Asia-Pacific Concrete Admixtures Market: By Type (Superplasticizers, Normal Plasticizers, Accelerating Agents, Waterproofing Admixtures, Others), By Geography - Analysis and Forecast to 2019

The Asia Pacific concrete admixtures market, along with its end products, has witnessed a linear growth in the past few years and this growth is estimated to increase in the coming years. Concrete admixtures are chemical formulations that are added to concrete at the initial mixing stage to enhance or modify the properties and workability of the mix. Concrete admixtures are used to enhance strength, durability, chemical resistance, and other properties, thus making concrete more suitable to satisfy the needs of modern civil structures. Concrete admixtures have found wide acceptance in the construction industry worldwide; especially for the construction of residential buildings, industrial amenities, and social and commercial complexes, and surface transportation infrastructure projects.

The concrete admixtures market in Asia Pacific has been experiencing significant growth in recent years, which is expected to continue in the near future, mainly driven by the highly growing demand from various end-use industries. Considerable amount of investments are being made by the various market players to serve the end-user applications in the future. China is the largest market for concrete admixtures market in the Asia-Pacific region, having accounted for 76.3% of the total Asia-Pacific demand in 2014.

Among the types covered in the report, normal plasticizers accounted for the largest share of 20.3% of the Asia Pacific concrete admixtures market in 2014. The air entraining agents segment is expected to be the fastest-growing segment in the coming years.

The improving quality of construction in developing economies; the increasing demand for buildings, roads, bridges, tunnels, and water retention structures; and the need to reduce water usage and construction time are among the key factors driving the growth of the concrete admixtures market in Asia Pacific.

This study basically aims to estimate the Asia Pacific concrete admixtures market for 2014 and to project its demand by 2019. This market research study provides a detailed qualitative and quantitative analysis of the market. Various secondary sources, such as encyclopedia, directories, industry journals, and databases, have been used to identify and collect information useful for this extensive and commercial study of the Asia Pacific market. The primary sources – experts from related industries and suppliers - have been interviewed to obtain and verify critical information as well as to assess the future prospects of concrete admixtures.

Competitive scenarios of the top players in the concrete admixtures market have been discussed in detail. Furthermore, the leading players of this industry have been profiled along with their recent developments and other strategic industry activities. The key players include Ashland Inc. (U.S.), BASF SE (Germany), CICO Technologies Ltd. (India), The Dow Chemical Company (U.S.), The Euclid Chemical Company (U.S.), and Pidilite Industries Ltd. (India), among others.

Scope of the Report:

This research report categorizes the Asia Pacific market for concrete admixtures on the basis of type and geography, along with forecasting volume, value, and analyzing trends in each of the sub-markets.

On the Basis of Type:

- Superplasticizers

- Normal Plasticizers

- Accelerating Agents

- Retarding Agents

- Air Entraining Agents

- Waterproofing

- Others

On the Basis of Geography:

- China

- India

- Japan

- South Korea

- Rest of APAC

Table Of Contents

1 Introduction (Page No. - 11)

1.1 Objectives Of The Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem Of Concrete Admixtures Market

2.2 Arriving At The Concrete Admixtures Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Asia Pacific Concrete Admixtures Market: Comparison With Parent Market

4.3 Market Drivers And Inhibitors

4.4 Porter’s Five Forces Analysis

4.4.1 Threat Of New Entrants

4.4.2 Threat Of Substitutes

4.4.3 Bargaining Power Of Buyers

4.4.4 Bargaining Power Of Suppliers

4.4.5 Degree Of Competition

4.5 Key Market Dynamics

5 Asia Pacific Concrete Admixtures Market, By Type (Page No. - 32)

5.1 Introduction

5.2 Asia Pacific Superplasticizers Market, By Geography

5.3 Asia Pacific Normal Plasticizers Market, By Geography

5.4 Asia Pacific Accelerating Agents Market, By Geography

5.5 Asia Pacific Retarding Agents Market, By Geography

5.6 Asia Pacific Air Entraining Agents Market, By Geography

5.7 Asia Pacific Waterproofing Market, By Geography

6 Concrete Admixture Market , By Region (Page No. - 47)

6.1 Introduction

6.2 China

6.3 India

6.4 South Korea

6.5 Japan

6.6 Rest Of Asia-Pacific

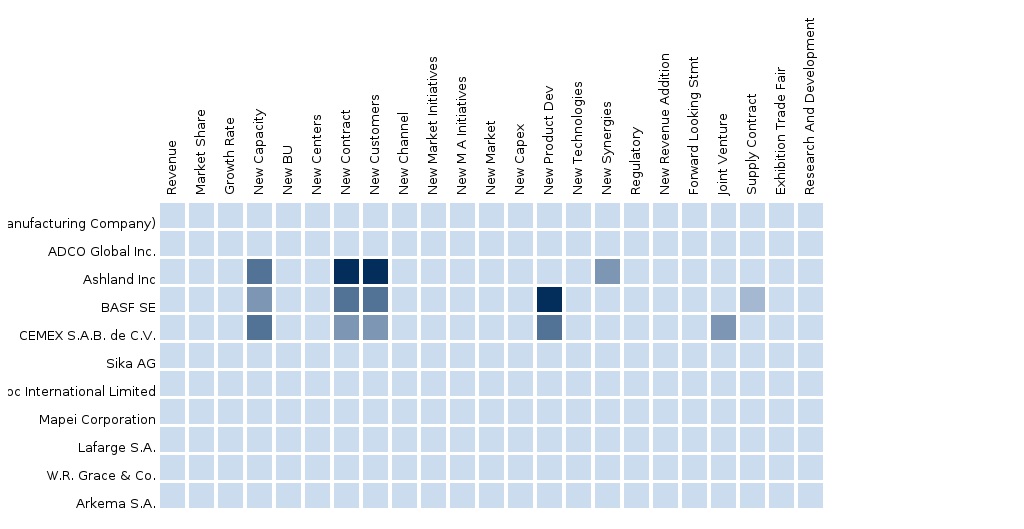

7 Asia Pacific Concrete Admixtures Market : Competitive Landscape (Page No. - 61)

7.1 Overview

7.2 New Product Launch & Development: Key Growth Strategy

7.3 Expansions

7.4 Joint Ventures

7.5 Mergers And Acquisitions

7.6 New Product Launch

7.7 Agreements

8 Asia Pacific Concrete Admixtures Market, By Company (Page No. - 67)

8.1 The Dow Chemical Company

8.2 Basf Se

8.3 Sika Ag

8.4 W.R. Grace & Co.

8.5 Rpm International Inc.

8.6 Ashland Inc.

8.7 Pidilite Industries

8.8 Cico Technologies Ltd.

8.9 Fosroc International Ltd.

8.1 Mapei Corporation (Pty) Ltd

9 Appendix (Page No. - 96)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 Concrete Admixtures Usage Data

9.1.5 Impact Analysis

9.1.6 Trade Analysis

9.1.7 Historical Data And Trends

9.2 Related Reports

9.3 Introducing Rt: Real-Time Market Intelligence

9.3.1 Rt Snapshots

List Of Tables

Table 1 Asia Pacific Concrete Admixtures Market: Comparison With Parent Market, 2013–2019 (Usd Mn)

Table 2 Asia Pacific Concrete Admixtures Market : Drivers And Inhibitors

Table 3 Asia Pacific Concrete Admixtures Market, By Type, 2013-2019 (Usd Mn)

Table 4 Asia Pacific Concrete Admixtures Market, By Type, 2013-2019 (Kt)

Table 5 Asia Pacific Concrete Admixtures Market, By Geography,2013-2019 (Usd Mn) 31

Table 6 Asia Pacific Concrete Admixtures Market, By Geography, 2013-2019 (Kt)

Table 7 Asia Pacific Concrete Admixtures Market, By Type, 2013-2019 (Usd Mn)

Table 8 Asia Pacific Concrete Admixtures Market, By Type, 2013-2019 (Kt)

Table 9 Asia Pacific Concrete Admixtures Market: Type Comparison With Construction Chemicals Market, 2013–2019 (Usd Mn)

Table 10 Asia Pacific Superplasticizers Market, By Geography, 2013–2019 (Usd Mn)

Table 11 Asia Pacific Super Plasticizers Market, By Geography, 2013–2019 (Kt)

Table 12 Asia Pacific Normal Plasticizers Market, By Geography, 2013-2019 (Usd Mn)

Table 13 Asia Pacific Normal Plasticizers Market, By Geography, 2013-2019 (Kt)

Table 14 Asia Pacific Accelerating Agents Market, By Geography, 2013-2019 (Usd Mn)

Table 15 Asia Pacific Accelerating Agents Market, By Geography, 2013-2019 (Kt)

Table 16 Asia Pacific Retarding Agents Market, By Geography, 2013-2019 (Usd Mn)

Table 17 Asia Pacific Retarding Agents Market, By Geography, 2013-2019 (Kt)

Table 18 Asia Pacific Air Entraining Agents Market, By Geography,2013–2019 (Usd Mn) 44

Table 19 Asia Pacific Air Entraining Agents Market, By Geography, 2013–2019 (Kt)

Table 20 Asia Pacific Waterproofing Market, By Geography, 2013–2019 (Usd Mn)

Table 21 Asia Pacific Waterproofing Market, By Geography, 2013–2019 (Kt)

Table 22 Asia Pacific Concrete Admixtures Market, By Geography,2013-2019 (Usd Mn) 48

Table 23 Asia Pacific Concrete Admixtures Market, By Geography, 2013-2019 (Kt)

Table 24 China Concrete Admixtures Market, By Type, 2013-2019 (Usd Mn)

Table 25 China Concrete Admixtures Market, By Type, 2013-2019 (Kt)

Table 26 India Concrete Admixtures Market, By Type, 2013-2019 (Usd Mn)

Table 27 India Concrete Admixture Market, By Type, 2013-2019 (Kt)

Table 28 South Korea Concrete Admixtures Market, By Type, 2013-2019 (Usd Mn)

Table 29 South Korea Concrete Admixtures Market , By Type, 2013-2019 (Kt)

Table 30 Japan Concrete Admixtures Market, By Type, 2013-2019 (Usd Mn)

Table 31 Japan Concrete Admixtures Market, By Type, 2013-2019 (Kt)

Table 32 Rest Of Apac Concrete Admixtures Market, By Type, 2013-2019 (Usd Mn)

Table 33 Rest Of Apac Concrete Admixtures Market, By Type, 2013-2019 (Kt)

Table 34 Asia Pacific Concrete Admixtures Market: Expansions

Table 35 Asia Pacific Concrete Admixtures Market: Joint Ventures

Table 36 Asia Pacific Concrete Admixtures Market: Mergers & Acquisitions

Table 37 Asia Pacific Concrete Admixtures Market: New Product Launch

Table 38 Asia Pacific Concrete Admixtures Market: Agreements

Table 39 The Dow Chemical Company ( Coating And Infrastructure): Business Segment, 2010 - 2014 (Usd Mn)

Table 40 Basf Se: Business Segment (Functional Materials And Solutions), 2010- 2014 (Usd Mn)

Table 41 Sika Ag: Revenue, 2010 - 2014 (Usd Mn)

Table 42 W.R. Grace & Co. : Business Segment, 2012- 2014 (Usd Mn)

Table 43 Rpm International Inc.: Business Segment, 2010 - 2014 (Usd Mn)

Table 44 Ashland Inc. (Performance Materials): Business Segment,2010 - 2014 (Usd Mn) 85

Table 45 Pidilite Industries: Business Segment, 2010 - 2014 (Usd Mn)

List Of Figures

Figure 1 Asia Pacific Concrete Admixtures Market : Segmentation & Coverage

Figure 2 Concrete Admixtures Market : Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macroindicator-Based Approach

Figure 7 Asia Pacific Concrete Admixtures Market: Snapshot

Figure 8 Concrete Admixtures Market : Growth Aspects

Figure 9 Asia Pacific Concrete Admixtures Market: Parent Market Comparison

Figure 10 Porter’s Five Force Analysis Of The Concrete Admixtures Market

Figure 11 Asia Pacific Concrete Admixtures Market, By Key Type, 2014 Vs 2019

Figure 12 Asia Pacific Concrete Admixtures Market Types, By Geography,2014 (Usd Mn) 29

Figure 13 Asia Pacific Concrete Admixtures Market: Growth Analysis, By Type,2014–2019 (%) 30

Figure 14 Asia Pacific Concrete Admixtures Market, By Key Type, 2014 & 2019 (Usd Mn)

Figure 15 Asia Pacific Concrete Admixtures Market, By Key Type, 2014 & 2019 (Kt)

Figure 16 Asia Pacific Concrete Admixtures Market: Type Comparison With Construction Chemicals Market, 2013–2019 (Usd Mn)

Figure 17 Asia Pacific Superplasticizers Market, By Key Geography,2013–2019 (Usd Mn) 37

Figure 18 Asia Pacific Normal Plasticizers Market, By Key Geography,2013-2019 (Usd Mn) 38

Figure 19 Asia Pacific Accelerating Agents Market, By Key Geography,2013-2019 (Usd Mn) 40

Figure 20 Asia Pacific Retarding Agents Market, By Key Geography,2013-2019 (Usd Mn) 42

Figure 21 Asia Pacific Air Entraining Agents Market, By Key Geography,2013–2019 (Usd Mn) 43

Figure 22 Asia Pacific Waterproofing Market, By Key Geography, 2013–2019 (Usd Mn)

Figure 23 Asia Pacific Concrete Admixtures Market : Growth Analysis, By Region, 2014-2019 (Usd Mn)

Figure 24 Asia Pacific Concrete Admixtures Market : Growth Analysis,By Geography, 2014-2019 (Kt) 49

Figure 25 China Concrete Admixtures Market, By Key Type, 2013-2019 (Usd Mn)

Figure 26 China Concrete Admixtures Market, Type Snapshot

Figure 27 India Concrete Admixtures Market , By Key Type, 2013-2019 (Usd Mn)

Figure 28 India Concrete Admixtures Market, Type Snapshot

Figure 29 South Korea Concrete Admixtures Market, By Key Type, 2013-2019 (Usd Mn)

Figure 30 South Korea Concrete Admixtures Market, Type Snapshot

Figure 31 Japan Concrete Admixtures Market, By Key Type, 2013-2019 (Usd Mn)

Figure 32 Japan Concrete Admixtures Market, Type Snapshot

Figure 33 Rest Of Apac Concrete Admixtures Market, By Key Type, 2013-2019 (Usd Mn)

Figure 34 Rest Of Apac Concrete Admixtures Market, By Type, 2014-2019 (%)

Figure 35 Major Growth Strategies In Asia-Pacific Concrete Admixtures Market, 2010 – 2014

Figure 36 The Dow Chemical Company: Revenue Mix, 2014 (%)

Figure 37 Contribution Of Concrete Admixtures (Coating And Infrastructures) Towards Company Revenues, 2010-2014 (Usd Mn)

Figure 38 Basf Se: Revenue Mix, 2014 (%)

Figure 39 Contribution Of Functional Materials And Solutions Towards Company Revenues, 2010-2014 (Usd Mn)

Figure 40 Sika Ag: Revenue Mix, 2014 (%)

Figure 41 Contribution Of Construction Industry Segment Towards Company Revenues, 2010-2014 (Usd Mn)

Figure 42 W.R. Grace & Co.: Revenue Mix, 2014 (%)

Figure 43 W.R. Grace & Co: Revenues, 2010-2014 (Usd Mn)

Figure 44 Rpm International Inc.: Revenue Mix, 2014 (%)

Figure 45 Rpm International Inc. Revenue, 2010-2014 (Usd Mn)

Figure 46 Ashland Inc.: Revenue Mix, 2014 (%)

Figure 47 Ashland Ind. Contribution Of Construction Company (Performance Materials)Revenues, 2010-2014 (Usd Mn)

Figure 48 Pidilite Industries: Revenue Mix, 2014 (%)

Figure 49 Contribution Of Consumer & Bazaar Products Towards Company Revenues, 2010-2014 (Usd Mn)

Chemical concrete admixtures are added in specific proportions to concrete for achieving certain design standards and performance requirements of concrete structures. The awareness regarding the use and benefits of admixtures has increased among construction developers significantly over the past few decades. The utilization of mineral and chemical admixtures in cement is most commonly found in developed countries. In recent years, there has been a considerable increase in the use of admixtures in concrete for various residential, commercial, and infrastructure projects, across most of the developing countries of the world (especially APAC countries). The growing need for housing units and improved sanitation levels; infrastructure investments; and funding by governments in developing countries have spurred the growth of cement consumption and admixtures in Asia Pacific.

The construction industry has been evolving continuously over the past decades, evident from the vast differences between the structures being built currently and the structures in the past decades. Changing lifestyles of people, the growing urbanization trend, and the rising demand for enhanced aesthetics of residential structures and infrastructure have led architects and engineers to innovate the design of concrete structures suited for various applications and requirements. However, tight project completion deadlines and increasing variable costs of construction may pose challenges for the growth of the construction industry in the coming years, thereby restraining the growth of the concrete admixtures market.

The utilization of chemical concrete admixtures (such as normal and superplasticizers, accelerating agents, retarding agents, air entraining agents, and waterproofing admixtures) provide flexibility to designers to modify and enhance the physical as well as chemical properties of concrete. This includes compressive strength, durability, surface finish, and resistance to withstand adverse climatic and working conditions, without compromising the quality of the concrete structure.

The key consumers of admixtures among developing economies of the world include China, India, Brazil, Egypt, and Turkey; and among the developed countries, the major consumers are the U.S., Spain, Germany, Japan, and Italy.

The Asia Pacific concrete admixtures market was valued at $7.22 billion in 2014 and is projected to reach a value of $12.06 billion by 2019, at a CAGR of 10.8% from 2014 to 2019. The improving quality of construction in developing economies; the increasing demand for buildings, roads, bridges, tunnels, and water retention structures; and the need to reduce water usage and construction time are among the key factors driving the growth of the concrete admixtures market in Asia Pacific.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement