Asia-Pacific Lubricants Market by Type (Mineral Oil Lubricants, Synthetic Lubricants, Bio-based Lubricants, and Greases), by Application (Transportation, and Industrial Machinery & Equipment) - Global Trends & Forecasts to 2020

Lubricants are used widely across various industries as it offers low operating costs. They are mostly used in engine oils for transportation. Reducing friction between moving surfaces and thereby enhance the operation by keeping the vehicles fleet ready and moving is the primary function of lubricants. In automotive engines, lubricants play an important role of cleaning and cooling the engine. They also help to reduce the engine wear and tear caused by the friction of its metal parts, as well as to carry off heat.

Factors such as rapid expansion of the automotive industry and industrialization in the Asia-Pacific region are driving the overall demand for lubricants.

Furthermore, considerable amount of investments in expansion are made by various market players to provide variety of lubricants across various industries in the coming years. Due to the presence of major key players in the region, the market in China dominates the Asia-Pacific lubricants market having accounted for a share of 63.1% in 2014.

Various secondary sources, such as encyclopedia, directories, industry journals, and databases are used to identify and collect information useful for this extensive commercial study of the lubricants market market. The primary sources include experts from related industries and suppliers who have been interviewed to obtain and verify critical information as well as to assess the future prospects of the market.

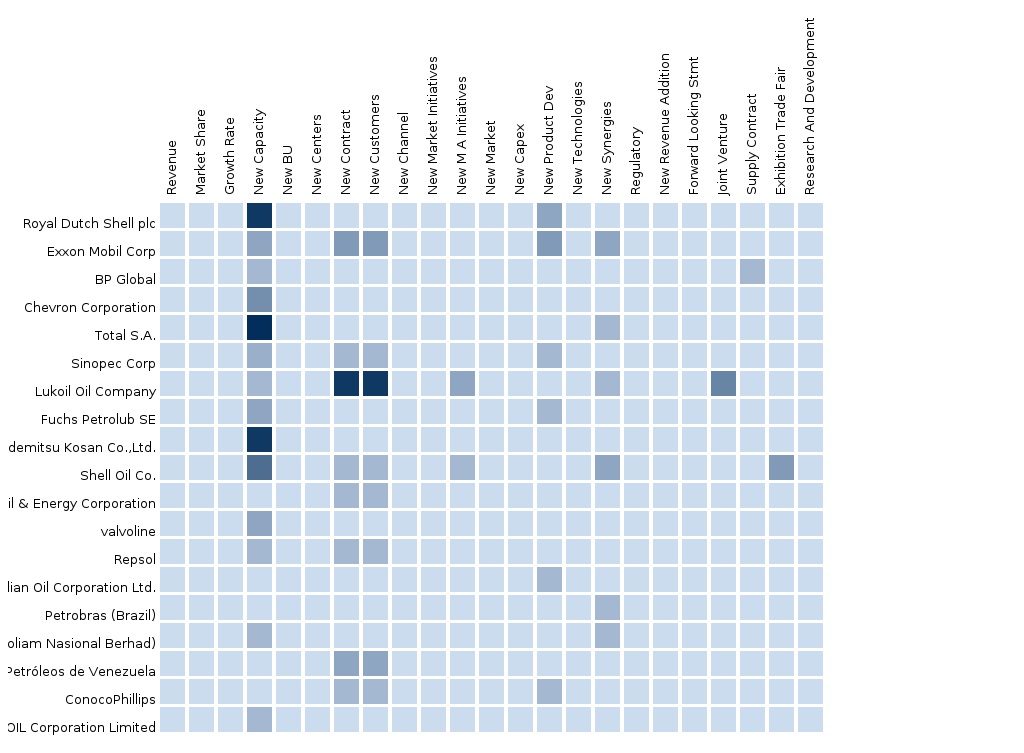

Competitive scenarios of the top players in the Asia-Pacific lubricants market has been discussed in detail. Leading players of this industry with their recent developments and other strategic industry activities are also covered in the report. The key players operational in the Asia-Pacific lubricants market are Royal Dutch Shell plc (The Netherlands), Exxon Mobil Corporation (U.S.), BP plc (U.K.), Chevron Corporation (U.S.), Total S.A. (France), PetroChina Company Limited (China), Sinopec Limited (China), and Idemitsu Kosan Co. Ltd. (Japan).

Scope of the report:

This research report categorizes the Asia-Pacific Lubricants market on the basis of applications, type, and geography along with forecasting volume, value, and analyzing trends in each of the sub-markets.

On the basis of application:

- Transportation

- Industrial Machinery & Equipment

On the basis of type:

- Mineral Oil Lubricants

- Synthetic Lubricants

- Bio-Based Lubricants

- Greases

Each application & type is described in detail in the report with volume and revenue forecasts for each application & type.

On the basis of country:

- China

- Japan

- India

- Thailand

- South Korea

- Australia & New Zealand

- Singapore

- Malaysia

- Taiwan

- Philippines

- Rest of Asia-Pacific

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency and Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Market Size Estimation

2.2 Market Breakdown & Data Triangulation

2.3 Market Share Estimation

2.3.1 Key Insights

2.3.2 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in the Lubricants Market

4.2 Lubricants Market: Type Segments

4.3 Lubricants Market in Asia-Pacific

4.4 Lubricants Market Attractiveness

4.5 Lubricant Applications, By Region (2015)

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.2.3 APAC, By Country

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Automotive Industry in Asia-Pacific

5.3.1.2 Massive Industrial Growth in Asia-Pacific

5.3.1.3 Increased Consumer Awareness Coupled With Stringent Government Regulations Drives the Sales of Synthetic Lubricants

5.3.2 Restraints

5.3.2.1 Shift Toward Synthetic Lubricant Contracts the Demand For Mineral Oil Lubricant: Affecting the Overall Lubricant Market

5.3.2.2 High Prices of Synthetic & Bio-Based Lubricants Affects the Lubricants Market Growth

5.3.3 Opportunities

5.3.3.1 Bric Countries Are Expected to Be the Lucrative Markets

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Lubricants Market, By Type

7.1 Introduction

7.2 Market Size & Projection

7.2.1 Widespread Availability & Low Cost Drive the Consumption of Mineral Oil Lubricants

7.3 Mineral Oil Lubricants

7.4 Synthetic Lubricants

7.4.1 Asia-Pacific to Outpace North American Consumption

7.5 Bio-Based Lubricants

7.5.1 Biodegradable Nature of Bio-Based Lubricants to Drive the Demand

7.6 Greases

8 Lubricants Market, By Application

8.1 Introduction

8.2 Market Size & Projection

8.2.1 Growth in Automotive is Driving the Demand For Lubricants

8.3 Transportation

8.3.1 Passenger Vehicles Are the Largest Consumers of Lubricants in Transportation

8.4 Industrial Machinery & Equipment

8.4.1 Increased Manufacturing Activities in Asia-Pacific Encourages Growth in Lubricants Industry

9 Lubricants Market, By Country

9.1 Introduction

9.1.1 China: Largest Consumer of Lubricants With Growing Industrial Activities

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 Taiwan

9.2.5 Thailand

9.2.6 Australia & New Zealand

9.2.7 Malaysia

9.2.8 South Korea

9.2.9 Singapore

9.2.10 Philippines

9.2.11 Rest of Asia-Pacific

10 Asia- Pacific Lubricants Market: Competitive Landscape

10.1 Expansions

10.2 New Product Development

10.3 Joint Ventures, Partnerships, and Collaborations

11 Asia Pacific Lubricants Market, By Company

11.1 Royal Dutch Shell Plc.

11.1.1 Overview

11.1.2 Key Financials

11.1.3 Product and Service Offerings

11.1.4 Related Developments

11.1.5 Swot Analysis

11.1.6 MMM View

11.2 Exxonmobil Corporation

11.2.1 Overview

11.2.2 Key Financials

11.2.3 Product and Service Offerings

11.2.4 Related Developments

11.2.5 MMM View

11.3 Bp Plc.

11.3.1 Overview

11.3.2 Key Financials

11.3.3 Product and Service Offerings

11.3.4 Related Developments

11.3.5 MMM View

11.4 Chevron Corporation

11.4.1 Overview

11.4.2 Key Financials

11.4.3 Product and Service Offerings

11.4.4 Related Developments

11.4.5 MMM View

11.5 Total S.A.

11.5.1 Overview

11.5.2 Key Financials

11.5.3 Product and Service Offerings

11.5.4 Related Developments

11.5.5 MMM View

11.6 Petrochina Company Limited

11.6.1 Overview

11.6.2 Key Financials

11.6.3 Product and Service Offerings

11.6.4 Related Developments

11.6.5 MMM View

11.7 Sinopec Limited

11.7.1 Overview

11.7.2 Key Financials

11.7.3 Product and Service Offerings

11.7.4 Related Developments

11.7.5 MMM View

11.8 Idemitsu Kosan Co. Ltd.

11.8.1 Overview

11.8.2 Key Financials

11.8.3 Product and Service Offerings

11.8.4 Related Developments

11.8.5 MMM View

12 Appendix

12.1 Related Reports

12.2 Customization Options

12.2.1 Asia Pacific Lubricants Market Types Matrix

12.2.2 Asia Pacific Lubricants Competitive Benchmarking

12.2.3 Asia Pacific Lubricants Market Vendor Landscaping

12.2.4 Asia Pacific Lubricants Market Data Tracker

12.2.5 Asia Pacific Lubricants Market Emerging Vendor Landscape

12.2.6 Asia Pacific Lubricants Market Channel Analysis

12.3 Introducing Rt: Real Time Market Intelligence

List of Tables

Table 1 Lubricants By Base Oil

Table 2 Asia-Pacific Lubricants Market, By Type, 2015–2020 (USD Mn)

Table 3 Mineral Oil Lubricants Market, By Country, 2013–2020 (USD Mn)

Table 4 Synthetic Lubricants Market, By Country, 2013–2020 (USD Mn)

Table 5 Bio-Based Lubricants Market, By Country, 2013–2020 (USD Mn)

Table 6 Greases Market , By Country, 2013–2020 (USD Mn)

Table 7 Lubricants Market Size, By Application, 2013–2020 (Kt)

Table 8 Lubricants in Transportation Market, By Type, 2013–2020 (Kt)

Table 9 Lubricants in Transportation Market, By Country, 2013–2020 (Kt)

Table 10 Lubricants in Industrial Machinery & Equipment Market, By Country, 2013–2020 (Kt)

Table 11 Lubricants Market, By Country, 2013–2020 (Kt)

Table 12 Lubricants Market Size, By Country, 2013–2020 (USD Million)

Table 13 Asia-Pacific: Lubricants Market, By Type, 2013–2020 (Kt)

Table 14 Asia-Pacific: Lubricants Market, By Application, 2013–2020 (Kt)

Table 15 China: Lubricants Market, By Type, 2013–2020 (Kt)

Table 16 China: Lubricants Market, By Application, 2013–2020 (Kt)

Table 17 India: Lubricants Market, By Type, 2013–2020 (Kt)

Table 18 India: Lubricants Market, By Application, 2013–2020 (Kt)

Table 19 Japan: Lubricants Market, By Type, 2013–2020 (Kt)

Table 20 Japan: Lubricants Market, By Application, 2013–2020 (Kt)

Table 21 Taiwan: Lubricants Market, By Type, 2013–2020 (Kt)

Table 22 Taiwan: Lubricants Market, By Application, 2013–2020 (Kt)

Table 23 Thailand: Lubricants Market, By Type, 2013–2020 (Kt)

Table 24 Thailand: Lubricants Market, By Application, 2013–2020 (Kt)

Table 25 Australia & New Zealand: Lubricants Market, By Type, 2013–2020 (Kt)

Table 26 Australia & New Zealand: Lubricants Market, By Application, 2013–2020 (Kt)

Table 27 Malaysia: Lubricants Market, By Type, 2013–2020 (Kt)

Table 28 Malaysia: Lubricants Market, By Application, 2013–2020 (Kt)

Table 29 South Korea: Lubricants Market, By Type, 2013–2020 (Kt)

Table 30 South Korea: Lubricants Market, By Application, 2013–2020 (Kt)

Table 31 Singapore: Lubricants Market, By Type, 2013–2020 (Kt)

Table 32 Singapore: Lubricants Market, By Application, 2013–2020 (Kt)

Table 33 Philippines: Lubricants Market, By Type, 2013–2020 (Kt)

Table 34 Philippines: Lubricants Market, By Application, 2013–2020 (Kt)

Table 35 Rest of Asia-Pacific: Lubricants Market, By Type, 2013–2020 (Kt)

Table 36 Rest of Asia-Pacific: Lubricants Market, By Application, 2013–2020 (Kt)

Table 37 Asia Pacific Lubricants Market: Expansions

Table 38 Asia Pacific Lubricants Market: New Product Development

Table 39 Asia Pacific Lubricants Market: Joint Ventures, Partnerships, and Collaborations

Table 40 Royal Dutch Shell Plc. : Key Financials, 2010-2014 (USD Billion)

Table 41 Exxonmobil Corporation : Key Financials, 2010-2014 (USD Billion)

Table 42 Bp Plc.: Key Financials, 2010-2014 (USD Billion)

Table 43 Chevron Corporation: Key Financials, 2010-2014 (USD Billion)

Table 44 Total S.A.: Key Financials, 2010-2014 (USD Billion)

Table 45 Petrochina Company Limited : Key Financials, 2010-2014 (USD Billion)

Table 46 Sinopec Limited: Key Financials, 2010-2014 (USD Billion)

Table 47 Idemitsu Kosan Co. Ltd.: Key Financials, 2010-2014 (USD Billion)

List of Figures

Figure 1 Asia-Pacific Lubricants Market

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Break Down of Primary Interviews, By Company Type, Designation & Region

Figure 5 Key Data From Secondary Sources

Figure 6 Key Data From Primary Sources

Figure 7 Mineral Oil Lubricants Expected to Dominate the Lubricants Market, 2015 & 2020

Figure 8 Asia-Pacific to Register Highest Growth Rate, 2014

Figure 9 Growth in the Lubricants Market, (2015-2020)

Figure 10 Synthetic & Bio-Based Lubricants to Grow At the Fastest Rate

Figure 11 China Captures the Lion’s Share in the Asia-Pacific Lubricants Market

Figure 12 India & Philippines Are the Fastest Growing Lubricants Market

Figure 13 India to Register High Growth Rate

Figure 14 Lubricants Formulation

Figure 15 Lubricants Market Segmentation, By Type

Figure 16 Lubricants Market Segmentation, By Application

Figure 17 Lubricant Market Segmentation, By Country

Figure 18 Overview of the Forces Affecting the Lubricants Market

Figure 19 Market Impact Vis-À-Vis Increasing Use of Synthetic Lubricants

Figure 20 Value Chain Analysis For Lubricants

Figure 21 Porter’s Five Forces Analysis (2013)

Figure 22 Grease Expected Register the Highest Cagr Between 2015 and 2020

Figure 23 India to Drive the Asia-Pacific Mineral Oil Lubricants Market

Figure 24 High Performance Characteristics of Synthetic Lubricants to Drive the Market

Figure 25 China is the Biggest Contributor to the Bio-Based Lubricants Segment

Figure 26 India & China to Witness the Fastest Growth in Grease Segment Between 2015 and 2020

Figure 27 Transportation Segment Qualifies the Highest Consumption

Figure 28 Increasing Use of Different Modes of Transport Fuels the Demand of Lubricants

Figure 29 Regional Snapshot (2015– 2020) — Asia-Pacific is the Fastest Growing Lubricants Market

Figure 30 Synthetic Lubricants to Gradually Replace Mineral Oil Lubricants in Some Countries

Figure 31 Asia-Pacific Market Snapshot: China & India Are the Most Lucrative Markets

Figure 32 Asia-Pacific Lubricants Market: Company Share Analysis, 2014(%)

Figure 33 Asia-Pacific Lubricants Market: Country Wise Market Share

Figure 34 Royal Dutch Shell Plc. : Revenue Mix

Figure 35 Royal Dutch Shell Plc. : Swot Analysis

Figure 36 Exxonmobil Corporation : Revenue Mix

Figure 37 Exxonmobil Corporation : Swot Analysis

Figure 38 Bp Plc.: Revenue Mix

Figure 39 Bp Plc. : Swot Analysis

Figure 40 Chevron: Revenue Mix, 2014

Figure 41 Chevron Corporation : Swot Analysis

Figure 42 Total S.A.: Revenue Mix, 2014

Figure 43 Total S.A. : Swot Analysis

Figure 44 Petrochina Company Limited : Revenue Mix, 2014

Figure 45 Petrochina Company Limited : Swot Analysis

Figure 46 Sinopec Limited : Revenue Mix

Figure 47 Sinopec Limited: Swot Analysis

Figure 48 Idemitsu Kosan Co. Ltd.: Revenue Mix

Figure 49 Idemitsu Kosan Co. Ltd. : Swot Analysis

Lubricants are a mixture of base oils and additives, in which the additives help to enhance, add, or suppress properties of the base oil. They are usually manufactured in the liquid or semi-solid state and are utilized to reduce the friction between moving surfaces of machines and equipment. In addition, lubricants also help reduce wear and tear of machinery and prevent overheating and corrosion. The efficiency of machinery essentially depends on the lubricant and the method of application. Thus, lubricants play a vital role in the smooth functioning of machinery.

The Asia-Pacific lubricants market was estimated at USD 70,555.2 million in 2015, and is expected to reach USD 82, 968.9 million by 2020, at a CAGR of 3.3% from 2015 to 2020. The mineral lubricants segment dominated the Asia-Pacific lubricants market, and is estimated at USD 52,925.0 MN in 2015.

The Asia-Pacific lubricants market is segmented on the basis of type, application, and country. On the basis of type, the market includes mineral oil lubricants, synthetic lubricants, bio-based lubricants, and greases. The greases type segment is expected to grow at a highest CAGR of 3.5% from 2015 to 2020, and accounted for a market share of 4.3% in 2014. By application, the market is segmented into transportation and industrial machinery & equipment. The transportation application is further segmented into commercial vehicles, passenger vehicles, aviation, and marine. The commercial vehicles segment contributed the largest share of, having accounted for a share of 23.7% in 2014. However, the passenger vehicles segment is expected to grow at the highest CAGR of 3.5% from 2015 to 2020

Lubricants utilized in all the aforementioned applications are of different grades and have different technical specifications such as viscosity, index, and density. The use of lubricants in both the applications is crucial for high performance of vehicles and longer machine life.

The market in China was valued at USD 4,706.8 million in 2015, and is expected to reach USD 5,415.7 million by 2020, at a CAGR of 2.8% during the forecast period. The market in Japan is expected to grow at a CAGR of 3.2% from 2015 to 2020, to reach a value of USD 1,645.9 million. India and Philippines are expected to grow at a CAGR of 4.4% and 3.6%, respectively from 2015 to 2020. The transportation application segment dominated the Asia-Pacific lubricants market, having accounted for a share of 59.9% (in terms of value) in 2014.

The key players operational in the Asia-Pacific lubricants market are Royal Dutch Shell plc (The Netherlands), Exxon Mobil Corporation (U.S.), BP plc (U.K.), Chevron Corporation (U.S.), Total S.A. (France), PetroChina Company Limited (China), Sinopec Limited (China), and Idemitsu Kosan Co. Ltd. (Japan).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement