Asia Pacific Biopesticides Market By Source (Microbial, Biorational), By Application (Permanent Crop, Arable Crop), By End-Use (Seed Treatment, On Farm, Post-Harvest), By Sub-Market, By Formulation, By Geography - Analysis & Forecast to 2019

The Asia Pacific biopesticides market is estimated to grow at a CAGR of 15.0% during the forecast period of 2014 to 2019. Biopesticides include the various types of crop protection products that are used on crops and plants to prevent the damage caused by pests, thereby increasing the crop yield. Biopesticides are eco-friendly products that include organic ingredients (microbes) for combating pests so as to prevent crop damage. The extensive damage caused by pests and the increase in population in both the developed as well as developing nations are the key drivers for the growth of this market.

Biopesticides provide various health benefits as they have minimal residual effects. Microbials and biorationals are the different types of commonly used biopesticides in the Asia Pacific region. Bioinsecticides, biofungicides, bioherbicides, and bionematicides are the major types of biopesticides commercially available. The cost to produce depends on the economy of scale as well as the complexities in the production system.

The Asia Pacific biopesticides market is dominated by China, followed by India. In China, deliberate efforts are being made to promote the usage of biopesticides to enhance the crop yield. Moreover, the Chinese government is offering subsidies for environment-friendly pesticides to ensure the adequate supply of key grain crops.

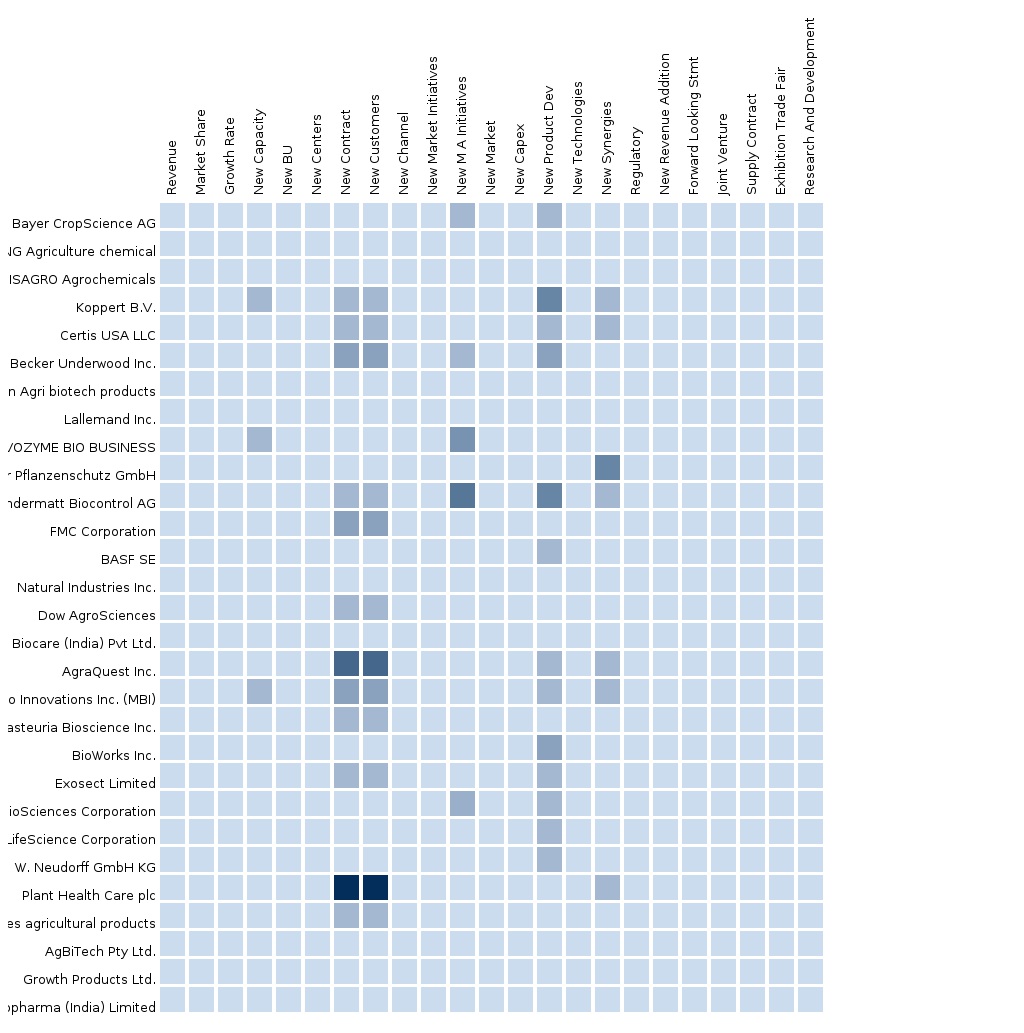

The Asia Pacific biopesticides market is a competitive market, with firms such as Bayer AG (Germany), Novozymes A/S (Denmark), Koppert B.V. (Netherlands), and Marrone Bio Innovations Inc. (U.S.), among others, who are expanding their market share in the region. To gain major market shares in the market, these companies are adapting numerous market strategies including innovative product developments, partnerships, mergers & acquisitions, and expansion of existing facilities. Apart from these companies, there are a large number of small firms present in the Asia Pacific market.

Scope of the Report

This research report categorizes the Asia Pacific biopesticides market into the following segments and sub segments:

Asia Pacific Biopesticides Market, By Submarket

- Bioinsecticides

- Biofungicides

- Bioherbicides

- Bionematicides

- Others

Asia Pacific Biopesticides Market, By Source

- Microbials

- Biorationals

- Others

Asia Pacific Biopesticides Market, By Application

- Permanent Crops

- Arable Crops

- Others

Asia Pacific Biopesticides Market, By End-Use

- Seed Treatment

- On Farm

- Post-Harvest

Asia Pacific Biopesticides Market, By Formulation

- Liquid-based Formulation

- Water Dispersible Granules

- Wettable Powder

- Pellets

- Others

Asia Pacific Biopesticides Market, By Geography

- China

- India

- Japan

- Australia

- Others

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Integrated Ecosystem of Biopesticides Market

2.2 Arriving at the Biopesticides Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 25)

4 Market Overview (Page No. - 27)

4.1 Introduction

4.2 Biopesticides Market: Comparison With Agricultural Biologicals Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 Asia-Pacific Biopesticides Market, By Source (Page No. - 38)

5.1 Introduction

5.2 Asia-Pacific Biopesticides Market: Source Comparison With Agricultural Biologicals Market

5.3 Asia-Pacific Microbial Biopesticides Market, By Geography

5.4 Asia-Pacific Biorational Biopesticides Market, By Geography

6 Asia-Pacific Biopesticides Market, By Application (Page No. - 46)

6.1 Introduction

6.2 Demand Side Analysis

6.3 Asia-Pacific Biopesticides Market in Permanent Crops, By Geography

6.4 Asia-Pacific Biopesticides Market in Arable Crops, By Geography

7 Asia-Pacific Biopesticides Market, By End-Use (Page No. - 53)

7.1 Introduction

7.2 Asia-Pacific Biopesticides Market in Seed Treatment, By Geography

7.3 Asia-Pacific Biopesticides Market in On Farm, By Geography

7.4 Asia-Pacific in Biopesticides Market in Post-Harvest, By Geography

8 Asia-Pacific Biopesticides Market, By Submarket (Page No. - 62)

8.1 Introduction

8.2 Asia-Pacific Biopesticides Market: Submarket Comparison With Agricultural Biologicals Market

8.3 Asia-Pacific Bioinsecticides Market, By Geography

8.4 Asia-Pacific Biofungicides Market, By Geography

8.5 Asia-Pacific Bioherbicides Market, By Geography

8.6 Asia-Pacific Bionematicides Market, By Geography

9 Asia-Pacific Biopesticides Market, By Formulation (Page No. - 73)

9.1 Introduction

9.2 Asia-Pacific Biopesticides Market: Formulation Comparison With Agricultural Biologicals Market

9.3 Asia-Pacific Liquid-Based Formulation Market, By Geography

9.4 Asia-Pacific Water Dispersible Granules Market, By Geography

9.5 Asia-Pacific Wettable Powder Market, By Geography

9.6 Asia-Pacific Pellets Market, By Geography

10 Asia-Pacific Biopesticides Market, By Geography (Page No. - 84)

10.1 Introduction

10.2 China Biopesticides Market

10.2.1 China Biopesticides Market, By Source

10.2.2 China Biopesticides Market, By Application

10.2.3 China Biopesticides Market, By End-Use

10.2.4 China Biopesticides Market, By Submarket

10.2.5 China Biopesticides Market, By Formulation

10.3 India Biopesticides Market

10.3.1 India Biopesticides Market, By Source

10.3.2 India Biopesticides Market, By Application

10.3.3 India Biopesticides Market, By End-Use

10.3.4 India Biopesticides Market, By Submarket

10.3.5 India Biopesticides Market, By Formulation

10.4 Japan Biopesticides Market

10.4.1 Japan Biopesticides Market, By Source

10.4.2 Japan Biopesticides Market, By Application

10.4.3 Japan Biopesticides Market, By End-Use

10.4.4 Japan Biopesticides Market, By Submarket

10.4.5 Japan Biopesticides Market, By Formulation

10.5 Australia Biopesticides Market

10.5.1 Australia Biopesticides Market, By Source

10.5.2 Australia Biopesticides Market, By Application

10.5.3 Australia Biopesticides Market, By End-Use

10.5.4 Australia Biopesticides Market, By Submarket

10.5.5 Australia Biopesticides Market, By Formulation

11 Asia-Pacific Biopesticides Market: Competitive Landscape (Page No. - 128)

11.1 Asia-Pacific Biopesticides Market: Company Share Analysis

11.2 Company Presence in Biopesticides Market, By Sub-Market

11.3 New Product Launch

11.4 Expansions and Acquisition

11.5 Investments and Agreements

11.6 Research & Development and Strategic Alliance

12 Asia-Pacific Biopesticides Market, By Company (Page No. - 132)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 Isagro S.P.A

12.2 Marrone Bio Innovations Inc.

12.3 Novozymes A/S

12.4 Koppert B.V.

12.5 Bayer AG

*Details On Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

13 Appendix (Page No. - 146)

13.1 Customization Options

13.1.1 Technical Analysis

13.1.2 Low-Cost Sourcing Locations

13.1.3 Regulatory Framework

13.1.4 Biopesticides Usage Data

13.1.5 Impact Analysis

13.1.6 Trade Analysis

13.1.7 Historical Data and Trends

13.2 Related Reports

13.3 Introducing Rt: Real Time Market Intelligence

13.3.1 Rt Snapshots

List of Tables (111 Tables)

Table 1 Global Biopesticides Peer Market Size, 2014 (USD MN)

Table 2 Asia-Pacific Biopesticides Application Markets, 2014 (USD MN)

Table 3 Asia-Pacific Biopesticides Market: Macroindicators, By Geography,2014 (MN HA)

Table 4 Asia-Pacific Biopesticides Market: Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Table 5 Asia-Pacific Biopesticides Market: Comparison With Agricultural Biologicals Market, 2013–2019 (‘000 HA)

Table 6 Asia-Pacific Biopesticides Market: Drivers and Inhibitors

Table 7 Asia-Pacific Biopesticides Market, By End-Use, 2013-2019 (USD MN)

Table 8 Asia-Pacific Biopesticides Market, By End-Use, 2013-2019 (‘000 HA)

Table 9 Asia-Pacific Biopesticides Market, By Submarket, 2013-2019 (USD MN)

Table 10 Asia-Pacific Biopesticides Market, By Submarket, 2013-2019 (‘000 HA)

Table 11 Asia-Pacific Biopesticides Market, By Formulation, 2013-2019 (USD MN)

Table 12 Asia-Pacific Biopesticides Market, By Formulation, 2013-2019 (‘000 HA)

Table 13 Asia-Pacific Biopesticides Market: Comparison With Application Markets, 2013-2019 (USD MN)

Table 14 Asia-Pacific Biopesticides Market, By Source, 2013-2019 (USD MN)

Table 15 Asia-Pacific Biopesticides Market, By Application, 2013-2019 (‘000 HA)

Table 16 Asia-Pacific Biopesticides Market: Source Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Table 17 Asia-Pacific Microbial Biopesticides Market, By Geography,2013-2019 (USD MN)

Table 18 Asia-Pacific Microbial Biopesticides Market, By Geography,2013-2019 (‘000 HA)

Table 19 Asia-Pacific Biorational Biopesticides Market, By Geography,2013-2019 (USD MN)

Table 20 Asia-Pacific Biorational Biopesticides Market, By Geography,2013-2019 (‘000 HA)

Table 21 Asia-Pacific Biopesticides Market, By Application, 2013-2019 (USD MN)

Table 22 Asia-Pacific Biopesticides: Market, By Application, 2013-2019 (‘000 HA)

Table 23 Asia-Pacific Biopesticides Market in Permanent Crops, By Geography,2013-2019 (USD MN)

Table 24 Asia-Pacific Biopesticides Market in Permanent Crops, By Geography,2013-2019 (‘000 HA)

Table 25 Asia-Pacific Biopesticides Market in Arable Crops, By Geography,2013-2019 (USD MN)

Table 26 Asia-Pacific Biopesticides Market in Arable Crops, By Geography,2013-2019 (‘000 HA)

Table 27 Asia-Pacific Biopesticides Market, By End-Use, 2013-2019 (USD MN)

Table 28 Asia-Pacific Biopesticides Market, By End-Use, 2013-2019 (‘000 HA)

Table 29 Asia-Pacific Biopesticides Market in Seed Treatment, By Geography 2013–2019 (USD MN)

Table 30 Asia-Pacific Biopesticides Market in Seed Treatment, By Geography 2013–2019 (‘000 HA)

Table 31 Asia-Pacific Biopesticides Market in On Farm, By Geography,2013–2019 (USD MN)

Table 32 Asia-Pacific Biopesticides Market in On Farm, By Geography,2013–2019 (‘000 HA)

Table 33 Asia-Pacific in Biopesticides Market in Post-Harvest, By Geography,2013-2019 (USD MN)

Table 34 Asia-Pacific in Biopesticides Market in Post-Harvest, By Geography,2013-2019 (‘000 HA)

Table 35 Asia-Pacific Biopesticides Market, By Submarket, 2013-2019 (USD MN)

Table 36 Asia-Pacific Biopesticides Market, By Submarket, 2013-2019 (‘000 HA)

Table 37 Asia-Pacific Biopesticides Market: Submarket Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Table 38 Asia-Pacific Bioinsecticides Market, By Geography, 2013-2019 (USD MN)

Table 39 Asia-Pacific Bioinsecticides Market, By Geography, 2013-2019 (‘000 HA)

Table 40 Asia-Pacific Biofungicides Market, By Geography, 2013-2019 (USD MN)

Table 41 Asia-Pacific Biofungicides Market, By Geography, 2013-2019 (‘000 HA)

Table 42 Asia-Pacific Bioherbicides Market, By Geography, 2013-2019 (USD MN)

Table 43 Asia-Pacific Bioherbicides Market, By Geography, 2013-2019 (‘000 HA)

Table 44 Asia-Pacific Bionematicides Market, By Geography, 2013-2019 (USD MN)

Table 45 Asia-Pacific Bionematicides Market, By Geography, 2013-2019 (‘000 HA)

Table 46 Asia-Pacific Biopesticides Market, By Formulation, 2013-2019 (USD MN)

Table 47 Asia-Pacific Biopesticides Market, By Formulation, 2013-2019 (‘000 HA)

Table 48 Asia-Pacific Biopesticides Market: Formulation Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Table 49 Asia-Pacific Liquid-Based Formulation Market, By Geography,2013–2019 (USD MN)

Table 50 Asia-Pacific Liquid-Based Formulation Market, By Geography,2013–2019 (‘000 HA)

Table 51 Asia-Pacific Water Dispersible Granules Market, By Geography,2013-2019 (USD MN)

Table 52 Asia-Pacific Water Dispersible Granules Market, By Geography,2013-2019 (‘000 HA)

Table 53 Asia-Pacific Wettable Powder Market, By Geography, 2013-2019 (USD MN)

Table 54 Asia-Pacific Wettable Powder Market, By Geography, 2013-2019 (‘000 HA)

Table 55 Asia-Pacific Pellets Market, By Geography, 2013-2019 (USD MN)

Table 56 Asia-Pacific Pellets Market, By Geography, 2013-2019 (‘000 HA)

Table 57 Asia-Pacific Biopesticides Market, By Geography, 2013-2019 (USD MN)

Table 58 Asia-Pacific Biopesticides Market, By Geography, 2013-2019 (‘000 HA)

Table 59 China Biopesticides Market, By Source, 2013-2019 (USD MN)

Table 60 China Biopesticides Market, By Source, 2013-2019 (‘000 HA)

Table 61 China Biopesticides Market, By Application, 2013-2019 (USD MN)

Table 62 China Biopesticides Market, By Application, 2013-2019 (‘000 HA)

Table 63 China Biopesticide Market, By End-Use, 2013-2019 (USD MN)

Table 64 China Biopesticides Market, By End-Use, 2013-2019 (‘000 HA)

Table 65 China Biopesticides Market, By Submarket, 2013-2019 (USD MN)

Table 66 China Biopesticides Market, By Submarket, 2013-2019 (‘000 HA)

Table 67 China Biopesticides Market, By Formulation, 2013-2019 (USD MN)

Table 68 China Biopesticides Market, By Formulation, 2013-2019 (‘000 HA)

Table 69 India Biopesticides Market, By Source, 2013-2019 (USD MN)

Table 70 India Biopesticides Market, By Source, 2013-2019 (‘000 HA)

Table 71 India Biopesticides Market, By Application, 2013-2019 (USD MN)

Table 72 India Biopesticides Market, By Application, 2013-2019 (‘000 HA)

Table 73 India Biopesticide Market, By End-Use, 2013-2019 (USD MN)

Table 74 India Biopesticides Market, By End-Use, 2013-2019 (‘000 HA)

Table 75 India Biopesticides Market, By Submarket, 2013-2019 (USD MN)

Table 76 India Biopesticides Market, By Submarket, 2013-2019 (‘000 HA)

Table 77 India Biopesticides Market, By Formulation, 2013-2019 (USD MN)

Table 78 India Biopesticides Market, By Formulation, 2013-2019 (‘000 HA)

Table 79 Japan Biopesticides Market, By Source, 2013-2019 (USD MN)

Table 80 Japan Biopesticides Market, By Source, 2013-2019 (‘000 HA)

Table 81 Japan Biopesticides Market, By Application, 2013-2019 (USD MN)

Table 82 Japan Biopesticides Market, By Application, 2013-2019 (‘000 HA)

Table 83 Japan Biopesticide Market, By End-Use, 2013-2019 (USD MN)

Table 84 Japan Biopesticides Market, By End-Use, 2013-2019 (‘000 HA)

Table 85 Japan Biopesticides Market, By Submarket, 2013-2019 (USD MN)

Table 86 Japan Biopesticides Market, By Submarket, 2013-2019 (‘000 HA)

Table 87 Japan Biopesticides Market, By Formulation, 2013-2019 (USD MN)

Table 88 Japan Biopesticides Market, By Formulation, 2013-2019 (‘000 HA)

Table 89 Australia Biopesticides Market, By Source, 2013-2019 (USD MN)

Table 90 Australia Biopesticides Market, By Source, 2013-2019 (‘000 HA)

Table 91 Australia Biopesticides Market, By Application, 2013-2019 (USD MN)

Table 92 Australia Biopesticides Market, By Application, 2013-2019 (‘000 HA)

Table 93 Australia Biopesticide Market, By End Use, 2013 - 2019 (USD MN)

Table 94 Australia Biopesticides Market, By End-Use, 2013-2019 (‘000 HA)

Table 95 Australia Biopesticides Market, By Submarket, 2013-2019 (USD MN)

Table 96 Australia Biopesticides Market, By Submarket, 2013-2019 (‘000 HA)

Table 97 Australia Biopesticides Market, By Formulation, 2013-2019 (USD MN)

Table 98 Australia Biopesticides Market, By Formulation, 2013-2019 (‘000 HA)

Table 99 Asia-Pacific Biopesticides Market: Company Share Analysis, 2014 (%)

Table 100 Asia-Pacific Biopesticides Market: New Product Launch

Table 101 Asia-Pacific Biopesticides Market: Expansions and Acquisition

Table 102 Asia-Pacific Biopesticides Market: Investments and Agreements

Table 103 Asia-Pacific Biopesticides Market: R&D and Strategic Alliance

Table 104 Isagro S.P.A: Annual Revenue, By Geography, 2009–2013 (USD MN)

Table 105 Isagro S.P.A: Annual Revenue, 2009 – 2013 (USD MN)

Table 106 Marrone Bio Innovation Inc.: Key Operations Data, 2010-2013 (USD MN)

Table 107 Novozymes A/S: Key Operations Data, 2010-2014 (USD MN)

Table 108 Novozymes A/S: Key Financials, By Geographic Segment, 2010-2014 (USD MN)

Table 109 Bayer AG: Revenues, By Segment, 2010-2014 (USD MN)

Table 110 Bayer AG: Key Financials, 2010-2014 (USD MN)

Table 111 Bayer AG: Revenue, By Geographic Segment, 2010-2014 (USD MN)

List of Figures (88 Figures)

Figure 1 Asia-Pacific Biopesticides Market: Segmentation & Coverage

Figure 2 Biopesticides Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 Asia-Pacific Biopesticides Market: Snapshot

Figure 9 Biopesticides Market: Growth Aspects

Figure 10 Asia-Pacific Biopesticides Market, By End-Use, 2014 vs 2019

Figure 11 Asia-Pacific Biopesticides Submarkets, By Geography, 2014 (USD MN)

Figure 12 Asia-Pacific Biopesticides Market: Growth Analysis, By Formulation,2014–2019 (%)

Figure 13 Asia-Pacific Biopesticides Market, By Source, 2014-2019 (USD MN)

Figure 14 Asia-Pacific Biopesticides Market, By Source, 2014-2019 (‘000 HA)

Figure 15 Asia-Pacific Biopesticides Market: Source Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Figure 16 Asia-Pacific Microbial Biopesticides Market, By Geography,2013-2019 (USD MN)

Figure 17 Asia-Pacific Biorational Biopesticides Market, By Geography,2013-2019 (USD MN)

Figure 18 Asia-Pacific Biopesticides Market, By Application, 2014-2019 (USD MN)

Figure 19 Asia-Pacific Biopesticides Market, By Application, 2014-2019 (‘000 HA)

Figure 20 Asia-Pacific Biopesticides Market in Permanent Crops, By Geography,2013-2019 (USD MN)

Figure 21 Asia-Pacific Biopesticides Market in Arable Crops, By Geography,2013-2019 (USD MN)

Figure 22 Asia-Pacific Biopesticides Market, By End-Use, 2013-2019 (USD MN)

Figure 23 Asia-Pacific Biopesticides Market, By End-Use, 2014 & 2019 (‘000 HA)

Figure 24 Asia-Pacific Biopesticides Market in Seed Treatment, By Geography,2013–2019 (USD MN)

Figure 25 Asia-Pacific Biopesticides Market in On Farm, By Geography,2013–2019 (USD MN)

Figure 26 Asia-Pacific in Biopesticides Market in Post-Harvest, By Geography,2013-2019 (USD MN)

Figure 27 Asia-Pacific Biopesticides Market, By Submarket, 2014-2019 (USD MN)

Figure 28 Asia-Pacific Biopesticides Market, By Submarket, 2014-2019 (‘000 HA)

Figure 29 Asia-Pacific Biopesticides Market: Submarket Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Figure 30 Asia-Pacific Bioinsecticides Market, By Geography, 2013-2019 (USD MN)

Figure 31 Asia-Pacific Biofungicides Market, By Geography, 2013-2019 (USD MN)

Figure 32 Asia-Pacific Bioherbicides Market, By Geography, 2013-2019 (USD MN)

Figure 33 Asia-Pacific Bionematicides Market, By Geography, 2013-2019 (USD MN)

Figure 34 Asia-Pacific Biopesticides Market, By Formulation, 2014 & 2019 (USD MN)

Figure 35 Asia-Pacific Biopesticides Market, By Formulation, 2014 & 2019 (‘000 HA)

Figure 36 Asia-Pacific Biopesticides Market: Formulation Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Figure 37 Asia-Pacific Liquid-Based Formulation Market, By Geography,2013–2019 (USD MN)

Figure 38 Asia-Pacific Water Dispersible Granules Market, By Geography,2013-2019 (USD MN)

Figure 39 Asia-Pacific Wettable Powder S Market, By Geography, 2013-2019 (USD MN)

Figure 40 Asia-Pacific Pellets Market, By Geography, 2013-2019 (USD MN)

Figure 41 Asia-Pacific Biopesticides Market: Growth Analysis, By Geography,2014-2019 (USD MN)

Figure 42 Asia-Pacific Biopesticides Market: Growth Analysis, By Geography,2014-2019 (‘000 HA)

Figure 43 China Biopesticides Market Overview, 2014 & 2019 (%)

Figure 44 China Biopesticides Market, By Source, 2013-2019 (USD MN)

Figure 45 China Biopesticides Market, By Source, 2014 & 2019 (%)

Figure 46 China Biopesticides Market, By Application, 2013-2019 (USD MN)

Figure 47 China Biopesticides Market: Application Snapshot

Figure 48 China Biopesticides Market, By End-Use, 2013-2019 (USD MN)

Figure 49 China Biopesticides Market, By Submarket, 2014-2019 (USD MN)

Figure 50 China Biopesticide Market, By Submarket, 2014 & 2019 (%)

Figure 51 China Biopesticides Market, By Formulation, 2014-2019 (USD MN)

Figure 52 China Biopesticide Market, By Formulation, 2014 & 2019 (%)

Figure 53 India Biopesticides Market Overview, 2014 & 2019 (%)

Figure 54 India Biopesticides Market, By Source, 2013-2019 (USD MN)

Figure 55 India Biopesticides Market, By Source, 2014 & 2019 (%)

Figure 56 India Biopesticides Market, By Application, 2013-2019 (USD MN)

Figure 57 India Biopesticides Market: Application Snapshot

Figure 58 India Biopesticides Market, By End-Use, 2013-2019 (USD MN)

Figure 59 India Biopesticides Market, By Submarket, 2014-2019 (USD MN)

Figure 60 India Biopesticide Market, By Submarket, 2014 & 2019 (%)

Figure 61 India Biopesticides Market, By Formulation, 2014-2019 (USD MN)

Figure 62 India Biopesticides Market, By Formulation, 2014 & 2019 (%)

Figure 63 Japan Biopesticides Market Overview, 2014 & 2019 (%)

Figure 64 Japan Biopesticides Market, By Source, 2013-2019 (USD MN)

Figure 65 Japan Biopesticides Market, By Source, 2014 & 2019 (%)

Figure 66 Japan Biopesticides Market, By Application, 2013-2019 (USD MN)

Figure 67 Japan Biopesticides Market: Application Snapshot

Figure 68 Japan Biopesticides Market, By End-Use, 2013-2019 (USD MN)

Figure 69 Japan Biopesticides Market, By Submarket, 2014-2019 (USD MN)

Figure 70 Japan Biopesticide Market, By Submarket, 2014 & 2019 (%)

Figure 71 Japan Biopesticides Market, By Formulation, 2013-2019 (USD MN)

Figure 72 Japan Biopesticide Market, By Formulation, 2014 & 2019 (%)

Figure 73 Australia Biopesticides Market Overview, 2014 & 2019 (%)

Figure 74 Australia Biopesticides Market, By Source, 2013-2019 (USD MN)

Figure 75 Australia Biopesticides Market, By Source, 2014 & 2019 (%)

Figure 76 Australia Biopesticides Market, By Application, 2013-2019 (USD MN)

Figure 77 Australia Biopesticides Market: Application Snapshot

Figure 78 Australia Biopesticides Market, By End-Use, 2013-2019 (USD MN)

Figure 79 Australia Biopesticides Market, By Submarket, 2014-2019 (USD MN)

Figure 80 Australia Biopesticide Market, By Submarket, 2014 & 2019 (%)

Figure 81 Australia Biopesticides Market Share, By Formulation, 2013-2019 (USD MN)

Figure 82 Australia Biopesticide Market, By Formulation, 2014 & 2019 (%)

Figure 83 Asia-Pacific Biopesticides Market: Company Share Analysis, 2014 (%)

Figure 84 Biopesticides: Company Product Coverage, By Type, 2014

Figure 85 Isagro S.P.A: Revenue Mix, By Geography 2013 (%)

Figure 86 Marrone Bio Innovation Inc.: Revenue Mix, 2014 (%)

Figure 87 Novozymes A/S: Revenue Mix, 2013 (%)

Figure 88 Bayer AG: Revenue Mix, 2014 (%)

Biopesticides (also known as biological pesticides) are pesticides derived from natural materials such as animals, plants, bacteria, and certain minerals. For example, canola oil and baking soda have pesticidal applications and are considered as biopesticides. In other words, biopesticides are biochemical pesticides that are made of naturally occurring substances that control pests through non-toxic mechanisms. These are eco-friendly and easy to use. Biopesticides are the key components of Integrated Pest Management (IPM) programs, and are receiving much attention as a means to reduce the load of synthetic chemical products that are used in order to control plant diseases.

The purpose of this study is to analyze the Asia-Pacific market for biopesticides. This report includes revenue forecasts, market trends, and opportunities for the period from 2014 to 2019. The analysis has been conducted on the various market segments derived on the basis of applications of biopesticides and further segmented on the basis of biopesticide types.

The Asia-Pacific biopesticides market was valued at $411.0 million in 2014 and is projected to reach $827.3 million by 2019, at a CAGR of 15.0% during the period under consideration. The market, by formulation, was led by the liquid-based formulation in 2014, with a share of 45.0% of the overall market in Asia-Pacific. Among submarkets, the bioinsecticides segment dominated the Asia-Pacific biopesticides market in 2014.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Agriculture Biologicals Market Biologicals-Europe and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Asia-Pacific Agriculture Biologicals Market Biologicals-Asia and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Latin America Agriculture Biologicals Market Biologicals-Latin America and Agriculture Biopesticides Market, Bio... |

Apr 2015 |

|

North America Agriculture Biologicals Market The North America agriculture biologicals market was valued at $1,409.07 million in 2014 and is projected to reach $2,758.24 million by 2019 at a CAGR of 14.4% during the forecast period. The market, by application is led by cereals and grains in 2014. In North America, U.S. has the largest share in the agriculture biologicals market. It constitutes of 72.47% of North America agriculture biologicals market. The biopesticides are mostly consumed in North America than other biological types. |

May 2015 |