Asia Pacific Refrigerant Market By Type (Fluorocarbon, Inorganic, Hydrocarbons, Others), Application (Domestic Refrigeration, Commercial Refrigeration, Industrial Refrigeration, Stationary AC, Mobile AC, Others), Geography – Forecast to 2021

Refrigerants are working fluids that absorb or extract heat from the substances to be refrigerated. They are used in various cooling mechanisms, such as refrigerators and air conditioners.

The Asia-Pacific refrigerant market was valued at USD 705.2 million in 2015 and is expected to reach USD 1,075.9 million by 2021, at a CAGR of 7.3% from 2016 to 2021. The Asia-Pacific refrigerants market in the region has been witnessing high growth, owing to the rise in the number of applications, technological advancements, and rise in the demand for cooling systems in emerging economies, such as China and India.

This study aims to estimate the market size of the Asia-Pacific refrigerant market in 2015, and project its value by 2021. This market research study provides a detailed qualitative and quantitative analysis of the Asia-Pacific refrigerant market. Various secondary sources, such as directories, industry journals, and databases have been used to identify and collect information useful for the extensive, commercial study of the Asia-Pacific refrigerant market. The primary sources, which include experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess the future prospects of the Asia-Pacific refrigerants market.

Some of the key players in the Asia-Pacific refrigerant include Asahi Glass Co. Ltd (Japan), Daikin Industries Ltd (Japan), SRF Ltd. (India), and Sinochem Group (China), Panasonic Corporation (Japan), and ARKEMA S.A. (France).

Audience for this report

- Refrigerants Companies

- Traders, Distributors, and Suppliers

- Governmental and Research Organizations

- Associations and Industry Bodies

- Technology Providers

Scope of the Report

The Asia-Pacific refrigerant market has been covered in detail in this report. In order to provide an overall scenario of the current market demand and forecasts have also been included. The market has been segmented as follows:

Based on Geography:

- China

- India

- Japan

- Indonesia

- Rest of Asia-Pacific

Based on Application:

- Domestic Refrigeration

- Commercial Refrigeration

- Transportation Refrigeration

- Industrial Refrigeration

- Stationary AC

- Mobile AC

- Chillers and Hydronic Heat Pump

Based on Type

- Fluorocarbon Refrigerants

- Inorganics Refrigerants

- Hydrocarbon Refrigerants

- Others

Table of Contents

1 Introduction

1.1 Objectives of The Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology

2.1 Integrated Ecosystem of Asia-Pacific Refrigerant Market

2.2 Arriving at The Asia-Pacific Refrigerant Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.3 Assumptions

3 Executive Summary

4 Market Overview

4.1 Introduction

4.2 Asia-Pacific Refrigerant Market: Comparison With Global Refrigerant Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand-Side Analysis

5 Premium Insights

5.1 Attractive Market Opportunities in The Asia-Pacific Refrigerants Market

5.2 Asia-Pacific Refrigerant Market, By Country

5.3 Asia-Pacific Refrigerant Market, By Type

5.4 Lifecycle Analysis

6 Asia-Pacific Refrigerant Market, By Type

6.1 Introduction

6.2 Asia-Pacific Refrigerant Market, Type Comparison

6.3 Asia-Pacific Fluorocarbon Refrigerant Market, By Geography

6.4 Asia-Pacific Inorganic Refrigerant Market, By Geography

6.5 Asia-Pacific Hydrocarbon Refrigerant Market, By Geography

6.6 Asia-Pacific Other Refrigerant Market, By Country

7 Asia-Pacific Refrigerant Market, By Application

7.1 Introduction

7.2 Asia-Pacific Refrigerant Market in Stationary Ac, By Geography

7.3 Asia-Pacific Refrigerant Market in Commercial Refrigeration, By Geography

7.4 Asia-Pacific Refrigerant Market in Mobile Ac, By Geography

7.5 Asia-Pacific Refrigerant Market in Industrial Refrigeration, By Geography

7.6 Asia-Pacific Refrigerant Market in Chillers & Hydronic Heat Pumps, By Geography

7.7 Asia-Pacific Refrigerant Market in Domestic Refrigeration, By Geography

7.8 Asia-Pacific Refrigerant Market in Transportation Refrigeration, By Geography

8 Asia-Pacific Refrigerant Market, By Geography

8.1 Introduction

8.2 China Refrigerant Market

8.2.1 China Refrigerant Market, By Type

8.3 India Refrigerant Market

8.3.1 India Refrigerant Market, By Application

8.3.2 India Refrigerant Market, By Type

8.4 Japan Refrigerant Market

8.4.1 Japan Refrigerant Market, By Application

8.4.2 Japan Refrigerant Market, By Type

8.5 Indonesia Refrigerant Market

8.5.1 Indonesia Refrigerant Market, By Application

8.5.2 Indonesia Refrigerant Market, By Type

8.6 Rest of Apac Refrigerant Market

8.6.1 Rest of Apac Refrigerant Market, By Application

8.6.2 Rest of Apac Refrigerant Market, By Type

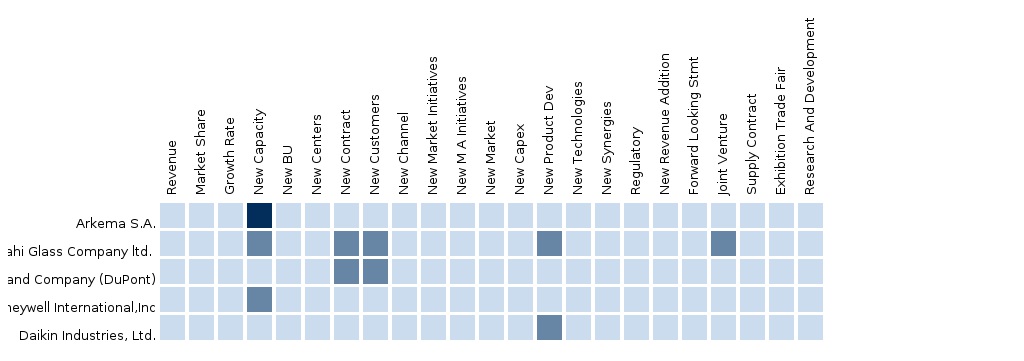

9 Asia-Pacific Refrigerant Market: Competitive Landscape

9.1 Asia-Pacific Refrigerant Market: Company Share Analysis

9.2 Agreements

9.3 Expansions

9.4 Joint Ventures

9.5 New Product Launches

10 Asia-Pacific Refrigerant Market, By Company

10.1 Asahi Glass Co., Ltd.

10.1.1 Overview

10.1.2 Key Financials

10.1.3 Product and Service Offerings

10.1.4 Related Developments

10.1.5 MMM View

10.2 Daikin Industries, Ltd.

10.2.1 Overview

10.2.2 Key Financials

10.2.3 Product and Service Offerings

10.2.4 Related Developments

10.2.5 MMM View

10.3 The Linde A.G.

10.3.1 Overview

10.3.2 Key Financials

10.3.3 Product and Service Offerings

10.3.4 Related Developments

10.3.5 MMM View

10.4 Sinochem Group

10.4.1 Overview

10.4.2 Key Financials

10.4.3 Product and Service Offerings

10.4.4 Related Developments

10.4.5 MMM View

10.5 SRF Limited

10.5.1 Overview

10.5.2 Key Financials

10.5.3 Product and Service Offerings

10.5.4 Related Developments

10.5.5 MMM View

11 Appendix

11.1 Customization Options

11.1.1 Technical Analysis

11.1.2 Low-Cost Sourcing Locations

11.1.3 Regulatory Framework

11.1.4 Asia-Pacific Refrigerants Usage Data

11.1.5 Impact Analysis

11.1.6 Trade Analysis

11.2 Related Reports

11.3 Introducing Rt: Real Time Market Intelligence

11.3.1 Rt Snapshots

List of Tables

Table 1 Asia-Pacific Refrigerant, Application Market, 2015 (Kilotons)

Table 2 Asia-Pacific Refrigerant Market: Comparison With Global Refrigerant Market, 2015-2020 (USD Million)

Table 3 Asia-Pacific Refrigerant Market: Drivers and Inhibitors

Table 4 Asia-Pacific Refrigerant Market, By Application, 2014-2021 (Kilotons)

Table 5 Asia-Pacific Refrigerant Market: Comparison With Application Markets, 2014-2021 (Kilotons)

Table 6 Asia-Pacific Refrigerant Market, By Type, 2014-2021 (USD Million)

Table 7 Asia-Pacific Refrigerant Market, By Type, 2016-2021 (Kilotons)

Table 8 Asia-Pacific Refrigerant Market: Type Comparison With Parent Market, 2014–2021 (USD Million)

Table 9 Asia-Pacific Fluorocarbon Refrigerant Market, By Geography, 2014-2021 (USD Million)

Table 10 Asia-Pacific Fluorocarbon Refrigerant Market, By Geography, 2014–2021 (Kilotons)

Table 11 Asia-Pacific Inorganic Refrigerant Market, By Geography, 2014-2021 (USD Million)

Table 12 Asia-Pacific Inorganic Refrigerant Market, By Geography, 2014-2021 (Kilotons)

Table 13 Asia-Pacific Hydrocarbon Refrigerant Market, By Geography, 2014-2021 (USD Million)

Table 14 Asia-Pacific Hydrocarbon Refrigerant Market, By Geography, 2014-2021 (Kilotons)

Table 15 Asia-Pacific Other Refrigerant Market, By Geography, 2014-2021 (USD Million)

Table 16 Asia-Pacific Other Refrigerant Market, By Geography, 2014-2021 (Kilotons)

Table 17 Asia-Pacific Refrigerant Market, By Application, 2014-2021 (Kilotons)

Table 18 Asia-Pacific Refrigerant Market in Stationary Ac, By Geography, 2014-2021 (Kilotons)

Table 19 Asia-Pacific Refrigerant Market in Commercial Refrigeration, By Geography, 2014-2021 (Kilotons)

Table 20 Asia-Pacific Refrigerant Market in Mobile Ac, By Geography, 2014-2021 (Kilotons)

Table 21 Asia-Pacific Refrigerant Market in Industrial Refrigeration, By Geography, 2014-2021 (Kilotons)

Table 22 Asia-Pacific Refrigerant Market in Chillers & Hydronic Heat Pumps, By Geography, 2014-2021 (Kilotons)

Table 23 Asia-Pacific Refrigerant Market in Domestic Refrigeration, By Geography, 2014-2021 (Kilotons)

Table 24 Asia-Pacific Refrigerant Market in Transportation Refrigeration, By Geography, 2014-2021 (Kilotons)

Table 25 Asia-Pacific Refrigerant Market, By Geography, 2016-2021 (Kilotons)

Table 26 China Refrigerant Market, By Application, 2014-2021 (Kilotons)

Table 27 China Refrigerant Market, By Type, 2016-2021 (USD Million)

Table 28 China Refrigerant Market, By Type, 2014-2021 (Kilotons)

Table 29 India Refrigerant Market, By Application, 2014-2021 (Kilotons)

Table 30 India Refrigerant Market, By Type, 2014-2021 (Kilotons)

Table 31 India Refrigerant Market, By Type, 2014-2021 (USD Million)

Table 32 Japan Refrigerant Market, By Application, 2014-2021 (Kilotons)

Table 33 Japan Refrigerant Market, By Type, 2014-2021 (USD Million)

Table 34 Japan Refrigerant Market, By Type, 2014-2021 (Kilotons)

Table 35 Indonesia Refrigerant Market, By Application, 2014-2021 (Kilotons)

Table 36 Indonesia Refrigerant Market, By Type, 2014-2021 (USD Million)

Table 37 Indonesia Refrigerant Market, By Type, 2014-2021 (Kilotons)

Table 38 Rest of Apac Refrigerant Market, By Application, 2014-2021 (Kilotons)

Table 39 Rest of Apac Refrigerant Market, By Type, 2014-2021 (USD Million)

Table 40 Rest of Apac Refrigerant Market, By Type, 2014-2021 (Kilotons)

Table 41 Asia-Pacific Refrigerant Market: Company Production Capacity, 2014 (%)

Table 42 Asia-Pacific Refrigerant Market: Agreements

Table 43 Asia-Pacific Refrigerant Market: Expansions

Table 44 Asia-Pacific Refrigerant Market: Joint Ventures

Table 45 Asia-Pacific Refrigerant Market: New Product Launches

Table 46 Asahi Glass Co., Ltd.: Key Financials, 2010-2014 (USD Million)

Table 47 Asahi Glass Co., Ltd.: Business Revenue Mix, 2010-2014 (USD Million)

Table 48 Daikin Industries, Ltd.: Key Financials, 2011-2015 (USD Million)

Table 49 Daikin Industries, Ltd.: Business Revenue Mix, 2011-2015 (USD Million)

Table 50 Daikin Industries, Ltd.: Geographic Revenue Mix, 2011-2015 (USD Million)

Table 51 The Linde A.G.: Key Financials, 2012-2015 (USD Million)

Table 52 The Linde A.G.: Business Revenue Mix, 2012-2015 (USD Million)

Table 53 The Linde A.G.: Geographic Revenue Mix, 2012-2015 (USD Million)

Table 54 Sinochem Group: Key Financials, 2010-2014 (USD Million)

Table 55 Srf Limited: Key Financials, 2011-2015 (USD Million)

Table 56 Srf Limited: Business Revenue Mix, 2011-2015 (USD Million)

Table 57 Srf Limited: Geographic Revenue Mix, 2011-2015 (USD Million)

List of Figures

Figure 1 Asia-Pacific Refrigerant Market: Segmentation & Coverage

Figure 2 Asia-Pacific Refrigerant Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Asia-Pacific Refrigerant Market Snapshot

Figure 8 Asia-Pacific Refrigerant Market, By Application, 2016 & 2021

Figure 9 Asia-Pacific Refrigerant Market Expected to Witness High Growth in The Coming Years

Figure 10 Rapid Growth Expected in The Indonesia Refrigerant Market During The Forecast Period

Figure 11 The Inorganic Refrigerants Segment is Expected to Drive The Growth of The Asia-Pacific Refrigerant Market

Figure 12 Indonesia Expected to Be The Fastest-Growing Market For Refrigerants During The Forecast Period

Figure 13 China is The Largest Market For Refrigerants in Asia-Pacific

Figure 14 Asia-Pacific Refrigerant Market, By Type, 2016 & 2021 (USD Million)

Figure 15 Asia-Pacific Refrigerant Market, By Type, 2016 & 2021 (Kilotons)

Figure 16 Asia-Pacific Refrigerant Market: Type Comparison, 2014–2021 (USD Million)

Figure 17 Asia-Pacific Fluorocarbon Refrigerant Market, By Geography, 2014–2021 (Kilotons)

Figure 18 Asia-Pacific Inorganic Refrigerant Market, By Geography, 2014-2021 (Kilotons)

Figure 19 Asia-Pacific Hydrocarbon Refrigerant Market, By Geography, 2014-2021 (Kilotons)

Figure 20 Asia-Pacific Other Refrigerant Market, By Country, 2014-2021 (Kilotons)

Figure 21 Asia-Pacific Refrigerant Market, By Application, 2016 & 2021 (Kilotons)

Figure 22 Asia-Pacific Refrigerant Market in Stationary Ac, By Geography, 2014-2021 (Kilotons)

Figure 23 Asia-Pacific Refrigerant Market in Commercial Refrigeration, By Geography, 2014-2021 (Kilotons)

Figure 24 Asia-Pacific Refrigerant Market in Mobile Ac, By Geography, 2014-2021 (Kilotons)

Figure 25 Asia-Pacific Refrigerant Market in Industrial Refrigeration, By Geography, 2014-2021 (Kilotons)

Figure 26 Asia-Pacific Refrigerant Market in Chillers & Hydronic Heat Pumps, By Geography, 2014-2021 (Kilotons)

Figure 27 Asia-Pacific Refrigerant Market in Domestic Refrigeration, By Geography, 2014-2021 (Kilotons)

Figure 28 Asia-Pacific Refrigerant Market in Transportation Refrigeration, By Geography, 2014-2021 (Kilotons)

Figure 29 Asia-Pacific Refrigerant Market: Growth Analysis, By Geography, 2016 & 2021 (Kilotons)

Figure 30 China Refrigerant Market Overview, 2016 & 2021 (Kilotons) (%)

Figure 31 China Refrigerant Market, By Application, 2014-2021 (Kilotons)

Figure 32 China Refrigerant Market: Application Snapshot (Kilotons)

Figure 33 China Refrigerant Market, By Type, 2014-2021 (USD Million)

Figure 34 China Refrigerant Market, By Type, 2016 & 2021 (Kilotons)

Figure 35 India Refrigerant Market Overview, 2016 & 2021 (Kilotons) (%)

Figure 36 India Refrigerant Market, By Application, 2016-2021 (Kilotons)

Figure 37 India Refrigerant Market: Application Snapshot (Kilotons)

Figure 38 India Refrigerant Market, By Type, 2016-2021 (USD Million)

Figure 39 India Refrigerant Market, By Type, 2015 & 2020 (Kilotons)

Figure 40 Japan Refrigerant Market Overview, 2016 & 2021 (Kilotons) (%)

Figure 41 Japan Refrigerant Market, By Application, 2014-2021 (Kilotons)

Figure 42 Japan Refrigerant Market: Application Snapshot (Kilotons)

Figure 43 Japan Refrigerant Market, By Type, 2014-2021 (USD Million)

Figure 44 Japan Refrigerant Market, By Type, 2016 & 2021 (Kilotons)

Figure 45 Indonesia Refrigerant Market Overview, 2016 & 2021 (%)

Figure 46 Indonesia Refrigerant Market, By Application (USD Million)

Figure 47 Indonesia Refrigerant Market: Application Snapshot (Kilotons)

Figure 48 Indonesia Refrigerant Market, By Type, 2014-2021 (USD Million)

Figure 49 Indonesia Refrigerant Market, By Type, 2016 & 2021 (Kilotons)

Figure 50 Rest of Apac Refrigerant Market Overview, 2016 & 2021 (Kilotons) (%)

Figure 51 Rest of Apac Refrigerant Market, By Application, 2014-2021 (Kilotons)

Figure 52 Rest of Apac Refrigerant Market: Application Snapshot (Kilotons)

Figure 53 Rest of Apac Refrigerant Market, By Type, 2014-2021 (USD Million)

Figure 54 Rest of Apac Refrigerant Market, By Type, 2016 & 2021 (Kilotons)

Figure 55 Asia-Pacific Refrigerant Market: Company Production Capacity, 2014 (%)

Figure 56 Asahi Glass Co., Ltd.: Revenue Mix, 2014 (%)

Figure 57 Asahi Glass Co., Ltd.: Revenues, 2010-2014 (USD Million)

Figure 58 Daikin Industries, Ltd.: Revenue Mix, 2015 (%)

Figure 59 Daikin Industries, Ltd.: Revenues, 2011-2015 (USD Million)

Figure 60 The Linde A.G.: Revenue Mix, 2015 (%)

Figure 61 The Linde A.G.: Revenues, 2012-2015 (USD Million)

Figure 62 Sinochem Group: Revenues, 2010-2014 (USD Million)

Figure 63 Srf Limited: Revenue Mix, 2015 (%)

Figure 64 Srf Limited: Revenues, 2011-2015 (USD Million)

Refrigerants are mainly used as a cooling medium in the air-conditioning and refrigeration industry. Technically, due to the repetitive evaporation and condensation of the refrigerant gas, heat is drawn from a system, to produce cooling effect. It is used in cooling equipment such as freezers, refrigerators, air conditioners, and heating units.

The Asia-Pacific refrigerant market was valued at USD 705.2 million in 2015 and is expected to reach USD 1,075.9 million by 2021, at a CAGR of 7.3% from 2016 to 2021

The Asia-Pacific refrigerant market has witnessed high growth in the recent years and the trend is expected to continue in coming years. The rise in the demand for refrigerant in the region can be mainly attributed to the rising demand for cooling products from the rising middle class population in emerging countries, such as China and India. The frequent changes in choice of refrigerants with respect to Montreal Protocol are some of the key challenges faced by companies operational in this market.

The growth in various applications segments, such as commercial refrigeration, transportation refrigeration, and mobile AC is expected to fuel the growth of the refrigerant market in Asia-Pacific. The stationary AC segment is expected to contribute the largest share to the refrigeration market in 2015. The domestic refrigeration segment of the market is expected to witness the highest growth in the coming year.

Based on product type, the hydrocarbon was the largest segment of the market. This segment is expected to grow at the highest CAGR of 6.0% from 2016 to 20201. It is projected to be followed by the inorganic segment. Inorganic refrigerants are environment friendly, and non-flammable, which is expected to drive growth of inorganic refrigerants during the forecast period.

China was the largest market for refrigerant in Asia-Pacific, and accounted for a share of 62.0% of the refrigerants in 2015. The high growth in the market in China can be attributed to the presence of domestic producers, such as Dongyue Group Co., Puyang Zhongwei Fine Chemical Co, Shandong Yuen Chemical Industry Co. Ltd, Sinochem Group, and Zhejhiang Juhua.

Some of the key players operational in the Asia-Pacific refrigerant market include Asahi Glass Co. Ltd (Japan), Daikin Industries Ltd (Japan), SRF Ltd. (India), and Sinochem Group (China), Panasonic Corporation (Japan), and ARKEMA S.A. (France).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement