Morocco Biostimulant and Biopesticide Market Biostimulants by Active Ingredient (Acid-based, Extract-based, Others), and Biopesticides by Type (Bioinsecticides, Biofungicides, Bioherbicides, and Bionematicides) - Forecast to 2021

The Moroccan biostimulants market is estimated to be valued at USD 5.3 million in 2016 and projected to reach USD 8.8 million by 2021, at a CAGR of 10.7% from 2016 to 2021. Similarly, the market for biopesticides in Morocco was valued at USD 10.7 million in 2015 and is projected to reach USD 19.4 million by 2021 at a CAGR of 10.3% from 2016 to 2021. With the increasing demand for natural fertilizers and plant growth regulators for rising organic farming in Morocco and initiatives taken by the Moroccan government for Integrated Pest Management (IPM) to promote the usage of biopesticides and biofertilizers for minimum environmental hazards; this is expected to boost the biostimulants as well as biopesticides market growth in the country.

The Moroccan biostimulants and biopesticides markets report is segmented on the basis of biostimulant active ingredients and biopesticide types. The main objectives of the report are to define, segment, and project the market size of biostimulants and biopesticides markets in Morocco with respect to the above-mentioned segmentations and provide a detailed study of key factors influencing the growth of the market along with profiling the key players in the market and their core competencies.

Years considered for this report

2015 – Base Year

2016 – Estimated Year

2021 – Projected Year

Research Methodology

This report includes estimations of market sizes for value (USD million) with the base year as 2015, and forecast period from 2016 to 2021. Top-down and bottom-up approaches have been used to estimate and validate the size of the biostimulants and biopesticides markets in Morocco and to estimate the size of various other dependent submarkets. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

Breakdown of primary interviews

“To know about assumptions considered for this research report, download the pdf brochure.”

*Others include sales managers, marketing managers, and product managers.

Note: 3 tiers of the companies are defined on the basis of their total revenue, as of 2014; Tier 1 = >USD 1000 Million, Tier 2 = USD 500-1000 Million, and Tier 3 = <500 Million

Target audience

The stakeholder’s for the report includes:

- Biostimulants and biopesticides manufacturers

- Biostimulants and biopesticides raw material suppliers

- Biostimulants and biopesticides product exporters & importers

- Fertilizers manufacturers

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

SCOPE OF THE REPORT

- This study estimates the Moroccan biostimulants and biopesticides markets, in terms of value(USD thousand), till 2021.

- It offers a detailed qualitative and quantitative analysis of this market with reference to the competitive landscape, and the preferred development strategies such as agreements, expansions, mergers, and acquisitions to gain a larger share in the market.

- It provides a comprehensive review of recent trends in the biostimulants and biopesticides markets along with PEST analysis of Morocco.

- It covers various important aspects of the market. These include supply chain analysis, trade analysis of pesticides in Morocco, parent market analysis for the biostimulants and biopesticides markets, competitive landscape, and market estimates in terms of value.

The Moroccan biostimulants and biopesticides markets has been segmented into -

On the basis of biostimulant active ingredients:

- Acid-Based

- Extract-Based

- Others (B-vitamins, chitin, and chitosin)

On the basis of biopesticide type:

- Bioinsecticides

- Biofungicides

- Bioherbicides

- Bionematicides

- Others (sulfur, oil, insect repellent, moth control, and other biochemicals)

With the given market data, MicroMarketMonitor offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization Considered

1.4 Base Currency

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Promotion for Organic Agriculture

2.2.2.2 Introduction of Integrated Pest Management (Ipm)

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary

3.1 Overview

3.2 Moroccan Biostimulant & Biopesticide Markets

4 Market Overview

4.1 Introduction

4.2 Moroccan Biostimulant and Biopesticide Markets Segmentation

4.2.1 Biostimulants Market

4.2.2 Biopesticides Market

5 Industry Trends

5.1 Supply Chain Analysis

5.1.1 Prominent Companies

5.1.2 Governing Organizations

5.1.3 End Users

5.2 Recent Trends in Morocco

5.2.1 Organic Farming

5.2.2 Integrated Pest Management

5.3 Pest Analysis

5.3.1 Political Environment

5.3.2 Economical Environment

5.3.3 Social Environment

5.3.4 Technological Environment

5.4 Trade Analysis for Pesticides in Morocco

6 Parent Market Analysis - Biopesticides

6.1 Introduction

6.2 Bioinsecticides

6.3 Biofungicides

6.4 Bioherbicides

6.5 Bionematicides

7 Moroccan Biopesticides Market, By Type

7.1 Introduction

7.2 Bioherbicides

7.3 Biofungicides

7.4 Bioinsecticides

7.5 Bionematicides

8 Parent Market Analysis - Biostimulants

8.1 Introduction

8.2 Humic Substances

8.3 Humic Substances, By Sub-Type

8.3.1 Humic Acid

8.3.2 Fulvic Acid

8.4 Seaweed Extracts

8.5 Microbial Amendments

8.6 Trace Minerals

8.7 Vitamins & Amino Acids

8.8 Other Ingredients & Additives

9 Moroccan Biostimulants Market, By Active Ingredient

9.1 Introduction

9.1.1 Average Price Analysis for the Moroccan Biostimulants Market

9.2 Acid-Based

9.3 Extract-Based

10 Competitive Landscape

10.1 Overview

10.2 Competitive Situation and Trends

10.3 Expansions & Investments

10.4 Partnerships, Collaborations, and Agreements

10.5 Acquisitions

10.6 New Product Launches

11 Company Profiles

11.1 Introduction

11.2 BASF Se

11.2.1 Business Overview

11.2.2 Products Offered in the Biostimulants Market

11.2.3 Recent Developments in the Biostimulants Market

11.2.4 Products Offered in the Biopesticides Market

11.2.5 Recent Developments in the Biopesticides Market

11.2.6 SWOT Analysis

11.2.7 MMM View

11.3 Novozymes A/S

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MMM View

11.4 Isagro SpA

11.4.1 Business Overview

11.4.2 Products Offered in Biostimulants Markets

11.4.3 Recent Developments in Biostimulants Markets

11.4.4 Products Offered in Biopesticides Markets

11.4.5 Recent Developments in Biopesticides Markets

11.4.6 SWOT Analysis

11.4.7 MMM View

11.5 SAPEC Group (Trade Corporation International)

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 SWOT Analysis

11.5.5 MMM View

11.6 Platform Specialty Products Corporation

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MMM View

11.7 Bayer Cropscience AG

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 SWOT Analysis

11.7.5 MMM View

11.8 Dow Chemical Company

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 SWOT Analysis

11.8.5 MMM View

11.9 Monsanto Company

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments&

11.9.4 SWOT Analysis

11.9.5 MMM View

11.1 Koppert B.V.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MMM View

11.11 Certis USA LLC

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.11.4 MMM View

12 Appendix

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Expansions & Investments

12.5 Partnerships, Collaborations, and Agreements

12.6 Acquisitions

12.7 New Product Launches

12.8 Related Reports

12.8.1 RT Snapshots

List of Tables

Table 1 The Major Pests Identified in Morocco

Table 2 Assumptions of the Study

Table 3 Morocco: Biostimulants and Biopesticides Market, 2014-2021(USD Thousand)

Table 4 Type of Crops Produced Organically in Morocco

Table 5 Vegetable Crops Dominated Organic Crop Production in Morocco, 2013

Table 6 Preventive and Curative Ipm Options

Table 7 Natural Pesticides Commercialized By the Government in Morocco

Table 8 Biopesticides Market Size, By Type, 2014-2021 (USD Million)

Table 9 Bioinsecticides Market Size, By Region, 2014-2021 (USD Million)

Table 10 Biofungicides Market Size, By Region, 2014-2021 (USD Million)

Table 11 Bioherbicides Market Size, By Region, 2014-2020 (USD Million)

Table 12 Bionematicides Market Size, By Region, 2014-2021 (USD Million)

Table 13 Moroccan Biopesticides Markets Size, By Type, 2014–2021 (USD Thousand)

Table 14 Moroccan Biopesticides Market Size, By Type, 2014–2021 (Metric Tons)

Table 15 Biostimulants Market Size, By Type, 2014–2021 (USD Million)

Table 16 Humic Substances Market Size, By Sub-Type, 2014–2021 (USD Million)

Table 17 Humic Substances Market Size, By Region, 2014–2021 (USD Million)

Table 18 Seaweed Extracts Market Size, By Region, 2014–2021 (USD Million)

Table 19 Microbial Amendments Market Size, By Region, 2014–2021 (USD Million)

Table 20 Trace Minerals Market Size, By Region, 2014–2021 (USD Million)

Table 21 Vitamins & Amino Acids Market Size, By Region, 2014–2021 (USD Million)

Table 22 Other Ingredients & Additives Market Size, By Region, 2014–2021 (USD Million)

Table 23 Morocco: Biostimulants Market Size, By Active Ingredient, 2014–2021 (USD Thousand)

Table 24 Morocco: Biostimulants Market Size, By Active Ingredient, 2014–2021 (000 Ha)

Table 25 Morocco: Biostimulants Market Size, By Active Ingredient, 2014–2021 (Metric Tons)

Table 26 Expansions & Investments

Table 27 Partnerships, Collaborations, and Agreements

Table 28 Acquisitions

Table 29 New Product Launches

Table 30 Expansions & Investments

Table 31 Partnerships, Collaborations, and Agreements

Table 32 Acquisitions

Table 33 New Product Launches

List of Figures

Figure 1 Moroccan Biostimulant & Biopesticide Markets Segmentation

Figure 2 Research Design: Moroccan Biostimulant & Biopesticide Markets

Figure 3 Share of Exports of Organic Products in Morocco, 2013

Figure 4 France Was the Leading Importer of Organic Products in 2013

Figure 5 Moroccan Biostimulants Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Moroccan Biopesticides Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Moroccan Biostimulants Market Size Estimation Methodology: Top-Down Approach

Figure 8 Moroccan Biopesticides Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Moroccan Biostimulant & Biopesticide Markets

Figure 11 Moroccan Biostimulant Market Size, By Active Ingredient, 2016 Vs. 2021 (USD Thousand)

Figure 12 Moroccan Biopesticide Market Size, By Biopesticide Type, 2016–2021 (USD Thousand)

Figure 13 Moroccan Biostimulants Market, By Active Ingredient

Figure 14 Moroccan Biopesticides Market, By Type

Figure 15 Supply Chain: Moroccan Biostimulant and Biopesticide Markets

Figure 16 Per Capita Expenditure On Food in Morocco

Figure 17 Pesticide Imports in Morocco (Volume and Value), 2002–2014

Figure 18 Pesticide Exports in Morocco (Volume and Value), 2002–2014

Figure 19 Biopesticides Market, By Type, 2016 Vs. 2021 (USD Million)

Figure 20 Bioinsecticides to Be the Fastest-Growing in the Moroccan Biopesticides Market

Figure 21 Biostimulants Market Size, By Type, 2016 Vs. 2021 (USD Million)

Figure 22 Humic Substances Market Size, By Region, 2016 Vs. 2021 (USD Million)

Figure 23 Seaweed Extracts Market Size, By Region, 2016 Vs. 2021 (USD Million)

Figure 24 Microbial Amendments Market Size, By Region, 2016 Vs. 2021 (USD Million)

Figure 25 Trace Minerals Market Size, By Region, 2016 Vs. 2021 (USD Million)

Figure 26 Vitamins & Amino Acids Market Size, By Region, 2016 Vs. 2021 (USD Million)

Figure 27 Other Ingredients & Additives Market Size, By Region, 2016 Vs. 2021 (USD Million)

Figure 28 Extract-Based Active Ingredients Segment is Projected to Be the Fastest-Growing in the Moroccan Biostimulants Market From 2016 to 2021

Figure 29 Moroccan Biostimulants Market: Average Price Analysis, 2015

Figure 30 Companies Adopted for New Product Launches As the Key Growth Strategy From 2010 to 2015

Figure 31 Partnerships, Collaborations, and Agreements Have Fueled Growth & Innovation

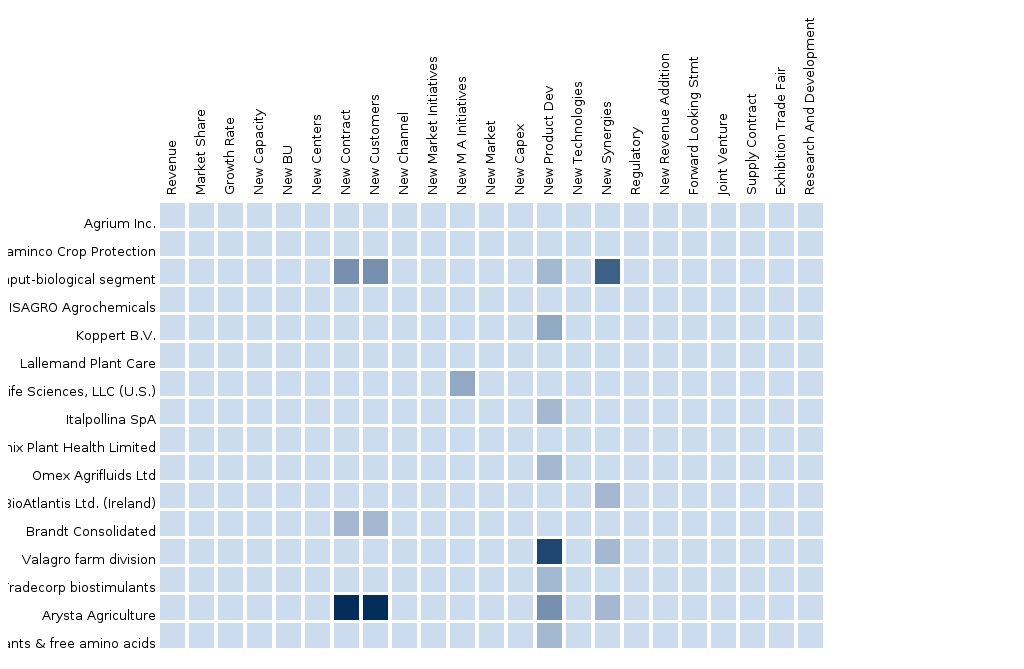

Figure 32 Partnerships, Collaborations, and Agreements: The Key Strategies

Figure 33 Annual Developments in the Biostimulants and Biopesticides Market, 2010–2016

Figure 34 Geographical Revenue Mix of Top Five Market Players

Figure 35 BASF SE: Company Snapshot

Figure 36 BASF SE: SWOT Analysis

Figure 37 Novozymes A/S: Company Snapshot

Figure 38 Novozymes A/S: SWOT Analysis

Figure 39 Isagro Spa: Company Snapshot

Figure 40 Isagro Spa: SWOT Analysis

Figure 41 Sapec Group: Company Snapshot

Figure 42 Sapec Group: SWOT Analysis

Figure 43 Platform Specialty Products Corporation: Company Snapshot

Figure 44 Platform Specialty Products Corporation: SWOT Analysis

Figure 45 Bayer Cropscience AG: Company Snapshot

Figure 46 Dow Chemical Company: Company Snapshot

Figure 47 Monsanto Company: Company Snapshot

Figure 48 Koppert B.V.: Company Snapshot

Figure 49 Certis USA LLC: Company Snapshot

The Moroccan biostimulants market is estimated to be valued at USD 5.3 million in 2016 and projected to reach USD 8.8 million by 2021, at a CAGR of 10.7% from 2016 to 2021. Similarly, the market for biopesticides in Morocco was valued at USD 10.7 million in 2015 and is projected to reach USD 19.4 million by 2021 at a CAGR of 10.3% from 2016 to 2021. The market growth is driven by the increasing awareness about use of biostimulants in organic farming and promotion of Integrated Pest Management (IPM) by the government of Morocco boosting the use of biopesticides for minimizing environmental hazards.

On the basis of active ingredients, the biostimulants market is led by the acid-based active ingredients type followed by extract-based active ingredients. The extract-based biostimulants segment is projected to be the fastest-growing active ingredient in the Moroccan biostimulants market due to its increasing application for crop yield enhancement.

The market for biopesticides in Morocco is segmented on the basis of type into bioinsecticides, biofungicides, bioherbicides, bionematicides, and others which include sulfur, oil, insect repellent, moth control, and other biochemicals. The usage of insecticides is high on vegetable crops due to frequent crop infestation by insects.

The key players identified in the Moroccan biostimulants and biopesticide markets are BASF SE (Germany), Novozymes A/S (Denmark), ISAGRO SPA (Italy), SAPEC Group (Trade corporation international) (Belgium), and Platform Specialty Products Corporation (U.S.). The other important companies operating in the biopesticides and biostimulants markets in Morocco are Bayer CropScience Ag (Germany), Dow Chemical Company (U.S.), Monsanto Company (U.S.), Koppert B.V. (The Netherlands), and Certis USA LLC (U.S.). Most key participants have been exploring new regions through new product launches, collaborations, and acquisitions across the globe to avail a competitive advantage through combined synergies.

To speak to our analyst for a discussion on the above findings, please fill up the required details by clicking on the Speak to Analyst tab.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement