Asia Pacific Acoustic Wave Sensor Market by Sensing Parameter (Temperature, Pressure, Mass, Torque, Humidity & Others), by Application (Automotive, Military & Aerospace, Consumer Electronics, Healthcare & Industry), by Geography - Analysis & Forecast to 2019

Acoustic waves are longitudinal waves that propagate by means of adiabatic compression and decompression. Acoustic wave sensor has a large application in sensor market. Acoustic wave sensors have major applications in automotive, military & aerospace, industrial sector, healthcare and consumer electronics and others. The APAC acoustic wave sensor market is approximated to grow at a CAGR of 32.8% from 2014 to 2019.

The acoustic wave sensor market is segmented by technology surface acoustic wave (SAW) and bulk acoustic wave (BAW). The forecast says; SAW sensors will show higher growth in comparison with BAW sensors as they are most commonly used for process monitoring applications. Also, it is expected that SAW sensors will show higher growth as they are most commonly used for process monitoring applications such as in petrochemical, oil and gas, and other process industries like paper, pulp, plastics, and more. The APAC market for acoustic wave sensors was valued at $94.5 million in 2014 and is expected to reach $390 million by 2019 at an estimated CAGR of 32.8% from 2014 to 2019.

The APAC Acoustic wave sensor market is currently riding a prosperous growth curve in terms of consumption of sensors for various applications, with companies listing, such as Vectron International (U.S.), Murata Manufacturing Co. Ltd. (Japan), Honeywell International (U.S.), Kyocera (Japan), API Technologies Corp.(U.S) and CeramTec (Germany). The acoustic wave sensor market in APAC is largely driven by industrial applications; followed by automotive industry. This is successfully achieved with the assistance of numerous market strategies adopted by the above companies, which includes new product developments, alliances, and acquisitions.

Scope of the Report

This research report categorizes the APAC acoustic wave sensor market into the following segments and sub segments:

APAC Acoustic Wave Sensor Market, by Sensing Parameter

- Temperature

- Pressure

- Mass

- Torque

- Humidity

- Viscosity

- Chemical Vapour

APAC Acoustic Wave Sensor Market, by Application

- Automotive

- Military & Aerospace

- Industrial sector

- Healthcare

- Consumer Electronics

APAC Acoustic Wave Sensor Market, by Geography

- Japan

- China

- India

- Others

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of APAC Acoustic Wave Sensor Market

2.2 Arriving at the Acoustic Wave Sensor Market Size

2.2.1 Bottom-Up Approach

2.2.2 Demand Side Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 APAC Acoustic Wave Sensor Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 APAC Acoustic Wave Sensor Market, By Sensing Parameter (Page No. - 29)

5.1 Introduction

5.2 APAC Acoustic Wave Sensor Market, Type Comparison With Sensor Market

5.3 APAC Temperature Acoustic Wave Sensor Market, By Geography

5.4 APAC Pressure Acoustic Wave Sensor Market, By Geography

5.5 APAC Mass Acoustic Wave Sensor Market, By Geography

5.6 APAC Torque Acoustic Wave Sensor Market, By Geography

5.7 APAC Humidity Acoustic Wave Sensor Market, By Geography

5.8 APAC Viscosity Acoustic Wave Sensor Market, By Geography

5.9 APAC Chemical Vapor Acoustic Wave Sensor Market, By Geography

6 APAC Acoustic Wave Sensor Market, By Application (Page No. - 46)

6.1 Introduction

6.2 APAC Acoustic Wave Sensor Market in Automotive, By Geography

6.3 APAC Acoustic Wave Sensor Market in Military and Aerospace, By Geography

6.4 APAC Acoustic Wave Sensor Market in Consumer Electronics, By Geography

6.5 APAC Acoustic Wave Sensor Market in Healthcare, By Geography

6.6 APAC Acoustic Wave Sensor Market in Industrial Sector, By Geography

7 APAC Acoustic Wave Sensor, By Geography (Page No. - 58)

7.1 Introduction

7.2 China Acoustic Wave Sensor Market

7.2.1 China Acoustic Wave Sensor Market, By Application

7.2.2 China Acoustic Wave Sensor Market, By Sensing Parameter

7.3 Japan Acoustic Wave Sensor Market

7.3.1 Japan Acoustic Wave Sensor Market, By Application

7.3.2 Japan Acoustic Wave Sensor Market, Sensing Parameter

7.4 India Acoustic Wave Sensor Market

7.4.1 India Acoustic Wave Sensor Market, By Application

7.4.2 India Acoustic Wave Sensor Market, Sensing Parameter

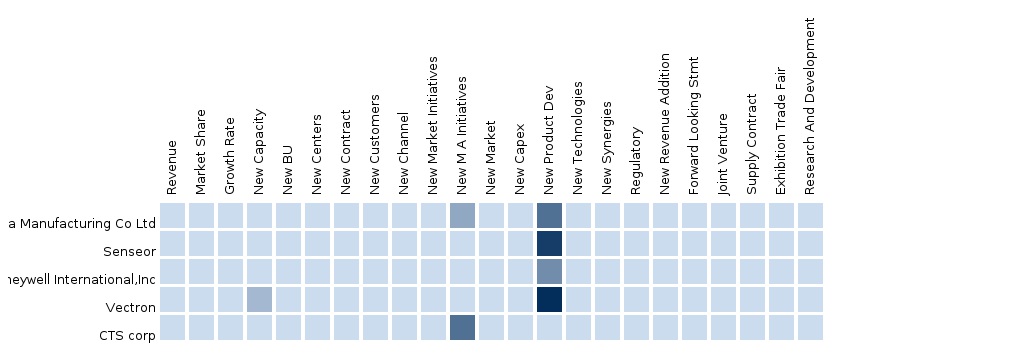

8 APAC Acoustic Wave Sensor Market Competitive Landscape (Page No. - 75)

8.1 APAC Acoustic Wave Sensor Market: Company Share Analysis

8.2 Company Presence in Acoustic Wave Sensor Market, By Sensing Parameter

8.3 New Product Development and New Launches

8.4 Mergers & Acquisitions

8.5 Collaborations

9 Acoustic Wave Sensor Market, By Company (Page No. - 80)

9.1 Seiko Epson Corporation

9.1.1 Overview

9.1.2 Key Financials

9.1.3 Product and Service Offerings

9.1.4 Related Developments

9.1.5 MMM View

9.2 Honeywell International

9.2.1 Overview

9.2.2 Key Financials

9.2.3 Product and Service Offerings

9.2.4 Related Developments

9.2.5 MMM View

9.3 Kyocera

9.3.1 Overview

9.3.2 Key Financials

9.3.3 Product and Service Offerings

9.3.4 Related Developments

9.3.5 MMM View

9.4 Murata Manufacturing Co. Ltd.

9.4.1 Overview

9.4.2 Key Financials

9.4.3 Product and Service Offerings

9.4.4 Related Developments

9.4.5 MMM View

9.5 Panasonic Corp.

9.5.1 Overview

9.5.2 Key Financials

9.5.3 Product and Service Offerings

9.5.4 Related Developments

9.5.5 MMM View

9.6 Senseor

9.6.1 Overview

9.6.2 Key Financials

9.6.3 Product and Service Offerings

9.6.4 Related Development

9.6.5 MMM View

9.7 Vectron International

9.7.1 Overview

9.7.2 Key Financials

9.7.3 Product and Service Offerings

9.7.4 Related Development

9.7.5 MMM View

10 Appendix (Page No. - 100)

10.1 Customization Options

10.1.1 Product Portfolio Analysis

10.1.2 Country Level Data Analysis

10.1.3 Product Comparison of Various Competitors

10.1.4 Trade Analysis

10.1.5 Technical Analysis

10.1.6 Impact Analysis

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

11 RT Snapshots (Page No. - 103)

List of Tables (66 Tables)

Table 1 APAC Acoustic Wave Sensor Application Market, 2014 (USD MN)

Table 2 Acoustic Wave Sensor Market: Macro Indicators, By Geography, 2012 & 2013 (USD MN)

Table 3 APAC Acoustic Wave Sensor Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 APAC Acoustic Wave Sensor Market: Drivers and Inhibitors

Table 5 APAC Acoustic Wave Sensor Market, By Application, 2013 - 2019 (USD MN)

Table 6 APAC Acoustic Wave Sensor Market, By Application, 2013 - 2019 (MN Unit)

Table 7 APAC Acoustic Wave Sensor Market, By Sensing Parameter, 2014 (USD MN)

Table 8 APAC Acoustic Wave Sensor Market, By Sensing Parameter, 2014 (MN Unit)

Table 9 APAC Acoustic Wave Sensor Market: Comparison With Application Markets, 2013 - 2019 (USD MN)

Table 10 APAC Acoustic Wave Sensor Market, By Sensing Parameter, 2013 - 2019 (USD MN)

Table 11 APAC Acoustic Wave Sensor Market, By Sensing Parameter, 2013 - 2019 (MN Unit)

Table 12 APAC Acoustic Wave Sensor Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 13 APAC Temperature Acoustic Wave Sensor Market, By Geography, 2013–2019 (USD MN)

Table 14 APAC Temperature Acoustic Wave Sensor Market, By Geography, 2013–2019 (MN Unit)

Table 15 APAC Pressure Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Table 16 APAC Pressure Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (MN Unit)

Table 17 APAC Mass Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Table 18 APAC Mass Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (MN Unit)

Table 19 APAC Torque Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Table 20 APAC Torque Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (MN Unit)

Table 21 APAC Humidity Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Table 22 APAC Humidity Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (MN Unit)

Table 23 APAC Viscosity Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Table 24 APAC Viscosity Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (MN Unit)

Table 25 APAC Chemical Vapor Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Table 26 APAC Chemical Vapor Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (MN Unit)

Table 27 APAC Acoustic Wave Sensor Market, By Application, 2013 - 2019 (USD MN)

Table 28 APAC Acoustic Wave Sensor Market, By Application, 2013 - 2019 (MN Unit)

Table 29 APAC Acoustic Wave Sensor Market, By Application, 2013 - 2019 (MN Unit)

Table 30 APAC Acoustic Wave Sensor Market in Automotive, By Geography, 2013 - 2019 (USD MN)

Table 31 APAC Acoustic Wave Sensor Market in Automotive, By Geography, 2013 - 2019 (MN Unit)

Table 32 APAC Acoustic Wave Sensor Market in Military and Aerospace, By Geography, 2013 - 2019 (USD MN)

Table 33 APAC Acoustic Wave Sensor Market in Military and Aerospace, By Geography, 2013 - 2019 (MN Unit)

Table 34 APAC Acoustic Wave Sensor Market in Consumer Electronics, By Geography, 2013 - 2019 (USD MN)

Table 35 APAC Acoustic Wave Sensor Market in Consumer Electronics, By Geography, 2013 - 2019 (MN Unit)

Table 36 APAC Acoustic Wave Sensor Market in Healthcare, By Geography, 2013 - 2019 (USD MN)

Table 37 APAC Acoustic Wave Sensor Market in Healthcare, By Geography, 2013 - 2019 (MN Unit)

Table 38 APAC Acoustic Wave Sensor Market in Industrial Sector, By Geography, 2013 - 2019 (USD MN)

Table 39 APAC Acoustic Wave Sensor Market in Industrial Sector, By Geography, 2013 - 2019 (MN Unit)

Table 40 APAC Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Table 41 APAC Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (MN Unit)

Table 42 China Acoustic Wave Sensor Market, By Application, 2013-2019 (USD MN)

Table 43 China Acoustic Wave Sensor Market, By Application, 2013-2019 (MN Unit)

Table 44 China Acoustic Wave Sensor Market, By Sensing Parameter, 2013 - 2019 (USD MN)

Table 45 Japan Acoustic Wave Sensor Market, By Application, 2013-2019 (USD MN)

Table 46 Japan Acoustic Wave Sensor Market, By Application, 2013-2019 (MN Unit)

Table 47 Japan Acoustic Wave Sensor Market, By Sensing Parameter, 2013 - 2019 (USD MN)

Table 48 India Acoustic Wave Sensor Market, By Application, 2013-2019 (USD MN)

Table 49 India Acoustic Wave Sensor Market, By Application, 2013-2019 (MN Unit)

Table 50 India Acoustic Wave Sensor Market, By Sensing Parameter, 2013 - 2019 (USD MN)

Table 51 APAC Acoustic Wave Sensor Market: Company Share Analysis, 2014 (%)

Table 52 APAC: New Product Development and New Launches

Table 53 Acoustic Wave Sensor Market: Mergers & Acquisitions

Table 54 Acoustic Wave Sensor Market: Collaborations

Table 55 Seiko Epson Corporation: Annual Revenue, By Business Segments, 2008–2013 (USD MN)

Table 56 Seiko Epson Corporation: Annual Revenue, By Geography Segments, 2008–2013 (USD MN)

Table 57 Honeywell International: Annual Revenue, By Business Segments, 2010–2014 (USD MN)

Table 58 Honeywell International: Annual Revenue, By Geography Segments, 2010–2014 (USD MN)

Table 59 Kyocera: Annual Revenue, By Business Segments, 2010–2014 (USD MN)

Table 60 Kyocera: Annual Revenue, By Geography Segments, 2010–2014 (USD MN)

Table 61 Murata: Annual Revenue, By Geography Segments, 2009–2013 (USD MN)

Table 62 Murata Manufacturing Co. Ltd., Operating Data, 2009–2013 (USD MN)

Table 63 Panasonic Corp.: Annual Revenue, By Business Segments, 2009–2013 (USD MN)

Table 64 Panasonic Corp.: Annual Revenue, By Geography Segments, 2009–2013 (USD MN)

Table 65 Vectron International: Annual Revenue, By Business Segments, 2008–2012 (USD MN)

Table 66 Vectron International: Annual Revenue, By Geographic Region Segments, 2008–2012 (USD MN)

List of Figures (44 Figures)

Figure 1 APAC Acoustic Wave Sensor Market: Segmentation & Coverage

Figure 2 APAC Acoustic Wave Sensor Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Bottom-Up Approach

Figure 5 Demand Side Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 APAC Acoustic Wave Sensor Market Snapshot

Figure 8 Acoustic Wave Sensor Market: Growth Aspects

Figure 9 APAC Acoustic Wave Sensor Market: Comparison With Parent Market

Figure 10 APAC Acoustic Wave Sensor Market, By Application, 2014 vs 2019

Figure 11 APAC Acoustic Wave Sensor Types, By Geography, 2014 (USD MN)

Figure 12 APAC Acoustic Wave Sensor Market, By Application, 2014 (USD MN)

Figure 13 APAC Acoustic Wave Sensor Market, By Sensing Parameter, 2014 & 2019 (USD MN)

Figure 14 APAC Acoustic Wave Sensor Market, By Sensing Parameter, 2014 & 2019 (MN Unit)

Figure 15 APAC Acoustic Wave Sensor Market: Type Comparison With Sensor Market, 2013–2019 (USD MN)

Figure 16 APAC Temperature Acoustic Wave Sensor Market, By Geography, 2013–2019 (USD MN)

Figure 17 APAC Pressure Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Figure 18 APAC Mass Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Figure 19 APAC Torque Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Figure 20 APAC Humidity Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Figure 21 APAC Viscosity Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Figure 22 APAC Chemical Vapor Acoustic Wave Sensor Market, By Geography, 2013 - 2019 (USD MN)

Figure 23 APAC Acoustic Wave Sensor Market, By Application, 2014 - 2019 (USD MN)

Figure 24 APAC Acoustic Wave Sensor Market in Automotive, By Geography, 2013 - 2019 (USD MN)

Figure 25 APAC Acoustic Wave Sensor Market in Military and Aerospace, By Geography, 2013 - 2019 (USD MN)

Figure 26 APAC Acoustic Wave Sensor Market in Consumer Electronics, By Geography, 2013 - 2019 (USD MN)

Figure 27 APAC Acoustic Wave Sensor Market in Healthcare, By Geography, 2013 - 2019 (USD MN)

Figure 28 APAC Acoustic Wave Sensor Market in Industrial Sector, By Geography, 2013 - 2019 (USD MN)

Figure 29 APAC Acoustic Wave Sensor Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 30 APAC Acoustic Wave Sensor Market: Growth Analysis, By Geography, 2014-2019 (MN Unit)

Figure 31 China Acoustic Wave Sensor Market Overview, 2014 & 2019 (USD MN)

Figure 32 China Acoustic Wave Sensor Market, By Application, 2013-2019 (USD MN)

Figure 33 China Acoustic Wave Sensor Market: Application Snapshot

Figure 34 China Acoustic Wave Sensor Market, By Sensing Parameter, 2013 - 2019 (USD MN)

Figure 35 Japan Acoustic Wave Sensor Market Overview, 2014 & 2019 (USD MN)

Figure 36 Japan Acoustic Wave Sensor Market, By Application, 2013-2019 (USD MN)

Figure 37 Japan Acoustic Wave Sensor Market: Application Snapshot

Figure 38 Japan Acoustic Wave Sensor, Sensing Parameter, 2013 - 2019 (USD MN)

Figure 39 India Acoustic Wave Sensor Market Overview, 2014 & 2019 (USD MN)

Figure 40 India Acoustic Wave Sensor Market, By Application, 2013-2019 (USD MN)

Figure 41 India Acoustic Wave Sensor Market: Application Snapshot

Figure 42 India Acoustic Wave Sensor, Sensing Parameter, 2013 - 2019 (USD MN)

Figure 43 Acoustic Wave Sensor Market: Company Share Analysis, 2013 (%)

Figure 44 Acoustic Wave Sensor: Company Product Coverage, By Sensing Parameter, 2014

Acoustic waves are longitudinal wave that propagate by means of adiabatic compression and decompression. Acoustic wave sensors works on piezoelectric principle, an input inter-digitated transducer on one side of the surface of the substrate, and an output inter-digitated transducer on the other side of the substrate. For acoustic wave devices, the change in oscillation frequency is when there is response from the device to the input stimulus. Acoustic wave sensors have major applications in automotive, military & aerospace, industrial sector, healthcare, consumer electronics, and others. The growth of acoustic wave sensors in consumer electronics is mainly due to their growing number of applications in smartphones, tablets, and the other portable devices.

The purpose of this study is to analyze the APAC market for acoustic wave sensors. This report includes revenue forecasts, market trends and opportunities for the period from 2014 to 2019, and the overview of the competitive landscape for the period from 2011 to 2014. The analysis has been conducted on the various market segments derived on the basis of technology, sensing parameter, application, and geography. On the basis of technology, the market is segmented into surface acoustic wave (SAW) sensor and bulk acoustic wave (BAW) sensor. And on the basis of sensing parameter, the market is segmented into temperature, pressure, mass, torque, humidity, viscosity, chemical vapor, and others. The main applications of the market include automotive, military & aerospace, industrial sector, healthcare, and consumer electronics. The geographical analysis includes China, India and Japan. The report also includes the key market drivers and inhibitors, along with their impact, in detail.

Apart from a general overview of the major companies in this market, this report also provides financial analysis, products, services, and the key developments of the major players in the industry. Vectron International (U.S.), Murata Manufacturing Co. Ltd. (Japan), Honeywell International (U.S.), Kyocera (Japan), API Technologies Corp., and CeramTec are some of the leading players covered in the APAC acoustic wave sensor market report.

The APAC Acoustic Wave Sensor market is estimated to grow due to various factors. The acoustic wave sensor market is mainly driven by industrial application and automotive industry. Industrial application is estimated to grow at a CAGR of 32.8% from 2014 to 2019. Acoustic wave sensors are also widely used in the automotive industry as well and the number is expected to touch $100.9 million by 2019 at an estimated CAGR of 30.9% from 2014 to 2019. The growth of acoustic wave sensors in consumer electronics is also going to get affected by their growing number of applications in smartphones, tablets, and other portable devices.

The APAC acoustic wave sensor market is estimated at $94.5 million in 2014 and is projected to reach $390 million by 2019, at a CAGR of 32.8% from 2014 to 2019. In the APAC region, China is the key market for acoustic wave sensor, having accounted for 48.5% of the market share in 2014, while the market in India is expected to grow at a favorable rate, at a CAGR of 24.9% from 2014 to 2019.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement