Asia-Pacific Polycarbonate Market by Applications (Automotive, Consumer, Electrical & Electronic, Medical, Optical Media, Packaging & Sheet & Film) & Geography - Trends & Forecasts to 2019

Polycarbonate is one of the most widely used engineering thermoplastics. It is derived from carbonate monomers, which is widely used across various industries, such as automotive, consumer goods, consumer electronic, medical, optical media, packaging, sheet film, and others (aerospace, gadgets, and others). The flexibility, impact resistance, optical properties and exceptional light transmission intensity are some of the major features that creates an upsurge in the demand for polycarbonate.

The Asia-Pacific polycarbonate market is experiencing enormous growth and is expected to continue the same growth pattern in the coming years. The Asia-Pacific polycarbonate market accounted for a share of 61.0% of the total global polycarbonate market in 2014. This is attributed mainly due to the technological advancement in major end-use segments and increasing adaptability of polycarbonate in the automotive market. Considerable amount of investments were also made by major key players to serve the growing demand of polycarbonate in the end-user applications in this region.

The consumer electronics segment dominates the application segment having accounted for a share of 22% in 2014, followed by the automotive and optical media segment. China and India are the major countries contributing to the increasing consumption of PC in the Asia-Pacific region due to growing population.

This market research study provides a detailed qualitative and quantitative analysis of the Asia-Pacific polycarbonate market. Various secondary sources such as encyclopedia, directories, industry journals, and databases are used to identify and collect information. The primary sources, includes experts from related industries and suppliers who have been interviewed to obtain and verify critical information as well as to assess the future prospects of the market.

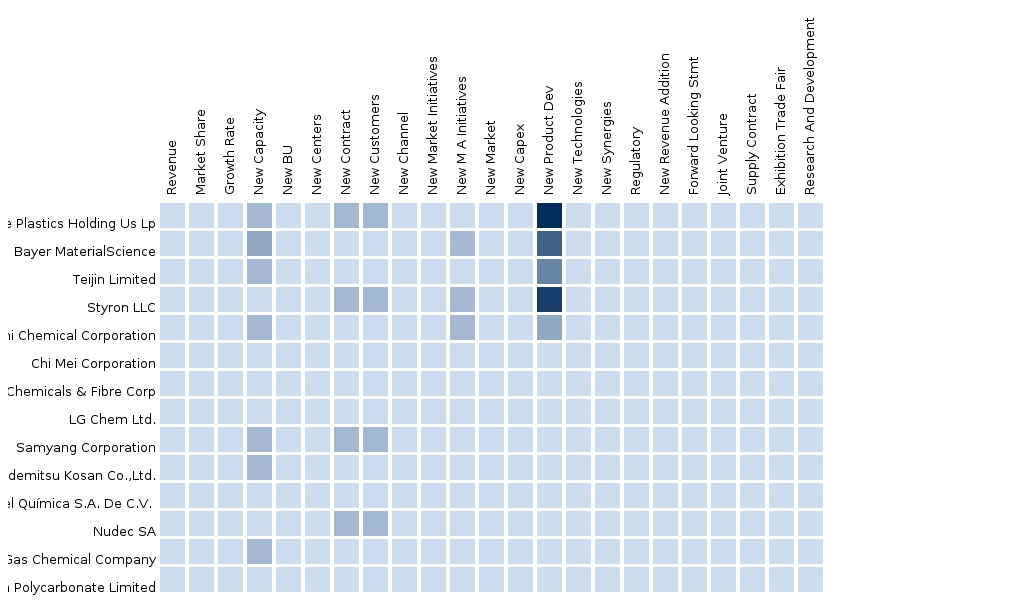

Competitive scenarios of the top players in the polycarbonate market have been discussed in detail. Leading players of this industry with their recent developments and other strategic industry activities were also covered in this report. Companies, such as Teijin Limited (Japan), Bayer Material Science AG (China), Samsung SDI Chemicals and Electronics Material Incorporation (South Korea), Mitsubishi Engineering-Plastics Limited (Japan), and others are operating in this market.

Scope of the report:

This research report categorizes the Asia-Pacific market for polycarbonate on the basis of applications and geography along with forecasting volume, value, and analyzing trends in each of the sub-markets.

On the basis of applications:

- Automotive

- Consumer Goods

- Consumer Electronic

- Medical Equipments

- Optical Media

- Packaging

- Sheet Film

- Others (Aerospace, Gadgets, and others)

Each application is described in detail in the report with volume and revenue forecasts for each application.

On the basis of geography:

- China

- Japan

- India

- South Korea

- Taiwan

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Polycarbonate Market

2.2 Arriving at the Polycarbonate Market Size

2.2.1 Ingredient-Based Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 19)

4.1 Introduction

4.2 Market Drivers And Inhibitors

4.3 Key Market Dynamics

4.4 Demand Side Analysis

5 Asia-Pacific Polycarbonate Market, By Application (Page No. - 24)

5.1 Introduction

5.2 Polycarbonate in Consumer Electronics, By Geography

5.3 Polycarbonate in Optical Media, By Geography

5.4 Polycarbonate in Consumer Goods, By Geography

5.5 Polycarbonate in Sheet/Films, By Geography

5.6 Polycarbonate in Automotive, By Geography

5.7 Polycarbonate in Medical, By Geography

5.8 Polycarbonate in Packaging, By Geography

6 Asia-Pacific Polycarbonate Market, By Geography (Page No. - 41)

6.1 Introduction

6.2 China Polycarbonate Market

6.2.1 China Polycarbonate Market, By Application

6.3 Japan Polycarbonate Market

6.3.1 Japan Polycarbonate, By Application

6.4 India Polycarbonate Market

6.4.1 India Polycarbonate Market, By Application

6.5 South Korea Polycarbonate Market

6.5.1 South Korea Polycarbonate Market, By Application

6.6 Taiwan Polycarbonate Market

6.6.1 Taiwan Polycarbonate Market, By Application

7 Asia-Pacific Polycarbonate Market: Competitive Landscape (Page No. - 62)

7.1 Polycarbonate Market: Company Share Analysis

7.2 Mergers & Acquisitions

7.3 Expansions

7.4 New Product Launch/Development

7.5 Joint Development

7.6 Collaboration

7.7 Agreements

7.8 New Technology

8 Asia-Pacific Polycarbonate Market, By Company (Page No. - 69)

8.1 Teijin Limited

8.1.1 Overview

8.1.2 Key Financials

8.1.3 Product And Service Offerings

8.1.4 Related Developments

8.1.5 MMM Analysis

8.2 Bayer Material Science

8.2.1 Overview

8.2.2 Key Financials

8.2.3 Key Financials

8.2.4 Product And Service Offerings

8.2.5 Related Developments

8.2.6 MMM Analysis

8.3 Mitsubishi Engineering-Plastics Corporation

8.3.1 Overview

8.3.2 Product And Service Offerings

8.3.3 Related Developments

8.3.4 MMM Analysis

8.4 CHI MEI Corporation

8.4.1 Overview

8.4.2 Key Operations Data

8.4.3 Product And Service Offerings

8.4.4 Related Developments

8.4.5 MMM Analysis

8.5 Formosa Idemitsu Petrochemical

8.5.1 Overview

8.5.2 Key Operations Data

8.5.3 Product And Service Offerings

8.5.4 MMM Analysis

8.6 Samsung Sdi Chemicals And Electronics Material Incorporation

8.6.1 Overview

8.6.2 Key Financials

8.6.3 Key Financials

8.6.4 Product And Service Offerings

8.6.5 Related Developments

8.6.6 MMM Analysis

9 Appendix (Page No. - 87)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 Impact Analysis

9.1.5 Trade Analysis

9.2 Related Reports

9.3 Introducing RT: Real-Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (48 Tables)

Table 1 Asia-Pacific Polycarbonate Application Market, 2014 (KT)

Table 2 Asia-Pacific Polycarbonate Market: Drivers And Inhibitors

Table 3 Asia-Pacific Polycarbonate Market, By Application, 2013-2019 (USD MN)

Table 4 Asia-Pacific Polycarbonate Market, By Application, 2013-2019 (KT)

Table 5 Asia-Pacific Polycarbonate Market: Application Markets, 2013-2019 (USD MN)

Table 6 Asia-Pacific Polycarbonate Market, By Application, 2013-2019 (USD MN)

Table 7 Asia-Pacific Polycarbonate: Market, By Application, 2013-2019 (KT)

Table 8 Asia-Pacific Polycarbonate in Consumer Electronics, By Geography, 2013-2019 (USD MN)

Table 9 Asia-Pacific Polycarbonate in Consumer Electronics, By Geography, 2013-2019 (KT)

Table 10 Asia-Pacific Polycarbonate in Optical Media, By Country, 2013-2019 (USD MN)

Table 11 Asia-Pacific Polycarbonate in Optical Media, By Country, 2013-2019 (KT)

Table 12 Asia-Pacific Polycarbonate in Consumer Goods, By Geography, 2013-2019 (USD MN)

Table 13 Asia-Pacific Polycarbonate in Consumer Goods, By Geography, 2013-2019 (KT)

Table 14 Asia-Pacific Polycarbonate in Sheets/Films, By Geography, 2013-2019 (USD MN)

Table 15 Asia-Pacific Polycarbonate in Sheets/Films, By Geography, 2013-2019 (KT)

Table 16 Asia-Pacific Polycarbonate in Automotive, By Geography, 2013-2019 (USD MN)

Table 17 Asia-Pacific Polycarbonate in Automotive, By Geography, 2013-2019 (KT)

Table 18 Asia-Pacific Polycarbonate in Medical, By Geography, 2013-2019 (USD MN)

Table 19 Asia-Pacific Polycarbonate in Medical, By Geography, 2013-2019 (KT)

Table 20 Asia-Pacific Polycarbonate in Packaging, By Geography, 2013-2019 (USD MN)

Table 21 Asia-Pacific Polycarbonate in Packaging, By Geography, 2013-2019 (KT)

Table 22 Asia-Pacific Polycarbonate Market, By Geography, 2013-2019 (USD MN)

Table 23 Asia-Pacific Polycarbonate Market, By Country, 2013-2014 (KT)

Table 24 China Polycarbonate Market, By Application, 2013-2019 (USD MN)

Table 25 China Polycarbonate Market, By Application, 2013-2019 (KT)

Table 26 Japan Polycarbonate Market, By Application, 2013-2019 (USD MN)

Table 27 Japan Polycarbonate Market, By Application, 2013-2019 (KT)

Table 28 India Polycarbonate Market, By Application, 2013-2019 (USD MN)

Table 29 India Polycarbonate Market, By Application, 2014-2019 (KT)

Table 30 South Korea Polycarbonate Market, By Application, 2013-2019 (USD MN)

Table 31 South Korea Polycarbonate Market, By Application, 2014-2019 (KT)

Table 32 Taiwan Polycarbonate Market, By Application, 2013-2019 (USD MN)

Table 33 Taiwan Polycarbonate Market, By Application, 2014-2019 (KT)

Table 34 Polycarbonate Market: Company Share Analysis, 2014 (%)

Table 35 Asia-Pacific Polycarbonate Market: Mergers & Acquisitions

Table 36 Asia-Pacific Polycarbonate Market: Expansions

Table 37 Asia-Pacific Polycarbonate Market: New Product Launch/Development

Table 38 Asia-Pacific Polycarbonate Market: Joint Development

Table 39 Asia-Pacific Polycarbonate: Collaboration

Table 40 Asia-Pacific Polycarbonate: Agreements

Table 41 Asia-Pacific Polycarbonate: New Technology

Table 42 Teijin Limited: Key Financials, 2010- 2014 (USD MN)

Table 43 Bayer Material Science: Key Financials, 2009- 2013 (USD MN)

Table 44 Bayer Material Science: Key Financials, 2012 - 2013 (USD MN)

Table 45 CHI MEI Corporation: Key Operations Data, 2011 - 2013 (USD MN)

Table 46 Formosa Idemitsu Petrochemical: Key Operations Data, 2009 - 2013 (USD MN)

Table 47 Samsung Sdi Chemicals And Electronics Material Incorporations: Key Financials, 2009- 2013 (USD MN)

Table 48 Samsung Sdi Chemicals And Electronics Material Incorporation: Key Financials, 2012 - 2013 (USD MN)

List of Figures (45 Figures)

Figure 1 Asia-Pacific Polycarbonate Market: Segmentation & Coverage

Figure 2 Polycarbonate Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Ingredient-Based Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Asia-Pacific Polycarbonate Market Snapshot

Figure 8 Polycarbonate Market: Growth Aspects

Figure 9 Asia-Pacific Polycarbonate Market, By Application, 2014 Vs 2019 (Usd Mn/Kt)

Figure 10 Asia-Pacific Polycarbonate Market, By Application, 2014-2019 (USD MN)

Figure 11 Asia-Pacific Polycarbonate Market, By Application, 2014-2019 (KT)

Figure 12 Asia-Pacific Polycarbonate Market in Consumer Electronics, By Geography, 2013-2019 (USD MN)

Figure 13 Asia-Pacific Polycarbonate Market in Optical Media, By Geography, 2013-2019 (USD MN)

Figure 14 Asia-Pacific Polycarbonate Market in Consumer Goods, By Geography, 2013-2019 (USD MN)

Figure 15 Asia-Pacific Polycarbonate Market in Sheet/Films, By Geography, 2013-2019 (USD MN)

Figure 16 Asia-Pacific Polycarbonate Market in Optical Media, By Geography, 2013-2019 (USD MN)

Figure 17 Asia-Pacific Polycarbonate Market in Medical, By Geography, 2013-2019 (USD MN)

Figure 18 Asia-Pacific Polycarbonate Market in Packaging, By Geography, 2013-2019 (USD MN)

Figure 19 Asia-Pacific Polycarbonate Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 20 Asia-Pacific Polycarbonate Market: Growth Analysis, By Geography, 2014-2019 (KT)

Figure 21 China Polycarbonate Market Overview, 2014 & 2019 (%)

Figure 22 China Polycarbonate Market, By Application, 2013-2019 (USD MN)

Figure 23 China Polycarbonate Market: Application Snapshot

Figure 24 Japan Polycarbonate Market Overview, 2014 & 2019 (%)

Figure 25 Japan Polycarbonate Market, By Application, 2013-2019 (USD MN)

Figure 26 Japan Polycarbonate Market: Application Snapshot

Figure 27 India Polycarbonate Market Overview, 2014 & 2019 (%)

Figure 28 India Polycarbonate Market, By Application, 2013-2019 (USD MN)

Figure 29 India Polycarbonate Market: Application Snapshot

Figure 30 South Korea Polycarbonate Market Overview, 2014 & 2019 (%)

Figure 31 South Korea Polycarbonate Market, By Application, 2013-2019 (USD MN)

Figure 32 South Korea Polycarbonate Market: Application Snapshot

Figure 33 Taiwan Polycarbonate Market Overview, 2014 & 2019 (%)

Figure 34 Taiwan Polycarbonate Market, By Application, 2013-2019 (USD MN)

Figure 35 Taiwan Polycarbonate Market: Application Snapshot

Figure 36 Polycarbonate Market: Company Share Analysis, 2013 (%)

Figure 37 Teijin Limited, Revenue Mix, 2014 (%)

Figure 38 Company Revenues, 2010-2014 (USD MN)

Figure 39 Bayer Material Science, Revenue Mix, 2013 (%)

Figure 40 Company Revenues, 2009-2013 (USD MN)

Figure 41 Company Revenues, 2011-2013 (USD MN)

Figure 42 Formosa Idemitsu Petrochemical, Revenue Mix, 2013 (%)

Figure 43 Company Revenues, 2009-2013 (USD MN)

Figure 44 Samsung Sdi Chemicals And Electronics Material Incorporation, Revenue Mix, 2013 (%)

Figure 45 Company Revenues, 2009-2013 (USD MN)

Polycarbonates are one of the most widely used engineering thermoplastics that are derived from carbonate monomers. Due to its various properties such as flexibility, impact resistance, optical properties and exceptional light transmitting intensity, polycarbonate is used as both commodity and engineering plastics. Unlike most thermoplastics, polycarbonates can undergo large plastic deformations without breaking or cracking. Thus, it is used across various applications, such as automotive, consumer goods, electrical & electronic, medical, optical media, packaging, sheet film, and others (aerospace, gadgets, and others)

The Asia-Pacific polycarbonate market accounted for a share of 61.3% in 2014. The consumption of polycarbonate in Asia-Pacific region was 2,369.7 KT in 2014, and is projected to reach 3,117.6 KT by 2019 at a CAGR of 5.6% from 2014 to 2019.

The increasing demand across industry verticals, such as automobile industry, consumer electronics, ID card &LED product markets, and optical media is driving the Asia-Pacific polycarbonate market.

The consumer electronics segment dominates the application segment of this market, followed by consumer goods segment. This segment was valued at $1,666.0 million in 2014, and is expected to reach $2,486.9 million by 2019, at a CAGR of 8.3% from 2014 to 2019.

Based on region, the polycarbonate market is segmented into major countries, China, Japan, India, South Korea, and Taiwan. China is the largest-growing market in this region. The polycarbonate market in China was valued at $4,977.4 million in 2014 and is expected to reach $7,333.4 million by 2019 at a CAGR of 8.1% from 2014 to 2019.

The key players in the Asia-Pacific Polycarbonate market include are Teijin Limited (Japan), Bayer Material Science AG (China), Samsung SDI Chemicals and Electronics Material Incorporation (South Korea), Mitsubishi Engineering-Plastics Limited. (Japan), and others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement