Global Polyvinylidene Fluoride Coatings Market, By Application (Food processing,Electrical and Electronics,Chemical processing,Building and construction and Others), By Geography — Forecast to 2021

Furthermore, considerable amount of investments are made by market players to address the increasing demand of Polyvinylidene Fluoride coatings products from varied industry verticals.

PVDF coatings can withstand a maximum temperature of 316°C. The heat resistance, non-flammability, and non-stick capabilities make it a preferred copolymer for extensive use in the food processing industry. Under the food processing application, the major demand for PVDF coating is from the cookware and bakeware markets. PVDF coatings in these markets are used in heat exchanger plates, impellers, filters, metal mesh and so on. Several coatings are FDA acceptable and are readily applied to products in the commercial food industry. For example, industrial baking trays are applied with non-stick coating for the easy removal of food products. Demand for this application is expected to grow especially in its use in the cookware and bakeware markets.

This market research study provides a detailed qualitative and quantitative analysis of the Global Polyvinylidene Fluoride coatings market. Various secondary sources, such as encyclopedia, directories, industry journals, and databases are used to identify and collect information useful for this extensive commercial study of Polyvinylidene Fluoride coatings market. The primary sources include experts from related industries and suppliers, who have been interviewed to obtain and verify critical information as well as to assess future prospects of the market.

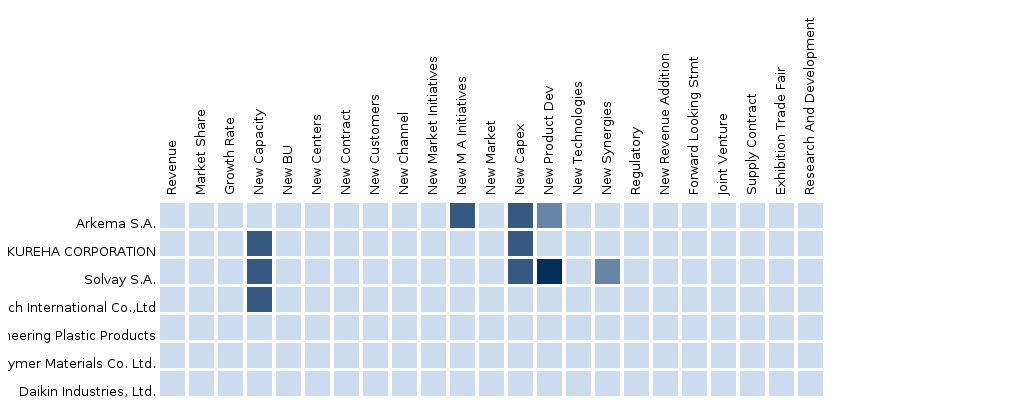

Competitive scenarios of top players in the Global Polyvinylidene Fluoride coatings market has been discussed in detail. Companies such as BASF SE, Akzo Nobel N.V., RPM International, and Whitford Corporation, among others are profiled in this report, along with recent developments that have taken place in Polyvinylidene Fluoride coatings market and growth strategies adopted by market players.

Scope of the report:

This research report categorizes the Global Polyvinylidene Fluoride coatings market on the basis of application and geography.

On the basis of application:

- Food processing

- Chemical processing

- Electrical and Electronics

- Building and construction

- Others

Each application is described in detail in this report with respect to volume and revenue forecast.

On the basis of geography:

- Asia-Pacific

- North America

- Europe

- RoW

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Polyvinylidene Fluoride Coating Market

2.2 Arriving at the Polyvinylidene Fluoride Coating Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 PVDF Coating Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Polyvinylidene Fluoride Coating Market, By Application (Page No. - 28)

5.1 Introduction

5.2 PVDF Coating in Food Processing, By Geography

5.3 PVDF Coating in Chemical Processing, By Geography

5.4 PVDF Coating in Electrical and Electronics, By Geography

5.5 PVDF Coating in Building and Construction, By Geography

6 Polyvinylidene Fluoride Coating Market, By Geography (Page No. - 40)

6.1 Introduction

6.2 Asia-Pacific Polyvinylidene Fluoride Coating Market

6.2.1 Asia-Pacific PVDF Coating Market, By Application

6.3 North America Polyvinylidene Fluoride Coating Market

6.3.1 North America PVDF Coating Market, By Application

6.4 Europe Polyvinylidene Fluoride Coating Market

6.4.1 Europe PVDF Coating Market, By Application

6.5 RoW Polyvinylidene Fluoride Coating Market

6.5.1 RoW PVDF Coating Market, By Application

7 Polyvinylidene Fluoride Coating Market: Competitive Landscape (Page No. - 53)

7.1 PVDF Coating Market: Company Share Analysis

7.2 Company Presence in PVDF Coating Market, By Geography

7.3 Mergers & Acquisitions

7.4 Expansions

7.5 New Product Development

8 Polyvinylidene Fluoride Coating Market, By Company (Page No. - 57)

(Overview, Financials, Products & Services, Strategy, and Developments)*

8.1 BASF SE

8.2 Whitford Corporation

8.3 Akzonnobel N.V.

8.4 PPG Industries, Inc.

8.5 The Valspar Corporation

8.6 Beckers Group

8.7 Nippon Paint Holdings Co. Ltd.

8.8 Tiger Drylac U.S.A., Inc.

*Details On Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

9 Appendix (Page No. - 75)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 Impact Analysis

9.1.5 Trade Analysis

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (43 Tables)

Table 1 Global PVDF Coating Peer Market Size, 2014 (Tons)

Table 2 Global PVDF Coating Application Market, 2014-2019 (USD MN)

Table 3 Global Polyvinylidene Fluoride Coating Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 4 Global Polyvinylidene Fluoride Coating Market: Comparison With Parent Market, 2013–2019 (Tons)

Table 5 Global Polyvinylidene Fluoride Coating Market: Drivers and Inhibitors

Table 6 Global PVDF Coating Market, By Application, 2012-2019 (USD MN)

Table 7 Global PVDF Coating Market, By Application, 2012-2019 (Tons)

Table 8 Global PVDF Coating Market, By Geography, 2012-2019 (USD MN)

Table 9 Global PVDF Coating Market, By Geography, 2012-2019 (Tons)

Table 10 Global PVDF Coating Market: Comparison With Application Markets, 2013-2019 (USD MN)

Table 11 Global PVDF Coating Market, By Application, 2012-2019 (USD MN)

Table 12 Global PVDF Coating: Market, By Application, 2012-2019 (Tons)

Table 13 Global PVDF Coating in Food Processing, By Geography, 2012-2019 (USD MN)

Table 14 Global PVDF Coating in Food Processing, By Geography, 2012-2019 (Tons)

Table 15 Global PVDF Coating in Chemical Processing, By Geography, 2012-2019 (USD MN)

Table 16 Global PVDF Coating in Chemical Processing, By Geography, 2012-2019 (Tons)

Table 17 Global PVDF Coating in Electrical and Electronics, By Geography, 2012-2019 (USD MN)

Table 18 Global PVDF Coating in Electrical and Electronics, By Geography, 2012-2019 (Tons)

Table 19 Global PVDF Coating in Building and Construction, By Geography, 2012-2019 (USD MN)

Table 20 Global PVDF Coating in Building and Construction, By Geography, 2012-2019 (Tons)

Table 21 Global PVDF Coating Market, By Geography, 2012-2019 (USD MN)

Table 22 Global PVDF Coating Market, By Geography, 2012-2019 (Tons)

Table 23 Asia-Pacific PVDF Coating Market, By Application, 2012-2019 (USD MN)

Table 24 Asia-Pacific PVDF Coating Market, By Application, 2012-2019 (Tons)

Table 25 North America PVDF Coating Market, By Application, 2012-2019 (USD MN)

Table 26 North America PVDF Coating Market, By Application, 2012-2019 (Tons)

Table 27 Europe PVDF Coating Market, By Application, 2012-2019 (USD MN)

Table 28 Europe PVDF Coating Market, By Application, 2012-2019 (Tons)

Table 29 RoW PVDF Coating Market, By Application, 2012-2019 (USD MN)

Table 30 RoW PVDF Coating Market, By Application, 2012-2019 (Tons)

Table 31 PVDF Coating Market: Top Five Companies, 2014 (Ranking)

Table 32 Global PVDF Coating Market: Mergers & Acquisitions

Table 33 Global PVDF Coating Market: Expansions

Table 34 Global PVDF Coating Market: New Product Development

Table 35 BASF SE: Key Financials, 2009-2013 (USD MN)

Table 36 BASF SE: Key Operations Data, 2009-2013 (USD MN)

Table 37 PPG Industries, Inc.: Key Financials, 2010-2014 (USD MN)

Table 38 PPG Industries, Inc.: Key Operations Data, 2010-2014 (USD MN)

Table 39 The Valspar Corporation: Key Financials, 2010-2014 (USD MN)

Table 40 The Valspar Corporation: Key Operations Data, 2010-2014 (USD MN)

Table 41 Beckers Group: Key Operations Data, 2010-2012 (USD MN)

Table 42 Nippon Paint Holdings Co. Ltd.: Key Financials, 2010-2014 (USD MN)

Table 43 Nippon Paint Holdings Co. Ltd.: Key Operations Data, 2010-2014 (USD MN)

List of Figures (32 Figures)

Figure 1 Global PVDF Coating Market: Segmentation and Coverage

Figure 2 PVDF Coating Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Global PVDF Coating Market Snapshot

Figure 8 PVDF Coating Market: Leading Players in the Region

Figure 9 Global PVDF Coating Market, By Application, 2014 Vs 2019

Figure 10 PVDF Coating: Application Market Scenario

Figure 11 Global PVDF Coating Market, By Application, 2014 Vs 2019 (USD MN)

Figure 12 Global PVDF Coating Market, By Application, 2012-2019 (Tons)

Figure 13 Global PVDF Coating Market in Food Processing, By Geography, 2012-2019 (USD MN)

Figure 14 Global PVDF Coating Market in Chemical Processing, By Geography, 2012-2019 (USD MN)

Figure 15 Global PVDF Coating Market in Electrical and Electronics , By Geography, 2012-2019 (USD MN)

Figure 16 Global PVDF Coating Market in Building and Construction, By Geography, 2012-2019 (USD MN)

Figure 17 Global PVDF Coating Market: Growth Analysis, By Geography, 2012-2019 (USD MN)

Figure 18 Global PVDF Coating Market: Growth Analysis, By Geography, 2012-2019 (Tons)

Figure 19 Asia-Pacific PVDF Coating Market, By Application, 2012-2019 (USD MN)

Figure 20 Asia-Pacific PVDF Coating Market: Application Snapshot

Figure 21 North America PVDF Coating Market, By Application, 2012-2019 (USD MN)

Figure 22 North America PVDF Coating Market: Application Snapshot

Figure 23 Europe PVDF Coating Market, By Application, 2012-2019 (USD MN)

Figure 24 Europe PVDF Coating Market: Application Snapshot

Figure 25 RoW PVDF Coating Market, By Application, 2012-2019 (USD MN)

Figure 26 RoW PVDF Coating Market: Application Snapshot

Figure 27 PVDF Coating: Company Coverage, By Geography, 2014

Figure 28 BASF SE Business Revenue Mix, 2013 (%)

Figure 29 PPG Industries, Inc.: Revenue Mix, 2014 (%)

Figure 30 The Valspar Corporation: Revenue Mix, 2014 (%)

Figure 31 Beckers Group: Key Operational Data, 2010-2012 (USD MN)

Figure 32 Nippon Paint Holdings Co. Ltd.: Revenue Mix, 2014 (%)

The Global Polyvinylidene Fluoride coatings market was valued at USD 180.0 million in 2015, and is expected to reach USD 250.0 million by 2021, at a CAGR of 7.0% from 2016 to 2021. The food processing application segment led the Global Polyvinylidene Fluoride coatings market.

The Global Polyvinylidene Fluoride coatings market is segmented on the basis of application (such as Food processing, Building & Construction, Electrical & Electronics, Chemical Processing and Others), and geography. Since the last few years, the use of PVDF coating in chemical processing equipment, roofing and building industry and many other segments is increasing rapidly. The excellent resistance properties and its multiple usages in the building and construction application have increased the demand and this segment is showing a high growth rate

The food processing application held the largest share in this market. In 2014, it had a consumption of 2,676.9 tons which is expected to reach 3,437.6 tons by 2019 at a CAGR of 5.1%. This application has the highest consumption due to an increase in consumption by end-users in the manufacture of plates, sheets, and tubing. Building and construction and electrical and electronics applications are estimated to have fastest growth rate, at a CAGR of 6.2% and 6.1% respectively.

Asia-Pacific is the most promising chemical market with its new emerging economies, vast population, and increasing demand from end-users, for example, food processing, chemical processing, and so on In 2015, the chemical processing application segment held a market share of around 31.2% in terms of volume, and is estimated to witness a CAGR of 7.4% by 2021.

Increase in the domestic demand for PVDF coating in Asia-Pacific region has led to strategic alliances by the major players in this region. The growing emerging economy and the demand for this coating helps drive the market in Asia-Pacific region

The global Polyvinylidene Fluoride coating market is following a positive trend due to the performance advantage this material offers, its excellent chemical properties, and good dielectric properties and is used in various industries such as building and construction, chemical processing, food processing, and so on.

Key companies operating in the Global Polyvinylidene Fluoride coatings market include BASF SE, Akzo Nobel N.V., Whitford Corporation, and PPG Industries, among others.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Polyvinylidene Fluoride (PVDF) Polyvinylidene Fluoride (PVDF)-North America can be segmented by Submarkets, Products, Ingredients, Groups, Companies and Applications. Submarkets of Polyvinylidene Fluoride (PVDF)-North America are Microfluidics. Products of Polyvinylidene Fluoride (PVDF)-North America... |

Upcoming |

|

Western Europe Polyvinylidene Fluoride (PVDF) Polyvinylidene Fluoride (PVDF)-Western Europe can be segmented by Submarkets, Products, Ingredients, Groups, Companies and Applications. Submarkets of Polyvinylidene Fluoride (PVDF)-Western Europe are Microfluidics. Products of Polyvinylidene Fluoride (PVDF)-Western... |

Upcoming |

|

Asia-Pacific Polyvinylidene Fluoride (PVDF) Polyvinylidene Fluoride (PVDF)-Asia-Pacific can be segmented by Submarkets, Products, Ingredients, Groups, Companies and Applications. Submarkets of Polyvinylidene Fluoride (PVDF)-Asia-Pacific are Microfluidics. Products of Polyvinylidene Fluoride (PVDF)-Asia-Pacific... |

Upcoming |

|

Polyvinylidene Fluoride (PVDF) Coating Polyvinylidene Fluoride (PVDF) Coating and Pipes, Tubes, Membrane... |

Upcoming |