U.S. Data Center Equipment Market, Technology Ecosystem and Supply Chain Trends, Forecast To 2030

According to MicroMarketMonitor, the U.S. Data Center Equipment Market size is projected to reach $326.9 billion by 2030, registering a CAGR of 16.0% during the forecast period. The study involved four key activities in estimating the market size of U.S. Data Center Equipment Market. Extensive secondary research was conducted to gather information on the market, related markets, and the broader industry. The next step was to validate these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to determine the total market size. Afterward, market segmentation and data triangulation techniques were applied to estimate the sizes of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research was used to gather essential information about the industry’s value chain, the market’s monetary flow, the overall pool of key U.S. Data Center Equipment Market classifications, and segmentation based on industry trends down to the most detailed level, and regional markets. It was also employed to collect information on key developments from a market-oriented perspective.

Primary Research

The U.S. Data Center Equipment Market consists of several stakeholders in the value chain, including Raw Material & Component suppliers, OEM, and end users. Various primary sources from both supply and demand sides of the market have been interviewed to gather qualitative and quantitative information. Key opinion leaders in end-use sectors are the primary interviewees from the demand side. Manufacturers, associations, and institutions involved in the U.S. Data Center Equipment industry are the main sources from the supply side.

Primary interviews were conducted to gather insights such as market statistics, revenue data from products and services, market breakdowns, market size estimates, market forecasts, and data triangulation. Primary research also helped us understand various trends related to resin type, thickness, product type, end-use industry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyers’ perspectives on the suppliers, products, component providers, and their current use of the U.S. Data Center Equipment Market, as well as the future outlook of their business, which will influence the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographic presence.

Other designations include sales representatives, production heads, and technicians.

MARKET SIZE ESTIMATION

The top-down approach was used to estimate and validate the size of various submarkets for the U.S. Data Center Equipment Market in the region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns based on type, electrode material, application and end-use industries, region were determined using secondary sources and verified through primary sources.

- All possible parameters that impact the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

U.S. Data Center Equipment Market: BOTTOM-UP APPROACH

Source: Secondary Research, Interviews with Experts, and MicroMarketMonitor Analysis

U.S. Data Center Equipment Market: TOP-DOWN APPROACH

Source: Secondary Research, Interviews with Experts, and MicroMarketMonitor Analysis

DATA TRIANGULATION

After determining the total market size from the estimation process for the U.S. Data Center Equipment Market above, the overall market has been divided into several segments and sub-segments. Data triangulation and market breakdown methods have been used, where applicable, to complete the overall market analysis and obtain accurate statistics for all segments and sub-segments. The data was triangulated by examining various factors and trends from both demand and supply sides. Additionally, the market size was confirmed using both top-down and bottom-up approaches, along with primary interviews. For each data segment, three sources were used—top-down approach, bottom-up approach, and expert interviews. The data was considered accurate when the values from these three sources matched.

MARKET DEFINITION

The market for U.S. data center equipment encompasses a comprehensive suite of hardware and systems essential for constructing, operating, and scaling digital infrastructure facilities. Key product types include servers and computing hardware—such as rack-mounted units, blade systems, and AI-optimized accelerators—for processing intensive workloads; storage solutions like solid-state arrays and tape libraries for data persistence; networking equipment encompassing switches, routers, and fiber optic cabling for high-speed interconnectivity; power and energy systems, including uninterruptible power supplies, generators, and battery storage for reliability; thermal management technologies such as air handlers, liquid cooling loops, and immersion pods for heat dissipation; and infrastructure materials like modular racks, raised floors, and containment barriers for structural integrity.

Services within this market extend to design, integration, and maintenance offerings, including turnkey installation, predictive analytics for uptime, and retrofitting for sustainability upgrades. These elements collectively enable hyperscale, colocation, edge, and enterprise architectures to support cloud computing, AI inference, and IoT edge processing.

Global market drivers are profoundly influencing this U.S.-centric ecosystem. The worldwide AI boom, led by advancements in generative models and neural architectures, necessitates denser, more efficient equipment to handle escalating compute demands, with U.S. operators at the forefront due to tech talent concentrations. Cloud repatriation and multi-hybrid strategies among multinational enterprises drive equipment standardization for seamless interoperability. The 5G and IoT global rollout decentralizes data flows, spurring U.S. edge deployments for low-latency applications in autonomous systems and smart grids.

Sustainability pressures, amplified by international accords like the Paris Agreement and EU green taxonomies, compel adoption of renewable-integrated power and water-efficient cooling, aligning U.S. builds with global ESG benchmarks. Geopolitical shifts toward supply chain diversification, including U.S.-led chip reshoring via the CHIPS Act, mitigate risks from Asia-Pacific disruptions, fostering domestic innovation. These drivers create a symbiotic global-U.S. dynamic, where international R&D pipelines—such as European optical tech and Asian semiconductor fabs—feed into American hyperscale expansions, ensuring the market's leadership in secure, scalable digital sovereignty.

KEY STAKEHOLDERS

- U.S. Data Center Equipment manufacturers

- Material and Component Suppliers

- Raw material suppliers

- Government and private research organizations

- Associations and industrial bodies

- R&D institutions

- Environmental support agencies

REPORT OBJECTIVES

- To define, describe, and forecast the size of the U.S. Data Center Equipment Market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on System Types, Reliability, Architecture, and Region

- To forecast the size of the market with respect to major regions in the country

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as partnerships, agreements, joint ventures, collaborations, announcements, awards, and expansions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

SCOPE OF REPORT

|

Report Metric |

Details |

||||||||||||||||||||||||||||||||||

|

Years Considered For Study |

2021–2030 |

||||||||||||||||||||||||||||||||||

|

Base Year |

2024 |

||||||||||||||||||||||||||||||||||

|

2025 Market Size |

USD 155.6 billion |

||||||||||||||||||||||||||||||||||

|

2030 Projected Market Size |

USD 326.9 billion |

||||||||||||||||||||||||||||||||||

|

CAGR (2025–2030): |

16.0% |

||||||||||||||||||||||||||||||||||

|

Forecast Period |

2025–2030 |

||||||||||||||||||||||||||||||||||

|

Currency and Unit Considered |

Value (USD Million/Billion) and Kiloton |

||||||||||||||||||||||||||||||||||

|

Segments |

System Types, Reliability, Architecture, and Region |

||||||||||||||||||||||||||||||||||

|

Regions |

Northern Virginia, Dallas-Fort Worth, Phoenix, Atlanta, Chicago, Silicon Valley / Northern California and Rest of the U.S. |

||||||||||||||||||||||||||||||||||

|

Companies |

|

This report categorizes the U.S. Data Center Equipment Market based on System Types, Architecture, and Region.

Based on System Types, the U.S. Data Center Equipment Market has been segmented into:

Power and Energy Systems

- Uninterruptible Power Supplies (UPS) (Static UPS Modules, UPS Batteries, & Flywheels)

- Power Generation & Control (Backup Generators (Diesel, Natural Gas), MV/LV Switchgear, Automatic Transfer Switch)

- Power Distribution & Monitoring (Intelligent Rack PDUs (iPDU), Busway Systems, Remote Power Panels (RPPs), Power Monitoring Software)

Thermal Management

- Air Cooling Equipment (Perimeter CRAC/CRAH Units, In-Row Coolers, Airflow Management (Containment Systems))

- Liquid Cooling Systems (Coolant Distribution Units (CDUs), Direct-to-Chip Cold Plates, Single-Phase Immersion Tanks, Dielectric Fluids)

- Heat Rejection Systems (Chillers, Cooling Towers (Evaporative/Adiabatic), Dry Coolers, Heat Exchangers, Water Pumps)

IT Infrastructure

- Servers (Rack, Blade, Tower)

- Storage Systems (SAN, NAS, DAS)

- Networking Hardware (Switches, Routers, Firewalls)

- Structured Cabling (Patch Panels, Trays)

Physical Support & Management

- Server Racks & Cabinets

- Cabling Infrastructure

- Physical Security Systems

- Fire Suppression Systems

- Environmental Monitoring Sensors

Based on Reliability, the U.S. Data Center Equipment Market has been segmented into:

- Tier I (Basic Capacity)

- Tier II (Redundant Capacity Components)

- Tier III (Concurrently Maintainable)

- Tier IV (Fault Tolerant)

Based on Architecture, the Market has been segmented into:

- Hyperscale

- Colocation

- Edge

- Enterprise

Based on Region, the Market has been segmented into:

- Northern Virginia (NoVa)

- Dallas-Fort Worth

- Phoenix

- Atlanta

- Chicago

- Silicon Valley / Northern California

- Rest of the U.S.

Available Customizations

Along with the given market data, MicroMarketMonitor offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown regions and state wise assessment

Company Information

- Detailed analysis and profiles of additional market players

- Introduction

- Objective of the study

- Market Definition

- Market Scope

- Years considered for the study.

- Regions covered.

- Currency

- Unit Considered

- Stakeholders

- Summary of changes

- Research Methodology

- Research Data

- Secondary Data

- Key data from secondary sources

- Primary Data

- Key data from primary sources

- Breakdown of Primary Interviews

- Secondary Data

- Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

- Data Triangulation

- Growth Rate Assumption/ Growth Forecast

- Supply Side

- Demand Side

- Factor Analysis

- Assumptions

- Limitations

- Risk Assessment

- Research Data

- Executive Summary

- Premium Insights

- Emerging Investment Hotspots

- Capex Distribution: IT, Power, Cooling, and Construction

- Equipment Spend Ratios – Hyperscale vs Colocation vs Edge

- Impact of AI and High-Density Computing

- Supply Chain Localization under IRA and BABA Acts

- Market Overview

- Introduction

- Macroeconomic & Industry Outlook

- CAPEX Distribution (IT vs Power vs Cooling vs Construction)

- Macroeconomic & Industry Outlook

- Market Dynamics

- Drivers

- AI Computing & Cloud Services

- 5G Rollout and Edge Expansion

- Government Policy & Energy Regulations

- Challenges

- Restraints

- Entry Barriers, Certification Requirements, and Customer Concentration

- Technical Bottlenecks & Localization Requirements (IRA, BABA)

- Opportunities

- Drivers

- Porter’s Five Forces Analysis

- Key Stakeholders and Buying Criteria

- Key Stakeholders in Buying Process

- Buying Criteria

- Introduction

- Regulatory Landscape

- Regional Safety Standards & Certifications

- Certification and Standards: UL, ANSI/TIA, ASHRAE, Uptime Institute, etc.

- ESG Trends

- U.S. / EU Standards on Carbon Emissions, Efficiency, and Renewables

- Supply Chain Analysis

- Key Players & Market Rankings

- Semiconductors

- Servers

- Power and Energy Systems

- Thermal Management

- Infrastructure and Structural Materials

- (O&M) - Operations & Maintenance

- Supply chain localization Mandates under U.S. policies (IRA, BABA)

- Key Players & Market Rankings

- Technology Trends Disruptions Impacting Customer’s Business

- Emerging Needs & Identified Common Issues

- Power and Energy Systems

- Thermal Management

- Infrastructure and Structural Materials

- Impact of AI / High-Power Computing

- Power Density, Reliability, Energy Efficiency (PUE) Targets

- Emerging Needs & Identified Common Issues

- U.S. Data Center Equipment Market, By System Types, USD Million, 2024 - 2030

- Introduction

- Power and Energy Systems

- Power Distribution & Monitoring (Intelligent Rack PDUs (iPDU), Busway Systems, Remote Power Panels (RPPs), Power Monitoring Software)

- Power Generation & Control (Backup Generators (Diesel, Natural Gas), MV/LV Switchgear, Automatic Transfer Switch)

- Uninterruptible Power Supplies (UPS) (Static UPS Modules, UPS Batteries, & Flywheels)

- Thermal Management

- Air Cooling Equipment (Perimeter CRAC/CRAH Units, In-Row Coolers, Airflow Management (Containment Systems))

- Liquid Cooling Systems (Coolant Distribution Units (CDUs), Direct-to-Chip Cold Plates, Single-Phase Immersion Tanks, Dielectric Fluids)

- Heat Rejection Systems (Chillers, Cooling Towers (Evaporative/Adiabatic), Dry Coolers, Heat Exchangers, Water Pumps)

- IT Infrastructure

- Specialized AI/HPC Compute (GPUs, Accelerators, TPUs)

- Servers (Rack, Blade, Tower)

- Storage Systems (SAN, NAS, DAS)

- Networking Hardware (Switches, Routers, Firewalls)

- Structured Cabling (Patch Panels, Trays)

- Physical Support & Management

- Server Racks & Cabinets

- Cabling Infrastructure

- Physical Security Systems

- Fire Suppression Systems

- Environmental Monitoring Sensors

- Introduction

- U.S. Data Center Equipment Market, By Reliability, USD Million, 2024 - 2030

- Introduction

- Tier I (Basic Capacity)

- Tier II (Redundant Capacity Components)

- Tier III (Concurrently Maintainable)

- Tier IV (Fault Tolerant)

- U.S. Data Center Equipment Market, By Architecture, USD Million, 2024 - 2030

- Introduction

- Hyperscale

- Colocation

- Edge

- Enterprise

- Introduction

- U.S. Data Center Equipment Market, By Region, USD Million, 2024 - 2030

- Introduction

- Northern Virginia (NoVa)

- Dallas-Fort Worth

- Phoenix

- Atlanta

- Chicago

- Silicon Valley / Northern California

- Rest of the U.S.

- Introduction

- Competitive Landscape

- Introduction

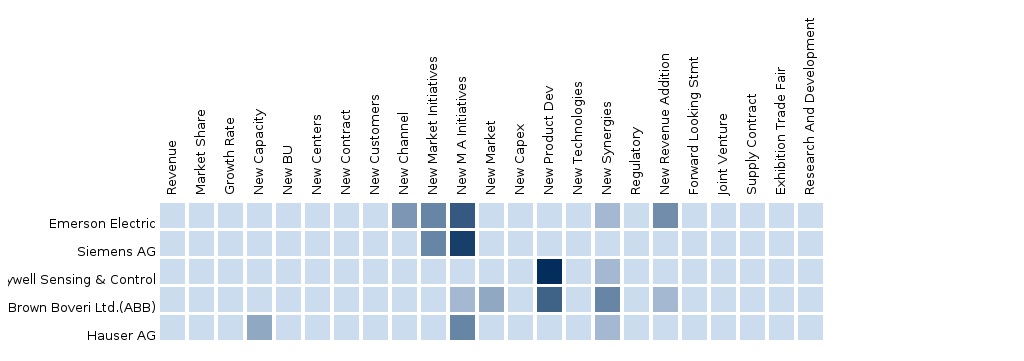

- Key Players' Strategies

- Market Share Analysis (2024)

- Revenue Analysis (2020-2024)

- Company Valuation and Financial Metrics

- Brand/Product Comparison

- Company Evaluation Matrix: Key Players, 2024

- Stars

- Emerging Leaders

- Pervasive Players

- Participants

- Company Footprint: Key Players, 2024

- Company Footprint

- Region Footprint

- Application Footprint

- End-Use Industry Footprint

- Company Evaluation Matrix: Startups/SMEs, 2024

- Progressive Companies

- Responsive Companies

- Dynamic Companies

- Starting Blocks

- Competitive Benchmarking: Startups/SMEs, 2024

- Detailed List of Key Start-ups/SMEs

- Competitive Benchmarking of Key Start-ups/SMEs

- Company Evaluation Matrix: Key Players, 2024

- Competitive Scenario

- New Product Launches

- Deals

- Expansions

- Introduction

- Company Profile

- Key Players

- Schneider Electric

- WESCO International, Inc.

- Asetek A/S

- Caterpillar Inc.

- Chatsworth Products, Inc.

- Dell Technologies Inc.

- Green Revolution Cooling, Inc.

- Hewlett Packard Enterprise Company

- Proterial Cable America, Inc.

- Nexans S.A.

- Stulz Holding GmbH

- Trane Technologies plc

- Eaton Plc

- Starline (Legrand)

- Panduit

- CommScope

- Chatsworth Products

- EAE USA

- Start Ups

- SUBMER TECHNOLOGIES, S.L.

- ICEOTOPE TECHNOLOGIES LIMITED

- CoolIT Systems Inc.

- ZutaCore, Inc.

- Bloom Energy Corporation

- CleanSpark, Inc.

- CubicPV Inc.

- Virtual Power Systems, Inc.

- Aligned Data Centers, LLC

- EdgeConneX, Inc.

- Compass Datacenters LLC

- Vapor IO, Inc.

- Modius, Inc.

- Ayar Labs, Inc.

- Lightmatter, Inc.

- DriveNets Ltd.

- Ranovus Inc.

- Megaport Limited

- Key Players

- Appendix

- Discussion Guide

- Related Reports

Industry Overview

The U.S. Data Center Equipment Market is projected to grow from USD 155.6 billion in 2025 to USD 326.9 billion by 2030, registering a CAGR of 16.0% during the forecast period.

The U.S. Data Center Equipment Market serves as the indispensable foundation for the nation's burgeoning digital economy, integrating advanced hardware solutions that power everything from hyperscale cloud operations to edge-enabled IoT ecosystems. This market encompasses a broad spectrum of equipment, including high-performance servers, robust power distribution systems, innovative thermal management technologies, and resilient structural infrastructures, all tailored to meet the escalating demands of artificial intelligence, machine learning, and real-time data processing. As enterprises and governments alike pivot toward data sovereignty and computational sovereignty, the sector is witnessing a profound evolution, where modular designs and software-defined architectures enable seamless scalability and interoperability.

At its core, the market is shaped by the interplay of technological innovation and infrastructural necessities. Hyperscalers are pioneering custom silicon integrations and liquid-cooled racks to handle dense AI workloads, while colocation providers offer flexible, multi-tenant environments that democratize access to cutting-edge compute resources. Edge deployments, spurred by 5G proliferation, are decentralizing processing to reduce latency in applications ranging from autonomous vehicles to smart manufacturing. Sustainability threads through every layer, with renewable energy tie-ins and energy-efficient cooling becoming non-negotiable amid corporate net-zero pledges and federal clean energy directives.

Supply chain dynamics add another layer of complexity and opportunity, as operators navigate global sourcing risks by embracing domestic manufacturing incentives and strategic partnerships. This ecosystem not only fuels economic vitality—generating roles in engineering, construction, and operations—but also positions the U.S. as a global leader in secure, resilient digital infrastructure. Looking ahead, the market's trajectory hinges on balancing explosive growth with equitable access, ensuring that innovations in power redundancy and thermal efficiency translate into widespread societal benefits. Stakeholders, from OEMs to policymakers, must collaborate to address power grid strains and talent gaps, forging a future where data centers are not just facilities but intelligent, adaptive hubs of progress.

Source: Secondary Research, Interviews with Experts, and MicroMarketMonitor Analysis

THE U.S. DATA CENTER MARKET: Dynamics

Driver: AI Acceleration and Hyperscale Investments Ignite Robust Demand Across Compute and Infrastructure Layers

The U.S. Data Center Equipment Market is propelled by a confluence of transformative drivers that amplify the need for advanced hardware and systems integration. Foremost among these is the relentless surge in artificial intelligence adoption, where generative models and neural network training demand specialized accelerators, high-bandwidth memory, and dense server configurations capable of processing vast datasets with minimal latency. Hyperscale operators, leveraging their scale for custom fabrications, are at the vanguard, channeling massive capital into greenfield campuses equipped with next-generation GPUs and tensor processing units. This AI momentum extends to enterprise sectors, where hybrid cloud migrations enable legacy systems to ingest real-time analytics, fostering a ripple effect across industries like finance, healthcare, and logistics.

Cloud computing's maturation further entrenches these dynamics, as service providers expand footprints to support multi-cloud orchestration and containerized workloads, necessitating upgraded networking fabrics and storage arrays for seamless data mobility. The proliferation of 5G networks and IoT devices compounds this, driving edge computing deployments that require ruggedized, low-power equipment for distributed inference at the network periphery. Sustainability imperatives serve as another potent driver, with operators integrating renewable microgrids and advanced battery storage to align with ESG frameworks, thereby attracting institutional investors focused on green infrastructure.

Regulatory tailwinds, including tax credits for energy-efficient builds and mandates for data localization, incentivize equipment upgrades that enhance resilience against cyber threats and natural disruptions. Economic multipliers—such as job creation in specialized fabrication and deployment—reinforce market vitality, drawing ancillary investments in fiber optics and cooling innovations. Collectively, these drivers create a self-sustaining cycle: AI's computational hunger spurs hardware evolution, which in turn unlocks new applications, ensuring the market's trajectory remains upward-bound. Operators responding proactively, through predictive maintenance tools and modular retrofits, are best positioned to capitalize on this momentum, transforming potential bottlenecks into avenues for differentiation and long-term operational excellence.

Restraint: Power Grid Limitations and Component Lead Times Curb Aggressive Expansion Plans

While the U.S. Data Center Equipment Market surges forward, several restraints are tempering its pace, with power grid inadequacies and protracted supply chain lead times emerging as primary hurdles that force operators to recalibrate ambitious rollout timelines. Regional transmission constraints, exacerbated by legacy infrastructure ill-equipped for surging loads from AI clusters, result in interconnection queues spanning years, compelling hyperscalers to seek off-grid alternatives like behind-the-meter generation, which adds complexity and upfront costs. This bottleneck disproportionately affects emerging hubs, where utility upgrades lag behind land availability, stalling greenfield projects and inflating operational risks.

Component scarcity, particularly for high-voltage transformers and specialized semiconductors, imposes another layer of restraint, as global manufacturing bottlenecks—stemming from raw material volatilities and trade frictions—extend procurement cycles from months to multi-year horizons. These delays cascade into facility underutilization, with operators holding excess capacity idle while awaiting critical power distribution units or cooling manifolds. Economic pressures, including rising interest rates and inflationary inputs for steel and copper, further squeeze margins, prompting deferred investments in non-essential upgrades.

Talent constraints in niche areas like liquid cooling installation and AI hardware orchestration amplify these issues, as skilled labor shortages drive up deployment costs and prolong commissioning phases. Regulatory overlays, such as stringent environmental impact assessments for large-scale builds, add procedural friction, particularly in ecologically sensitive zones. These restraints collectively foster a cautious investment climate, where operators prioritize phased expansions over wholesale overhauls. Mitigation strategies, including diversified supplier networks and predictive analytics for demand forecasting, are gaining traction, yet their implementation requires cross-stakeholder coordination. Ultimately, addressing these restraints demands a holistic approach—blending policy advocacy for grid modernization with technological workarounds like dynamic load shifting— to restore unencumbered growth and prevent market fragmentation.

Opportunity: Edge Proliferation and Green Tech Integrations Open Avenues for Innovative Scalability and Revenue Diversification

Amid the U.S. Data Center Equipment Market's expansion, a wealth of opportunities emerges, particularly in untapped frontiers like edge computing and sustainable technology infusions, offering stakeholders pathways to innovate and capture emerging value pools. Edge architectures present a prime arena, where the convergence of 5G, autonomous systems, and industrial IoT demands compact, high-availability micro-facilities equipped with disaggregated compute and low-latency interconnects. This decentralization not only alleviates core data center congestion but also enables new business models, such as telco-edge partnerships that monetize proximity-based services for AR/VR and predictive maintenance in manufacturing.

Sustainability-focused opportunities abound, as operators pivot toward circular economy principles, retrofitting facilities with recyclable rack materials and AI-optimized energy management systems that harvest waste heat for district heating. Federal incentives for carbon-neutral builds, coupled with corporate procurement preferences for low-emission suppliers, create niches for advanced thermal solutions like immersion cooling, which promise dramatic efficiency gains in high-density environments. Modular prefabrication emerges as another lever, allowing rapid deployment in underserved regions with abundant renewables, thus bridging urban-rural digital divides.

Supply chain localization offers strategic upside, with reshoring initiatives inviting OEMs to co-develop domestic sourcing for critical components like transformers and cabling, reducing lead times and geopolitical exposures. Cross-industry synergies—such as integrating data center excess capacity for blockchain validation or quantum-secure networking—further diversify revenue streams. For end-users, opportunities lie in composable infrastructure that allows on-demand scaling, minimizing capex while maximizing utilization. Visionary players are already piloting these vectors, forging consortia for standards development and talent pipelines. By embracing these opportunities, the market can evolve from a cost center to a profit engine, fostering resilient ecosystems that not only meet current demands but anticipate the next wave of digital disruption, ensuring inclusive growth across geographies and sectors.

Challenge: Cybersecurity Vulnerabilities and Sustainability Compliance Strain Operational Resilience

The U.S. Data Center Equipment Market confronts multifaceted challenges that test the sector's adaptability, with cybersecurity threats and escalating sustainability compliance demands posing the most acute tests to operational integrity and long-term viability. As facilities become hyper-connected hubs for sensitive AI datasets, sophisticated attacks—ranging from ransomware to supply chain compromises—exploit vulnerabilities in legacy networking gear and IoT endpoints, potentially cascading into widespread outages. The shift toward zero-trust architectures and quantum-resistant encryption, while essential, introduces integration complexities, especially in heterogeneous environments blending on-premises and cloud assets.

Sustainability challenges intensify this pressure, as operators grapple with water-intensive cooling in drought-prone regions and the carbon footprint of diesel backups, all under the glare of SEC-mandated disclosures and state-level emissions caps. Achieving net-zero pathways requires overhauling equipment lifecycles, from energy-hungry servers to non-recyclable structural composites, often clashing with short-term ROI imperatives. Water stewardship emerges as a flashpoint, with public scrutiny over consumption volumes prompting moratoriums on new builds in water-stressed locales.

Geopolitical and economic headwinds compound these, as tariff escalations on imported components disrupt budgeting, while workforce upskilling lags behind the need for expertise in emerging tech like immersion systems. Interoperability issues across vendor ecosystems further hinder seamless upgrades, fostering silos that undermine efficiency. These challenges demand proactive countermeasures: embedded security-by-design in OEM offerings, collaborative R&D for bio-based materials, and advocacy for streamlined permitting. Forward-leaning operators are turning these pain points into differentiators, deploying AI-monitored perimeters and circular supply loops to build trust and compliance. Navigating this terrain requires resilience, innovation, and ecosystem-wide dialogue to safeguard the market's role as a pillar of digital trust and environmental stewardship.

U.S. DATA CENTER EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

The U.S. Data Center Equipment Market thrives within a vibrant, interconnected ecosystem where key stakeholders—original equipment manufacturers (OEMs), end-user industries, regulatory and policy makers, and ancillary enablers—collaborate to address the complexities of scaling AI-centric infrastructure. OEMs form the innovation core, designing and supplying mission-critical components like power systems, thermal solutions, and modular racks that ensure uptime and efficiency. Leading players include WESCO International, Inc., Schneider Electric, Asetek A/S, Caterpillar Inc., Chatsworth Products, Inc., Dell Technologies Inc., Green Revolution Cooling, Inc., Hewlett Packard Enterprise Company, Proterial Cable America, Inc., Nexans S.A., Stulz Holding GmbH, Trane Technologies plc, Eaton Plc, Starline (Legrand), Panduit, CommScope, Chatsworth Products, and EAE USA. These firms drive advancements through R&D in liquid cooling and energy storage, often co-engineering with clients for bespoke integrations.

End-user industries anchor demand, with hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud commanding the bulk through massive campus builds, while colocation giants such as Equinix and Digital Realty provide neutral platforms for enterprises in finance, healthcare, and telecom. Edge users, including telecom operators like Verizon and AT&T, plus industrial players in manufacturing and energy, push for distributed, low-latency setups. These sectors not only procure equipment but influence specifications via SLAs for sustainability and security, fostering feedback loops that refine product roadmaps.

Regulatory and policy makers, including the Federal Energy Regulatory Commission (FERC), Environmental Protection Agency (EPA), and state utilities commissions, shape the landscape through grid interconnection rules, emissions standards, and incentives under the Inflation Reduction Act. Bodies like the U.S. Department of Energy (DOE) fund pilots for small modular reactors, while NIST guidelines fortify cybersecurity protocols. Others—utilities (e.g., Dominion Energy), labor academies, and standards consortia like the Open Compute Project—bridge gaps, ensuring equitable access and interoperability. This ecosystem's strength lies in symbiotic partnerships: OEMs supply, end-users deploy, regulators enforce, and enablers optimize, collectively mitigating risks like power shortages while amplifying opportunities in green tech. Through joint ventures and policy dialogues, stakeholders cultivate a resilient framework that sustains innovation, promotes inclusivity, and positions the U.S. as a global digital powerhouse.

Source: Secondary Research, Interviews with Experts, and MicroMarketMonitor Analysis

By Product Type: Power Systems Dominate While Thermal Management Accelerates in High-Density AI Environments

In the Product Type segment—encompassing Power and Energy Systems, Thermal Management, and Infrastructure and Structural Materials—Power and Energy Systems claim the largest sub-segment, driven by the imperative for unwavering reliability in hyperscale operations. Uninterruptible power supplies (UPS) and backup generators form the backbone, integrating with battery energy storage systems (BESS) to deliver seamless failover during grid anomalies, essential for AI workloads intolerant to even millisecond interruptions. This dominance stems from hyperscalers' stringent availability targets, where layered redundancy prevents revenue losses from downtime, substantiated by industry benchmarks showing power-related failures as the top outage cause.

Thermal Management emerges as the fastest-growing sub-segment, propelled by the thermal bottlenecks of next-gen chips like high-wattage GPUs that generate heat fluxes beyond air-cooling capacities. Direct-to-chip liquid cooling and full-immersion variants lead this charge, offering superior dissipation and energy recapture, aligning with sustainability goals by slashing cooling overheads. Drivers include rack density escalations in AI clusters and water conservation mandates in arid regions, with operators reporting halved PUE metrics post-adoption. Innovations from firms like Asetek and Green Revolution Cooling validate this trajectory, as closed-loop designs enable denser configurations without environmental trade-offs.

Infrastructure and Structural Materials, though foundational, support these leaders through modular raised floors and seismic-resistant enclosures that facilitate rapid assembly. Prefabrication drivers, tied to labor shortages, allow parallel construction, reducing timelines amid urbanization pressures. Interdependencies amplify growth: robust power feeds enable thermal scalability, while structural modularity houses both. This segment's evolution underscores a shift toward holistic, adaptive systems, where OEMs like Eaton and Schneider Electric pioneer integrations for future-proof facilities, ensuring the market meets escalating compute demands with efficiency and resilience.

Hyperscale Leads with Scale Efficiencies as Edge Surges on Decentralized Processing Needs

The Architecture segment—spanning Hyperscale, Colocation, Edge, and Enterprise—sees Hyperscale as the largest sub-segment, characterized by vast, integrated campuses optimized for cloud-native and AI orchestration. These architectures excel in custom server pods and fabric interconnects, enabling petascale processing for foundation models, with their scale yielding procurement leverage and operational synergies. Dominance is rooted in hyperscalers' control over the full stack, from silicon to software, as evidenced by their lead in fiber densification and renewable PPAs, which minimize latency and costs for global workloads.

Edge architecture vaults ahead as the fastest-growing sub-segment, driven by 5G's enablement of ultra-low-latency applications in smart cities, autonomous logistics, and telehealth. Micro data centers and containerized nodes, ruggedized for peripheral deployment, offload inference from cores, reducing bandwidth strain and enhancing responsiveness. Key drivers include IoT's explosion—projected to connect billions of devices—and private 5G networks, with telcos like CommScope accelerating rollouts. This growth is substantiated by edge's role in democratizing AI, allowing SMEs to leverage local compute without cloud dependencies.

Colocation provides multi-tenant flexibility, growing steadily via neutral platforms that share power and cooling, while Enterprise architectures modernize on-premises with hybrid composability for secure, regulated data. Cross-pollination, such as hyperscale modularity in edge kits, boosts interoperability. Challenges like edge's security exposures are met with zero-trust embeds, fostering a balanced ecosystem where architectures evolve in tandem, supporting the market's pivot to pervasive, intelligent computing.

Northern Virginia Retains Primacy While Atlanta Emerges as a Power-Abundant Growth Epicenter

In the Regional segment—covering Northern Virginia (NoVa), Dallas-Fort Worth, Phoenix, Atlanta, Chicago, Silicon Valley/Northern California, and Rest of the U.S.—Northern Virginia holds the largest sub-segment, as the epicenter of global data flows with unmatched fiber density and ecosystem maturity. Its proximity to policy centers and transatlantic cables supports hyperscale clusters, with established utilities facilitating rapid expansions despite land premiums. This leadership is driven by historical investments, creating a virtuous cycle of talent attraction and supplier proximity, as seen in its role hosting over a third of U.S. capacity.

Atlanta surges as the fastest-growing sub-segment, fueled by Southeastern connectivity booms, tax abatements, and access to hydropower and natural gas veins that bypass coastal grid strains. Emerging as a bridge between Atlantic cables and inland enterprises, it attracts colocation and edge builds, with announcements for gigawatt-scale campuses underscoring its momentum. Drivers include Georgia's pro-business policies and lower operational costs, enabling faster interconnection than legacy hubs.

Dallas-Fort Worth leverages ERCOT's flexibility for diverse loads, Phoenix capitalizes on solar synergies and arid-adapted cooling, Chicago draws Midwest renewables and logistics, and Silicon Valley innovates via venture ecosystems. The Rest of the U.S., including upstarts like Des Moines and Reno, taps untapped wind and geothermal for diversification. Regional strategies emphasize power-secure siting, with inter-hub fiber meshes enhancing national resilience. This dispersion mitigates risks like seismic vulnerabilities, promoting balanced growth and innovation tailored to local strengths.

Source: Secondary Research, Interviews with Experts, and MicroMarketMonitor Analysis

Key Market Players

- WESCO International, Inc.

- Schneider Electric

- Asetek A/S

- Caterpillar Inc.

- Chatsworth Products, Inc.

- Dell Technologies Inc.

- Green Revolution Cooling, Inc.

- Hewlett Packard Enterprise Company

- Proterial Cable America, Inc.

- Nexans S.A.

- Stulz Holding GmbH

- Trane Technologies plc

- Eaton Plc

- Starline (Legrand)

- Panduit

- CommScope

- EAE USA

Recent Developments

- In January 2024, Dell Technologies Inc. launched the PowerEdge XE9785 server, optimized for AI workloads with integrated liquid cooling, targeting hyperscale data centers to enhance thermal efficiency in high-density environments.

- In March 2024, Schneider Electric acquired a stake in a U.S.-based battery storage firm to bolster its EcoStruxure Microgrid solutions for data centers, aiming to integrate renewable energy seamlessly into power systems.

- In April 2024, Hewlett Packard Enterprise Company announced a multi-year partnership with a major hyperscaler for custom GreenLake edge solutions, deploying modular compute nodes across 50 U.S. sites to support 5G-enabled IoT.

- In May 2024, Eaton Plc introduced the 93PM G2 UPS series, featuring advanced lithium-ion batteries for extended runtime in colocation facilities, reducing footprint by 30% compared to traditional models.

- In June 2024, Green Revolution Cooling, Inc. secured a $50 million contract with a Silicon Valley operator for immersion cooling retrofits, enabling 100 kW rack densities in existing enterprise architectures.

- In July 2024, Caterpillar Inc. unveiled microgrid diesel-hybrid generators tailored for remote edge data centers, incorporating emissions controls to meet EPA standards in Phoenix deployments.

- In August 2024, CommScope expanded its SYSTIMAX cabling portfolio with 800G fiber optics for NoVa hyperscalers, partnering with a fiber provider for nationwide rollout to support AI traffic surges.

- In September 2024, Trane Technologies plc acquired a thermal management startup, integrating its direct-to-chip cooling tech into data center chillers, targeting Atlanta's growing campus builds.

- In October 2024, Panduit launched intelligent PDUs with real-time monitoring for structural infrastructure, signed a deal with Chatsworth Products for integrated rack solutions in Chicago facilities.

- In January 2025, WESCO International, Inc. merged with a key distributor to consolidate supply chains for power components, enhancing delivery speeds for Dallas-Fort Worth projects amid lead-time pressures.

- In February 2025, Asetek A/S released next-gen liquid cooling pumps for enterprise servers, collaborating with Lenovo on a pilot for hybrid cloud upgrades in Rest of U.S. regions.

- In March 2025, Nexans S.A. inked a large agreement with Equinix for high-voltage cabling in new colocation sites, focusing on sustainable copper alternatives to reduce environmental impact.

- In April 2025, Stulz Holding GmbH announced the CRAC Plus series with AI-optimized airflow for edge nodes, securing a partnership with Verizon for nationwide telecom deployments.

- In May 2025, Starline (Legrand) introduced busway systems with embedded sensors for NoVa retrofits, winning a contract from Digital Realty for scalable power distribution in expanding campuses.

- In June 2025, EAE USA partnered with Proterial Cable America, Inc. on advanced grounding solutions for Phoenix solar-integrated data centers, emphasizing resilience against grid fluctuations.

Frequently Asked Questions (FAQs)

1. Which factors influence the growth of the U.S. Data Center Equipment Market?

- The growth of the market is influenced by surging AI and machine learning workloads demanding high-density compute, cloud migration accelerating scalable architectures, and 5G/IoT driving edge deployments for low-latency processing. Sustainability mandates push renewable integrations and efficient cooling, while federal incentives for green infrastructure spur investments. Supply chain localization amid geopolitical risks further bolsters domestic manufacturing, collectively fostering innovation in power and thermal systems for resilient digital ecosystems.

2. Which country is expected to hold the largest share of the U.S. Data Center Equipment Market?

- As the market is inherently U.S.-focused, the United States dominates its entire share, with no international fragmentation. Within this, Northern Virginia leads regionally due to fiber density and policy proximity, capturing the bulk of hyperscale builds. This concentration reflects America's digital leadership, supported by robust utilities and incentives that outpace global peers, ensuring sustained dominance in equipment deployment and innovation.

3. Who are the major manufacturers of the U.S. Data Center Equipment Market?

- Major manufacturers include Dell Technologies Inc., Hewlett Packard Enterprise Company, Schneider Electric, Eaton Plc, and Vertiv, specializing in servers, power systems, and cooling. Others like Green Revolution Cooling, Inc., Trane Technologies plc, and CommScope excel in thermal and networking solutions, while Caterpillar Inc. and WESCO International, Inc. focus on energy and distribution. These OEMs drive advancements through R&D and partnerships, tailoring equipment for AI and sustainability needs

4. What are the opportunities in the U.S. Data Center Equipment Market?

- Opportunities abound in edge computing for 5G/IoT integrations, offering low-latency micro-facilities in underserved areas. Sustainable innovations like immersion cooling and renewable microgrids attract ESG investments, while modular prefabrication enables rapid scaling in power-rich regions. Supply chain reshoring creates niches for domestic OEMs, and hybrid architectures support enterprise AI pilots, unlocking revenue through partnerships and circular economy models for long-term efficiency gains.

5. Which application is expected to hold the largest share of the U.S. Data Center Equipment Market?

- Hyperscale applications hold the largest share, powering cloud services and AI training for providers like AWS and Azure through massive, custom campuses with integrated power and cooling. This dominance arises from scale efficiencies in handling zettabyte-scale data, outpacing colocation's multi-tenant flexibility and edge's distributed nodes, as hyperscalers drive the majority of equipment procurements for global workload orchestration.

Please visit https://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement