Asia Pacific Application Delivery Network Market by Product (Controllers, Application Security Equipment, and Application Gateways), by Vertical (Education, Media and Entertainment, BFSI, Government, and Others) - Forecasts to 2019

The Asia Pacific Application Delivery Network (ADN) market is mainly driven by the increasing business mobility, data center consolidation, and network virtualization. The APAC ADN market was valued at USD 849.4 million in 2014, and is projected to reach USD 1,950.2 million by 2019, at a Compound Annual Growth Rate (CAGR) of 18.1% from 2014 to 2019.

The Asia Pacific Application Delivery Network market is a combination of WAN optimization and Application Delivery Controllers (ADCs). The enterprises use the ADN to access the distributed applications over the web. The ADNs are also required for the effective delivery of the important information and to provide security to this information and the network. ADN is a suite of technologies that can be deployed in the data centers or corporate networks and is used to provide application availability, visibility, and security.

The report also provides an extensive competitive landscape of companies that operate in this market. The main companies that operate in this market and extensively covered in this report are F5 Networks (U.S.), Citrix Systems (U.S.), Barracuda Networks (U.S.), Kemp Technologies (U.S.), Radware (U.S.), Array Networks (U.S.), and A10 Networks (U.S.).

Segment- and country-specific company shares, news and deals, mergers and acquisitions, segment-specific pipeline products, product approvals, and product recalls of major companies have been provided in detail in the report.

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation and Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of ADN Market

2.2 Arriving at the ADN Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 ADN Market: Comparison With Networking/Communication Solutions Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand-Side Analysis

5 Asia Pacific Application Delivery Network Market Analysis, By Product (Page No. - 27)

5.1 Introduction

5.2 APAC ADN Market, Product Comparison With Networking/Communications Solutions Market

5.3 APAC Controller Market in Adn, By Geography

5.4 APAC Application Security Equipment Market in Adn, By Geography

5.5 APAC Application Gateway Market in Adn, By Geography

5.6 Sneak View: APAC ADN Market, By Product

6 Asia Pacific Application Delivery Network Market Analysis, By Vertical (Page No. - 34)

6.1 Introduction

6.2 Demand-Side Analysis

6.3 APAC ADN Market in Education, By Geography

6.4 APAC ADN Market in Media and Entertainment, By Geography

6.5 APAC ADN Market in BFSI, By Geography

6.6 APAC ADN Market in Government, By Geography

6.7 Sneak View: APAC ADN Market, By Vertical

7 Asia Pacific Application Delivery Network Market Analysis, By Geography (Page No. - 44)

7.1 Introduction

7.2 China ADN Market

7.2.1 China ADN Market, By Product

7.2.2 China ADN Market, By Vertical

7.3 Japan ADN Market

7.3.1 Japan ADN Market, By Product

7.3.2 Japan ADN Market, By Vertical

7.4 India ADN Market

7.4.1 India ADN Market, By Product

7.4.2 India ADN Market, By Vertical

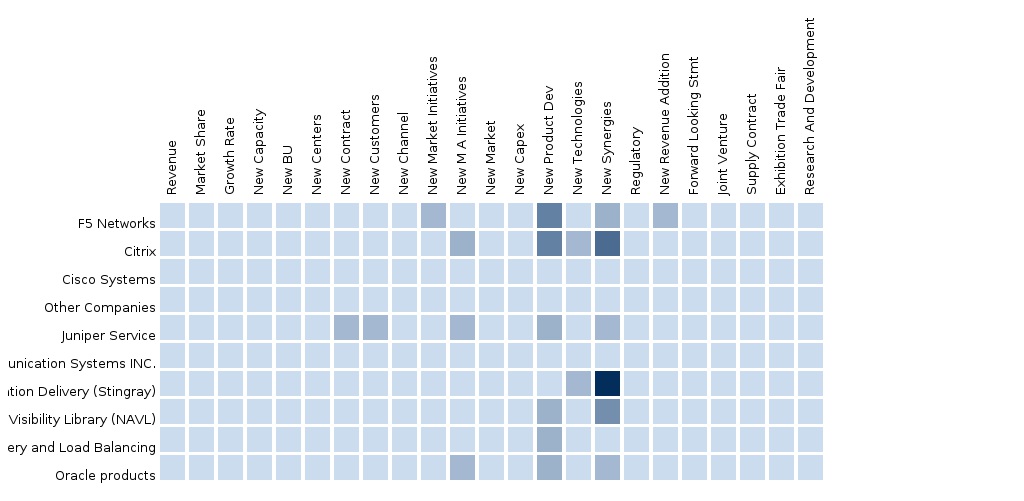

8 Asia Pacific Application Delivery Network Market: Competitive Landscape (Page No. - 57)

8.1 Company Presence in ADN Market, By Product

8.2 Mergers and Acquisitions

8.3 Expansions

8.4 Investments

8.5 New Synergies

9 Company Profile (Page No. - 61)

9.1 F5 Networks, Inc.

9.1.1 Business Overview

9.1.2 Key Financials

9.1.3 Product and Service Offerings

9.1.4 Related Developments

9.1.5 MMM View

9.2 Citrix Systems

9.2.1 Business Overview

9.2.2 Key Operations Data

9.2.3 Product and Service Offerings

9.2.4 Related Developments

9.2.5 MMM View

9.3 Baracudda Networks

9.3.1 Business Overview

9.3.2 Key Financials

9.3.3 Product and Service Offerings

9.3.4 Related Developments

9.3.5 MMM View

9.4 Kemp Technologies

9.4.1 Business Overview

9.4.2 Key Financials

9.4.3 Product and Service Offerings

9.4.4 Related Developments

9.4.5 MMM View

9.5 Radware

9.5.1 Business Overview

9.5.2 Key Financials

9.5.3 Product and Service Offerings

9.5.4 Related Developments

9.5.5 MMM Analysis

9.6 Array Networks

9.6.1 Business Overview

9.6.2 Key Operations Data

9.6.3 Product and Service Offerings

9.6.4 Related Developments

9.6.5 MMM View

9.7 A10 Networks

9.7.1 Business Overview

9.7.2 Key Operations Data

9.7.3 Product and Service Offerings

9.7.4 Related Developments

9.7.5 MMM View

10 Appendix (Page No. - 80)

10.1 Customization Options

10.1.1 Solutions Matrix

10.1.2 Value Chain Analysis

10.1.3 Vendor Landscaping

10.1.4 Market Data Tracker

10.1.5 Vertical Analysis

10.2 Related Reports

10.3 Introducing RT: Real-Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (34 Tables)

Table 1 Global Networking/Communications Solutions Peer Market Size, 2014 (USD MN)

Table 2 APAC Industry Market Size, 2014 (USD MN)

Table 3 APAC ADN Market: Ict Expenditure, By Geography, 2014 (USD MN)

Table 4 APAC ADN Market: Comparisonw Ith Parent Market, 2013–2019 (USD MN)

Table 5 APAC ADN Market: Drivers and Inhibitors

Table 6 APAC ADN Market, By Product, 2013–2019 (USD MN)

Table 7 APAC ADN Market, By Vertical, 2013–2019 (USD MN)

Table 8 APAC ADN Market: Comparison With Vertical Market, 2013–2019 (USD MN)

Table 9 APAC ADN Market, By Product, 2013–2019 (USD MN)

Table 10 APAC ADN Market: Product Comparison With Networking/Communications Solutions Market, 2013–2019 (USD MN)

Table 11 APAC Controller Market in Adn, By Geography, 2013–2019 (USD MN)

Table 12 APAC Application Security Equipment Market in Adn, By Geography, 2013–2019 (USD MN)

Table 13 APAC Application Gateway Market in Adn, By Geography, 2013–2019 (USD MN)

Table 14 APAC ADN Market, By Vertical, 2013–2019 (USD MN)

Table 15 APAC ADN Market in Education, By Geography, 2013–2019 (USD MN)

Table 16 APAC ADN Market in Media and Entertainment, By Geography, 2013–2019 (USD MN)

Table 17 APAC ADN Market in BFSI, By Geography, 2013–2019 (USD MN)

Table 18 APAC ADN Market in Government, By Geography, 2013–2019 (USD MN)

Table 19 APAC ADN Market, By Geography, 2013–2019 (USD MN)

Table 20 China ADN Market, By Product, 2013–2019 (USD MN)

Table 21 China ADN Market, By Vertical, 2013–2019 (USD MN)

Table 22 Japan ADN Market, By Product, 2013–2019 (USD MN)

Table 23 Japan ADN Market, By Vertical, 2013–2019 (USD MN)

Table 24 India ADN Market, By Product, 2013–2019 (USD MN)

Table 25 India ADN Market, By Vertical, 2013–2019 (USD MN)

Table 26 APAC ADN Market: Mergers and Acquisitions

Table 27 APAC ADN Market: Expansions

Table 28 APAC ADN Market: Investments

Table 29 APAC ADN Market: Joint Ventures

Table 30 F5 Networks, Inc.: Key Financials, 2010–2014 (USD MN)

Table 31 F5 Networks, Inc.: Key Financials, By Geography, 2010–2014 (USD MN)

Table 32 Citrix Systems: Key Financials, 2009–2013 (USD MN)

Table 33 Baracuda Networks: Key Financials, 2010–2014 (USD MN)

Table 34 Radware: Key Financials, 2010–2014 (USD MN)

List of Figures (45 Figures)

Figure 1 APAC ADN Market: Segmentation and Coverage

Figure 2 ADN Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 APAC ADN Market Snapshot

Figure 9 ADN Market: Growth Aspects

Figure 10 APAC ADN Product Market, By Geography, 2014 vs. 2019

Figure 11 APAC ADN Market, By Vertical, 2014 vs. 2019

Figure 12 APAC ADN Market, By Product, 2014–2019 (USD MN)

Figure 13 APAC ADN Market: Product Comparison With Networking/Communications Solutions Market, 2013–2019 (USD MN)

Figure 14 APAC Controller Market in Adn, By Geography, 2013–2019 (USD MN)

Figure 15 APAC Application Security Equipment Market in Adn, By Geography, 2013–2019 (USD MN)

Figure 16 APAC Application Gateway Market in Adn, By Geography, 2013–2019 (USD MN)

Figure 17 ADN: Application Market Scenario

Figure 18 APAC ADN Market, By Vertical, 2014–2019 (USD MN)

Figure 19 APAC ADN Market in Education, By Geography, 2013–2019 (USD MN)

Figure 20 APAC ADN Market in Media and Entertainment, By Geography, 2013–2019 (USD MN)

Figure 21 APAC ADN Market in BFSI, By Geography, 2013–2019 (USD MN)

Figure 22 APAC ADN Market in Government, By Geography, 2013–2019 (USD MN)

Figure 23 Sneak View: APAC ADN Market, By Vertical

Figure 24 APAC ADN Market: Growth Analysis, By Geography, 2013–2019 (USD MN)

Figure 25 China ADN Market Overview, 2014 vs. 2019 (%)

Figure 26 China ADN Market, By Product, 2013–2019 (USD MN)

Figure 27 China ADN Market Share, By Product, 2014–2019 (%)

Figure 28 China ADN Market, By Vertical, 2013-2019 (USD MN)

Figure 29 China ADN Market: Vertical Snapshot

Figure 30 Japan ADN Market Overview, 2014 vs. 2019 (%)

Figure 31 Japan ADN Market, By Product, 2013–2019 (USD MN)

Figure 32 Japan ADN Market Share, By Product, 2014–2019 (%)

Figure 33 Japan ADN Market, By Vertical, 2013–2019 (USD MN)

Figure 34 Japan ADN Market: Vertical Snapshot

Figure 35 India ADN Market Overview, 2014 vs. 2019 (%)

Figure 36 India ADN Market, By Product, 2013–2019 (USD MN)

Figure 37 India ADN Market: Product Snapshot

Figure 38 India ADN Market, By Vertical, 2013–2019 (USD MN)

Figure 39 India ADN Market: Vertical Snapshot

Figure 40 ADN: Company Product Coverage,2014

Figure 41 F5 Networks: Revenue Mix, 2014 (%)

Figure 42 F5 Networks Revenues, 2010–2014 (USD MN)

Figure 43 Citrix Systems Revenues, 2009–2013 (USD MN)

Figure 44 Baracuda Networks Revenue Mix, 2014 (%)

Figure 45 Radware, Revenue 2010-2014 (USD MN)

The Asia-Pacific (APAC) Application Delivery Network (ADN) market was valued at USD 849.4 million in 2014, and is projected to reach USD 1,950.2 million by 2019, at a CAGR of 18.1% from 2014 to 2019.

The biggest challenge the enterprises nowadays face is to enhance productivity as well as ensure security and low response time. The ADN helps to overcome this challenge by providing optimized and secured flow of data, information on network. The ADN helps in classifying and prioritizing the content, applications in real time. It delivers fast and secure applications across the distributed enterprise.

This study has been undertaken to understand the market dynamics in the area of ADN, current revenue generated by ADN, and its future forecast in terms of market value. This study identified the product, vertical, and geography, where opportunities for the APAC ADN market can be expected in the coming future. Total ADN shipment and its average selling price have been analyzed in order to arrive at the final market size of the ADN system. Further, the APAC ADN market value has also been analyzed by clubbing the market value of the top market players involved in the development of ADN. This is further verified post a discussion with key market players.

The market drivers such as the increase in the business mobility in which the employees are allowed to work from anywhere on any device, the increase in the IT industry, data consolidation, and network visualization contribute to the increasing demand of the ADN market.

The APAC ADN market is broadly segmented into verticals, such as education, media and entertainment, Banking, Financial Services, and Insurance (BFSI), government, and others. The education vertical was the largest segment of this market in 2014, whereas the government vertical is expected to be the fastest growing vertical from 2014 to 2019.

Major companies operational in the APAC AND market include F5 Networks (U.S.), Citrix Systems (U.S.), Barracuda Networks (U.S.), Kemp Technologies (U.S.), Radware (U.S.), Array Networks (U.S.), and A10 Networks (U.S.).

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement