

6.6 Asian Pharmacy Information Systems Market for Hardware, By Country, 2013-2019 (USD MN)

7 Asian Pharmacy Information Systems Market, By Deployment (Page No. - 42)

7.1 Introduction

7.2 Asian Pharmacy Information Systems Market, By Deployment, 2014 vs. 2019 (USD MN)

7.3 Asian Pharmacy Information Systems Market, Deployment Comparison With Asian Pharmacy Information Systems Market

7.4 Asia: Web-Based Pharmacy Information Systems Market, By Country

7.5 Asian On-Premise Pharmacy Information Systems Market, By Country

7.6 Asian Cloud-Based Pharmacy Information Systems Market, By Country

8 Asian Pharmacy Information Systems Market, By End User (Page No. - 49)

8.1 Introduction

8.2 Asian Pharmacy Information Systems Market for Hospitals, By Country

8.3 Asian Pharmacy Information Systems Market for Office-Based Physicians, By Country

8.4 Asian Pharmacy Information Systems Market for Emergency Healthcare Service Providers, By Country

9 Asian Pharmacy Information Systems Market, By Geography (Page No. - 55)

9.1 Introduction

9.2 Japan Pharmacy Information Systems Market

9.2.1 Japan Pharmacy Information Systems Market, By Type

9.2.2 Japan Pharmacy Information Systems Market, By Component

9.2.3 Japan Pharmacy Information Systems Market, By Deployment

9.2.4 Japan Pharmacy Information Systems Market, By End User

9.3 China Pharmacy Information Systems Market

9.3.1 China Pharmacy Information Systems Market, By Type

9.3.2 China Pharmacy Information Systems Market, By Component

9.3.3 China Pharmacy Information Systems Market, By Deployment

9.3.4 China Pharmacy Information Systems Market, By End User

9.4 India Pharmacy Information Systems Market

9.4.1 India Pharmacy Information Systems Market, By Type

9.4.2 India Pharmacy Information Systems Market, By Component

9.4.3 India Pharmacy Information Systems Market, By Deployment

9.4.4 India Pharmacy Information Systems Market, By End User

9.5 Republic of Korea Pharmacy Information Systems Market

9.5.1 Republic of Korea Pharmacy Information Systems Market, By Type

9.5.2 Republic of Korea Pharmacy Information Systems Market, By Component

9.5.3 Republic of Korea Pharmacy Information Systems Market, By Deployment

9.5.4 Republic of Korea Pharmacy Information Systems Market, By End User

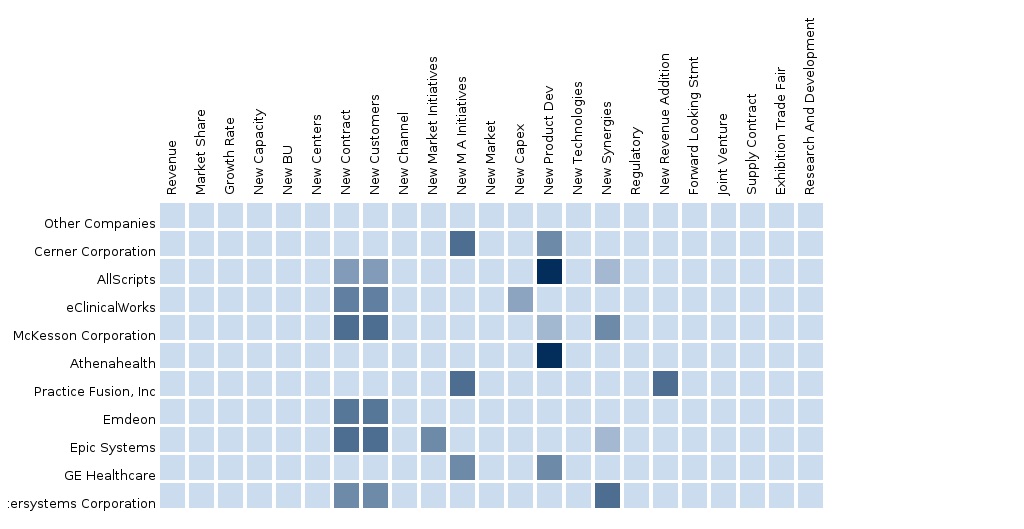

10 Competitive Landscape (Page No. - 85)

10.1 Asia Pharmacy Information System Market Share, By Company

10.2 New Product Launches

10.3 Agreements and Collaborations

10.4 Partnerships

10.5 Other Developments

11 Company Profiles (Page No. - 91)

(Overview, Financials, ProduCTS & Services, Strategy, and Developments)*

11.1 Allscripts

11.2 Athenahealth, Inc.

11.3 Carestream Health

11.4 Cerner Corporation

11.5 Eclinicalworks

11.6 Epic Systems Corporation

11.7 Mckesson Corporation

11.8 Parata Systems

11.9 Quality Systems, Inc.

11.10 Scriptpro Llc

11.11 Swisslog

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

12 Appendix (Page No. - 119)

12.1 Customization Options

12.1.1 Impact Analysis

12.2 Related Reports

12.3 Introducing RT: Real Time Market Intelligence

12.3.1 RT Snapshots

List of Table (57 Tables)

Table 1 Asia: Pharmacy Information Systems Peer Market Size, 2014 (USD MN)

Table 2 Asia: Pharmacy Information Systems Market: Macroindicators, By Country, 2014 (USD MN)

Table 3 Asian Pharmacy Information Systems Market: Comparison With Clinical Information Systems (Parent) Market, 2013 – 2019 (USD MN)

Table 4 Asian Pharmacy Information System Market: Drivers and Inhibitors

Table 5 Asia Pharmacy Information Systems Market, By Type, 2013 - 2019 (USD MN)

Table 6 Asia Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Table 7 Asia Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 8 Asia Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Table 9 Asia Pharmacy Information Systems Market, By Country, 2013 - 2019 (USD MN)

Table 10 Asia Pharmacy Information Systems Market, By Type, 2013–2019 (USD MN)

Table 11 Asian Pharmacy Information Systems Market: Comparison With Types, 2013–2019 (USD MN)

Table 12 Asia: Inpatient Pharmacy Information Systems Market, By Country, 2013–2019 (USD MN)

Table 13 Asia: Outpatient Pharmacy Information Systems Market, By Country, 2013–2019 (Usd Million)

Table 14 Asia Pharmacy Information Systems Market, By Component, 2013–2019 (USD MN)

Table 15 Asia Pharmacy Information Systems Market: Component Comparison With Parent Market, 2013–2019 (USD MN)

Table 16 Asia Pharmacy Information Systems Market for Services, By Country, 2013–2019 (USD MN)

Table 17 Asia Pharmacy Information Systems Market for Software, By Country, 2013–2019 (USD MN)

Table 18 Asia Pharmacy Information Systems Market for Hardware, By Country, 2013–2019 (USD MN)

Table 19 Asia Pharmacy Information Systems Market, By Deployment, 2013–2019 (USD MN)

Table 20 Asia Pharmacy Information Systems Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 21 Asia: Web-Based Pharmacy Information Systems Market, By Country, 2013–2019 (USD MN)

Table 22 Asia: On-Premise Pharmacy Information Systems Market, By Country, 2013–2019 (USD MN)

Table 23 Asia: Cloud-Based Pharmacy Information Systems Market, By Country, 2013–2019 (USD MN)

Table 24 Asia: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Table 25 Asia: Pharmacy Information Systems Market for Hospitals, By Country, 2013 - 2019 (USD MN)

Table 26 Asia: Pharmacy Information Systems Market for Office-Based Physicians, By Country, 2013 - 2019 (USD MN)

Table 27 Asia: Pharmacy Information Systems Market for Emergency Healthcare Service Providers, By Country, 2013 - 2019 (USD MN)

Table 28 Asia: Pharmacy Information Systems Market, By Country, 2013 - 2019 (USD MN)

Table 29 Japan: Pharmacy Information Systems Market, By Type, 2013-2019 (USD MN)

Table 30 Japan: Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Table 31 Japan: Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 32 Japan: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Table 33 China: Pharmacy Information Systems Market, By Type, 2013-2019 (USD MN)

Table 34 China: Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Table 35 China: Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 36 China: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Table 37 India: Pharmacy Information Systems Market, By Type, 2013-2019 (USD MN)

Table 38 India: Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Table 39 India: Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 40 India: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Table 41 Republic of Korea: Pharmacy Information Systems Market, By Type, 2013-2019 (USD MN)

Table 42 Republic of Korea: Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Table 43 Republic of Korea: Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Table 44 Republic of Korea: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Table 45 Asia: Pharmacy Information System Market: Company Share Analysis, 2014 (%)

Table 46 Asian Pharmacy Information Systems Market: Acquisitions

Table 47 Asian Pharmacy Information Systems Market: New Product Launches

Table 48 Asian Pharmacy Information Systems Market: Agreements and Collaborations

Table 49 Asian Pharmacy Information Systems Market: Partnerships

Table 50 Asian Pharmacy Information Systems Market: Other Developments

Table 51 Allscripts.: Key Operations Data, 2009 - 2013 (USD MN)

Table 52 Allscripts: Key Financials, 2011- 2013 (USD MN)

Table 53 Athenahealth, Inc.: Key Financials, 2010 - 2014 (USD MN)

Table 54 Cerner Corporation: Key Financials, 2008 - 2013 (USD MN)

Table 55 Mckesson Corporation: Key Operations Data, 2010 - 2014 (USD MN)

Table 56 Mckesson Corporation: Key Financials, 2008 - 2014 (USD MN)

Table 57 Quality Systems, Inc.: Key Financials, 2010 - 2014 (USD MN)

List of Figures (68 Figures)

Figure 1 Asia: Pharmacy Information Systems Market: Segmentation & Coverage

Figure 2 Pharmacy Information Systems Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 Bottom-Up Approach

Figure 5 Macroindicator-Based Approach - 2014

Figure 6 Asia Pharmacy Information Systems Market Snapshot

Figure 7 Asia Pharmacy Information Systems Market, By Country, 2014 vs. 2019 (USD MN)

Figure 8 Asia Pharmacy Information Systems Market, By Type, 2014 vs. 2019, (USD MN)

Figure 9 Asian Pharmacy Information Systems Market: Comparison With Types, 2013–2019 (USD MN)

Figure 10 Asia: Inpatient Pharmacy Information Systems Market, By Country, 2013-2019 (USD MN)

Figure 11 Asia: Outpatient Pharmacy Information Systems Market, By Country, 2013 - 2019 (USD MN)

Figure 12 Asia Pharmacy Information Systems Market, By Component, 2014 vs. 2019 (USD MN)

Figure 13 Asia Pharmacy Information Systems Market: Component Comparison With Pharmacy Information Systems Market, 2013–2019 (USD MN)

Figure 14 Asia Pharmacy Information Systems Market for Services, By Country, 2013 - 2019 (USD MN)

Figure 15 Asia Pharmacy Information Systems Market for Software, By Country, 2013 - 2019 (USD MN)

Figure 16 Asia Pharmacy Information Systems Market for Hardware, By Country, 2013 - 2019 (USD MN)

Figure 17 Asia Pharmacy Information Systems Market, By Deployment, 2014 vs. 2019 (USD MN)

Figure 18 Asia Pharmacy Information Systems Market: Deployment Comparison With Asian Pharmacy Information System Market, 2013–2019 (USD MN)

Figure 19 Asia: Web-Based Pharmacy Information Systems Market, By Country, 2013–2019 (USD MN)

Figure 20 Asia: On-Premise Pharmacy Information Systems Market, By Country, 2013–2019 (USD MN)

Figure 21 Asia: Cloud-Based Pharmacy Information Systems Market, By Country, 2013–2019 (USD MN)

Figure 22 Asia Pharmacy Information Systems Market, By End User, 2014 & 2019 (USD MN)

Figure 23 Asia Pharmacy Information Systems Market for Hospitals, By Country, 2013 - 2019 (USD MN)

Figure 24 Asia Pharmacy Information Systems Market for Office-Based Physicians, By Country, 2013 - 2019 (USD MN)

Figure 25 Asia Pharmacy Information Systems Market for Emergency Healthcare Service Providers, By Country, 2013 - 2019 (USD MN)

Figure 26 Asia: Pharmacy Information Systems Market: Growth Analysis, By Country, 2014 & 2019 (USD MN)

Figure 27 Japan: Pharmacy Information Systems Market Overview, 2014 & 2019 (%)

Figure 28 Japan: Pharmacy Information Systems Market, By Type, 2013-2019 (USD MN)

Figure 29 Japan: Pharmacy Information Systems Market, By Type Snapshot, 2014 & 2019 (%)

Figure 30 Japan: Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Figure 31 Japan: Pharmacy Information Systems Market Snapshot, By Component, 2014 vs. 2019 (USD MN)

Figure 32 Japan: Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Figure 33 Japan: Pharmacy Information Systems Market Snapshot, By Deployment, 2014 & 2019 (USD MN)

Figure 34 Japan: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Figure 35 Japan: Pharmacy Information Systems Market Snapshot, By End User, 2014 vs. 2019 (USD MN)

Figure 36 China: Pharmacy Information Systems Market Overview, 2014 & 2019 (%)

Figure 37 China: Pharmacy Information Systems Market, By Type, 2013-2019 (USD MN)

Figure 38 China: Pharmacy Information Systems Market, By Type Snapshot, 2014 & 2019 (%)

Figure 39 China: Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Figure 40 China: Pharmacy Information Systems Market Snapshot, By Component, 2014 vs. 2019 (USD MN)

Figure 41 China: Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Figure 42 China: Pharmacy Information Systems Market Snapshot, By Deployment, 2014 & 2019 (USD MN)

Figure 43 China: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Figure 44 China: Pharmacy Information Systems Market Snapshot, By End User, 2014 vs. 2019 (USD MN)

Figure 45 India: Pharmacy Information Systems Market Overview, 2014 & 2019 (%)

Figure 46 India: Pharmacy Information Systems Market, By Type, 2013-2019 (USD MN)

Figure 47 India: Pharmacy Information Systems Market, By Type Snapshot, 2014 & 2019 (%)

Figure 48 India: Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Figure 49 India: Pharmacy Information Systems Market Snapshot, By Component, 2014 vs. 2019 (USD MN)

Figure 50 India: Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Figure 51 India: Pharmacy Information Systems Market Snapshot, By Deployment, 2014 vs. 2019 (USD MN)

Figure 52 India: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Figure 53 India: Pharmacy Information Systems Market Snapshot, By End User, 2014 vs. 2019 (USD MN)

Figure 54 Republic of Korea: Pharmacy Information Systems Market Overview, 2014 & 2019 (%)

Figure 55 Republic of Korea: Pharmacy Information Systems Market, By Type, 2013-2019 (USD MN)

Figure 56 Republic of Korea: Pharmacy Information Systems Market, By Type Snapshot, 2014 & 2019 (%)

Figure 57 Republic of Korea: Pharmacy Information Systems Market, By Component, 2013 - 2019 (USD MN)

Figure 58 Republic of Korea: Pharmacy Information Systems Market Snapshot, By Component, 2014 vs. 2019 (USD MN)

Figure 59 Republic of Korea: Pharmacy Information Systems Market, By Deployment, 2013 - 2019 (USD MN)

Figure 60 Republic of Korea: Pharmacy Information Systems Market Snapshot, By Deployment, 2014 vs. 2019 (USD MN)

Figure 61 Republic of Korea: Pharmacy Information Systems Market, By End User, 2013 - 2019 (USD MN)

Figure 62 Republic of Korea: Pharmacy Information Systems Market Snapshot, By End User, 2014 vs. 2019 (USD MN)

Figure 63 Asia: Pharmacy Information System Market Share, By Company, 2014

Figure 64 Allscripts: Revenue Mix, 2013 (%)

Figure 65 Cerner Corporation: Revenue Mix, 2013 (%)

Figure 66 Mckesson Corporation: Revenue Mix, 2014 (%)

Figure 67 Quality Systems: Revenue Mix, 2013 (%)

Figure 68 Swisslog Company Revenue Mix, 2013 (%)

A pharmacy information system is a web-based system designed to provide high flexibility and easy usage facility to clinics and pharmacy stores. It consists of one central store and many pharmacies connected through a network distributed through various geographical locations. These systems ease complex information search as well as help doctors and pharmacists to coordinate. They also help in maintaining the medical stock with least paper work. The main functionality of these systems includes dispensing medicines over centers associated with the systems. These systems have greatly helped the U.S. Department of Defense Military Health System in the improvement of safety and quality of its prescription service.

The Asian pharmacy information systems market was valued at $522.6 million in 2014, and is expected to reach a value of $776.8 million by 2019, at a CAGR of 8.3% from 2014 to 2019.

Among the types of the pharmacy information systems, the inpatient pharmacy information systems segment is estimated to reach $570.0 million by 2019. Among the end-user segments, the hospitals segment is estimated to grow at the highest CAGR of 7.5% and reach a market value of $333.2 million by 2019. The services segment is expected to grow at a CAGR of 9.1% from 2014 to 2019. The web-based segment led the Asian pharmacy information systems market, by deployment, with a value of $319.2 million in 2014 and is estimated to reach $490.4 million by 2019 at a CAGR of 9.0%.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North American Clinical Cardiovascular Information And Imaging Solution The North American Clinical CVIS market is anticipated to boom due to the inherent advantages it offers in the field of interventional cardiology. This report encompasses the market share, value chain analysis, and market metrics along with the market drivers and restraints. A DeepDive analysis of the top players of this domain have also been considered in the report. |

Upcoming |

|

European Clinical Cardiovascular Information And Imaging Solution market Globally, Europe is the second largest Clinical Information Systems market, which is expected to reach a CAGR value of 6.35%, from 2012 to 2018. The European chromatography market is segmented into geography, sub-market, application, component, deployment, and end-user. A DeepDive analysis of the top players of this domain have also been considered in the report. |

Upcoming |

|

Asia Clinical Information Systems Market The Asian clinical CVIS market report includes the market share, value chain analysis, and market metrics that include drivers, restraints, and upcoming opportunities. The market is segmented into geography, sub-market, application, component, deployment, and end-user. A DeepDive analysis of the top players of this domain have also been considered in this report. |

Upcoming |