Asia-Pacific Mass Notification System Market by Product (Hardware, Software & Services), by Solution (In-building, Wide-area, Distributed Recipient), by Vertical, by Application, by Geography - Analysis and Forecast to 2019

The Asia-Pacific mass notification market is expected to grow from $281.9 million in 2014 to $918.0 million in 2019, at CAGR of 26.6% from 2014 to 2019. The market is primarily driven by the increasing need for public safety and the increasing terrorism threats.

Mass notification systems (MNSs) are imperative, due to the increasing number of adversities, such as human killings, shootings, bombings or natural calamities, such as earthquakes, floods, hurricanes, wildfires. MNSs are a subset of emergency communication systems, and play a vital role in alerting masses before, during, or after any emergency or incident, which can cause disruption. MNSs are being implemented across various industry verticals, such as education, defense, healthcare, energy & power, and government for enhancing public safety as well as business continuity.

Asia-Pacific has witnessed major terrorist and criminal incidents and natural disasters in the recent years. This has led to huge investments in the Asia-Pacific mass notification market. The increased spending on public security and safety infrastructure in China has further fuelled the growth of the mass notification market in the region.

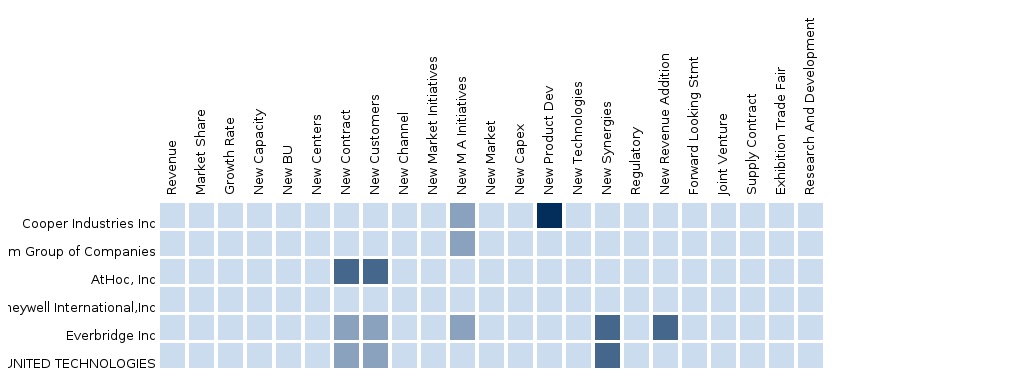

The Asia-Pacific mass notification market report further provides competitive benchmarking of leading players in the industry such as Honeywell International, Athoc Inc., Cooper Industries, Microm Group, and others, in terms of their product offerings, key strategies and operational parameters. The report provides market trends, overall adoption scenarios, competitive landscapes and key drivers, restraints, and opportunities in this market. The report aims at estimating the current size and the future growth potential of this market across the different verticals and countries.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Integrated Ecosystem of Mass Notification System Market

2.2 Arriving at the APAC Mass Notification System Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.2.4 Macro-Indicator Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 24)

4 Market Overview (Page No. - 26)

4.1 Introduction

4.2 Mass Notification Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Asia-Pacific Mass Notification System Market, By Product (Page No. - 33)

5.1 Introduction

5.2 Asia-Pacific Mass Notification System Market, Product Comparison With Parent Market

5.3 Asia-Pacific Mass Notification System Market in Hardware Market,By Geography

5.4 Asia-Pacific Mass Notification System Market in Software & Services Market, By Geography

6 Asia-Pacific Mass Notification System Market, By Solution (Page No. - 39)

6.1 Introduction

6.2 Asia-Pacific Mass Notification System Market in In-Building Solution Market, By Geography

6.3 Asia-Pacific Mass Notification System Market in Wide-Area Solution Market, By Geography

6.4 Asia-Pacific Mass Notification System Market in Distributed Recipient Solution Market, By Geography

7 Mass Notification System Market, By Application (Page No. - 45)

7.1 Introduction

7.2 Asia-Pacific Mass Notification System Market in Interoperable Emergency Communication Market, By Geography

7.3 Asia-Pacific Mass Notification System Market in Business Continuity & Disaster Recovery Market, By Geography

7.4 Asia-Pacific Mass Notification System Market in Integrated Public Alert & Warning Market, By Geography

7.5 Asia-Pacific Mass Notification System Market in Business Operation Market, By Geography

8 Asia-Pacific Mass Notification System Market, By Vertical (Page No. - 53)

8.1 Introduction

8.2 Demand Side Analysis

8.3 Asia-Pacific Mass Notification System Market in Education, By Geography

8.4 Asia-Pacific Mass Notification System Market in Defense, By Geography

8.5 Asia-Pacific Mass Notification System Market in Healthcare, By Geography

8.6 Asia-Pacific Mass Notification System Market in Energy & Power,By Geography

9 Mass Notification System Market, By Geography (Page No. - 62)

9.1 Introduction

9.2 China Mass Notification System Market

9.2.1 China Mass Notification System Market, By Solution

9.2.2 China Mass Notification System Market, By Application

9.2.3 China Mass Notification System Market, By Vertical

9.3 Japan Mass Notification System Market

9.3.1 Japan Mass Notification System Market, By Solution

9.3.2 Japan Mass Notification System Market, By Application

9.3.3 Japan Mass Notification System Market, By Vertical

9.4 Australia Mass Notification System Market

9.4.1 Australia Mass Notification System Market, By Solution

9.4.2 Australia Mass Notification System Market, By Application

9.4.3 Australia Mass Notification System Market, By Vertical

10 Asia-Pacific Mass Notification System Market: Competitive Landscape (Page No. - 82)

10.1 Industry Coverage Analysis

10.2 Mergers & Acquisitions

10.3 Product Launch

10.4 Expansions

10.5 Product Agreement

11 Asia-Pacific Mass Notification System Market, By Company (Page No. - 85)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 Athoc Inc.

11.2 Eaton Corporation

11.3 Everbridge Inc.

11.4 Mircom Group of Companies

11.5 Honeywell

11.6 (X)Matters

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

12 Appendix (Page No. - 99)

12.1 Customization Options

12.2 Related Reports

12.3 Introducing RT: Real Time Market Intelligence

12.3.1 RT Snapshots

List of Tables (48 Tables)

Table 1 Asia-Pacific Mass Notification System Peer Market Size, 2014 (USD MN)

Table 2 APAC Mass Notification System Vertical Market, 2014 (USD MN)

Table 3 Asia-Pacific Mass Notification System Market: Macro-Indicator,By Geography, 2014 (USD MN)

Table 4 Asia-Pacific Mass Notification Market: Comparison With Parent Market, 2013-2019 (USD MN)

Table 5 Asia-Pacific Mass Notification System Market: Drivers and Inhibitors

Table 6 Asia-Pacific Mass Notification System Market, By Application,2013 - 2019 (USD MN)

Table 7 Asia-Pacific Mass Notification System Market, By Geography,2013 - 2019 (USD MN)

Table 8 Asia-Pacific Mass Notification System Market, By Solution,2013 - 2019 (USD MN)

Table 9 Asia-Pacific Mass Notification System Market, By Product,2013 - 2019 (USD MN)

Table 10 Asia-Pacific Mass Notification System Market, By Vertical,2013 - 2019 (USD MN)

Table 11 Asia-Pacific Mass Notification System Market, By Product,2013-2019 (USD MN)

Table 12 Asia-Pacific Mass Notification System Market: Product Comparison With Parent Market, 2013-2019 (USD MN)

Table 13 Asia-Pacific Mass Notification System Market in Hardware Market, By Geography, 2013-2019 (USD MN)

Table 14 Asia-Pacific Mass Notification System Market in Software & Services Market, By Geography, 2013-2019 (USD MN)

Table 15 Asia-Pacific Mass Notification System Market, By Solution,2013-2019 (USD MN)

Table 16 Asia-Pacific Mass Notification System Market in In-Building Solution Market, By Geography, 2013-2019 (USD MN)

Table 17 Asia-Pacific Mass Notification System Market in Wide-Area Solution Market, By Geography, 2013-2019 (USD MN)

Table 18 Asia-Pacific Mass Notification System Market in Distributed Recipient Solution Market, By Geography, 2013-2019 (USD MN)

Table 19 Asia-Pacific Mass Notification System Market, By Application,2013-2019 (USD MN)

Table 20 Asia-Pacific Mass Notification System Market in Interoperable Emergency Communication Market, By Geography, 2013-2019 (USD MN)

Table 21 Asia-Pacific Mass Notification System Market in Business Continuity & Disaster Recovery Market, By Geography, 2013-2019 (USD MN)

Table 22 Asia-Pacific Mass Notification System Market in Integrated Public Alert & Warning Market, By Geography, 2013-2019 (USD MN)

Table 23 Asia-Pacific Mass Notification System Market in Business Operation Market, By Geography, 2013-2019 (USD MN)

Table 24 Asia-Pacific Mass Notification System Market, By Vertical,2013-2019 (USD MN)

Table 25 Asia-Pacific Mass Notification System Market in Education, By Geography, 2013-2019 (USD MN)

Table 26 Asia-Pacific Mass Notification System Market in Defense, By Geography, 2013-2019 (USD MN)

Table 27 Asia-Pacific Mass Notification System Market in Healthcare,By Geography, 2013-2019 (USD MN)

Table 28 Asia-Pacific Mass Notification System Market in Energy & Power,By Geography, 2013-2019 (USD MN)

Table 29 Asia-Pacific Mass Notification System Market, By Geography,2013-2019 (USD MN)

Table 30 China Mass Notification System Market, By Solution, 2013-2019 (USD MN)

Table 31 China Mass Notification System Market, By Application, 2013-2019 (USD MN)

Table 32 China Mass Notification System Market, By Vertical, 2013-2019 (USD MN)

Table 33 Japan Mass Notification System Market, By Solution, 2013-2019 (USD MN)

Table 34 Japan Mass Notification System Market, By Application, 2013-2019 (USD MN)

Table 35 Japan Mass Notification System Market, By Vertical, 2013-2019 (USD MN)

Table 36 Australia Mass Notification System Market, By Solution,2013-2019 (USD MN)

Table 37 Australia Mass Notification System Market, By Application,2013-2019 (USD MN)

Table 38 Australia Mass Notification System Market, By Vertical,2013-2019 (USD MN)

Table 39 Asia-Pacific Mass Notification System Market: Mergers & Acquisitions

Table 40 Asia-Pacific Mass Notification System Market: Product Launch

Table 41 Asia-Pacific Mass Notification System Market: Product Upgrade

Table 42 APAC Mass Notification System Market: Product Agreement

Table 43 Cooper Industries (Eaton Corporation): Key Financials, 2010-2014 (USD MN)

Table 44 Cooper Industries (Eaton Corporation): Revenue, By Business Segment, 2010-2013 (USD MN)

Table 45 Cooper Industries (Eaton Corporation): Revenue, By Geography,2010-2013 (USD MN)

Table 46 Key Financials Honeywell: Key Financials, 2011-2014 (USD MN)

Table 47 Geographic Revenue Mix, 2010-2014 (USD MN)

Table 48 Business Revenue Mix, 2010-2014 (USD MN)

List of Figures (57 Figures)

Figure 1 Asia-Pacific Mass Notification System Market: Segmentation & Coverage

Figure 2 Mass Notification System Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Macro-Indicator Based Approach

Figure 8 Asia-Pacific Mass Notification System Market, 2014 Snapshot

Figure 9 Mass Notification System Market: Growth Aspects

Figure 10 Mass Notification Market: Comparison With Parent Market

Figure 11 Asia-Pacific Mass Notification System, By Application, 2014 & 2019 (USD MN)

Figure 12 Asia-Pacific Mass Notification System Market, By Product,2014 & 2019 (USD MN)

Figure 13 Asia-Pacific Mass Notification System Market: Product Comparison With Market, 2014-2019 (USD MN)

Figure 14 Asia-Pacific Mass Notification System Market in Hardware Market,By Geography, 2013-2019 (USD MN)

Figure 15 Asia-Pacific Mass Notification System Market in Software & Services Market, By Geography, 2014-2019 (USD MN)

Figure 16 Asia-Pacific Mass Notification System Market, By Solution,2014 & 2019 (USD MN)

Figure 17 Asia-Pacific Mass Notification System Market in In-Building Solutions Market, By Geography, 2013-2019 (USD MN)

Figure 18 Asia-Pacific Mass Notification System Market in Wide-Area Solution Market, By Geography, 2013-2019 (USD MN)

Figure 19 Asia-Pacific Mass Notification System Market in Distributed Recipient Solution Market, By Geography, 2013-2019 (USD MN)

Figure 20 Asia-Pacific Mass Notification System Market, By Application,2014 & 2019 (USD MN)

Figure 21 Asia-Pacific Mass Notification System Market in Interoperable Emergency Communication Market, By Geography, 2013-2019 (USD MN)

Figure 22 Asia-Pacific Mass Notification System Market in Business Continuity & Disaster Recovery Market, By Geography, 2013-2019 (USD MN)

Figure 23 Asia-Pacific Mass Notification System Market in Integrated Public Alert & Warning Market, By Geography, 2013-2019 (USD MN)

Figure 24 Asia-Pacific Mass Notification System Market in Business Operation Market, By Geography, 2014-2019 (USD MN)

Figure 25 Asia-Pacific Mass Notification System Market, By Vertical,2014 & 2019 (USD MN)

Figure 26 Education

Figure 27 Defense

Figure 28 Healthcare

Figure 29 Asia-Pacific Mass Notification System Market in Education, By Geography, 2014-2019 (USD MN)

Figure 30 Asia-Pacific Mass Notification System Market in Defense, By Geography, 2013-2019 (USD MN)

Figure 31 Asia-Pacific Mass Notification System Market in Healthcare,By Geography, 2013-2019 (USD MN)

Figure 32 Asia-Pacific Mass Notification System Market in Energy & Power,By Geography, 2014-2019 (USD MN)

Figure 33 Asia-Pacific Mass Notification System Market: Growth Analysis,By Geography, 2014-2019 (USD MN)

Figure 34 China Mass Notification System Market Overview, 2014 & 2019 (%)

Figure 35 China Mass Notification System Market, By Solution, 2014 - 2019 (USD MN)

Figure 36 China Mass Notification System Market Share, By Solution, 2014 & 2019 (%)

Figure 37 China Mass Notification System Market, By Application, 2013-2019 (USD MN)

Figure 38 China Mass Notification System Market: Application Snapshot

Figure 39 China Mass Notification System Market, By Vertical, 2013 - 2019 (USD MN)

Figure 40 China Mass Notification System Market Share, By Vertical, Snapshot 2014 & 2019 (%)

Figure 41 Japan Mass Notification System Market Overview, 2014 & 2019 (%)

Figure 42 Japan Mass Notification System Market, By Solution, 2013-2019 (USD MN)

Figure 43 Japan Mass Notification System Market Share, By Solution, 2014-2019 (%)

Figure 44 Japan Mass Notification System Market, By Application, 2013-2019 (USD MN)

Figure 45 Japan Mass Notification System Market: Application Snapshot

Figure 46 Japan Mass Notification System Market, By Vertical, 2013 - 2019 (USD MN)

Figure 47 Japan Mass Notification System Market Share, By Vertical, Snapshot 2014 & 2019 (%)

Figure 48 Australia Mass Notification System Market Overview, 2014 & 2019 (%)

Figure 49 Australia Mass Notification System Market, By Solution,2014-2019 (USD MN)

Figure 50 Australia Mass Notification System Market: Type Snapshot

Figure 51 Australia Mass Notification System Market, By Application,2014 - 2019 (USD MN)

Figure 52 Australia Mass Notification System Market: Application Snapshot

Figure 53 Australia Mass Notification System Market, By Vertical,2013 - 2019 (USD MN)

Figure 54 Australia Mass Notification System Market Share, By Vertical, Snapshot 2014 & 2019 (%)

Figure 55 Industry Coverage Analysis

Figure 56 Eaton Revenue Mix, 2013 (%)

Figure 57 Honeywell Revenue Mix, 2014

Mass notification systems (MNSs) are imperative, due to the increasing number of adversities, such as human killings, shootings, bombings or natural calamities, such as earthquakes, floods, hurricanes, wildfires. MNSs are a subset of emergency communication systems, and play a vital role in alerting masses before, during, or after any emergency or incident, which can cause disruption. MNSs are being implemented across various industry verticals, such as education, defense, healthcare, energy & power, and government for enhancing public safety as well as business continuity.

Various safety rules and standards have been set up by government, which mentions specifications for MNSs. These specifications play an important role in the design and integration of the MNS. Furthermore, traditional MNSs are being replaced by technologically advanced hybrid systems, due to their low cost and flexibility of deployment models without any compromise on data security, sensitivity, and privacy. Integration of various MNSs, such as network alerting systems, public address (PA) systems, telephony alerting systems, hosted messaging systems, and other similar systems with emergency communication systems is expected to act as a very powerful end-to-end crisis communication system in future.

The Asia-Pacific mass notification system market contributed share of 9.2% to the global mass notification market in 2014. This market is expected to witness substantial growth in the near future, due to the increased awareness for safety regulations and need for better communication services during emergencies.

The education, defense, and healthcare segments contributed share of 28.4%, 24.7%, and 14.0% respectively to the market in 2014. Among the various applications, the interoperable emergency communication, business continuity & disaster recovery, integrated public alert & warning segments contributed share of 44.0%, 29.0% and 20.4% respectively to the market in the same year, while the rest 6.6% was contributed by the business operations segment.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement