Asia Pacific Software Defined Networking (SDN) Market By Solution(SDN Switching, Controllers, Cloud Virtualization Applications, Network Virtualization Security), by End Users(Telecommunications Providers, Cloud Service Providers, Enterprises), and by Countries(China, India, Japan, Rest of APAC) – Forecasts to 2019

Asia Pacific Software Defined Networking market (SDN) is an innovative approach to networking wherein the control of the network is de-coupled from the physical hardware and is handled by a software application, called “SDN Controller.” The aim behind this approach is to eliminate physical infrastructure limitations of networks. In traditional network architecture, when a packet arrives at a switch, protocols built into the switch’s proprietary firmware tell the switch where to forward the packet. The switch sends every packet with the same destination over the same path, and treats all the packets in the same way. The traditional switches do not perform the application-specific traffic routing. However, in large enterprises, smart switches are used, which are designed with application-specific integrated circuits, and are sophisticated enough to recognize different types of packets and treat them differently. But, the limitation with these switches is that they are too expensive. SDN offers a cost-effective networking approach with an aim to lower down the operational cost thereby reducing latency and performing efficient network traffic management.

Asia Pacific Software defined networking market (SDN) is an architecture purporting to be dynamic, manageable, cost-effective, and adaptable, seeking to be suitable for the high-bandwidth, dynamic nature of today's applications. SDN architecture decouples network control and forwarding functions, enabling network control to become directly programmable and the underlying infrastructure to be abstracted from applications and network services.

Today, enterprises are undergoing technology transformations, such as network virtualization and data center consolidation which in turn increases network complexity, network automation demands, and network transfer rates issue with big data and High-Performance Computing (HPC). Major problem encountered in converting network into cloud in the drop of transfer rates across the networks is the highly distributed networks with globally dispersed data centers and increased number of end-user devices. Enterprises are always on the lookout for cheap and efficient methods to manage networks as well as address the network issues faced commonly in running critical business applications.

SDN addresses these challenges by offering solutions that enables dynamic networking, real-time, and application-centric resource allocation. SDN also offers network automation, in terms of detecting and resolving potential bottlenecks. SDN advances the network in terms of direct programmability of networks, improves agility of the network, converts the network into a centrally managed one, automates the network, and orchestrates the network.

The SDN technology provides operators with several advantages including increased flexibility and performance along with simplified operations. With the emergence in 2011, the SDN concept gives network operators better control of their infrastructure, allowing optimization and customization, and thereby reducing the operational and capital costs.

The MicroMarketMonitor Asia Pacific Software Defined Networking market (SDN) market research report covers solutions segment, end-user types, geographical analysis, and company profiles for key industry players in the Asia-Pacific Software Defined Networking.

Table of Contents

1 Introduction

1.1 Key Take-aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Points

1.5.2 Data Triangulation and Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary

2.1 Abstract

2.2 Overall Market Size

3 Market Overview

3.1 Market Definition

3.2 Market Evolution

3.3 Business/Application/Cloud Orchestration

3.4 Path Computation Element (PCE)

3.5 Openflow

3.6 Market Segmentation

3.7 Market Dynamics

3.7.1 Drivers

3.7.2 Restraints

3.7.3 Opportunities

3.8 Impact Analysis of DRO

3.9 Value Chain

3.10 SDN Ecosystem

4 Asia Pacific Software Defined Networking Market (SDN): Technology Trends, Standards, Business Model and Adoption Factors

4.1 Introduction

4.2 Technologies and Platforms

4.2.1 Recent Trends

4.2.2 Deep Packet Inspection (DPI)

4.2.3 Geographic Load Balancing

4.2.4 Power Management

4.2.5 Cloud Management

4.2.6 Software Applications

4.3 Standards

4.3.1 Data Center Bridging (DCB)

4.3.1.1 Priority Flow Control (PFC) 802.1qbb

4.3.1.2 Congestion Management (802.1qau)

4.3.1.3 Bandwidth Management (802.1qaz)

4.3.1.4 Data Center Bridging Exchange (CBX)

4.3.2 Fiber Channel Over Ethernet (FCOE)

4.3.3 Network Virtualization Using Generic Routing Encapsulation (NVGRE)

4.3.4 Shortest Path Bridging (Spb)

4.3.5 Transparent Interconnection of Lots of Links (TRILL)

4.3.6 Virtual Ethernet Port Aggregator (VEPA)

4.3.7 Multiprotocol Label Switching (MPLS)

4.3.8 Virtual Extensible Local Area Network (VXLAN)

4.4 Business Model

4.4.1 Business Model: Now

4.4.1.1 Manual Process-Driven Approach

4.4.1.2 Network Functionality At A Virtual Layer

4.4.1.3 Device Centricity

4.4.1.4 Openflow-Driven Approach

4.4.1.5 Critical Success Factors

4.4.2 Business Model: in The Future

4.4.2.1 Enterprise Data Center Networks Approach

4.4.2.2 Hyper-Scale Cloud Networking

4.4.2.3 SDN: A Function of Software Development

4.4.2.4 Collaboration With Virtual Networking Frameworks

4.4.2.5 Virtual Networking Leadership

4.5 Asia Pacific Software Defined Networking-Adoption Factors

4.5.1 Academia and Open Source Communities

4.5.1.1 Opendaylight

4.5.1.2 Opencontrail

4.5.1.3 Open Network Operating System (ONOS)

4.5.1.4 Floodlight

4.5.1.5 Nodeflow

4.5.1.6 Mininet

4.5.1.7 Snabb Switch

4.5.1.8 Openvswitch

4.5.1.9 Pantou

4.5.1.10 Nox

4.5.1.11 Pox

4.5.1.12 Jaxon

4.5.1.13 Routeflow

4.5.1.14 Flowvisor

4.5.1.15 Flowscale

4.5.2 Early Standardization

4.5.3 SDN Is A Solution Sell, Not A Box Sell

4.5.4 SDN Overcomes The “Rip and Replace” Strategy

4.5.5 Role of Var

4.6 Technology and Market Roadmap

4.6.1 SDN Inevitable

4.6.2 Functionality To Openflow Controllers

4.6.3 Revolutionizing Network Utilization

4.6.4 Transitioning For Competitive Advantage

4.6.5 Enterprise Commercialization

5 Asia Pacific Software Defined Networking Market Size, Analysis and Forecast By Solution

5.1 Introduction

5.2 SDN Switching

5.2.1 Overview

5.2.2 Markets Size and Forecast

5.2.3 Market Size & Forecast By Countries

5.3 SDN Controllers

5.3.1 Overview

5.3.2 Market Size & Forecast

5.3.3 Market Size and Forecast By Countries

5.4 Cloud Virtualization Applications

5.4.1 Overview

5.4.2 Market Size and Forecast

5.4.3 Market Size & Forecast By Countries

5.5 Network Virtualization Security

5.5.1 Overview

5.5.2 Market Size and Forecast

5.5.3 Market Size & Forecast By Countries

6 Asia Pacific Software Defined Networking Market: Market Analysis and Forecast By End Users

6.1 Introduction

6.2 Telecommunications Providers

6.2.1 Overview

6.2.2 Market Size and Forecast

6.2.3 Market Size & Forecast By Countries

6.3 Cloud Service Providers

6.3.1 Overview

6.3.2 Market Size and Forecast

6.3.3 Market Size & Forecast By Countries

6.4 Enterprises

6.4.1 Overview

6.4.2 Market Size and Forecast

6.4.3 Market Size & Forecast By Countries

7 Asia Pacific Software Defined Networking Market: Market Analysis and Forecast By Countries

7.1 Introduction

7.2 Parfait Chart

7.3 China

7.3.1 Overview

7.3.2 Market Size and Forecast

7.3.3 Market Size & Forecast By End-User

7.3.4 Market Size and Forecast By Solutions

7.4 India

7.4.1 Overview

7.4.2 Market Size and Forecast

7.4.3 Market Size and Forecast By End-Users

7.4.4 Market Size and Forecast By Solutions

7.4 Japan

7.4.1 Overview

7.4.2 Market Size and Forecast

7.4.3 Market Size and Forecast By End-Users

7.4.4 Market Size and Forecast By Solutions

7.5 Rest of APAC

7.5.1 Overview

7.5.2 Market Size and Forecast

7.5.3 Market Size & Forecast By End-Users

7.5.4 Market Size and Forecast By Solutions

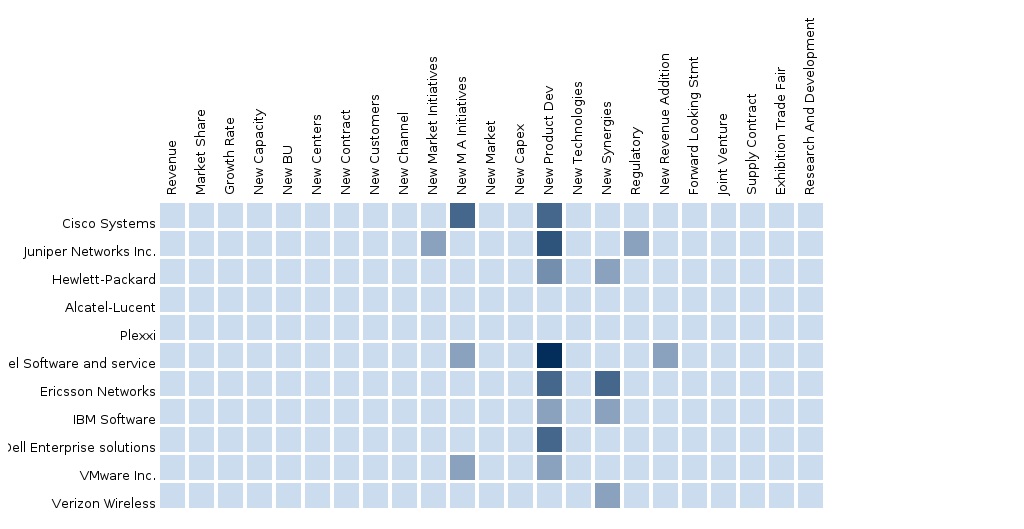

8 Asia Pacific Software Defined Networking Market: Competitive Landscape

8.1 Competitive Landscape

8.2 Ecosystem and Roles

8.2.1 Portfolio Comparison

8.3 End-User Landscape

8.3.1 Market Opportunity Analysis

8.3.2 End-User Analysis

8.3.2.1 The Global Networking Is Expected to Reach $50 Billion By 2019

8.3.2.2 The Smartphone Market Will Experience Immense Growth By 2019 and Is Expected to Reach $9.3 Billion Driven By Byod Trend

8.3.2.3 Cloud Computing Market Is Expected to Reach $480 Billion By 2019 Driving The Demand For SDN Solutions

9 Company Profiles

9.1 AT&T Inc.

9.1.1 Introduction

9.1.2 Products & Services

9.1.3 Strategies & Insights

9.1.4 New Developments

9.1.5 MMM View

9.2 Cisco Systems, Inc.

9.2.1 Introduction

9.2.2 Products & Services

9.2.3 Strategies & Insights

9.2.4 New Developments

9.2.5 MMM View

9.3 Dell Inc.

9.3.1 Introduction

9.3.2 Products & Services

9.3.3 Strategies & Insights

9.3.4 New Developments

9.3.5 MMM View

9.4 Hewlett-Packard Company

9.4.1 Introduction

9.4.2 Products & Services

9.4.3 Strategies & Insights

9.4.4 New Developments

9.4.5 MMM View

9.5 IBM

9.5.1 Introduction

9.5.2 Products & Services

9.5.3 Strategies & Insights

9.5.4 New Developments

9.5.5 MMM View

9.6 Intel Corporation

9.6.1 Introduction

9.6.2 Products & Services

9.6.3 Strategies & Insights

9.6.4 New Developments

9.6.5 MMM View

9.7 Juniper Networks

9.7.1 Introduction

9.7.2 Products & Services

9.7.3 Strategies & Insights

9.7.4 New Developments

9.7.5 MMM View

9.8 Nec Corporation

9.8.1 Introduction

9.8.2 Products & Services

9.8.3 Strategies & Insights

9.8.4 New Developments

9.8.5 MMM View

9.9 Pica8 Inc.

9.9.1 Introduction

9.9.2 Products & Services

9.9.3 Strategies & Insights

9.9.4 New Developments

9.9.5 MMM View

9.10 Plexxi, Inc.

9.10.1 Introduction

9.10.2 Products & Services

9.10.3 Strategies & Insights

9.10.4 New Developments

9.10.5 MMM View

9.11 Alcatel-Lucent

9.11.1 Introduction

9.11.2 Products & Services

9.11.3 Strategies & Insights

9.11.4 New Developments

9.11.5 MMM View

10 Appendix

10.1 Venture Capital (VC) Funding

10.2 Merger & Acquisitions (M&A)

List of Tables (37 Tables)

Table 1 Forecast Assumptions

Table 2 Global SDN Market Size, 2014-2019 ($Million)

Table 3 Asia Pacific Software Defined Networking Market, By Solutions, 2014 – 2019 ($Million)

Table 4 Asia Pacific Software Defined Networking Market, By Solutions, 2014 – 2019 (Y-O-Y %)

Table 5 APAC SDN: Switching Market, 2014-2019 ($Million, Y-O-Y %)

Table 6 APAC SDN: Switching Market, By Countries, 2014 – 2019 ($Million)

Table 7 APAC SDN: Switching Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 8 APAC SDN: Controllers Market, 2014-2019 ($Million, Y-O-Y %)

Table 9 APAC SDN: Controllers Market, By Countries, 2014 – 2019 ($Million)

Table 10 APAC SDN: Controllers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 11 APAC SDN: Cloud Virtualization Application Market, 2014-2019 ($Million, Y-O-Y %)

Table 12 APAC SDN: Cloud Virtualization Applications Market, By Countries, 2014 – 2019 ($Million)

Table 13 APAC SDN: Cloud Virtualization Applications Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 14 APAC SDN: Network Virtualization Security Market, 2014-2019 ($Million, Y-O-Y %)

Table 15 APAC SDN: Network Virtualization Security Market, By Countries, 2014 – 2019 ($Million)

Table 16 APAC SDN: Network Virtualization Security Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 17 APAC SDN Market, By End-Users, 2014 – 2019 ($Million)

Table 18 APAC SDN Market, By End-Users, 2014 – 2019 (Y-O-Y %)

Table 19 APAC SDN: Telecommunications Provider Market, 2014-2019 ($ Million, Y-O-Y %)

Table 20 APAC SDN: Telecom Providers Market, By Countries, 2014 – 2019 ($Million)

Table 21 APAC SDN: Telecom Providers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 22 APAC SDN: Cloud Service Providers Market, 2014-2019 ($ Million, Y-O-Y %)

Table 23 APAC SDN: Cloud Service Providers Market, By Countries, 2014 – 2019 ($Million)

Table 24 APAC SDN: Cloud Service Providers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 25 APAC SDN: Enterprise Data Center Market, 2014-2019 ($ Million, Y-O-Y %)

Table 26 APAC SDN: Enterprise Data Centers Market, By Countries, 2014 – 2019 ($Million)

Table 27 APAC SDN: Enterprise Data Centers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 28 APAC SDN Market Revenue By Countries, 2014 – 2019 ($Million)

Table 29 APAC SDN Market, By Countries, 2014 – 2019 (Y-O-Y %)

Table 30 APAC SDN: North America Market, 2014-2019 ($Million, Y-O-Y %)

Table 31 APAC SDN: North America Market, By End-Users, 2014 – 2019 ($Million)

Table 32 APAC SDN: North America Market, By End-Users, 2014 – 2019 (Y-O-Y %)

Table 33 APAC SDN: North America Market, By Solutions, 2014 – 2019 ($Million)

Table 34 APAC SDN: North America Market, By Solutions, 2014 – 2019 (Y-O-Y %)

Table 35 APAC SDN Competitive Ecosystem

Table 36 APAC SDN: Venture Capital (VC) Funding

Table 37 APAC SDN: Mergers And Acquisitions (M&A)

List Of Figures (32 Figures)

Figure 1 Secondary And Primary Research

Figure 2 Data Triangulation And Market Forecasting

Figure 3 Global SDN Market Size, 2014-2019 ($Million)

Figure 4 Asia Pacific Software Defined Networking Market Evolution

Figure 5 SDN Market Segmentation

Figure 6 Impact Analysis Of Dro On APAC SDN Market

Figure 7 APAC SDN: Value Chain

Figure 8 Aster*X Controller Design For The Main Control Logic

Figure 9 Google SDN Wan History

Figure 10 Asia Pacific Software Defined Networking Market, By Solutions, 2014 – 2019 (Y-O-Y %)

Figure 11 APAC SDN: Switching Market, 2014-2019 ($Million, Y-O-Y %)

Figure 12 APAC SDN: Switching Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 13 APAC SDN: Controllers Market, 2014-2019 ($Million, Y-O-Y %)

Figure 14 APAC SDN: Controllers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 15 APAC SDN: Cloud Virtualization Application Market, 2014-2019 ($Million, Y-O-Y %)

Figure 16 APAC SDN: Cloud Virtualization Applications Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 17 APAC SDN: Network Virtualization Security Market, 2014-2019 ($Million, Y-O-Y %)

Figure 18 APAC SDN: Network Virtualization Security Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 19 APAC SDN Market, By End-Users, 2014 – 2019 (Y-O-Y %)

Figure 20 APAC SDN: Telecommunications Provider Market, 2014-2019 ($Million, Y-O-Y %)

Figure 21 APAC SDN: Telecom Providers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 22 APAC SDN: Cloud Service Providers Market, 2014-2019 ($Million, Y-O-Y %)

Figure 23 APAC SDN: Cloud Service Providers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 24 APAC SDN: Enterprise Data Center Market, 2014-2019 ($Million, Y-O-Y %)

Figure 25 APAC SDN: Enterprise Data Centers Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 26 APAC SDN Market, By Countries, 2014 – 2019 (Y-O-Y %)

Figure 27 APAC SDN Market: Parfait Chart

Figure 28 APAC SDN: North America Market, 2014-2019 ($Million, Y-O-Y %)

Figure 29 APAC SDN: North America Market, By End-Users, 2014 – 2019 (Y-O-Y %)

Figure 30 APAC SDN: North America Market, By Solutions, 2014 – 2019 (Y-O-Y %)

Figure 31 APAC SDN: Portfolio Comparison

Figure 32 APAC SDN: Market Opportunity Plot

Telecommunication providers have been looking for ways to optimize costs and increase network efficiency over the last decade. In addition, industries are witnessing a huge push for newer forms of networking that are faster, simpler, and easier to manage. SDN has grown into a key technology to address this trend. SDN is a first-of-its-kind networking concept that has picked up significant market traction in recent years. The technology helps communication providers to redirect network traffic and ease network congestion, ultimately resulting in significant cost savings that can be utilized to drive core business goals. While the Asia-Pacific SDN market is presently at a nascent and fragmented stage, industry consolidation is set to happen in the near future, which will improve the adoption of SDNs by enterprises, as a result of increased communication.

The market for Asia-Pacific SDN is expected to evolve gradually from being a standards-driven market to becoming a function of software development, which would ultimately revolutionize network utilization and become inevitable. Over the forecast period of 2014 to 2019, the SDN technology is expected to become highly ubiquitous across telecom networks, mainly penetrating into the enterprise networks.

The major forces driving the market include network expansion, Telco Operating Expenditure (OPEX) savings, and mobility, which are expected to positively impact the growth of the Asia-Pacific SDN market because of the rapidly-growing global demand for mobility. At the same time, opportunities in controller applications and Value-Added Reseller (VAR) products are also expected to benefit the growth of the Asia-Pacific SDN market in the coming years.

The report provides a detailed competitive landscape of the market, along with the strategic profiles of the key players in the Asia-Pacific software defined networking market. Furthermore, comprehensive descriptions of the market dynamic forces such as drivers, restraints, and opportunities have also been provided in the report.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement